All Solid State Battery Market

All Solid State Battery Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702037 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

All Solid State Battery Market Size

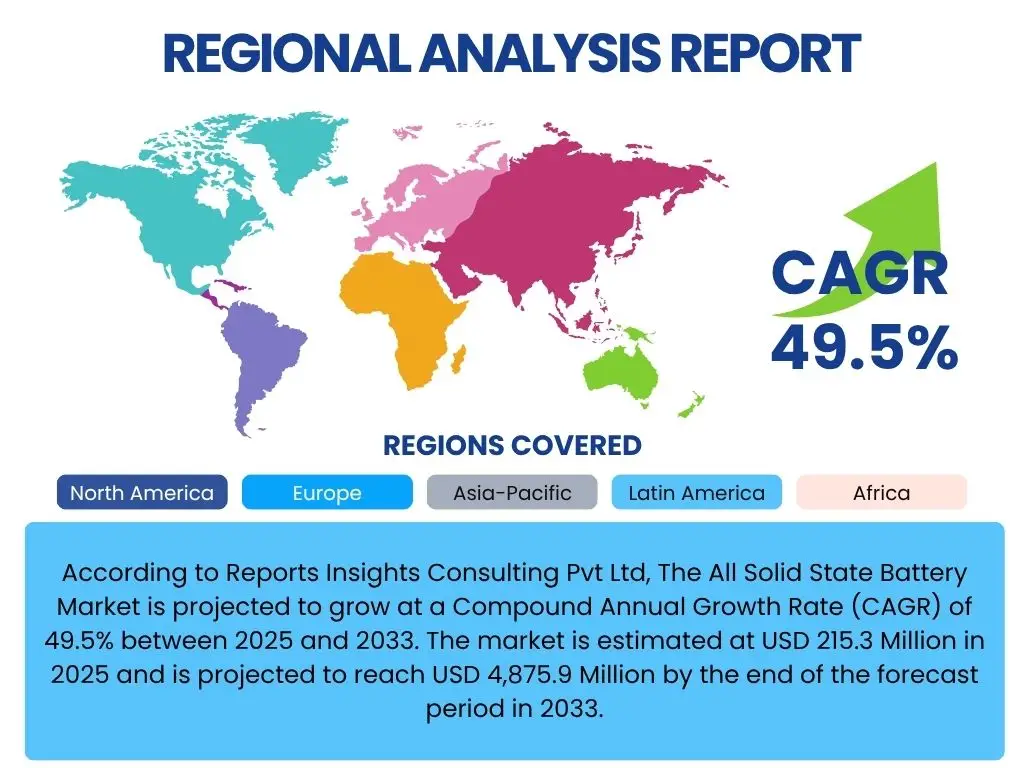

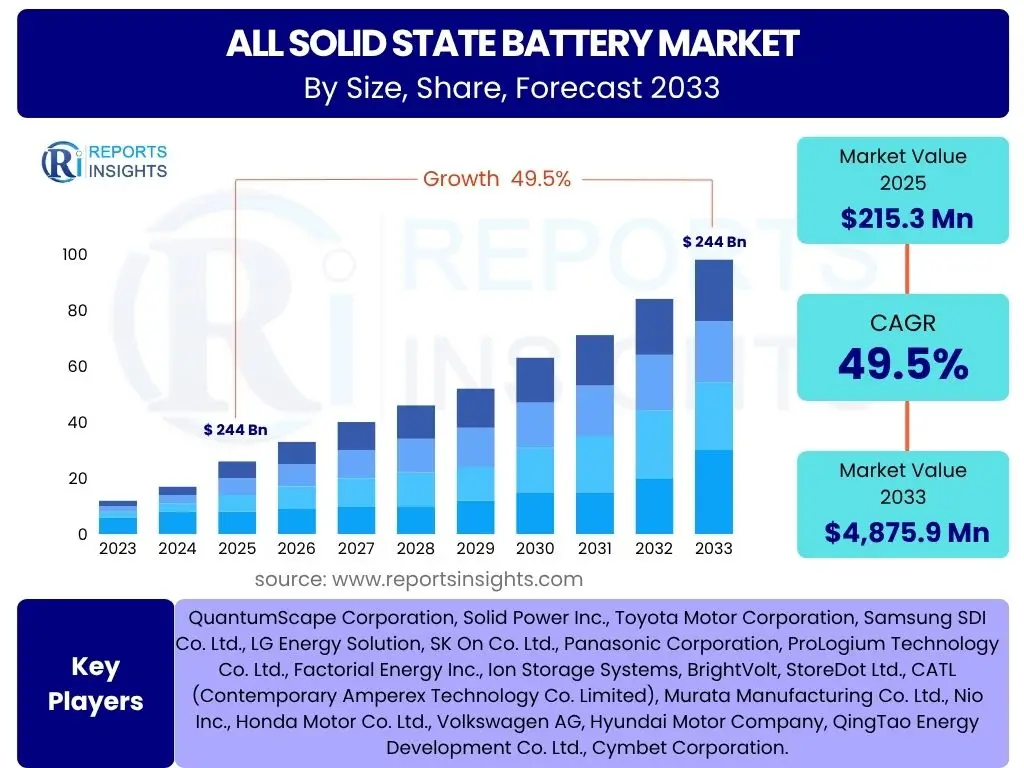

According to Reports Insights Consulting Pvt Ltd, The All Solid State Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 49.5% between 2025 and 2033. The market is estimated at USD 215.3 Million in 2025 and is projected to reach USD 4,875.9 Million by the end of the forecast period in 2033.

Key All Solid State Battery Market Trends & Insights

The All Solid State Battery market is currently experiencing a transformative phase, driven by a profound shift towards enhanced energy storage solutions. Common user inquiries frequently center on the cutting-edge technologies enabling higher energy density, the inherent safety advantages over traditional lithium-ion batteries, and the ongoing efforts to reduce manufacturing costs. There is significant interest in understanding the progression from laboratory breakthroughs to commercial viability, particularly within the automotive sector, which is poised to be a primary beneficiary of this technology. Stakeholders are keen to identify how advancements in solid electrolyte materials and electrode design are contributing to improved performance and cycle life, alongside the strategic collaborations and investments accelerating market development.

Further insights reveal a growing emphasis on miniaturization and integration capabilities, which are crucial for portable electronics and advanced medical devices. Users are also exploring the potential for rapid charging and extended range, critical factors for widespread electric vehicle adoption. The market is witnessing a trend toward diversified applications beyond electric vehicles, encompassing grid energy storage, aerospace, and defense, indicating the versatile nature and broad applicability of solid-state battery technology once cost and scalability challenges are addressed. This underscores a collective anticipation for a disruptive shift in the energy storage landscape.

- Accelerated advancements in solid electrolyte materials, including sulfide, oxide, and polymer-based systems, enhancing stability and conductivity.

- Increasing strategic investments and partnerships between automotive OEMs, battery manufacturers, and material suppliers to expedite commercialization.

- Intensified focus on developing scalable and cost-effective manufacturing processes to move beyond laboratory-scale production.

- Growing demand from the electric vehicle sector for batteries offering higher energy density, extended range, and superior safety.

- Emergence of solid-state batteries in niche applications such as medical implants, wearables, and aerospace due to their compact size and enhanced safety profile.

AI Impact Analysis on All Solid State Battery

User inquiries regarding the impact of Artificial Intelligence (AI) on All Solid State Batteries often revolve around its potential to accelerate material discovery, optimize manufacturing processes, and enhance battery performance and safety. There is a strong curiosity about how AI can overcome current R&D bottlenecks, such as the lengthy trial-and-error approach to identifying ideal solid electrolyte compositions or predicting material degradation. Users anticipate AI's role in complex data analysis, enabling researchers to quickly sift through vast datasets of material properties and simulations to pinpoint promising candidates for battery components.

Furthermore, common questions address AI's application in streamlining the highly intricate and precise manufacturing of solid-state batteries, where even minute variations can impact performance. This includes AI-driven quality control, predictive maintenance for production lines, and optimizing electrode and electrolyte interface designs to minimize resistance. The integration of AI in Battery Management Systems (BMS) for real-time performance monitoring, predictive diagnostics, and optimizing charging cycles is also a significant area of user interest, highlighting the expectation that AI will be a critical enabler for the widespread adoption and long-term reliability of all solid-state battery technology.

- AI-driven materials discovery and optimization, significantly reducing the time and cost associated with identifying novel solid electrolytes and electrode materials.

- Enhanced manufacturing process control and automation through AI, leading to higher yield rates, improved quality, and reduced production costs for complex solid-state structures.

- Development of advanced Battery Management Systems (BMS) powered by AI, enabling real-time performance monitoring, predictive maintenance, and optimized charging/discharging cycles to extend battery life.

- Simulation and modeling capabilities improved by AI, allowing for more accurate predictions of battery behavior under various conditions, accelerating design iterations and performance validation.

- AI-assisted fault detection and diagnostics, improving the safety and reliability of solid-state batteries by identifying potential issues before they escalate.

Key Takeaways All Solid State Battery Market Size & Forecast

Analysis of common user questions regarding the All Solid State Battery market size and forecast consistently reveals a deep interest in the disruptive potential and projected growth trajectory of this technology. Users are primarily concerned with understanding the magnitude of the market's expansion, the primary drivers behind this anticipated growth, and the timeline for widespread commercial adoption. There is a clear recognition that solid-state batteries represent a significant leap forward in energy storage, promising superior performance and safety over existing lithium-ion solutions.

The insights indicate that stakeholders view the market as being on the cusp of significant expansion, moving from a niche, R&D-intensive phase to one of substantial commercialization, particularly within the electric vehicle sector. Key takeaways underscore the expectation of robust capital expenditure in manufacturing infrastructure, the imperative for cross-industry collaborations, and the critical role of continuous material innovation in realizing the full market potential. The market forecast signifies a strong confidence in the technology's ability to address critical energy storage challenges, positioning it as a cornerstone for future electrification across various industries.

- The All Solid State Battery market is poised for exponential growth, driven by an urgent global demand for safer, higher-performing, and more energy-dense power solutions.

- The electric vehicle segment is anticipated to be the primary catalyst for market expansion, with solid-state batteries offering critical advantages like increased range and reduced charging times.

- Significant investments in research and development, coupled with strategic partnerships across the value chain, are crucial for overcoming existing technical and manufacturing barriers.

- While challenges remain concerning scalability and cost reduction, ongoing innovations and pilot projects indicate a clear path towards commercial viability within the forecast period.

- The market's long-term potential extends beyond automotive, encompassing diverse applications in consumer electronics, grid storage, and specialized industrial sectors, diversifying revenue streams.

All Solid State Battery Market Drivers Analysis

The propulsion of the All Solid State Battery market is predominantly fueled by an escalating demand for superior energy storage solutions across multiple sectors. A primary driver is the global push towards electric vehicles (EVs), where solid-state batteries promise to address key consumer anxieties related to range anxiety and charging times, while simultaneously enhancing vehicle safety. The inherent non-flammable nature of solid electrolytes significantly reduces the risk of thermal runaway, making them a safer alternative to conventional lithium-ion batteries and driving their adoption, especially in high-performance applications.

Furthermore, the continuous advancements in energy density capabilities of solid-state batteries are crucial for enabling lighter, more compact, and longer-lasting electronic devices, appealing to consumer electronics and specialized industrial segments. Government initiatives and robust funding for battery research and development, particularly in key automotive manufacturing regions, also play a pivotal role in accelerating technological breakthroughs and commercialization efforts. These combined factors create a compelling environment for the growth and integration of all solid-state battery technology into mainstream applications, transforming the energy storage landscape.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increased demand for Electric Vehicles (EVs) with enhanced performance. | +15-20% | Global (with strong emphasis on Asia Pacific, Europe, North America) | Short to Mid-term (2025-2030) |

| Superior safety features (non-flammable solid electrolytes). | +10-15% | Global (critical for regulatory acceptance and consumer trust) | Mid-term (2027-2033) |

| Higher energy density and extended range capabilities. | +12-18% | Asia Pacific (China, Japan, South Korea), Europe, North America | Mid to Long-term (2028-2033) |

| Faster charging capabilities compared to liquid electrolyte batteries. | +8-12% | North America, Europe | Mid-term (2026-2032) |

| Strong government support and R&D funding for battery innovation. | +5-10% | Europe (Germany, France), Asia Pacific (Japan, South Korea, China), North America (USA) | Short to Mid-term (2025-2030) |

All Solid State Battery Market Restraints Analysis

Despite the immense promise of all solid-state battery technology, several significant restraints impede its rapid market penetration and widespread adoption. A primary concern revolves around the prohibitively high manufacturing costs associated with current production methods. The specialized materials, precise fabrication processes, and stringent quality control required for solid electrolytes and interface engineering contribute to elevated production expenses, making them uncompetitive with mature lithium-ion battery technologies, particularly for mass-market applications.

Furthermore, scalability challenges pose a considerable hurdle. Translating laboratory-scale successes into high-volume manufacturing remains a complex task, often involving difficulties in achieving consistent material properties, maintaining solid-solid contact at interfaces, and managing dendrite formation over numerous charge-discharge cycles. The availability of certain specialized materials and the nascent supply chain for these components also present bottlenecks, potentially limiting production capacities and increasing lead times. Addressing these technical and economic restraints is paramount for solid-state batteries to achieve their full market potential.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High manufacturing costs and complex production processes. | -10-15% | Global (impacts cost-competitiveness across all regions) | Short to Mid-term (2025-2030) |

| Scalability challenges from laboratory to mass production. | -12-18% | Global (fundamental technical challenge) | Mid-term (2027-2033) |

| Technical complexities related to solid-solid interfaces and dendrite formation. | -8-12% | Global (hinders performance and cycle life) | Mid to Long-term (2028-2033) |

| Limited availability of specialized raw materials and nascent supply chains. | -5-10% | Asia Pacific (dominant material processing), Europe, North America | Short-term (2025-2028) |

| Lack of established recycling and end-of-life infrastructure. | -3-7% | Europe (stringent regulations), North America | Long-term (2030-2033) |

All Solid State Battery Market Opportunities Analysis

The All Solid State Battery market is characterized by a multitude of promising opportunities that could significantly accelerate its growth trajectory. One key area of expansion lies in the diversification of applications beyond electric vehicles. While automotive remains a primary focus, the superior safety, energy density, and compact form factor of solid-state batteries present compelling advantages for integration into consumer electronics, medical devices, and even aerospace and defense sectors, creating new revenue streams and market segments.

Furthermore, the continuous development of novel solid electrolyte materials and electrode chemistries offers substantial opportunities for performance enhancements, cost reduction, and extended cycle life, making the technology more competitive and broadly adoptable. Strategic collaborations and joint ventures between established automotive players, innovative battery startups, and material science companies are fostering a collaborative ecosystem, pooling resources and expertise to overcome technical hurdles and accelerate commercialization. The growing global emphasis on sustainable and circular economy principles also presents an opportunity for developing robust recycling infrastructure for solid-state batteries, aligning with environmental goals and creating a long-term viable ecosystem.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into consumer electronics (wearables, smartphones, IoT devices). | +10-15% | Asia Pacific (major manufacturing hub), North America, Europe | Short to Mid-term (2025-2030) |

| Applications in aerospace and defense requiring high energy density and safety. | +8-12% | North America, Europe (key defense spenders) | Mid-term (2027-2033) |

| Development of grid-scale energy storage solutions for renewable integration. | +12-18% | Europe (renewable energy focus), Asia Pacific (China, India), North America | Mid to Long-term (2028-2033) |

| Breakthroughs in new solid electrolyte materials and electrode designs. | +7-10% | Global (driven by academic and industrial R&D) | Long-term (2030-2033) |

| Strategic partnerships and collaborations across the value chain. | +5-8% | Global (facilitating knowledge sharing and capital investment) | Short to Mid-term (2025-2030) |

All Solid State Battery Market Challenges Impact Analysis

The All Solid State Battery market faces several formidable challenges that could impact its commercialization timeline and widespread adoption. A significant hurdle is the long and capital-intensive commercialization timeline, transitioning from lab-scale prototypes to mass production. This involves overcoming intricate engineering problems related to manufacturing precision, material purity, and the integration of multiple layers within the battery cell, all while maintaining high performance and consistency.

Ensuring long-term stability and cycle life under various operating conditions remains a critical technical challenge. Issues such as interface degradation between the solid electrolyte and electrodes, volume changes during cycling, and the formation of dendrites can compromise battery performance over time. Furthermore, the burgeoning intellectual property landscape surrounding solid-state battery technologies can lead to complex patent disputes, potentially slowing down innovation and market entry for new players. Overcoming these technical and regulatory challenges requires substantial R&D investment, interdisciplinary collaboration, and a robust framework for standardization.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Long and capital-intensive commercialization timelines. | -10-15% | Global (impacts investment returns and market entry) | Mid-term (2027-2033) |

| Ensuring long-term stability, cycle life, and thermal management. | -8-12% | Global (critical for product reliability and consumer acceptance) | Mid to Long-term (2028-2033) |

| High specific manufacturing equipment costs and infrastructure requirements. | -5-10% | Asia Pacific (manufacturing hubs), Europe, North America | Short to Mid-term (2025-2030) |

| Managing complex intellectual property (IP) landscape and patent disputes. | -7-10% | Global (affects competitive landscape) | Short-term (2025-2028) |

| Competition from advanced lithium-ion battery technologies and evolving alternatives. | -3-7% | Asia Pacific (dominant Li-ion producers), Global | Short to Mid-term (2025-2030) |

All Solid State Battery Market - Updated Report Scope

This comprehensive report delves into the All Solid State Battery market, offering an in-depth analysis of its current landscape, historical performance, and future projections. It provides a detailed examination of market size, growth drivers, restraints, opportunities, and challenges, underpinned by extensive primary and secondary research. The scope encompasses detailed segmentation across various types, capacities, applications, and end-use industries, providing a holistic view of the market dynamics. Furthermore, the report highlights regional market trends and profiles key industry players, offering strategic insights for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 215.3 Million |

| Market Forecast in 2033 | USD 4,875.9 Million |

| Growth Rate | 49.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | QuantumScape Corporation, Solid Power Inc., Toyota Motor Corporation, Samsung SDI Co. Ltd., LG Energy Solution, SK On Co. Ltd., Panasonic Corporation, ProLogium Technology Co. Ltd., Factorial Energy Inc., Ion Storage Systems, BrightVolt, StoreDot Ltd., CATL (Contemporary Amperex Technology Co. Limited), Murata Manufacturing Co. Ltd., Nio Inc., Honda Motor Co. Ltd., Volkswagen AG, Hyundai Motor Company, QingTao Energy Development Co. Ltd., Cymbet Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The All Solid State Battery market is meticulously segmented to provide a granular understanding of its diverse components and evolving dynamics. This comprehensive segmentation allows for a detailed analysis of market performance across different battery types, capacities, and a broad spectrum of applications and end-use industries. By dissecting the market along these lines, stakeholders can identify specific growth pockets, emerging technological preferences, and areas demanding further innovation, enabling targeted strategic planning and investment decisions.

Understanding these segments is crucial for market participants to tailor their product development, marketing strategies, and supply chain management effectively, aligning with the varied requirements of different sectors from high-power automotive applications to miniature medical devices. This granular view facilitates a more accurate assessment of competitive landscapes and market opportunities, particularly as the technology matures and finds broader commercial viability across global markets.

- By Type: Polymer Solid State Batteries, Inorganic Solid State Batteries (Sulfide-based, Oxide-based, Solid Polymer Electrolyte (SPE), Hybrid Solid-State Electrolyte (HSSE))

- By Capacity: Less than 20 mAh, 20 mAh - 500 mAh, More than 500 mAh

- By Application: Electric Vehicles (BEV, PHEV, FCEV), Consumer Electronics (Smartphones, Wearables, Laptops, IoT Devices), Medical Devices, Aerospace & Defense, Industrial & Robotics, Grid Energy Storage, Others

- By End-Use Industry: Automotive, Energy & Power, Consumer Goods & Electronics, Healthcare & Medical, Aerospace & Defense, Industrial, Others

Regional Highlights

- North America: This region demonstrates strong growth potential driven by significant R&D investments, increasing electric vehicle adoption, and supportive government policies aimed at boosting domestic battery manufacturing and technological innovation. The presence of major automotive players and leading research institutions contributes to its leadership in advanced battery development.

- Europe: Europe is a pivotal market, fueled by stringent environmental regulations, ambitious decarbonization targets, and a robust automotive industry that is actively transitioning towards electrification. Countries like Germany and France are investing heavily in gigafactories and research initiatives to establish a competitive edge in solid-state battery production and application.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily due to the dominant presence of major battery manufacturers, a rapidly expanding electric vehicle market, and extensive government support for battery R&D and production, particularly in China, Japan, and South Korea. This region also leads in consumer electronics manufacturing, driving demand for compact, high-performance batteries.

- Latin America: While currently a smaller market, Latin America offers emerging opportunities driven by increasing environmental awareness, burgeoning EV markets in countries like Brazil and Mexico, and a growing interest in renewable energy integration.

- Middle East and Africa (MEA): The MEA region is at an nascent stage but holds potential due to diversification efforts from oil-dependent economies towards sustainable energy, infrastructure development, and nascent electric mobility initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the All Solid State Battery Market.- QuantumScape Corporation

- Solid Power Inc.

- Toyota Motor Corporation

- Samsung SDI Co. Ltd.

- LG Energy Solution

- SK On Co. Ltd.

- Panasonic Corporation

- ProLogium Technology Co. Ltd.

- Factorial Energy Inc.

- Ion Storage Systems

- BrightVolt

- StoreDot Ltd.

- CATL (Contemporary Amperex Technology Co. Limited)

- Murata Manufacturing Co. Ltd.

- Nio Inc.

- Honda Motor Co. Ltd.

- Volkswagen AG

- Hyundai Motor Company

- QingTao Energy Development Co. Ltd.

- Cymbet Corporation

Frequently Asked Questions

What are the primary advantages of All Solid State Batteries over traditional Lithium-ion batteries?

All Solid State Batteries offer significant advantages, including enhanced safety due to the use of non-flammable solid electrolytes, higher energy density allowing for longer range and more compact designs, faster charging capabilities, and potentially longer cycle life, making them ideal for applications requiring robust performance and safety.

When are All Solid State Batteries expected to be widely commercialized for electric vehicles?

While some pilot projects and niche applications are emerging, widespread commercialization for mainstream electric vehicles is generally anticipated between 2028 and 2033. This timeline is contingent on overcoming current challenges related to manufacturing scalability, cost reduction, and achieving consistent long-term performance.

What are the main challenges hindering the mass production of All Solid State Batteries?

Key challenges include the high cost of specialized materials and complex manufacturing processes, difficulties in scaling up production from laboratory to industrial volumes, ensuring stable and low-resistance interfaces between solid components, and mitigating issues like dendrite formation and volume changes during repeated cycling.

Which industries are expected to benefit most from the adoption of All Solid State Batteries?

The automotive industry, particularly the electric vehicle segment, is poised to be the largest beneficiary due to demands for extended range and safety. Other significant beneficiaries include consumer electronics (smartphones, wearables), medical devices, aerospace and defense, and stationary grid energy storage applications, leveraging their high energy density and safety features.

How is AI impacting the development and manufacturing of All Solid State Batteries?

AI is accelerating the development of All Solid State Batteries by facilitating rapid materials discovery and optimization through advanced simulations and data analysis. In manufacturing, AI enables precise process control, predictive maintenance, and quality assurance, which are crucial for the complex production of these advanced batteries, ultimately driving down costs and improving efficiency.