Aircraft Aerostructure Market

Aircraft Aerostructure Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705060 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Aircraft Aerostructure Market Size

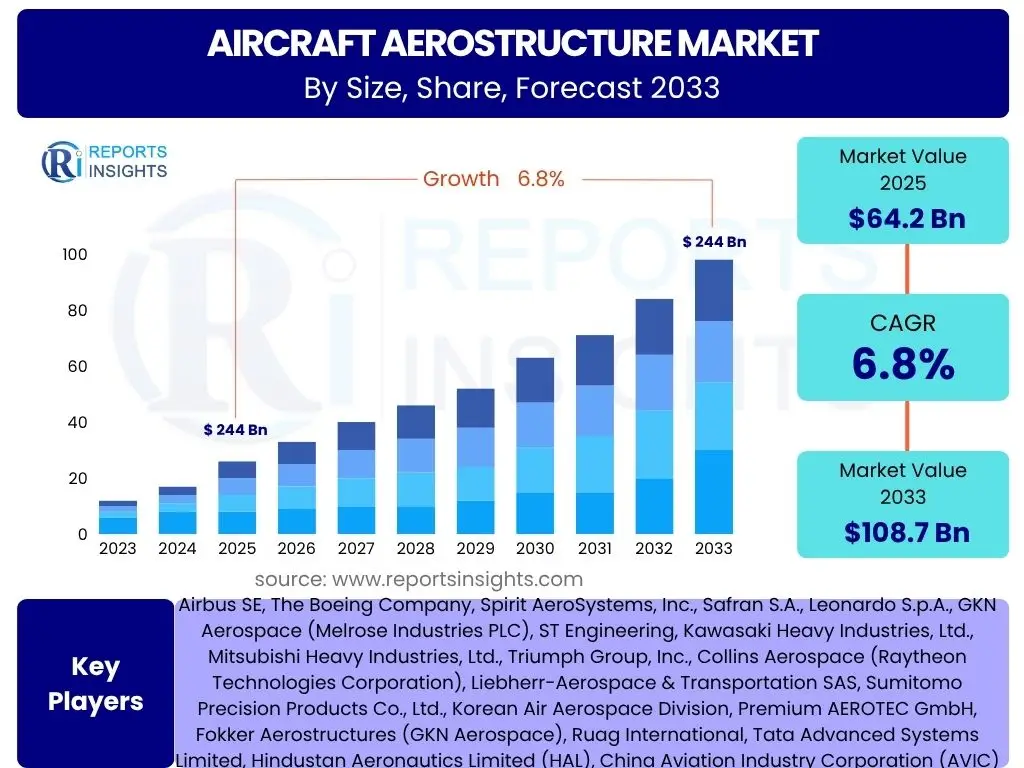

According to Reports Insights Consulting Pvt Ltd, The Aircraft Aerostructure Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 64.2 billion in 2025 and is projected to reach USD 108.7 billion by the end of the forecast period in 2033.

Key Aircraft Aerostructure Market Trends & Insights

The Aircraft Aerostructure market is undergoing significant transformation, driven by a confluence of technological advancements, evolving aerospace demands, and increasing focus on efficiency and sustainability. One prominent trend is the pervasive adoption of advanced materials, particularly composites like carbon fiber reinforced polymers (CFRPs), which are increasingly replacing traditional metallic structures. This shift is primarily motivated by the need for lighter aircraft to improve fuel efficiency and reduce emissions, a critical objective for both commercial and military aviation sectors. The performance benefits of these materials, including superior strength-to-weight ratios and enhanced fatigue resistance, are compelling manufacturers to invest heavily in their research, development, and integration into new aircraft designs.

Another pivotal trend is the proliferation of advanced manufacturing techniques such as additive manufacturing (3D printing) and automated production systems. These technologies are revolutionizing the design and fabrication processes of aerostructures by enabling the creation of complex geometries with reduced material waste and shorter production cycles. The ability to print intricate, integrated components not only streamlines assembly but also contributes to overall structural integrity and weight savings. Furthermore, the aerospace industry is witnessing a growing emphasis on modular and standardized aerostructure components, facilitating easier maintenance, repair, and overhaul (MRO) operations, and supporting faster aircraft assembly lines, thereby addressing the backlog in aircraft orders.

The market also reflects a strong drive towards sustainable aviation and digitalization. Manufacturers are exploring bio-composites and recyclable materials to align with environmental regulations and industry-wide sustainability goals. Concurrently, the integration of digital twins, simulation tools, and data analytics across the aerostructure lifecycle is enhancing design optimization, predictive maintenance capabilities, and supply chain transparency. These digital advancements are enabling proactive identification of potential issues, optimization of manufacturing workflows, and the creation of more resilient and efficient operational paradigms for aircraft fleets globally.

- Increased adoption of advanced composite materials (e.g., CFRP) for lightweighting.

- Emergence of additive manufacturing (3D printing) for complex component fabrication.

- Rising integration of automation and robotics in aerostructure production.

- Focus on modular and standardized aerostructure designs for easier MRO.

- Growing emphasis on sustainable materials and eco-friendly manufacturing processes.

- Digitalization of the aerostructure lifecycle, including simulation and predictive analytics.

- Demand for enhanced structural health monitoring and smart aerostructures.

AI Impact Analysis on Aircraft Aerostructure

Artificial Intelligence (AI) is rapidly transforming the Aircraft Aerostructure sector by introducing unprecedented levels of optimization, efficiency, and predictive capabilities across the entire product lifecycle, from design to maintenance. Users are increasingly inquiring about AI's role in accelerating the design phase, particularly through generative design, where algorithms explore numerous design permutations to identify optimal structures for weight reduction and performance. This capability significantly reduces traditional design iterations, leading to faster development cycles and more innovative structural solutions that would be difficult or impossible to achieve manually. Concerns often revolve around the validation and certification of AI-generated designs, given the stringent safety requirements in aerospace, but the industry is actively developing robust frameworks to address these challenges.

In manufacturing, AI is enhancing precision, quality control, and operational efficiency. Users are interested in how AI-powered robotics can automate complex assembly tasks, reducing human error and increasing throughput. Furthermore, AI algorithms are being deployed for real-time defect detection during manufacturing processes, using computer vision and sensor data to identify anomalies that might compromise structural integrity. This proactive quality assurance minimizes rework, reduces scrap rates, and ensures that components meet rigorous aerospace standards. The application of AI in supply chain management also addresses user concerns regarding material flow optimization and inventory management, predicting demand and potential disruptions to ensure timely delivery of critical aerostructure components.

Beyond production, AI's impact on maintenance, repair, and overhaul (MRO) is a significant area of user interest. Predictive maintenance, powered by AI and machine learning, analyzes vast amounts of sensor data from in-service aircraft to forecast component degradation and predict potential failures before they occur. This allows for scheduled, condition-based maintenance rather than time-based or reactive repairs, drastically reducing aircraft downtime, optimizing maintenance schedules, and extending the operational life of aerostructures. The ability of AI to analyze structural health monitoring data and provide actionable insights is enhancing safety, improving fleet readiness, and driving down operational costs for airlines and military operators globally.

- Generative design for optimized aerostructure geometry and material usage.

- AI-powered robotics and automation for precision manufacturing and assembly.

- Real-time quality control and defect detection during production using computer vision.

- Predictive maintenance analytics for proactive identification of structural degradation.

- Optimization of supply chain logistics for aerostructure components.

- Enhanced material characterization and selection through AI-driven simulations.

- AI-assisted structural health monitoring (SHM) for in-service aircraft.

Key Takeaways Aircraft Aerostructure Market Size & Forecast

The Aircraft Aerostructure market is poised for robust growth through 2033, fundamentally driven by an anticipated surge in global air passenger traffic and the imperative for modernizing aging aircraft fleets. The forecast indicates a sustained expansion, fueled by increasing demand for new, fuel-efficient aircraft across commercial, military, and general aviation sectors. This growth trajectory is not merely about volume but also about the increasing complexity and sophistication of aerostructures, necessitating advanced materials and manufacturing processes. The long-term outlook remains positive, underscored by strategic investments in research and development aimed at enhancing structural performance and sustainability.

A significant takeaway is the pivotal role of technological innovation in shaping the market's future. The widespread adoption of lightweight composite materials and the advent of advanced manufacturing techniques like additive manufacturing are not just trends but fundamental shifts that are redefining production capabilities and aircraft performance. These innovations are critical for meeting stringent environmental regulations and achieving operational efficiencies. Furthermore, the market's expansion is intrinsically linked to global macroeconomic stability and defense budgets, influencing the procurement cycles for both commercial and military aircraft programs.

The market's resilience is also highlighted by its adaptability to emerging segments, such as Urban Air Mobility (UAM) and drone technology, which, while nascent, present long-term growth avenues for specialized aerostructures. While challenges such as supply chain volatility and high R&D costs persist, the overarching demand for air travel and defense capabilities provides a strong foundational impetus for the aerostructure market's continued upward trajectory. Stakeholders will focus on optimizing manufacturing processes, diversifying material portfolios, and leveraging digital technologies to capitalize on this sustained growth.

- Market projected for strong growth, driven by global air traffic and fleet modernization.

- Technological advancements in materials (composites) and manufacturing (additive) are key enablers.

- Commercial aircraft segment to remain dominant, with military and regional aircraft also contributing significantly.

- Emerging opportunities in sustainable aviation and Urban Air Mobility (UAM) aerostructures.

- Asia Pacific anticipated as the fastest-growing region due to rising air travel demand and manufacturing capabilities.

- Emphasis on lightweighting, fuel efficiency, and reduced emissions continues to drive innovation.

Aircraft Aerostructure Market Drivers Analysis

The Aircraft Aerostructure market is significantly propelled by the increasing global demand for new aircraft, particularly within the commercial aviation sector. As air passenger traffic continues to grow, airlines are expanding their fleets and replacing older, less efficient aircraft with newer models that offer enhanced fuel efficiency and lower operational costs. This ongoing fleet modernization drive necessitates a continuous supply of advanced aerostructures, which form the foundational framework of every aircraft. The emphasis on lighter, stronger, and more durable structures directly impacts fuel consumption and maintenance requirements, making them a critical component in achieving airline profitability and environmental objectives.

Technological advancements in materials science and manufacturing processes also serve as a primary driver. The transition from traditional aluminum alloys to advanced composite materials such as carbon fiber reinforced polymers (CFRPs) and glass fiber reinforced polymers (GFRPs) is a testament to this trend. These materials offer superior strength-to-weight ratios, corrosion resistance, and fatigue life, which are crucial for enhancing aircraft performance and extending their lifespan. Furthermore, innovations in manufacturing techniques like additive manufacturing (3D printing) and automated assembly lines are enabling the production of more complex, integrated aerostructures with reduced material waste and shorter lead times, thereby improving overall production efficiency and cost-effectiveness for manufacturers.

The expansion of the aerospace industry into new segments, including regional jets, business jets, and military aircraft, further contributes to market growth. Increasing geopolitical tensions and the need for enhanced national security are driving defense spending globally, leading to higher procurement of military aircraft, which in turn fuels the demand for specialized and robust aerostructures. Moreover, the burgeoning market for Unmanned Aerial Vehicles (UAVs) and the emerging Urban Air Mobility (UAM) sector, encompassing electric vertical takeoff and landing (eVTOL) aircraft, present new avenues for aerostructure development, requiring innovative designs and materials tailored to their unique operational profiles and performance requirements.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increase in global air passenger traffic | +1.8% | Global, particularly APAC and North America | Mid-to-Long Term (2025-2033) |

| Rising demand for new fuel-efficient aircraft | +2.1% | Global, all major aircraft manufacturing regions | Mid-to-Long Term (2025-2033) |

| Technological advancements in materials (composites) | +1.5% | North America, Europe, Asia Pacific (Innovators) | Short-to-Long Term (Ongoing) |

| Growth in military aircraft procurement | +0.9% | North America, Europe, Middle East, Asia Pacific | Mid-term (2025-2029) |

| Advancements in manufacturing processes (Additive, Automation) | +1.2% | Global, key manufacturing hubs | Short-to-Mid Term (Ongoing) |

Aircraft Aerostructure Market Restraints Analysis

The Aircraft Aerostructure market faces several significant restraints that could temper its growth trajectory. One primary concern is the inherent high cost associated with research, development, and manufacturing of advanced aerostructures. The adoption of new materials, particularly high-performance composites, requires substantial upfront investment in specialized equipment, manufacturing processes, and skilled labor. Furthermore, the rigorous certification and regulatory compliance processes in the aerospace industry add significant time and cost burdens, delaying the market entry of innovative solutions and increasing overall project expenses. These cost pressures can deter smaller players and limit the rapid scalability of new technologies.

Supply chain complexities and volatility represent another critical restraint. The global aerospace supply chain is intricate, involving numerous specialized suppliers for raw materials, components, and sub-assemblies. Geopolitical instability, trade disputes, and natural disasters can disrupt this delicate network, leading to material shortages, increased lead times, and inflated costs. Recent global events have highlighted the fragility of these supply chains, causing production delays and impacting the ability of aerostructure manufacturers to meet delivery schedules. This volatility necessitates strategic inventory management and diversification of supplier bases, adding another layer of operational complexity.

Moreover, the aerospace industry is highly cyclical and sensitive to global economic downturns and geopolitical events. Economic slowdowns can lead to reduced air travel, lower airline profitability, and subsequent deferrals or cancellations of new aircraft orders, directly impacting the demand for aerostructures. Additionally, stringent environmental regulations, while driving innovation in sustainable materials, can also impose design and operational constraints that increase manufacturing costs and complexity. The shortage of skilled labor, particularly in advanced manufacturing and composite fabrication, further complicates production efforts, creating bottlenecks and increasing wage pressures in key manufacturing regions.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High R&D and manufacturing costs | -0.8% | Global | Long Term (Ongoing) |

| Complex certification and regulatory processes | -0.7% | Global | Long Term (Ongoing) |

| Supply chain disruptions and volatility | -1.2% | Global | Short-to-Mid Term (2025-2027) |

| Skilled labor shortages | -0.5% | North America, Europe | Mid-to-Long Term (Ongoing) |

| Global economic uncertainties | -0.9% | Global | Short-to-Mid Term (Variable) |

Aircraft Aerostructure Market Opportunities Analysis

The Aircraft Aerostructure market presents numerous opportunities for growth and innovation, primarily driven by the burgeoning demand for sustainable aviation solutions. With increasing environmental consciousness and stricter emission regulations, there is a significant push towards developing and integrating eco-friendly materials and manufacturing processes. This includes the research and adoption of advanced sustainable composites, bio-based resins, and recyclable materials that can reduce the environmental footprint of aircraft throughout their lifecycle. Companies investing in green aerostructure technologies will gain a competitive edge and tap into a growing segment of environmentally conscious consumers and airlines.

The emergence of new aircraft platforms, particularly in the Urban Air Mobility (UAM) and Unmanned Aerial Systems (UAS) sectors, represents a substantial long-term opportunity. eVTOL aircraft and various types of drones require lightweight, high-strength, and often uniquely shaped aerostructures optimized for electric propulsion and diverse operational environments. This nascent but rapidly expanding market necessitates novel design approaches, rapid prototyping capabilities, and the production of smaller, highly customized aerostructure components. Manufacturers with the agility to adapt to these new design requirements and production scales can secure significant market share in these innovative segments.

Furthermore, the digitalization of the aerospace industry, encompassing Industry 4.0 principles, offers immense opportunities for enhancing efficiency and competitiveness. The integration of advanced analytics, artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) into aerostructure design, manufacturing, and MRO processes can unlock significant value. Opportunities lie in developing smart aerostructures with integrated sensors for real-time health monitoring, predictive maintenance solutions that minimize downtime, and automated factories that reduce production costs and time-to-market. Companies leveraging these digital transformations will achieve superior operational performance and deliver more advanced, reliable products to their customers.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing focus on sustainable aviation materials | +1.4% | Global | Mid-to-Long Term (2027-2033) |

| Development of Urban Air Mobility (UAM) and eVTOL aircraft | +1.6% | North America, Europe, Asia Pacific | Long Term (2028-2033) |

| Increased adoption of digitalization and Industry 4.0 in manufacturing | +1.1% | Global | Short-to-Mid Term (Ongoing) |

| Expansion in emerging markets (e.g., Asia Pacific) | +1.0% | Asia Pacific, Latin America, Middle East | Mid-to-Long Term (2025-2033) |

| Retrofitting and upgrade demand for existing aircraft fleets | +0.8% | Global | Short-to-Mid Term (2025-2030) |

Aircraft Aerostructure Market Challenges Impact Analysis

The Aircraft Aerostructure market faces several significant challenges that could impede its growth and operational efficiency. One prominent challenge is the volatility of raw material prices, particularly for advanced composites and specialized metals. Fluctuations in the cost of carbon fiber, titanium, and aluminum directly impact manufacturing expenses, making it difficult for aerostructure manufacturers to maintain stable pricing and profit margins. Geopolitical tensions, trade policies, and global demand-supply imbalances can exacerbate this volatility, forcing companies to absorb higher costs or pass them on to customers, potentially affecting aircraft affordability and order volumes.

Another critical challenge is the inherent complexity associated with integrating new technologies and materials into existing production lines. While advancements in composites and additive manufacturing offer substantial benefits, their incorporation requires significant retooling, process redesign, and workforce retraining. The strict aerospace certification standards for new materials and manufacturing methods also add considerable time and expense to the development cycle, posing a barrier to rapid innovation. Ensuring the long-term reliability and maintainability of these advanced structures, especially under extreme operational conditions, necessitates extensive testing and validation, which further compounds the complexity.

Furthermore, managing the intricate global supply chain for aerostructure components presents ongoing challenges. The dependency on a limited number of specialized suppliers for critical parts can lead to bottlenecks and increased lead times during periods of high demand or unforeseen disruptions. Maintaining quality control across a dispersed supply chain, ensuring compliance with international regulations, and mitigating the risks of counterfeit parts are constant concerns. Additionally, intellectual property protection in a globally competitive environment remains a significant challenge, as innovative aerostructure designs and manufacturing processes are highly valuable assets that require robust safeguarding against infringement.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility of raw material prices | -0.6% | Global | Short-to-Mid Term (Ongoing) |

| Integration complexities of new technologies and materials | -0.7% | Global | Long Term (Ongoing) |

| Stringent quality standards and certification hurdles | -0.5% | Global | Long Term (Ongoing) |

| Maintaining competitive pricing in a high-cost industry | -0.4% | Global | Ongoing |

| Cybersecurity threats in connected manufacturing environments | -0.3% | Global | Ongoing |

Aircraft Aerostructure Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the Aircraft Aerostructure market, covering market size estimations, growth forecasts, key trends, and a detailed examination of market drivers, restraints, opportunities, and challenges. It offers extensive segmentation analysis by aircraft type, material, component, and end-use, complemented by a thorough regional breakdown. The report profiles leading market players, assesses their strategies, and examines the competitive landscape to provide a holistic view of the industry. It integrates insights on the impact of emerging technologies and provides a forward-looking perspective on market evolution.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 64.2 billion |

| Market Forecast in 2033 | USD 108.7 billion |

| Growth Rate | 6.8% CAGR |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Airbus SE, The Boeing Company, Spirit AeroSystems, Inc., Safran S.A., Leonardo S.p.A., GKN Aerospace (Melrose Industries PLC), ST Engineering, Kawasaki Heavy Industries, Ltd., Mitsubishi Heavy Industries, Ltd., Triumph Group, Inc., Collins Aerospace (Raytheon Technologies Corporation), Liebherr-Aerospace & Transportation SAS, Sumitomo Precision Products Co., Ltd., Korean Air Aerospace Division, Premium AEROTEC GmbH, Fokker Aerostructures (GKN Aerospace), Ruag International, Tata Advanced Systems Limited, Hindustan Aeronautics Limited (HAL), China Aviation Industry Corporation (AVIC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Aircraft Aerostructure market is meticulously segmented to provide a granular understanding of its diverse components and drivers. The segmentation by aircraft type includes Commercial Aircraft, encompassing narrow-body, wide-body, and regional jets, which constitute the largest segment due to global air travel demand. Military Aircraft, covering fighter jets, transport aircraft, trainer aircraft, and special mission aircraft, represent another significant segment, driven by defense spending and fleet modernization efforts. Additionally, the market is segmented by Business Jets, Rotary Wing Aircraft, Unmanned Aerial Vehicles (UAVs), and the emerging Urban Air Mobility (UAM) Aircraft, each with unique aerostructure requirements and growth trajectories.

From a material perspective, the market is primarily segmented into Composites, including Carbon Fiber Reinforced Polymer (CFRP) and Glass Fiber Reinforced Polymer (GFRP), which are gaining dominance due to their lightweight and high-strength properties. Traditional materials such as Aluminum Alloys, Steel Alloys, and Titanium Alloys continue to hold substantial market share, particularly in older aircraft models and specific structural applications where their properties are still preferred. The shift towards composites is a key trend, influencing material sourcing, manufacturing processes, and overall aircraft performance. Understanding the material composition of aerostructures is crucial for manufacturers to align with industry demands for fuel efficiency and reduced emissions.

Further segmentation is conducted by component and end-use. Key components analyzed include the Fuselage, Wing, Empennage, Nacelle, and Flight Control Surfaces, each representing a distinct structural assembly vital for aircraft operation. The end-use segment differentiates between Original Equipment Manufacturers (OEMs) and the Aftermarket (MRO - Maintenance, Repair, and Overhaul). The OEM segment involves the supply of aerostructures for new aircraft production, while the aftermarket segment focuses on components and services required for the maintenance, repair, and upgrade of existing aircraft fleets. Both segments contribute significantly to market revenue, with the aftermarket segment providing stable demand driven by the operational lifespan of aircraft.

- By Aircraft Type:

- Commercial Aircraft (Narrow-body, Wide-body, Regional Jets)

- Military Aircraft (Fighter Jets, Transport Aircraft, Trainer Aircraft, Special Mission Aircraft)

- Business Jets

- Rotary Wing Aircraft

- Unmanned Aerial Vehicles (UAVs)

- Urban Air Mobility (UAM) Aircraft

- By Material:

- Composites (Carbon Fiber Reinforced Polymer, Glass Fiber Reinforced Polymer, Other Composites)

- Aluminum Alloys

- Steel Alloys

- Titanium Alloys

- Others

- By Component:

- Fuselage

- Wing

- Empennage

- Nacelle

- Flight Control Surfaces

- Others

- By End-Use:

- Original Equipment Manufacturer (OEM)

- Aftermarket (MRO)

Regional Highlights

- North America: This region holds a significant share of the Aircraft Aerostructure market, driven by the presence of major aircraft manufacturers, robust defense spending, and advanced aerospace research and development capabilities. The United States, in particular, is a hub for innovation in composite materials and advanced manufacturing technologies for aerostructures. The region benefits from ongoing commercial aircraft production programs and substantial military aircraft procurement, maintaining its position as a leading market.

- Europe: Europe is another key player in the Aircraft Aerostructure market, home to prominent aircraft OEMs and a strong ecosystem of aerostructure suppliers. Countries like France, Germany, and the UK are at the forefront of aerospace manufacturing and technological advancements, particularly in composite application and sustainable aviation initiatives. The region's market is supported by both commercial aircraft orders and significant investments in defense and space programs.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market for Aircraft Aerostructures. This growth is primarily attributed to the rapid expansion of air passenger traffic, leading to substantial demand for new commercial aircraft, especially in China and India. Additionally, increasing defense budgets, domestic aircraft manufacturing initiatives, and growing investments in MRO capabilities across the region are fueling market expansion. APAC is also emerging as a manufacturing hub, attracting foreign investment and fostering local aerospace industry development.

- Latin America: While a smaller market compared to North America and Europe, Latin America exhibits potential for growth driven by increasing air travel demand, fleet modernization efforts by regional airlines, and some local aerospace manufacturing capabilities. Investment in infrastructure and economic stability will be key factors influencing market expansion in this region.

- Middle East and Africa (MEA): The MEA region's market for Aircraft Aerostructures is influenced by the significant investments in expanding airline fleets, particularly in the Middle East, driven by the growth of international air travel hubs. Increasing defense spending in several countries also contributes to the demand for military aircraft aerostructures. Africa presents long-term growth opportunities as its aviation infrastructure and air travel continue to develop.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Aerostructure Market.- Airbus SE

- The Boeing Company

- Spirit AeroSystems, Inc.

- Safran S.A.

- Leonardo S.p.A.

- GKN Aerospace (Melrose Industries PLC)

- ST Engineering

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Triumph Group, Inc.

- Collins Aerospace (Raytheon Technologies Corporation)

- Liebherr-Aerospace & Transportation SAS

- Sumitomo Precision Products Co., Ltd.

- Korean Air Aerospace Division

- Premium AEROTEC GmbH

- Fokker Aerostructures (GKN Aerospace)

- Ruag International

- Tata Advanced Systems Limited

- Hindustan Aeronautics Limited (HAL)

- China Aviation Industry Corporation (AVIC)

Frequently Asked Questions

What is the projected growth rate for the Aircraft Aerostructure Market?

The Aircraft Aerostructure Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033, reaching an estimated value of USD 108.7 billion by the end of the forecast period. This growth is primarily fueled by increasing demand for new aircraft, advancements in materials technology, and ongoing fleet modernization efforts across commercial and military aviation sectors.

Which factors are driving the demand for Aircraft Aerostructures?

Key drivers include the global increase in air passenger traffic, leading to robust demand for new commercial aircraft. Additionally, technological advancements in lightweight composite materials and advanced manufacturing processes, alongside rising military aircraft procurement and the emergence of new aviation segments like Urban Air Mobility (UAM), significantly propel market growth.

How is AI impacting the Aircraft Aerostructure industry?

AI is transforming the industry by enabling generative design for optimized structures, enhancing manufacturing precision and quality control through automation and computer vision, and revolutionizing maintenance with predictive analytics for in-service aerostructures. AI applications aim to improve efficiency, reduce costs, and enhance the safety and longevity of aircraft components.

Which region is expected to lead the Aircraft Aerostructure Market growth?

The Asia Pacific (APAC) region is anticipated to be the fastest-growing market. This is driven by significant increases in air passenger traffic, substantial investments in commercial and military aircraft procurement, and expanding domestic manufacturing capabilities in countries such as China and India, making it a pivotal area for future market expansion.

What are the primary challenges faced by the Aircraft Aerostructure Market?

The market faces challenges such as the high costs associated with research, development, and manufacturing of advanced aerostructures, coupled with complex and stringent certification processes. Supply chain volatility, skilled labor shortages, and the inherent cyclical nature of the aerospace industry also present significant operational and economic hurdles for market participants.