Automotive eCall Market

Automotive eCall Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702168 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Automotive eCall Market Size

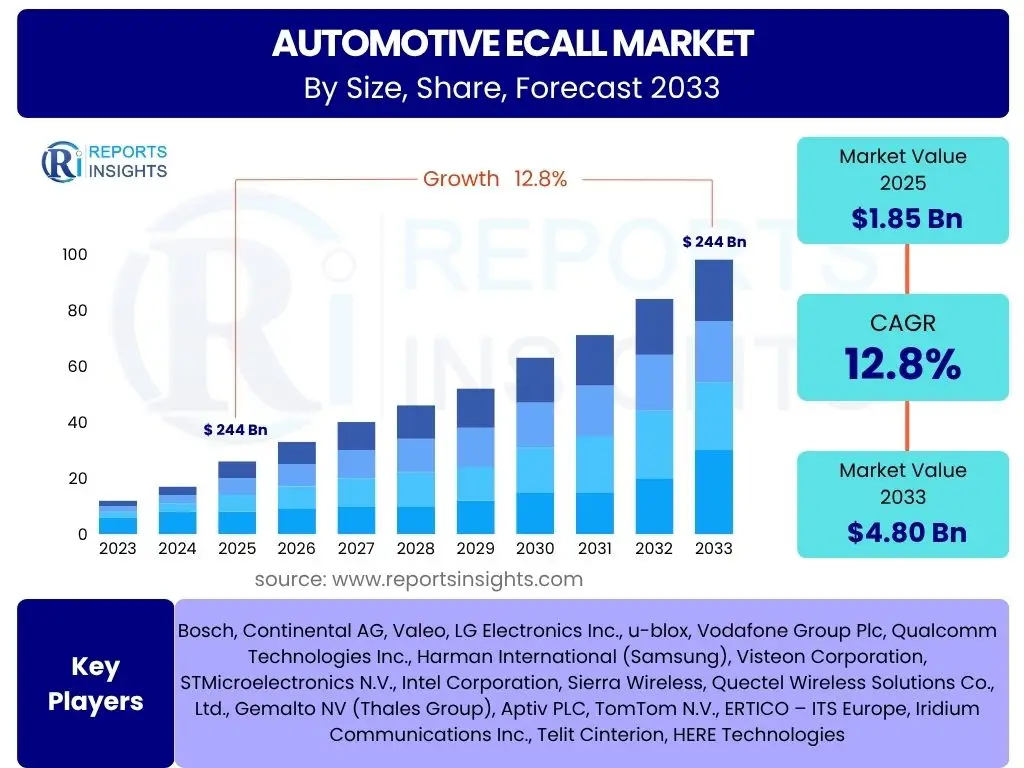

According to Reports Insights Consulting Pvt Ltd, The Automotive eCall Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2025 and 2033. The market is estimated at USD 1.85 Billion in 2025 and is projected to reach USD 4.80 Billion by the end of the forecast period in 2033.

Key Automotive eCall Market Trends & Insights

The Automotive eCall market is experiencing dynamic shifts driven by advancements in connectivity and an intensified focus on road safety. A significant trend involves the integration of eCall systems with broader connected vehicle ecosystems, moving beyond basic emergency notification to encompass predictive maintenance, remote diagnostics, and advanced telematics services. This convergence enhances the overall value proposition of in-vehicle safety solutions and aligns with the industry's push towards smart mobility. Furthermore, the increasing stringency of global safety regulations continues to be a primary catalyst, mandating the inclusion of eCall functionalities in new vehicle models across various regions.

Another emerging trend is the growing demand for aftermarket eCall solutions, particularly in regions where older vehicles remain prevalent or where regulatory mandates are not yet fully comprehensive. These retrofit solutions provide a cost-effective way to enhance vehicle safety for a wider consumer base, expanding the market beyond original equipment manufacturer (OEM) installations. Technological advancements, including improved sensor accuracy, enhanced satellite positioning, and the incorporation of artificial intelligence for more precise crash detection and assessment, are also shaping the market, leading to more reliable and efficient emergency response systems.

- Integration with connected car ecosystems for holistic safety and telematics.

- Rising adoption of aftermarket eCall solutions in diverse geographic markets.

- Advancements in sensor technology and GNSS modules for enhanced accuracy.

- Regulatory harmonization and expansion of eCall mandates globally.

- Shift towards software-defined vehicles enabling more flexible eCall updates and integrations.

AI Impact Analysis on Automotive eCall

Artificial intelligence is poised to revolutionize Automotive eCall systems by enhancing their capabilities beyond simple crash detection and notification. AI algorithms can process vast amounts of sensor data in real-time, allowing for more precise and rapid identification of crash events, distinguishing between minor incidents and severe collisions. This improved accuracy significantly reduces the incidence of false positives, optimizing emergency service response and minimizing unnecessary dispatches. Moreover, AI can analyze crash dynamics to provide more detailed information to emergency responders, such as impact severity, vehicle deformation, and potential occupant injuries, enabling tailored and efficient rescue efforts.

The application of AI extends to predictive analytics within eCall systems. By leveraging historical driving data, environmental conditions, and driver behavior patterns, AI could potentially identify high-risk scenarios and even issue proactive warnings or intervene in critical situations before a crash occurs. This transition from reactive emergency response to proactive accident prevention represents a significant leap in automotive safety. Furthermore, AI can facilitate seamless integration with autonomous driving systems, allowing vehicles to not only detect and report accidents but also potentially take immediate evasive actions or safely bring the vehicle to a stop if an incident is unavoidable, further enhancing occupant safety.

- Improved crash detection accuracy and severity assessment using machine learning algorithms.

- Reduction of false alarms, optimizing emergency service resource allocation.

- Predictive capabilities for identifying high-risk driving scenarios and potential incidents.

- Enhanced data analysis for detailed post-crash insights, aiding emergency response.

- Seamless integration with Advanced Driver-Assistance Systems (ADAS) and autonomous driving platforms.

Key Takeaways Automotive eCall Market Size & Forecast

The Automotive eCall market is set for robust expansion throughout the forecast period, primarily driven by the escalating global emphasis on road safety and the continuous evolution of automotive technology. The substantial projected Compound Annual Growth Rate (CAGR) underscores the increasing integration of eCall systems as a standard safety feature in vehicles worldwide, transitioning from a premium offering to a fundamental requirement. This growth is a direct reflection of stringent regulatory pressures in mature markets and a growing awareness of life-saving capabilities in developing economies, solidifying eCall's position as an indispensable component of modern vehicle safety infrastructure.

Furthermore, the market's trajectory indicates a shift towards more sophisticated and interconnected eCall solutions. The integration of advanced telematics, real-time data processing, and potentially AI-driven analytics will enhance the efficacy and utility of these systems. The continuous innovation in sensor technology and communication modules also contributes significantly to this positive outlook, ensuring that eCall systems are not only compliant with mandates but also highly reliable and adaptable to future automotive advancements. This comprehensive evolution reinforces the market's long-term growth potential and its pivotal role in mitigating road accident fatalities.

- Market demonstrates strong growth potential driven by regulatory mandates and technological advancements.

- Increasing adoption rates across diverse vehicle segments globally.

- Shift towards more integrated and intelligent eCall systems with enhanced functionalities.

- Significant opportunities in both OEM and aftermarket segments contribute to overall market expansion.

- Continuous innovation in connectivity and sensor technology underpins market sustainability.

Automotive eCall Market Drivers Analysis

The growth of the Automotive eCall market is predominantly fueled by a confluence of regulatory imperatives and a heightened global emphasis on road safety. Governments worldwide are enacting stricter mandates, compelling vehicle manufacturers to integrate eCall systems, thereby establishing a baseline for accident response. Concurrently, increasing consumer demand for advanced safety features, coupled with the rising incidence of road accidents, further accelerates the adoption of these vital emergency call systems. The continuous evolution of telematics and connected car technologies also provides a robust foundation for eCall deployment, enhancing its functionality and reliability. Moreover, the integration of cellular networks and satellite communication infrastructure supports the seamless operation of eCall services across vast geographical areas, making them accessible and effective in various terrains.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Strict Regulatory Mandates for eCall Systems | +3.5% | Europe, Russia, India, Middle East | Short to Medium Term (2025-2029) |

| Increasing Consumer Awareness and Demand for Safety | +2.8% | North America, Europe, Asia Pacific | Medium to Long Term (2026-2033) |

| Rise in Road Accidents and Fatalities Globally | +2.0% | Global | Ongoing (2025-2033) |

| Advancements in Telematics and Connected Car Technologies | +2.5% | Global | Short to Medium Term (2025-2030) |

| Growth of Automotive Industry in Emerging Economies | +1.5% | Asia Pacific, Latin America, Africa | Medium to Long Term (2027-2033) |

Automotive eCall Market Restraints Analysis

Despite its significant benefits, the Automotive eCall market faces several impediments that could temper its growth trajectory. The substantial initial investment required for implementing and maintaining eCall infrastructure, particularly for smaller manufacturers or in developing regions, poses a considerable financial barrier. This includes the cost of specialized hardware, software integration, and the establishment of robust communication links with Public Safety Answering Points (PSAPs). Furthermore, concerns surrounding data privacy and the secure transmission of sensitive location and vehicle data present ongoing challenges, necessitating robust regulatory frameworks and technological safeguards to build and maintain consumer trust.

Another significant restraint is the varying levels of emergency infrastructure readiness across different countries and regions. While some nations have highly advanced PSAPs equipped to handle eCall data seamlessly, others may lack the necessary technological capabilities, leading to delays or inefficiencies in emergency response. This disparity can hinder the widespread, uniform adoption of eCall systems. Additionally, the potential for false alarms, although mitigated by advanced algorithms, still exists and can strain emergency resources if not managed effectively, creating a perception of unreliability and potentially leading to less stringent regulatory enforcement in some areas.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Implementation and Maintenance Costs | -2.0% | Developing Regions, Small OEMs | Short to Medium Term (2025-2029) |

| Data Privacy and Security Concerns | -1.5% | Europe (GDPR), North America, Asia Pacific | Medium to Long Term (2026-2033) |

| Lack of Standardized Infrastructure in Some Regions | -1.8% | Latin America, Middle East, Africa, parts of Asia Pacific | Short to Medium Term (2025-2030) |

| Technical Complexities and Integration Challenges | -1.2% | Global | Short Term (2025-2027) |

| Potential for False Alarms and Resource Strain | -0.8% | Global | Ongoing (2025-2033) |

Automotive eCall Market Opportunities Analysis

The Automotive eCall market presents numerous avenues for expansion and innovation, driven by evolving technological landscapes and untapped market segments. Significant opportunities lie in the integration of eCall systems with advanced vehicle-to-everything (V2X) communication and 5G networks, promising faster and more reliable data transmission, which is critical for immediate emergency response. This technological synergy can enhance the accuracy of incident location and provide richer data to emergency services, leading to more effective interventions. Moreover, the development of predictive eCall systems, which leverage AI and real-time data to anticipate and mitigate accidents before they occur, represents a substantial long-term growth opportunity, shifting the paradigm from reactive to proactive safety.

Furthermore, expanding the application of eCall beyond passenger vehicles to include commercial fleets, public transportation, and even motorcycles represents a substantial growth potential, broadening the market's reach and impact. The commercial vehicle segment, in particular, offers significant potential due to the high mileage and increased accident risk associated with such vehicles. The aftermarket segment also continues to present robust opportunities, especially in regions with a large installed base of older vehicles, allowing for broader penetration of eCall technology without the need for new vehicle purchases. Strategic partnerships between eCall providers, telematics companies, and emergency service organizations can also unlock new service models and expand market penetration.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration with 5G and V2X Communication Technologies | +3.0% | Global (especially developed economies) | Medium to Long Term (2027-2033) |

| Expansion into Commercial Vehicles and Public Transport | +2.5% | Global | Medium Term (2026-2030) |

| Development of Predictive and Proactive eCall Systems | +2.2% | North America, Europe, Asia Pacific | Long Term (2029-2033) |

| Growth in Aftermarket Solutions for Older Vehicles | +1.8% | Asia Pacific, Latin America, Europe (older fleet) | Short to Medium Term (2025-2029) |

| Strategic Partnerships with Emergency Services and Insurers | +1.5% | Global | Ongoing (2025-2033) |

Automotive eCall Market Challenges Impact Analysis

The Automotive eCall market is navigating several complex challenges that demand innovative solutions to ensure sustained growth and effectiveness. A primary hurdle involves achieving seamless interoperability across diverse eCall systems and regional emergency service infrastructures, which is crucial for a globally harmonized response. Different technical standards, communication protocols, and Public Safety Answering Point (PSAP) capabilities across countries can impede the smooth and universal deployment of eCall services, leading to fragmented market penetration and varying levels of service efficiency. Addressing these interoperability issues requires significant collaborative efforts between governments, automotive manufacturers, and telecommunications providers to establish unified standards and guidelines.

Furthermore, the inherent cybersecurity risks associated with connected vehicle systems, including potential vulnerabilities for data breaches or system manipulation, necessitate continuous investment in robust security protocols to maintain public trust and system integrity. As eCall systems become more sophisticated and integrated with vehicle networks, the attack surface for malicious actors expands, requiring proactive measures to safeguard sensitive user and vehicle data. Rapid technological obsolescence also poses a challenge, as eCall systems must be adaptable to evolving communication technologies and vehicle architectures to remain relevant and effective throughout a vehicle's lifespan. Ensuring the reliability of eCall in diverse environmental conditions, such as extreme weather or remote areas with poor network coverage, presents additional operational complexities.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Interoperability Issues Across Different Systems and Regions | -1.7% | Global | Ongoing (2025-2033) |

| Cybersecurity Threats to Connected eCall Systems | -1.3% | Global | Ongoing (2025-2033) |

| Rapid Technological Obsolescence and Integration Complexity | -1.0% | Global | Medium Term (2026-2030) |

| Ensuring Data Privacy While Enabling Effective Emergency Response | -0.9% | Europe, North America | Ongoing (2025-2033) |

| Managing and Reducing False Positives Effectively | -0.7% | Global | Short Term (2025-2027) |

Automotive eCall Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Automotive eCall Market, covering historical data, current market dynamics, and future projections. The scope includes a detailed examination of market size, growth drivers, restraints, opportunities, and challenges influencing the industry's trajectory from 2019 to 2033. The report segments the market by various criteria, including components, deployment types, vehicle types, and technology, offering a granular view of market performance across different segments. Regional insights highlight key growth pockets and regulatory landscapes in major geographical areas. The analysis also covers the competitive landscape, profiling key industry players and their strategic initiatives, providing stakeholders with valuable insights for informed decision-making.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 4.80 Billion |

| Growth Rate | 12.8% |

| Number of Pages | 265 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Continental AG, Valeo, LG Electronics Inc., u-blox, Vodafone Group Plc, Qualcomm Technologies Inc., Harman International (Samsung), Visteon Corporation, STMicroelectronics N.V., Intel Corporation, Sierra Wireless, Quectel Wireless Solutions Co., Ltd., Gemalto NV (Thales Group), Aptiv PLC, TomTom N.V., ERTICO – ITS Europe, Iridium Communications Inc., Telit Cinterion, HERE Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Automotive eCall market is meticulously segmented to provide a granular understanding of its diverse components, deployment methods, and application areas. This segmentation highlights the various facets of the market, from the hardware and software elements that constitute an eCall system to the different types of vehicles in which these systems are installed. Understanding these segments is crucial for stakeholders to identify specific growth opportunities, tailor product development, and refine market entry strategies. The market's structure reflects the evolving technological landscape and the varying demands across different automotive sectors and geographical regions.

Further analysis within these segments reveals key trends. For instance, the Telematics Control Unit (TCU) and advanced sensor integration are pivotal in the component segment, driven by the need for robust and accurate accident detection. The OEM segment continues to dominate due to regulatory mandates, but the aftermarket segment is gaining traction, particularly for older vehicles and in regions where new car mandates are not yet in full effect. The increasing penetration of electric vehicles also represents a unique segment, as eCall systems in EVs must contend with specific power management and high-voltage safety considerations. This detailed segmentation offers a comprehensive roadmap of the market's current state and future potential.

- By Component:

- Telematics Control Unit (TCU)

- Sensors (Accelerometer, Gyroscope, GNSS)

- Communication Module (2G/3G, 4G/LTE, 5G)

- Microcontroller Unit (MCU)

- Antennas

- Others (e.g., microphones, speakers)

- By Type:

- Automatic eCall

- Manual eCall

- By Deployment:

- OEM (Original Equipment Manufacturer)

- Aftermarket

- By Vehicle Type:

- Passenger Cars (Hatchback, Sedan, SUV)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles, Buses, Coaches)

- Electric Vehicles (Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), Fuel Cell Electric Vehicles (FCEV))

- Motorcycles

- By Technology:

- Embedded Systems

- Smartphone-Based Systems

- Hybrid Systems

- By Application:

- Accident Detection

- Emergency Assistance

- Vehicle Tracking

- Roadside Assistance

- Theft Recovery

Regional Highlights

- Europe: This region holds a dominant position in the Automotive eCall Market, largely due to the mandatory implementation of eCall systems in all new type-approved cars and light commercial vehicles since April 2018 under EU regulations. This mandate has created a strong baseline for adoption, fostering a mature market with robust infrastructure and high consumer awareness. The continuous push for enhanced road safety and the development of next-generation intelligent transport systems further solidify Europe's market leadership.

- North America: The market in North America is characterized by high technological adoption and a strong focus on advanced telematics and connected car services. While there isn't a direct federal mandate mirroring the EU's eCall, initiatives like General Motors' OnStar system have established a de facto standard for in-vehicle emergency assistance. Consumer demand for safety and convenience features, coupled with a proactive approach from leading automotive manufacturers, drives consistent market growth and innovation, particularly in integration with smartphone ecosystems and value-added services.

- Asia Pacific (APAC): The Asia Pacific region is projected to exhibit the highest growth rate in the Automotive eCall Market over the forecast period. This surge is attributed to rapidly expanding automotive industries in countries like China and India, increasing disposable incomes, and a growing emphasis on vehicle safety due to rising road accidents. Regulatory developments, such as India's upcoming eCall mandate, are set to significantly boost adoption. Furthermore, the region's technological prowess and investment in smart city initiatives contribute to the development of sophisticated eCall solutions tailored to local needs.

- Latin America: The Automotive eCall market in Latin America is in an nascent stage but is experiencing gradual growth. Factors such as increasing vehicle production, improving road infrastructure in some countries, and a rising awareness of automotive safety features are contributing to its expansion. While comprehensive mandates are not widespread, voluntary adoption by OEMs and the growth of aftermarket solutions present opportunities. Economic stability and governmental support for road safety initiatives will be key to accelerating market development.

- Middle East and Africa (MEA): The MEA region is witnessing steady, albeit slower, growth in the eCall market. Growth is primarily driven by expanding automotive markets, particularly in the GCC countries, and an increasing focus on developing advanced smart city infrastructure. Regulatory efforts are emerging, with some countries exploring or implementing their own eCall or similar emergency response systems. The diversity within the region means varied adoption rates, with countries investing in advanced infrastructure showing more rapid development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive eCall Market.- Bosch

- Continental AG

- Valeo

- LG Electronics Inc.

- u-blox

- Vodafone Group Plc

- Qualcomm Technologies Inc.

- Harman International (Samsung)

- Visteon Corporation

- STMicroelectronics N.V.

- Intel Corporation

- Sierra Wireless

- Quectel Wireless Solutions Co., Ltd.

- Gemalto NV (Thales Group)

- Aptiv PLC

- TomTom N.V.

- ERTICO – ITS Europe

- Iridium Communications Inc.

- Telit Cinterion

- HERE Technologies

Frequently Asked Questions

Analyze common user questions about the Automotive eCall market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is eCall in automotive industry?

eCall is an in-vehicle emergency call system designed to automatically or manually alert emergency services in the event of a serious road accident. It transmits critical data, including location, time, and vehicle information, to Public Safety Answering Points (PSAPs) to expedite emergency response and reduce fatalities.

How does an eCall system work?

When an accident occurs, eCall systems, typically triggered by airbag deployment or severe impact sensors, automatically establish an emergency call to the nearest PSAP. It transmits a minimum set of data (MSD) including GPS coordinates and vehicle details. Occupants can also manually activate the system via a button. A voice connection is then established with the emergency operator.

Is eCall mandatory in all new vehicles?

eCall is mandatory for all new type-approved passenger cars and light commercial vehicles sold in the European Union since April 2018. Russia has a similar system called ERA-GLONASS. While not universally mandated globally, many other countries are considering or implementing similar regulations, and manufacturers are increasingly offering it as a standard feature.

What are the primary benefits of eCall systems?

The primary benefit of eCall is significantly reducing emergency response times to road accidents, especially in remote areas or when occupants are incapacitated. This can lead to a substantial decrease in fatalities and severe injuries. It also provides precise location data, aiding emergency services in quickly locating crash sites and deploying appropriate resources.

What is the future outlook for the Automotive eCall market?

The Automotive eCall market is set for strong growth, driven by expanding regulatory mandates, increasing consumer safety awareness, and technological integration with connected car ecosystems. Future developments include AI-enhanced crash detection, predictive safety features, and expanded application to commercial vehicles and smart city infrastructure, fostering more sophisticated and proactive emergency response solutions.