Commercial Food Processor Market

Commercial Food Processor Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703993 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Commercial Food Processor Market Size

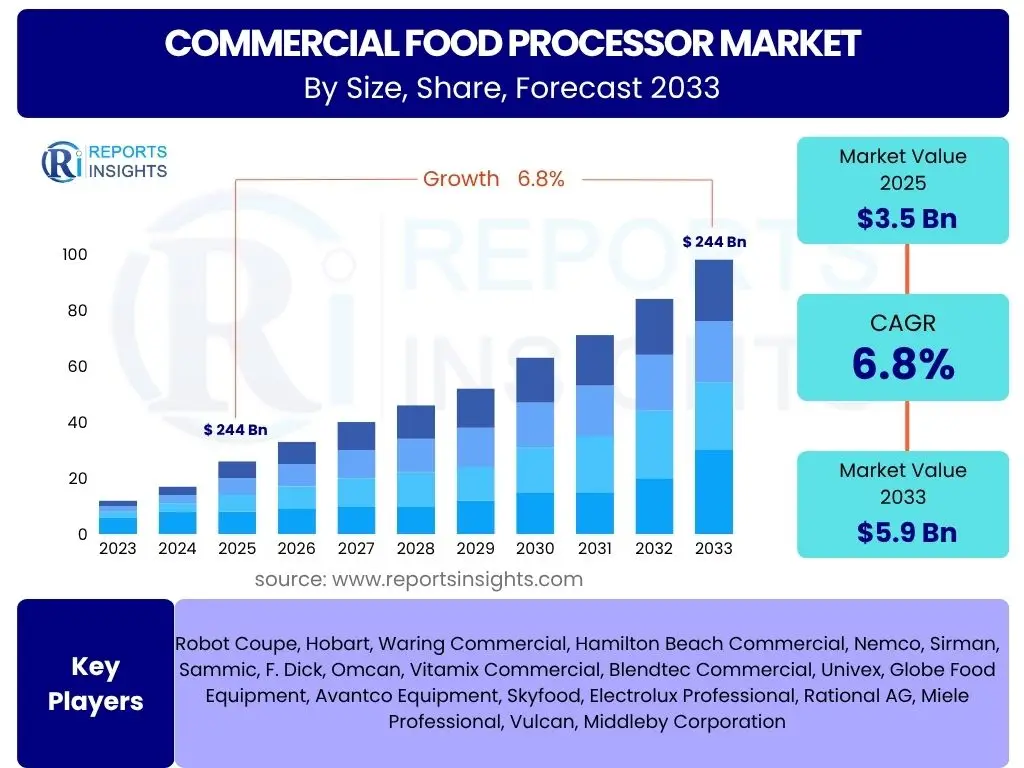

According to Reports Insights Consulting Pvt Ltd, The Commercial Food Processor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 3.5 Billion in 2025 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033.

Key Commercial Food Processor Market Trends & Insights

The commercial food processor market is currently experiencing significant shifts driven by evolving consumer demands, technological advancements, and operational efficiency requirements within the food service industry. Key trends indicate a strong focus on automation, multi-functionality, and enhanced hygiene features to meet the rigorous demands of commercial kitchens and food preparation facilities. Businesses are increasingly seeking solutions that can streamline complex food preparation tasks, reduce manual labor, and maintain consistent output quality, leading to higher adoption rates of advanced processing equipment.

Furthermore, the growing emphasis on sustainable practices and energy efficiency is influencing product design and material selection within the market. Manufacturers are responding with innovations that offer improved energy consumption, reduced food waste, and longer product lifecycles. The expanding global HoReCa (Hotel, Restaurant, and Cafe) sector, coupled with the rising popularity of diverse cuisines and prepared meal solutions, is fueling the demand for versatile and robust food processing equipment capable of handling a wide array of ingredients and preparation styles.

- Increased adoption of automation and smart technology for enhanced operational efficiency.

- Growing demand for multi-functional food processors capable of diverse tasks (slicing, dicing, chopping, pureeing).

- Focus on hygiene-friendly designs and materials for easier cleaning and maintenance.

- Rising demand from Quick Service Restaurants (QSRs) and institutional catering for high-capacity, durable machines.

- Integration of energy-efficient components and sustainable manufacturing practices.

AI Impact Analysis on Commercial Food Processor

The integration of Artificial Intelligence (AI) into commercial food processing represents a transformative shift, addressing common user questions about how technology can optimize kitchen operations and ensure higher standards. AI algorithms can analyze vast datasets from sensors embedded in food processors to monitor performance metrics such as motor temperature, blade wear, and processing speeds. This enables predictive maintenance, allowing for timely servicing of equipment before critical failures occur, thereby minimizing downtime and extending the lifespan of machinery, which is a significant concern for commercial operators regarding equipment longevity and repair costs.

Beyond maintenance, AI is also poised to enhance operational precision and quality control. Users often inquire about consistency in food preparation; AI can ensure this by dynamically adjusting processing parameters based on ingredient characteristics, achieving uniform cuts, textures, and blends. For example, AI-powered vision systems can inspect ingredients for quality and consistency before or during processing, identifying anomalies that human operators might miss. This leads to reduced waste, improved food safety, and a more consistent end product, directly addressing user expectations for efficiency and quality assurance in high-volume environments.

- Predictive maintenance capabilities, reducing downtime and extending equipment lifespan.

- Enhanced quality control through AI-powered ingredient analysis and processing adjustments.

- Optimization of processing parameters for consistent output and reduced waste.

- Automated recipe execution and scaling, improving precision and efficiency in batch production.

- Data-driven insights for operational efficiency and supply chain optimization.

Key Takeaways Commercial Food Processor Market Size & Forecast

The commercial food processor market is poised for robust and sustained growth through 2033, driven primarily by the global expansion of the HoReCa sector and an increasing emphasis on operational efficiency and labor cost reduction in commercial kitchens. This growth trajectory underscores the critical role that advanced food processing equipment plays in modern food preparation, enabling businesses to meet rising consumer demand for convenience, variety, and quality in food products. The forecasted market expansion highlights a consistent need for efficient, durable, and versatile processing solutions across various food service segments.

Technological innovation, particularly in automation and smart features, will be a significant determinant of market share and future development. Manufacturers that can effectively integrate these capabilities, alongside a focus on user-friendliness, energy efficiency, and stringent hygiene standards, are well-positioned for success. Furthermore, the market's trajectory suggests that investment in high-capacity and multi-functional processors will be a strategic imperative for businesses aiming to optimize their kitchen workflows and elevate their culinary offerings in an increasingly competitive landscape.

- Sustained market expansion driven by global food service industry growth.

- Increased investment in high-capacity and multi-functional processing equipment.

- Technological advancements, including automation and smart features, are critical for competitive advantage.

- Growing emphasis on hygiene, food safety, and energy efficiency in product design.

- Strategic importance of efficient food preparation tools for labor optimization in commercial kitchens.

Commercial Food Processor Market Drivers Analysis

The commercial food processor market is experiencing significant growth propelled by several key drivers. The escalating demand for processed and convenience foods globally, coupled with the rapid expansion of the hospitality sector, including restaurants, hotels, and catering services, is creating a sustained need for efficient food preparation equipment. These businesses rely heavily on commercial food processors to manage high volumes of food production, ensure consistency in preparation, and significantly reduce labor costs associated with manual food chopping, slicing, and dicing. The imperative to maximize operational efficiency and productivity within commercial kitchens is a primary motivator for adoption.

Additionally, stringent food safety regulations and rising hygiene standards are compelling food service establishments to invest in equipment that facilitates easy cleaning and reduces cross-contamination risks. Modern commercial food processors are designed with materials and features that comply with these regulations, offering enhanced safety and sanitation. The continuous innovation in food processor technology, introducing features like improved motor power, versatile attachments, and ergonomic designs, further drives market expansion by offering superior performance and user experience. Moreover, the increasing adoption of these machines in emerging economies, driven by evolving dietary habits and urbanization, contributes significantly to market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in HoReCa and QSR sectors | +1.5% | Global, particularly Asia Pacific & Middle East | Short to Mid-term (2025-2030) |

| Increasing demand for processed and convenience foods | +1.2% | North America, Europe, Asia Pacific | Mid to Long-term (2025-2033) |

| Focus on labor cost reduction and operational efficiency | +1.0% | Global | Short to Mid-term (2025-2030) |

| Technological advancements and automation integration | +0.8% | Developed economies (North America, Europe) | Mid-term (2027-2033) |

| Stricter food safety and hygiene regulations | +0.7% | Global | Ongoing |

Commercial Food Processor Market Restraints Analysis

Despite the positive growth trajectory, the commercial food processor market faces several significant restraints that could impede its expansion. One primary challenge is the high initial investment cost associated with purchasing commercial-grade food processors. These machines, especially high-capacity and technologically advanced models, represent a substantial capital expenditure for many businesses, particularly small to medium-sized enterprises (SMEs) and new entrants in the food service industry. This high upfront cost can deter potential buyers, leading them to opt for less efficient manual labor or lower-grade equipment, thereby limiting market penetration.

Another restraint involves the ongoing maintenance and repair costs, as well as the need for specialized spare parts. Commercial food processors operate under demanding conditions, leading to wear and tear that necessitates regular servicing and occasional part replacement. The availability and cost of these services and parts can add significantly to the total cost of ownership, making it a recurring concern for operators. Furthermore, the increasing complexity of advanced food processors may require skilled labor for operation and troubleshooting, which can be a challenge in regions facing labor shortages or lacking adequate training infrastructure, thereby constraining market growth to more developed areas.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High initial investment cost | -0.9% | Emerging economies, SMEs globally | Short to Mid-term (2025-2030) |

| Maintenance and repair expenses | -0.6% | Global | Ongoing |

| Energy consumption and operational costs | -0.4% | Global, particularly regions with high energy prices | Mid-term (2027-2033) |

| Requirement for skilled labor for advanced models | -0.3% | Regions with labor shortages | Mid to Long-term (2025-2033) |

Commercial Food Processor Market Opportunities Analysis

The commercial food processor market presents numerous opportunities for growth and innovation. A significant opportunity lies in the expansion into emerging economies, particularly in Asia Pacific, Latin America, and Africa, where the food service industry is undergoing rapid modernization and urbanization. As disposable incomes rise and consumer preferences shift towards out-of-home dining and convenience foods, the demand for efficient kitchen equipment is soaring. Manufacturers can capitalize on these burgeoning markets by offering cost-effective, durable, and regionally tailored food processing solutions that cater to diverse culinary needs and operational scales.

Another lucrative opportunity stems from the increasing demand for customization and specialized food products. Businesses are seeking processors that can handle specific ingredients or achieve unique textures for niche culinary applications, such as vegan food preparation, gluten-free products, or artisanal food items. This creates a market for highly versatile machines with a wide range of attachments and precise control functionalities. Furthermore, the growing focus on sustainability and eco-friendly practices opens avenues for manufacturers to develop and market energy-efficient models and equipment made from recyclable materials, appealing to environmentally conscious businesses and consumers. The integration of smart kitchen technology and IoT also presents an opportunity for developing connected food processors that offer enhanced monitoring, remote control, and data analytics capabilities.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion in emerging economies | +1.1% | Asia Pacific, Latin America, Middle East & Africa | Mid to Long-term (2027-2033) |

| Development of multi-functional and specialized processors | +0.9% | Global | Short to Mid-term (2025-2030) |

| Integration with smart kitchen ecosystems and IoT | +0.7% | Developed economies (North America, Europe) | Mid-term (2027-2033) |

| Growing demand for sustainable and energy-efficient solutions | +0.6% | Global | Long-term (2030-2033) |

| Customization for niche culinary applications | +0.5% | North America, Europe | Short to Mid-term (2025-2030) |

Commercial Food Processor Market Challenges Impact Analysis

The commercial food processor market faces several challenges that require strategic navigation by manufacturers and suppliers. Intense market competition is a primary concern, with numerous established and emerging players vying for market share. This fierce competition often leads to price wars, reduced profit margins, and increased pressure for continuous innovation. Differentiating products in a saturated market requires significant investment in research and development, as well as robust marketing and distribution networks, posing a hurdle for smaller or newer entrants.

Another significant challenge is managing volatile raw material prices and disruptions in the global supply chain. The manufacturing of commercial food processors relies on various materials, including stainless steel, plastics, and electronic components, whose prices can fluctuate due to geopolitical events, trade policies, or global demand shifts. Supply chain disruptions, as experienced during recent global events, can lead to production delays, increased manufacturing costs, and an inability to meet market demand. Furthermore, rapidly evolving consumer preferences and technological advancements necessitate continuous product upgrades, which can be challenging to keep pace with while maintaining cost-effectiveness and market relevance. Adherence to a complex and ever-changing landscape of international food safety and electrical standards also adds a layer of regulatory complexity to product development and market entry.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense market competition and price sensitivity | -0.8% | Global | Ongoing |

| Volatile raw material prices and supply chain disruptions | -0.7% | Global | Short to Mid-term (2025-2030) |

| Meeting diverse and evolving regulatory standards | -0.5% | Global | Ongoing |

| Rapid technological obsolescence and need for constant innovation | -0.4% | Developed economies | Mid-term (2027-2033) |

Commercial Food Processor Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Commercial Food Processor Market, encompassing historical data from 2019 to 2023, current market estimations for 2024, and detailed projections up to 2033. The report offers a granular examination of market size, growth drivers, restraints, opportunities, and challenges affecting the industry landscape. It delves into various market segments, including product types, capacity, material, and end-user applications, providing a holistic view of the market dynamics across key regions globally. The scope also includes a competitive analysis profiling leading market players and their strategic initiatives, along with an assessment of the impact of emerging technologies like AI on the market's future trajectory.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Robot Coupe, Hobart, Waring Commercial, Hamilton Beach Commercial, Nemco, Sirman, Sammic, F. Dick, Omcan, Vitamix Commercial, Blendtec Commercial, Univex, Globe Food Equipment, Avantco Equipment, Skyfood, Electrolux Professional, Rational AG, Miele Professional, Vulcan, Middleby Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The commercial food processor market is segmented across several key dimensions to provide a detailed understanding of its diverse landscape and consumer needs. This segmentation allows for targeted analysis of market drivers, restraints, and opportunities specific to each category, revealing distinct purchasing patterns and technological preferences. Understanding these segments is crucial for manufacturers to tailor their product offerings and for businesses to select equipment that best suits their operational scale and specific culinary requirements.

The market is broadly categorized by type, product type, capacity, material, and end-user, each influencing design, functionality, and adoption rates. For instance, the choice between batch and continuous processors is determined by production volume, while the material segment reflects durability and hygiene concerns. End-user segmentation highlights the varying needs of different commercial environments, from high-volume industrial food processing units to smaller, specialized catering services. This granular breakdown provides a comprehensive framework for strategic decision-making and market forecasting.

- By Type:

- Batch Processors: Designed for specific quantities, suitable for smaller operations or varied preparation.

- Continuous Processors: Ideal for high-volume, continuous production, commonly found in larger establishments.

- By Product Type:

- Bowl-style Processors: Versatile for chopping, pureeing, mixing, and kneading in a contained bowl.

- Combination Processors: Offer multiple functionalities, often integrating cutting and mixing capabilities.

- Specialty Processors: Dedicated machines for specific tasks like dicing, slicing, or shredding.

- By Capacity:

- Less than 5 Liters: Compact units for small cafes, delis, or backup use.

- 5-10 Liters: Mid-range capacity suitable for most restaurants and medium-sized catering.

- Above 10 Liters: High-capacity units for large-scale operations, industrial kitchens, and institutional food services.

- By Material:

- Stainless Steel: Preferred for durability, hygiene, and resistance to corrosion, commonly used for bowls and blades.

- Heavy-duty Polycarbonate: Used for transparent bowls, offering visibility and lightweight durability.

- ABS Plastic: Employed for external casings and some attachments, balancing durability with cost-effectiveness.

- By End-User:

- Restaurants: Need for versatile, medium-capacity processors for daily meal preparation.

- Hotels & Cafes: Demand for durable, multi-functional machines for diverse culinary offerings.

- Catering Services: Require robust, portable, and high-capacity units for off-site events.

- Institutional Food Services: Focus on large-capacity, high-efficiency, and highly durable machines for schools, hospitals, and corporate cafeterias.

- Industrial Food Processing Units: Require continuous, high-volume processing capabilities.

- Others: Including bakeries, delis, and specialized food outlets.

Regional Highlights

The global commercial food processor market exhibits diverse growth patterns across different regions, influenced by varying levels of economic development, culinary traditions, and the maturity of the food service industry. Each region presents unique opportunities and challenges, shaping the adoption and demand for commercial food processing equipment. Understanding these regional dynamics is crucial for market participants to tailor their strategies, product offerings, and distribution networks effectively.

North America and Europe currently represent the most mature markets, characterized by high adoption rates of advanced and automated food processors due to high labor costs and stringent food safety regulations. These regions are also at the forefront of technological innovation and smart kitchen integration. Conversely, the Asia Pacific region is rapidly emerging as a significant growth hub, driven by urbanization, changing dietary habits, and the expansion of the HoReCa sector. Latin America, the Middle East, and Africa are also witnessing substantial growth as their food service industries modernize and demand for processed foods increases, offering immense potential for market expansion.

- North America: Leading market in terms of technological adoption and mature food service infrastructure; high demand for automated and efficient solutions.

- Europe: Strong focus on quality, hygiene, and energy efficiency; significant market for specialized and professional-grade equipment.

- Asia Pacific (APAC): Fastest-growing region driven by rapid urbanization, increasing disposable incomes, and expanding quick service restaurant chains; high potential for new market entrants.

- Latin America: Emerging market with growing food service industry and increasing demand for commercial kitchen equipment due to economic development.

- Middle East and Africa (MEA): Demonstrating considerable growth propelled by booming tourism, hospitality sector expansion, and diversification of economies away from oil.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Food Processor Market.- Robot Coupe

- Hobart

- Waring Commercial

- Hamilton Beach Commercial

- Nemco

- Sirman

- Sammic

- F. Dick

- Omcan

- Vitamix Commercial

- Blendtec Commercial

- Univex

- Globe Food Equipment

- Avantco Equipment

- Skyfood

- Electrolux Professional

- Rational AG

- Miele Professional

- Vulcan

- Middleby Corporation

Frequently Asked Questions

What are the primary types of commercial food processors?

Commercial food processors primarily fall into two main types: batch processors and continuous feed processors. Batch processors are designed to handle specific quantities of ingredients at a time, ideal for varied preparations and smaller operations. Continuous feed processors are suited for high-volume production, allowing ingredients to be fed continuously for uninterrupted processing, common in larger industrial or institutional kitchens.

How do commercial food processors enhance kitchen efficiency?

Commercial food processors significantly enhance kitchen efficiency by automating and speeding up labor-intensive tasks such as chopping, slicing, dicing, shredding, and pureeing. This automation reduces manual labor, minimizes prep time, ensures consistent ingredient preparation, and frees up staff for other culinary responsibilities, leading to higher overall productivity and quicker service in busy commercial environments.

What factors should be considered when purchasing a commercial food processor?

Key factors to consider include capacity (matching output needs), power (motor strength for consistent performance), versatility (attachments for various tasks), durability (construction material like stainless steel for longevity), ease of cleaning (critical for hygiene), safety features, and available warranty/service support. Budget and kitchen space are also important practical considerations.

What are the latest innovations in commercial food processor technology?

Recent innovations include the integration of smart technology for precise control and monitoring, multi-functional designs offering a wider range of culinary applications, enhanced energy efficiency for reduced operational costs, improved safety mechanisms, and designs that prioritize quick disassembly for easier cleaning and maintenance. AI-driven predictive maintenance is also emerging as a key innovation.

How does a commercial food processor contribute to food safety standards?

Commercial food processors contribute to food safety by minimizing human contact with ingredients during preparation, reducing the risk of cross-contamination. Their designs often incorporate food-grade materials and smooth surfaces that are easy to clean and sanitize, preventing bacterial buildup. Consistent processing also ensures uniform cooking times and ingredient quality, which are vital for meeting health and safety regulations.