Commercial Aircraft NextGen Avionic Market

Commercial Aircraft NextGen Avionic Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701596 | Last Updated : July 30, 2025 |

Format : ![]()

![]()

![]()

![]()

Commercial Aircraft NextGen Avionic Market Size

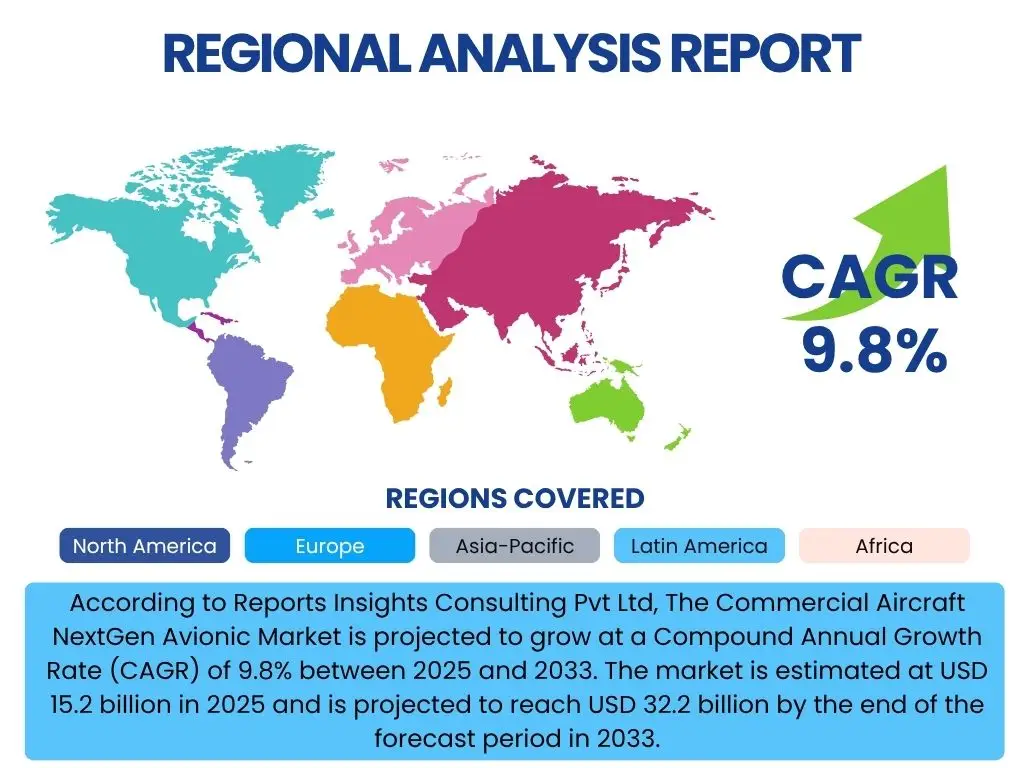

According to Reports Insights Consulting Pvt Ltd, The Commercial Aircraft NextGen Avionic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2033. The market is estimated at USD 15.2 billion in 2025 and is projected to reach USD 32.2 billion by the end of the forecast period in 2033.

Key Commercial Aircraft NextGen Avionic Market Trends & Insights

Common user inquiries regarding market trends in commercial aircraft NextGen avionics frequently revolve around the integration of advanced technologies, the evolution of connectivity solutions, and the push for enhanced operational efficiency and safety. Users seek to understand how digitalization, automation, and data-driven insights are reshaping aircraft systems. There is also significant interest in the regulatory landscape and the adoption of more open and modular system architectures to future-proof investments and facilitate upgrades.

The market is witnessing a profound transformation driven by the increasing demand for connected aircraft, capable of real-time data exchange for operational optimization, predictive maintenance, and enhanced passenger experience. This connectivity extends beyond the cockpit to various aircraft systems, enabling a holistic view of performance and maintenance needs. Furthermore, the emphasis on reducing pilot workload and enhancing situational awareness is leading to the development of more intuitive human-machine interfaces and advanced automation features. The trend towards sustainable aviation also influences avionics development, with a focus on optimizing flight paths and fuel efficiency through advanced navigation and flight management systems.

- Increased adoption of integrated modular avionics (IMA) for enhanced flexibility and upgradeability.

- Pervasive integration of secure, high-bandwidth satellite communication systems (e.g., Ka-band, Ku-band) for cockpit and cabin connectivity.

- Growing emphasis on cybersecurity measures to protect networked avionics systems from evolving threats.

- Development of advanced sensor technologies and synthetic vision systems for improved situational awareness and adverse weather operations.

- Leveraging big data analytics and machine learning for predictive maintenance and operational efficiency.

- Transition towards software-defined avionics (SDA) enabling faster updates and customization.

- Expansion of global air traffic management (ATM) modernization initiatives driving demand for compatible NextGen avionics.

AI Impact Analysis on Commercial Aircraft NextGen Avionic

User questions concerning the impact of Artificial Intelligence (AI) on Commercial Aircraft NextGen Avionics typically focus on its potential to revolutionize flight operations, maintenance, and safety protocols. Key themes include how AI will assist pilots, optimize flight paths, enable predictive maintenance, and enhance decision-making capabilities. There are also queries about the challenges associated with AI integration, such as data quality, certification processes, and the ethical implications of autonomous systems in critical applications. Users are keen to understand the balance between AI assistance and human oversight, and the long-term implications for crew roles and operational procedures.

AI's influence on NextGen avionics is multifaceted, extending from predictive analytics for system reliability to intelligent automation within the cockpit. By analyzing vast datasets from flight operations, maintenance logs, and sensor inputs, AI algorithms can identify subtle patterns indicative of potential failures, shifting maintenance from reactive to proactive. This significantly enhances fleet availability and reduces operational costs. In the cockpit, AI is poised to act as a highly sophisticated co-pilot, processing complex information in real-time to offer optimal flight trajectories, manage emergency situations, and reduce cognitive load on pilots, thereby enhancing safety and efficiency.

Moreover, AI is facilitating the development of adaptive and learning systems that can continuously improve performance based on operational experience. This includes intelligent routing systems that can dynamically adjust to weather changes or air traffic congestion, optimizing fuel consumption and flight times. The integration of AI also supports the evolution towards more autonomous flight capabilities, though this aspect is subject to rigorous regulatory scrutiny and public acceptance. Data integrity and the robustness of AI models are critical considerations, necessitating advanced validation and verification processes to ensure the reliability and trustworthiness of AI-powered avionics systems.

- Predictive Maintenance: AI algorithms analyze sensor data to forecast component failures, enabling proactive maintenance and reducing unscheduled downtime.

- Enhanced Flight Management: AI optimizes flight paths, fuel consumption, and arrival times by continuously analyzing real-time data such as weather, air traffic, and aircraft performance.

- Augmented Crew Decision Support: AI systems provide pilots with intelligent insights and recommendations for complex situations, improving situational awareness and operational safety.

- Intelligent Automation: Automation of routine tasks, allowing human operators to focus on higher-level decision-making and anomaly detection.

- Adaptive Flight Control Systems: AI-driven control laws can adapt to changing flight conditions or aircraft damage, enhancing stability and control.

- Cybersecurity Intelligence: AI identifies and responds to potential cyber threats within avionics networks, bolstering system integrity.

Key Takeaways Commercial Aircraft NextGen Avionic Market Size & Forecast

Common user questions regarding the key takeaways from the Commercial Aircraft NextGen Avionic market size and forecast often focus on the overarching growth trajectory, the primary drivers of this expansion, and the areas presenting the most significant investment potential. Users are particularly interested in understanding the long-term viability of the market, the influence of technological advancements, and the role of global air traffic recovery in shaping its future. Insights are sought on the strategic imperatives for market participants to capitalize on the anticipated growth and navigate emerging challenges.

The market for Commercial Aircraft NextGen Avionics is poised for substantial growth over the forecast period, driven primarily by the ongoing need for aircraft modernization, the imperative for enhanced operational efficiency, and the increasing demand for secure and high-bandwidth connectivity. This robust growth underscores a critical industry shift towards more integrated, intelligent, and data-centric aviation systems. Significant investments in research and development, particularly in areas like AI, cybersecurity, and open architecture platforms, are essential for stakeholders looking to secure a competitive edge. The retrofit market, catering to aging aircraft fleets, presents a particularly lucrative opportunity alongside the integration of NextGen systems into new aircraft deliveries.

- The market exhibits robust growth, projected to more than double in value by 2033, driven by a global push for aviation modernization.

- Technological advancements in connectivity, AI, and modular systems are central to this growth, enabling safer and more efficient air travel.

- The emphasis on reducing operational costs and enhancing fuel efficiency through advanced avionics is a key driver for airline adoption.

- Cybersecurity and data integrity are becoming paramount considerations, influencing system design and procurement decisions across the industry.

- Significant opportunities exist in both the linefit for new aircraft and the retrofit market for upgrading existing fleets, particularly in rapidly expanding aviation markets.

Commercial Aircraft NextGen Avionic Market Drivers Analysis

The Commercial Aircraft NextGen Avionic market is propelled by a confluence of factors aimed at enhancing operational efficiency, safety, and connectivity within the aviation sector. These drivers reflect the industry's continuous evolution towards more sophisticated, integrated, and data-driven flight systems. The increasing volume of air traffic globally necessitates more advanced air traffic management solutions, which in turn require modern avionics capable of precise navigation and communication. Additionally, the aging global aircraft fleet is creating a substantial demand for retrofit solutions, as airlines seek to extend the operational life of their assets while upgrading to the latest technological standards to meet performance and regulatory requirements.

Moreover, the relentless pursuit of fuel efficiency and reduced carbon emissions is compelling airlines to invest in NextGen avionics that facilitate optimized flight paths, real-time weather avoidance, and enhanced engine performance monitoring. Regulatory mandates, particularly those related to air traffic management modernization programs like SESAR in Europe and NextGen in the US, are also significant drivers, compelling operators to adopt compliant avionics solutions. The growing passenger demand for in-flight connectivity and entertainment further stimulates innovation and integration of advanced cabin management and communication systems, transforming the passenger experience and creating new revenue streams for airlines.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Air Passenger Traffic & Fleet Expansion | +2.1% | Global, particularly Asia Pacific & Middle East | 2025-2033 |

| Aging Aircraft Fleet & Demand for Retrofit Solutions | +1.8% | North America, Europe, Asia Pacific | 2025-2030 |

| Stringent Aviation Regulations & Air Traffic Management Modernization (e.g., SESAR, NextGen) | +1.5% | North America, Europe, China | 2025-2033 |

| Technological Advancements in AI, IoT, & Data Analytics | +1.9% | Global | 2026-2033 |

| Demand for Enhanced Operational Efficiency & Fuel Savings | +1.7% | Global | 2025-2033 |

Commercial Aircraft NextGen Avionic Market Restraints Analysis

Despite robust growth drivers, the Commercial Aircraft NextGen Avionic market faces several significant restraints that could impede its full potential. The inherent complexity and high cost associated with the research, development, and integration of cutting-edge avionics systems represent a primary barrier. Developing new avionic solutions requires substantial upfront investment in advanced materials, software development, and specialized engineering expertise, which can deter smaller players and lead to longer product development cycles. Furthermore, the extensive testing and certification processes mandated by aviation authorities are not only time-consuming but also incredibly expensive, adding layers of cost and delaying market entry for innovative products.

Another critical restraint is the long lifecycle of aircraft and the conservative nature of the aviation industry. Airlines typically operate aircraft for decades, and upgrading avionics systems involves significant downtime, which translates into lost revenue. This often makes airlines hesitant to invest in non-mandatory upgrades unless there is a clear and immediate return on investment or a regulatory imperative. Additionally, the increasing sophistication of networked avionics systems introduces heightened cybersecurity risks. The potential for cyberattacks on critical flight systems necessitates continuous investment in robust security measures, which adds to the overall cost and complexity of NextGen avionics, posing a challenge for widespread adoption and trust.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Research & Development (R&D) and Integration Costs | -1.2% | Global | 2025-2033 |

| Long & Stringent Certification Processes | -1.0% | Global (EASA, FAA) | 2025-2033 |

| Cybersecurity Threats & Vulnerabilities | -0.8% | Global | 2025-2033 |

| Aging Infrastructure Compatibility Issues | -0.7% | Global, particularly developing economies | 2025-2030 |

Commercial Aircraft NextGen Avionic Market Opportunities Analysis

The Commercial Aircraft NextGen Avionic market is rife with opportunities stemming from the evolving needs of the aviation industry and technological breakthroughs. A significant opportunity lies in the burgeoning retrofit market, where older aircraft fleets require substantial upgrades to meet new operational standards, regulatory compliance, and enhanced connectivity demands. This presents a continuous revenue stream for avionics manufacturers beyond initial equipment sales. Furthermore, the advent of new aviation concepts, such as Urban Air Mobility (UAM) and Advanced Air Mobility (AAM), is creating an entirely new segment for specialized avionics solutions tailored for electric vertical takeoff and landing (eVTOL) aircraft and drones, characterized by requirements for high autonomy and compact, lightweight designs.

Another prominent opportunity involves the shift towards open architecture systems and software-defined avionics. This trend allows for greater interoperability, easier upgrades, and reduced lifecycle costs, fostering innovation and enabling airlines to integrate systems from multiple vendors more flexibly. The growing demand for enhanced cabin experience and in-flight connectivity (IFC) also opens avenues for advanced cabin management systems and high-speed broadband solutions, transforming the passenger journey. Additionally, the increasing focus on sustainable aviation and the push for reduced environmental impact are driving the development of avionics that enable more efficient flight operations, such as optimized descent profiles and continuous climb operations, presenting opportunities for innovative solutions that contribute to green aviation initiatives.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for Retrofit & Upgrade Solutions for Existing Aircraft | +1.6% | North America, Europe, Asia Pacific | 2025-2031 |

| Emergence of Urban Air Mobility (UAM) & Advanced Air Mobility (AAM) | +1.9% | North America, Europe, Asia Pacific | 2028-2033 |

| Development & Adoption of Open Architecture Avionics Systems | +1.5% | Global | 2025-2033 |

| Expansion of In-Flight Connectivity (IFC) & Cabin Management Systems | +1.3% | Global | 2025-2033 |

Commercial Aircraft NextGen Avionic Market Challenges Impact Analysis

The Commercial Aircraft NextGen Avionic market faces several formidable challenges that necessitate strategic navigation by industry players. One significant hurdle is ensuring seamless interoperability between new NextGen avionics systems and legacy aircraft infrastructure. Many airlines operate mixed fleets, and integrating advanced digital systems with older analog or proprietary interfaces can be complex, costly, and time-consuming, potentially delaying modernization efforts. This interoperability issue also extends to various systems and components from different manufacturers, demanding standardized protocols and interfaces that are still evolving across the industry.

Another critical challenge is the escalating threat of cyberattacks targeting networked avionics systems. As aircraft become more connected and reliant on digital data, they become increasingly vulnerable to sophisticated cyber threats that could compromise safety, data integrity, or operational continuity. Developing robust, resilient, and continuously updated cybersecurity measures is an ongoing and expensive endeavor. Furthermore, the aviation industry faces a persistent talent shortage, particularly for highly specialized engineers and technicians with expertise in advanced avionics, software development, and cybersecurity. This talent gap can hinder innovation, slow down development cycles, and impact the deployment and maintenance of NextGen avionics, posing a long-term challenge for the market's growth trajectory.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Interoperability with Legacy Systems & Lack of Standardization | -1.5% | Global | 2025-2031 |

| Intensifying Cybersecurity Threats & Data Breaches | -1.3% | Global | 2025-2033 |

| Shortage of Skilled Workforce & Technical Expertise | -0.9% | Global, particularly developed economies | 2025-2033 |

| High Cost of Upgrade & Integration for Airlines | -1.0% | Global | 2025-2030 |

Commercial Aircraft NextGen Avionic Market - Updated Report Scope

This report offers a comprehensive analysis of the Commercial Aircraft NextGen Avionic Market, providing detailed insights into its current state, historical performance from 2019 to 2023, and a robust forecast spanning 2025 to 2033. The study meticulously covers market size estimations, growth drivers, restraints, emerging opportunities, and critical challenges impacting the industry. It includes a deep dive into key market trends, a comprehensive segmentation analysis by system, aircraft type, application, and fit, alongside a detailed profiling of leading market players. Regional dynamics and their influence on market growth across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa are also thoroughly examined, offering a holistic view for strategic decision-making.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 32.2 Billion |

| Growth Rate | 9.8% |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Raytheon Technologies (Collins Aerospace), Thales Group, Safran S.A., GE Aviation, BAE Systems plc, L3Harris Technologies Inc., Parker-Hannifin Corporation (Parker Aerospace), Panasonic Avionics Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Universal Avionics Systems Corporation, Esterline Technologies Corporation, Diehl Aerospace GmbH, Curtiss-Wright Corporation, Teledyne Technologies Inc., Garmin Ltd., Astronautics Corporation of America, Smiths Group plc, Cobham plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Commercial Aircraft NextGen Avionic market is meticulously segmented to provide a granular view of its diverse components and their respective contributions to overall market growth. This comprehensive segmentation allows for a deeper understanding of technological adoption patterns, operational requirements across different aircraft types, and the strategic opportunities present in both new aircraft installations and the existing fleet modernization market. Analyzing these segments helps stakeholders identify high-growth areas and tailor their product development and market entry strategies effectively.

The segmentation by system highlights the foundational technologies driving NextGen avionics, from critical flight management and navigation systems to advanced communication and integrated modular architectures. Aircraft type segmentation differentiates demand characteristics and technology adoption rates across various commercial aviation categories, reflecting the unique operational profiles and investment cycles of narrow-body, wide-body, and regional aircraft, as well as business jets and helicopters. Furthermore, the application-based segmentation provides insight into how these avionic systems are deployed within the cockpit, cabin, and other operational areas, revealing shifts in functional requirements and integration trends. Finally, the fit segmentation distinguishes between original equipment manufacturer (OEM) installations and the aftermarket retrofit segment, underscoring the significant opportunities in upgrading existing aircraft fleets to meet current and future standards.

- By System:

- Flight Management Systems (FMS)

- Communication Systems

- Navigation Systems

- Surveillance Systems

- Weather Systems

- Integrated Modular Avionics (IMA)

- Cabin Management Systems (CMS)

- Cockpit Displays

- By Aircraft Type:

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Jets

- Business Jets

- Commercial Helicopters

- By Application:

- Cockpit Systems

- Cabin Systems

- Flight Control Systems

- Communication & Navigation Systems

- Surveillance Systems

- Maintenance & Diagnostics

- By Fit:

- Linefit (OEM)

- Retrofit

Regional Highlights

- North America: This region is a leading adopter of NextGen avionics, driven by significant investments in air traffic management modernization programs like the FAA's NextGen initiative, a large existing fleet requiring upgrades, and the presence of major aerospace manufacturers and technology innovators. The emphasis on general aviation and business jets also contributes to advanced avionics demand.

- Europe: Characterized by stringent safety regulations and strong aerospace manufacturing capabilities, Europe is rapidly integrating NextGen avionics through initiatives such as SESAR (Single European Sky ATM Research). The region's focus on sustainable aviation and cross-border operational efficiency drives the adoption of advanced navigation and communication systems.

- Asia Pacific (APAC): Expected to be the fastest-growing market, APAC's growth is fueled by exponential increases in air passenger traffic, aggressive fleet expansion plans by regional airlines, and significant infrastructure development in key countries like China, India, and Southeast Asian nations. The region presents substantial opportunities for both linefit and retrofit markets.

- Latin America: This region shows steady growth driven by fleet modernization efforts by airlines aiming to improve operational efficiency and comply with international aviation standards. Investments in air transport infrastructure and increasing air travel demand contribute to the market expansion.

- Middle East & Africa (MEA): Growth in MEA is primarily driven by the expansion of major airlines, significant investments in new aircraft, and the development of regional aviation hubs. The adoption of advanced avionics is crucial for enhancing competitive advantage and ensuring operational excellence in a rapidly developing air travel market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Aircraft NextGen Avionic Market.- Honeywell International Inc.

- Raytheon Technologies (Collins Aerospace)

- Thales Group

- Safran S.A.

- GE Aviation

- BAE Systems plc

- L3Harris Technologies Inc.

- Parker-Hannifin Corporation (Parker Aerospace)

- Panasonic Avionics Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Universal Avionics Systems Corporation

- Esterline Technologies Corporation

- Diehl Aerospace GmbH

- Curtiss-Wright Corporation

- Teledyne Technologies Inc.

- Garmin Ltd.

- Astronautics Corporation of America

- Smiths Group plc

- Cobham plc

Frequently Asked Questions

What are NextGen Avionics?

NextGen Avionics refer to advanced electronic systems and components within commercial aircraft that enhance communication, navigation, surveillance, and air traffic management capabilities. They leverage digital technologies, integrated architectures, and advanced sensors to improve flight safety, operational efficiency, and environmental performance.

Why is the Commercial Aircraft NextGen Avionic Market growing?

The market is growing due to increasing global air passenger traffic, the need to modernize aging aircraft fleets, stringent aviation regulations mandating advanced systems, a strong demand for enhanced operational efficiency and fuel savings, and ongoing technological advancements in areas like AI, IoT, and connectivity solutions.

What role does AI play in NextGen Avionics?

AI in NextGen Avionics is critical for predictive maintenance, optimizing flight paths and fuel consumption, enhancing crew decision support, enabling intelligent automation of routine tasks, and improving cybersecurity measures. It helps process vast amounts of data to provide real-time insights and improve overall system performance and safety.

What are the main challenges for the Commercial Aircraft NextGen Avionic Market?

Key challenges include the high cost of research, development, and integration, long and stringent certification processes, increasing cybersecurity threats to networked systems, interoperability issues with legacy aircraft infrastructure, and a persistent shortage of skilled personnel in specialized avionics engineering and maintenance.

Which regions are key markets for Commercial Aircraft NextGen Avionics?

North America and Europe are significant established markets driven by modernization initiatives and a strong aerospace base. Asia Pacific is emerging as the fastest-growing region due to rapid fleet expansion and increasing air traffic. Latin America and the Middle East & Africa are also showing steady growth from fleet upgrades and airline expansion.