Automotive Power Module Market

Automotive Power Module Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_706095 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Automotive Power Module Market Size

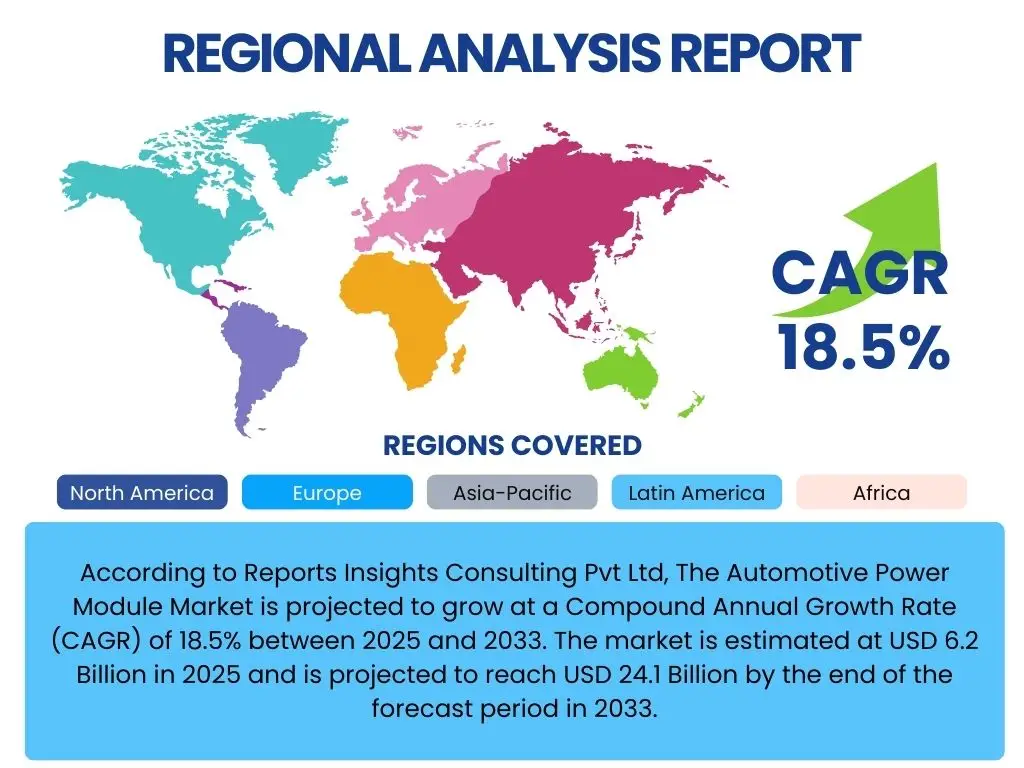

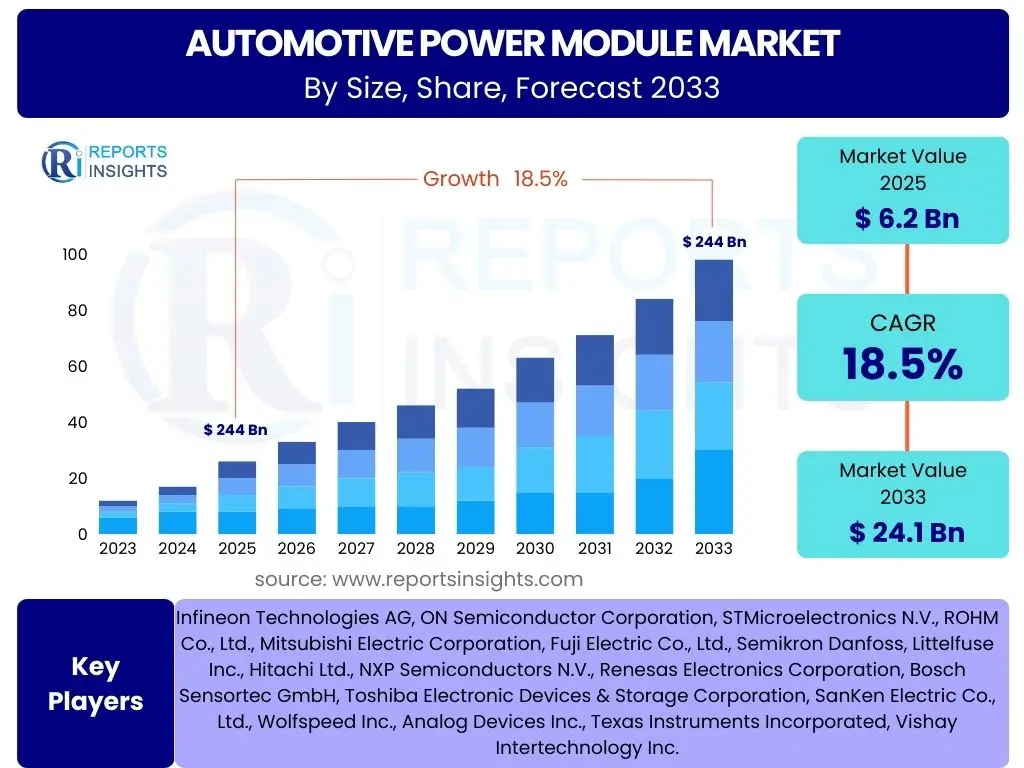

According to Reports Insights Consulting Pvt Ltd, The Automotive Power Module Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033. The market is estimated at USD 6.2 Billion in 2025 and is projected to reach USD 24.1 Billion by the end of the forecast period in 2033.

Key Automotive Power Module Market Trends & Insights

The Automotive Power Module market is undergoing a significant transformation driven by the rapid evolution of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). A primary trend observed is the increasing demand for high-efficiency and compact power modules, critical for optimizing energy conversion in EVs and extending battery range. There is a strong emphasis on integrating wide-bandgap (WBG) semiconductors, particularly Silicon Carbide (SiC) and Gallium Nitride (GaN), due to their superior performance at high temperatures and frequencies, leading to smaller, lighter, and more efficient power electronics.

Another crucial insight is the growing complexity of power architectures in modern vehicles, necessitating modules that can handle higher power densities and offer enhanced reliability. This includes advancements in integrated power modules that combine multiple functionalities, reducing the overall component count and simplifying vehicle design. Furthermore, the market is witnessing a move towards standardized yet customizable module designs, allowing manufacturers to adapt quickly to diverse application requirements while maintaining cost efficiencies through scale.

The convergence of electrification and autonomous driving technologies further shapes the market. Power modules are not only vital for propulsion but also for powering the sophisticated sensor suites, AI processing units, and communication systems required for autonomous operation. This dual demand drives innovation in thermal management solutions and robust packaging technologies to ensure long-term performance under demanding automotive conditions, reflecting a shift towards more resilient and intelligent power solutions.

- Electrification of vehicles (EVs, HEVs, PHEVs) driving demand for efficient power conversion.

- Increased adoption of Wide-Bandgap (WBG) semiconductors (SiC, GaN) for improved efficiency and power density.

- Miniaturization and integration of power modules for compact designs and reduced system complexity.

- Advancements in thermal management solutions for enhanced reliability and performance.

- Growing demand for higher voltage power modules (800V and above) to support faster charging and higher power outputs.

- Development of intelligent power modules with integrated control and diagnostic functions.

- Emphasis on modular and scalable designs to meet diverse application requirements.

- Convergence of power modules with ADAS and autonomous driving systems.

AI Impact Analysis on Automotive Power Module

The integration of Artificial Intelligence (AI) is set to profoundly impact the Automotive Power Module market by enhancing design, manufacturing, and operational efficiencies. Users frequently inquire about how AI can optimize power module performance and extend their lifespan. AI algorithms can be employed in the design phase for predictive modeling, allowing engineers to simulate and optimize thermal management, electrical characteristics, and material selection with unprecedented precision. This leads to the development of more efficient and reliable power modules, significantly reducing iterative design cycles and time-to-market.

In manufacturing, AI-powered systems can enable real-time quality control, anomaly detection, and predictive maintenance for production lines. This minimizes defects, optimizes resource allocation, and ensures consistent product quality, addressing user concerns about manufacturing complexities and scalability. Furthermore, AI can facilitate intelligent inventory management and supply chain optimization for critical components, improving resilience against disruptions. Users are keenly interested in how these advancements translate into cost savings and faster production of high-performance modules.

From an operational standpoint, AI can be integrated directly into vehicle systems to manage and optimize the performance of power modules in real-time. This includes intelligent energy management systems that adapt to driving conditions, predictive analytics for identifying potential component failures before they occur, and self-learning algorithms that fine-tune power distribution for maximum efficiency and longevity. These applications address user expectations for smarter, more reliable, and energy-efficient automotive power systems, ultimately improving vehicle performance and reducing total cost of ownership.

- AI-driven design optimization for thermal management and electrical performance.

- Predictive maintenance and anomaly detection in power module manufacturing processes.

- Real-time energy management and power distribution optimization in vehicles.

- Enhanced quality control and defect prediction through machine vision and AI algorithms.

- Simulation and modeling of power module behavior under various operating conditions.

- AI-powered analytics for supply chain optimization and material procurement.

- Development of intelligent power modules with integrated AI for adaptive control.

Key Takeaways Automotive Power Module Market Size & Forecast

The Automotive Power Module market is poised for robust expansion, driven by the irreversible global shift towards vehicle electrification and the increasing sophistication of automotive electronics. Users are primarily concerned with understanding the primary growth catalysts and the longevity of this market trend. The significant projected CAGR reflects sustained investment in EV infrastructure and the widespread adoption of hybrid and electric vehicles, indicating a long-term growth trajectory. This expansion is not merely incremental but represents a fundamental transformation in automotive power architectures, moving away from traditional internal combustion engine (ICE) power delivery towards highly integrated and efficient electric power management systems.

A crucial insight from the market forecast is the accelerating adoption of advanced semiconductor materials like Silicon Carbide (SiC) and Gallium Nitride (GaN). These materials are central to achieving the higher power density, efficiency, and reliability demanded by next-generation electric vehicles. The market's valuation reaching over USD 24 billion by 2033 underscores the substantial revenue opportunities for manufacturers and suppliers of these critical components. This growth is also fueled by regulatory mandates for reduced emissions and consumer preferences for more sustainable and high-performance vehicles, ensuring continued market momentum.

Ultimately, the market size and forecast highlight the automotive power module as an indispensable component in the future of mobility. Its growth is intertwined with advancements in battery technology, charging infrastructure, and autonomous driving, positioning it as a foundational element for smart, connected, and electrified vehicles. The sustained high growth rate signifies not just a passing trend but a pivotal shift in automotive engineering and consumer expectations, making it a key area for strategic investment and innovation.

- Significant growth primarily driven by electric vehicle adoption across all vehicle types.

- Transition to wide-bandgap materials (SiC, GaN) is a major technological accelerator.

- Increased market value reflects rising demand for high-performance and efficient power conversion.

- Integration of power modules into advanced safety and autonomous driving systems.

- Regulatory support for emissions reduction and electrification initiatives worldwide.

Automotive Power Module Market Drivers Analysis

The Automotive Power Module market is significantly propelled by the global imperative to electrify the automotive fleet. The escalating demand for Electric Vehicles (EVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs) directly translates into a higher requirement for advanced power modules. These modules are indispensable for efficient power conversion and management within the powertrain, including inverters, converters, and on-board chargers. Stringent emission regulations imposed by governments worldwide also serve as a powerful catalyst, compelling automotive manufacturers to accelerate the transition from internal combustion engines to electric propulsion systems, thereby boosting the power module market.

Technological advancements in semiconductor materials, particularly the proliferation of Silicon Carbide (SiC) and Gallium Nitride (GaN), are revolutionizing the power module landscape. These wide-bandgap (WBG) materials offer superior performance characteristics, such as higher power density, improved thermal conductivity, and reduced switching losses, compared to traditional silicon-based components. This enables the development of more compact, efficient, and reliable power modules, which are crucial for enhancing EV range, reducing charging times, and minimizing overall system weight and cost. The continuous innovation in these materials expands the application scope and performance capabilities of power modules.

Furthermore, the increasing integration of advanced safety features and autonomous driving systems in modern vehicles contributes substantially to market growth. These sophisticated systems, including ADAS sensors, LiDAR, radar, and high-performance computing units, require robust and precise power management. Automotive power modules are essential for ensuring the stable and efficient operation of these critical electronic components. The growing complexity of vehicle electronics and the shift towards software-defined vehicles create an ongoing demand for specialized and high-reliability power modules capable of handling diverse power requirements across numerous vehicle subsystems.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Growth in Electric Vehicle (EV) Production and Sales | +5.0% | Global, particularly China, Europe, North America | Short to Long Term (2025-2033) |

| Technological Advancements in Wide-Bandgap (WBG) Semiconductors (SiC, GaN) | +4.5% | Global, R&D hubs in Japan, Germany, USA | Short to Medium Term (2025-2029) |

| Stringent Government Regulations and Emission Standards | +3.5% | Europe, China, North America | Medium to Long Term (2027-2033) |

| Increasing Adoption of Advanced Driver-Assistance Systems (ADAS) and Autonomous Driving | +2.5% | Global, significant in developed automotive markets | Medium to Long Term (2027-2033) |

| Development of Faster EV Charging Infrastructure | +2.0% | Global, especially China, Europe, North America | Short to Medium Term (2025-2029) |

Automotive Power Module Market Restraints Analysis

Despite the strong growth drivers, the Automotive Power Module market faces several significant restraints. One major challenge is the high upfront cost associated with wide-bandgap (WBG) semiconductor materials like Silicon Carbide (SiC) and Gallium Nitride (GaN). While these materials offer superior performance, their manufacturing processes are complex and yield rates can be lower compared to traditional silicon, leading to higher unit costs for power modules. This cost factor can hinder broader adoption, especially in more cost-sensitive vehicle segments or regions, impacting the overall market's growth trajectory and making it difficult for some manufacturers to scale production profitably.

Another critical restraint is the complexity and limitations of thermal management within automotive power modules. As power density increases and modules become more compact, effectively dissipating heat becomes increasingly challenging. Inadequate thermal management can lead to reduced efficiency, diminished reliability, and premature failure of components, which are unacceptable risks in safety-critical automotive applications. Developing advanced cooling solutions that are both effective and cost-efficient remains a significant hurdle, requiring continuous research and development to keep pace with evolving module capabilities.

Furthermore, the automotive industry's stringent reliability and safety standards, combined with long product lifecycle requirements, present a considerable barrier. Power modules must operate flawlessly under extreme conditions—ranging from wide temperature fluctuations and vibrations to humidity and electromagnetic interference—for extended periods, often exceeding 10-15 years. The extensive testing, validation, and certification processes required to meet these rigorous standards prolong development cycles and increase development costs. This complexity can deter new entrants and slow down the adoption of innovative but unproven technologies, impacting the speed at which new solutions can reach the market.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Upfront Cost of Wide-Bandgap (WBG) Materials (SiC, GaN) | -3.0% | Global | Short to Medium Term (2025-2029) |

| Challenges in Thermal Management for High Power Density Modules | -2.5% | Global | Short to Medium Term (2025-2029) |

| Stringent Automotive Reliability and Safety Standards | -2.0% | Global | Long Term (2025-2033) |

| Supply Chain Volatility and Raw Material Scarcity | -1.5% | Global | Short Term (2025-2027) |

| Need for Specialized Manufacturing Processes and Infrastructure | -1.0% | Global | Medium Term (2027-2030) |

Automotive Power Module Market Opportunities Analysis

The Automotive Power Module market presents significant growth opportunities, particularly stemming from the ongoing paradigm shift towards electric mobility. The expansion of EV charging infrastructure globally, especially the deployment of high-power DC fast chargers, creates a direct demand for robust and high-voltage power modules. These modules are crucial for efficient power conversion and delivery in charging stations, enabling faster charging times and supporting the increasing battery capacities of modern EVs. This segment offers a lucrative avenue for power module manufacturers to diversify their offerings beyond in-vehicle applications.

Another substantial opportunity lies in the continuous innovation in packaging technologies and materials. Advancements that enable higher power density, improved thermal performance, and enhanced reliability in a smaller footprint are highly sought after. This includes the development of module designs that integrate more functionalities, reduce parasitic inductances, and offer better electromagnetic compatibility. Companies investing in research and development for novel packaging solutions, such as embedded die technologies or advanced substrate materials, can gain a significant competitive edge and capture a larger market share by meeting the evolving needs for compact and efficient power electronics.

Furthermore, the emergence of new mobility concepts, such as autonomous vehicles, robotaxis, and electric commercial vehicles, opens up entirely new application areas for automotive power modules. These vehicles often operate under different duty cycles and power requirements than traditional passenger cars, necessitating specialized and highly reliable power management solutions for their sophisticated electronic systems. The focus on vehicle-to-everything (V2X) communication, advanced sensor fusion, and complex AI processing in autonomous vehicles creates a consistent demand for power modules that can deliver precise and stable power. Early movers in these niche segments can establish strong positions and benefit from the long-term growth of these transformative mobility solutions.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of High-Power DC Fast Charging Infrastructure for EVs | +4.0% | Global, emphasis on densely populated areas | Short to Medium Term (2025-2029) |

| Innovation in Packaging Technologies (e.g., higher power density, better thermal management) | +3.5% | Global, R&D centers in Europe, Asia, North America | Medium to Long Term (2027-2033) |

| Growth of New Mobility Concepts (Autonomous Vehicles, Robotaxis, Electric Commercial Vehicles) | +3.0% | Urban centers, developed markets, and logistics industries | Medium to Long Term (2028-2033) |

| Expansion into High-Voltage (800V+) Architectures for EVs | +2.5% | Global, particularly premium EV segments | Short to Medium Term (2025-2029) |

| Integration of Power Modules with Smart Grid and Vehicle-to-Grid (V2G) Technologies | +1.5% | Europe, parts of North America and Asia | Long Term (2030-2033) |

Automotive Power Module Market Challenges Impact Analysis

The Automotive Power Module market faces significant challenges, particularly concerning the consistent supply of high-quality raw materials. The reliance on specialized materials, especially for wide-bandgap semiconductors like SiC and GaN, makes the supply chain vulnerable to geopolitical tensions, trade disputes, and natural disasters. Any disruption in the supply of these critical raw materials, or limitations in their processing capacity, can lead to production delays, increased costs, and ultimately, impact the availability of power modules for automotive manufacturers. Ensuring a stable and diversified supply chain is a continuous and complex endeavor that demands strategic foresight and international collaboration.

Another notable challenge is the intense competitive landscape within the market, driven by a growing number of established semiconductor companies and emerging specialized players. This heightened competition often leads to price erosion and puts pressure on profit margins. Manufacturers must continuously innovate and differentiate their products through superior performance, reliability, and cost-effectiveness to maintain market share. The need for significant investment in research and development to stay ahead of technological curves, combined with fierce pricing pressures, can be particularly challenging for smaller players or those with less diversified portfolios.

Furthermore, the need for skilled labor and expertise in designing, manufacturing, and testing advanced power modules is a substantial hurdle. The intricate nature of wide-bandgap semiconductors, coupled with the complex packaging and thermal management requirements, demands highly specialized engineering talent. A shortage of professionals with expertise in power electronics, semiconductor manufacturing, and automotive systems can impede innovation, slow down production scalability, and increase operational costs. Universities and industries need to collaborate to bridge this skills gap, which is crucial for the sustained growth and technological advancement of the automotive power module market.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Supply Chain Vulnerabilities and Raw Material Availability (e.g., SiC substrates) | -2.0% | Global, particularly reliant on key material suppliers | Short to Medium Term (2025-2028) |

| Intense Competition and Pricing Pressure | -1.5% | Global | Long Term (2025-2033) |

| Shortage of Skilled Labor and Expertise in Power Electronics | -1.0% | Global, prominent in developed economies | Long Term (2025-2033) |

| Rapid Technological Obsolescence and Need for Constant R&D Investment | -0.8% | Global | Long Term (2025-2033) |

| Cybersecurity Risks in Connected Automotive Systems | -0.5% | Global | Medium to Long Term (2027-2033) |

Automotive Power Module Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Automotive Power Module Market, offering a detailed understanding of its size, growth trajectory, key trends, and influencing factors. The scope encompasses a thorough examination of market dynamics, including drivers, restraints, opportunities, and challenges, providing a strategic outlook for stakeholders. It delves into the impact of emerging technologies like AI and wide-bandgap semiconductors on market evolution. The report also offers detailed segmentation analysis across various parameters and highlights regional market performance, presenting a holistic view of the industry landscape from historical data to future projections.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 24.1 Billion |

| Growth Rate | 18.5% |

| Number of Pages | 265 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies AG, ON Semiconductor Corporation, STMicroelectronics N.V., ROHM Co., Ltd., Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., Semikron Danfoss, Littelfuse Inc., Hitachi Ltd., NXP Semiconductors N.V., Renesas Electronics Corporation, Bosch Sensortec GmbH, Toshiba Electronic Devices & Storage Corporation, SanKen Electric Co., Ltd., Wolfspeed Inc., Analog Devices Inc., Texas Instruments Incorporated, Vishay Intertechnology Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Automotive Power Module market is meticulously segmented to provide a granular understanding of its diverse applications and technological nuances. This segmentation highlights the various facets contributing to market dynamics, allowing for a detailed analysis of growth opportunities within specific categories. Understanding these segments is crucial for identifying key growth areas, competitive landscapes, and strategic investment opportunities for market participants. The segmentation reflects the broad scope of power module applications, from essential powertrain functions to advanced infotainment systems.

The segmentation by vehicle type differentiates demand patterns across passenger and commercial vehicles, recognizing the varying power requirements and design considerations for each. Component-based segmentation focuses on the specific functions power modules perform within the vehicle, such as inverters for motor control or DC-DC converters for voltage regulation. Material-based segmentation, particularly the distinction between silicon and wide-bandgap materials, underscores the technological shifts driving market innovation. Furthermore, voltage-based and application-based segmentations provide insights into the performance capabilities and diverse end-uses of these critical components, from high-voltage EV powertrains to low-voltage infotainment systems.

- By Vehicle Type: Passenger Cars (PHEV, HEV, BEV), Commercial Vehicles (Electric Buses, Electric Trucks, Other Electric Commercial Vehicles)

- By Component: Inverter Modules, Converter Modules (DC-DC Converters), On-board Charger Modules, Motor Control Modules, Other Modules

- By Material: Silicon (Si) Based, Silicon Carbide (SiC) Based, Gallium Nitride (GaN) Based

- By Voltage: Up to 400V, 401V-800V, Above 800V

- By Application: Powertrain & Chassis, Body & Comfort, Safety & Security, Infotainment & Telematics, Other Applications

Regional Highlights

- Asia Pacific (APAC): Expected to dominate the market due to the rapid growth of EV production and adoption in countries like China, Japan, South Korea, and India. Government initiatives promoting electric mobility and significant investments in automotive manufacturing hubs further bolster growth.

- Europe: A strong market driven by stringent emission regulations, high consumer awareness regarding environmental sustainability, and substantial investments in EV charging infrastructure. Countries like Germany, Norway, and the UK are at the forefront of EV adoption and technological development.

- North America: Exhibiting robust growth with increasing government support for EVs, rising consumer demand for sustainable transportation, and significant R&D activities in power electronics. The US and Canada are key contributors to market expansion.

- Latin America: An emerging market with growing interest in electric vehicles and associated infrastructure development, though at an earlier stage compared to developed regions. Brazil and Mexico show potential for future growth.

- Middle East & Africa (MEA): Gradually developing its EV ecosystem, with initiatives focusing on diversifying economies away from fossil fuels and increasing investments in smart city projects that include electric transport. Growth is expected to accelerate in the latter half of the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Power Module Market.- Infineon Technologies AG

- ON Semiconductor Corporation

- STMicroelectronics N.V.

- ROHM Co., Ltd.

- Mitsubishi Electric Corporation

- Fuji Electric Co., Ltd.

- Semikron Danfoss

- Littelfuse Inc.

- Hitachi Ltd.

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Bosch Sensortec GmbH

- Toshiba Electronic Devices & Storage Corporation

- SanKen Electric Co., Ltd.

- Wolfspeed Inc.

- Analog Devices Inc.

- Texas Instruments Incorporated

- Vishay Intertechnology Inc.

Frequently Asked Questions

What is an automotive power module?

An automotive power module is an integrated electronic component designed to efficiently manage and convert electrical power within a vehicle. These modules typically incorporate power semiconductor devices (like IGBTs, MOSFETs, SiC, or GaN) and are crucial for various vehicle systems, especially in electric and hybrid vehicles for applications such as motor control, battery charging, and auxiliary power. They are engineered to operate under harsh automotive conditions, ensuring reliability and performance.

Why are Silicon Carbide (SiC) and Gallium Nitride (GaN) important in automotive power modules?

Silicon Carbide (SiC) and Gallium Nitride (GaN) are wide-bandgap (WBG) semiconductors offering superior performance over traditional silicon. They enable power modules to operate at higher temperatures, frequencies, and voltages with lower switching losses. This results in more compact, lighter, and significantly more efficient power modules, which are essential for extending EV range, reducing charging times, and improving overall system efficiency in electric and hybrid vehicles.

How do power modules contribute to electric vehicle performance?

Power modules are fundamental to electric vehicle performance as they manage the flow of high-voltage power between the battery, motor, and other electrical systems. Inverters, a key type of power module, convert DC battery power to AC for the electric motor, while converters manage voltage levels for auxiliary systems. Efficient power modules minimize energy loss during these conversions, directly improving battery range, acceleration, and charging speed, thereby enhancing the overall efficiency and dynamic performance of the EV.

What are the key applications of automotive power modules?

Automotive power modules are crucial for a wide range of applications within modern vehicles, particularly electric and hybrid vehicles. Primary applications include electric powertrains (inverters for motor control), on-board chargers, DC-DC converters for auxiliary systems, battery management systems, and thermal management units. They also support advanced driver-assistance systems (ADAS), infotainment, and lighting by providing stable and efficient power conversion.

What are the future trends in the automotive power module market?

Future trends in the automotive power module market include a continued shift towards wide-bandgap materials (SiC, GaN) for enhanced efficiency and power density, further integration of multiple functions into single, more compact modules, and advancements in thermal management technologies. The market will also see increased adoption of higher voltage architectures (800V+) for faster EV charging, greater use of intelligent power modules with integrated control features, and a stronger emphasis on standardization and modularity to accelerate vehicle development.