Card Market

Card Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703784 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Card Market Size

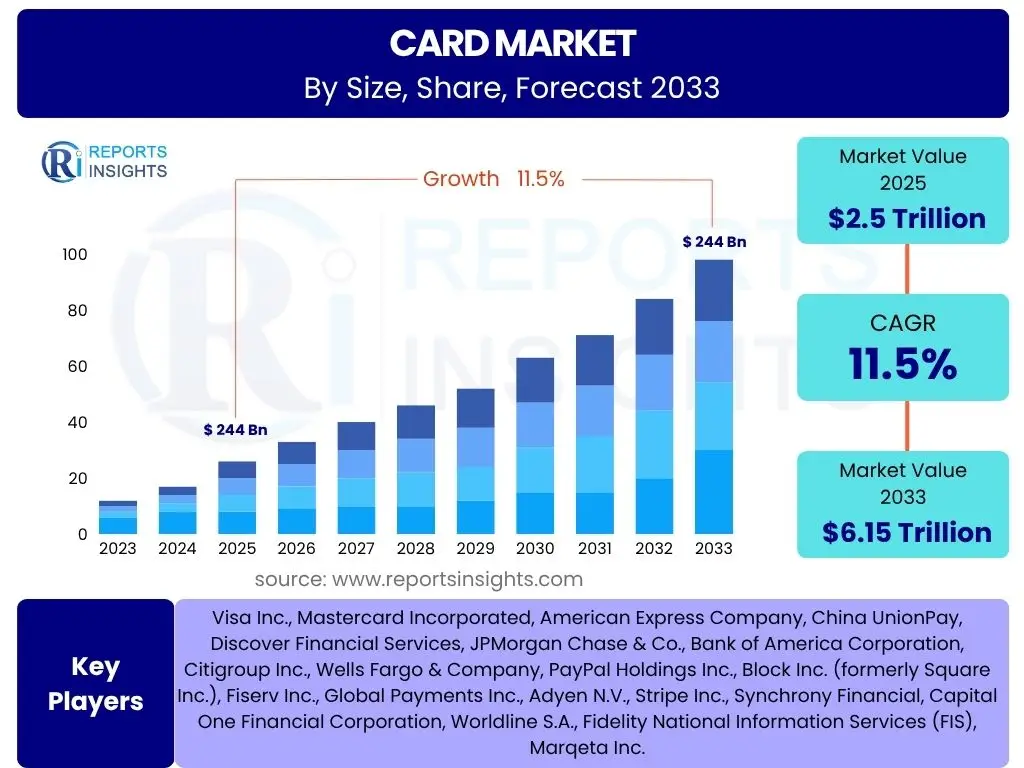

According to Reports Insights Consulting Pvt Ltd, The Card Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2025 and 2033. The market is estimated at USD 2.5 Trillion in 2025 and is projected to reach USD 6.15 Trillion by the end of the forecast period in 2033.

Key Card Market Trends & Insights

The global card market is experiencing dynamic shifts driven by accelerating digital transformation, evolving consumer payment preferences, and advancements in financial technology. Users frequently inquire about the forces shaping this evolution, including the shift away from cash, the adoption of contactless technologies, and the rise of digital wallets. Key insights point to a market increasingly focused on seamless, secure, and integrated payment experiences across various channels, driven by the omnipresence of e-commerce and mobile connectivity.

Emerging economies are witnessing significant growth in card adoption, fueled by initiatives promoting financial inclusion and the expansion of payment infrastructure. This demographic shift, coupled with the increasing penetration of smartphones, is creating new opportunities for card issuers and payment networks to onboard previously unbanked or underbanked populations. The demand for diverse card products, ranging from traditional credit and debit cards to specialized prepaid and commercial cards, continues to grow as consumers and businesses seek tailored financial solutions.

Furthermore, the market is characterized by intense competition and continuous innovation, with fintech companies challenging traditional banking models and driving the development of new payment solutions. Personalization, enhanced security features, and value-added services like loyalty programs and rewards are becoming critical differentiators. Stakeholders are focused on leveraging data analytics to understand consumer behavior better and offer more relevant and convenient card-based financial tools.

- Proliferation of Contactless and Mobile Payments

- Increased Adoption of Digital Wallets and Tokenization

- Growth in E-commerce and Cross-border Transactions

- Expansion of Financial Inclusion Initiatives

- Focus on Personalized Card Products and Loyalty Programs

- Enhanced Security Measures and Fraud Prevention Technologies

- Integration of Cards with Open Banking and APIs

AI Impact Analysis on Card

The integration of Artificial Intelligence (AI) is fundamentally transforming the card market, addressing critical user concerns regarding fraud, security, and personalized customer experiences. AI-driven algorithms are being deployed across the entire card lifecycle, from initial application and credit assessment to transaction monitoring and customer support. This advanced capability allows for real-time analysis of vast datasets, enabling financial institutions to detect anomalous behavior indicative of fraud with unprecedented accuracy, thereby significantly reducing financial losses and enhancing consumer trust.

Beyond security, AI is revolutionizing how card products are designed and marketed. Machine learning models analyze consumer spending patterns, preferences, and creditworthiness to offer highly personalized card products, credit limits, and reward schemes. This level of customization improves customer satisfaction and loyalty, leading to higher engagement and profitability for issuers. AI also optimizes operational efficiencies by automating routine tasks, streamlining customer service interactions through intelligent chatbots, and improving decision-making processes for risk management.

Looking ahead, the influence of AI is expected to deepen, driving further innovation in card technology and payment infrastructure. This includes predictive analytics for anticipating market trends, hyper-personalized financial advice delivered through card-linked applications, and dynamic pricing models for merchant services. While the benefits are substantial, addressing challenges related to data privacy, algorithmic bias, and regulatory compliance will be paramount for widespread and ethical AI adoption within the card market.

- Enhanced Fraud Detection and Prevention through Predictive Analytics

- Improved Credit Scoring and Risk Assessment for Card Issuance

- Hyper-Personalized Card Offers and Reward Programs

- Automated Customer Service and Support via AI-powered Chatbots

- Optimization of Operational Efficiencies in Card Processing

- Development of AI-driven Security Features like Biometric Authentication

- Data-driven Insights for Strategic Product Development and Marketing

Key Takeaways Card Market Size & Forecast

Analyzing the card market size and its projected forecast reveals several critical insights frequently sought by users, particularly regarding growth trajectories, underlying drivers, and potential future shifts. The consistent and robust Compound Annual Growth Rate (CAGR) signifies a sustained expansion, primarily propelled by the global digital transformation and increasing adoption of electronic payments. This strong growth indicates a favorable environment for investment and innovation within the payment ecosystem, suggesting that card-based transactions will continue to be a dominant force in global commerce.

A significant takeaway is the market's resilience and adaptability to technological advancements and changing consumer behaviors. The forecast underscores the ongoing shift from cash-centric economies to digital payment landscapes, particularly in emerging markets where card penetration is rapidly increasing. The substantial increase in market value from 2025 to 2033 reflects not only volume growth but also the expansion into new use cases and demographics, ensuring a broader base of card users and transactions.

Furthermore, the long-term forecast highlights the imperative for market participants to continuously innovate and adapt to remain competitive. Key players must focus on enhancing security features, integrating new technologies like AI and blockchain, and developing diverse product portfolios to cater to evolving consumer and business needs. The projected market size underscores the immense potential for growth, but also the increasing complexity of the payment landscape, requiring strategic foresight and agile responses from all stakeholders.

- The Card Market demonstrates robust growth, projected to more than double in value by 2033.

- Digitalization and e-commerce expansion are primary accelerators of market growth.

- Emerging economies are pivotal to future market expansion and card adoption.

- Innovation in security and personalized offerings will be critical for market leadership.

- The shift from cash to electronic payments is a long-term, irreversible trend underpinning growth.

- Strategic partnerships and technological integration will shape competitive advantages.

Card Market Drivers Analysis

The Card Market is propelled by a confluence of macroeconomic, technological, and behavioral factors that collectively foster its expansion and increased adoption globally. These drivers reflect the ongoing transition towards a cashless society, the convenience and efficiency offered by electronic payments, and the continuous innovation within the financial technology sector. Understanding these catalysts is crucial for identifying growth pockets and formulating effective market strategies across various regions and product segments.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Growth of E-commerce and Online Transactions | +1.8% | Global, particularly Asia Pacific and North America | Short to Medium Term (2025-2029) |

| Increasing Adoption of Digital Wallets and Contactless Payments | +1.5% | Europe, North America, emerging APAC markets | Medium Term (2026-2031) |

| Government Initiatives Promoting Digital Payments and Financial Inclusion | +1.2% | Asia Pacific (India, China), Latin America, Africa | Long Term (2027-2033) |

| Technological Advancements in Payment Security (e.g., Tokenization, Biometrics) | +1.0% | Global | Medium to Long Term (2026-2033) |

| Rising Disposable Income and Urbanization in Emerging Economies | +0.9% | Asia Pacific, Latin America, Middle East & Africa | Long Term (2028-2033) |

Card Market Restraints Analysis

Despite significant growth potential, the Card Market faces several inhibiting factors that can temper its expansion and influence adoption rates. These restraints typically revolve around issues of security, trust, regulatory complexities, and the persistence of traditional payment habits. Addressing these challenges effectively is vital for stakeholders to maintain growth momentum and ensure widespread consumer and merchant acceptance, particularly in regions where electronic payment infrastructure is still developing.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Concerns Regarding Data Security and Card Fraud | -1.5% | Global, particularly affecting consumer trust | Short to Medium Term (2025-2030) |

| Complex and Evolving Regulatory Landscape (e.g., GDPR, PSD2) | -1.2% | Europe, North America, highly regulated markets | Medium Term (2026-2032) |

| Preference for Cash Payments in Certain Demographics/Regions | -0.8% | Developing markets, rural areas, older demographics | Long Term (2028-2033) |

| High Interchange Fees and Merchant Transaction Costs | -0.7% | Small and Medium-sized Businesses globally | Medium Term (2027-2033) |

| Emergence of Alternative Payment Methods (e.g., Account-to-Account, BNPL) | -0.5% | Global, especially among younger demographics | Short to Medium Term (2025-2030) |

Card Market Opportunities Analysis

The Card Market is replete with opportunities for innovation, expansion, and deeper market penetration, driven by untapped demographics, technological advancements, and evolving business models. These opportunities represent avenues for significant growth, allowing market players to diversify their offerings, enter new geographical regions, and cater to niche segments. Capitalizing on these emerging trends is crucial for maintaining competitive edge and ensuring long-term profitability within the dynamic payment landscape.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Underserved and Emerging Markets | +1.6% | Asia Pacific (Southeast Asia), Africa, Latin America | Long Term (2027-2033) |

| Development of Specialized Card Products for Niche Segments (e.g., Gig Economy, SMEs) | +1.3% | Global, especially developed markets | Medium Term (2026-2031) |

| Integration with Open Banking and Embedded Finance Ecosystems | +1.0% | Europe, North America, expanding globally | Medium to Long Term (2027-2033) |

| Leveraging IoT and Wearable Technology for Payments | +0.8% | North America, Europe, tech-forward markets | Long Term (2028-2033) |

| Enhanced Value Proposition through AI-driven Personalization and Loyalty Programs | +0.7% | Global | Short to Medium Term (2025-2030) |

Card Market Challenges Impact Analysis

The Card Market, while exhibiting strong growth, faces persistent challenges that demand proactive strategies from all participants. These obstacles range from maintaining robust security in the face of evolving cyber threats to navigating an increasingly complex regulatory environment and adapting to rapidly shifting consumer expectations. Overcoming these hurdles is essential for sustaining growth, preserving market integrity, and ensuring continued trust in card-based payment systems across the globe.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Escalating Cyber Threats and Sophisticated Fraud Schemes | -1.8% | Global | Ongoing, Short Term (2025-2028) |

| Intensifying Competition from Non-Bank and Fintech Players | -1.4% | Global, especially developed markets | Medium Term (2026-2031) |

| Ensuring Interoperability Across Diverse Payment Systems and Regions | -1.0% | Cross-border transactions, fragmented markets | Long Term (2027-2033) |

| Addressing Consumer Privacy Concerns and Data Governance Requirements | -0.9% | Europe, North America, expanding globally | Medium Term (2026-2032) |

| Maintaining Merchant Acceptance Amidst Rising Transaction Costs | -0.6% | SMEs, cost-sensitive merchants | Short to Medium Term (2025-2030) |

Card Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Card Market, offering detailed insights into its current size, historical performance, and future growth projections. The scope encompasses a thorough examination of market drivers, restraints, opportunities, and challenges, alongside a granular segmentation analysis by card type, application, technology, issuer, and end-user. It also highlights regional dynamics and profiles key industry players to offer a holistic understanding of the competitive landscape and market potential through 2033.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.5 Trillion |

| Market Forecast in 2033 | USD 6.15 Trillion |

| Growth Rate | 11.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Visa Inc., Mastercard Incorporated, American Express Company, China UnionPay, Discover Financial Services, JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., Wells Fargo & Company, PayPal Holdings Inc., Block Inc. (formerly Square Inc.), Fiserv Inc., Global Payments Inc., Adyen N.V., Stripe Inc., Synchrony Financial, Capital One Financial Corporation, Worldline S.A., Fidelity National Information Services (FIS), Marqeta Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Card Market is comprehensively segmented to provide a detailed and granular understanding of its diverse components, reflecting various product types, operational technologies, and end-user applications. This segmentation allows for precise market analysis, identifying high-growth areas and informing targeted business strategies for stakeholders across the payment ecosystem. Each segment presents unique dynamics influenced by consumer preferences, regulatory frameworks, and technological advancements.

- By Card Type: This segment categorizes the market based on the functional nature of the card.

- Credit Card: Offers revolving credit, enabling purchases on borrowed funds.

- Debit Card: Directly links to a bank account, deducting funds immediately.

- Prepaid Card: Loaded with funds in advance, offering controlled spending.

- Gift Card: Pre-loaded with a specific value for retail purchases, often non-reloadable.

- Loyalty Card: Rewards customers for repeat purchases at specific merchants or networks.

- Commercial Card: Includes corporate credit/debit cards, purchasing cards, and travel & entertainment cards for businesses.

- By Application: This segmentation focuses on the primary use cases and environments where cards are utilized for transactions.

- Retail Payments: Transactions at physical retail points of sale.

- Online Payments: Purchases made through e-commerce platforms and websites.

- ATM Cash Withdrawal: Use of cards to withdraw physical cash from automated teller machines.

- POS Transactions: Broad category covering point-of-sale transactions, including both retail and service-oriented purchases.

- Travel & Entertainment: Card usage for booking flights, hotels, dining, and leisure activities.

- Fuel & Utilities: Payments for gasoline, electricity, water, and other utility services.

- Healthcare: Transactions for medical services, prescriptions, and health-related products.

- Transportation: Payments for public transport, ride-sharing services, and tolls.

- Bill Payments: Recurring payments for services like internet, mobile, and subscriptions.

- By Technology: This segment analyzes the underlying technological infrastructure supporting card functionality and security.

- Magnetic Stripe: Traditional technology storing data on a magnetic strip.

- EMV Chip: Cards embedded with a microchip for enhanced security.

- Contactless (NFC): Near Field Communication technology enabling tap-and-go payments.

- Virtual Cards: Digitally generated card numbers for online and mobile transactions, lacking a physical form.

- Biometric Cards: Integrate fingerprint or other biometric authentication for secure transactions.

- QR Code: Uses Quick Response codes for payment initiation, popular in some Asian markets.

- By Issuer: Categorization based on the type of entity that issues the cards to consumers and businesses.

- Banks: Traditional financial institutions offering a wide range of card products.

- Non-Banking Financial Companies (NBFCs): Non-bank entities providing financial services, including card issuance.

- Fintechs: Technology-driven financial companies innovating in payment solutions and card products.

- Retailers: Store-specific or co-branded cards offered by retail chains to their customers.

- By End-User: This segment classifies the market based on the type of consumer or entity utilizing the cards.

- Individual Consumers: Personal use for daily purchases, travel, and online shopping.

- Commercial: Includes usage by businesses of varying sizes and government entities.

- Small and Medium Enterprises (SMEs): Cards for business expenses, procurement, and payroll.

- Large Enterprises: Corporate cards for extensive business operations, travel, and procurement.

- Government Agencies: Cards used for public sector expenditures and disbursement programs.

Regional Highlights

- North America: This region holds a significant share of the Card Market, characterized by high card penetration, advanced payment infrastructure, and robust e-commerce adoption. The United States and Canada lead in the usage of credit and debit cards, with a strong focus on security innovations like EMV and tokenization. The market here is mature but continues to grow through digital transformation, contactless payment proliferation, and the expansion of loyalty and rewards programs.

- Europe: Europe is a highly diverse market with varying levels of card adoption and regulatory landscapes. Western European countries exhibit high rates of contactless and mobile payments, driven by initiatives like PSD2 and strong consumer preferences for digital solutions. Eastern Europe is experiencing rapid growth in card usage as economies transition from cash-dominated systems, propelled by financial inclusion efforts and the expansion of modern payment networks.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the Card Market, fueled by a large and rapidly expanding consumer base, increasing internet and smartphone penetration, and supportive government policies promoting digital payments. Countries like China and India are at the forefront of this growth, with massive adoption of mobile payments and QR code-based transactions, alongside the steady increase in traditional card usage for both online and offline retail.

- Latin America: This region is an emerging growth market for cards, driven by urbanization, expanding financial inclusion, and the increasing formalization of economies. While cash remains prevalent, there is a clear shift towards electronic payments, supported by fintech innovation and government initiatives to modernize payment systems. Brazil, Mexico, and Argentina are key markets leading this transition, with growing adoption of credit, debit, and prepaid cards.

- Middle East and Africa (MEA): The MEA region presents significant untapped potential, with varied development stages across countries. The Middle East, particularly the GCC countries, shows high card penetration and rapid adoption of digital payment solutions due to high disposable incomes and government support for smart city initiatives. Africa, on the other hand, is characterized by lower card penetration but immense growth opportunities, primarily driven by mobile money services and efforts to bring unbanked populations into the formal financial system, which often includes debit and prepaid card issuance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Card Market.- Visa Inc.

- Mastercard Incorporated

- American Express Company

- China UnionPay

- Discover Financial Services

- JPMorgan Chase & Co.

- Bank of America Corporation

- Citigroup Inc.

- Wells Fargo & Company

- PayPal Holdings Inc.

- Block Inc. (formerly Square Inc.)

- Fiserv Inc.

- Global Payments Inc.

- Adyen N.V.

- Stripe Inc.

- Synchrony Financial

- Capital One Financial Corporation

- Worldline S.A.

- Fidelity National Information Services (FIS)

- Marqeta Inc.

Frequently Asked Questions

What is the projected growth rate of the global Card Market?

The global Card Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2025 and 2033, indicating robust expansion driven by digital payment trends and financial inclusion initiatives worldwide.

How will AI impact the future of card payments?

AI is set to significantly impact card payments by enhancing fraud detection through predictive analytics, enabling hyper-personalized card offers, improving credit risk assessments, and automating customer service operations, leading to more secure and customized financial experiences.

What are the primary drivers for the growth of the Card Market?

Key drivers include the rapid growth of e-commerce, increasing adoption of digital wallets and contactless payments, government initiatives promoting digital transactions, and advancements in payment security technologies like tokenization and biometrics.

Which regions are expected to show the highest growth in card adoption?

The Asia Pacific (APAC) region, particularly countries like China and India, is expected to exhibit the highest growth in card adoption due to large populations, increasing smartphone penetration, and supportive government policies for digital payments.

What are the main challenges facing the Card Market?

Major challenges include escalating cyber threats and sophisticated fraud schemes, intense competition from non-bank and fintech players, complex and evolving regulatory landscapes, and the need to address consumer privacy concerns regarding data usage.