Balsa Wood Market

Balsa Wood Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702838 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Balsa Wood Market Size

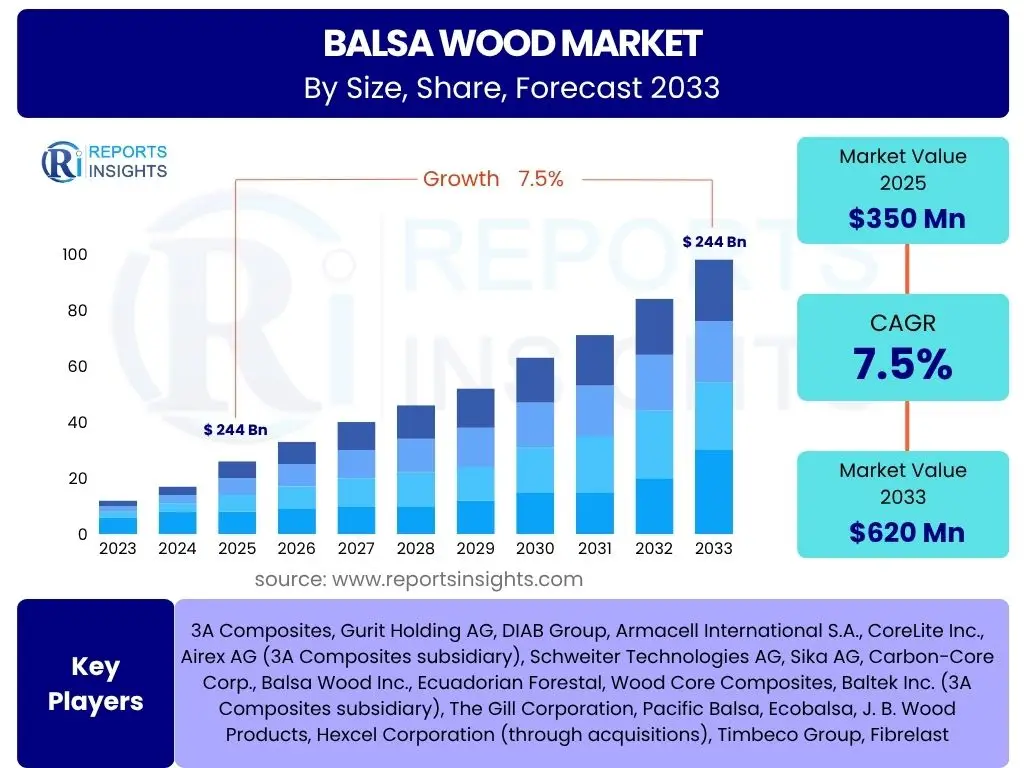

According to Reports Insights Consulting Pvt Ltd, The Balsa Wood Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2033. The market is estimated at USD 350 Million in 2025 and is projected to reach USD 620 Million by the end of the forecast period in 2033.

Key Balsa Wood Market Trends & Insights

The Balsa wood market is experiencing significant evolution driven by global shifts towards sustainability and lightweight material solutions. Industry stakeholders and end-users are increasingly inquiring about the role of balsa in green energy transitions, specifically its application in larger wind turbine blades, and its burgeoning adoption across various high-performance composite structures. There is a discernible trend towards understanding the supply chain's resilience, the impact of responsible sourcing, and the technological advancements in processing methods that enhance balsa's properties for diverse industrial applications. Furthermore, market participants are keenly observing how balsa wood's natural characteristics are being leveraged to develop innovative products that meet stringent performance and environmental criteria.

Key insights reveal a sustained focus on optimizing balsa's inherent strength-to-weight ratio for critical applications while addressing concerns related to its natural variability and supply consistency. The industry is witnessing a push for advanced lamination and impregnation techniques that improve balsa's resistance to moisture and enhance its mechanical properties, thereby expanding its utility beyond traditional uses. Additionally, the growing emphasis on circular economy principles is prompting research into recyclable composite solutions featuring balsa wood, positioning it as a material of choice for sustainable industrial growth. These trends collectively underscore balsa wood's strategic importance in sectors prioritizing efficiency, performance, and environmental stewardship.

- Increasing demand from the renewable energy sector, particularly for large-scale wind turbine blades, driving significant market expansion.

- Growing adoption of balsa wood as a core material in lightweight composite structures across aerospace, automotive, and marine industries.

- Rising focus on sustainable sourcing, certified plantations, and environmental stewardship in balsa wood production and supply chains.

- Advancements in balsa wood processing technologies, including densification, impregnation, and lamination, to enhance material properties and performance.

- Diversification of applications into new niche markets such as high-performance sporting goods, architectural modeling, and specialized packaging.

- Development of innovative hybrid composite materials incorporating balsa wood to achieve optimal strength-to-weight ratios and cost-effectiveness.

- Increased research and development initiatives aimed at improving balsa wood's dimensional stability and resistance to environmental factors.

AI Impact Analysis on Balsa Wood

The integration of Artificial Intelligence (AI) across various industrial sectors has prompted considerable inquiry regarding its potential influence on the balsa wood market. Common user questions revolve around how AI can optimize the cultivation, harvesting, processing, and distribution of balsa wood, ultimately impacting efficiency, cost, and sustainability. Stakeholders are keen to understand if AI can address existing challenges such as supply chain inconsistencies, quality control variability, and the prediction of market demand and pricing. The overarching expectation is that AI could usher in a new era of precision in forestry and material science, leading to a more robust and responsive balsa wood industry.

AI's influence on the balsa wood domain is anticipated to be transformative, primarily by enhancing operational intelligence and predictive capabilities. From smart plantation management systems that monitor growth rates and optimize harvesting schedules to advanced quality assurance protocols utilizing computer vision for defect detection, AI offers solutions to critical industry pain points. Furthermore, AI-driven analytics can significantly improve supply chain logistics, reduce waste, and provide more accurate demand forecasts, thereby stabilizing pricing and ensuring consistent material availability. The technology holds the promise of unlocking new levels of efficiency and sustainability, making balsa wood a more competitive and reliable material on the global stage.

- Optimized plantation management and growth prediction through AI-powered sensors and data analytics, leading to improved yield and resource efficiency.

- Enhanced quality control and automated grading of balsa wood planks and blocks using machine vision and deep learning algorithms to identify defects and ensure consistency.

- Predictive maintenance for processing machinery and equipment in balsa wood production facilities, reducing downtime and operational costs.

- Supply chain optimization and demand forecasting through AI models that analyze market trends, logistics data, and historical purchasing patterns, leading to more efficient inventory management.

- Development of new material composites and balsa wood applications through AI-driven material design and simulation, accelerating innovation in product development.

- Improved sustainability monitoring and compliance by tracking sourcing, deforestation risks, and environmental impact using AI-enabled data platforms.

- Automated market analysis and competitive intelligence to identify emerging opportunities and challenges within the balsa wood sector.

Key Takeaways Balsa Wood Market Size & Forecast

Analyzing common user questions about the Balsa Wood market size and forecast reveals a strong interest in understanding the primary drivers of growth, particularly in emerging applications, and the factors that could potentially restrain or challenge this expansion. Users consistently inquire about the long-term viability of balsa wood as a core material, especially given its environmental profile and supply chain dynamics. There is also significant curiosity regarding regional growth disparities and the strategic implications for investors and market participants seeking to capitalize on balsa wood's increasing demand.

The key takeaways from the market size and forecast underscore balsa wood's critical role in the accelerating renewable energy sector, particularly wind power, which is poised to be the dominant growth catalyst. The material's unique properties, combined with advancements in processing and sustainable sourcing initiatives, position it favorably for continued adoption in high-performance lightweight applications across diverse industries. While supply chain resilience and price stability remain areas of focus, the overall outlook for the balsa wood market is robust, driven by its unparalleled strength-to-weight ratio and eco-friendly attributes. Strategic investments in sustainable plantations and technological innovations will be crucial for sustained growth and market leadership.

- The Balsa wood market is poised for robust expansion, primarily fueled by the burgeoning demand from the wind energy sector as a core material for turbine blades.

- Significant growth opportunities exist in lightweighting applications across aerospace, automotive, and marine industries, driven by stringent performance and fuel efficiency requirements.

- Sustainability and traceability in the supply chain are becoming increasingly critical for market acceptance and competitive differentiation, influencing procurement decisions.

- Innovation in balsa wood processing, including lamination, impregnation, and densification techniques, will be key to expanding its functional properties and unlocking new market value.

- While raw material supply fluctuations and price volatility pose challenges, strategic sourcing and diversification of supply bases are emerging as vital strategies for market stability.

- Geographic market expansion is anticipated, with emerging economies showing increasing potential for both supply and demand for balsa wood and its derivatives.

- The market's resilience will depend on the industry's ability to balance rapid demand growth with sustainable forestry practices and efficient resource management.

Balsa Wood Market Drivers Analysis

The balsa wood market is significantly propelled by several key drivers that underscore its unique value proposition in modern industries. Foremost among these is the escalating global demand for renewable energy, particularly wind power, where balsa wood serves as an indispensable core material in wind turbine blades due to its exceptional strength-to-weight ratio and structural integrity. This burgeoning sector provides a robust and consistent demand base, directly influencing market growth. Concurrently, the increasing imperative across aerospace, automotive, and marine industries to develop lightweight, fuel-efficient, and high-performance structures further solidifies balsa wood's market position, as it offers an optimal balance of rigidity and minimal mass.

Beyond these industrial applications, the growing global emphasis on sustainable and eco-friendly materials is providing an additional impetus for the balsa wood market. As companies and consumers increasingly prioritize environmentally responsible choices, balsa wood, being a fast-growing and renewable resource, aligns perfectly with these evolving preferences. Its use in green building initiatives, insulation, and various eco-conscious product designs reflects a broader market shift towards sustainable alternatives. These drivers collectively contribute to the expansion and diversification of the balsa wood market, positioning it as a material of choice for future-oriented industries.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Renewable Energy Sector (Wind Turbines) | +2.5% | Europe, North America, Asia Pacific (China, India) | Long-term (2025-2033) |

| Increasing Demand for Lightweight Materials | +1.8% | North America, Europe, Asia Pacific (Aerospace, Automotive hubs) | Mid-to-Long-term (2026-2033) |

| Expanding Applications in Construction and Insulation | +1.2% | Global (with emphasis on developed markets) | Mid-term (2027-2033) |

| Focus on Sustainable and Eco-Friendly Materials | +1.0% | Global (particularly Europe, North America) | Ongoing, Long-term |

| Technological Advancements in Balsa Processing | +0.8% | Major R&D hubs (Germany, USA, Japan) | Mid-term (2026-2030) |

Balsa Wood Market Restraints Analysis

Despite its significant growth prospects, the balsa wood market faces several notable restraints that could temper its expansion. A primary concern is the volatility and consistency of the supply chain, largely due to balsa wood's geographical concentration in specific regions, making it susceptible to climatic events, geopolitical instability, and logistical challenges. This can lead to unpredictable availability and impact production schedules for end-use industries. Closely related to supply is the inherent price fluctuation of balsa wood. As a natural commodity, its pricing can be influenced by harvesting yields, demand surges, and speculative trading, creating uncertainty for manufacturers who rely on stable material costs for their long-term planning and competitiveness.

Furthermore, the balsa wood market encounters stiff competition from alternative core materials such as PET foam, PVC foam, and various honeycombs, which offer comparable mechanical properties, sometimes at lower or more stable prices. While balsa retains advantages in specific applications, the continuous innovation in synthetic materials poses a competitive threat. Environmental regulations and growing concerns over deforestation, even for sustainably managed plantations, also present a restraint. Increased scrutiny regarding responsible sourcing and land use can lead to stricter compliance requirements, potentially increasing operational costs and limiting accessible supply, thereby hindering market expansion in certain regions or applications.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Supply Chain Volatility and Raw Material Availability | -1.5% | Global, especially for major importing regions | Ongoing, Short-to-Mid-term |

| Price Fluctuations and Cost Management | -1.2% | Global, affecting all end-use industries | Ongoing, Short-to-Mid-term |

| Competition from Alternative Core Materials | -1.0% | North America, Europe, Asia Pacific | Long-term, as alternatives innovate |

| Environmental Regulations and Deforestation Concerns | -0.8% | Europe, North America (importing regions with strict policies) | Ongoing, Long-term |

| Natural Variability in Wood Properties | -0.5% | Global, affects quality control and manufacturing consistency | Ongoing |

Balsa Wood Market Opportunities Analysis

The balsa wood market is replete with significant opportunities for growth and innovation, driven by evolving industrial demands and technological advancements. A primary area of opportunity lies in the continuous development of advanced balsa-based composites. As industries push the boundaries of material science, there is immense potential to combine balsa with various resins and fibers to create next-generation materials that offer superior performance characteristics, such as enhanced impact resistance, fire retardancy, or even integrated functionalities. This allows balsa wood to penetrate new, high-value applications where specific material properties are paramount.

Furthermore, untapped markets in emerging economies represent a considerable opportunity. As these regions experience economic growth and infrastructural development, the demand for lightweight, high-performance, and sustainable materials is expected to surge. Establishing robust supply chains and processing capabilities in these areas can unlock significant market potential. Innovation in cultivation and processing technologies also presents a strong opportunity; advancements in sustainable forestry, faster-growing balsa strains, and more efficient milling techniques can improve yield, reduce waste, and enhance the overall cost-effectiveness and consistency of balsa wood supply, thereby expanding its competitiveness against synthetic alternatives and broadening its applicability across industries, including marine and sporting goods.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Advanced Balsa-Based Composites | +1.5% | Global (R&D focused regions like Europe, North America, Japan) | Long-term (2027-2033) |

| Untapped Markets in Emerging Economies | +1.0% | Asia Pacific (Southeast Asia, India), Latin America, Africa | Mid-to-Long-term (2026-2033) |

| Innovation in Cultivation and Processing Technologies | +0.9% | Major balsa producing countries (Ecuador) and R&D centers | Mid-term (2026-2030) |

| Increased Adoption in Marine and Sporting Goods | +0.8% | Coastal regions, markets with strong leisure industries | Mid-to-Long-term (2027-2033) |

| Growing Focus on Bio-based and Circular Economy Materials | +0.7% | Global, driven by sustainability mandates | Ongoing, Long-term |

Balsa Wood Market Challenges Impact Analysis

The balsa wood market faces several significant challenges that require strategic intervention to ensure sustainable growth and market stability. A prominent challenge is the issue of illegal logging and the prevalence of uncertified sourcing. Despite growing demand for sustainably produced balsa, illicit practices can undermine efforts to ensure traceability and environmental compliance, impacting the market's reputation and potentially leading to supply chain disruptions. This also poses a risk to companies committed to ethical sourcing, as it creates an uneven playing field with lower-cost, unsustainably harvested materials. Addressing this requires robust certification schemes and stricter enforcement across the supply chain.

Another inherent challenge is the relatively long growth cycles of balsa trees, which, while fast-growing for a tree, still require several years to reach maturity suitable for industrial use. This long lead time makes it difficult to quickly scale up production in response to sudden spikes in demand, creating potential supply shortages and exacerbating price volatility. Effective plantation management, including advanced silviculture techniques and strategic planning, is crucial to mitigate this. Furthermore, maintaining consistent quality and achieving standardization across different batches of balsa wood remains a technical challenge. Natural variations in wood density and mechanical properties can affect performance in critical applications, necessitating rigorous grading and quality control processes to meet the stringent requirements of industries like wind energy and aerospace. High logistics and transportation costs, particularly for a bulky yet lightweight material, also present a barrier, especially for global distribution, impacting overall profitability and market accessibility in various regions.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Illegal Logging and Uncertified Sourcing | -1.3% | Ecuador, Papua New Guinea (producing regions); Europe, North America (importing regions) | Ongoing, Long-term |

| Long Growth Cycles and Plantation Management | -1.0% | Ecuador, other producing countries | Ongoing |

| Quality Consistency and Standardization | -0.9% | Global, particularly critical for high-performance applications | Ongoing |

| Logistics and Transportation Costs | -0.7% | Global, affects all long-distance trade | Ongoing |

| Vulnerability to Pests and Diseases | -0.5% | Producing regions | Short-to-Mid-term (Intermittent) |

Balsa Wood Market - Updated Report Scope

This market research report provides an exhaustive analysis of the global Balsa Wood Market, offering critical insights into its current landscape, historical performance, and future growth trajectory. The scope encompasses detailed market sizing, forecasting, and a deep dive into the underlying market dynamics, including drivers, restraints, opportunities, and challenges that shape the industry. Furthermore, the report presents a comprehensive segmentation analysis by application, end-use industry, and type/form, providing granular understanding of market trends and revenue streams across various segments. Geographical market insights are also thoroughly examined, highlighting regional specificities and growth potential, along with profiles of key market participants.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 350 Million |

| Market Forecast in 2033 | USD 620 Million |

| Growth Rate | 7.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | 3A Composites, Gurit Holding AG, DIAB Group, Armacell International S.A., CoreLite Inc., Airex AG (3A Composites subsidiary), Schweiter Technologies AG, Sika AG, Carbon-Core Corp., Balsa Wood Inc., Ecuadorian Forestal, Wood Core Composites, Baltek Inc. (3A Composites subsidiary), The Gill Corporation, Pacific Balsa, Ecobalsa, J. B. Wood Products, Hexcel Corporation (through acquisitions), Timbeco Group, Fibrelast |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The global balsa wood market is comprehensively segmented to provide a detailed understanding of its diverse applications, end-use industries, and product forms. This segmentation analysis helps in identifying key growth areas, market saturation points, and opportunities for product differentiation. Each segment is analyzed based on its current market share, projected growth rate, and influencing factors, offering a granular view of the market's intricate structure and dynamics.

Understanding these segments is crucial for strategic planning, allowing stakeholders to pinpoint high-potential sectors and tailor their offerings accordingly. For instance, the dominance of the wind energy sector highlights the need for specialized balsa wood products that meet stringent quality and performance standards for turbine blades. Similarly, the expanding applications in aerospace and automotive underscore the importance of balsa's lightweight properties for efficiency gains. Analyzing the various forms, such as core material versus lumber, also provides insights into manufacturing processes and value chain optimization, enabling a more targeted approach to market penetration and expansion.

- By Application:

- Wind Energy: Dominant segment, driven by global renewable energy initiatives and the need for lightweight, rigid core materials in turbine blades.

- Aerospace: Used in aircraft structures, interior components, and UAVs for weight reduction and high strength-to-weight ratio.

- Automotive: Employed in vehicle body panels, flooring, and interior parts to improve fuel efficiency and performance.

- Marine: Utilized in boat hulls, decks, and superstructures for buoyancy, rigidity, and lightweight construction.

- Construction: Applied in architectural models, insulation panels, and non-load bearing structures.

- Sporting Goods: Found in surfboards, model aircraft, fishing lures, and other equipment requiring light yet strong materials.

- Model Making: Traditional and significant application due to its ease of workability and lightness.

- Packaging: Used for lightweight and protective packaging solutions.

- Others: Includes applications in musical instruments, toys, and crafts.

- By End-Use Industry:

- Aerospace and Defense: Focus on high-performance composites for structural integrity and weight reduction.

- Renewable Energy: Primary driver, particularly wind turbine manufacturing.

- Transportation: Encompasses automotive, marine, and rail for lightweighting and efficiency.

- Consumer Goods: Includes sporting goods, toys, and various leisure products.

- Construction: For architectural elements, insulation, and specialized building components.

- Others: Diverse industries leveraging balsa's unique properties.

- By Type/Form:

- Core Material: Predominant form, used as a core in sandwich composite structures.

- Lumber: Standardized timber used in construction, model making, and general carpentry.

- Panels: Large sheets or boards for various applications, often laminated.

- Blocks: Raw balsa wood blocks for carving, modeling, or further processing.

- Others: Includes veneers, chips, and customized forms.

Regional Highlights

- North America: The region exhibits significant demand for balsa wood, largely driven by its mature aerospace and defense industries, as well as a growing renewable energy sector. The United States and Canada are key markets for high-performance composites utilizing balsa wood, particularly in the manufacturing of wind turbine blades and lightweight automotive components. Strong emphasis on sustainable sourcing and technological innovation also characterizes this market.

- Europe: Europe is a major consumer of balsa wood, propelled by its leading position in wind energy production and a robust automotive industry focused on lightweighting. Countries such as Germany, Denmark, and Spain are at the forefront of wind turbine manufacturing, while the broader European Union's stringent environmental regulations further stimulate demand for sustainably sourced balsa. Research and development in advanced composite materials are also prominent here.

- Asia Pacific (APAC): This region is emerging as a significant market, driven by rapid industrialization, increasing energy demands, and expanding manufacturing capabilities in countries like China and India. The burgeoning wind energy sector, coupled with growing aerospace and automotive industries, is fueling the demand for balsa wood. Furthermore, the region is also a key player in balsa wood cultivation, especially Papua New Guinea, contributing to the global supply chain.

- Latin America: Ecuador stands as the primary global supplier of balsa wood, holding a dominant position in cultivation and raw material export. The region's market dynamics are heavily influenced by production capacities, sustainable forestry practices, and the export demands from North America, Europe, and Asia Pacific. Brazil is also an emerging market for balsa wood applications.

- Middle East and Africa (MEA): While currently a smaller market, the MEA region shows potential, particularly with increasing investments in renewable energy projects and infrastructure development. The adoption of lightweight materials in construction and transportation sectors is anticipated to drive modest growth in the long term, with a focus on sourcing from established international suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Balsa Wood Market.- 3A Composites

- Gurit Holding AG

- DIAB Group

- Armacell International S.A.

- CoreLite Inc.

- Airex AG

- Schweiter Technologies AG

- Sika AG

- Carbon-Core Corp.

- Balsa Wood Inc.

- Ecuadorian Forestal

- Wood Core Composites

- Baltek Inc.

- The Gill Corporation

- Pacific Balsa

- Ecobalsa

- J. B. Wood Products

- Hexcel Corporation

- Timbeco Group

- Fibrelast

Frequently Asked Questions

What is balsa wood primarily used for?

Balsa wood is primarily used as a core material in lightweight composite structures due to its exceptional strength-to-weight ratio. Its most significant application is in the manufacturing of wind turbine blades, where it provides structural integrity with minimal added weight. Other key applications include aerospace components, automotive parts, marine structures (like boat hulls), sporting goods, and model making.

Why is balsa wood preferred in wind turbine blades?

Balsa wood is highly preferred in wind turbine blades because of its unique combination of properties: an outstanding strength-to-weight ratio, high rigidity, and excellent shear strength. These characteristics allow for the construction of very large yet lightweight and durable blades, which are essential for efficient energy capture. Its natural cell structure also provides good adhesion for composite laminates.

Is balsa wood a sustainable material?

Yes, balsa wood is generally considered a sustainable material. It is one of the fastest-growing commercial tree species, capable of reaching maturity in 5-7 years, significantly faster than most hardwoods. This rapid growth rate allows for quick reforestation and a renewable supply, especially when sourced from sustainably managed plantations that adhere to responsible forestry practices and certifications.

What factors influence the price of balsa wood?

The price of balsa wood is influenced by several factors, including raw material availability and supply chain consistency, which can be affected by weather conditions or political stability in key producing regions like Ecuador. Demand from major industries, particularly the rapidly growing wind energy sector, also plays a significant role. Furthermore, quality consistency, grading standards, and global logistics and transportation costs impact the final price.

How is AI impacting the balsa wood market?

AI is impacting the balsa wood market by optimizing various stages of the supply chain. This includes AI-powered analytics for precise plantation management and yield prediction, machine vision for automated quality control and grading of timber, and advanced algorithms for supply chain optimization and demand forecasting. These applications lead to increased efficiency, reduced waste, improved product consistency, and better resource allocation across the industry.