Mobile Card Reader Market

Mobile Card Reader Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702553 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Mobile Card Reader Market Size

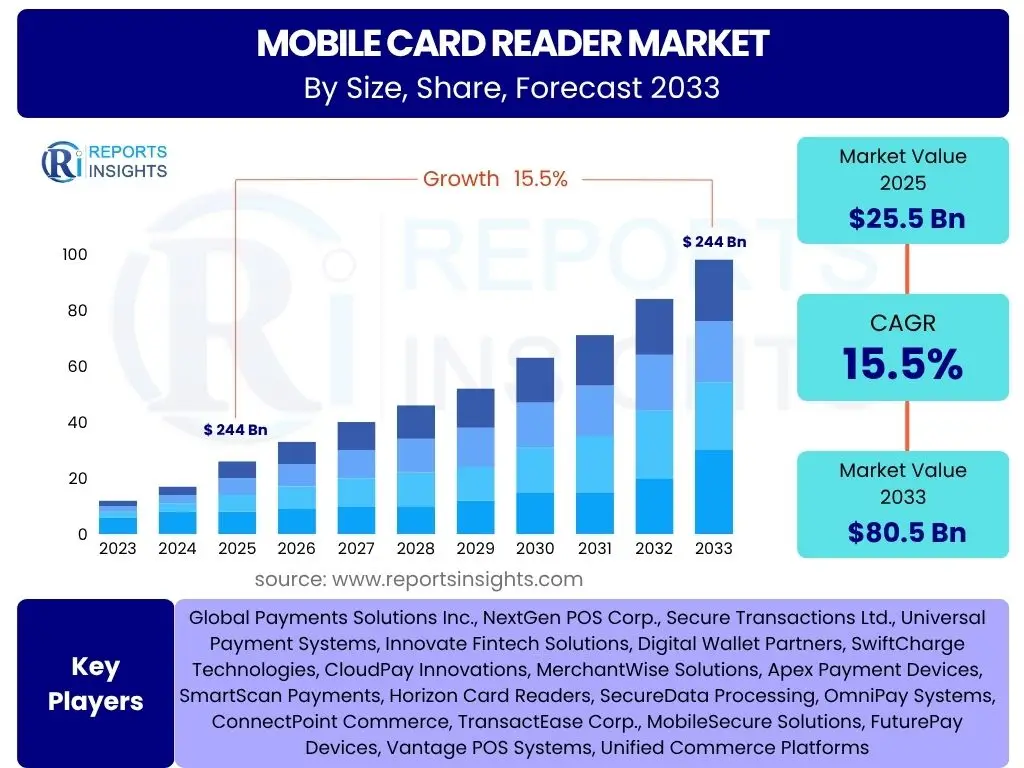

According to Reports Insights Consulting Pvt Ltd, The Mobile Card Reader Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2025 and 2033. The market is estimated at USD 25.5 Billion in 2025 and is projected to reach USD 80.5 Billion by the end of the forecast period in 2033.

Key Mobile Card Reader Market Trends & Insights

Users frequently inquire about the evolving landscape of mobile card readers, seeking to understand the significant shifts and innovations shaping their functionality and adoption. Common questions revolve around the integration of new technologies, the expansion into diverse merchant segments, and the overall impact on payment ecosystems. Analysis reveals a strong emphasis on enhanced security features, the seamless integration with broader business management tools, and the drive towards ubiquitous, frictionless transactions.

The market is witnessing a profound transformation driven by consumer demand for convenience and merchant needs for flexible, cost-effective payment solutions. This includes a notable shift towards contactless payment methods and a greater emphasis on solutions that support diverse payment types beyond traditional cards, such as digital wallets and QR codes. Furthermore, the increasing sophistication of mobile devices and connectivity options is enabling more robust and reliable mobile card reader performance, expanding their utility across various operational environments.

The convergence of retail and technology is also a dominant theme, with mobile card readers becoming integral components of comprehensive point-of-sale (POS) systems. This integration extends beyond simple transaction processing, encompassing inventory management, customer relationship management (CRM), and data analytics, providing merchants with holistic business insights. The trend indicates a move towards intelligent payment terminals that serve multiple functions, thereby maximizing operational efficiency and enhancing the overall customer experience.

- Proliferation of Contactless and NFC Payment Technologies

- Increased Adoption of Mobile Point-of-Sale (mPOS) Solutions by Small and Medium-sized Enterprises (SMEs)

- Integration of Cloud-Based Payment Processing and Business Management Systems

- Growing Demand for Enhanced Security Features and Tokenization

- Development of Multi-Functional Mobile Card Readers Supporting Various Payment Methods

AI Impact Analysis on Mobile Card Reader

Common user questions related to the impact of AI on mobile card readers often center on security enhancements, personalized customer experiences, and predictive business insights. Users are keen to understand how artificial intelligence can fortify transaction security against evolving fraud tactics and how it might enable more intelligent, adaptive payment processes. There is also significant interest in AI's potential to transform raw transaction data into actionable intelligence for merchants, optimizing operations and customer engagement.

AI's integration into mobile card reader technology is poised to revolutionize several key areas. In terms of security, AI algorithms can analyze transaction patterns in real-time, identifying anomalies and potential fraud attempts with unprecedented accuracy, thereby significantly reducing financial risks for both merchants and consumers. This proactive approach to fraud detection moves beyond traditional rule-based systems, offering a dynamic and evolving defense mechanism. Furthermore, AI can aid in validating identities and ensuring compliance, adding an extra layer of trust to mobile transactions.

Beyond security, AI holds immense promise for enhancing the customer experience and providing valuable business intelligence. By analyzing purchasing behaviors and preferences, AI-powered systems can enable personalized offers and loyalty programs directly through the mobile card reader interface, fostering greater customer engagement. For merchants, AI can provide predictive analytics, forecasting sales trends, managing inventory more efficiently, and optimizing staffing levels based on transaction data. This intelligence transforms the mobile card reader from a simple payment device into a strategic business tool, enabling more informed decision-making and fostering sustainable growth.

- Enhanced Fraud Detection and Prevention through Real-Time Behavioral Analytics

- Personalized Customer Experiences and Targeted Marketing via Transaction Data Analysis

- Predictive Analytics for Inventory Management and Sales Forecasting

- Automated Compliance Checks and Reduced Manual Verification Processes

- Improved Customer Support and Dispute Resolution through AI-driven Insights

Key Takeaways Mobile Card Reader Market Size & Forecast

Users frequently seek concise summaries and critical conclusions regarding the mobile card reader market's growth trajectory and future projections. The primary queries revolve around the significant drivers behind market expansion, the major opportunities for stakeholders, and the underlying factors contributing to the forecasted market size. The insights consistently highlight the pervasive shift towards digital payment solutions and the increasing adoption by diverse business segments as fundamental catalysts.

The market is characterized by robust growth, primarily fueled by the accelerating global transition to cashless transactions and the widespread proliferation of smartphones and tablets. This creates an environment where portable and cost-effective payment solutions like mobile card readers are not just convenient but essential for businesses of all sizes, especially micro-merchants and SMEs, to remain competitive. The forecast indicates sustained momentum driven by technological advancements and supportive regulatory frameworks promoting digital payments.

A key takeaway is the increasing versatility and sophistication of mobile card reader devices. Modern solutions offer more than just card processing; they integrate with comprehensive business management platforms, providing value-added services such as inventory tracking, loyalty programs, and detailed sales analytics. This evolution transforms these devices into indispensable tools for operational efficiency and customer engagement, cementing their role in the future of retail and service industries. The market's future will be defined by ongoing innovation in security, connectivity, and integration capabilities.

- Significant Growth Trajectory Driven by Global Digital Payment Adoption

- High Potential in Untapped and Emerging Markets for Mobile Card Reader Solutions

- Increasing Relevance for Small and Medium-sized Businesses (SMBs) and Micro-Merchants

- Emphasis on Enhanced Security Features and Compliance Standards

- Integration with Broader Business Ecosystems as a Key Differentiator

Mobile Card Reader Market Drivers Analysis

The mobile card reader market is experiencing substantial growth propelled by several key drivers that reflect the evolving landscape of global commerce and technology adoption. A primary factor is the rapid proliferation of smartphones and tablets worldwide, transforming these devices into powerful platforms for mobile payment acceptance. This widespread availability of compatible hardware significantly lowers the barrier to entry for merchants wishing to accept digital payments, making mobile card readers an accessible and attractive option.

Furthermore, the increasing global preference for cashless transactions, driven by convenience, security, and government initiatives promoting digital economies, directly fuels the demand for mobile card readers. Consumers are increasingly moving away from cash, opting for card and mobile-based payments for everyday transactions. This shift necessitates that businesses, especially small and medium-sized enterprises (SMEs) and independent merchants, adopt flexible and portable payment acceptance solutions to meet customer expectations and avoid losing sales.

Technological advancements, particularly in EMV chip technology, Near Field Communication (NFC) for contactless payments, and enhanced data encryption, have significantly improved the security and speed of mobile card transactions. These innovations instill greater confidence in both merchants and consumers regarding the safety of their financial data. Additionally, the cost-effectiveness and ease of setup associated with mobile card readers, compared to traditional POS systems, make them particularly appealing to new businesses and those with mobile workforces or fluctuating payment needs.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Proliferation of Smartphones and Tablets | +1.8% | Global, particularly Asia Pacific and Latin America | Short-Medium Term (2025-2028) |

| Growing Adoption by SMEs and Micro-Merchants | +2.2% | Developing Economies, North America, Europe | Medium Term (2025-2030) |

| Increasing Preference for Digital and Contactless Payments | +1.6% | North America, Europe, parts of Asia Pacific | Short Term (2025-2027) |

| Technological Advancements in Payment Security (EMV, NFC) | +1.4% | Global | Medium-Long Term (2026-2033) |

| Cost-Effectiveness and Ease of Use Compared to Traditional POS | +1.0% | Global, particularly emerging markets | Short-Medium Term (2025-2029) |

Mobile Card Reader Market Restraints Analysis

Despite the robust growth, the mobile card reader market faces several restraints that could impede its full potential. A significant concern revolves around security vulnerabilities and the perception of data breaches. While technology continually advances, the risk of cyber threats, including malware attacks on connected devices and data interception, remains a persistent challenge. This concern often leads to hesitance among some merchants and consumers, particularly for high-value transactions, impacting broader adoption rates.

Another notable restraint is the high transaction fees imposed by payment processors, which can disproportionately affect small businesses and micro-merchants with thin profit margins. While mobile card readers offer affordability in terms of hardware, the recurring per-transaction costs can accumulate, making them less attractive for businesses operating on tight budgets or processing a high volume of small-ticket transactions. This economic burden can limit the profitability and sustainability of using these solutions for certain business models.

Furthermore, challenges related to internet connectivity and technological literacy in certain geographic regions or demographic segments can act as significant impediments. Mobile card readers rely on stable internet connections, which may not be consistently available in rural or underdeveloped areas. Similarly, a lack of familiarity with digital payment technologies among some merchants or consumers can hinder adoption, requiring significant educational efforts and infrastructure development to overcome.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Security Concerns and Perceived Risk of Data Breaches | -1.2% | Global, especially sensitive industries | Ongoing |

| High Transaction Fees for Small Businesses and Micro-Merchants | -0.9% | Developing Economies, price-sensitive markets | Medium Term (2025-2030) |

| Lack of Reliable Internet Connectivity and Technological Literacy | -0.8% | Rural areas, specific parts of APAC, MEA, LATAM | Long Term (2026-2033) |

Mobile Card Reader Market Opportunities Analysis

The mobile card reader market is rich with opportunities stemming from evolving consumer behaviors, technological advancements, and untapped market segments. A significant avenue for growth lies in the integration of mobile card readers with value-added services beyond basic payment processing. This includes linking transactions directly to loyalty programs, inventory management systems, and customer relationship management (CRM) software. By offering comprehensive business solutions, vendors can provide greater utility to merchants, making their offerings more indispensable and driving broader adoption.

Expansion into emerging and underserved markets presents another substantial opportunity. Regions with large unbanked populations or those transitioning rapidly from cash-based to digital economies, particularly in Asia Pacific, Latin America, and Africa, represent immense potential. As these regions develop their digital infrastructure and financial inclusion initiatives, the demand for affordable and accessible payment acceptance solutions like mobile card readers is expected to surge, offering a vast new customer base for market players.

Furthermore, the continuous evolution of payment technologies, such as biometric authentication and advanced encryption techniques, offers opportunities for product differentiation and market expansion. Developing mobile card readers that incorporate these cutting-edge security features can attract businesses with stringent security requirements, such as those in healthcare or high-value retail. Tailoring solutions for niche industries, including healthcare for patient billing, transportation for ticketing, or field services for on-site payments, also provides specialized market segments ripe for penetration and innovation.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration with Value-Added Services (Loyalty, Inventory, CRM) | +1.8% | North America, Europe, developed Asia Pacific | Medium-Long Term (2026-2033) |

| Expansion into Untapped and Emerging Markets (Unbanked, Rural) | +2.4% | Asia Pacific, Latin America, Middle East & Africa | Long Term (2027-2033) |

| Development of Advanced Security Features (Biometrics, Tokenization) | +1.5% | Global, particularly enterprise and high-security sectors | Medium Term (2026-2030) |

| Customized Solutions for Niche Industries (Healthcare, Transportation) | +1.2% | Global, specific industry verticals | Medium-Long Term (2026-2033) |

Mobile Card Reader Market Challenges Impact Analysis

Despite numerous growth prospects, the mobile card reader market is confronted by several significant challenges that demand strategic navigation from industry players. Intense competition marks the market, with numerous established and emerging companies vying for market share. This fierce rivalry often leads to price wars, commoditization of basic features, and compressed profit margins, making it difficult for new entrants and even some incumbents to sustain profitability without strong differentiation or economies of scale.

Another critical challenge is the rapid pace of technological obsolescence. The payment technology landscape is continually evolving, with new standards, security protocols, and connectivity options emerging frequently. Mobile card reader manufacturers must constantly innovate and update their devices to remain compatible with the latest payment infrastructures and security requirements, which entails significant research and development investments and shorter product lifecycles. Failure to adapt quickly can result in products becoming outdated, eroding market relevance.

Furthermore, navigating complex and diverse regulatory landscapes across different jurisdictions poses a substantial challenge. Payment processing is heavily regulated, with varying compliance standards such as PCI DSS (Payment Card Industry Data Security Standard), EMV mandates, and regional data privacy laws (e.g., GDPR, CCPA). Companies operating globally must ensure their mobile card reader solutions adhere to all relevant local and international regulations, which can be a costly and time-consuming endeavor. Maintaining consumer trust amidst persistent security threats and data breaches also remains an ongoing challenge, requiring transparent communication and robust security measures.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Competition and Price Wars | -0.7% | Global | Ongoing |

| Rapid Technological Obsolescence and Need for Constant Innovation | -0.8% | Global, technology-driven markets | Short-Medium Term (2025-2028) |

| Complex and Diverse Regulatory Compliance Requirements | -0.6% | Europe (GDPR), North America, India, China | Ongoing |

| Maintaining Consumer Trust Amidst Evolving Security Threats | -0.5% | Global | Ongoing |

Mobile Card Reader Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the Mobile Card Reader Market, encompassing its size, growth trends, key drivers, restraints, opportunities, and challenges. The report delivers strategic insights for stakeholders, offering a holistic view of the market's current state and its projected evolution over the forecast period, aiding in informed decision-making and strategic planning.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 80.5 Billion |

| Growth Rate | 15.5% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Payments Solutions Inc., NextGen POS Corp., Secure Transactions Ltd., Universal Payment Systems, Innovate Fintech Solutions, Digital Wallet Partners, SwiftCharge Technologies, CloudPay Innovations, MerchantWise Solutions, Apex Payment Devices, SmartScan Payments, Horizon Card Readers, SecureData Processing, OmniPay Systems, ConnectPoint Commerce, TransactEase Corp., MobileSecure Solutions, FuturePay Devices, Vantage POS Systems, Unified Commerce Platforms |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The mobile card reader market is meticulously segmented to provide a granular understanding of its dynamics, catering to diverse merchant needs and technological preferences. This segmentation allows for a detailed analysis of specific market niches and their growth potential, identifying areas of high demand and emerging opportunities. Understanding these segments is crucial for businesses to tailor their strategies and product offerings effectively, ensuring they address the specific requirements of various user groups and industries.

- By Type:

- Magnetic Stripe Readers: Traditional readers for swiping magnetic stripe cards.

- EMV Chip Readers: Devices that accept cards with embedded EMV chips for enhanced security.

- NFC/Contactless Readers: Supports tap-and-go payments from contactless cards, smartphones, and wearables.

- By Connectivity:

- Bluetooth: Wireless connection to a smartphone or tablet.

- USB: Direct wired connection, typically for charging and data transfer.

- Audio Jack: Connects via the audio jack of a mobile device, common in early models.

- Wi-Fi: Connects directly to a Wi-Fi network for standalone operation.

- By End-User:

- Retail & Hospitality: Small boutiques, cafes, restaurants, food trucks, and pop-up shops.

- Healthcare: Mobile payment solutions for clinics, home care services, and pharmacies.

- Transportation: On-board payments for taxis, buses, and delivery services.

- Field Services: Mobile payments for plumbers, electricians, contractors, and repair services.

- Other Commercial Applications: Includes education, government services, non-profit organizations, and events.

Regional Highlights

- North America: A mature market characterized by high adoption rates of mobile payment solutions, driven by technological advancements, strong consumer spending, and the widespread presence of small and medium-sized businesses. The region is a hub for innovation in fintech and digital payments, with a strong emphasis on EMV and NFC adoption.

- Europe: Exhibits robust growth, largely due to supportive regulatory frameworks (like PSD2), high smartphone penetration, and a strong preference for contactless payments. Countries within the EU are actively promoting digital payment ecosystems, creating fertile ground for mobile card reader market expansion.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid digitalization, increasing smartphone penetration, and the vast number of unbanked and underbanked populations transitioning to digital payments. India and China, in particular, are witnessing exponential growth due to government initiatives and widespread mobile payment adoption.

- Latin America: An emerging market with significant growth potential, driven by increasing internet and smartphone penetration, a growing middle class, and efforts to reduce reliance on cash. The region presents opportunities for affordable and accessible mobile payment solutions.

- Middle East and Africa (MEA): Shows promising growth as governments and financial institutions invest in digital infrastructure and financial inclusion programs. While growth is nascent in some areas, the rising mobile connectivity and young populations are key drivers for future adoption of mobile card readers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Card Reader Market.- Global Payments Solutions Inc.

- NextGen POS Corp.

- Secure Transactions Ltd.

- Universal Payment Systems

- Innovate Fintech Solutions

- Digital Wallet Partners

- SwiftCharge Technologies

- CloudPay Innovations

- MerchantWise Solutions

- Apex Payment Devices

- SmartScan Payments

- Horizon Card Readers

- SecureData Processing

- OmniPay Systems

- ConnectPoint Commerce

- TransactEase Corp.

- MobileSecure Solutions

- FuturePay Devices

- Vantage POS Systems

- Unified Commerce Platforms

Frequently Asked Questions

Analyze common user questions about the Mobile Card Reader market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of mobile card readers available?

Mobile card readers are primarily categorized by the payment technologies they support: magnetic stripe readers (for swiping), EMV chip readers (for inserting cards), and NFC/contactless readers (for tap-and-go payments). Many modern devices combine these capabilities to accept a broader range of payment methods.

How secure are mobile card readers for processing transactions?

Modern mobile card readers incorporate robust security features, including EMV chip technology, encryption (point-to-point encryption), and tokenization, which convert sensitive card data into unique, non-sensitive tokens. These technologies significantly reduce the risk of fraud and data breaches, ensuring secure transactions.

Which industries benefit most from using mobile card readers?

Industries that benefit most include retail and hospitality (especially small businesses, cafes, food trucks), field services (plumbers, electricians), transportation (taxis, delivery services), and healthcare (mobile clinics, home care). Their portability and cost-effectiveness make them ideal for businesses needing flexible payment solutions.

What is the future outlook for the mobile card reader market?

The mobile card reader market is projected for significant growth, driven by increasing digital payment adoption, e-commerce expansion, and demand from small and medium-sized enterprises. Future trends include enhanced security, AI integration for analytics, and broader integration with comprehensive business management platforms.

How do transaction fees work with mobile card readers?

Transaction fees for mobile card readers typically involve a percentage of each transaction amount, sometimes with a small fixed fee per transaction. These fees cover costs such as interchange fees (paid to card-issuing banks), network fees (paid to card networks like Visa/Mastercard), and payment processor markups. Fees vary by provider and transaction volume.