Artificial Intelligence Accelerator Market

Artificial Intelligence Accelerator Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705889 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Artificial Intelligence Accelerator Market Size

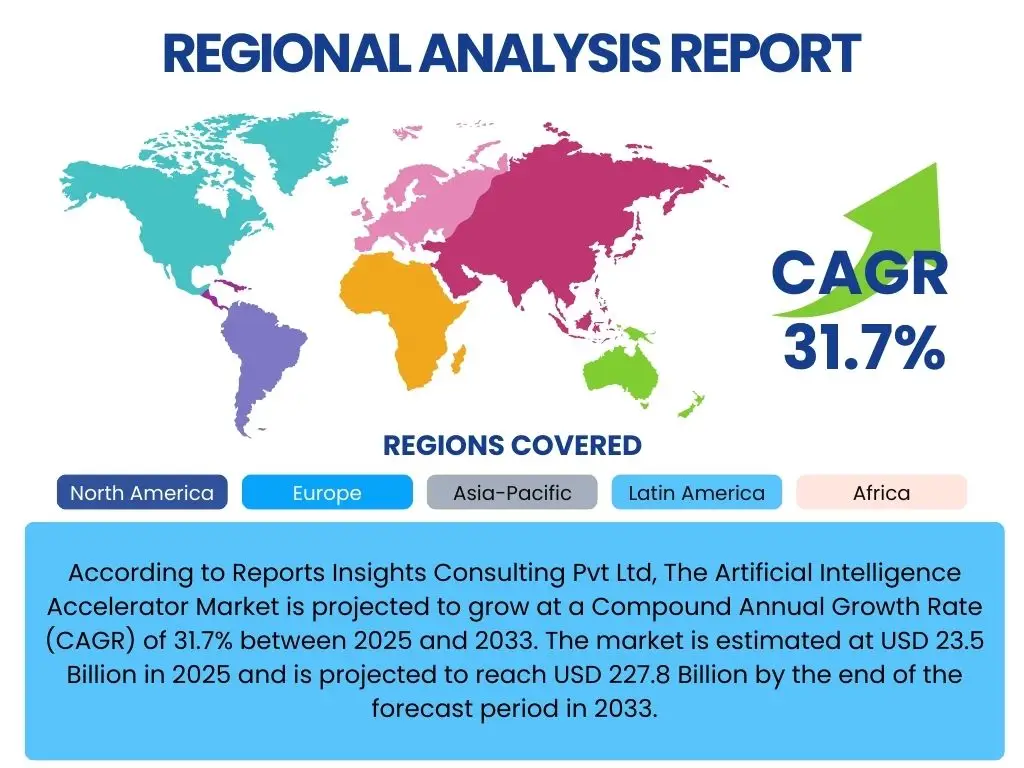

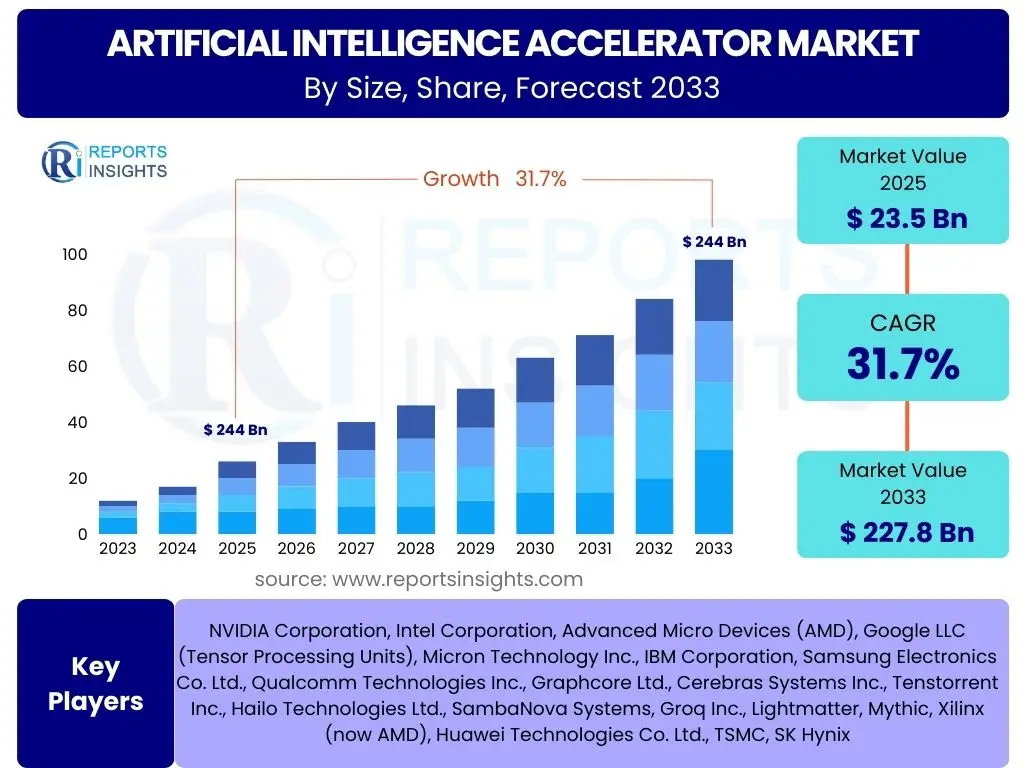

According to Reports Insights Consulting Pvt Ltd, The Artificial Intelligence Accelerator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 31.7% between 2025 and 2033. The market is estimated at USD 23.5 Billion in 2025 and is projected to reach USD 227.8 Billion by the end of the forecast period in 2033.

Key Artificial Intelligence Accelerator Market Trends & Insights

The Artificial Intelligence Accelerator market is undergoing rapid evolution, driven by increasing computational demands of advanced AI models and the pervasive integration of AI across diverse industries. Common user inquiries often revolve around emerging technologies, the shift towards specialized hardware, and the impact of evolving AI paradigms on accelerator design. Key trends highlight a significant move beyond general-purpose processors towards highly optimized, domain-specific architectures capable of handling complex deep learning and machine learning workloads with greater efficiency and lower power consumption.

This market is witnessing a strong emphasis on edge AI processing, spurred by the proliferation of IoT devices and the need for real-time inference capabilities closer to data sources, reducing latency and bandwidth requirements. Cloud AI accelerators continue to dominate for large-scale training, but the growth in edge applications is fostering innovation in smaller, more energy-efficient form factors. Furthermore, there's a growing convergence of hardware and software co-design, where accelerator architectures are increasingly optimized for specific AI frameworks and algorithms, blurring the lines between traditional hardware and software development.

Another prominent trend is the rising importance of sustainability and energy efficiency in accelerator design, driven by the substantial power consumption of large AI models. This encourages research into novel computing paradigms, such as neuromorphic and analog computing, which promise significant gains in energy efficiency. Additionally, the increasing complexity of AI workloads, including generative AI and multimodal models, is pushing the boundaries of current accelerator capabilities, necessitating continuous innovation in memory technologies, interconnects, and processing unit designs to manage ever-growing data volumes and model sizes.

- Proliferation of Edge AI and on-device inference capabilities.

- Increased demand for domain-specific AI architectures (ASICs).

- Growing investment in neuromorphic and in-memory computing technologies.

- Emphasis on energy efficiency and sustainable AI hardware solutions.

- Hybrid deployment models combining cloud and edge acceleration.

- Development of specialized accelerators for Generative AI and Large Language Models.

- Emergence of AI software-hardware co-design for optimized performance.

AI Impact Analysis on Artificial Intelligence Accelerator

User questions regarding the impact of Artificial Intelligence on the Artificial Intelligence Accelerator market frequently center on how AI itself influences hardware design, the demand for specific types of accelerators, and the continuous cycle of innovation between AI algorithms and the silicon that powers them. The overarching theme is that AI's advancements are not merely beneficiaries of accelerators but are also significant drivers of their evolution. As AI models become more sophisticated, they necessitate increasingly powerful and specialized hardware, creating a self-reinforcing loop where complex AI enables the design of better accelerators, which in turn unlock even more advanced AI capabilities.

The escalating complexity and scale of modern AI models, particularly deep learning networks and large language models (LLMs), directly impact the demand for high-performance AI accelerators. These models require unprecedented computational power for both training and inference, pushing traditional CPU and even general-purpose GPU architectures to their limits. This has led to a surge in the development and adoption of application-specific integrated circuits (ASICs) like TPUs and custom NPUs, which are meticulously designed to accelerate specific AI computations, offering superior performance per watt and lower latency for targeted workloads.

Furthermore, AI plays a crucial role in the design and optimization of accelerators themselves. Machine learning algorithms are increasingly employed in electronic design automation (EDA) tools to optimize chip layouts, predict performance, and identify potential bottlenecks, leading to more efficient and powerful accelerator designs. Generative AI is beginning to be explored for automated chip design and verification, potentially revolutionizing the speed and efficiency of hardware development. This symbiotic relationship ensures that as AI capabilities grow, the demand for and sophistication of AI accelerators will continue to intensify, fostering a dynamic and innovative market environment.

- Increased demand for specialized processing units for complex AI models.

- AI algorithms driving the development of more energy-efficient accelerators.

- Utilization of AI in chip design and optimization processes (AI for AI).

- Emergence of accelerators tailored for generative AI and large language models.

- Greater emphasis on high memory bandwidth and low latency interconnects.

- Push towards hybrid and heterogeneous computing architectures.

Key Takeaways Artificial Intelligence Accelerator Market Size & Forecast

Common user questions regarding key takeaways from the Artificial Intelligence Accelerator market size and forecast often focus on understanding the primary growth drivers, the most promising investment areas, and the strategic implications for businesses. The market is characterized by robust, double-digit growth, indicating a foundational shift in how computational power is delivered for AI workloads. A primary insight is the indispensable role of specialized hardware in unlocking the full potential of artificial intelligence, transitioning from general-purpose processors to purpose-built accelerators as AI applications proliferate across all sectors.

A significant takeaway is that the market's expansion is not uniform; it is segmented by distinct needs arising from training versus inference workloads, cloud versus edge deployments, and varied industry-specific requirements. This necessitates a diversified approach from market players, focusing on niche solutions while also striving for broader compatibility. The intensifying competition among semiconductor giants and innovative startups underscores the high stakes and the rapid pace of technological advancements, making continuous research and development critical for maintaining a competitive edge.

Moreover, the forecast highlights the increasing importance of software ecosystems and developer tools alongside the hardware. The success of an AI accelerator is not solely dependent on its raw processing power but also on the ease with which developers can utilize it, integrate it into existing systems, and optimize their AI models for it. Therefore, collaborations between hardware manufacturers, software providers, and cloud service providers will be pivotal for accelerating market adoption and realizing the projected growth. Energy efficiency and sustainability are also emerging as critical long-term considerations, influencing future design choices and market preferences.

- Robust market expansion driven by pervasive AI adoption across industries.

- Criticality of specialized hardware for efficient AI training and inference.

- Hybrid deployment models (cloud and edge) driving diverse accelerator needs.

- Intense competition and significant R&D investment are key market characteristics.

- Energy efficiency and sustainability are growing imperatives for accelerator design.

- The importance of a strong software ecosystem alongside hardware innovation.

Artificial Intelligence Accelerator Market Drivers Analysis

The Artificial Intelligence Accelerator market is significantly driven by the escalating demand for high-performance computing necessary to train and deploy increasingly complex artificial intelligence models. The proliferation of AI applications across virtually every industry, from autonomous vehicles and smart cities to healthcare diagnostics and financial trading, necessitates specialized hardware that can process vast amounts of data with high throughput and low latency. Traditional CPUs and even general-purpose GPUs are often insufficient for these demanding workloads, creating a persistent demand for purpose-built AI accelerators.

Another major driver is the advent and rapid growth of edge AI computing. As IoT devices become more intelligent and autonomous, the need to perform AI inference locally—at the edge—rather than relying solely on cloud infrastructure becomes paramount. This shift is driven by requirements for real-time decision-making, reduced latency, enhanced data privacy, and lower bandwidth consumption. Edge AI accelerators, characterized by their energy efficiency and smaller form factors, are crucial for enabling these distributed AI applications across various consumer and industrial devices.

Furthermore, substantial investments in AI research and development by governments, tech giants, and venture capitalists worldwide continue to fuel the market. These investments lead to breakthroughs in AI algorithms, which in turn require more advanced computational capabilities, creating a virtuous cycle of innovation. The competitive landscape among leading technology companies also drives continuous innovation in accelerator design, pushing the boundaries of performance, efficiency, and cost-effectiveness to gain a competitive edge in the rapidly expanding AI ecosystem.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Adoption of AI in Enterprises | +5.8% | Global, particularly North America, APAC | Short to Mid-term (2025-2030) |

| Rise of Edge AI Computing | +4.2% | Global, particularly IoT-heavy regions | Mid to Long-term (2027-2033) |

| Increasing Demand for HPC in AI Workloads | +6.5% | Global, particularly Data Centers, Research Institutions | Short to Mid-term (2025-2030) |

| Advancements in Deep Learning Algorithms | +4.0% | Global | Continuous |

| Government Initiatives and Funding for AI R&D | +3.5% | US, China, Europe, Japan | Mid to Long-term (2026-2033) |

| Proliferation of IoT Devices and Smart Technologies | +3.0% | Global | Mid-term (2025-2030) |

Artificial Intelligence Accelerator Market Restraints Analysis

Despite robust growth, the Artificial Intelligence Accelerator market faces several significant restraints, notably the high cost associated with the research, development, and manufacturing of advanced semiconductor chips. Designing cutting-edge AI accelerators requires immense capital investment in highly specialized fabrication facilities (fabs) and sophisticated design tools, often reaching billions of dollars. This financial barrier limits the number of players capable of competing at the highest end of the market and can slow down the pace of innovation for smaller entities, impacting overall market accessibility and adoption.

Another substantial restraint is the complexity of integrating new AI accelerator hardware into existing IT infrastructures and the lack of widespread standardization across different platforms and programming models. Enterprises often operate with diverse hardware and software stacks, and introducing a new, specialized accelerator requires significant effort in terms of compatibility, driver development, and software optimization. This fragmentation can hinder seamless adoption, increase deployment timelines, and require specialized technical expertise, thereby increasing total cost of ownership and reducing the incentive for broad-scale implementation.

Furthermore, concerns regarding power consumption and heat dissipation present a critical challenge, particularly for high-performance accelerators used in data centers and for edge devices with limited power budgets. As AI models grow larger and demand more computational power, the energy required to operate these accelerators escalates, leading to higher operational costs and environmental impact. Managing the heat generated by these powerful chips also adds complexity and cost to system design, potentially limiting their deployment in environments without adequate cooling infrastructure, thus acting as a brake on unconstrained market expansion.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High R&D and Manufacturing Costs | -3.5% | Global | Continuous |

| Lack of Standardized Programming Models | -2.8% | Global | Short to Mid-term (2025-2028) |

| Power Consumption and Heat Dissipation | -2.0% | Global, particularly Data Centers | Continuous |

| Supply Chain Complexities and Geopolitical Risks | -2.5% | Global, particularly Asia Pacific | Short to Mid-term (2025-2029) |

| Shortage of Skilled AI Hardware Engineers | -1.8% | Global | Long-term (2028-2033) |

Artificial Intelligence Accelerator Market Opportunities Analysis

The Artificial Intelligence Accelerator market presents significant opportunities driven by the untapped potential in specific application areas and the evolving nature of AI workloads. One primary opportunity lies in the continued expansion of edge AI and IoT devices, where real-time, low-latency processing is critical. As industries embrace smart manufacturing, autonomous systems, and connected consumer electronics, the demand for highly efficient, compact, and specialized edge AI accelerators will skyrocket, opening new market segments for innovative chip designers and manufacturers.

Another compelling opportunity arises from the rapid advancement and adoption of generative AI and large language models (LLMs). These models, characterized by their immense size and computational intensity, require unprecedented processing capabilities for both training and inference, pushing the boundaries of existing hardware. Developing accelerators specifically optimized for the unique architectural demands of transformer models and other generative AI architectures represents a lucrative avenue for market growth, creating demand for novel memory solutions, interconnects, and massively parallel processing units.

Furthermore, the increasing focus on sustainability and energy efficiency across all industries presents an opportunity for companies that can deliver high-performance AI accelerators with significantly reduced power consumption. As environmental concerns mount and energy costs rise, businesses are actively seeking solutions that minimize their carbon footprint. Innovations in low-power chip design, neuromorphic computing, and more efficient fabrication processes will enable market players to capture a growing segment of environmentally conscious customers and contribute to the broader goal of green AI.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Untapped Potential in Edge AI and IoT | +4.5% | Global, particularly developing economies | Mid to Long-term (2026-2033) |

| Growth in Generative AI and Large Language Models | +5.0% | Global, particularly North America, Europe, APAC | Short to Mid-term (2025-2030) |

| Hybrid Cloud AI Deployments | +3.8% | Global | Mid-term (2025-2030) |

| Focus on Energy-Efficient and Sustainable AI Hardware | +3.0% | Global, particularly regulated markets | Long-term (2028-2033) |

| Expansion into New AI-driven Industries (e.g., Space, Agritech) | +2.5% | Global | Long-term (2029-2033) |

Artificial Intelligence Accelerator Market Challenges Impact Analysis

The Artificial Intelligence Accelerator market faces significant challenges, particularly the rapid pace of technological obsolescence. With AI algorithms evolving at an unprecedented rate and new models constantly emerging, the hardware designed to accelerate them can quickly become outdated. This creates a difficult balance for manufacturers, who must invest heavily in R&D for cutting-edge designs, knowing that their products might have a short shelf life before being surpassed by newer architectures or more efficient processing paradigms. This rapid cycle can lead to high investment risks and pressure on profitability.

Another critical challenge is the intense competition and the high barrier to entry in the advanced semiconductor market. The industry is dominated by a few established players with immense financial resources, expertise, and patented technologies. New entrants, particularly startups, face an uphill battle to secure funding, attract top talent, and establish manufacturing partnerships. This highly competitive environment pushes companies to constantly innovate, but also means that even slight missteps in product strategy or timing can lead to significant market share losses, further impacting pricing pressures and margins.

Furthermore, global supply chain disruptions and geopolitical tensions pose substantial challenges. The production of advanced AI accelerators relies on a complex, interconnected global supply chain for raw materials, specialized components, and sophisticated manufacturing equipment. Any disruptions, whether from natural disasters, trade disputes, or political instabilities, can severely impact production schedules, increase costs, and delay product launches, creating uncertainty for market players and end-users alike. Ensuring resilient and diversified supply chains has become a paramount concern for companies operating in this sector.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Technological Obsolescence | -3.0% | Global | Continuous |

| High R&D Costs and Long Development Cycles | -2.5% | Global | Continuous |

| Intense Competition and Market Saturation for General Purpose | -2.2% | Global, particularly mature markets | Short to Mid-term (2025-2029) |

| Supply Chain Vulnerabilities and Geopolitical Risks | -2.8% | Global, particularly Asia Pacific | Short to Mid-term (2025-2030) |

| Interoperability and Standardization Issues | -1.5% | Global | Mid-term (2026-2031) |

Artificial Intelligence Accelerator Market - Updated Report Scope

This report provides a comprehensive analysis of the Artificial Intelligence Accelerator Market, covering market size, trends, drivers, restraints, opportunities, and challenges. It offers detailed segmentation analysis and regional insights, along with profiles of key market players, to provide a holistic view of the industry landscape and future growth prospects. The scope focuses on providing actionable insights for stakeholders seeking to understand market dynamics and strategic positioning.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 23.5 Billion |

| Market Forecast in 2033 | USD 227.8 Billion |

| Growth Rate | 31.7% |

| Number of Pages | 267 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | NVIDIA Corporation, Intel Corporation, Advanced Micro Devices (AMD), Google LLC (Tensor Processing Units), Micron Technology Inc., IBM Corporation, Samsung Electronics Co. Ltd., Qualcomm Technologies Inc., Graphcore Ltd., Cerebras Systems Inc., Tenstorrent Inc., Hailo Technologies Ltd., SambaNova Systems, Groq Inc., Lightmatter, Mythic, Xilinx (now AMD), Huawei Technologies Co. Ltd., TSMC, SK Hynix |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Artificial Intelligence Accelerator market is comprehensively segmented to provide granular insights into its diverse components and drivers. This detailed segmentation allows for a precise understanding of how different technological approaches, processing needs, and industry applications contribute to the overall market landscape. By analyzing each segment, stakeholders can identify specific growth pockets, understand competitive dynamics within sub-markets, and tailor their strategies to address distinct demands across the AI ecosystem.

Segmentation by type, such as GPUs, FPGAs, and ASICs, reveals the ongoing shift towards specialized hardware, with ASICs gaining prominence for their efficiency in specific AI workloads, while GPUs remain crucial for flexible high-performance computing. The distinction between training and inference processing highlights the varied demands for computational intensity and latency, impacting accelerator design. Furthermore, segmenting by architecture into cloud and edge accelerators underscores the contrasting requirements for scale versus power efficiency and real-time processing capabilities, reflecting different deployment models and use cases.

Moreover, the market is segmented by the specific AI technology being accelerated, like deep learning or natural language processing, indicating the need for specialized hardware optimized for these complex algorithms. Lastly, the segmentation by end-user industry, from automotive to healthcare and telecommunications, provides critical insights into the vertical adoption of AI accelerators, demonstrating how diverse sectors are leveraging these technologies to drive innovation and efficiency. This multi-faceted approach to segmentation provides a holistic view of the market's structure and future trajectory.

- By Type:

- Graphics Processing Units (GPUs)

- Field-Programmable Gate Arrays (FPGAs)

- Application-Specific Integrated Circuits (ASICs)

- Tensor Processing Units (TPUs)

- Neural Processing Units (NPUs)

- Custom Processors

- Neuromorphic Chips

- By Processing Type:

- Training

- Inference

- By Architecture:

- Cloud AI Accelerators

- Edge AI Accelerators

- By Technology:

- Deep Learning

- Machine Learning

- Computer Vision

- Natural Language Processing (NLP)

- Speech Recognition

- By End-User Industry:

- Consumer Electronics

- Automotive

- Healthcare & Life Sciences

- Manufacturing & Industrial

- BFSI (Banking, Financial Services, and Insurance)

- Retail & E-commerce

- Telecommunications

- Data Centers

- Robotics

- Media & Entertainment

- Government & Defense

Regional Highlights

- North America: Dominant in market share, driven by significant R&D investments, the presence of major technology companies, cloud service providers, and early adoption of advanced AI solutions across various industries, including data centers, automotive, and consumer electronics. The region leads in venture capital funding for AI startups and advanced semiconductor development.

- Asia Pacific (APAC): Exhibits the highest growth potential, fueled by rapid digitalization, government initiatives promoting AI, massive investments in data centers and smart cities, and a robust manufacturing ecosystem. Countries like China, Japan, South Korea, and India are key contributors due to large domestic markets and increasing AI adoption in sectors such as consumer electronics, automotive, and telecommunications.

- Europe: Characterized by strong governmental support for AI research, a focus on industrial automation, and stringent data privacy regulations that influence edge AI development. Countries like Germany (Industry 4.0), the UK, and France are investing in AI infrastructure, particularly in sectors such as manufacturing, healthcare, and robotics, though at a comparatively slower pace than North America or APAC in terms of overall market size.

- Latin America: An emerging market for AI accelerators, with increasing adoption of AI in sectors such as financial services, retail, and agriculture. Growth is supported by rising digital literacy, expanding internet penetration, and increasing foreign investments in technology infrastructure, though the market remains smaller compared to developed regions.

- Middle East and Africa (MEA): Shows nascent but growing demand, driven by smart city initiatives (e.g., UAE, Saudi Arabia) and diversification efforts away from oil economies. Investments in data centers, telecommunications infrastructure, and AI-driven government services are creating opportunities, particularly in cloud and enterprise AI accelerator deployments, albeit from a smaller base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial Intelligence Accelerator Market.- NVIDIA Corporation

- Intel Corporation

- Advanced Micro Devices (AMD)

- Google LLC

- Micron Technology Inc.

- IBM Corporation

- Samsung Electronics Co. Ltd.

- Qualcomm Technologies Inc.

- Graphcore Ltd.

- Cerebras Systems Inc.

- Tenstorrent Inc.

- Hailo Technologies Ltd.

- SambaNova Systems

- Groq Inc.

- Lightmatter

- Mythic

- Huawei Technologies Co. Ltd.

- TSMC

- SK Hynix

- Fujitsu Limited

Frequently Asked Questions

Analyze common user questions about the Artificial Intelligence Accelerator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Artificial Intelligence Accelerator?

An AI accelerator is specialized hardware designed to efficiently process and accelerate artificial intelligence computations, particularly for machine learning and deep learning algorithms. Unlike general-purpose CPUs, these accelerators are optimized for parallel processing of data, crucial for both training and inferencing AI models, leading to significant performance and power efficiency improvements.

What are the primary types of AI Accelerators?

The main types include Graphics Processing Units (GPUs), which are widely used for their parallel processing capabilities; Field-Programmable Gate Arrays (FPGAs), offering reconfigurability for specific tasks; and Application-Specific Integrated Circuits (ASICs) like Google's TPUs or custom NPUs, which are highly optimized for particular AI workloads, providing maximum performance and efficiency for dedicated tasks.

Which industries are heavily adopting AI Accelerators?

Key industries adopting AI accelerators include automotive (for autonomous driving), healthcare (for medical imaging and diagnostics), consumer electronics (for smart devices and personal assistants), data centers (for cloud AI services), and manufacturing (for industrial automation and quality control). Their adoption is pervasive across any sector leveraging advanced AI capabilities.

What are the key factors driving the growth of the AI Accelerator market?

Major growth drivers include the increasing complexity of AI models, the rising demand for high-performance computing in AI workloads, the rapid expansion of edge AI applications, and substantial investments in AI research and development globally. These factors collectively push the need for more efficient and specialized hardware.

What is the future outlook for the Artificial Intelligence Accelerator market?

The market is poised for robust growth, driven by continued AI innovation, the expansion of generative AI, and the increasing need for energy-efficient computing. Future trends point towards greater specialization of chips, hybrid cloud-edge deployment models, and a strong emphasis on integrating hardware and software to maximize performance for evolving AI applications.