Copper Molybdenum Market

Copper Molybdenum Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701598 | Last Updated : July 30, 2025 |

Format : ![]()

![]()

![]()

![]()

Copper Molybdenum Market Size

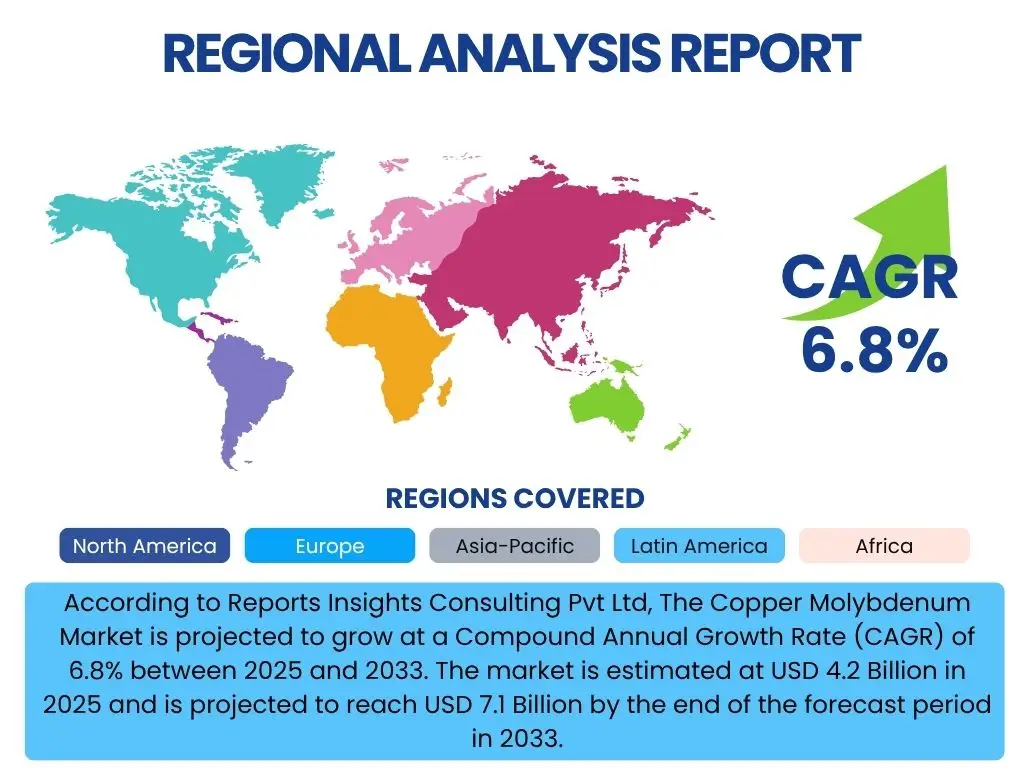

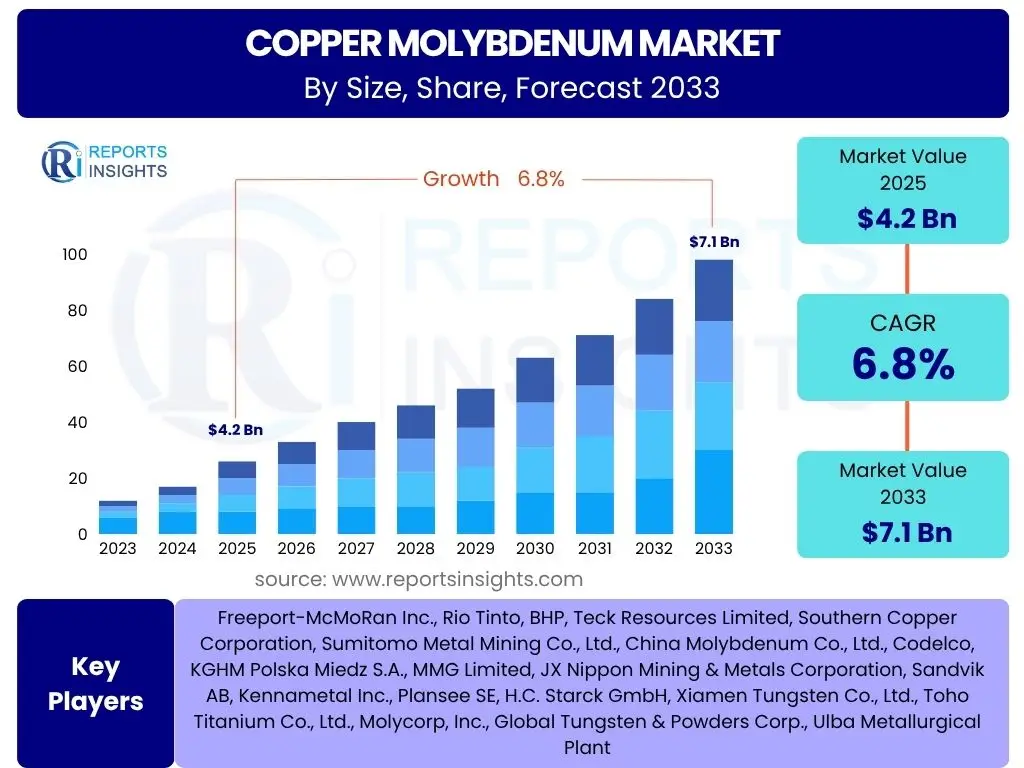

According to Reports Insights Consulting Pvt Ltd, The Copper Molybdenum Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 4.2 Billion in 2025 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033.

Key Copper Molybdenum Market Trends & Insights

The Copper Molybdenum market is witnessing significant transformation driven by evolving industrial demands and technological advancements. Key user inquiries often revolve around emerging applications in high-growth sectors, the shift towards sustainable practices, and the impact of geopolitical factors on supply chains. The market is increasingly influenced by the expansion of renewable energy infrastructure, the burgeoning electric vehicle (EV) industry, and the growing demand for high-performance alloys in various manufacturing processes. Furthermore, there is a pronounced trend towards optimizing material properties for enhanced thermal and electrical conductivity, crucial for advanced electronics and energy storage solutions.

Innovations in material science are also shaping market dynamics, with research focused on developing new copper-molybdenum alloys that offer superior mechanical strength and corrosion resistance. Users are keen to understand how these metallurgical advancements translate into new market opportunities and competitive advantages. The integration of digital technologies, such as advanced analytics and IoT in mining and processing, is another area of interest, promising improved efficiency and resource utilization. This holistic evolution underscores a market moving towards greater specialization, efficiency, and environmental consciousness, addressing the complex requirements of modern industries.

- Growing adoption in electric vehicle (EV) battery components and charging infrastructure.

- Increased demand from renewable energy sectors, particularly solar and wind power.

- Rising applications in high-performance electronics and semiconductor manufacturing.

- Emphasis on sustainable sourcing and recycling initiatives to mitigate environmental impact.

- Development of advanced copper-molybdenum alloys for specialized industrial uses.

- Geopolitical influences impacting global supply chain stability and material pricing.

- Technological advancements in extraction and processing enhancing material purity and efficiency.

AI Impact Analysis on Copper Molybdenum

User inquiries concerning AI's influence on the Copper Molybdenum domain predominantly center on its role in optimizing operational efficiencies, enhancing material discovery, and predicting market dynamics. There is significant interest in how artificial intelligence and machine learning algorithms can revolutionize mineral exploration, reducing the time and cost associated with identifying viable deposits. Users anticipate AI's capacity to analyze vast geological datasets, leading to more precise drilling targets and improved resource estimation. Furthermore, questions arise regarding AI's application in streamlining complex extraction and processing operations, from predictive maintenance of heavy machinery to optimizing chemical processes for higher yield and reduced waste, thereby significantly impacting production costs and environmental footprints.

Beyond the operational aspects, the market is keen on understanding AI's potential in accelerating the development of novel copper-molybdenum alloys with tailored properties. AI-driven simulations and computational materials science can predict material behaviors under various conditions, significantly shortening R&D cycles for new applications in aerospace, defense, and high-tech electronics. Users also express curiosity about AI's role in market forecasting, particularly in predicting price fluctuations and demand shifts for these critical metals, enabling better inventory management and strategic procurement decisions. This broad range of applications highlights AI as a transformative force, promising enhanced productivity, innovative material solutions, and improved market responsiveness across the Copper Molybdenum value chain.

- Enhanced mineral exploration and resource identification through predictive analytics.

- Optimization of mining and processing operations for increased efficiency and yield.

- Accelerated development of new copper-molybdenum alloys via AI-driven material design.

- Predictive maintenance for industrial machinery, reducing downtime and operational costs.

- Improved supply chain management and logistics through demand forecasting and optimization.

- Automated quality control and defect detection in copper-molybdenum products.

- Simulation of market trends and price fluctuations for strategic decision-making.

Key Takeaways Copper Molybdenum Market Size & Forecast

Common user questions regarding key takeaways from the Copper Molybdenum market size and forecast often focus on understanding the primary growth catalysts, the long-term sustainability of demand, and the major factors influencing market volatility. A critical insight is the robust demand driven by global electrification trends, encompassing electric vehicles, renewable energy infrastructure, and advancements in power transmission. The market's resilience is further supported by its essential role in high-tech manufacturing, where copper-molybdenum alloys are indispensable for their superior thermal and electrical properties. Despite potential short-term price fluctuations inherent to commodity markets, the underlying demand trajectory remains positive, underpinned by significant industrial transformation and technological innovation.

Another key takeaway frequently sought by users is the identification of regions poised for the most significant growth and the strategic implications for investment and supply chain planning. Asia Pacific, particularly China and India, is identified as a dominant growth hub due to rapid industrialization and infrastructure development. The long-term forecast suggests continued expansion, albeit with an increasing emphasis on sustainable mining practices and efficient recycling to address environmental concerns and resource scarcity. The market's growth is not merely volumetric but also qualitative, driven by the demand for higher purity materials and specialized alloys for cutting-edge applications, signaling a shift towards value-added products and advanced manufacturing techniques.

- Significant market expansion fueled by electric vehicle adoption and renewable energy investments.

- Asia Pacific region to remain a primary growth engine due to industrial and infrastructure development.

- Continued demand for high-performance alloys in electronics and specialized industrial applications.

- Market growth influenced by material science advancements and sustainable practices.

- Potential for price volatility due to supply-demand dynamics and geopolitical factors.

- Increasing focus on circular economy principles, including recycling and resource efficiency.

- Strategic importance of copper-molybdenum in critical emerging technologies.

Copper Molybdenum Market Drivers Analysis

The Copper Molybdenum market is primarily driven by the escalating global demand for advanced materials in key industrial sectors. The rapid expansion of electric vehicle manufacturing significantly contributes to this demand, as copper and molybdenum are critical components in batteries, charging infrastructure, and electrical wiring, enabling efficient power transfer and thermal management. Concurrently, the global push towards renewable energy sources, such as solar panels and wind turbines, necessitates substantial quantities of these metals for electrical conductivity and structural integrity. Furthermore, the burgeoning electronics and semiconductor industries rely heavily on copper-molybdenum for integrated circuits, heat sinks, and other high-performance components, where their unique thermal and electrical properties are indispensable. Infrastructure development, particularly in emerging economies, also plays a pivotal role, driving demand for electrical grids, construction, and telecommunications networks.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Electric Vehicle (EV) Production | +1.8% | North America, Europe, Asia Pacific (China, South Korea) | Short to Mid-term (2025-2030) |

| Expansion of Renewable Energy Infrastructure | +1.5% | Global, particularly Europe, Asia Pacific (China, India), North America | Mid to Long-term (2027-2033) |

| Increasing Demand from Electronics & Semiconductor Industry | +1.2% | Asia Pacific (Taiwan, South Korea, Japan), North America | Short to Mid-term (2025-2030) |

| Urbanization and Infrastructure Development in Emerging Economies | +1.0% | Asia Pacific (India, Southeast Asia), Latin America, Africa | Mid to Long-term (2028-2033) |

| Advancements in High-Performance Alloys | +0.8% | Global, especially R&D hubs in North America, Europe, Japan | Mid to Long-term (2027-2033) |

Copper Molybdenum Market Restraints Analysis

The Copper Molybdenum market faces several significant restraints that could impede its growth trajectory. Price volatility of raw materials, particularly copper, due to fluctuating global commodity markets and geopolitical events, presents a major challenge for consistent planning and investment. Environmental regulations and stringent mining policies, aimed at mitigating ecological impact, can increase operational costs for producers and limit the expansion of new mining projects, thereby affecting supply. Furthermore, the inherent complexities of the supply chain, including logistics, trade barriers, and the concentration of production in specific regions, make the market vulnerable to disruptions. The high energy consumption associated with the extraction and processing of these metals also contributes to operational expenses and environmental concerns, pushing for more sustainable yet often costlier alternatives.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Raw Material Price Volatility (Copper, Molybdenum) | -1.5% | Global | Short to Mid-term (2025-2030) |

| Stringent Environmental Regulations & Mining Policies | -1.2% | Europe, North America, parts of Asia Pacific (China) | Mid to Long-term (2027-2033) |

| Supply Chain Disruptions & Geopolitical Instability | -1.0% | Global, particularly regions with high political risk | Short to Mid-term (2025-2028) |

| High Energy Consumption in Extraction & Processing | -0.8% | Global, particularly high-cost production regions | Long-term (2029-2033) |

| Emergence of Substitute Materials for specific applications | -0.5% | Global, particularly in niche markets | Mid to Long-term (2028-2033) |

Copper Molybdenum Market Opportunities Analysis

The Copper Molybdenum market presents significant opportunities for growth and innovation, primarily stemming from the accelerating global transition towards sustainable technologies and advanced manufacturing. The escalating demand for electric vehicle components and renewable energy infrastructure offers substantial avenues for market expansion, as both industries are highly dependent on the electrical and thermal properties of these metals. Furthermore, advancements in material science are continuously creating new applications for copper-molybdenum alloys, particularly in aerospace, defense, and medical devices, where high strength-to-weight ratios and corrosion resistance are critical. The increasing focus on circular economy principles, including enhanced recycling technologies for industrial waste and end-of-life products, also represents a considerable opportunity to secure sustainable supply chains and reduce environmental footprints, fostering long-term market stability and growth.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increased Investment in Green Technologies (EVs, Renewables) | +2.0% | Global, particularly developed economies and rapidly industrializing nations | Mid to Long-term (2026-2033) |

| Technological Advancements in Alloy Development | +1.5% | North America, Europe, East Asia (Japan, South Korea) | Mid to Long-term (2027-2033) |

| Growth in High-Tech & Specialized Industrial Applications | +1.0% | Global, focusing on advanced manufacturing hubs | Short to Mid-term (2025-2030) |

| Development of Efficient Recycling Technologies | +0.8% | Europe, North America, Japan | Long-term (2029-2033) |

| Emergence of New Markets in Developing Countries | +0.7% | Southeast Asia, Latin America, Africa | Mid to Long-term (2028-2033) |

Copper Molybdenum Market Challenges Impact Analysis

The Copper Molybdenum market faces several significant challenges that could hinder its growth and operational stability. One primary concern is the escalating cost and decreasing availability of high-grade ore deposits, making extraction more complex and expensive. This necessitates deeper mining and more intensive processing, which in turn increases capital expenditure and environmental impact. Volatility in global economic conditions and industrial output directly affects demand for these foundational metals, leading to unpredictable market cycles and inventory management complexities. Furthermore, the stringent regulatory frameworks, particularly concerning environmental protection and labor standards in mining operations, can impose substantial compliance costs and limit expansion opportunities. Geopolitical tensions and trade disputes also pose a constant threat, potentially disrupting supply chains and impacting the global flow of raw materials and finished products, leading to market uncertainty and price spikes.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Depletion of High-Grade Ore Deposits | -1.8% | Global, particularly mature mining regions | Long-term (2029-2033) |

| Volatility in Global Economic Conditions | -1.5% | Global | Short to Mid-term (2025-2028) |

| Increasing Regulatory Scrutiny & Environmental Compliance Costs | -1.2% | Europe, North America, Australia, South America | Mid to Long-term (2027-2033) |

| Geopolitical Tensions & Trade Protectionism | -1.0% | Global, especially key producing and consuming regions | Short to Mid-term (2025-2029) |

| Skilled Labor Shortages in Mining and Processing | -0.7% | Global, particularly in remote mining areas | Mid to Long-term (2026-2033) |

Copper Molybdenum Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Copper Molybdenum market, covering historical data, current market dynamics, and future projections. It delves into the key drivers, restraints, opportunities, and challenges influencing market growth across various applications and geographical regions. The report offers detailed segmentation analysis, highlighting dominant and emerging segments, along with a thorough examination of the competitive landscape, profiling key market players and their strategic initiatives. It aims to deliver actionable insights to stakeholders for informed decision-making and strategic planning in this evolving global market.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Freeport-McMoRan Inc., Rio Tinto, BHP, Teck Resources Limited, Southern Copper Corporation, Sumitomo Metal Mining Co., Ltd., China Molybdenum Co., Ltd., Codelco, KGHM Polska Miedz S.A., MMG Limited, JX Nippon Mining & Metals Corporation, Sandvik AB, Kennametal Inc., Plansee SE, H.C. Starck GmbH, Xiamen Tungsten Co., Ltd., Toho Titanium Co., Ltd., Molycorp, Inc., Global Tungsten & Powders Corp., Ulba Metallurgical Plant |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Copper Molybdenum market is extensively segmented to provide a granular view of its diverse applications and forms, reflecting the varied industrial demands and manufacturing processes. These segments are critical for understanding specific market niches and identifying high-growth areas. The segmentation by application highlights the key industries driving demand, from high-tech electronics and the rapidly expanding electric vehicle sector to traditional heavy industries and emerging medical applications. This allows for a precise evaluation of where the material's unique properties are most valued and strategically utilized.

Further segmentation by form (rods, wires, plates, powder, alloys, etc.) indicates the different stages of processing and the specific product formats required by various end-users. The market's complexity is also captured through end-use industry segmentation, providing insights into which sectors are the primary consumers, ranging from automotive and electrical & electronics to construction and healthcare. This multi-dimensional segmentation facilitates a comprehensive understanding of market dynamics, enabling stakeholders to pinpoint specific opportunities and tailor strategies for different market verticals and product types.

- By Application:

- Electronics & Semiconductors

- Electric Vehicles

- Aerospace & Defense

- Energy & Power Generation

- Industrial Machinery

- Medical Devices

- Others

- By Form:

- Rods

- Wires

- Plates

- Sheets

- Powder

- Alloys

- Others

- By End-Use Industry:

- Automotive

- Electrical & Electronics

- Construction

- Heavy Industry

- Healthcare

- Others

Regional Highlights

The global Copper Molybdenum market exhibits significant regional variations, influenced by industrial development, resource availability, and technological adoption rates. Asia Pacific stands as the dominant region, primarily driven by the rapid expansion of manufacturing, electronics, and automotive industries in China, South Korea, Japan, and India. This region's robust economic growth and increasing investment in infrastructure and renewable energy projects contribute substantially to the demand for copper and molybdenum. Furthermore, the presence of major production facilities and a large consumer base solidifies Asia Pacific's leading position, making it a critical hub for both supply and demand dynamics in the global market.

North America and Europe also represent mature yet growing markets, characterized by advanced technological applications, stringent environmental regulations, and a strong emphasis on electric vehicle adoption and green energy transitions. These regions are leaders in research and development for new alloys and sustainable processing methods, driving demand for high-performance copper-molybdenum products in aerospace, defense, and high-tech electronics. Latin America, particularly countries like Chile and Peru, plays a crucial role in raw material supply, given their significant copper and molybdenum reserves. The Middle East and Africa regions are emerging markets, with increasing investments in infrastructure and industrial diversification projects contributing to a nascent but growing demand for these metals.

- Asia Pacific: Dominant market share due to rapid industrialization, high electronics manufacturing output, and significant investments in EVs and renewable energy, especially in China, South Korea, Japan, and India.

- North America: Strong demand driven by advanced manufacturing, aerospace and defense sectors, and increasing adoption of electric vehicles; focus on technological innovation and sustainable practices.

- Europe: Mature market with robust demand from automotive (EVs), renewable energy, and industrial machinery sectors; emphasis on circular economy and advanced material research.

- Latin America: Key region for raw material supply, particularly copper and molybdenum mining, with countries like Chile and Peru being major global producers influencing supply side.

- Middle East & Africa (MEA): Emerging market with growing demand from infrastructure development, industrial diversification efforts, and nascent automotive and energy sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Copper Molybdenum Market.- Freeport-McMoRan Inc.

- Rio Tinto

- BHP

- Teck Resources Limited

- Southern Copper Corporation

- Sumitomo Metal Mining Co., Ltd.

- China Molybdenum Co., Ltd.

- Codelco

- KGHM Polska Miedz S.A.

- MMG Limited

- JX Nippon Mining & Metals Corporation

- Sandvik AB

- Kennametal Inc.

- Plansee SE

- H.C. Starck GmbH

- Xiamen Tungsten Co., Ltd.

- Toho Titanium Co., Ltd.

- Global Tungsten & Powders Corp.

- Ulba Metallurgical Plant

- Mitsubishi Materials Corporation

Frequently Asked Questions

Analyze common user questions about the Copper Molybdenum market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current market size of the Copper Molybdenum industry?

The Copper Molybdenum market is estimated at USD 4.2 Billion in 2025, reflecting its critical role in various industrial applications globally.

What are the primary applications driving demand for Copper Molybdenum?

Key applications driving demand include electric vehicles, renewable energy infrastructure, high-performance electronics, and aerospace and defense components due to their superior thermal and electrical properties.

Which regions are leading in Copper Molybdenum market growth?

Asia Pacific, particularly China and India, is projected to be the leading region in market growth, driven by rapid industrialization, infrastructure development, and manufacturing expansion.

What are the main challenges facing the Copper Molybdenum market?

Major challenges include price volatility of raw materials, stringent environmental regulations, potential supply chain disruptions, and the depletion of high-grade ore deposits.

How is AI impacting the Copper Molybdenum market?

AI is transforming the market through optimized mineral exploration, enhanced operational efficiency in mining and processing, accelerated material design for new alloys, and improved market forecasting capabilities.