Automatic Assembly Machine Market

Automatic Assembly Machine Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_706276 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Automatic Assembly Machine Market Size

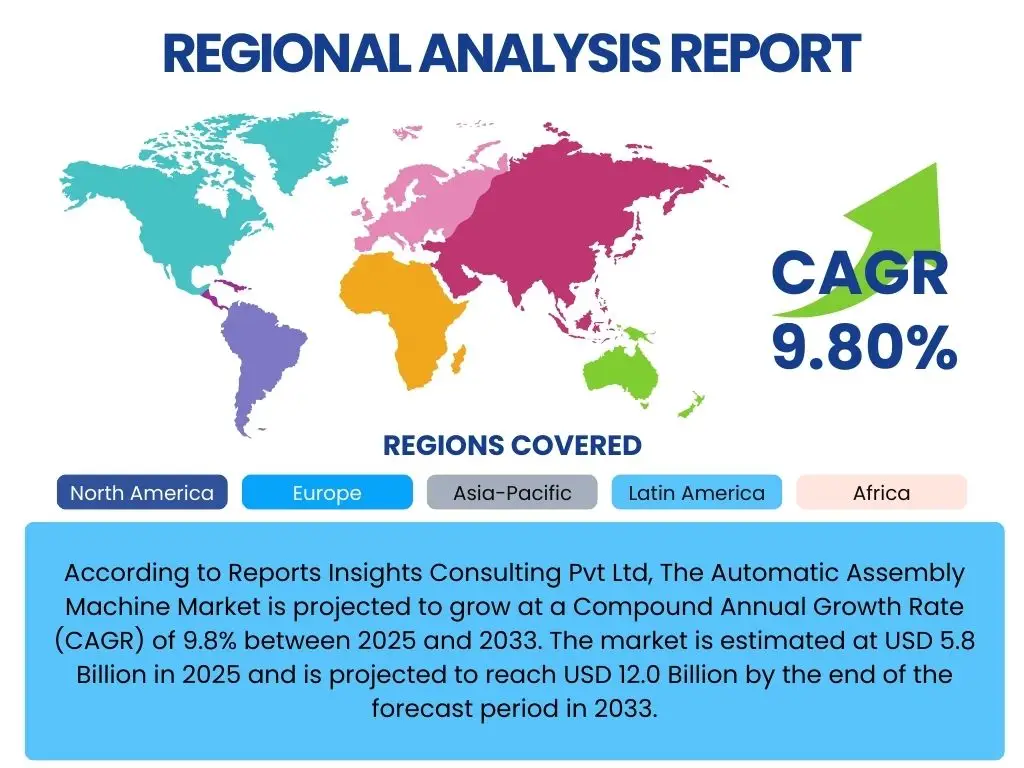

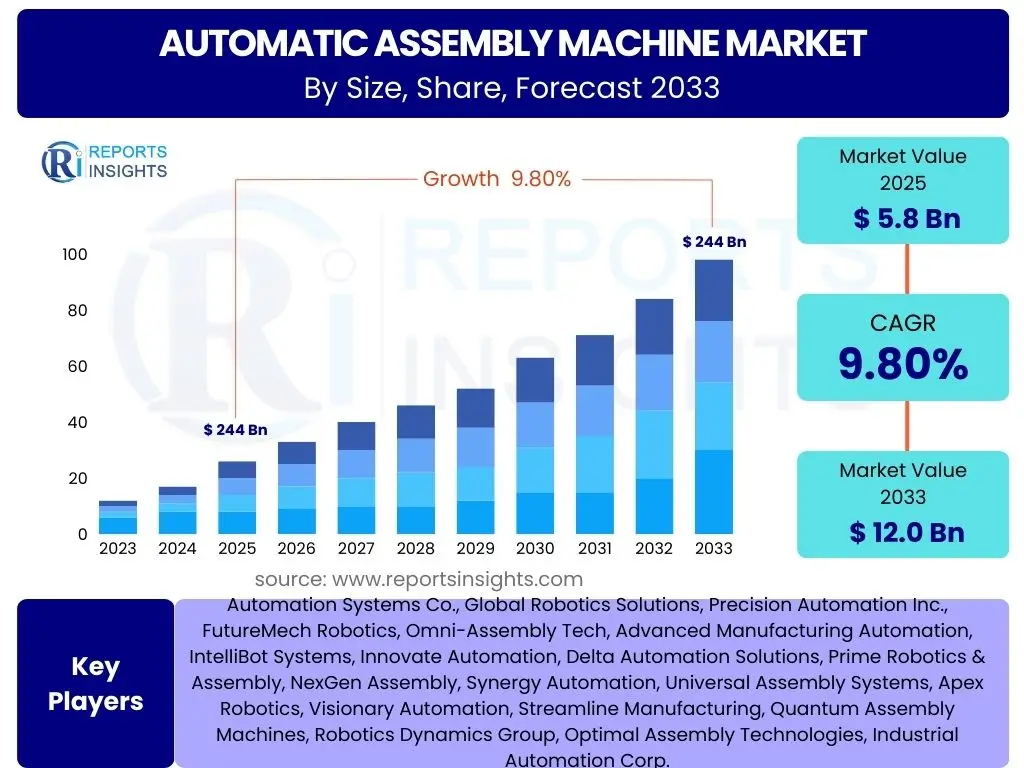

According to Reports Insights Consulting Pvt Ltd, The Automatic Assembly Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2033. The market is estimated at USD 5.8 Billion in 2025 and is projected to reach USD 12.0 Billion by the end of the forecast period in 2033.

Key Automatic Assembly Machine Market Trends & Insights

User inquiries frequently highlight the accelerating integration of Industry 4.0 principles, including IoT connectivity, cloud computing, and advanced data analytics, into automatic assembly processes. There is a strong interest in how these technologies enhance real-time monitoring, predictive maintenance, and overall operational efficiency. Another prominent theme is the increasing demand for flexible and reconfigurable assembly solutions to support high-mix, low-volume production, driven by consumer preferences for customized products. Furthermore, discussions revolve around the growing emphasis on collaborative robotics (cobots) that can work safely alongside human operators, improving productivity while maintaining human oversight for complex tasks.

Interest also centers on the widespread adoption of vision systems and artificial intelligence for enhanced quality control, defect detection, and precise component placement, pushing the boundaries of assembly accuracy and reliability. Users are keen to understand how these sophisticated sensing and cognitive capabilities are transforming traditional assembly lines into intelligent, adaptive systems. The trend towards miniaturization in electronics and medical devices is also a significant area of inquiry, necessitating micro-assembly solutions and precision automation. Sustainability and energy efficiency in manufacturing processes, including the use of more energy-efficient machines and optimized assembly sequences, are emerging as critical considerations for market participants.

- Integration of Industry 4.0 technologies (IoT, AI, Big Data).

- Rising demand for flexible and reconfigurable assembly systems.

- Increased adoption of collaborative robots (cobots) for human-robot interaction.

- Advanced vision systems and AI for quality inspection and precision.

- Focus on micro-assembly for miniaturized components in electronics and medical.

- Emphasis on sustainable and energy-efficient manufacturing processes.

- Growing trend of lights-out manufacturing and fully automated facilities.

AI Impact Analysis on Automatic Assembly Machine

Common user questions regarding AI's impact on automatic assembly machines often center on its role in optimizing operational efficiency, enhancing precision, and enabling predictive capabilities. Users are particularly interested in how AI algorithms can analyze vast datasets from sensors and production lines to identify anomalies, predict equipment failures, and optimize assembly sequences in real time. This allows for more proactive maintenance, reduced downtime, and improved throughput, moving beyond traditional automation to truly intelligent manufacturing systems. The ability of AI to learn from past operations and adapt to new scenarios is a key area of discussion, highlighting its potential to drive continuous improvement in complex assembly environments.

Furthermore, inquiries frequently address AI's contribution to quality assurance and defect detection. Users want to know how AI-powered vision systems can identify minute imperfections or misalignments that human operators might miss, ensuring higher product quality and reducing waste. The role of AI in empowering robotic arms with enhanced dexterity and decision-making capabilities for intricate assembly tasks, such as handling delicate components or performing complex maneuvers, is also a significant topic. This includes enabling robots to perform tasks with greater adaptability and less reliance on rigid programming, thereby making assembly processes more robust and versatile. The potential for AI to facilitate greater human-robot collaboration, where AI-driven insights support human decision-making and task allocation, is another area of keen interest.

- AI-driven predictive maintenance reducing machine downtime.

- Enhanced quality control and defect detection via AI-powered vision systems.

- Optimization of assembly sequences and robot path planning.

- Adaptive manufacturing processes with real-time AI adjustments.

- Improved human-robot collaboration through intelligent task allocation.

- Autonomous problem-solving and error recovery in assembly lines.

- Data-driven insights for continuous process improvement and efficiency gains.

Key Takeaways Automatic Assembly Machine Market Size & Forecast

User questions about the key takeaways from the Automatic Assembly Machine market size and forecast consistently point towards an understanding of the robust growth trajectory and the underlying factors driving this expansion. A primary takeaway is the significant shift towards automation across various industrial sectors, propelled by the need for increased efficiency, reduced labor costs, and enhanced product quality. The forecast indicates a substantial market expansion, driven by advancements in robotics, AI, and sensor technologies that make automatic assembly solutions more versatile and accessible to a wider range of manufacturers, including small and medium-sized enterprises (SMEs).

Another crucial insight gleaned from user queries is the strategic importance of investing in automated assembly to maintain a competitive edge in global manufacturing. The market's growth is not merely volumetric but also qualitative, reflecting the integration of smart capabilities that enable adaptability, predictive analytics, and seamless integration with broader Industry 4.0 ecosystems. This signifies that future growth will be characterized by smarter, more interconnected, and highly flexible assembly solutions, moving beyond mere mechanization to intelligent automation. The rising demand for customized products and shorter product lifecycles further underscores the imperative for agile and automated assembly lines to meet dynamic market needs.

- Substantial market growth projected due to widespread industrial automation.

- Technological advancements in robotics, AI, and vision systems are key growth enablers.

- Automation is crucial for cost reduction, quality improvement, and efficiency.

- Shift towards intelligent, flexible, and adaptive assembly solutions.

- Increasing adoption by various industries, including SMEs.

- Competitive advantage derived from early adoption of advanced assembly technologies.

- Driven by demand for customization and shorter product lifecycles.

Automatic Assembly Machine Market Drivers Analysis

The global automatic assembly machine market is primarily driven by the escalating demand for increased production efficiency and reduced operational costs across manufacturing sectors. Companies are constantly seeking ways to optimize their assembly lines, minimize human error, and accelerate throughput to meet growing consumer demands and shrinking product lifecycles. Automation offers a compelling solution by providing consistent precision and speed, thereby lowering per-unit production costs and improving overall output quality. The global shift towards smart manufacturing and Industry 4.0 initiatives further accelerates the adoption of these machines, as they form a foundational component of interconnected, data-driven factories.

Moreover, the rising cost of labor and a growing shortage of skilled manual labor in many industrialized nations compel manufacturers to invest in automated solutions. Automatic assembly machines mitigate reliance on a large human workforce, ensuring production continuity and consistent quality regardless of labor availability. The increasing complexity of products, particularly in electronics and medical devices, also necessitates the precision and repeatability that only automated systems can reliably provide. This trend, coupled with the global push for higher product quality and stricter regulatory standards, makes automatic assembly machines indispensable for modern manufacturing environments aiming for excellence and compliance.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing demand for production efficiency and cost reduction | +2.5% | Global, particularly developed economies | 2025-2033 (Long-term) |

| Rising labor costs and shortage of skilled workforce | +2.0% | North America, Europe, East Asia | 2025-2033 (Long-term) |

| Advancements in robotics, AI, and vision systems | +1.8% | Global, R&D hubs | 2025-2033 (Long-term) |

| Growing adoption of Industry 4.0 and smart manufacturing | +1.5% | Global, strong in Germany, Japan, USA, China | 2025-2033 (Long-term) |

| Increasing product complexity and demand for higher quality | +1.2% | Global, high-tech manufacturing regions | 2025-2033 (Mid-term) |

Automatic Assembly Machine Market Restraints Analysis

Despite the strong growth drivers, the automatic assembly machine market faces significant restraints, primarily centered around the substantial initial capital investment required for these sophisticated systems. Small and medium-sized enterprises (SMEs) often find it challenging to allocate the necessary funds for machine purchase, installation, and integration, which can run into millions of dollars. This high entry barrier limits broader adoption, particularly in emerging economies or for companies with tighter budget constraints. The long return on investment period associated with such large capital expenditures can also deter potential buyers, making financial planning and risk assessment critical for market penetration.

Another major restraint is the technical complexity involved in integrating, operating, and maintaining automatic assembly machines. These systems often require specialized programming, complex software configurations, and highly skilled personnel for troubleshooting and repairs. The scarcity of trained engineers and technicians capable of managing these advanced automation solutions poses a significant hurdle, leading to potential operational delays and increased maintenance costs. Furthermore, the lack of standardization across different machine components and communication protocols can hinder seamless integration into existing manufacturing ecosystems, adding to complexity and expense. The rapid pace of technological obsolescence also means that once deployed, these expensive systems may quickly become outdated, necessitating further investment in upgrades or replacements.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High initial capital investment | -1.5% | Global, particularly SMEs and emerging markets | 2025-2033 (Long-term) |

| Technical complexity and need for skilled labor | -1.2% | Global, especially regions with skill gaps | 2025-2033 (Long-term) |

| Integration challenges with existing infrastructure | -0.8% | Global, industries with legacy systems | 2025-2033 (Mid-term) |

| Risk of technological obsolescence | -0.5% | Global, high-tech industries | 2025-2033 (Mid-term) |

Automatic Assembly Machine Market Opportunities Analysis

The automatic assembly machine market presents substantial opportunities driven by the expanding adoption of automation across new industrial verticals and the increasing demand for customized and small-batch production. Traditionally dominant in automotive and electronics, automation is now finding fertile ground in sectors such as medical devices, aerospace, food and beverage, and consumer goods, which are recognizing the benefits of precision, speed, and hygiene offered by automated assembly. This diversification of application areas opens up significant untapped market potential for manufacturers of assembly machines, allowing them to tailor solutions to specific industry requirements and compliance standards. The push for localized manufacturing and reshoring initiatives in various countries also creates demand for domestic automation capabilities.

Furthermore, the rising trend of mass customization and the need for flexible manufacturing systems to accommodate shorter product lifecycles provide a strong impetus for market growth. Manufacturers are increasingly seeking assembly solutions that can be rapidly reconfigured or reprogrammed to switch between different product variants without extensive downtime. This agility is crucial for responding to dynamic consumer preferences and market fluctuations. The integration of advanced technologies like cloud computing, edge AI, and advanced analytics offers opportunities for creating smarter, more interconnected, and highly optimized assembly lines. Developing user-friendly interfaces and modular automation solutions could also lower the entry barrier for smaller enterprises, democratizing access to advanced assembly capabilities and expanding the market base significantly.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into new industry verticals (e.g., medical, food & beverage) | +1.8% | Global, emerging markets | 2025-2033 (Long-term) |

| Growing demand for flexible and reconfigurable assembly systems for mass customization | +1.5% | Global, high-consumer demand regions | 2025-2033 (Long-term) |

| Development of user-friendly and modular automation solutions for SMEs | +1.2% | Global, particularly Asia Pacific, Latin America | 2025-2033 (Mid-term) |

| Integration of advanced digital technologies (IoT, AI, Cloud) for smart factories | +1.0% | Global, technologically advanced regions | 2025-2033 (Long-term) |

| Increasing focus on localized manufacturing and reshoring | +0.7% | North America, Europe | 2025-2033 (Mid-term) |

Automatic Assembly Machine Market Challenges Impact Analysis

The automatic assembly machine market faces several key challenges, one of the most prominent being cybersecurity risks associated with increasingly connected and digitized manufacturing environments. As assembly lines become integrated into broader IT networks and cloud platforms, they become vulnerable to cyber threats, including data breaches, intellectual property theft, and operational disruptions. A single cyberattack can halt production, compromise sensitive designs, and severely damage a company's reputation. Manufacturers of assembly machines must invest heavily in robust cybersecurity measures and secure-by-design principles to mitigate these escalating risks, which adds to the overall cost and complexity of the systems.

Another significant challenge is the rapid pace of technological change and the need for continuous innovation to remain competitive. The lifecycle of automation technologies is shortening, requiring constant research and development to introduce new features, improve performance, and integrate emerging capabilities like advanced AI and machine learning. This puts pressure on manufacturers to keep their product portfolios updated and to ensure backward compatibility or smooth upgrade paths for existing customers. Furthermore, the high investment cost combined with concerns about return on investment (ROI) for smaller or traditional manufacturers poses a hurdle. Convincing these companies of the long-term benefits and providing clear ROI models is crucial. The lack of standardized communication protocols among different automation components and systems from various vendors also creates integration headaches, leading to prolonged deployment times and higher engineering costs for end-users.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Cybersecurity risks in connected manufacturing environments | -0.9% | Global, high-tech industries | 2025-2033 (Long-term) |

| Rapid technological advancements and obsolescence | -0.7% | Global, R&D intensive regions | 2025-2033 (Long-term) |

| Ensuring positive Return on Investment (ROI) for end-users | -0.6% | Global, particularly traditional industries, SMEs | 2025-2033 (Mid-term) |

| Interoperability and standardization issues between systems | -0.5% | Global, complex manufacturing setups | 2025-2033 (Mid-term) |

Automatic Assembly Machine Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the Automatic Assembly Machine market, encompassing historical data, current market dynamics, and future projections. The scope includes a detailed examination of market size, growth drivers, restraints, opportunities, and challenges. Segmentation analysis covers various machine types, applications, and components, providing a granular view of market trends and potential areas for investment. Regional insights highlight key growth markets and their unique market characteristics, offering a holistic understanding of the global landscape. The report also profiles key industry players, offering strategic insights into their market positioning and competitive strategies, ensuring stakeholders have the critical information needed for informed decision-making and strategic planning.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 12.0 Billion |

| Growth Rate | 9.8% CAGR |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Automation Systems Co., Global Robotics Solutions, Precision Automation Inc., FutureMech Robotics, Omni-Assembly Tech, Advanced Manufacturing Automation, IntelliBot Systems, Innovate Automation, Delta Automation Solutions, Prime Robotics & Assembly, NexGen Assembly, Synergy Automation, Universal Assembly Systems, Apex Robotics, Visionary Automation, Streamline Manufacturing, Quantum Assembly Machines, Robotics Dynamics Group, Optimal Assembly Technologies, Industrial Automation Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Automatic Assembly Machine Market is comprehensively segmented to provide a detailed understanding of its various facets, enabling stakeholders to identify specific growth areas and market opportunities. This segmentation considers different machine types, which reflects the varying levels of automation and flexibility offered, from highly specialized fixed automation to adaptable robotic systems. Understanding these distinctions is crucial for manufacturers to align their product offerings with specific industrial needs, whether it's for high-volume, repetitive tasks or intricate, variable assembly processes.

Further segmentation by application highlights the diverse industrial sectors adopting automatic assembly solutions, demonstrating where the strongest demand lies and where future growth is anticipated. This includes traditional heavy industries like automotive and electronics, as well as rapidly expanding sectors such as medical devices and consumer goods. Component-based segmentation provides insights into the technologies and hardware driving these machines, indicating key areas for technological innovation and supply chain development. Finally, the distinction between semi-automatic and fully automatic operations helps delineate the market based on the level of human intervention required, reflecting different stages of automation adoption across industries and regions.

- By Machine Type:

- Fixed Automation Assembly Machines

- Flexible Automation Assembly Machines

- Robotic Assembly Machines

- Cartesian Robots

- SCARA Robots

- Articulated Robots

- Collaborative Robots

- By Application:

- Automotive

- Electronics & Electrical

- Medical Devices

- Aerospace & Defense

- Consumer Goods

- Packaging

- Others (Food & Beverage, Industrial Manufacturing)

- By Component:

- Controllers

- End Effectors (Grippers, Welders, Drills)

- Vision Systems

- Sensors

- Feeders

- Conveyors

- Safety Systems

- Software (PLC, SCADA, HMI, AI/ML)

- Motors & Drives

- Others

- By Operation Type:

- Semi-Automatic

- Fully Automatic

Regional Highlights

- North America: This region is characterized by early adoption of advanced automation technologies, driven by high labor costs, a strong focus on manufacturing efficiency, and significant investments in Industry 4.0 initiatives. The automotive, aerospace, and medical device sectors are major contributors to market growth, with a growing emphasis on intelligent automation and flexible assembly solutions.

- Europe: Europe is a significant market, particularly Germany and other Western European countries, known for their robust industrial base and leadership in smart factory concepts. The region benefits from strong government support for automation and research in advanced robotics. The automotive, industrial manufacturing, and electronics sectors are key drivers, along with a growing interest in sustainable and energy-efficient assembly processes.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing market due to rapid industrialization, expanding manufacturing sectors in countries like China, Japan, South Korea, and India, and increasing foreign investments. The region serves as a global manufacturing hub, driving the demand for high-volume, cost-effective automatic assembly solutions, particularly in electronics, automotive, and consumer goods.

- Latin America: This region is experiencing steady growth in automatic assembly machine adoption, primarily influenced by the expansion of automotive and electronics manufacturing. Countries like Mexico and Brazil are leading the charge, driven by efforts to improve manufacturing competitiveness and attract foreign investment.

- Middle East and Africa (MEA): While currently a smaller market, MEA is expected to show gradual growth, propelled by diversification efforts away from oil-dependent economies and increasing investments in industrial infrastructure. Sectors such as automotive assembly, packaging, and general manufacturing are beginning to adopt automation to enhance productivity and quality.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Assembly Machine Market.- Automation Systems Co.

- Global Robotics Solutions

- Precision Automation Inc.

- FutureMech Robotics

- Omni-Assembly Tech

- Advanced Manufacturing Automation

- IntelliBot Systems

- Innovate Automation

- Delta Automation Solutions

- Prime Robotics & Assembly

- NexGen Assembly

- Synergy Automation

- Universal Assembly Systems

- Apex Robotics

- Visionary Automation

- Streamline Manufacturing

- Quantum Assembly Machines

- Robotics Dynamics Group

- Optimal Assembly Technologies

- Industrial Automation Corp.

Frequently Asked Questions

Analyze common user questions about the Automatic Assembly Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Automatic Assembly Machine?

An Automatic Assembly Machine is an automated system designed to precisely and efficiently join multiple components to create a final product or sub-assembly, minimizing human intervention. These machines integrate robotics, vision systems, and advanced controls to perform tasks like part feeding, placement, fastening, and inspection with high speed and accuracy, crucial for modern manufacturing processes.

What are the primary benefits of using Automatic Assembly Machines?

The primary benefits include significant improvements in production efficiency, reduced manufacturing costs due to lower labor requirements and waste, enhanced product quality through consistent precision and repeatability, increased production speed, and improved workplace safety by automating hazardous tasks. They also enable higher throughput and scalability for production lines.

Which industries are the largest adopters of Automatic Assembly Machines?

The automotive industry is a leading adopter, utilizing these machines for complex vehicle assembly. Electronics and electrical industries also extensively use them for assembling circuit boards and electronic devices. Other significant sectors include medical devices for precision assembly, aerospace and defense, consumer goods, and packaging, all seeking high accuracy and speed.

What is the role of AI in Automatic Assembly Machines?

AI plays a transformative role by enabling advanced capabilities such as predictive maintenance, optimizing assembly sequences, enhancing quality control through intelligent vision systems for defect detection, and allowing robots to adapt to variations in parts or processes. AI contributes to smarter, more efficient, and adaptable assembly lines, reducing downtime and improving overall performance.

What are the major challenges in the Automatic Assembly Machine market?

Major challenges include the substantial initial capital investment required, which can be a barrier for smaller companies. Technical complexity and the need for highly skilled labor to operate and maintain these systems are also significant. Additionally, cybersecurity risks for connected machines and the rapid pace of technological obsolescence pose ongoing challenges for manufacturers and end-users alike.