Consumer Luxury Good Market

Consumer Luxury Good Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702411 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Consumer Luxury Good Market Size

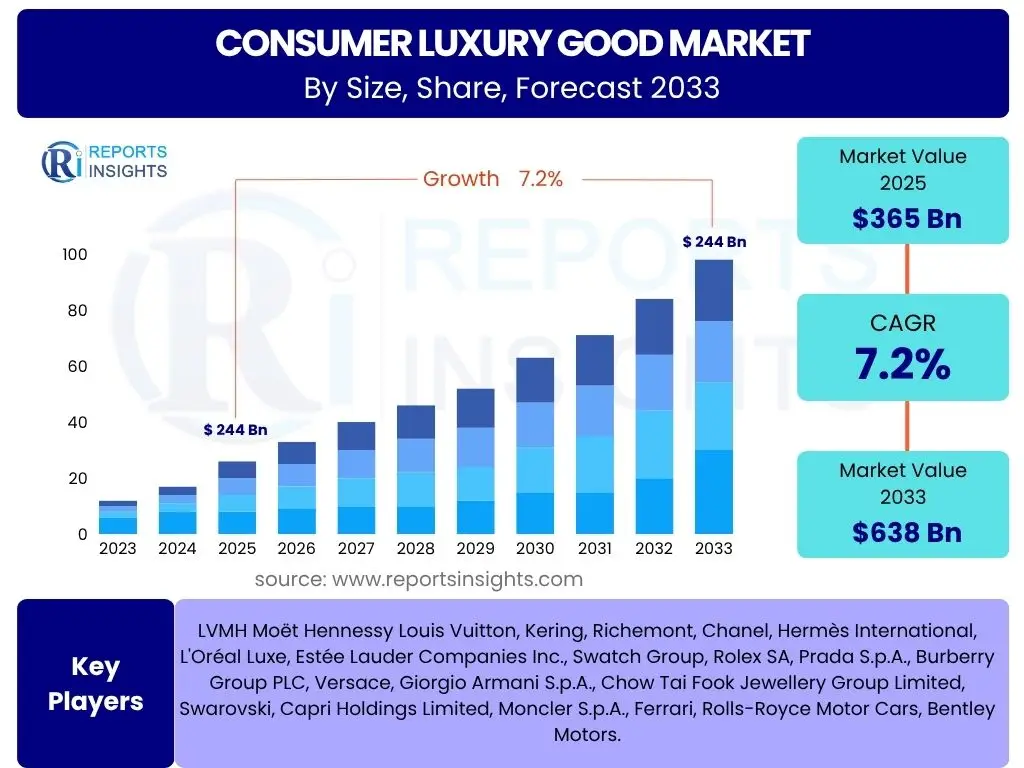

According to Reports Insights Consulting Pvt Ltd, The Consumer Luxury Good Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2033. The market is estimated at USD 365 Billion in 2025 and is projected to reach USD 638 Billion by the end of the forecast period in 2033.

Key Consumer Luxury Good Market Trends & Insights

The consumer luxury goods market is experiencing a significant transformation driven by evolving consumer behaviors, technological advancements, and a heightened focus on sustainability. Users frequently inquire about the enduring appeal of traditional luxury, the rise of new consumption patterns, and how brands are adapting to maintain relevance. Key themes emerging from these inquiries include the increasing importance of digital channels, the shift towards experiential luxury over mere product ownership, and the growing demand for transparent and ethically sourced products.

Moreover, there is a distinct interest in how luxury brands are engaging with younger demographics, particularly Gen Z and Millennials, who possess different values and purchasing habits compared to older generations. These demographics are less influenced by traditional advertising and more by authentic brand narratives, social impact, and digital presence. The market is also observing a blurring of lines between product categories, with luxury brands increasingly diversifying into hospitality, fine dining, and immersive experiences to offer a holistic lifestyle proposition.

The global economic landscape and geopolitical events also remain a central concern for market participants, influencing consumer confidence and purchasing power. Despite these challenges, the underlying desire for quality, craftsmanship, and exclusivity continues to drive demand. Brands are increasingly leveraging personalization and bespoke services to cater to individual preferences, enhancing customer loyalty and reinforcing the unique value proposition inherent in luxury goods.

- Digital Transformation and E-commerce Dominance: Accelerated shift to online sales channels and digital brand experiences.

- Sustainability and Ethical Sourcing: Growing consumer demand for environmentally conscious and socially responsible luxury products.

- Experiential Luxury: Increased preference for unique, personalized experiences over tangible goods.

- Personalization and Customization: Tailored products and services to meet individual consumer preferences.

- Rise of the Resale Market: Growth in pre-owned luxury goods driven by sustainability and affordability.

- Influence of Gen Z and Millennials: Brands adapting to the values and digital-native habits of younger consumers.

- Health and Wellness Integration: Expansion of luxury brands into premium wellness, beauty, and lifestyle categories.

AI Impact Analysis on Consumer Luxury Good

The integration of Artificial Intelligence (AI) into the consumer luxury goods sector is a topic of significant interest, with users frequently querying its applications across various business functions, from personalized customer experiences to supply chain optimization. The primary concerns revolve around balancing technological efficiency with the preservation of human touch, craftsmanship, and the exclusive nature of luxury. Users seek to understand how AI can enhance, rather than diminish, the unique attributes that define luxury brands, particularly regarding personalization, design, and customer service interactions.

AI's potential for revolutionizing customer engagement is a major theme. By leveraging vast datasets, AI algorithms can analyze consumer preferences, purchase history, and behavioral patterns to offer hyper-personalized recommendations and bespoke services. This capability extends to virtual try-ons, AI-powered chatbots for instantaneous support, and predictive analytics for anticipating future trends. The goal is to create seamless, intuitive, and highly individualized customer journeys that mirror the exclusivity traditionally found in physical luxury boutiques.

Beyond customer-facing applications, AI is significantly impacting back-end operations, enhancing efficiency and reducing waste. This includes optimizing inventory management, improving demand forecasting, streamlining logistics, and identifying fraudulent activities. Furthermore, AI is beginning to play a role in the creative process, assisting designers with trend analysis and generating innovative patterns or materials, thereby pushing the boundaries of traditional luxury design while maintaining a human-centric approach to creativity. The challenge lies in integrating AI ethically and transparently, ensuring data privacy and maintaining brand authenticity.

- Enhanced Personalization: AI-driven recommendations and tailored customer experiences.

- Optimized Supply Chain: Predictive analytics for inventory management and logistics efficiency.

- AI-Powered Customer Service: Chatbots and virtual assistants for instant support and query resolution.

- Trend Forecasting and Product Design: AI assisting in identifying emerging trends and generating design concepts.

- Fraud Detection and Brand Protection: AI algorithms safeguarding against counterfeiting and unauthorized sales.

- Immersive Digital Experiences: Virtual try-on and augmented reality applications enhancing online shopping.

- Data-Driven Marketing: Precision targeting of consumers through AI-powered advertising campaigns.

Key Takeaways Consumer Luxury Good Market Size & Forecast

The consumer luxury good market is poised for robust growth through the forecast period, driven by a confluence of factors including rising disposable incomes in emerging economies, increasing digitalization, and an evolving consumer mindset that values experiences and ethical consumption. Key insights reveal a market that is not only expanding in volume but also diversifying in its offerings and engagement strategies. The shift towards online channels and the integration of advanced technologies are becoming indispensable for brands seeking to capture market share and sustain growth.

A significant takeaway is the pivotal role of Asia Pacific, particularly China, as the primary engine of market expansion, demonstrating resilient demand and a rapidly growing high-net-worth individual (HNWI) population. While traditional markets in North America and Europe continue to provide stable foundations, the dynamic growth in emerging regions presents considerable opportunities. Furthermore, the market's future trajectory is heavily influenced by brands' ability to adapt to younger generations' preferences, who are driving the demand for sustainable, personalized, and digitally accessible luxury.

The forecast underscores a market that is increasingly resilient to economic fluctuations, exhibiting a strong capacity for innovation and adaptation. Brands that strategically invest in digital transformation, embrace sustainability as a core value, and prioritize authentic customer engagement are expected to thrive. The market's future will also be characterized by a greater emphasis on brand narratives that resonate with evolving societal values, moving beyond mere product attributes to encompass purpose and impact.

- Sustained Growth Trajectory: The market is projected for consistent expansion, surpassing pre-pandemic levels.

- Asia Pacific Dominance: Expected to remain the largest and fastest-growing region, particularly driven by China.

- Digital Transformation Imperative: Online sales and digital engagement are critical for market success.

- Shifting Consumer Values: Growing demand for sustainability, personalization, and experiential offerings.

- Resilience Amidst Challenges: The luxury market demonstrates robustness against economic uncertainties and geopolitical shifts.

Consumer Luxury Good Market Drivers Analysis

The consumer luxury good market is primarily driven by macro-economic factors combined with evolving consumer preferences. A significant driver is the continuous increase in disposable income across various global regions, particularly within emerging economies. As wealth accumulates, especially among the burgeoning middle and affluent classes, the propensity for discretionary spending on luxury items naturally rises. This demographic expansion provides a larger potential customer base for high-end products and services, fostering consistent market growth.

Furthermore, the growth of the high-net-worth individual (HNWI) population globally continues to fuel demand for ultra-luxury goods and bespoke experiences. These individuals seek exclusive, rare, and personalized offerings that signify status and provide unique value. Alongside economic prosperity, the increasing penetration of e-commerce and digital platforms has democratized access to luxury goods, expanding market reach beyond traditional physical retail spaces. This digital accessibility allows brands to connect with a wider audience and cater to global demand more efficiently, significantly impacting market dynamics.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Disposable Income & Affluent Population | +1.5% | Asia Pacific (China, India), Middle East | Long-term |

| Increasing E-commerce Penetration & Digitalization | +1.2% | Global, particularly North America, Europe | Medium-term |

| Growing Demand for Personalization & Exclusivity | +0.9% | Global | Medium-term |

| Brand Marketing & Influencer Collaborations | +0.8% | Global | Short to Medium-term |

| Urbanization & Lifestyle Aspirations | +0.7% | Emerging Markets (APAC, LATAM) | Long-term |

Consumer Luxury Good Market Restraints Analysis

Despite robust growth prospects, the consumer luxury good market faces several restraints that could impede its expansion. Economic downturns and recessions represent a significant threat, as luxury purchases are highly discretionary and often among the first expenditures to be cut during periods of financial uncertainty. Geopolitical instability, including trade wars, political unrest, and international conflicts, also poses a substantial restraint by disrupting supply chains, impacting tourism, and reducing consumer confidence, particularly in key luxury markets.

Another persistent challenge is the proliferation of counterfeit luxury products. These illicit goods not only erode brand value and intellectual property but also divert significant revenue away from legitimate luxury companies. Furthermore, supply chain vulnerabilities, such as raw material shortages, labor disputes, or logistical bottlenecks, can severely impact production capabilities and timely delivery, leading to missed sales opportunities and potential damage to brand reputation. Adapting to evolving consumer values, such as the growing demand for minimalism and anti-consumerism among certain segments, also presents a subtle but long-term restraint on traditional luxury consumption patterns.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Economic Volatility & Recessions | -0.8% | Global | Short to Medium-term |

| Geopolitical Instability & Trade Barriers | -0.7% | Europe, Asia Pacific | Short to Medium-term |

| Proliferation of Counterfeit Goods | -0.6% | Global, particularly Asia Pacific | Long-term |

| Supply Chain Disruptions | -0.5% | Global | Short-term |

| Shifting Consumer Values (e.g., Minimalism) | -0.4% | North America, Europe | Long-term |

Consumer Luxury Good Market Opportunities Analysis

The consumer luxury good market presents numerous opportunities for growth and innovation. One of the most significant opportunities lies in the expansion into untapped or underserved emerging markets, particularly in Southeast Asia, Latin America, and parts of the Middle East and Africa. These regions are witnessing a rapid increase in wealth and a growing appreciation for luxury goods, offering fertile ground for new brand entries and expansion strategies. Tailoring products and marketing to local cultural nuances can unlock substantial revenue streams in these diverse markets.

Furthermore, the increasing importance of sustainability and ethical practices provides a powerful avenue for brand differentiation and consumer engagement. Consumers, especially younger demographics, are increasingly willing to pay a premium for luxury products that are environmentally friendly, ethically sourced, and transparently produced. Brands that genuinely commit to these values can build stronger connections with conscious consumers and enhance their brand image. The growing luxury resale market also represents a significant opportunity, allowing brands to extend product lifecycles, attract new customer segments, and integrate circular economy principles into their business models. Investing in immersive digital experiences, such as augmented reality (AR) try-ons and virtual reality (VR) stores, further enhances the online shopping journey and captures the attention of tech-savvy consumers.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion in Emerging Markets | +1.0% | APAC, LATAM, MEA | Long-term |

| Growth of Sustainable & Ethical Luxury | +0.9% | Global, particularly Europe, North America | Medium to Long-term |

| Development of Experiential Luxury Offerings | +0.8% | Global | Medium-term |

| Leveraging Technology (AR/VR, NFTs) | +0.7% | Global | Short to Medium-term |

| Growth in the Luxury Resale Market | +0.6% | North America, Europe, Asia Pacific | Medium-term |

Consumer Luxury Good Market Challenges Impact Analysis

The consumer luxury good market, while resilient, faces distinct challenges that require strategic navigation. One major hurdle is maintaining exclusivity and brand integrity in an increasingly digital and mass-market accessible landscape. The pervasive nature of social media and e-commerce can inadvertently dilute the perception of exclusivity, which is a cornerstone of luxury. Brands must carefully balance broad digital outreach with curated, exclusive experiences to preserve their aspirational appeal. Furthermore, fierce competition from established players and new direct-to-consumer (DTC) luxury brands necessitates continuous innovation and differentiation to capture and retain discerning consumers.

Another significant challenge involves managing evolving consumer expectations, particularly from younger demographics like Gen Z, who demand authenticity, transparency, and social responsibility alongside luxury. Brands must not only adapt their product lines but also their entire operational ethos to align with these values, which can involve substantial investment in sustainable practices and ethical supply chains. Additionally, securing and retaining highly skilled artisans and creative talent remains a constant challenge, as the luxury industry relies heavily on exceptional craftsmanship and innovative design. Adapting to fluctuating regulatory environments, especially concerning environmental and labor standards, also adds complexity to global operations and product development.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Maintaining Exclusivity in Digital Age | -0.9% | Global | Long-term |

| Intensifying Competition & Market Saturation | -0.8% | Global | Medium to Long-term |

| Adapting to Rapidly Evolving Consumer Preferences | -0.7% | Global | Medium-term |

| Talent Acquisition & Retention (Artisans, Designers) | -0.6% | Europe, Asia Pacific | Long-term |

| Regulatory Compliance & Ethical Sourcing | -0.5% | Europe, North America | Medium to Long-term |

Consumer Luxury Good Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Consumer Luxury Good Market, offering critical insights into its current landscape, historical performance, and future growth projections. The scope encompasses a thorough examination of market size, trends, drivers, restraints, opportunities, and challenges influencing the industry's trajectory. It further delves into the impact of key technological advancements, such as Artificial Intelligence, on various facets of the luxury sector, providing stakeholders with a forward-looking perspective.

The report segments the market extensively by product type, end-user, and distribution channel, offering granular insights into each category's dynamics and growth potential. A detailed regional analysis highlights key country-level contributions and emerging market trends across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Additionally, the report profiles leading market players, offering an understanding of their strategies, product portfolios, and competitive positioning, ensuring a holistic view of the global consumer luxury goods landscape.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 365 Billion |

| Market Forecast in 2033 | USD 638 Billion |

| Growth Rate | 7.2% CAGR |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | LVMH Moët Hennessy Louis Vuitton, Kering, Richemont, Chanel, Hermès International, L'Oréal Luxe, Estée Lauder Companies Inc., Swatch Group, Rolex SA, Prada S.p.A., Burberry Group PLC, Versace, Giorgio Armani S.p.A., Chow Tai Fook Jewellery Group Limited, Swarovski, Capri Holdings Limited, Moncler S.p.A., Ferrari, Rolls-Royce Motor Cars, Bentley Motors. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The consumer luxury good market is meticulously segmented to provide a granular understanding of its diverse components and their respective growth trajectories. This segmentation allows for precise market analysis, identifying high-growth areas and informing strategic business decisions. The primary segmentation is based on product type, reflecting the wide array of luxury goods available, from fashion and accessories to hard luxury and experiential offerings. Each product category exhibits unique market dynamics influenced by trends, consumer preferences, and brand positioning.

Further segmentation by end-user, differentiating between male, female, and unisex consumers, sheds light on gender-specific consumption patterns and product preferences within the luxury space. This helps brands tailor their marketing and product development strategies more effectively. The distribution channel segmentation, encompassing both offline and online avenues, is crucial in understanding how luxury products reach consumers. The accelerated shift towards digital platforms, alongside the enduring importance of physical retail, underscores the necessity of an omnichannel approach for luxury brands to maximize market reach and customer engagement.

- Product Type:

- Apparel

- Footwear

- Accessories

- Jewelry

- Watches

- Cosmetics & Fragrances

- Other Luxury Goods (e.g., Luxury Travel, Automotive, Yachts)

- End-User:

- Men

- Women

- Unisex

- Distribution Channel:

- Offline (Mono-brand Stores, Department Stores, Specialty Boutiques)

- Online (Brand E-commerce, Multi-brand Platforms, Social Commerce)

Regional Highlights

The global consumer luxury good market exhibits distinct regional dynamics, with varied growth drivers and consumer behaviors across different geographies. Asia Pacific continues to be the most dominant and rapidly growing region, primarily driven by the escalating wealth and rising aspirations of consumers in countries like China, India, and South Korea. This region benefits from a large population base, increasing disposable incomes, and a strong cultural affinity for luxury goods as status symbols. The robust e-commerce infrastructure and digital adoption rates further amplify luxury consumption in this region.

North America maintains a significant share of the market, characterized by mature consumer spending habits, a robust economy, and a strong presence of both traditional and new luxury brands. The region's market is largely influenced by technological integration in retail, the growing demand for sustainable luxury, and a strong focus on experiential luxury. Europe, the historical heartland of luxury, continues to be a crucial market, renowned for its heritage brands, craftsmanship, and luxury tourism. While growth may be more measured compared to APAC, the region's established luxury ecosystem and high per capita spending ensure its enduring importance.

Latin America and the Middle East & Africa (MEA) represent emerging luxury markets with considerable potential. Latin America's growth is propelled by an expanding affluent class and increasing exposure to global luxury trends. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, showcases robust demand for high-end goods, supported by oil wealth, tourism, and a young, luxury-appreciating demographic. While smaller in market size compared to developed regions, these areas are expected to demonstrate significant growth rates as economic conditions improve and luxury brands expand their presence.

- Asia Pacific (APAC): Dominant and fastest-growing region, led by China and India, driven by rising disposable incomes and expanding affluent populations.

- North America: Stable and mature market, characterized by strong online sales and increasing demand for sustainable and experiential luxury.

- Europe: A heritage stronghold for luxury, with established brands and a focus on craftsmanship; recovering tourism contributes to sustained demand.

- Middle East & Africa (MEA): Emerging market with high growth potential, particularly in GCC countries, fueled by wealth and tourism.

- Latin America: Growing affluent class and increasing urbanization are driving demand for luxury goods, albeit from a smaller base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Consumer Luxury Good Market.- LVMH Moët Hennessy Louis Vuitton

- Kering

- Richemont

- Chanel

- Hermès International

- L'Oréal Luxe

- Estée Lauder Companies Inc.

- Swatch Group

- Rolex SA

- Prada S.p.A.

- Burberry Group PLC

- Versace

- Giorgio Armani S.p.A.

- Chow Tai Fook Jewellery Group Limited

- Swarovski

- Capri Holdings Limited

- Moncler S.p.A.

- Ferrari

- Rolls-Royce Motor Cars

- Bentley Motors

Frequently Asked Questions

What is the projected growth rate of the Consumer Luxury Good Market?

The Consumer Luxury Good Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2033. This consistent growth indicates a resilient market driven by increasing global wealth and evolving consumer preferences.

Which product categories are performing best in the luxury market?

While all luxury categories show growth, accessories (particularly handbags and eyewear), jewelry, and experiential luxury (e.g., high-end travel and dining) are currently demonstrating robust performance. Cosmetics and fragrances also continue to be strong entry points into luxury for many consumers.

How is sustainability influencing luxury brands and consumer choices?

Sustainability is profoundly influencing luxury, as consumers increasingly demand ethically sourced materials, transparent supply chains, and environmentally responsible production. Brands are responding by investing in eco-friendly practices, promoting circular economy models, and emphasizing their commitment to social responsibility, turning sustainability into a key differentiator.

What role does e-commerce play in the growth of the luxury market?

E-commerce plays a pivotal role, driving significant market growth by enhancing accessibility and convenience for luxury consumers globally. Online channels facilitate personalized interactions, virtual try-ons, and seamless purchasing experiences, expanding brand reach beyond traditional physical stores and attracting digital-native younger demographics.

Which regions offer the most significant growth potential for luxury goods?

Asia Pacific, particularly China and India, offers the most significant growth potential due to rapidly rising disposable incomes and a burgeoning affluent class. Emerging markets in Latin America and the Middle East & Africa also present considerable opportunities as their economies develop and luxury consumption increases.