Athletic Apparel and Footwear Wholesale Market

Athletic Apparel and Footwear Wholesale Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703374 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Athletic Apparel and Footwear Wholesale Market Size

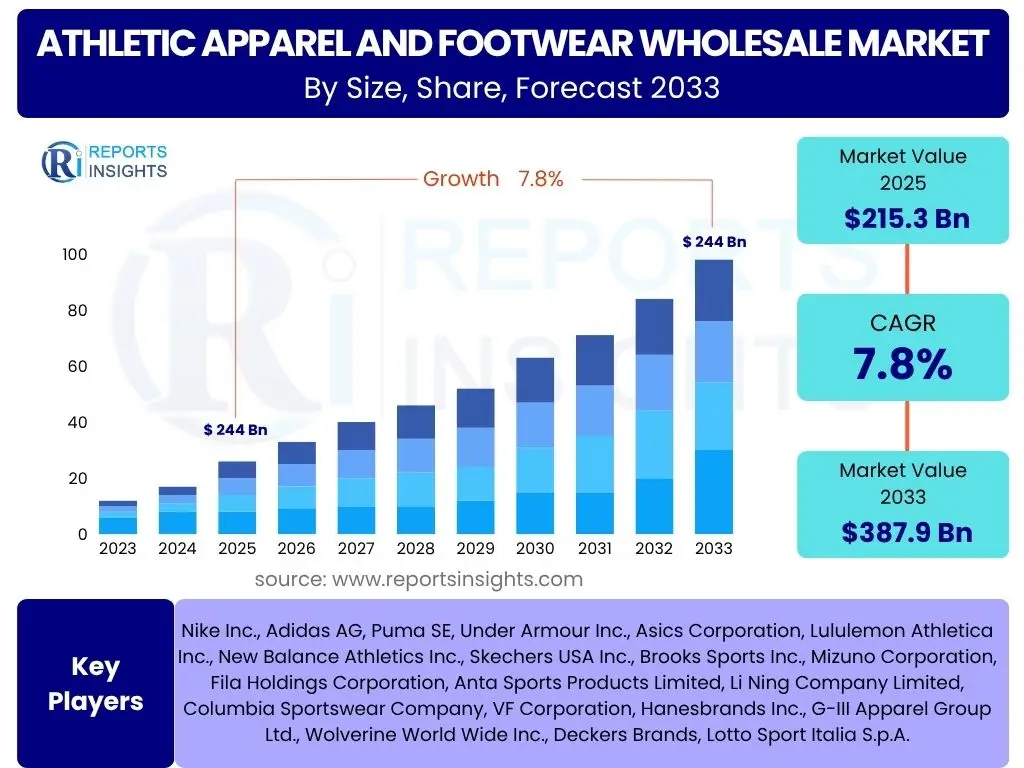

According to Reports Insights Consulting Pvt Ltd, The Athletic Apparel and Footwear Wholesale Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033. The market is estimated at USD 215.3 billion in 2025 and is projected to reach USD 387.9 billion by the end of the forecast period in 2033.

Key Athletic Apparel and Footwear Wholesale Market Trends & Insights

The Athletic Apparel and Footwear Wholesale market is currently shaped by several transformative trends driven by evolving consumer lifestyles, technological advancements, and a heightened focus on sustainability. The pervasive influence of the athleisure movement continues to blur the lines between casual wear and performance gear, driving demand for versatile products suitable for both active pursuits and everyday comfort. Digital transformation is also a critical trend, with e-commerce platforms and digital marketing strategies becoming indispensable channels for wholesale distribution and brand engagement, significantly expanding market reach and operational efficiency.

Another significant insight revolves around the growing consumer demand for sustainable and ethically produced goods. Wholesalers are increasingly pressured to source products from manufacturers adhering to eco-friendly practices, including the use of recycled materials, reduced water consumption, and fair labor practices. Furthermore, technological innovation in material science, such as moisture-wicking fabrics, advanced cushioning technologies, and lightweight designs, continues to push performance boundaries, offering new selling propositions for wholesale buyers. The rise of personalized and customizable options, although more prevalent in direct-to-consumer models, also influences wholesale demand for modular or customizable components.

- Athleisure Wear Expansion: Continued blending of athletic wear with casual fashion, driving demand for versatile and comfortable products.

- Sustainability and Ethical Sourcing: Increased consumer and regulatory pressure for eco-friendly materials, production processes, and fair labor practices across the supply chain.

- Digital Transformation and E-commerce Growth: Accelerated adoption of online wholesale platforms, digital showrooms, and data-driven sales strategies.

- Performance Material Innovation: Continuous development of advanced fabrics and footwear technologies for enhanced comfort, durability, and athletic performance.

- Health and Wellness Movement: Growing global focus on active lifestyles and fitness, fueling demand for specialized athletic gear.

AI Impact Analysis on Athletic Apparel and Footwear Wholesale

Artificial intelligence is profoundly transforming the Athletic Apparel and Footwear Wholesale sector by optimizing various operational aspects and enhancing strategic decision-making. AI-powered analytics are instrumental in predicting consumer demand with greater accuracy, allowing wholesalers to manage inventory levels more efficiently, reduce waste, and improve order fulfillment rates. This predictive capability extends to identifying emerging fashion trends and popular product features, enabling brands to anticipate market shifts and stock relevant merchandise, thereby minimizing stockouts and overstocking scenarios.

Beyond demand forecasting, AI is revolutionizing supply chain management within the wholesale market. Algorithms can optimize logistics, identify potential bottlenecks, and suggest alternative shipping routes or sourcing options to mitigate disruptions. Furthermore, AI-driven personalization tools, though primarily consumer-facing, are influencing wholesale buyers' purchasing decisions by providing data on what specific demographics or retailers' customer bases prefer, allowing for more tailored product assortments. The integration of AI in quality control and automated warehousing solutions is also improving operational efficiencies, reducing manual errors, and accelerating the flow of goods from manufacturers to retailers.

- Demand Forecasting and Inventory Optimization: AI algorithms analyze vast datasets to predict consumer trends and purchasing patterns, leading to more accurate inventory management and reduced obsolescence.

- Supply Chain Efficiency: AI optimizes logistics, identifies potential disruptions, and improves route planning for timely and cost-effective delivery of goods to wholesalers.

- Personalization and Merchandising Insights: While primarily consumer-facing, AI provides wholesalers with deep insights into product preferences, enabling more targeted product assortments for their retail partners.

- Automated Quality Control: AI-powered vision systems can detect defects in apparel and footwear at manufacturing and warehousing stages, enhancing product quality and reducing returns.

- Data-driven Product Development: AI analyzes market feedback and performance data to inform design and material innovation, leading to more appealing and high-performing wholesale offerings.

Key Takeaways Athletic Apparel and Footwear Wholesale Market Size & Forecast

The Athletic Apparel and Footwear Wholesale market is poised for robust expansion, driven by underlying shifts in global consumer behavior and technological integration. The projected Compound Annual Growth Rate of 7.8% signifies sustained momentum, largely attributable to the enduring appeal of athletic and athleisure wear, coupled with increasing health consciousness worldwide. Market participants should prioritize agility and adaptability in their strategies to capitalize on this growth, particularly by embracing digital channels and sustainable practices.

A significant takeaway is the market's evolving landscape, where traditional wholesale models are being augmented by advanced analytics and AI-driven insights to optimize operations from sourcing to distribution. The forecast reaching USD 387.9 billion by 2033 underscores the substantial revenue opportunities available for businesses that can effectively navigate supply chain complexities, meet diverse consumer demands, and innovate within product design and material science. Success in this dynamic environment will hinge on strategic investments in technology, sustainable manufacturing, and fostering strong, responsive supply chain partnerships.

- Significant Growth Trajectory: The market is set for substantial expansion, nearly doubling in value from 2025 to 2033, indicating strong underlying demand.

- Digital Integration Imperative: E-commerce and digital platforms will continue to be crucial for wholesale operations, market reach, and competitive advantage.

- Sustainability as a Core Differentiator: Sustainable materials and ethical production are increasingly critical for market acceptance and long-term viability.

- Efficiency through Technology: AI and advanced analytics are vital for optimizing inventory, supply chains, and understanding market trends.

- Consumer Lifestyle Influence: The persistent athleisure trend and a global emphasis on health and wellness will remain primary demand drivers.

Athletic Apparel and Footwear Wholesale Market Drivers Analysis

The Athletic Apparel and Footwear Wholesale market is significantly propelled by a confluence of macroeconomic and consumer-centric drivers. A primary driver is the global increase in health and fitness awareness, which encourages more individuals to participate in sports and active lifestyles, directly boosting demand for related apparel and footwear. This trend is amplified by government initiatives promoting physical activity and the widespread influence of social media in showcasing fitness culture. The expansion of fitness centers, sports leagues, and outdoor recreational activities further solidifies this demand base for wholesalers.

Moreover, the rapid growth of e-commerce platforms and digital retail channels has profoundly impacted the wholesale market. Online accessibility has broadened the reach for brands and wholesalers, enabling them to connect with a wider array of retailers globally, including smaller independent boutiques and specialized online stores. This digital proliferation streamlines ordering, improves inventory visibility, and reduces geographical barriers, making wholesale transactions more efficient and expansive. Innovations in material science, leading to more comfortable, durable, and high-performance products, also serve as a crucial driver, continuously exciting consumer interest and providing wholesalers with advanced products to offer.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Health and Fitness Awareness | +1.5% | Global, particularly North America, Europe, Asia Pacific | Long-term (2025-2033) |

| Growth of E-commerce and Online Retail Channels | +1.2% | Global, strongest in Asia Pacific, North America | Mid-term to Long-term (2025-2033) |

| Rising Athleisure Trend Popularity | +1.0% | Global, prominent in developed economies | Mid-term (2025-2029) |

| Technological Advancements in Material Science | +0.8% | Global | Long-term (2025-2033) |

Athletic Apparel and Footwear Wholesale Market Restraints Analysis

Despite significant growth drivers, the Athletic Apparel and Footwear Wholesale market faces notable restraints that could temper its expansion. One prominent challenge is the volatility of raw material prices, including cotton, synthetic fibers, and rubber. Fluctuations in these commodity prices directly impact manufacturing costs, subsequently affecting wholesale pricing and profit margins. Geopolitical tensions, trade disputes, and environmental factors can exacerbate this volatility, making long-term planning and stable pricing agreements difficult for wholesalers.

Another significant restraint is the intensely competitive landscape, characterized by the presence of numerous established global brands and emerging direct-to-consumer (DTC) players. This fierce competition leads to price wars, reduced brand loyalty among retailers, and increased marketing expenditures for wholesalers to maintain market share. The rise of DTC channels, where brands bypass traditional wholesale partners to sell directly to consumers, also poses a structural restraint by reducing the reliance of some brands on wholesale distribution, potentially shrinking the available market for wholesalers. Additionally, complex global supply chain logistics, including international shipping delays, customs regulations, and labor issues, present ongoing operational hurdles that can delay product delivery and increase costs.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatile Raw Material Prices | -0.7% | Global | Mid-term to Long-term (2025-2033) |

| Intense Market Competition | -0.6% | Global, particularly developed markets | Long-term (2025-2033) |

| Supply Chain Disruptions and Logistics Challenges | -0.5% | Global | Short-term to Mid-term (2025-2028) |

| Threat from Direct-to-Consumer (DTC) Sales Models | -0.4% | Global, prominent in North America, Europe | Long-term (2025-2033) |

Athletic Apparel and Footwear Wholesale Market Opportunities Analysis

Significant opportunities exist within the Athletic Apparel and Footwear Wholesale market for strategic growth and innovation. One major avenue is the expansion into emerging markets, particularly in Asia Pacific, Latin America, and Africa. These regions represent vast untapped consumer bases with rising disposable incomes and increasing interest in health and fitness, presenting lucrative prospects for wholesalers to introduce and scale their product offerings. Establishing robust distribution networks and localized marketing strategies in these areas can yield substantial returns.

Furthermore, the growing consumer demand for sustainable and ethically produced athletic wear offers a substantial opportunity for wholesalers to differentiate themselves and capture market share. By prioritizing partnerships with manufacturers who utilize eco-friendly materials, implement fair labor practices, and reduce their carbon footprint, wholesalers can cater to a rapidly expanding segment of environmentally conscious consumers. The integration of smart apparel and wearable technology also presents a niche but growing opportunity. Wholesalers capable of incorporating tech-enabled features like biometric tracking or performance monitoring into their product lines can appeal to tech-savvy consumers and specialized retailers, opening new revenue streams and fostering innovation in the athletic wear sector.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging Markets | +1.1% | Asia Pacific, Latin America, Africa | Long-term (2026-2033) |

| Growing Demand for Sustainable Products | +0.9% | Global, strong in North America, Europe | Mid-term to Long-term (2025-2033) |

| Product Customization and Personalization | +0.7% | Global | Mid-term (2025-2030) |

| Integration of Smart Apparel and Wearable Technology | +0.6% | Global | Long-term (2027-2033) |

Athletic Apparel and Footwear Wholesale Market Challenges Impact Analysis

The Athletic Apparel and Footwear Wholesale market faces several persistent challenges that demand strategic responses from industry players. One significant challenge is managing the rapidly evolving consumer preferences and fashion trends. The dynamic nature of the athletic and athleisure market means that popular styles and technologies can shift quickly, leading to potential inventory obsolescence for wholesalers if they fail to adapt swiftly. This necessitates agile supply chains and data-driven forecasting to minimize risks associated with misjudging demand or trends.

Counterfeiting and intellectual property theft also pose a substantial challenge, particularly for high-value athletic apparel and footwear. The proliferation of counterfeit goods, often sold through illicit online channels, undermines legitimate sales, damages brand reputation, and erodes consumer trust. Wholesalers must implement robust anti-counterfeiting measures and work with brands to protect intellectual property. Furthermore, navigating complex and diverse international trade regulations, tariffs, and compliance standards across different regions can be burdensome and add significant costs and delays to wholesale operations, impacting profitability and efficiency. Maintaining a balance between global supply chain efficiencies and responsiveness to local market demands represents an ongoing operational hurdle.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapidly Changing Consumer Preferences and Trends | -0.8% | Global | Long-term (2025-2033) |

| Counterfeiting and Intellectual Property Theft | -0.6% | Global, prominent in Asia Pacific | Long-term (2025-2033) |

| Navigating Complex Trade Regulations and Tariffs | -0.5% | Global | Mid-term to Long-term (2025-2033) |

| Fluctuating Exchange Rates | -0.4% | Global | Short-term to Mid-term (2025-2028) |

Athletic Apparel and Footwear Wholesale Market - Updated Report Scope

This market research report offers an in-depth analysis of the global Athletic Apparel and Footwear Wholesale market, providing comprehensive insights into its current size, historical performance, and future growth projections. The scope encompasses detailed segmentation analysis across various product types, end-users, and distribution channels, coupled with extensive regional breakdowns. It also includes an examination of key market dynamics such as drivers, restraints, opportunities, and challenges, along with a thorough impact analysis of emerging technologies like Artificial Intelligence. The report profiles leading market players, offering a competitive landscape view to inform strategic decision-making for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 215.3 Billion |

| Market Forecast in 2033 | USD 387.9 Billion |

| Growth Rate | 7.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Nike Inc., Adidas AG, Puma SE, Under Armour Inc., Asics Corporation, Lululemon Athletica Inc., New Balance Athletics Inc., Skechers USA Inc., Brooks Sports Inc., Mizuno Corporation, Fila Holdings Corporation, Anta Sports Products Limited, Li Ning Company Limited, Columbia Sportswear Company, VF Corporation, Hanesbrands Inc., G-III Apparel Group Ltd., Wolverine World Wide Inc., Deckers Brands, Lotto Sport Italia S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Athletic Apparel and Footwear Wholesale market is meticulously segmented to provide a granular understanding of its diverse components and their respective growth trajectories. This segmentation allows for targeted analysis of consumer preferences, product innovations, and distribution strategies across different categories. The market is primarily categorized by product type, encompassing both athletic apparel and athletic footwear, each with distinct sub-segments catering to specific activities and consumer needs.

Further segmentation by end-user differentiates demand patterns among men, women, and children, recognizing the unique fashion trends, performance requirements, and purchasing behaviors within each demographic. The segmentation by distribution channel highlights the evolving landscape of wholesale transactions, distinguishing between traditional offline retail channels and the increasingly dominant online platforms. This comprehensive segmentation framework is crucial for identifying high-growth areas, understanding competitive dynamics, and developing precise market entry and expansion strategies for businesses operating in the wholesale athletic wear sector.

- By Product Type:

- Athletic Apparel:

- Tops (T-shirts, Hoodies, Jackets)

- Bottoms (Pants, Shorts, Leggings)

- Outerwear (Coats, Vests)

- Innerwear & Undergarments (Sports Bras, Base Layers)

- Accessories (Socks, Headwear, Gloves)

- Athletic Footwear:

- Running Shoes

- Training Shoes

- Walking Shoes

- Hiking Shoes

- Sports-Specific Footwear (Basketball, Soccer, Tennis, etc.)

- Casual Athletic Footwear

- Athletic Apparel:

- By End-User:

- Men

- Women

- Kids

- By Distribution Channel:

- Online Channels:

- E-commerce Platforms

- Brand Websites

- Offline Channels:

- Specialty Stores

- Department Stores

- Supermarkets & Hypermarkets

- Other Retail Stores (e.g., Discount Stores)

- Online Channels:

Regional Highlights

- North America: This region holds a significant share of the Athletic Apparel and Footwear Wholesale market, driven by high consumer awareness regarding health and fitness, strong disposable incomes, and the prominent influence of athleisure fashion. The presence of major global brands and a well-established retail infrastructure further contribute to its dominance. Growth in this region is also supported by continuous innovation in product design and material technology, catering to a sophisticated consumer base that prioritizes both performance and style.

- Europe: Characterized by a strong tradition in sports and outdoor activities, Europe is a robust market for athletic apparel and footwear wholesale. Countries such as Germany, the UK, and France are key contributors, driven by a growing interest in sustainable and eco-friendly products. The market benefits from a diverse range of athletic pursuits, from team sports to individual fitness regimes, and a cultural emphasis on active living. Regulatory support for sports participation and fashion-conscious consumers seeking performance and design also fuel demand.

- Asia Pacific (APAC): Expected to witness the highest growth rate during the forecast period, the APAC region is a dynamic market for athletic apparel and footwear wholesale. Factors such as rapidly growing middle-class populations, increasing disposable incomes, rising health consciousness, and expanding sports infrastructure in countries like China, India, and Japan are key drivers. The region's vast consumer base and the increasing adoption of Western fitness trends present significant opportunities for market expansion, with digital penetration further accelerating market reach.

- Latin America: This region is experiencing steady growth in the athletic apparel and footwear wholesale market, influenced by rising sports participation, particularly in soccer and fitness activities. Economic improvements and growing urbanization are contributing to increased consumer spending on health and wellness products. Brazil and Mexico are leading markets, characterized by a burgeoning young population and a developing retail landscape that is increasingly embracing international athletic brands.

- Middle East and Africa (MEA): The MEA market is projected for moderate growth, primarily driven by government initiatives promoting sports and healthy lifestyles, urbanization, and increasing tourism. Investment in sports infrastructure and events, coupled with a young demographic, is fostering a nascent but expanding market for athletic wear. However, varying economic conditions and cultural preferences can influence market dynamics, requiring localized strategies for wholesalers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Athletic Apparel and Footwear Wholesale Market.- Nike Inc.

- Adidas AG

- Puma SE

- Under Armour Inc.

- Asics Corporation

- Lululemon Athletica Inc.

- New Balance Athletics Inc.

- Skechers USA Inc.

- Brooks Sports Inc.

- Mizuno Corporation

- Fila Holdings Corporation

- Anta Sports Products Limited

- Li Ning Company Limited

- Columbia Sportswear Company

- VF Corporation

- Hanesbrands Inc.

- G-III Apparel Group Ltd.

- Wolverine World Wide Inc.

- Deckers Brands

- Lotto Sport Italia S.p.A.

Frequently Asked Questions

What is the projected growth rate for the Athletic Apparel and Footwear Wholesale market?

The Athletic Apparel and Footwear Wholesale market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033, reaching an estimated USD 387.9 billion by 2033.

What are the primary drivers of growth in this market?

Key growth drivers include increasing global health and fitness awareness, the significant expansion of e-commerce channels, the enduring popularity of the athleisure trend, and continuous technological advancements in material science for product innovation.

How does AI impact the Athletic Apparel and Footwear Wholesale sector?

AI significantly impacts the sector by optimizing demand forecasting and inventory management, enhancing supply chain efficiency, providing data-driven merchandising insights, and improving automated quality control processes throughout the wholesale pipeline.

Which regions are expected to show the most significant market expansion?

The Asia Pacific (APAC) region is expected to exhibit the highest growth rate due to rising disposable incomes, increasing health consciousness, and expanding sports infrastructure in countries like China and India, making it a key focus area for market expansion.

What are the main challenges facing the Athletic Apparel and Footwear Wholesale market?

Major challenges include rapidly changing consumer preferences and fashion trends, the pervasive issue of counterfeiting and intellectual property theft, and the complexities of navigating diverse international trade regulations and tariffs.