Conductive Die Attach Film Market

Conductive Die Attach Film Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701071 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Conductive Die Attach Film Market Size

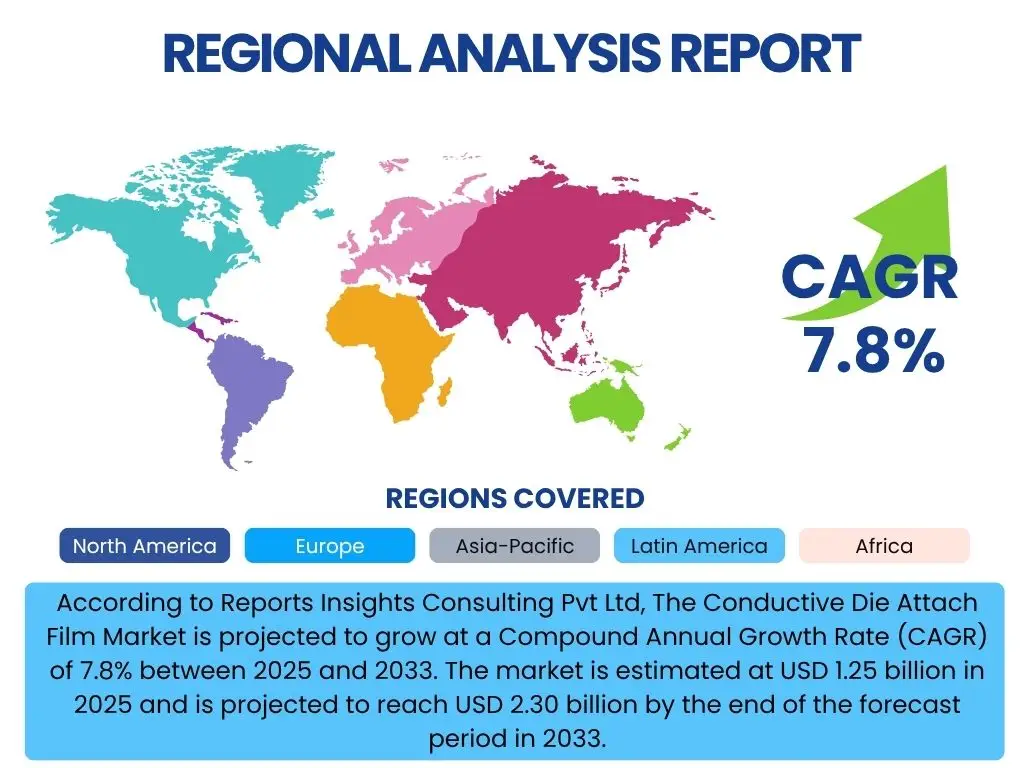

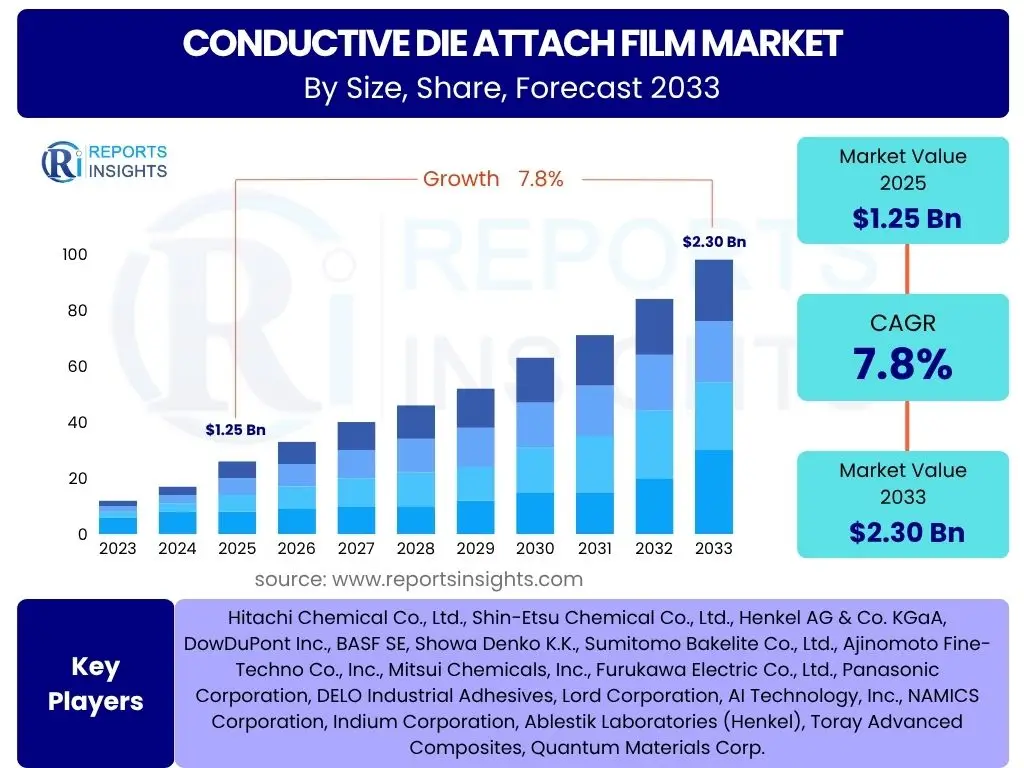

According to Reports Insights Consulting Pvt Ltd, The Conductive Die Attach Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033. The market is estimated at USD 1.25 billion in 2025 and is projected to reach USD 2.30 billion by the end of the forecast period in 2033.

Key Conductive Die Attach Film Market Trends & Insights

The Conductive Die Attach Film market is experiencing dynamic shifts driven by advancements in semiconductor technology and increasing demand for compact, high-performance electronic devices. A key trend is the continuous miniaturization of electronic components, necessitating thinner, more reliable, and thermally efficient die attach solutions. This drives innovation in film formulations, focusing on improved electrical and thermal conductivity, reduced curing times, and enhanced adhesion properties for increasingly sensitive and densely packed integrated circuits.

Another significant trend is the burgeoning adoption of advanced packaging technologies such as 3D ICs, System-in-Package (SiP), and Chip-on-Wafer (CoW), all of which heavily rely on high-performance conductive die attach films. The expansion of emerging technologies like 5G, Artificial Intelligence (AI), Internet of Things (IoT), and autonomous vehicles further accelerates the demand for specialized conductive films capable of handling higher power densities and operating temperatures. Furthermore, there is a growing emphasis on environmentally friendly and halogen-free formulations due to stricter regulatory landscapes and increasing industry awareness regarding sustainability.

These trends collectively shape the R&D landscape, pushing manufacturers to develop materials that offer superior performance under extreme conditions, ensuring long-term reliability for critical applications. The market is also witnessing a move towards customized film solutions tailored to specific semiconductor designs and manufacturing processes, moving away from a one-size-fits-all approach. This customization is crucial for optimizing performance in highly specialized applications, ensuring compatibility with diverse substrates and processing requirements, and ultimately contributing to higher yields and reduced production costs for semiconductor manufacturers globally.

- Miniaturization of electronic components driving demand for thinner films.

- Rapid adoption of advanced packaging technologies (3D ICs, SiP).

- Increased integration of 5G, IoT, AI, and automotive electronics.

- Development of high thermal and electrical conductivity films.

- Shift towards eco-friendly and halogen-free material formulations.

- Growing demand for customized die attach film solutions.

- Focus on high reliability and performance under extreme operating conditions.

AI Impact Analysis on Conductive Die Attach Film

Artificial Intelligence (AI) exerts a multi-faceted influence on the Conductive Die Attach Film market, primarily by driving demand for the underlying hardware that powers AI applications. The rapid proliferation of AI, machine learning, and deep learning algorithms necessitates high-performance processors, GPUs, and specialized AI accelerators, all of which require advanced packaging solutions and, consequently, high-quality conductive die attach films. As AI models become more complex and require greater computational power, the demand for chips with higher transistor density and improved thermal management capabilities intensifies, directly benefiting the market for conductive films designed to dissipate heat efficiently.

Beyond demand generation, AI is also transforming the manufacturing and research processes within the semiconductor industry, indirectly impacting conductive die attach films. AI-powered analytics and machine learning algorithms are being utilized to optimize manufacturing parameters for die attach processes, leading to improved yield rates, enhanced material consistency, and predictive maintenance for production equipment. This optimization capability ensures more efficient use of conductive films and contributes to higher quality end products. Furthermore, AI can accelerate material discovery and development, allowing researchers to simulate and test new film compositions more rapidly, potentially leading to the creation of novel materials with superior conductive and adhesive properties tailored for future AI hardware.

The integration of AI into quality control systems within semiconductor manufacturing also plays a crucial role. AI-driven vision systems can detect microscopic defects in die attach processes with unparalleled precision, ensuring the integrity and reliability of the bond. This level of scrutiny emphasizes the need for consistent and high-quality conductive die attach films. The overall trajectory suggests that as AI continues to evolve and permeate various industries, its demand-side and operational efficiencies will increasingly contribute to the growth and technological advancement within the conductive die attach film market, pushing for films that can meet the stringent demands of next-generation AI processing units and their associated thermal management challenges.

- Increased demand for high-performance AI processors driving chip production.

- AI-driven optimization of die attach manufacturing processes for efficiency.

- Accelerated material discovery and formulation through AI simulations.

- Enhanced quality control and defect detection in die bonding using AI.

- Need for films with superior thermal conductivity for AI hardware heat dissipation.

- Development of specialized films for advanced AI packaging architectures.

- Predictive analytics for equipment maintenance ensuring consistent film application.

Key Takeaways Conductive Die Attach Film Market Size & Forecast

The Conductive Die Attach Film market is poised for robust growth, driven primarily by the relentless innovation in the semiconductor industry and the expanding applications of electronic devices. A fundamental takeaway is the direct correlation between the proliferation of advanced packaging technologies and the demand for these films. As the industry moves towards more compact, powerful, and integrated chips, the reliance on high-performance conductive films for efficient heat dissipation and electrical connectivity becomes paramount, ensuring the stability and longevity of intricate electronic systems across various sectors.

Another critical insight is the significant role of emerging technologies, such as 5G networks, artificial intelligence, and the Internet of Things, in stimulating market expansion. These technologies demand higher data processing speeds, increased power efficiency, and enhanced reliability from electronic components, which in turn necessitates superior die attach solutions. The automotive industry, with its rapid shift towards electric vehicles and autonomous driving systems, also represents a substantial growth avenue, requiring robust and durable conductive films capable of withstanding harsh environmental conditions and ensuring long-term performance.

Furthermore, the market's future growth will be influenced by continuous material innovation, focusing on ultra-thin films, improved thermal management, and environmentally compliant formulations. The competitive landscape suggests that companies investing in R&D for next-generation materials and offering customized solutions will gain a significant competitive edge. Overall, the market is characterized by a strong demand pull from diverse high-tech industries, indicating a sustained period of expansion and technological evolution for conductive die attach films.

- Market demonstrates strong growth potential driven by semiconductor advancements.

- Advanced packaging technologies are a primary demand catalyst.

- Emerging tech (5G, AI, IoT, Automotive) significantly boosts film adoption.

- Emphasis on high thermal and electrical conductivity for performance.

- Sustainable and eco-friendly film development is a growing priority.

- Customized solutions are crucial for meeting specific application needs.

- Continuous material innovation is key for competitive advantage.

Conductive Die Attach Film Market Drivers Analysis

The Conductive Die Attach Film market is significantly propelled by several key drivers, primarily stemming from the exponential growth and technological evolution within the global electronics and semiconductor industries. The increasing demand for miniaturized and high-performance electronic devices, ranging from smartphones and wearables to high-end servers and data center equipment, necessitates more sophisticated and efficient die attach solutions. As electronic components become smaller and denser, the need for films that offer superior electrical conductivity, thermal management, and mechanical integrity becomes critical, driving the adoption of advanced conductive die attach films.

Furthermore, the rapid expansion of advanced packaging technologies like System-in-Package (SiP), Chip-on-Wafer (CoW), and 3D Integrated Circuits (3D ICs) acts as a powerful catalyst for market growth. These packaging innovations enable higher integration density and improved performance, but they rely heavily on specialized die attach films that can bond multiple dies with precision and reliability. The pervasive growth of emerging technologies such as 5G connectivity, Artificial Intelligence (AI), the Internet of Things (IoT), and autonomous vehicles also fuels demand, as these applications require robust, high-performance chips that depend on advanced die attach films for their functionality and thermal stability.

The burgeoning automotive electronics sector, characterized by the increasing adoption of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and in-car infotainment systems, presents another substantial driver. Electronic components in automotive applications must withstand extreme temperatures, vibrations, and harsh operating environments, demanding highly reliable and durable conductive die attach films. The continuous research and development efforts by key market players to innovate new materials with enhanced properties, such as improved heat dissipation capabilities and faster curing times, further contribute to market expansion by addressing evolving industry needs and performance benchmarks.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Miniaturization of Electronic Devices | +1.5% | Global, particularly Asia Pacific (APAC) | 2025-2033 (Long-term) |

| Growth of Advanced Packaging Technologies | +1.2% | Global, especially North America, APAC | 2025-2033 (Long-term) |

| Proliferation of 5G, AI, and IoT Technologies | +1.0% | Global, high impact in China, USA, Korea, Japan | 2025-2030 (Mid-term) |

| Expansion of Automotive Electronics | +0.8% | Europe, North America, China | 2026-2033 (Mid- to Long-term) |

| Increasing Demand for High-Performance Computing | +0.7% | Global, particularly USA, Europe, Japan | 2025-2033 (Long-term) |

Conductive Die Attach Film Market Restraints Analysis

Despite robust growth prospects, the Conductive Die Attach Film market faces several restraints that could potentially impede its full expansion. One significant challenge is the high cost associated with the research, development, and manufacturing of advanced conductive die attach films. These films often incorporate specialized materials and complex manufacturing processes to achieve desired electrical and thermal properties, leading to higher production costs. This can make them less competitive for certain cost-sensitive applications or in emerging markets where budget constraints are more pronounced, pushing manufacturers to seek cheaper, albeit less performant, alternatives.

Another substantial restraint is the stringent performance and reliability requirements demanded by end-use industries, particularly in automotive, aerospace, and high-performance computing. Any failure in the die attach film can lead to catastrophic failure of the entire electronic component, making quality control and consistency paramount. Meeting these high standards necessitates rigorous testing and adherence to complex manufacturing protocols, which adds to operational complexities and can slow down product development cycles. The ongoing miniaturization trend also contributes to this challenge, as achieving reliable bonds in ever-smaller spaces with thinner films presents significant engineering hurdles and demands higher precision.

Furthermore, the market faces competition from alternative die attach materials and technologies, such as non-conductive films, epoxy adhesives, and solder-based solutions. While conductive die attach films offer unique advantages, the continued innovation in these alternative methods might present viable substitutes for specific applications, thereby limiting market penetration for conductive films. Supply chain volatility, particularly concerning critical raw materials, and the increasing complexity of international trade regulations also pose potential disruptions, affecting production schedules and material costs, and thus impacting market growth stability. These factors collectively require strategic planning and continuous innovation from market players to mitigate their adverse effects.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Manufacturing and R&D Costs | -0.9% | Global, impacting developing economies more | 2025-2030 (Mid-term) |

| Stringent Performance and Reliability Requirements | -0.7% | Global, particularly for critical applications | 2025-2033 (Long-term) |

| Competition from Alternative Die Attach Materials | -0.6% | Global, varying by application segment | 2025-2030 (Mid-term) |

| Supply Chain Volatility of Raw Materials | -0.5% | Global, particularly impacting regions reliant on specific imports | 2025-2027 (Short-term) |

| Intellectual Property and Patent Challenges | -0.4% | Global, high impact in competitive regions like APAC | 2025-2033 (Long-term) |

Conductive Die Attach Film Market Opportunities Analysis

The Conductive Die Attach Film market presents numerous lucrative opportunities, driven by technological advancements and the expansion into new application areas. A significant opportunity lies in the burgeoning demand for high-performance computing (HPC) and data centers. As cloud computing, big data analytics, and artificial intelligence become more pervasive, the need for powerful, efficient, and thermally stable processors escalates. Conductive die attach films, with their superior thermal management capabilities, are critical components in these high-power applications, offering a substantial growth avenue for specialized film solutions designed for extreme operating conditions and enabling higher integration densities in server architectures.

Another key opportunity emerges from the rapid proliferation of wearable electronics and medical devices. These devices often require ultra-miniaturized components with flexible or bendable substrates, necessitating die attach films that are not only highly conductive but also offer excellent flexibility, low stress, and biocompatibility. The development of novel film materials that can meet these unique demands, such as stretchable conductive films or those with very low curing temperatures, will unlock new market segments. Furthermore, the increasing focus on sustainable and green manufacturing practices worldwide opens doors for companies innovating in eco-friendly and halogen-free conductive film formulations, appealing to a growing segment of environmentally conscious manufacturers and consumers.

Geographic expansion, particularly into emerging economies in Asia Pacific and Latin America, also offers considerable growth prospects. These regions are experiencing rapid industrialization, increasing disposable incomes, and a surge in domestic electronics manufacturing, leading to higher demand for semiconductor components. Collaborations with semiconductor foundries and original equipment manufacturers (OEMs) to develop customized film solutions for specific chip designs and next-generation packaging technologies will also provide a competitive edge. The ongoing innovation in advanced packaging, such as fan-out wafer-level packaging (FOWLP) and glass interposers, will continue to create demand for novel conductive die attach films capable of supporting these cutting-edge assembly methods, thereby expanding the market's reach and enhancing its technological capabilities.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in High-Performance Computing (HPC) & Data Centers | +1.3% | Global, particularly North America, Europe, APAC | 2025-2033 (Long-term) |

| Emergence of Wearable & Flexible Electronics | +1.0% | Global, high potential in Asia Pacific | 2026-2033 (Mid- to Long-term) |

| Development of Eco-Friendly & Halogen-Free Films | +0.8% | Europe, North America, Japan, South Korea | 2025-2030 (Mid-term) |

| Untapped Potential in Emerging Economies | +0.7% | Southeast Asia, Latin America, India | 2027-2033 (Long-term) |

| Expansion in Advanced Medical Devices | +0.6% | North America, Europe, Japan | 2025-2033 (Long-term) |

Conductive Die Attach Film Market Challenges Impact Analysis

The Conductive Die Attach Film market faces several significant challenges that necessitate strategic responses from industry participants. One primary challenge is the rapid pace of technological advancements in semiconductor manufacturing, which constantly demands newer, more sophisticated film properties. As chips become smaller, more powerful, and operate at higher temperatures, existing film technologies can quickly become obsolete, requiring continuous and costly investment in research and development to keep pace. This creates immense pressure on manufacturers to innovate rapidly while maintaining cost-effectiveness and scalability, preventing a one-size-fits-all solution for diverse and evolving packaging needs.

Another critical challenge is maintaining stringent quality control and achieving high yields in production. Die attach films are integral to the reliability and performance of semiconductor devices, and even microscopic defects can lead to significant product failures. Ensuring consistent film thickness, uniform particle dispersion, and defect-free application across millions of units presents substantial manufacturing complexities. The highly competitive nature of the semiconductor industry also means that even slight variations in performance or cost can impact market share, forcing manufacturers to optimize their processes continuously to meet uncompromising industry standards and customer expectations for defect-free products.

Furthermore, the global supply chain for raw materials, particularly for specialized conductive fillers like silver, copper, and carbon nanotubes, is susceptible to price volatility and geopolitical disruptions. This can impact the cost of production and the stability of supply for conductive die attach film manufacturers. Additionally, increasing environmental regulations concerning hazardous substances and manufacturing processes (e.g., solvent use, waste disposal) impose compliance burdens and necessitate investments in greener technologies and materials. These regulatory pressures, combined with the intense competition from established players and new entrants, require companies to navigate a complex landscape that balances innovation, cost management, and regulatory adherence while striving for market leadership.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Technological Obsolescence | -0.8% | Global, higher impact in technologically advanced regions | 2025-2033 (Long-term) |

| Maintaining High Quality Control and Yields | -0.7% | Global, particularly in high-volume manufacturing hubs | 2025-2030 (Mid-term) |

| Fluctuations in Raw Material Prices | -0.6% | Global, impacting regions reliant on specific imports | 2025-2028 (Short- to Mid-term) |

| Complex Regulatory and Environmental Compliance | -0.5% | Europe, North America, Japan (due to stringent regulations) | 2025-2033 (Long-term) |

| Intense Competition and Pricing Pressures | -0.4% | Global, highly competitive in Asia Pacific | 2025-2030 (Mid-term) |

Conductive Die Attach Film Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Conductive Die Attach Film market, offering a detailed segmentation by various parameters including product type, application, end-use industry, and geographic region. It covers historical data from 2019 to 2023, provides current market estimates for 2024, and offers forward-looking projections up to 2033. The report delves into key market drivers, restraints, opportunities, and challenges influencing market dynamics, along with a thorough competitive landscape analysis, including profiles of leading market participants. It aims to deliver strategic insights for stakeholders to make informed business decisions in this evolving industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.30 Billion |

| Growth Rate | 7.8% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Chemical Co., Ltd., Shin-Etsu Chemical Co., Ltd., Henkel AG & Co. KGaA, DowDuPont Inc., BASF SE, Showa Denko K.K., Sumitomo Bakelite Co., Ltd., Ajinomoto Fine-Techno Co., Inc., Mitsui Chemicals, Inc., Furukawa Electric Co., Ltd., Panasonic Corporation, DELO Industrial Adhesives, Lord Corporation, AI Technology, Inc., NAMICS Corporation, Indium Corporation, Ablestik Laboratories (Henkel), Toray Advanced Composites, Quantum Materials Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Conductive Die Attach Film market is extensively segmented to provide a granular understanding of its diverse applications and material compositions. This segmentation allows for precise market analysis, identifying high-growth areas and niche opportunities within the broader industry landscape. By categorizing the market based on various technical and application-specific criteria, stakeholders can gain deeper insights into consumer preferences, technological shifts, and competitive dynamics across different market verticals. This detailed breakdown highlights the specialized requirements of various electronic components and end-use industries, showcasing the versatility and critical importance of conductive die attach films in modern electronics manufacturing.

The segmentation by type distinguishes between Isotropic Conductive Films (ICF), Anisotropic Conductive Films (ACF), and Non-Conductive Films (NCF) used in conjunction with conductive elements. Each type possesses distinct electrical properties and application methods, catering to different bonding needs. Material segmentation, encompassing epoxy-based, silicone-based, acrylate-based, and polyimide-based films, reflects the various chemical compositions that offer unique performance characteristics such as thermal stability, adhesion strength, and flexibility. This allows for tailored solutions depending on the operating environment and stress factors of the final device.

Application-based segmentation covers a wide array of electronic components, including memory devices, logic devices, optoelectronics, power devices, and RF devices, each demanding specific film properties for optimal performance. Furthermore, the end-use industry segmentation provides insight into market demand from key sectors like consumer electronics, automotive, industrial, IT & telecom, medical, and aerospace & defense, underscoring the broad utility of these films. Finally, the segmentation by form, namely wafer-level films and sheet/roll films, distinguishes between methods of film application during manufacturing, reflecting different production scales and integration levels. This comprehensive segmentation provides a holistic view of the market's structure and its inherent complexities.

- By Type:

- Isotropic Conductive Films (ICF)

- Anisotropic Conductive Films (ACF)

- Non-Conductive Films (NCF)

- By Material:

- Epoxy-based

- Silicone-based

- Acrylate-based

- Polyimide-based

- By Application:

- Memory Devices

- Logic Devices

- Optoelectronics

- Power Devices

- RF Devices

- By End-Use Industry:

- Consumer Electronics

- Automotive

- Industrial

- IT & Telecom

- Medical

- Aerospace & Defense

- By Form:

- Wafer-level Film

- Sheet/Roll Film

Regional Highlights

- Asia Pacific (APAC): The Asia Pacific region stands as the dominant market for Conductive Die Attach Films, primarily driven by the presence of a vast and rapidly expanding semiconductor manufacturing ecosystem, particularly in countries like China, South Korea, Taiwan, and Japan. This region is a global hub for electronics production, assembly, and packaging, fueled by significant investments in R&D, a large pool of skilled labor, and favorable government policies promoting technological advancement. The booming consumer electronics sector, coupled with increasing adoption of 5G infrastructure, AI, and IoT devices, further accelerates the demand for advanced die attach films. The region also benefits from a robust supply chain for raw materials and component manufacturing, making it a critical market for both production and consumption. Countries like India and Southeast Asian nations are also emerging as significant contributors, attracting foreign direct investment in electronics manufacturing, thereby sustaining the region's market leadership.

- North America: North America represents a mature yet innovative market for Conductive Die Attach Films, characterized by significant R&D activities and a strong presence of leading semiconductor design and high-performance computing companies. The demand here is largely driven by the aerospace and defense sectors, advanced medical devices, and the burgeoning data center and AI industries, all requiring highly reliable and thermally efficient electronic components. While manufacturing has seen some shifts, the region remains at the forefront of technological innovation in packaging and chip design, driving the need for specialized and high-value conductive film solutions. Strategic investments in domestic semiconductor production, particularly in advanced nodes, will further bolster the regional market.

- Europe: Europe's Conductive Die Attach Film market is characterized by a strong focus on the automotive industry, industrial electronics, and specialized medical applications. Countries like Germany, France, and the Netherlands are key players in automotive electronics manufacturing, driving demand for robust and durable die attach films capable of withstanding harsh environments. The region's emphasis on sustainability also fosters innovation in eco-friendly and halogen-free film formulations. While not as dominant in high-volume consumer electronics manufacturing as APAC, Europe excels in niche, high-value applications that require superior performance and reliability, ensuring a steady demand for advanced conductive die attach films.

- Latin America: The Latin American market for Conductive Die Attach Films is in an nascent stage but is expected to exhibit moderate growth. This growth is primarily influenced by increasing foreign investment in electronics assembly plants, a growing consumer electronics market, and nascent automotive manufacturing capabilities in countries like Mexico and Brazil. While the overall market size is smaller compared to other regions, urbanization and improving economic conditions are expected to drive demand for electronic devices, subsequently boosting the regional market for die attach films. Localized production and partnerships are key strategies for market players to penetrate this developing region.

- Middle East and Africa (MEA): The Middle East and Africa region presents a nascent but emerging market for Conductive Die Attach Films. Growth is primarily driven by expanding IT infrastructure projects, increasing digitalization efforts, and some investments in industrial electronics. The development of smart cities and diversification of economies away from traditional sectors are creating new opportunities for electronic component demand. While currently a smaller market, strategic investments in technological infrastructure and a growing youth demographic with increasing access to electronic devices are expected to contribute to gradual market expansion in the long term, particularly in countries like UAE, Saudi Arabia, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Conductive Die Attach Film Market.- Hitachi Chemical Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Henkel AG & Co. KGaA

- DowDuPont Inc.

- BASF SE

- Showa Denko K.K.

- Sumitomo Bakelite Co., Ltd.

- Ajinomoto Fine-Techno Co., Inc.

- Mitsui Chemicals, Inc.

- Furukawa Electric Co., Ltd.

- Panasonic Corporation

- DELO Industrial Adhesives

- Lord Corporation

- AI Technology, Inc.

- NAMICS Corporation

- Indium Corporation

- Ablestik Laboratories (Henkel)

- Toray Advanced Composites

- Quantum Materials Corp.

- Dyneon GmbH (3M Company)

Frequently Asked Questions

Analyze common user questions about the Conductive Die Attach Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Conductive Die Attach Film?

A Conductive Die Attach Film is a thin, adhesive material used in semiconductor packaging to mechanically bond a semiconductor die (chip) to a substrate or leadframe while providing electrical and thermal conductivity. It ensures reliable electrical connections and dissipates heat generated by the chip, critical for device performance and longevity.

Why are Conductive Die Attach Films important in electronics?

These films are crucial for their dual role in establishing robust electrical pathways and efficiently managing heat within integrated circuits. They enable miniaturization, enhance device reliability by preventing overheating, and support the functionality of high-performance components in modern electronic devices across various industries.

What are the primary applications of Conductive Die Attach Films?

Primary applications include bonding dies in memory devices, logic chips (CPUs/GPUs), power semiconductors, optoelectronic components, and RF devices. They are widely utilized in consumer electronics, automotive systems, industrial equipment, telecommunications infrastructure, and medical devices.

How do Conductive Die Attach Films differ from non-conductive alternatives?

Conductive films contain electrically conductive fillers (e.g., silver particles) to provide electrical pathways and thermal conductivity, whereas non-conductive alternatives primarily offer mechanical bonding and electrical insulation, often paired with separate thermal interfaces for heat management.

What are the key trends shaping the Conductive Die Attach Film market?

Key trends include the continuous miniaturization of electronic components, growth in advanced packaging technologies (e.g., 3D ICs), increasing demand from 5G, AI, and automotive electronics, and a growing emphasis on developing high-performance, eco-friendly, and customized film solutions.