Business Jet Ground Handling Service Market

Business Jet Ground Handling Service Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702796 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Business Jet Ground Handling Service Market Size

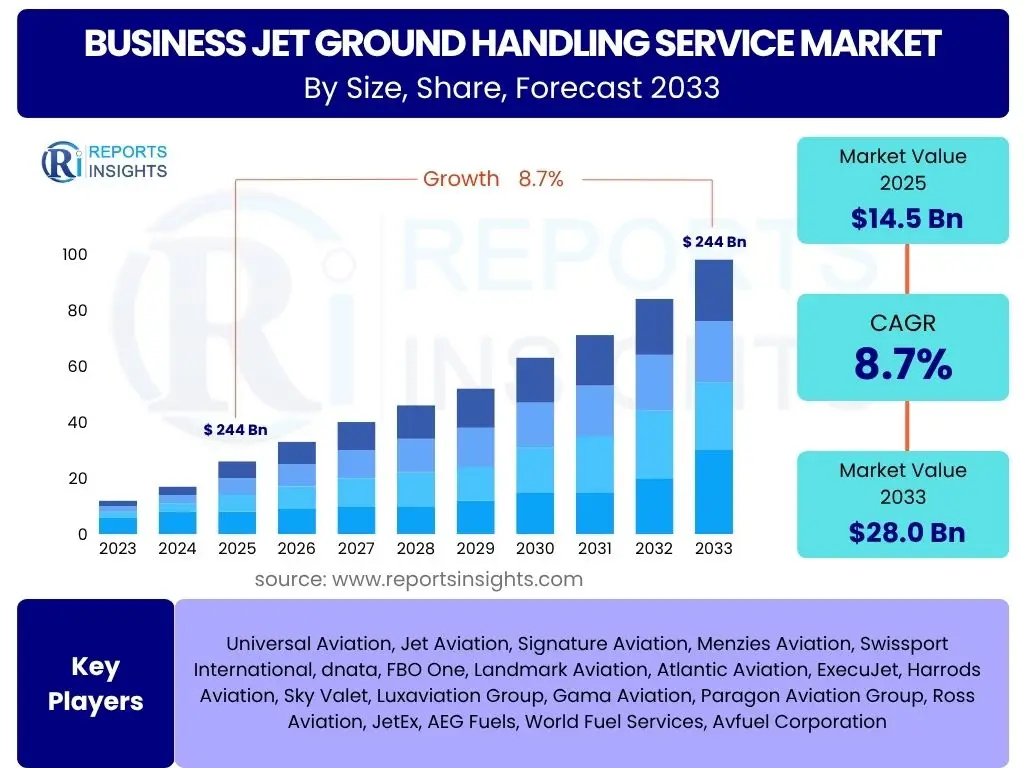

According to Reports Insights Consulting Pvt Ltd, The Business Jet Ground Handling Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2033. The market is estimated at USD 14.5 Billion in 2025 and is projected to reach USD 28.0 Billion by the end of the forecast period in 2033.

Key Business Jet Ground Handling Service Market Trends & Insights

The Business Jet Ground Handling Service market is witnessing significant transformation driven by evolving customer expectations, technological advancements, and increasing emphasis on operational efficiency and sustainability. Users frequently inquire about how the industry is adapting to these shifts, particularly concerning digitalization of services, personalized client experiences, and the integration of eco-friendly practices. There is a strong interest in understanding the impact of new service models and the expansion of FBO (Fixed-Base Operator) networks globally.

Modern business jet travelers demand seamless, expedited, and highly customized services, pushing ground handlers to adopt advanced logistics and concierge-style offerings. The drive for sustainability is also prominent, with growing interest in electric ground support equipment (eGSE) and sustainable aviation fuel (SAF) initiatives at FBOs. Furthermore, the market is observing a trend towards consolidation among smaller ground handling operators, as larger entities seek to expand their geographic footprint and service portfolios, improving overall service consistency and quality across diverse locations.

- Digitization of operational processes and client communication.

- Increased demand for personalized and expedited VIP services.

- Growing adoption of sustainable aviation practices and equipment.

- Expansion of FBO networks and service agreements globally.

- Emphasis on enhanced security measures and compliance.

AI Impact Analysis on Business Jet Ground Handling Service

Common user questions regarding AI's impact on business jet ground handling services revolve around efficiency gains, predictive capabilities, and enhanced safety. Stakeholders are particularly interested in how artificial intelligence can optimize resource allocation, automate routine tasks, and improve decision-making processes, leading to faster turnarounds and reduced operational costs. Concerns also include data privacy, the need for skilled personnel to manage AI systems, and the initial investment required for implementation.

AI's influence is anticipated to revolutionize several facets of ground handling, from baggage and cargo management to aircraft marshaling and maintenance scheduling. Predictive analytics, powered by AI, can forecast potential equipment failures or operational delays, enabling proactive intervention and minimizing disruptions. This shift towards data-driven operations is expected to enhance overall service reliability and significantly improve the passenger experience by reducing waiting times and streamlining procedures. Furthermore, AI-driven security systems can provide real-time threat detection and response capabilities, bolstering safety protocols across the airfield.

- Optimization of resource allocation and scheduling through predictive analytics.

- Automation of routine tasks such as baggage handling and fueling coordination.

- Enhanced predictive maintenance for ground support equipment, reducing downtime.

- Improved real-time situational awareness and security monitoring.

- Personalized service delivery and improved customer experience through data insights.

Key Takeaways Business Jet Ground Handling Service Market Size & Forecast

Key takeaways from the Business Jet Ground Handling Service market size and forecast consistently highlight robust growth driven by the expansion of the global business jet fleet and the increasing complexity of international travel. Users frequently inquire about the primary factors contributing to this growth, the most promising regions for investment, and the technological advancements poised to shape the industry's future. The market's resilience against economic fluctuations and its capacity for innovation are also subjects of significant interest.

The market is poised for sustained expansion, primarily fueled by rising high-net-worth individual (HNWI) populations, corporate globalization, and the convenience offered by private aviation over commercial alternatives. Regional dynamics indicate North America and Europe as established leaders, while Asia Pacific and the Middle East represent significant growth frontiers due to burgeoning economic activities and infrastructure development. Technological integration, particularly AI and automation, will be crucial for service differentiation and operational efficiency, underscoring a future where advanced solutions are integral to ground handling excellence.

- Significant market growth projected, driven by increasing business jet movements.

- Technological integration, including AI and automation, is a critical growth enabler.

- Emerging economies in Asia Pacific and the Middle East present substantial expansion opportunities.

- Focus on sustainability and personalized service delivery will define competitive advantage.

- Infrastructure development at regional airports is vital for market penetration.

Business Jet Ground Handling Service Market Drivers Analysis

The Business Jet Ground Handling Service market is significantly influenced by several key drivers that contribute to its robust growth trajectory. These drivers primarily stem from the expanding private aviation sector, the increasing demand for luxury and convenience, and the globalization of business operations. The continued growth in the number of ultra-high-net-worth individuals (UHNWIs) and corporations requiring efficient and flexible air travel solutions directly fuels the need for comprehensive ground handling support.

Moreover, the preference for private jet travel, particularly in a post-pandemic environment where health and safety are paramount, has further accelerated market demand. This preference translates into a higher utilization of business jets, consequently increasing the volume of ground handling operations required at airports worldwide. Advances in aircraft technology, leading to larger and more complex business jets, also necessitate sophisticated ground support equipment and skilled personnel, driving investment in the ground handling infrastructure and services.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increase in Global Business Jet Fleet Size and Utilization | +2.5% | Global, particularly North America, Europe, Asia Pacific | 2025-2033 |

| Rising Number of High-Net-Worth Individuals (HNWIs) and Corporate Travel | +2.0% | North America, Europe, Middle East, Asia Pacific | 2025-2033 |

| Demand for Enhanced Passenger Experience and VIP Services | +1.8% | Global, especially premium travel hubs | 2025-2033 |

| Technological Advancements in Ground Support Equipment (GSE) and Operations | +1.5% | Developed regions with high investment capacity | 2026-2033 |

| Globalization of Business and Increased Cross-Border Mobility | +1.0% | All major economic corridors | 2025-2033 |

| Expansion and Modernization of Airport Infrastructure Globally | +0.9% | Emerging markets, key regional hubs | 2027-2033 |

Business Jet Ground Handling Service Market Restraints Analysis

Despite robust growth, the Business Jet Ground Handling Service market faces several restraints that could potentially impede its full expansion. One significant challenge is the high operational costs associated with maintaining a diverse fleet of specialized ground support equipment, managing skilled labor, and adhering to stringent regulatory compliance. These costs can be particularly burdensome for smaller operators and may limit their ability to invest in necessary upgrades or service expansions.

Infrastructure limitations at certain regional airports and general aviation facilities also pose a considerable restraint. Many smaller airfields may lack the advanced facilities, apron space, or fuel storage capacities required for modern, larger business jets, thereby restricting the scope of ground handling services that can be offered. Furthermore, strict environmental regulations and evolving safety standards necessitate continuous investment in eco-friendly equipment and advanced training, adding complexity and cost to operations. Economic downturns or geopolitical instability can also lead to reduced business travel, directly impacting demand for ground handling services.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Operational Costs and Capital Expenditure | -1.2% | Global, particularly for smaller FBOs | 2025-2033 |

| Infrastructure Limitations at Regional and Smaller Airports | -1.0% | Developing regions, remote areas | 2025-2033 |

| Stringent Regulatory Compliance and Safety Standards | -0.8% | Global, especially highly regulated markets (EU, USA) | 2025-2033 |

| Shortage of Skilled Labor and Specialized Workforce | -0.7% | North America, Europe | 2026-2033 |

| Economic Volatility and Geopolitical Instability | -0.5% | Globally, impacts regions disproportionately | Intermittent |

Business Jet Ground Handling Service Market Opportunities Analysis

The Business Jet Ground Handling Service market is ripe with opportunities, particularly in expanding geographical markets and through the adoption of advanced technologies. Emerging economies, especially in Asia Pacific, Latin America, and the Middle East, are experiencing significant economic growth and an increase in their business jet fleets, creating a substantial demand for sophisticated ground handling services. Investment in airport infrastructure in these regions further amplifies these opportunities.

Technological innovation presents another critical avenue for growth, with digitalization, automation, and AI integration promising enhanced efficiency, safety, and customer satisfaction. The development of sustainable aviation practices, including electric ground support equipment and sustainable aviation fuel (SAF) logistics, also offers a competitive edge and aligns with global environmental goals. Furthermore, the expansion of value-added services such as advanced MRO (Maintenance, Repair, and Overhaul) capabilities, luxury concierge services, and bespoke travel packages provides new revenue streams and strengthens client loyalty.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging Markets (Asia Pacific, Middle East, Latin America) | +2.3% | China, India, UAE, Brazil, Mexico | 2025-2033 |

| Integration of Advanced Technologies (AI, Automation, IoT) | +2.0% | Global, especially technologically advanced markets | 2026-2033 |

| Development of Sustainable Aviation Ground Handling Practices | +1.7% | Europe, North America, environmentally conscious regions | 2027-2033 |

| Growth in Value-Added Services (MRO, Concierge, Security) | +1.5% | Global, high-end private aviation markets | 2025-2033 |

| Strategic Partnerships and Consolidation for Global Reach | +1.0% | Global | 2025-2030 |

Business Jet Ground Handling Service Market Challenges Impact Analysis

The Business Jet Ground Handling Service market, while expanding, faces several inherent challenges that demand strategic responses from industry players. One significant challenge is the ongoing shortage of skilled labor, particularly for specialized roles requiring expertise in advanced ground support equipment and complex aircraft handling procedures. This can lead to operational inefficiencies, increased labor costs, and potential service quality degradation.

Another considerable challenge is navigating the fragmented regulatory landscape across different countries and regions, which often entails varying safety standards, customs procedures, and environmental mandates. Adherence to these diverse regulations adds complexity and can impede seamless international operations. Furthermore, the industry is susceptible to economic fluctuations and unforeseen global events, which can suddenly impact business travel demand. Cybersecurity threats targeting operational data and IT infrastructure also represent an emerging and critical challenge for ground handling service providers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Skilled Labor Shortage and Workforce Retention | -1.5% | North America, Europe, rapidly growing markets | 2025-2033 |

| Complex and Diverse Regulatory Landscape | -1.0% | Global, especially cross-border operations | 2025-2033 |

| Economic Downturns and Geopolitical Disruptions | -0.9% | Global, with varying regional impacts | Intermittent |

| High Initial Investment in Advanced Equipment and Infrastructure | -0.8% | Developing markets, new entrants | 2025-2030 |

| Increasing Cybersecurity Threats to Aviation Operations | -0.7% | Global, technologically advanced FBOs | 2026-2033 |

Business Jet Ground Handling Service Market - Updated Report Scope

The updated report scope for the Business Jet Ground Handling Service market provides an in-depth analysis of market dynamics, growth drivers, restraints, opportunities, and challenges across various segments and key regions. It offers a comprehensive overview of the market size and forecasts, incorporating the latest industry trends and technological advancements impacting ground handling operations. This report is designed to assist stakeholders in making informed strategic decisions by providing granular insights into the competitive landscape and future market trajectory.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 28.0 Billion |

| Growth Rate | 8.7% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Universal Aviation, Jet Aviation, Signature Aviation, Menzies Aviation, Swissport International, dnata, FBO One, Landmark Aviation, Atlantic Aviation, ExecuJet, Harrods Aviation, Sky Valet, Luxaviation Group, Gama Aviation, Paragon Aviation Group, Ross Aviation, JetEx, AEG Fuels, World Fuel Services, Avfuel Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Business Jet Ground Handling Service market is comprehensively segmented to provide granular insights into its diverse components, allowing for a detailed understanding of market dynamics and opportunities within specific service offerings, aircraft types, end-user categories, and airport types. This segmentation approach facilitates targeted strategic planning and investment decisions for stakeholders across the private aviation ecosystem. Analyzing each segment reveals unique growth drivers and competitive landscapes, from specialized aircraft handling to comprehensive VIP concierge services.

Understanding these distinct segments is crucial for identifying areas of high growth potential and tailoring service offerings to meet specific client needs. For instance, the demand for sophisticated aircraft maintenance and cleaning services differs significantly between light jets and bizliners, while security and fueling services are universally critical. The breakdown by end-user also highlights varying service expectations, from the efficiency required by corporate flight departments to the personalized attention sought by private owners, ensuring that market players can effectively address the nuanced requirements of their clientele.

- By Service Type: Aircraft Handling, Passenger Handling, Baggage Handling, Cargo Handling, Aircraft Maintenance and Cleaning, Fueling Services, Catering Services, Security Services, Crew Services, Concierge Services, Other Ground Services.

- By Aircraft Type: Light Jet, Mid-Size Jet, Super Mid-Size Jet, Large Jet, Bizliners.

- By End-User: Charter Operators, Fractional Ownership, Private Owners, Corporate Flight Departments, Government/Military.

- By Airport Type: Major International Airports, Regional Airports, General Aviation Airports.

Regional Highlights

- North America: North America holds the largest share of the Business Jet Ground Handling Service market, primarily driven by the substantial presence of high-net-worth individuals, a robust corporate travel culture, and an extensive network of general aviation airports and FBOs. The region benefits from early adoption of private jet travel and a mature aviation infrastructure that supports a wide array of ground handling services. Innovation in service delivery, technological integration, and the emphasis on efficiency and safety are key drivers in this market.

- Europe: Europe represents a significant market for business jet ground handling services, characterized by diverse regulatory environments and a strong emphasis on luxury and bespoke services. The region's dense network of cities and business hubs, coupled with a robust private banking sector, drives consistent demand for private jet travel. Key countries such as the UK, Germany, France, and Switzerland are at the forefront of this market, offering sophisticated ground handling facilities and a high standard of service.

The European market is increasingly focused on sustainability initiatives, with a rising demand for environmentally friendly ground support equipment and carbon-offset programs. Regulatory harmonization efforts, though challenging, aim to streamline operations across different countries. The market also sees a trend towards consolidation among FBOs to achieve economies of scale and offer integrated services across the continent, enhancing convenience for multinational corporations and private owners.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market for Business Jet Ground Handling Services, fueled by rapid economic development, increasing urbanization, and a burgeoning population of HNWIs in countries like China, India, Singapore, and Australia. Significant investments in new airport infrastructure and the expansion of existing facilities are creating fertile ground for market expansion.

While still developing in some areas, the APAC market is characterized by a strong demand for modern, efficient, and technologically advanced services. Cultural nuances often necessitate highly personalized and flexible service offerings. The growth of regional economic corridors and the increasing intra-Asia business travel are key factors driving the need for sophisticated ground handling capabilities, often with an emphasis on seamless customs and immigration support for international flights.

- Latin America: The Latin American market for business jet ground handling services is experiencing steady growth, driven by increasing economic activity in countries such as Brazil, Mexico, and Argentina. The region's challenging commercial aviation infrastructure often makes private jet travel a preferred option for business and leisure, especially for connecting major business centers and remote areas. Key demand areas include resource-rich regions and major capital cities.

While the market is still maturing compared to North America or Europe, there is a growing interest in improving service standards and adopting advanced technologies. Investment in FBO infrastructure and skilled personnel remains a focus to meet the evolving demands of both domestic and international business jet operators. Political and economic stability fluctuations can, however, influence market growth rates intermittently.

- Middle East and Africa (MEA): The Middle East and Africa region presents significant growth opportunities, particularly in the Middle East, driven by substantial wealth accumulation, a strong business and tourism sector, and strategic geographical location. Countries like the UAE, Saudi Arabia, and Qatar are investing heavily in world-class aviation infrastructure, including dedicated private jet terminals and state-of-the-art FBOs, making them key hubs for business jet traffic.

The African market, while smaller, shows potential in key economic centers and for resource exploration activities, driving demand for robust ground handling services. The focus in the Middle East is on delivering ultra-luxury and highly efficient services, catering to an discerning clientele. Security and rapid turnaround times are paramount in this region, alongside a growing interest in sustainable aviation practices as part of broader national visions.

The United States, in particular, dominates the North American market due to the sheer volume of business jet movements and a highly competitive landscape among ground handling providers. Canada also contributes significantly, with a growing number of corporate operations and cross-border flights. The focus in North America is on seamless, personalized experiences, rapid turnaround times, and the implementation of advanced digital solutions for operational management and client interaction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Business Jet Ground Handling Service Market.- Universal Aviation

- Jet Aviation

- Signature Aviation

- Menzies Aviation

- Swissport International

- dnata

- FBO One

- Landmark Aviation

- Atlantic Aviation

- ExecuJet

- Harrods Aviation

- Sky Valet

- Luxaviation Group

- Gama Aviation

- Paragon Aviation Group

- Ross Aviation

- JetEx

- AEG Fuels

- World Fuel Services

- Avfuel Corporation

Frequently Asked Questions

What is the projected growth rate of the Business Jet Ground Handling Service Market?

The Business Jet Ground Handling Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2033, reaching an estimated value of USD 28.0 Billion by the end of 2033.

Which regions are expected to drive market growth for business jet ground handling?

North America and Europe currently dominate the market, while Asia Pacific and the Middle East are anticipated to exhibit the fastest growth, driven by increasing wealth, business globalization, and significant investments in aviation infrastructure.

How is technology, specifically AI, impacting ground handling services for business jets?

AI is set to revolutionize ground handling by optimizing resource allocation, automating routine tasks, enabling predictive maintenance for equipment, enhancing real-time security monitoring, and personalizing the overall passenger experience, leading to improved efficiency and safety.

What are the primary challenges faced by the Business Jet Ground Handling Service market?

Key challenges include a shortage of skilled labor, navigating complex and diverse regulatory landscapes, susceptibility to economic downturns, high initial investment costs for advanced equipment, and increasing cybersecurity threats.

What are the key service types included in business jet ground handling?

Key service types encompass aircraft handling, passenger handling, baggage and cargo management, aircraft maintenance and cleaning, fueling, catering, security, crew services, and concierge services, among others, designed to provide comprehensive support for business jet operations.