Anti obesity Drug Market

Anti obesity Drug Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703427 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Anti obesity Drug Market Size

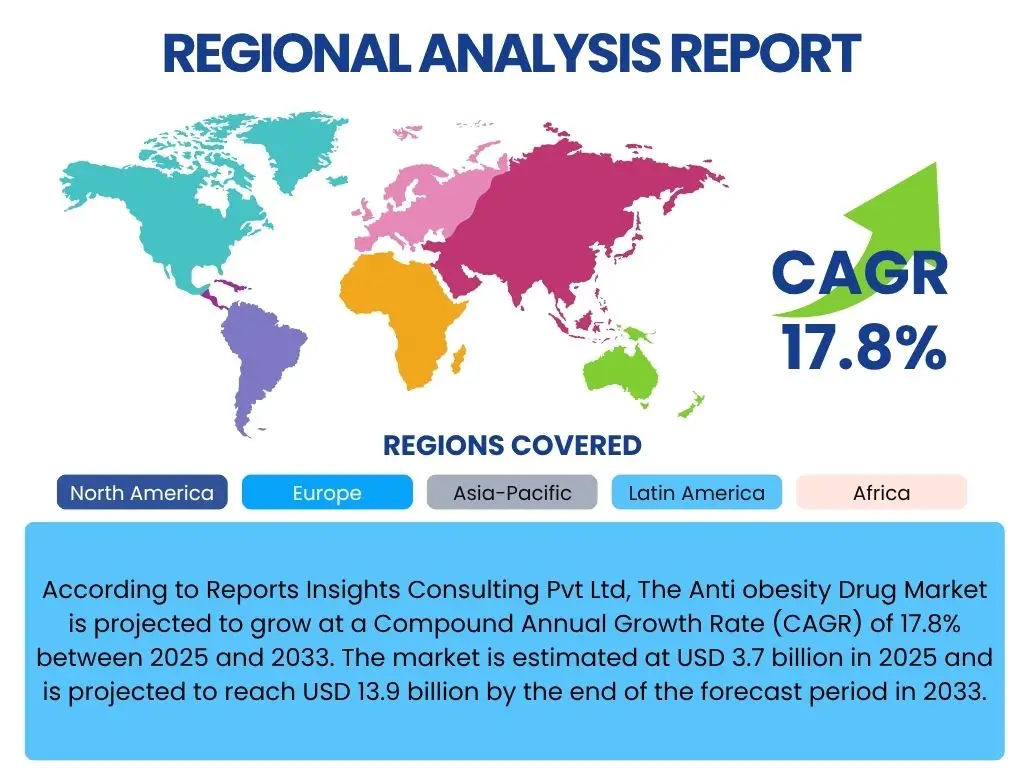

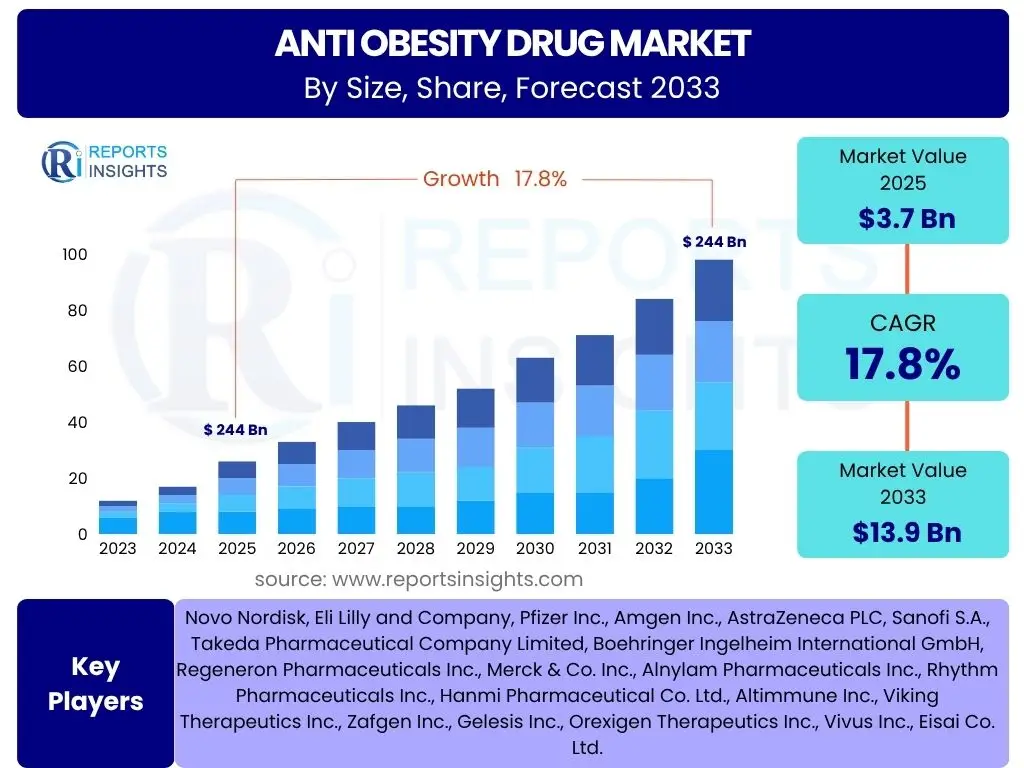

According to Reports Insights Consulting Pvt Ltd, The Anti obesity Drug Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.8% between 2025 and 2033. The market is estimated at USD 3.7 billion in 2025 and is projected to reach USD 13.9 billion by the end of the forecast period in 2033.

The substantial growth in the anti-obesity drug market is primarily driven by the escalating global prevalence of obesity and related comorbidities such as diabetes, cardiovascular diseases, and hypertension. This increasing disease burden places significant pressure on healthcare systems worldwide, necessitating effective therapeutic interventions. Advances in pharmaceutical research and development have led to the introduction of novel drug classes with improved efficacy and safety profiles, attracting both prescribers and patients seeking viable weight management solutions.

Furthermore, heightened public awareness campaigns regarding the health risks associated with obesity, coupled with growing acceptance of pharmacological treatments as a legitimate option for weight loss, contribute significantly to market expansion. Regulatory approvals for new medications, particularly those demonstrating sustained weight reduction and cardiovascular benefits, are also pivotal in expanding market access and physician confidence. The shift towards a more comprehensive approach to obesity management, often integrating medication with lifestyle modifications, reinforces the long-term growth trajectory of this market.

Key Anti obesity Drug Market Trends & Insights

Common user inquiries regarding anti-obesity drug market trends frequently revolve around the emergence of new drug classes, the growing focus on combination therapies, and the integration of digital health solutions. Users are keenly interested in understanding how advancements in GLP-1 receptor agonists and multi-agonist drugs are reshaping treatment paradigms, moving beyond traditional weight loss approaches to address metabolic health holistically. There is also significant curiosity about the industry's response to patient adherence challenges and the potential for long-term therapeutic benefits beyond mere weight reduction, including cardiovascular risk mitigation.

- Dominance of GLP-1 Receptor Agonists: Drugs like semaglutide and tirzepatide are setting new efficacy benchmarks, driving significant market share and investor interest due to their superior weight loss and glycemic control properties.

- Emergence of Multi-Agonist Therapies: Development of drugs targeting multiple hormonal pathways (e.g., GLP-1/GIP/glucagon) for enhanced efficacy and broader metabolic benefits.

- Focus on Cardiovascular and Metabolic Benefits: Beyond weight loss, new drugs are being developed and marketed based on their ability to reduce risks associated with comorbidities like cardiovascular events and type 2 diabetes.

- Integration of Digital Health and Personalized Medicine: Growing adoption of digital platforms for patient monitoring, adherence support, and lifestyle intervention, alongside the development of personalized treatment approaches based on genetic and metabolic profiles.

- Increased R&D Investment and Pipeline Expansion: Pharmaceutical companies are significantly increasing investment in anti-obesity drug research, leading to a robust pipeline of novel compounds and next-generation therapies.

AI Impact Analysis on Anti obesity Drug

User questions concerning AI's impact on anti-obesity drugs often focus on its application in accelerating drug discovery, optimizing clinical trial design, and personalizing treatment strategies. There is considerable interest in how AI can identify novel therapeutic targets, predict drug efficacy and potential side effects, and streamline patient recruitment for trials. Furthermore, users are curious about AI's role in developing precision medicine approaches for obesity, where treatments are tailored to individual patient characteristics, potentially improving outcomes and reducing adverse events. The overarching theme is the transformative potential of AI to enhance the speed, efficiency, and effectiveness of bringing new anti-obesity medications to market and optimizing their use.

- Accelerated Drug Discovery: AI algorithms analyze vast datasets to identify novel drug targets, screen potential compounds, and predict their efficacy, significantly shortening the early stages of drug development.

- Optimized Clinical Trial Design: AI aids in identifying suitable patient populations, predicting patient responses, and monitoring trial progression, leading to more efficient and successful clinical trials for anti-obesity drugs.

- Personalized Treatment Approaches: AI-driven analytics can segment patients based on genetic, metabolic, and lifestyle data to predict individual responses to specific anti-obesity medications, enabling more personalized and effective treatment plans.

- Enhanced Patient Monitoring and Adherence: AI-powered wearable devices and digital platforms can monitor patient progress, track medication adherence, and provide tailored interventions, improving overall treatment outcomes.

- Biomarker Identification: AI assists in discovering novel biomarkers for obesity and related conditions, facilitating early diagnosis, disease progression monitoring, and the development of targeted therapies.

Key Takeaways Anti obesity Drug Market Size & Forecast

Common user questions regarding key takeaways from the anti-obesity drug market size and forecast typically center on identifying the primary growth drivers, the fastest-growing segments, and the long-term market sustainability. Users seek clarity on why the market is experiencing such rapid expansion, what factors are expected to sustain this growth through the forecast period, and which specific drug classes or regions will emerge as significant contributors to the market's value. There is also interest in understanding the overall investment landscape and the potential for new market entrants to disrupt established players, signaling a demand for concise summaries of the market's most compelling attributes and future outlook.

- Significant Market Expansion: The anti-obesity drug market is poised for robust growth, driven by increasing obesity rates and advancements in pharmacotherapy, projected to nearly quadruple in value by 2033.

- GLP-1 Agonists as Growth Engine: GLP-1 receptor agonists and multi-agonists will remain the primary drivers of market growth due to their superior efficacy and broader metabolic benefits.

- Shifting Treatment Paradigms: The market is moving towards medical intervention for obesity, complementing lifestyle changes, and increasingly emphasizing long-term health outcomes beyond weight loss.

- Investment and Innovation Surge: High levels of R&D investment are fueling a robust pipeline of novel drugs, indicating sustained innovation and expansion in therapeutic options.

- Global Market Potential: While North America leads, emerging economies offer significant untapped potential for future market penetration due to rising awareness and improving healthcare infrastructure.

Anti obesity Drug Market Drivers Analysis

The anti-obesity drug market is propelled by a confluence of factors, foremost among them being the escalating global prevalence of obesity and overweight populations. This growing health crisis, recognized by the World Health Organization as a major public health concern, necessitates effective medical interventions to manage weight and mitigate associated comorbidities. Increased awareness among both patients and healthcare professionals regarding obesity as a chronic disease requiring treatment, rather than merely a lifestyle choice, is fostering greater acceptance and demand for pharmacological solutions. Furthermore, continuous innovation in drug development, leading to the approval of highly efficacious and safer medications, is significantly expanding therapeutic options and improving patient outcomes.

The economic burden of obesity-related diseases, including diabetes, cardiovascular disorders, and certain cancers, motivates healthcare systems and payers to seek preventative and therapeutic measures, including drug interventions. Government initiatives and public health campaigns aimed at reducing obesity rates also indirectly support the market by increasing screening, diagnosis, and treatment access. Lastly, advancements in understanding the complex physiological mechanisms of obesity have paved the way for more targeted and effective drug discovery, moving beyond older medications with limited efficacy or significant side effects, thereby enhancing market confidence and adoption.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Obesity Prevalence | +5.5% | Global, particularly North America, Europe, Asia Pacific | Long-term (2025-2033) |

| Growing Awareness of Obesity as a Chronic Disease | +4.0% | Developed Economies, gradually expanding to Emerging Markets | Medium to Long-term (2025-2033) |

| Advances in Drug Development & Approvals of Efficacious Medications | +4.5% | Global, led by North America and Europe | Medium to Long-term (2025-2033) |

| Rising Healthcare Expenditure and Focus on Preventative Care | +3.8% | North America, Western Europe | Medium-term (2025-2029) |

Anti obesity Drug Market Restraints Analysis

Despite significant growth potential, the anti-obesity drug market faces several notable restraints. A primary concern is the high cost of newly approved and highly effective medications. These premium prices can limit patient access, especially in healthcare systems with limited public funding or where insurance coverage for obesity drugs is not comprehensive. The long-term nature of obesity treatment often means patients require medication for extended periods, making the cumulative cost a substantial barrier for many individuals and healthcare payers. This affordability challenge can hinder broad market penetration, particularly in developing regions.

Another significant restraint is the perception and stigma associated with obesity medications. Some patients and healthcare providers still view pharmacological interventions as a last resort or as a superficial solution, overlooking the medical necessity for treating a complex chronic disease. This stigma can lead to reluctance in prescribing or taking these drugs, impacting adherence and overall market adoption. Furthermore, concerns regarding potential side effects, especially with long-term use, and the need for continuous monitoring can deter some patients, particularly given the historical context of withdrawn weight loss drugs due to safety issues. Stringent regulatory approval processes, demanding robust clinical trial data on efficacy and long-term safety, also add to development costs and timelines, potentially slowing market expansion.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Cost of Novel Anti-obesity Medications | -3.0% | Global, particularly in emerging markets and less generous insurance systems | Long-term (2025-2033) |

| Limited Insurance Coverage and Reimbursement Challenges | -2.5% | North America, parts of Europe | Medium-term (2025-2029) |

| Concerns Regarding Long-term Safety and Side Effects | -1.8% | Global | Long-term (2025-2033) |

| Patient Adherence to Long-term Treatment Regimens | -1.5% | Global | Medium-term (2025-2029) |

Anti obesity Drug Market Opportunities Analysis

The anti-obesity drug market is ripe with opportunities, primarily driven by the ongoing shift in the medical community's perception of obesity from a lifestyle issue to a treatable chronic disease. This evolving understanding fosters greater willingness among healthcare providers to prescribe and patients to accept pharmacological interventions. The continuous development of novel drug candidates with superior efficacy, improved safety profiles, and diverse mechanisms of action presents significant growth avenues. These innovations include multi-agonist therapies, orally administered GLP-1 agonists, and combination therapies that offer more comprehensive weight management and metabolic benefits, expanding the addressable patient population.

Furthermore, the significant unmet medical need in emerging economies, where obesity rates are rapidly rising due to urbanization and changing dietary habits, represents a substantial untapped market. As healthcare infrastructure improves and disposable incomes increase in these regions, access to and demand for anti-obesity drugs are expected to surge. Integration of digital health platforms and artificial intelligence into obesity management also offers a unique opportunity to enhance patient engagement, monitor progress, improve adherence, and provide personalized support, thereby optimizing treatment outcomes and expanding the reach of these medications beyond traditional clinical settings. Lastly, the potential for these drugs to demonstrate benefits beyond weight loss, such as reducing the risk of major adverse cardiovascular events (MACE) or improving outcomes in conditions like non-alcoholic steatohepatitis (NASH), opens up new therapeutic indications and market segments, increasing their overall value proposition and adoption.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Novel, More Efficacious Drug Candidates | +4.0% | Global, particularly developed markets | Long-term (2025-2033) |

| Expansion into Emerging Markets with Rising Obesity Rates | +3.5% | Asia Pacific, Latin America, Middle East & Africa | Long-term (2027-2033) |

| Increased Adoption of Digital Health and Telemedicine for Obesity Management | +2.8% | North America, Europe | Medium-term (2025-2029) |

| Discovery of New Therapeutic Indications (e.g., NASH, Cardiovascular Protection) | +2.2% | Global | Long-term (2028-2033) |

Anti obesity Drug Market Challenges Impact Analysis

The anti-obesity drug market faces several persistent challenges that can impede its full growth potential. One significant hurdle is the issue of patient adherence to long-term treatment regimens. Obesity is a chronic condition, and effective drug therapy often requires sustained daily or weekly administration. Many patients struggle with adherence over extended periods due to factors like cost, side effects, or a lack of immediate perceived benefits, leading to suboptimal outcomes and lower patient retention rates. This challenge is compounded by the need for continuous lifestyle modifications alongside medication, which can be difficult for patients to maintain consistently.

Another key challenge is the intense competition from established weight loss alternatives, including bariatric surgery and various non-pharmacological interventions like dietary programs and exercise regimes. While anti-obesity drugs offer a less invasive option, the efficacy of bariatric surgery, particularly for severe obesity, can sometimes outweigh the benefits of medication for some patients, especially those considering a permanent solution. Furthermore, the market faces scrutiny regarding the potential for off-label use of other medications, originally approved for different conditions, which can dilute the demand for specifically approved anti-obesity drugs. Lastly, gaining favorable reimbursement policies from diverse healthcare systems globally remains a complex challenge, as payers often weigh the high cost of these innovative drugs against their perceived long-term health benefits and cost-effectiveness, leading to variable access and uptake across regions.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Patient Adherence and Long-term Treatment Compliance | -1.5% | Global | Medium to Long-term (2025-2033) |

| Competition from Bariatric Surgery and Other Weight Loss Interventions | -1.2% | Developed Economies | Medium-term (2025-2029) |

| Reimbursement Difficulties and Payer Hesitation | -1.8% | Global, particularly market-based healthcare systems | Long-term (2025-2033) |

| Public Perception and Stigma Associated with Anti-obesity Medication | -1.0% | Global | Long-term (2025-2033) |

Anti obesity Drug Market - Updated Report Scope

This comprehensive market research report on the Anti-obesity Drug Market offers an in-depth analysis of industry trends, market dynamics, and competitive landscape from 2019 to 2033. It provides detailed insights into market size, growth projections, and key segments, including drug class, mechanism of action, route of administration, and distribution channels. The report also highlights the impact of artificial intelligence on drug discovery and patient management, alongside a thorough analysis of market drivers, restraints, opportunities, and challenges across various geographic regions. This study serves as a crucial resource for stakeholders seeking to understand the evolving landscape and strategic imperatives within the anti-obesity pharmaceutical sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.7 Billion |

| Market Forecast in 2033 | USD 13.9 Billion |

| Growth Rate | 17.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Novo Nordisk, Eli Lilly and Company, Pfizer Inc., Amgen Inc., AstraZeneca PLC, Sanofi S.A., Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, Regeneron Pharmaceuticals Inc., Merck & Co. Inc., Alnylam Pharmaceuticals Inc., Rhythm Pharmaceuticals Inc., Hanmi Pharmaceutical Co. Ltd., Altimmune Inc., Viking Therapeutics Inc., Zafgen Inc., Gelesis Inc., Orexigen Therapeutics Inc., Vivus Inc., Eisai Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The anti-obesity drug market is meticulously segmented to provide a granular view of its diverse components, enabling stakeholders to identify key growth areas and strategic opportunities. This comprehensive segmentation encompasses categorization by drug class, which highlights the dominance and evolving landscape of GLP-1 receptor agonists, alongside other emerging and established therapeutic agents. Further divisions by mechanism of action shed light on how different drugs target physiological pathways to achieve weight loss, from appetite suppression to metabolic modulation. The market is also segmented by route of administration, distinguishing between oral and injectable formulations, reflecting patient preference and convenience.

Additionally, the analysis extends to distribution channels, outlining the reach and impact of hospital, retail, and online pharmacies in drug delivery. Finally, the segmentation by end-use considers the application of these drugs across adult and pediatric populations, recognizing the distinct needs and regulatory considerations for each group. This detailed breakdown ensures a holistic understanding of the market structure, competitive dynamics, and future growth trajectories across all key dimensions, aiding in targeted market strategies and product development.

- Drug Class

- GLP-1 Receptor Agonists: Dominant and rapidly growing segment due to high efficacy in weight loss and metabolic benefits.

- SGLT2 Inhibitors: Primarily for diabetes but showing promise for weight management.

- Amylin Analogues: Used in combination therapies, particularly with insulin.

- Combination Therapies: Drugs combining multiple mechanisms for enhanced effect.

- Centrally Acting Agents: Medications influencing satiety and appetite centers in the brain.

- Others: Including lipase inhibitors and other emerging classes.

- Mechanism of Action

- Appetite Suppressants: Drugs that reduce hunger and increase satiety.

- Lipase Inhibitors: Block fat absorption in the gut.

- Metabolic Modulators: Influence metabolic pathways to promote weight loss.

- Hormonal Regulators: Mimic or modulate endogenous hormones involved in appetite and metabolism.

- Route of Administration

- Oral: Preferred for convenience and ease of use.

- Injectable: Common for many current highly efficacious GLP-1 agonists.

- Distribution Channel

- Hospital Pharmacies: For inpatient and specialized care.

- Retail Pharmacies: Primary channel for outpatient prescriptions.

- Online Pharmacies: Growing channel for accessibility and convenience.

- End-Use

- Adults: Largest segment due to higher prevalence of obesity.

- Pediatrics: Emerging segment with growing awareness and specific drug approvals for adolescent obesity.

Regional Highlights

- North America: Leads the anti-obesity drug market due to the high prevalence of obesity, advanced healthcare infrastructure, significant R&D investments, and favorable reimbursement policies for innovative drugs. The United States accounts for the largest share, driven by a large addressable patient pool and early adoption of new therapies.

- Europe: Represents a substantial market share, with increasing awareness campaigns and government initiatives to combat obesity. Countries like Germany, the UK, and France are key contributors, supported by robust healthcare systems and a growing pipeline of approved drugs.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate during the forecast period, primarily driven by rising disposable incomes, increasing prevalence of obesity in populous countries like China and India, improving healthcare access, and growing adoption of Western lifestyles. Investment in healthcare infrastructure and pharmaceutical R&D is also rising in this region.

- Latin America: Shows promising growth due to increasing obesity rates, particularly in Brazil and Mexico, coupled with expanding healthcare access and growing public health awareness campaigns. Market expansion is supported by rising investments in pharmaceutical development.

- Middle East and Africa (MEA): This region is projected for steady growth, driven by a growing prevalence of obesity in countries like Saudi Arabia and UAE, improving healthcare spending, and increasing awareness of obesity as a treatable condition. However, market penetration is relatively lower compared to developed regions due to economic disparities and nascent healthcare systems in some areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anti obesity Drug Market.- Novo Nordisk

- Eli Lilly and Company

- Pfizer Inc.

- Amgen Inc.

- AstraZeneca PLC

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Boehringer Ingelheim International GmbH

- Regeneron Pharmaceuticals Inc.

- Merck & Co. Inc.

- Alnylam Pharmaceuticals Inc.

- Rhythm Pharmaceuticals Inc.

- Hanmi Pharmaceutical Co. Ltd.

- Altimmune Inc.

- Viking Therapeutics Inc.

- Zafgen Inc.

- Gelesis Inc.

- Orexigen Therapeutics Inc.

- Vivus Inc.

- Eisai Co. Ltd.

Frequently Asked Questions

What is the current estimated size of the Anti-obesity Drug Market?

The Anti-obesity Drug Market is estimated at USD 3.7 billion in 2025.

What is the projected growth rate for the Anti-obesity Drug Market?

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.8% between 2025 and 2033.

Which drug classes are driving the growth in the Anti-obesity Drug Market?

GLP-1 receptor agonists and multi-agonist therapies are the primary drivers, owing to their high efficacy and expanding indications beyond weight loss.

What are the key factors influencing the Anti-obesity Drug Market?

The market is driven by increasing global obesity prevalence, advancements in drug development, growing awareness of obesity as a chronic disease, and the focus on comprehensive metabolic health.

Which region holds the largest share in the Anti-obesity Drug Market?

North America currently holds the largest market share due to high obesity rates, robust healthcare infrastructure, and significant R&D investments.