Car Rental and Leasing Market

Car Rental and Leasing Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703510 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Car Rental and Leasing Market Size

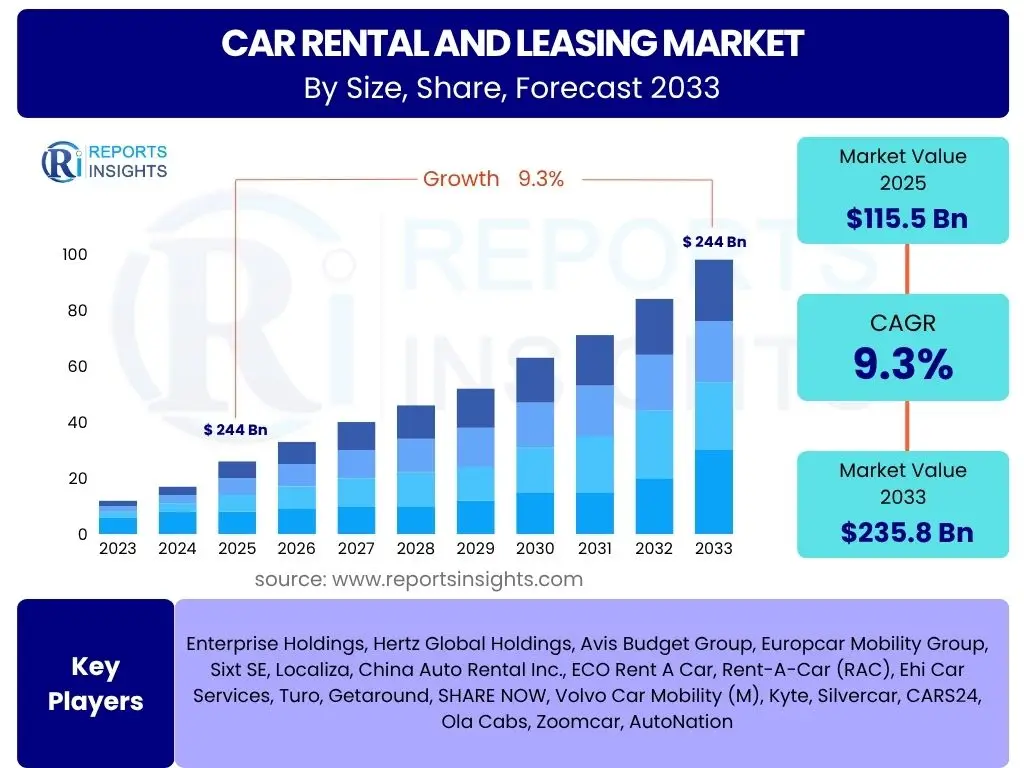

According to Reports Insights Consulting Pvt Ltd, The Car Rental and Leasing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.3% between 2025 and 2033. The market is estimated at USD 115.5 billion in 2025 and is projected to reach USD 235.8 billion by the end of the forecast period in 2033.

Key Car Rental and Leasing Market Trends & Insights

User queries regarding market trends in car rental and leasing frequently revolve around the adoption of new technologies, shifts in consumer behavior, and the integration of sustainable practices. The market is increasingly characterized by a move towards digitized services, offering seamless online booking and contactless vehicle pick-up and return. There is a notable surge in demand for flexible mobility solutions, including subscription-based models and short-term rentals, driven by changing ownership perceptions and the need for adaptable transport options in urban environments.

Furthermore, the growing emphasis on environmental sustainability is accelerating the integration of electric vehicles (EVs) into rental fleets, alongside a rising interest in hybrid models. The recovery of the travel and tourism sector post-pandemic, coupled with the resurgence of corporate travel, continues to fuel demand for traditional rental services while also spurring innovation in fleet management and customer engagement. The industry is also witnessing an expansion into specialized vehicle segments to cater to diverse customer needs, from commercial delivery vehicles to premium luxury rentals.

- Digitization of booking and operational processes (e.g., mobile apps, contactless services).

- Growth of subscription-based car usage models offering flexibility over ownership.

- Accelerated adoption and integration of electric vehicles (EVs) and hybrid vehicles into fleets.

- Increasing demand for short-term and hourly rentals, particularly in urban areas.

- Focus on enhanced sanitization and safety protocols in rental vehicles.

- Development of comprehensive loyalty programs and personalized customer experiences.

- Expansion into last-mile delivery solutions and commercial fleet leasing.

AI Impact Analysis on Car Rental and Leasing

User inquiries concerning AI's influence on the car rental and leasing sector often focus on its potential to enhance operational efficiency, personalize customer experiences, and optimize fleet management. Artificial intelligence is rapidly becoming a cornerstone for transforming traditional rental processes, from predictive analytics for demand forecasting to intelligent pricing algorithms that maximize revenue. Its application extends to streamlining customer interactions through AI-powered chatbots and virtual assistants, providing instant support and personalized recommendations based on usage history and preferences.

In fleet management, AI is instrumental in predictive maintenance, identifying potential vehicle issues before they escalate, thereby reducing downtime and operational costs. Moreover, AI-driven fraud detection systems enhance security and minimize risks. The technology also plays a crucial role in optimizing vehicle allocation and relocation, ensuring optimal fleet utilization across different locations. As AI capabilities advance, its integration is expected to create highly automated, efficient, and customer-centric rental and leasing services, fundamentally reshaping the industry's landscape and competitive dynamics.

- Enhanced demand forecasting and dynamic pricing strategies.

- Personalized customer experiences through AI-driven recommendations and offers.

- Optimized fleet management, including predictive maintenance and vehicle allocation.

- Automated customer service via chatbots and virtual assistants.

- Improved fraud detection and prevention mechanisms.

- Streamlined pick-up and drop-off processes through smart sensors and recognition.

- Data-driven insights for route optimization and operational efficiency.

Key Takeaways Car Rental and Leasing Market Size & Forecast

Analysis of common user questions regarding the car rental and leasing market size and forecast highlights a strong interest in understanding the underlying growth drivers, the long-term sustainability of the market, and the impact of macro-economic factors. The market is poised for robust expansion, primarily fueled by the recovery of global tourism, increasing business travel, and the evolving preference for flexible mobility solutions over traditional car ownership. Digital transformation is central to this growth, enabling seamless customer experiences and operational efficiencies that attract a broader user base.

The forecast indicates a resilient market, adapting to new challenges through technological innovation and diversified service offerings. Sustainability initiatives, particularly the integration of electric vehicles, are becoming critical differentiators and growth enablers. Stakeholders are keen on identifying emerging regional opportunities and understanding how competitive dynamics will evolve with the entry of new players and business models. The overall outlook suggests a dynamic market, characterized by continuous innovation, customer-centric approaches, and a strategic pivot towards sustainable and integrated mobility ecosystems.

- Significant growth projected, driven by tourism, business travel, and urbanization.

- Digital transformation and technological adoption are crucial for market expansion.

- Sustainability initiatives, especially EV fleet expansion, are key growth catalysts.

- Flexible mobility models (e.g., subscriptions) are gaining traction, challenging traditional ownership.

- Emerging markets offer substantial growth opportunities for expansion.

- The market is becoming increasingly competitive with new entrants and evolving business models.

Car Rental and Leasing Market Drivers Analysis

The growth of the car rental and leasing market is fundamentally driven by several interconnected factors that reflect global economic shifts, technological advancements, and evolving consumer preferences. A primary driver is the robust recovery and expansion of the global tourism sector, which directly correlates with the demand for short-term vehicle rentals for leisure travelers. Concurrently, the resurgence of corporate travel and the growing need for business mobility solutions contribute significantly to the leasing segment, as companies seek flexible and cost-effective transportation for their employees.

Urbanization trends and the increasing global population density also play a pivotal role, leading to reduced car ownership in dense urban centers where parking is limited and public transport is extensive. In such environments, car rental and leasing provide a convenient alternative, offering access to vehicles without the burdens of ownership. Furthermore, the rising disposable incomes in developing economies enable a larger segment of the population to afford travel and rental services, further broadening the market's customer base and fostering its continued expansion.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global Tourism and Travel Recovery | +1.5% | North America, Europe, Asia Pacific | Short- to Mid-term (2025-2028) |

| Increasing Corporate Travel and Business Mobility Needs | +1.2% | Global | Mid-term (2026-2030) |

| Shifting Consumer Preference from Ownership to Access | +1.0% | Urban Centers Globally, Developed Economies | Long-term (2028-2033) |

| Urbanization and Limited Parking Infrastructure | +0.8% | Major Cities Worldwide | Long-term (2028-2033) |

| Growth in Disposable Income in Emerging Economies | +0.7% | Asia Pacific, Latin America, MEA | Long-term (2028-2033) |

| Technological Advancements (Online Platforms, Telematics) | +0.6% | Global | Ongoing (2025-2033) |

Car Rental and Leasing Market Restraints Analysis

Despite robust growth prospects, the car rental and leasing market faces several significant restraints that could impede its expansion. One major challenge is the intense price competition prevalent in the industry, driven by numerous regional and global players, which often leads to reduced profit margins. Fluctuations in fuel prices directly impact operational costs for rental companies, making it difficult to maintain stable pricing strategies and profitability, particularly for fleets heavily reliant on internal combustion engine vehicles.

Furthermore, the rising popularity of alternative transportation modes, such as ride-sharing services (e.g., Uber, Lyft), carpooling, and robust public transportation networks, presents a competitive threat. These alternatives offer convenience and cost-effectiveness, potentially reducing the demand for traditional short-term car rentals, especially for short distances or within metropolitan areas. High maintenance and operational costs, including vehicle acquisition, insurance, and repairs, also remain substantial financial burdens for rental and leasing companies, requiring efficient fleet management to mitigate their impact on overall profitability and market growth.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Price Competition | -0.9% | Global | Ongoing (2025-2033) |

| Fluctuating Fuel Prices | -0.8% | Global | Ongoing (2025-2033) |

| Growth of Ride-Sharing and Public Transportation | -0.7% | Developed Economies, Urban Areas | Long-term (2028-2033) |

| High Vehicle Acquisition and Maintenance Costs | -0.6% | Global | Ongoing (2025-2033) |

| Stringent Environmental Regulations and EV Costs | -0.5% | Europe, North America, China | Mid- to Long-term (2027-2033) |

Car Rental and Leasing Market Opportunities Analysis

The car rental and leasing market is presented with significant opportunities for expansion and innovation. A key avenue for growth lies in the increasing adoption and integration of electric vehicles (EVs) into rental fleets. As sustainability becomes a core focus for consumers and regulations, offering a diverse range of EVs caters to evolving environmental consciousness and provides a competitive edge. This shift also opens opportunities for developing charging infrastructure partnerships and specialized EV maintenance services.

Furthermore, the emergence of long-term car subscription services represents a substantial growth opportunity, offering consumers the flexibility of car access without the commitment of ownership or the rigid structure of traditional leases. This model appeals to a demographic seeking adaptable mobility solutions. Expansion into underserved or emerging markets, particularly in Asia Pacific, Latin America, and parts of Africa, where car ownership is lower but demand for mobility is rising, also presents lucrative prospects. Moreover, collaborating with smart city initiatives for integrated transport solutions and providing specialized vehicle rentals (e.g., commercial vans for last-mile delivery, luxury cars for events) can further diversify revenue streams and market reach.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion of Electric Vehicle (EV) Fleets | +1.3% | Global, particularly Europe, North America, China | Mid- to Long-term (2027-2033) |

| Development of Car Subscription Services | +1.1% | Developed Economies, Urban Areas | Long-term (2028-2033) |

| Untapped Markets in Emerging Economies | +1.0% | Asia Pacific, Latin America, MEA | Long-term (2028-2033) |

| Integration with Smart City Mobility Solutions | +0.9% | Global Urban Centers | Long-term (2028-2033) |

| Specialized Vehicle Rentals (e.g., Commercial, Luxury) | +0.7% | Global | Ongoing (2025-2033) |

Car Rental and Leasing Market Challenges Impact Analysis

The car rental and leasing market faces several significant challenges that require strategic responses from industry players. One prominent challenge is the vulnerability to global supply chain disruptions, particularly those impacting vehicle manufacturing and availability. Shortages of semiconductor chips and other components can severely limit the ability of rental companies to acquire new vehicles, leading to fleet shortages and inflated acquisition costs, directly impacting service availability and pricing for consumers.

Another critical concern is cybersecurity and data privacy. As the industry increasingly relies on digital platforms for bookings, payments, and telematics, protecting sensitive customer data and preventing cyberattacks becomes paramount. A data breach could severely damage a company's reputation and lead to significant financial penalties. Moreover, adapting to rapidly evolving consumer preferences, such as the demand for seamless digital experiences, personalized services, and sustainable options, while managing the capital intensity of fleet upgrades, poses a continuous challenge for maintaining competitiveness and market relevance in a dynamic mobility landscape.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global Supply Chain Disruptions (Vehicle Availability) | -0.9% | Global | Short- to Mid-term (2025-2027) |

| Cybersecurity Threats and Data Privacy Concerns | -0.8% | Global | Ongoing (2025-2033) |

| Rapid Technological Shifts and Investment Requirements | -0.7% | Global | Ongoing (2025-2033) |

| Adapting to Evolving Consumer Preferences | -0.6% | Developed Economies | Ongoing (2025-2033) |

| Regulatory Complexities and Compliance Costs | -0.5% | Regional (e.g., Europe for emissions) | Ongoing (2025-2033) |

Car Rental and Leasing Market - Updated Report Scope

This comprehensive market report offers an in-depth analysis of the global Car Rental and Leasing market, providing valuable insights into its current state, historical performance, and future projections. It covers key market dynamics, competitive landscape, regional outlooks, and significant market trends and drivers, enabling stakeholders to make informed strategic decisions.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 115.5 billion |

| Market Forecast in 2033 | USD 235.8 billion |

| Growth Rate | 9.3% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Enterprise Holdings, Hertz Global Holdings, Avis Budget Group, Europcar Mobility Group, Sixt SE, Localiza, China Auto Rental Inc., ECO Rent A Car, Rent-A-Car (RAC), Ehi Car Services, Turo, Getaround, SHARE NOW, Volvo Car Mobility (M), Kyte, Silvercar, CARS24, Ola Cabs, Zoomcar, AutoNation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Car Rental and Leasing market is segmented to provide a granular understanding of its diverse components and drivers. These segmentations allow for a detailed analysis of specific market niches, consumer behaviors, and strategic opportunities within different operational contexts. By categorizing the market based on vehicle types, rental durations, application areas, and booking channels, the report offers a comprehensive view of where demand is originating and how it is being fulfilled across the industry.

Each segment presents unique growth dynamics and competitive landscapes. For instance, the transition to Electric Vehicles within fleets signifies a major shift, while the distinction between short-term and long-term rentals highlights varied consumer needs for flexibility versus extended access. Understanding these segments is crucial for market participants to tailor their offerings, optimize resource allocation, and identify high-potential areas for investment and expansion, ensuring relevance and sustained growth in an evolving mobility ecosystem.

- By Rental Type: Business, Leisure

- By Vehicle Type: Economy, Luxury, SUV, Commercial Vehicles, Electric Vehicles

- By End-Use: Corporate, Leisure/Tourism, Local/Personal, Replacement Vehicles

- By Booking Channel: Online Booking (Websites, Mobile Apps), Offline Booking (Branch Visits, Phone Calls)

- By Duration: Short-Term (Hourly, Daily, Weekly), Long-Term (Monthly, Yearly)

- By Propulsion Type: Internal Combustion Engine (ICE) Vehicles, Electric Vehicles (EVs), Hybrid Vehicles

Regional Highlights

- North America: This region represents a mature and technologically advanced market. The United States and Canada are significant contributors, driven by high disposable incomes, robust tourism, and a strong corporate sector. The region is witnessing a rapid adoption of digital solutions and a growing interest in flexible leasing and car-sharing models. Significant investments in electric vehicle infrastructure and fleet modernization are also characteristic of this market.

- Europe: A diverse market with strong environmental regulations influencing fleet composition and a high reliance on tourism, particularly in Southern and Western Europe. Countries like Germany, France, and the UK are key players, experiencing growth in both traditional rentals and emerging mobility services, including EV rentals and subscription models. Urbanization and well-developed public transport systems in some areas also drive demand for short-term rental solutions.

- Asia Pacific (APAC): Expected to be the fastest-growing region, fueled by rapid urbanization, increasing disposable incomes, and the expansion of the middle-class population, particularly in countries like China, India, Japan, and Australia. The region presents immense opportunities for new market entrants and the expansion of existing players, with a rising demand for both leisure and business rentals, alongside a burgeoning interest in shared mobility solutions.

- Latin America: This region offers significant growth potential, driven by developing tourism sectors and increasing business activities in major economies like Brazil, Mexico, and Argentina. While still developing in terms of infrastructure and widespread digital adoption compared to more mature markets, the growing middle class and increasing demand for accessible transportation contribute to market expansion.

- Middle East and Africa (MEA): Characterized by strong growth in key tourism hubs and business centers, particularly in the GCC countries (e.g., UAE, Saudi Arabia) and parts of South Africa. The region benefits from increasing international tourism, large-scale events, and growing economic diversification efforts, which boost demand for both short-term rentals and corporate leasing services. Investment in infrastructure and digital transformation is gradually enhancing market capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Rental and Leasing Market.- Enterprise Holdings

- Hertz Global Holdings

- Avis Budget Group

- Europcar Mobility Group

- Sixt SE

- Localiza

- China Auto Rental Inc.

- ECO Rent A Car

- Rent-A-Car (RAC)

- Ehi Car Services

- Turo

- Getaround

- SHARE NOW

- Volvo Car Mobility (M)

- Kyte

- Silvercar

- CARS24

- Ola Cabs

- Zoomcar

- AutoNation

Frequently Asked Questions

What is the projected growth rate for the Car Rental and Leasing Market?

The Car Rental and Leasing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.3% between 2025 and 2033, demonstrating a robust expansion trajectory over the forecast period.

How is AI impacting the Car Rental and Leasing industry?

AI is significantly transforming the industry by enabling dynamic pricing, personalized customer experiences, predictive maintenance for fleets, and optimized operational efficiencies through advanced data analytics and automation, enhancing overall service delivery and profitability.

What are the primary drivers for the growth of the Car Rental and Leasing Market?

Key drivers include the recovery of global tourism, increasing corporate travel, a shift in consumer preference from car ownership to access, urbanization trends, and rising disposable incomes, all contributing to a sustained demand for flexible mobility solutions.

Are electric vehicles (EVs) playing a significant role in the Car Rental and Leasing Market?

Yes, EVs are increasingly becoming a pivotal factor. The expansion of EV fleets is a major opportunity, driven by sustainability goals, regulatory pushes, and evolving consumer preferences for eco-friendly transportation options.

Which regions are key contributors to the Car Rental and Leasing Market?

North America and Europe are mature markets with significant contributions. Asia Pacific is projected as the fastest-growing region, driven by rapid urbanization and economic development, while Latin America and MEA also show substantial growth potential.