Crop Protection Product Market

Crop Protection Product Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704451 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Crop Protection Product Market Size

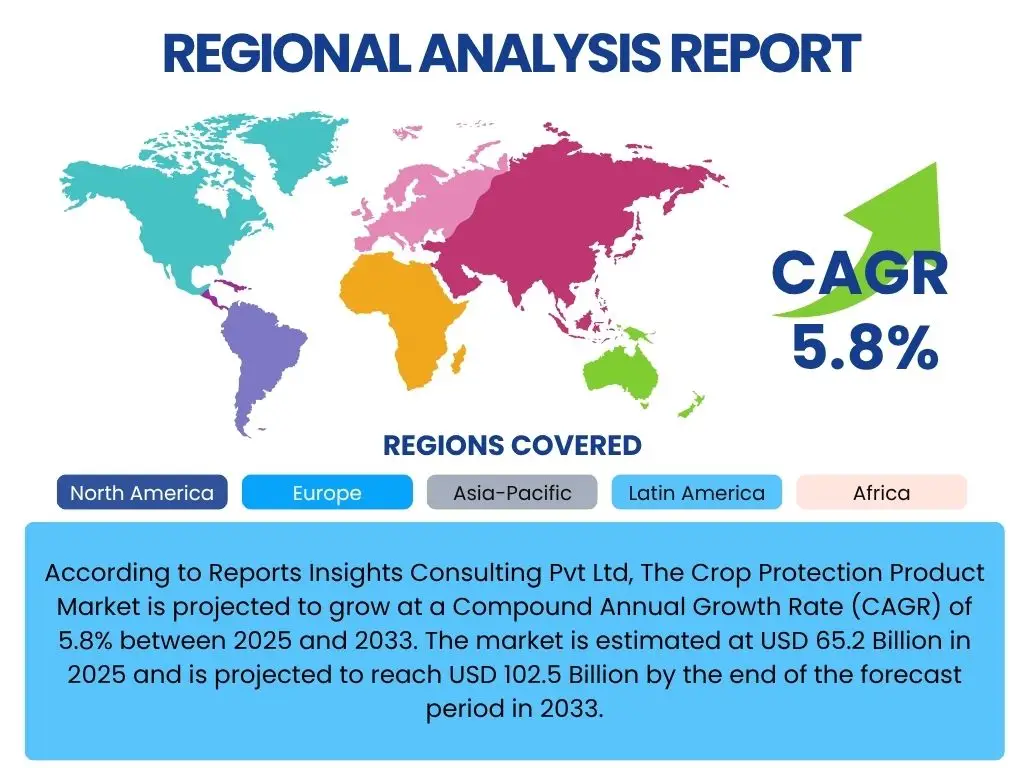

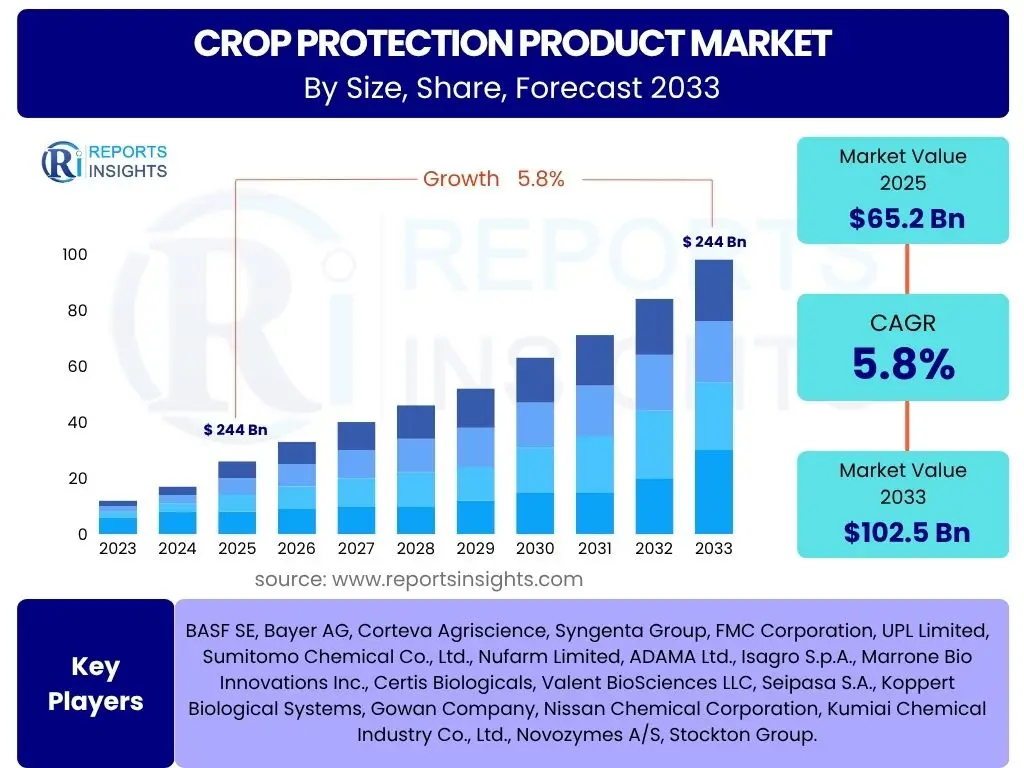

According to Reports Insights Consulting Pvt Ltd, The Crop Protection Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033. The market is estimated at USD 65.2 Billion in 2025 and is projected to reach USD 102.5 Billion by the end of the forecast period in 2033.

Key Crop Protection Product Market Trends & Insights

The Crop Protection Product market is experiencing significant transformation, driven by a global shift towards sustainable agriculture and enhanced productivity. Users frequently inquire about the integration of advanced technologies, the evolving regulatory landscape, and the increasing prominence of environmentally friendly solutions. Key trends indicate a move away from traditional chemical-intensive methods towards more integrated and precise protection strategies, reflecting growing consumer and regulatory demand for safer food production.

Insights suggest that investment in biologicals and digital farming solutions is accelerating, with companies focusing on innovation to address challenges such as pest resistance and climate change. The market is adapting to stricter regulations regarding pesticide residues and environmental impact, prompting a strong emphasis on research and development into novel, low-toxicity compounds and delivery systems. This evolution underscores a broader industry commitment to balancing agricultural output with ecological preservation.

- Increasing adoption of biological crop protection products (biopesticides, biostimulants).

- Integration of precision agriculture technologies (IoT, AI, drones) for optimized application.

- Development of innovative and sustainable chemical formulations with reduced environmental impact.

- Growing demand for integrated pest management (IPM) strategies.

- Digital platforms offering real-time data and advisory services for farmers.

- Expansion of customized and localized crop protection solutions.

AI Impact Analysis on Crop Protection Product

Common user questions regarding AI's influence on crop protection reveal a strong interest in its potential to revolutionize farming practices, enhance efficiency, and minimize environmental harm. Users seek to understand how AI contributes to smarter decision-making, improved resource management, and the development of next-generation crop protection solutions. There is also curiosity about the practical applications of AI, from predictive analytics for disease outbreaks to autonomous systems for targeted pesticide delivery.

The key themes emerging from this analysis include the expectation of AI-driven precision agriculture, where inputs like water, fertilizers, and crop protection agents are applied with unprecedented accuracy. Users anticipate that AI will play a critical role in addressing labor shortages, optimizing yields, and fostering more sustainable agricultural ecosystems. Concerns often revolve around data privacy, initial investment costs, and the need for robust infrastructure to support widespread AI adoption in diverse farming environments.

- Enhanced disease and pest detection through image recognition and predictive analytics.

- Optimization of pesticide and fertilizer application rates, reducing waste and environmental impact.

- Automated monitoring and decision-making for farm management via drones and robotics.

- Yield prediction and crop health assessment based on real-time data analysis.

- Development of smart sprayers that apply chemicals only where needed.

- Improved efficacy of biological control agents through AI-driven deployment strategies.

Key Takeaways Crop Protection Product Market Size & Forecast

The analysis of common user questions about the Crop Protection Product market size and forecast highlights a primary focus on growth trajectories, dominant market segments, and geographical contributions to the overall market expansion. Users are keen to understand the underlying factors driving the projected increases and how different product categories and regions will contribute to the market's evolution over the forecast period. The insights collectively indicate a robust growth outlook, underscored by continuous innovation and adaptation to evolving agricultural needs.

Key takeaways reveal that the market's expansion is not merely quantitative but also qualitative, shifting towards more sophisticated, sustainable, and technology-driven solutions. While traditional chemical products maintain a significant share, the accelerated growth of biologicals and integrated solutions is a clear indicator of future market direction. Furthermore, regional growth disparities suggest varied levels of technological adoption and regulatory pressures influencing market dynamics globally.

- The market is poised for steady growth, driven by increasing global food demand and technological advancements.

- Biological crop protection products are emerging as a high-growth segment, reflecting sustainability trends.

- Precision agriculture integration will be a crucial factor in enhancing product efficacy and market value.

- Asia Pacific is expected to remain a dominant region, with significant growth opportunities in emerging economies.

- Regulatory landscapes and climate change impacts will increasingly shape product development and market access.

Crop Protection Product Market Drivers Analysis

The global Crop Protection Product market is propelled by a confluence of macroeconomic and technological factors. A primary driver is the burgeoning global population, which necessitates a continuous increase in food production from finite arable land. This pressure intensifies the need for effective crop protection solutions to maximize yields and minimize post-harvest losses, ensuring food security worldwide. Additionally, the increasing incidence of pest resistance to existing chemical formulations mandates ongoing innovation in new active ingredients, fostering research and development within the industry.

Technological advancements, particularly in biotechnology and digital agriculture, also play a crucial role. These innovations enable the development of more targeted, efficient, and environmentally friendly crop protection agents. Furthermore, the rising awareness among farmers regarding the economic benefits of preventing crop damage and improving quality drives the adoption of advanced protection measures. Climate change and its unpredictable effects on pest and disease patterns further underscore the importance of robust and adaptive crop protection strategies.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Food Demand | +0.8% | Global | Long-term (2025-2033) |

| Growing Pest & Disease Incidence | +0.6% | Global | Ongoing |

| Advancements in Agricultural Technologies | +0.7% | North America, Europe, Asia Pacific | Mid-to-Long term (2027-2033) |

| Limited Arable Land & Need for Higher Yields | +0.5% | Asia Pacific, Africa, Latin America | Long-term (2025-2033) |

| Rising Adoption of Precision Agriculture | +0.4% | North America, Europe | Mid-term (2026-2030) |

Crop Protection Product Market Restraints Analysis

Despite robust growth drivers, the Crop Protection Product market faces several significant restraints that could impede its trajectory. Stringent environmental regulations and evolving public perceptions regarding chemical residues in food and soil pose substantial challenges. Regulatory bodies worldwide are imposing stricter limits on pesticide usage and introducing bans on certain active ingredients, necessitating extensive research and development for new, compliant alternatives, which adds considerable cost and time to product development cycles. This often leads to increased market entry barriers for novel solutions.

Another key restraint is the high cost associated with research and development of new crop protection chemicals and biologicals. Bringing a new product to market can take over a decade and cost hundreds of millions of dollars, creating a significant financial burden on companies. Furthermore, the rise of counterfeit products in various regions, particularly in developing economies, not only undermines the sales of legitimate products but also poses risks to agricultural efficacy and environmental safety. Supply chain disruptions, often exacerbated by geopolitical tensions or global events, can also impact raw material availability and distribution, thereby restraining market growth.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Environmental Regulations | -0.7% | Europe, North America | Ongoing |

| High R&D Costs & Long Development Cycles | -0.5% | Global | Long-term (2025-2033) |

| Public Perception & Concerns over Chemical Residues | -0.4% | Europe, North America | Ongoing |

| Emergence of Counterfeit Products | -0.3% | Asia Pacific, Latin America | Ongoing |

| Volatility in Raw Material Prices | -0.2% | Global | Short-to-Mid term (2025-2027) |

Crop Protection Product Market Opportunities Analysis

The Crop Protection Product market presents significant opportunities driven by evolving agricultural practices and technological innovation. The increasing global emphasis on sustainable agriculture and organic farming practices is creating a lucrative niche for biological crop protection products, including biopesticides and biostimulants. These eco-friendly solutions offer a viable alternative to synthetic chemicals, appealing to environmentally conscious consumers and stringent regulatory frameworks. The demand for such products is projected to surge as more farmers seek sustainable ways to manage pests and diseases.

Moreover, the advent of precision agriculture technologies, such as drones, IoT sensors, and AI-driven analytics, offers immense potential for optimizing the application of crop protection products. These technologies enable targeted spraying, reducing chemical overuse and increasing efficacy, thereby presenting opportunities for companies to develop and integrate smart solutions. Expansion into emerging markets, particularly in Asia Pacific, Latin America, and Africa, also represents a substantial growth avenue, as these regions exhibit increasing agricultural industrialization and a growing need for modern crop protection solutions to enhance food security.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Biopesticides & Biologics | +0.9% | Global | Long-term (2025-2033) |

| Integration with Precision Agriculture Technologies | +0.7% | North America, Europe, Asia Pacific | Mid-to-Long term (2027-2033) |

| Expansion into Emerging Markets | +0.6% | Asia Pacific, Latin America, Africa | Long-term (2025-2033) |

| Development of Digital Farming Platforms | +0.5% | Global | Mid-term (2026-2030) |

| Focus on Seed Treatment & Soil Health Solutions | +0.3% | Global | Ongoing |

Crop Protection Product Market Challenges Impact Analysis

The Crop Protection Product market faces several inherent challenges that can affect its growth and stability. One significant challenge is the evolution of pest and weed resistance to established chemical active ingredients. This necessitates continuous innovation and the development of new modes of action, leading to a never-ending cycle of research and development to stay ahead of resistance development. Such a dynamic environment places constant pressure on R&D budgets and timelines.

Another major challenge stems from the unpredictable impacts of climate change, which can alter pest migration patterns, disease prevalence, and crop vulnerability, making consistent crop protection planning difficult. This variability often requires farmers to adapt quickly and may necessitate different product mixes or application timings. Furthermore, farmer education and the adoption rate of new, often more complex, crop protection technologies or integrated pest management (IPM) strategies can be slow, especially in regions with limited access to information or resources. Overcoming these challenges requires collaborative efforts across the industry, research institutions, and governmental bodies to ensure sustainable agricultural practices.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Pest & Weed Resistance Evolution | -0.6% | Global | Ongoing |

| Impacts of Climate Change on Pest Dynamics | -0.5% | Global | Ongoing |

| Farmer Education & Adoption of New Technologies | -0.4% | Developing Economies | Long-term (2025-2033) |

| Supply Chain Vulnerabilities & Geopolitical Instability | -0.3% | Global | Short-to-Mid term (2025-2028) |

| Intellectual Property Protection & Piracy | -0.2% | Asia Pacific, Latin America | Ongoing |

Crop Protection Product Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Crop Protection Product market, encompassing its historical performance, current dynamics, and future projections. It delivers critical insights into market size, growth drivers, restraints, opportunities, and challenges influencing the industry from 2019 to 2033. The scope includes detailed segmentation analysis by product type, crop type, formulation, and application method, offering a granular view of market trends and competitive landscape across various regions. This report serves as an invaluable resource for stakeholders seeking to understand market potential and strategic positioning.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 65.2 Billion |

| Market Forecast in 2033 | USD 102.5 Billion |

| Growth Rate | 5.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Bayer AG, Corteva Agriscience, Syngenta Group, FMC Corporation, UPL Limited, Sumitomo Chemical Co., Ltd., Nufarm Limited, ADAMA Ltd., Isagro S.p.A., Marrone Bio Innovations Inc., Certis Biologicals, Valent BioSciences LLC, Seipasa S.A., Koppert Biological Systems, Gowan Company, Nissan Chemical Corporation, Kumiai Chemical Industry Co., Ltd., Novozymes A/S, Stockton Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Crop Protection Product market is extensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation helps in identifying key growth areas, market preferences, and strategic opportunities across different product categories and agricultural applications. Analyzing these segments provides crucial insights into market penetration, consumer behavior, and the competitive landscape for various solutions tailored to specific crop protection needs.

Understanding the interplay between these segments is vital for businesses looking to innovate and align their offerings with evolving agricultural demands and environmental standards. For instance, the rapid growth in biopesticides highlights a shift towards sustainable solutions, while the dominance of herbicides reflects ongoing challenges with weed management in major crop types. This granular analysis facilitates targeted product development and market entry strategies.

- By Type: Herbicides, Insecticides, Fungicides, Biopesticides, and Others (e.g., Plant Growth Regulators).

- By Crop Type: Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Commercial Crops (e.g., Cotton, Sugarcane), and Others (e.g., Ornamental Crops, Forage Crops).

- By Formulation: Liquid Formulations (e.g., Emulsifiable Concentrates, Suspension Concentrates) and Dry Formulations (e.g., Wettable Powders, Granules).

- By Application Method: Foliar Spray, Seed Treatment, Soil Treatment, and Post-Harvest.

Regional Highlights

- North America: Characterized by high adoption of precision agriculture and advanced crop protection technologies. Strict environmental regulations drive demand for integrated pest management and biological solutions. Significant R&D investments by key players.

- Europe: Leads in sustainable agriculture practices and stringent pesticide regulations, fostering innovation in biopesticides and low-impact solutions. Emphasis on reduced chemical usage and organic farming.

- Asia Pacific (APAC): The largest and fastest-growing market due to increasing population, expanding agricultural land, and rising demand for food. Adoption of modern farming techniques and growing awareness among farmers contribute to market expansion. China, India, and Southeast Asian countries are key contributors.

- Latin America: Experiences strong growth driven by expanding arable land, large-scale commercial farming, and increasing adoption of herbicides and insecticides for crops like soybeans, corn, and sugarcane. Brazil and Argentina are prominent markets.

- Middle East and Africa (MEA): Emerging market with significant potential, primarily due to increasing investments in agriculture, food security initiatives, and the need to combat desertification and pest outbreaks. Introduction of modern farming techniques is gradually boosting demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crop Protection Product Market.- BASF SE

- Bayer AG

- Corteva Agriscience

- Syngenta Group

- FMC Corporation

- UPL Limited

- Sumitomo Chemical Co., Ltd.

- Nufarm Limited

- ADAMA Ltd.

- Isagro S.p.A.

- Marrone Bio Innovations Inc.

- Certis Biologicals

- Valent BioSciences LLC

- Seipasa S.A.

- Koppert Biological Systems

- Gowan Company

- Nissan Chemical Corporation

- Kumiai Chemical Industry Co., Ltd.

- Novozymes A/S

- Stockton Group

Frequently Asked Questions

What are the primary types of crop protection products?

The primary types of crop protection products include herbicides for weed control, insecticides for insect management, fungicides for disease prevention, and biopesticides, which are derived from natural sources.

How large is the global Crop Protection Product market?

The global Crop Protection Product market is estimated at USD 65.2 billion in 2025 and is projected to reach USD 102.5 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 5.8%.

What are the key drivers of growth in the Crop Protection Product market?

Key drivers include increasing global food demand, the rising incidence of pests and diseases, advancements in agricultural technologies like precision farming, and the growing need to maximize yields from limited arable land.

What challenges does the Crop Protection Product market face?

The market faces challenges such as the evolution of pest and weed resistance, stringent environmental regulations, high research and development costs for new products, and the impacts of climate change on pest dynamics.

How are biopesticides impacting the Crop Protection Product market?

Biopesticides are significantly impacting the market by offering sustainable and environmentally friendly alternatives to synthetic chemicals. Their adoption is growing rapidly due to increasing consumer demand for organic produce and supportive regulatory policies.