Blood Plasma Derivative Market

Blood Plasma Derivative Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_706279 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Blood Plasma Derivative Market Size

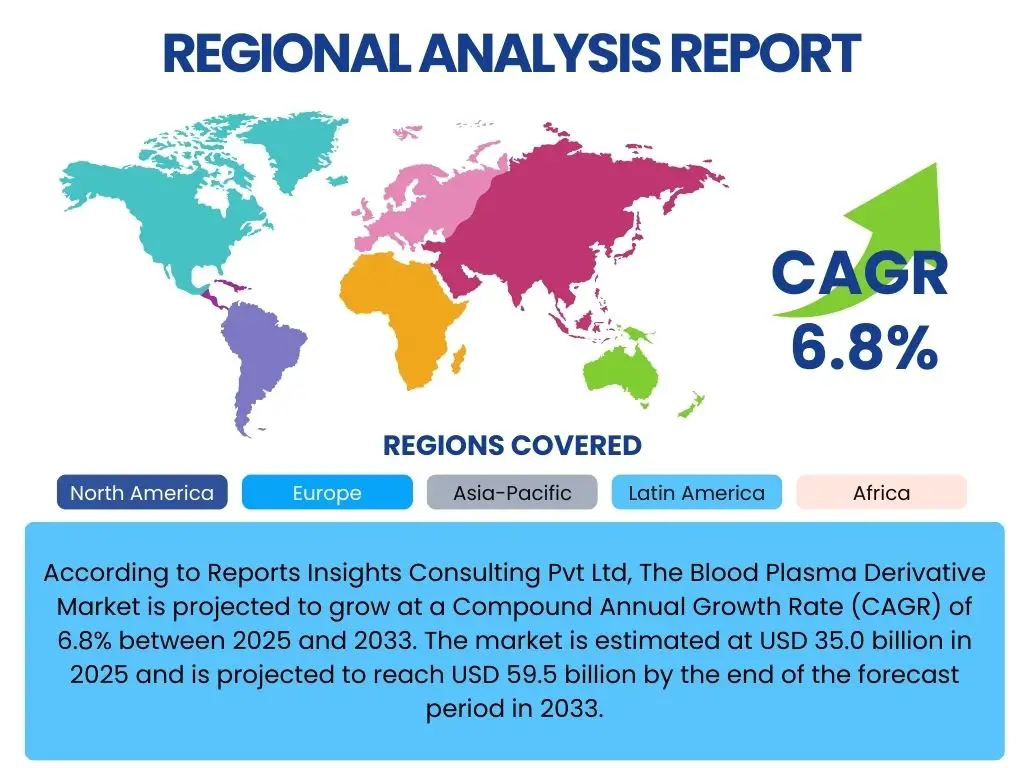

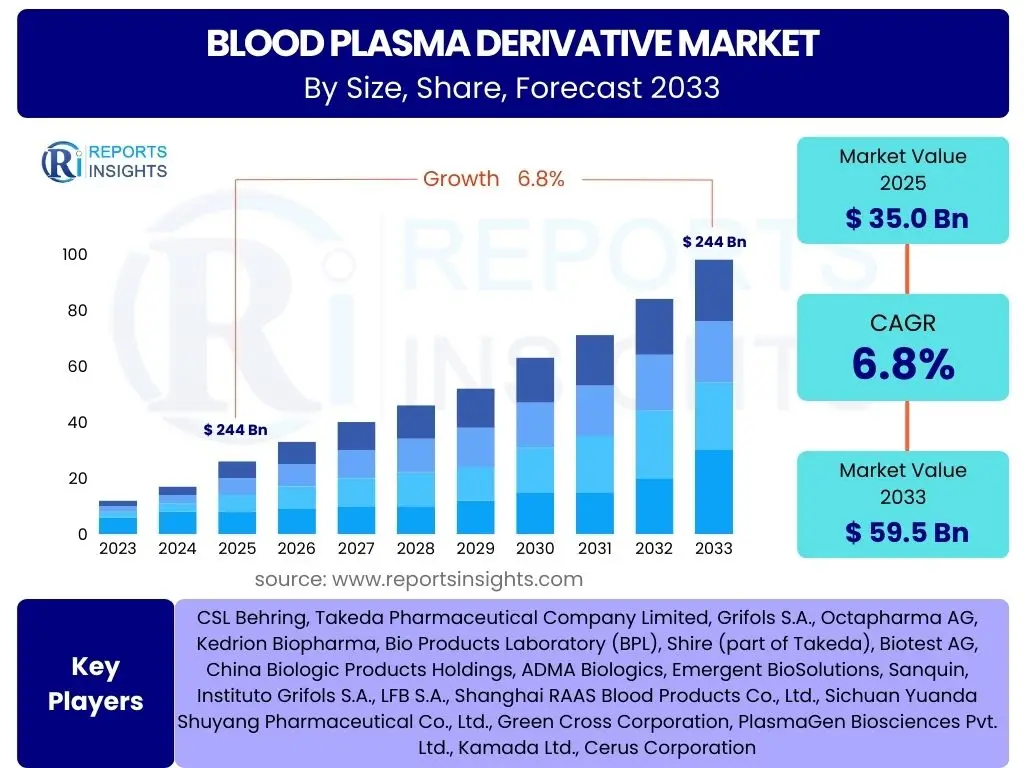

According to Reports Insights Consulting Pvt Ltd, The Blood Plasma Derivative Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 35.0 billion in 2025 and is projected to reach USD 59.5 billion by the end of the forecast period in 2033.

Key Blood Plasma Derivative Market Trends & Insights

User inquiries frequently focus on the evolving landscape of the blood plasma derivative market, seeking to understand the significant shifts and innovations that are shaping its trajectory. Analysis of these questions reveals a keen interest in advancements in therapeutic applications, new product development, and the expansion of market reach, particularly in emerging economies. Stakeholders are keen to identify not only the current prevailing trends but also their potential long-term implications for investment and strategic planning. The market is experiencing a dynamic phase driven by increasing demand for critical therapies and continuous technological refinement.

Furthermore, discussions often center on the increasing prevalence of chronic and rare diseases, which directly fuels the demand for plasma-derived therapies. The growing understanding of complex immunological and neurological disorders has expanded the application spectrum of these derivatives, moving beyond traditional uses. This expansion is paralleled by an intensified focus on improving the safety and efficacy of plasma products through advanced purification and processing techniques. Regulatory bodies globally are also playing a crucial role by establishing stringent guidelines, thereby ensuring product quality and patient safety, which in turn influences market trends and product innovation.

The market also observes a notable trend towards strategic collaborations, mergers, and acquisitions among key players. These alliances are often aimed at consolidating market share, expanding geographic footprint, and pooling resources for research and development. Such consolidations facilitate the acceleration of new product launches and the penetration into untapped markets, particularly in regions with developing healthcare infrastructures. Additionally, the increasing adoption of personalized medicine approaches is influencing the development of highly specific plasma-derived therapies, catering to individual patient needs and further diversifying the market's product portfolio.

- Increasing demand for immunoglobulins in treating primary immunodeficiency disorders and neurological conditions.

- Growing prevalence of bleeding disorders and alpha-1 antitrypsin deficiency driving demand for specific coagulation factors and AAT.

- Technological advancements in plasma fractionation and purification enhancing product safety and yield.

- Expansion of therapeutic applications beyond traditional uses into new neurological and autoimmune indications.

- Strategic collaborations, mergers, and acquisitions accelerating market consolidation and global reach.

- Rising investment in research and development for novel plasma-derived therapies and recombinant alternatives.

- Focus on expanding plasma collection infrastructure and donor recruitment initiatives globally.

- Increasing awareness and improved diagnostic capabilities for plasma-related disorders.

- Geographic expansion into emerging markets with developing healthcare systems and rising disposable incomes.

AI Impact Analysis on Blood Plasma Derivative

Common user questions regarding AI's impact on the blood plasma derivative market frequently revolve around its potential to revolutionize various stages of the value chain, from plasma collection and processing to drug discovery and patient management. Users seek to understand how AI can enhance efficiency, reduce costs, improve safety, and accelerate innovation within this highly specialized sector. There is a particular interest in AI's role in optimizing complex biological processes and in handling vast datasets generated in clinical trials and real-world evidence studies.

The integration of artificial intelligence and machine learning algorithms is anticipated to significantly transform the operational landscape of plasma derivative manufacturing. AI can be leveraged for predictive analytics to optimize plasma donor recruitment and retention strategies, ensuring a stable and sufficient supply. Furthermore, AI-driven solutions can enhance the efficiency and precision of fractionation processes, leading to higher yields of purified derivatives and reduced waste. This technological adoption also extends to quality control, where AI can identify anomalies and ensure consistent product quality with greater accuracy than traditional methods, thereby bolstering patient safety.

Beyond manufacturing, AI holds substantial promise in the realm of research and development for new plasma-derived therapies. Machine learning models can analyze vast genomic and proteomic datasets to identify novel therapeutic targets and biomarkers, accelerating the drug discovery pipeline. In clinical settings, AI can assist in the early diagnosis of plasma-related disorders, predict patient responses to specific derivatives, and personalize treatment regimens. This integration of AI is expected to lead to more effective therapies, improved patient outcomes, and a more streamlined, data-driven approach to market development and expansion.

- Enhanced drug discovery and development through AI-driven target identification and lead optimization.

- Optimized plasma collection and donor management systems using predictive analytics.

- Improved efficiency and yield in plasma fractionation and purification processes.

- Advanced quality control and anomaly detection in manufacturing to ensure product safety and consistency.

- Predictive modeling for supply chain management, minimizing shortages and optimizing distribution.

- Personalized medicine approaches through AI analysis of patient data for tailored derivative therapies.

- Faster and more accurate diagnosis of plasma-related disorders using AI-powered diagnostic tools.

- Automation of data analysis in clinical trials, accelerating insights and regulatory submissions.

- Development of smart monitoring systems for patient adherence and therapy effectiveness.

Key Takeaways Blood Plasma Derivative Market Size & Forecast

User inquiries about key takeaways from the blood plasma derivative market size and forecast consistently highlight a need for concise, actionable insights regarding future growth prospects and strategic implications. These questions often aim to identify the most significant opportunities, potential challenges, and critical success factors for stakeholders. The overall sentiment reflects a strong interest in understanding the drivers behind projected growth and how these might influence investment decisions and market positioning over the forecast period.

The market is poised for robust expansion, primarily fueled by the increasing global prevalence of chronic and rare diseases that rely on plasma-derived therapies for treatment. This sustained demand, coupled with continuous advancements in fractionation technologies and an expanding array of therapeutic applications, underpins the positive growth trajectory. Stakeholders should recognize the critical importance of investing in research and development to introduce novel therapies and improve existing ones, thereby securing competitive advantages in a rapidly evolving landscape.

Moreover, the forecast underscores the growing significance of emerging economies as key growth engines, driven by improving healthcare infrastructure and increasing access to specialized treatments. However, navigating the stringent regulatory environments and managing the complexities of plasma supply chain logistics will remain critical challenges. Companies that can efficiently address these operational hurdles while strategically expanding their geographical footprint and product portfolios are best positioned to capitalize on the market's significant growth potential.

- The blood plasma derivative market is projected for significant and consistent growth, exceeding an 6% CAGR through 2033.

- Immunoglobulins and coagulation factors are expected to remain the largest and fastest-growing product segments.

- Increasing prevalence of neurological, immunological, and bleeding disorders globally is a primary growth driver.

- North America and Europe currently dominate the market, but Asia Pacific is emerging as a high-growth region.

- Technological advancements in plasma processing and purification are critical for market expansion and product safety.

- Strategic partnerships and global expansion initiatives will be key for market leaders to maintain and grow their share.

- Ensuring a stable and ethical supply of human plasma remains a fundamental challenge and a strategic priority.

Blood Plasma Derivative Market Drivers Analysis

The blood plasma derivative market is significantly propelled by a confluence of factors, primarily the escalating global incidence of various chronic and rare diseases that necessitate these therapies. Conditions such as primary immunodeficiency disorders, hemophilia, idiopathic thrombocytopenic purpura (ITP), and alpha-1 antitrypsin deficiency increasingly rely on plasma-derived products for effective management and treatment. The growing awareness and improved diagnostic capabilities for these conditions contribute to a larger diagnosed patient pool, thereby driving higher demand for specialized plasma derivatives. This intrinsic link between disease burden and therapy demand forms a robust foundation for market expansion, pushing pharmaceutical companies to enhance production capacities and innovate new applications.

Further driving the market forward are the continuous advancements in plasma collection and fractionation technologies. Innovations in donor screening, plasma separation techniques, and viral inactivation methods have significantly enhanced the safety profile and purity of plasma derivatives, instilling greater confidence among healthcare providers and patients. These technological leaps not only optimize the yield of valuable proteins from donated plasma but also reduce the risk of pathogen transmission, addressing a historical concern associated with blood-derived products. Such improvements contribute to the widespread adoption of these therapies in various clinical settings globally, fostering market growth.

Moreover, the demographic shift towards an aging global population contributes substantially to market growth, as the elderly are more susceptible to age-related immunological and neurological disorders that often require treatment with plasma derivatives like immunoglobulins. Increased healthcare expenditure, particularly in developing economies, coupled with supportive government initiatives and favorable reimbursement policies for orphan drugs and rare disease treatments, further stimulate market demand. The expansion of therapeutic indications for existing derivatives and the introduction of new applications across diverse medical fields also open up new revenue streams and opportunities for market participants.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Prevalence of Chronic and Rare Diseases | +1.5% | Global, particularly North America, Europe, Asia Pacific | Short to Long-term (2025-2033) |

| Advancements in Plasma Fractionation Technologies | +1.2% | Global | Mid to Long-term (2027-2033) |

| Growing Geriatric Population and Associated Disorders | +1.0% | North America, Europe, Japan, China | Long-term (2029-2033) |

Blood Plasma Derivative Market Restraints Analysis

Despite robust growth drivers, the blood plasma derivative market faces significant restraints that can impede its expansion. One of the primary challenges is the high cost associated with plasma-derived therapies. The complex manufacturing processes, stringent quality control measures, and extensive research and development required to bring these products to market contribute to their premium pricing. This can make these life-saving treatments inaccessible to a large segment of the population, particularly in developing countries with limited healthcare budgets and less comprehensive reimbursement policies. The economic burden on patients and healthcare systems often limits widespread adoption, creating a barrier to market growth.

Another substantial restraint is the highly stringent regulatory framework governing the collection, processing, and distribution of blood plasma derivatives. Regulatory bodies worldwide, such as the FDA in the US and EMA in Europe, impose rigorous standards to ensure the safety, purity, and potency of these products. Compliance with these regulations involves extensive clinical trials, complex approval processes, and continuous post-market surveillance, all of which are time-consuming and capital-intensive. This regulatory complexity can delay product launches, increase operational costs for manufacturers, and limit the introduction of novel therapies, thereby slowing market development and innovation.

Furthermore, the inherent reliance on human plasma donations presents a unique set of challenges. The availability of source plasma is directly dependent on donor willingness and regulatory guidelines surrounding collection. Fluctuations in plasma supply due to factors like pandemics, donor eligibility criteria, or ethical concerns about compensated donations can create supply-demand imbalances, leading to shortages of critical derivatives. While manufacturers strive to optimize collection networks and expand plasma centers, maintaining a consistent and sufficient supply remains a persistent challenge that can restrain market growth and stability, potentially impacting patient access to essential treatments.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Cost of Plasma-Derived Therapies | -0.8% | Global, particularly developing nations | Short to Long-term (2025-2033) |

| Stringent Regulatory Approval Processes | -0.7% | Global, particularly developed markets | Short to Mid-term (2025-2029) |

| Risk of Pathogen Transmission and Donor Sourcing Challenges | -0.5% | Global | Ongoing (2025-2033) |

Blood Plasma Derivative Market Opportunities Analysis

Significant opportunities for growth within the blood plasma derivative market arise from the increasing focus on the development of recombinant therapies and biosimilars. As the patent expirations for several blockbuster plasma-derived products approach, pharmaceutical companies are investing heavily in producing recombinant versions, which offer advantages such as reduced risk of pathogen transmission and potentially more consistent supply, as they do not rely on human plasma donations. This shift towards biotechnology-derived alternatives, alongside the burgeoning market for biosimilars, presents a lucrative avenue for innovation and market penetration, especially as healthcare systems seek more cost-effective treatment options without compromising efficacy. This trend enables companies to expand their product portfolios and cater to a broader patient base.

The expansion into emerging economies represents another substantial opportunity for market players. Countries in Asia Pacific, Latin America, and the Middle East and Africa are witnessing significant improvements in healthcare infrastructure, increasing disposable incomes, and a rising awareness of chronic and rare diseases. These regions often have large, underserved patient populations and a growing demand for advanced medical treatments, including plasma derivatives. Establishing local manufacturing facilities, forging strategic partnerships with regional distributors, and navigating local regulatory landscapes can enable companies to tap into these nascent markets, diversify their revenue streams, and capture considerable market share over the long term, thereby fostering sustained global growth.

Furthermore, the increasing number of orphan drug designations and the rising focus on rare disease treatments provide a unique and compelling opportunity for the blood plasma derivative market. Many rare diseases have limited or no treatment options, making plasma-derived therapies a critical lifeline for affected individuals. Governments and regulatory bodies often provide incentives, such as tax credits, market exclusivity, and expedited review processes, for drugs developed to treat rare conditions. This supportive regulatory environment encourages pharmaceutical companies to invest in research and development for novel plasma derivatives specifically targeting these niche, high-need indications, promising higher profit margins and addressing unmet medical needs. This strategic focus ensures sustained innovation and specialized market expansion.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Recombinant Therapies and Biosimilars | +0.9% | Global | Mid to Long-term (2027-2033) |

| Expansion into Emerging Economies | +1.1% | Asia Pacific, Latin America, MEA | Short to Long-term (2025-2033) |

| Increasing Number of Orphan Drug Designations | +0.7% | North America, Europe | Short to Mid-term (2025-2029) |

Blood Plasma Derivative Market Challenges Impact Analysis

The blood plasma derivative market faces persistent challenges related to maintaining a consistent and adequate supply of human plasma. The industry's reliance on voluntary or compensated plasma donations means that supply can be vulnerable to various factors, including public health crises, changes in donor behavior, and stringent donor eligibility criteria. Supply chain disruptions, often exacerbated by logistical complexities in collection, transportation, and storage, can lead to shortages of essential products, impacting patient access and treatment continuity. Addressing these supply-side vulnerabilities requires continuous investment in expanding plasma collection infrastructure and fostering donor engagement, which can be capital-intensive and time-consuming, posing a significant hurdle to market stability.

Another critical challenge is managing the inherent complexities and scalability issues associated with the manufacturing of blood plasma derivatives. The fractionation process is intricate, requiring specialized equipment, highly controlled environments, and skilled personnel to ensure product purity, potency, and safety. Scaling up production to meet increasing global demand while adhering to rigorous quality standards is a formidable task. Any deviation in the manufacturing process can lead to significant product losses and regulatory non-compliance, which can have severe financial repercussions and erode market confidence. Furthermore, the long manufacturing lead times for plasma derivatives mean that companies must accurately forecast demand years in advance, adding another layer of complexity to production planning.

Lastly, the market is subject to increasing pricing pressures and intense competition from alternative therapies. Payers, including governments and private insurers, are continually seeking ways to reduce healthcare expenditures, leading to demands for lower drug prices. This pressure is compounded by the emergence of recombinant factor therapies and other synthetic alternatives that, while not entirely replacing plasma derivatives, offer competitive options for certain indications. Manufacturers must balance the need for profitability with market access demands, which can lead to reduced margins and necessitate strategic pricing models. This competitive landscape mandates continuous innovation and differentiation to maintain market share and value proposition.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Maintaining Consistent Plasma Supply | -0.6% | Global | Ongoing (2025-2033) |

| Manufacturing Complexities and Scalability Issues | -0.4% | Global | Short to Mid-term (2025-2029) |

| Pricing Pressures and Competition from Alternative Therapies | -0.5% | Global, particularly developed markets | Long-term (2029-2033) |

Blood Plasma Derivative Market - Updated Report Scope

This report offers a comprehensive analysis of the global blood plasma derivative market, detailing its current size, historical performance, and future growth projections from 2025 to 2033. It provides an in-depth exploration of market dynamics, including key trends, drivers, restraints, opportunities, and challenges influencing the industry. The scope encompasses detailed segmentation by product type, application, and end-user, along with a thorough regional analysis across major geographies. Furthermore, the report highlights the competitive landscape by profiling leading companies and includes essential insights for stakeholders seeking to understand and capitalize on market movements.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 35.0 billion |

| Market Forecast in 2033 | USD 59.5 billion |

| Growth Rate | 6.8% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | CSL Behring, Takeda Pharmaceutical Company Limited, Grifols S.A., Octapharma AG, Kedrion Biopharma, Bio Products Laboratory (BPL), Shire (part of Takeda), Biotest AG, China Biologic Products Holdings, ADMA Biologics, Emergent BioSolutions, Sanquin, Instituto Grifols S.A., LFB S.A., Shanghai RAAS Blood Products Co., Ltd., Sichuan Yuanda Shuyang Pharmaceutical Co., Ltd., Green Cross Corporation, PlasmaGen Biosciences Pvt. Ltd., Kamada Ltd., Cerus Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The blood plasma derivative market is comprehensively segmented to provide a granular view of its diverse components and their respective contributions to overall market growth. This segmentation is crucial for understanding the various product types, their applications across different disease areas, and the key end-users driving demand. Analyzing these segments helps in identifying niche markets, emerging therapeutic areas, and strategic investment opportunities within the broader plasma derivative industry. The detailed breakdown allows for a precise assessment of market trends and growth potential across specific categories, aiding stakeholders in informed decision-making.

The product type segmentation differentiates between major plasma derivatives such as Immunoglobulin, Albumin, Coagulation Factors, and Alpha-1 Antitrypsin, each serving distinct therapeutic purposes. Immunoglobulins, for instance, are vital in treating a wide range of immunological and neurological conditions, while coagulation factors are indispensable for managing bleeding disorders like hemophilia. Understanding the dynamics of each product type is essential, as their demand is influenced by the prevalence of specific diseases and advancements in their therapeutic applications. This detailed view helps in recognizing the dominant and emerging product categories within the market landscape.

Furthermore, the market is segmented by application, which outlines the primary therapeutic areas where plasma derivatives are utilized, including hemophilia, primary immunodeficiency diseases, and neurological disorders. This allows for an understanding of which medical conditions are driving the highest demand for these products. The end-user segmentation, encompassing hospitals, clinics, and academic & research institutes, provides insights into the primary points of consumption and the infrastructure supporting the administration and research of plasma-derived therapies. This multi-faceted segmentation provides a holistic perspective on the market's structure and operational flow.

- By Product Type:

- Immunoglobulin (Intravenous Immunoglobulin (IVIg), Subcutaneous Immunoglobulin (SCIg))

- Albumin

- Coagulation Factors (Factor VIII, Factor IX, Von Willebrand Factor (vWF), Prothrombin Complex Concentrates (PCC))

- Alpha-1 Antitrypsin

- Other Plasma Derivatives (C1 Esterase Inhibitor, Antithrombin III, etc.)

- By Application:

- Hemophilia (Hemophilia A, Hemophilia B)

- Primary Immunodeficiency Diseases (PID)

- Idiopathic Thrombocytopenic Purpura (ITP)

- Neurological Disorders (Chronic Inflammatory Demyelinating Polyneuropathy (CIDP), Guillain-Barré Syndrome (GBS))

- Alpha-1 Antitrypsin Deficiency

- Other Rare Diseases

- Other Applications (Burn Treatment, Trauma Management, etc.)

- By End-user:

- Hospitals

- Clinics

- Academic & Research Institutes

Regional Highlights

- North America: This region dominates the blood plasma derivative market, primarily due to the high prevalence of target diseases such as hemophilia and immunodeficiency disorders, advanced healthcare infrastructure, significant R&D investments, and favorable reimbursement policies. The presence of major market players and well-established plasma collection networks further contributes to its leading position. The United States specifically accounts for the largest share within this region, driven by high per capita healthcare spending and a strong regulatory framework facilitating product innovation and market access.

- Europe: As the second-largest market, Europe exhibits strong demand for plasma derivatives, supported by increasing awareness of rare diseases, an aging population, and robust healthcare systems. Countries like Germany, France, and the UK are key contributors, benefiting from advanced medical research and widespread adoption of plasma therapies. The region's stringent quality and safety standards for blood products, coupled with significant investments in fractionation technologies, ensure a stable and growing market.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC is characterized by a large patient pool, improving healthcare infrastructure, increasing disposable incomes, and a growing focus on rare disease diagnosis and treatment. Countries such as China, India, and Japan are at the forefront of this growth, driven by expanding access to healthcare services, rising awareness about plasma-derived therapies, and increasing investments by global and local manufacturers. The region offers substantial untapped potential, making it a key strategic focus for market expansion.

- Latin America: This region presents emerging opportunities for market growth, influenced by improving economic conditions, expanding healthcare access, and increasing awareness of chronic diseases. Countries like Brazil and Mexico are seeing rising demand for plasma derivatives, albeit at a slower pace compared to developed regions. Challenges include less developed healthcare infrastructure and varying reimbursement policies, yet the underlying patient need drives gradual market expansion.

- Middle East and Africa (MEA): The MEA region is a nascent but promising market, driven by increasing healthcare expenditure, a rising incidence of chronic diseases, and efforts to modernize healthcare facilities. Growth in this region is propelled by international collaborations and investments aimed at enhancing access to advanced therapies. While challenges related to affordability and healthcare infrastructure persist, ongoing developments signal a gradual but steady increase in the adoption of blood plasma derivatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Plasma Derivative Market.- CSL Behring

- Takeda Pharmaceutical Company Limited

- Grifols S.A.

- Octapharma AG

- Kedrion Biopharma

- Bio Products Laboratory (BPL)

- Biotest AG

- China Biologic Products Holdings

- ADMA Biologics

- Emergent BioSolutions

- Sanquin

- Instituto Grifols S.A.

- LFB S.A.

- Shanghai RAAS Blood Products Co., Ltd.

- Sichuan Yuanda Shuyang Pharmaceutical Co., Ltd.

- Green Cross Corporation

- PlasmaGen Biosciences Pvt. Ltd.

- Kamada Ltd.

- Cerus Corporation

- Roche (indirectly through related therapies)

Frequently Asked Questions

Analyze common user questions about the Blood Plasma Derivative market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of blood plasma derivatives?

Blood plasma derivatives are primarily used in the treatment of a wide range of medical conditions, including primary immunodeficiency diseases, bleeding disorders such as hemophilia A and B, neurological disorders like Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) and Guillain-Barré Syndrome (GBS), and Alpha-1 Antitrypsin Deficiency. They are also vital in burn treatment, trauma management, and liver disease support, offering critical protein replacement therapies.

What is the projected growth rate for the Blood Plasma Derivative Market?

The Blood Plasma Derivative Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 35.0 billion in 2025 and is forecast to reach USD 59.5 billion by the end of 2033, driven by increasing disease prevalence and therapeutic advancements.

Which are the major types of blood plasma derivatives available in the market?

The major types of blood plasma derivatives include Immunoglobulins (such as Intravenous Immunoglobulin - IVIg and Subcutaneous Immunoglobulin - SCIg), Albumin, Coagulation Factors (like Factor VIII, Factor IX, and Prothrombin Complex Concentrates), and Alpha-1 Antitrypsin. Other derivatives include C1 Esterase Inhibitor and Antithrombin III, each serving specific therapeutic needs.

What key factors are driving the growth of the Blood Plasma Derivative Market?

Key drivers include the rising global prevalence of chronic and rare diseases requiring plasma-derived therapies, continuous technological advancements in plasma fractionation and purification, and the increasing global geriatric population susceptible to related disorders. Additionally, growing awareness and improved diagnostic capabilities contribute significantly to market expansion.

What are the main challenges faced by the Blood Plasma Derivative Market?

The primary challenges involve maintaining a consistent and sufficient supply of human plasma due to donor reliance and regulatory complexities, managing the inherent manufacturing complexities and scalability issues, and navigating increasing pricing pressures from payers alongside competition from alternative recombinant therapies. These factors collectively impact market stability and accessibility.