Additive Manufacturing and Material Market

Additive Manufacturing and Material Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703453 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Additive Manufacturing and Material Market Size

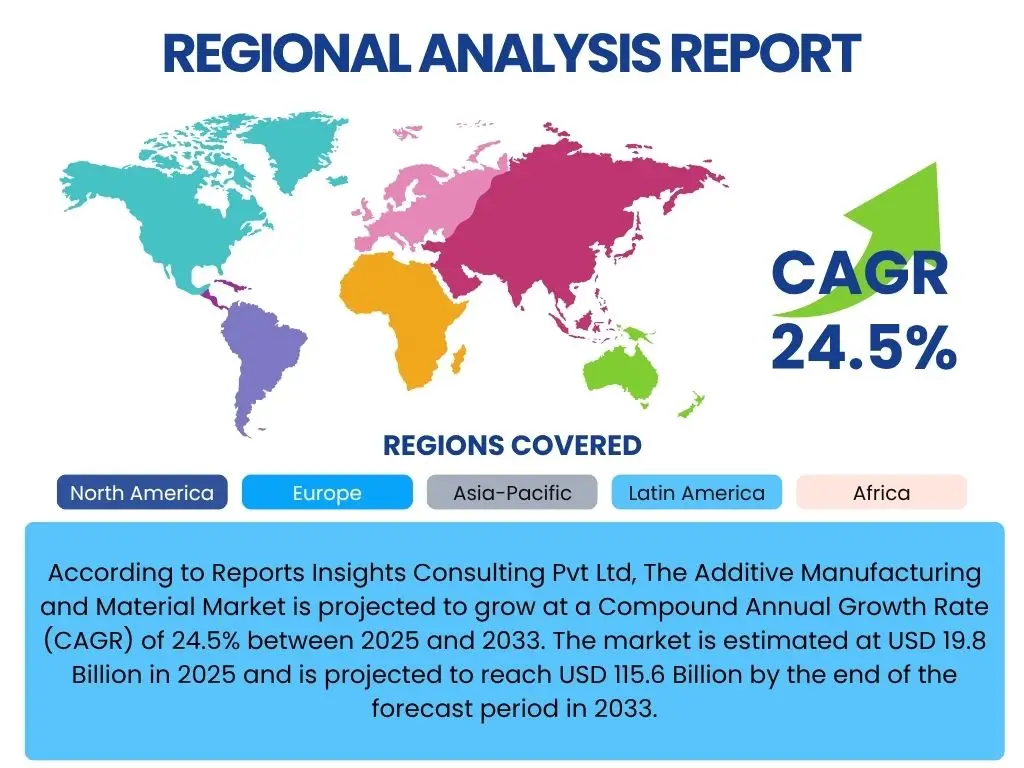

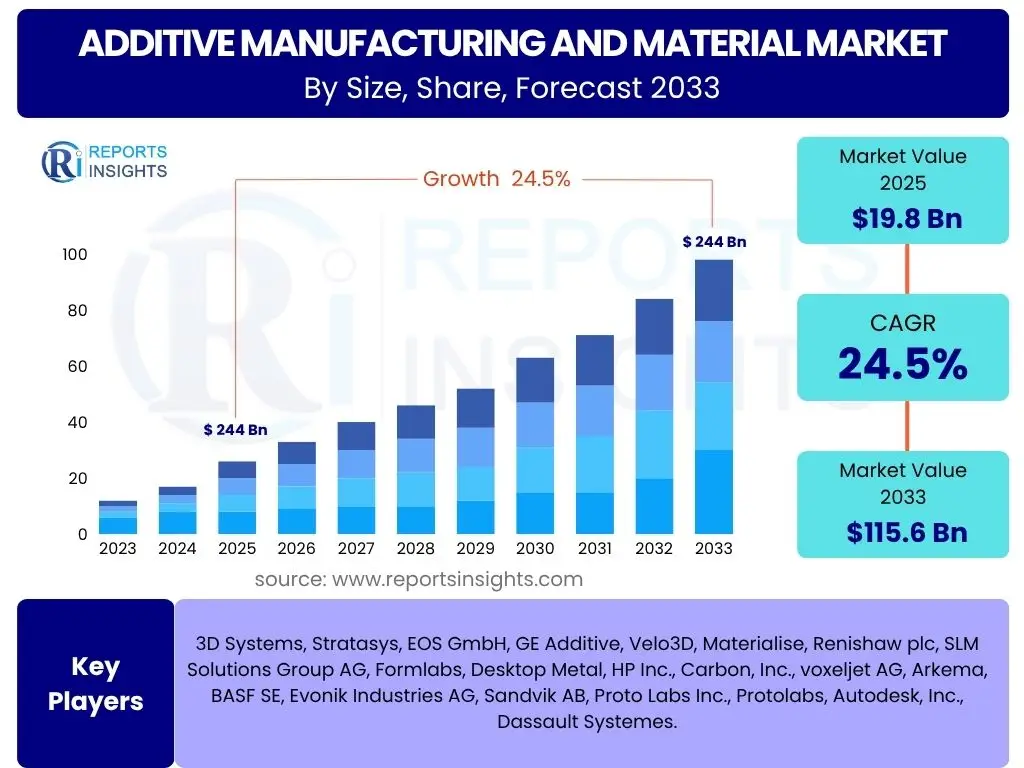

According to Reports Insights Consulting Pvt Ltd, The Additive Manufacturing and Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 24.5% between 2025 and 2033. The market is estimated at USD 19.8 Billion in 2025 and is projected to reach USD 115.6 Billion by the end of the forecast period in 2033.

Key Additive Manufacturing and Material Market Trends & Insights

The Additive Manufacturing and Material market is undergoing a significant transformation, driven by advancements across various fronts. A prominent trend involves the increasing industrialization of additive manufacturing processes, moving beyond rapid prototyping to enable large-scale production of functional end-use parts. This shift is supported by the development of more robust and high-performance materials, coupled with enhanced machine capabilities that offer greater precision, speed, and reliability.

Furthermore, the integration of digital technologies, such as artificial intelligence and machine learning, is optimizing the entire additive manufacturing workflow, from design and simulation to post-processing and quality control. There is also a growing emphasis on sustainable practices within the industry, with a focus on reducing material waste and developing recyclable or bio-based additive manufacturing materials. These trends collectively underscore a maturing market poised for expansive adoption across diverse industrial sectors.

- Industrialization of Additive Manufacturing for End-Use Parts

- Expansion of High-Performance Material Portfolios (Metals, Polymers, Composites)

- Advancements in Multi-Material Printing Capabilities

- Increased Adoption of AI and Machine Learning for Design Optimization and Process Control

- Development of Integrated Post-Processing Solutions

- Focus on Sustainable and Circular Economy Practices

- Rise of Decentralized and On-Demand Manufacturing Models

AI Impact Analysis on Additive Manufacturing and Material

Artificial intelligence is profoundly reshaping the additive manufacturing landscape, addressing critical challenges and unlocking new capabilities. AI algorithms are increasingly being used in generative design, allowing for the rapid exploration of complex geometries and optimized structures that are difficult or impossible to achieve with traditional design methods. This leads to lighter, stronger, and more efficient parts, accelerating product development cycles and enhancing performance.

Beyond design, AI's influence extends to process optimization, where machine learning models analyze real-time sensor data during printing to predict and compensate for potential defects, ensuring higher part quality and reducing material waste. Predictive maintenance, intelligent parameter optimization, and automated quality assurance systems are becoming standard, leading to more reliable, repeatable, and cost-effective additive manufacturing operations. The integration of AI therefore not only streamlines workflows but also pushes the boundaries of what is achievable with additive technologies, making them more competitive for industrial applications.

- Generative Design and Topology Optimization for Enhanced Part Performance

- Real-Time Process Monitoring and Anomaly Detection for Quality Control

- Predictive Maintenance of Additive Manufacturing Equipment

- Intelligent Parameter Optimization for Diverse Materials and Geometries

- Automated Post-Processing and Inspection Systems

- Supply Chain Optimization and On-Demand Production Planning

- Material Characterization and Discovery through Machine Learning

Key Takeaways Additive Manufacturing and Material Market Size & Forecast

The substantial growth trajectory of the Additive Manufacturing and Material market, with an impressive projected CAGR, signifies its transition from a niche technology to a mainstream manufacturing solution. This expansion is primarily fueled by the increasing demand for customized products, the ability to create complex geometries, and the continuous innovation in materials and printing technologies. The market's robust forecast underscores its critical role in enabling agile manufacturing, reducing lead times, and facilitating on-demand production across a myriad of industries.

Key stakeholders are strategically investing in research and development to enhance machine capabilities, expand material portfolios, and integrate digital twins and AI for process optimization. This forward momentum indicates a strong market appetite for solutions that deliver efficiency, flexibility, and sustainability. The market is positioned to capitalize on emerging applications in high-value sectors, driving significant revenue growth and market penetration throughout the forecast period.

- Robust Market Expansion Driven by Industrial Adoption

- Significant Investment in R&D to Enhance Capabilities

- Growing Demand for Customized and Complex Geometries

- Increasing Integration of Digitalization (AI, IoT) in Workflows

- Shift Towards Production of End-Use Functional Parts

- Opportunity for Cost Reduction and Supply Chain Resilience

- Continued Diversification of Applications Across Industries

Additive Manufacturing and Material Market Drivers Analysis

The Additive Manufacturing and Material market is propelled by a convergence of factors that emphasize efficiency, design freedom, and rapid innovation. A primary driver is the accelerating demand for highly customized and complex components, especially within sectors such as healthcare, aerospace, and automotive, where bespoke solutions offer significant performance advantages. Additive manufacturing technologies excel in producing intricate geometries and lightweight structures, which are unachievable through traditional manufacturing methods, thereby meeting critical industry needs for performance optimization and resource efficiency.

Furthermore, the continuous advancements in material science are expanding the application scope of additive manufacturing, enabling the use of high-performance polymers, advanced metals, and novel composites. This material versatility, combined with the technology's capability to reduce lead times and production costs for low-volume runs, makes it an increasingly attractive option for both prototyping and direct manufacturing. The growing emphasis on supply chain resilience and decentralized manufacturing also positions additive manufacturing as a strategic technology for localized production and reduced reliance on global logistics, particularly after recent global disruptions.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Customization and Complex Geometries | +5.5% | Global, particularly North America, Europe | Mid-to-Long Term (2025-2033) |

| Advancements in Material Science and Compatibility | +4.8% | Global, all regions | Mid-to-Long Term (2025-2033) |

| Reduced Lead Times and Production Costs for Small Batches | +4.2% | Global, particularly Asia Pacific (Manufacturing Hubs) | Mid-to-Long Term (2025-2033) |

| Growing Adoption in End-Use Industries (Aerospace, Healthcare, Automotive) | +3.9% | North America, Europe, Asia Pacific | Mid-to-Long Term (2025-2033) |

| Focus on Supply Chain Resiliency and On-Demand Manufacturing | +3.5% | Global | Mid-to-Long Term (2025-2033) |

Additive Manufacturing and Material Market Restraints Analysis

Despite its significant growth, the Additive Manufacturing and Material market faces several restraints that could impede its wider adoption and full potential. One major challenge is the high initial investment required for advanced additive manufacturing systems, including the cost of specialized machinery, software, and post-processing equipment. This substantial upfront capital expenditure can be prohibitive for small and medium-sized enterprises (SMEs) or companies with limited budget allocations, thereby restricting market penetration in certain segments.

Another significant restraint is the limited availability of a diverse range of qualified and certifiable materials for specific high-performance applications. While material science is advancing, the breadth of materials suitable for additive manufacturing, especially for critical industrial parts requiring stringent specifications, is still narrower compared to traditional manufacturing. Furthermore, the slow development of industry standards and regulatory frameworks for qualification and certification of additively manufactured parts presents a hurdle, particularly in highly regulated sectors like aerospace and medical, where rigorous validation is paramount for safety and reliability.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment and Operating Costs | -3.0% | Global, particularly emerging economies | Mid-to-Long Term (2025-2033) |

| Limited Availability of Qualified Materials for Mass Production | -2.5% | Global | Mid-to-Long Term (2025-2033) |

| Lack of Standardized Processes and Regulatory Frameworks | -2.2% | Global, especially highly regulated regions | Mid-to-Long Term (2025-2033) |

| Challenges with Post-Processing Requirements and Surface Finish | -1.8% | Global | Mid-to-Long Term (2025-2033) |

| Scalability Issues for High-Volume Manufacturing | -1.5% | Global | Mid-to-Long Term (2025-2033) |

Additive Manufacturing and Material Market Opportunities Analysis

The Additive Manufacturing and Material market is poised for significant growth driven by numerous emerging opportunities across various industries. A major opportunity lies in the expanding adoption within the healthcare sector, particularly for medical implants, prosthetics, and personalized drugs. The ability to create patient-specific devices with complex geometries and porous structures offers unparalleled therapeutic benefits and drives demand. Similarly, the aerospace and defense industry presents a robust opportunity for lightweighting components and producing complex parts with integrated functionalities, contributing to fuel efficiency and superior performance.

Furthermore, the integration of additive manufacturing into existing digital manufacturing workflows and Industry 4.0 initiatives creates significant avenues for growth. This includes the development of end-to-end digital threads, from design to production, enabling greater automation, data analytics, and remote manufacturing capabilities. The increasing focus on sustainability also presents an opportunity, as additive manufacturing can reduce material waste and enable on-demand production, aligning with eco-friendly business models. Emerging applications in construction, energy, and consumer electronics further diversify the market's potential, promising substantial revenue streams and technological advancements.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Applications in Healthcare (Medical & Dental) | +6.0% | North America, Europe, Asia Pacific | Mid-to-Long Term (2025-2033) |

| Expansion in Aerospace & Defense for Lightweight Components | +5.5% | North America, Europe | Mid-to-Long Term (2025-2033) |

| Integration with Industry 4.0 and Digital Manufacturing Ecosystems | +5.0% | Global | Mid-to-Long Term (2025-2033) |

| Emerging Markets and Developing Economies Adoption | +4.5% | Asia Pacific, Latin America, MEA | Mid-to-Long Term (2025-2033) |

| Focus on Sustainable Manufacturing and Circular Economy | +4.0% | Global | Mid-to-Long Term (2025-2033) |

Additive Manufacturing and Material Market Challenges Impact Analysis

The Additive Manufacturing and Material market encounters several challenges that necessitate strategic interventions for continued growth and broader industrial integration. One significant challenge is the inherent complexity and variability in the additive manufacturing process itself. Achieving consistent part quality, especially for critical applications, requires stringent control over numerous process parameters, material properties, and environmental conditions. This complexity often leads to unpredictable outcomes and difficulties in achieving repeatable results, which can hinder mass production adoption.

Another key challenge is the existing skill gap within the workforce. The additive manufacturing ecosystem demands specialized expertise in design for additive manufacturing, materials science, machine operation, and post-processing techniques. A shortage of adequately trained professionals can limit the effective deployment and optimization of additive technologies within organizations. Furthermore, intellectual property concerns related to digital designs and distributed manufacturing models pose a substantial legal and security challenge, requiring robust protective measures and clear legal frameworks to ensure innovation and fair competition.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complexity and Variability in Process Control | -2.8% | Global | Mid-to-Long Term (2025-2033) |

| Shortage of Skilled Workforce and Expertise | -2.5% | Global | Mid-to-Long Term (2025-2033) |

| Intellectual Property and Data Security Concerns | -2.0% | Global | Mid-to-Long Term (2025-2033) |

| Cost-Effectiveness for High-Volume Production | -1.7% | Global | Mid-to-Long Term (2025-2033) |

| Integration with Legacy Manufacturing Systems | -1.5% | Global | Mid-to-Long Term (2025-2033) |

Additive Manufacturing and Material Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the Additive Manufacturing and Material market, offering detailed insights into its current state, historical performance, and future projections. The report covers various market attributes, including base year, historical data, forecast period, market sizing, growth rates, key trends, and a thorough segmentation analysis. It identifies crucial market drivers, restraints, opportunities, and challenges, providing a holistic view of the market dynamics shaping its trajectory. The report also highlights the competitive landscape by profiling key players and their strategic initiatives, alongside a detailed regional analysis to offer a complete market overview essential for strategic decision-making.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 19.8 Billion |

| Market Forecast in 2033 | USD 115.6 Billion |

| Growth Rate | 24.5% |

| Number of Pages | 256 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | 3D Systems, Stratasys, EOS GmbH, GE Additive, Velo3D, Materialise, Renishaw plc, SLM Solutions Group AG, Formlabs, Desktop Metal, HP Inc., Carbon, Inc., voxeljet AG, Arkema, BASF SE, Evonik Industries AG, Sandvik AB, Proto Labs Inc., Protolabs, Autodesk, Inc., Dassault Systemes. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Additive Manufacturing and Material market is extensively segmented to provide a granular understanding of its diverse components and their respective contributions to market growth. This segmentation is crucial for identifying key growth areas, understanding technological preferences, and assessing material demand across various applications and end-use sectors. The market is primarily broken down by technology, material type, application, and the end-use industry, reflecting the varied landscape of additive manufacturing adoption.

Each segment offers unique insights into market dynamics. For instance, technology segmentation highlights the dominance and evolution of different printing processes, from powder bed fusion for metals to vat photopolymerization for high-resolution polymer parts. Material segmentation showcases the increasing demand for high-performance polymers and advanced metal alloys suitable for critical applications. Application and end-use industry breakdowns illustrate where additive manufacturing is most impactful, from rapid prototyping and tooling to the direct manufacturing of functional components in aerospace, healthcare, and automotive sectors, providing a comprehensive view of market opportunities and strategic priorities.

- By Technology:

- Fused Deposition Modeling (FDM)

- Stereolithography (SLA)

- Selective Laser Sintering (SLS)

- Digital Light Processing (DLP)

- Binder Jetting

- Material Jetting

- Powder Bed Fusion (PBF)

- Directed Energy Deposition (DED)

- Sheet Lamination

- Extrusion-Based

- Vat Photopolymerization

- By Material:

- Polymers

- Thermoplastics

- Thermosets

- Elastomers

- Metals

- Titanium

- Aluminum

- Nickel

- Steel Alloys

- Cobalt-Chrome

- Ceramics

- Composites

- Others

- Polymers

- By Application:

- Prototyping

- Tooling

- Functional Parts Manufacturing

- Research and Development

- By End-Use Industry:

- Aerospace & Defense

- Automotive

- Healthcare (Medical & Dental)

- Consumer Goods

- Industrial

- Education

- Construction

- Energy

- Jewelry

- Others

Regional Highlights

- North America: This region is a dominant force in the Additive Manufacturing and Material market, primarily driven by significant investments in research and development, particularly from the aerospace, defense, and healthcare sectors. The presence of key market players, robust technological infrastructure, and increasing adoption of advanced manufacturing processes contribute to its leading position. The United States, in particular, showcases high innovation and application across various industries, maintaining its strong market share.

- Europe: Europe represents a mature and highly innovative market for additive manufacturing, with countries like Germany, the UK, and France at the forefront. The region benefits from strong government support for industrial automation, a focus on sustainable manufacturing, and a well-established automotive and industrial machinery sector. Collaborative research initiatives and an emphasis on developing new materials and processes further bolster market growth.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate, fueled by rapid industrialization, increasing manufacturing activities, and growing awareness of additive manufacturing benefits in emerging economies like China, India, and South Korea. Government initiatives promoting advanced manufacturing, coupled with significant investments in R&D and manufacturing capabilities, are driving widespread adoption across automotive, consumer electronics, and healthcare industries.

- Latin America: While still in nascent stages compared to developed regions, Latin America is experiencing gradual adoption of additive manufacturing, primarily driven by the automotive and medical sectors in countries like Brazil and Mexico. Increasing foreign investments and a growing industrial base are expected to create new opportunities, though economic instability and high initial costs remain challenges.

- Middle East and Africa (MEA): The MEA region is witnessing emerging interest in additive manufacturing, particularly within the oil and gas, construction, and healthcare sectors, driven by diversification efforts and infrastructure development projects. Countries like UAE and Saudi Arabia are investing in advanced technologies to reduce reliance on traditional industries, albeit from a lower base, indicating future growth potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Additive Manufacturing and Material Market.- 3D Systems

- Stratasys

- EOS GmbH

- GE Additive

- Velo3D

- Materialise

- Renishaw plc

- SLM Solutions Group AG

- Formlabs

- Desktop Metal

- HP Inc.

- Carbon, Inc.

- voxeljet AG

- Arkema

- BASF SE

- Evonik Industries AG

- Sandvik AB

- Proto Labs Inc.

- Protolabs

- Autodesk, Inc.

- Dassault Systemes

Frequently Asked Questions

What is the projected growth rate for the Additive Manufacturing and Material market?

The Additive Manufacturing and Material market is projected to grow at a Compound Annual Growth Rate (CAGR) of 24.5% between 2025 and 2033, indicating a substantial expansion in market size.

Which industries are the primary drivers of demand for Additive Manufacturing?

The aerospace & defense, healthcare (medical & dental), and automotive industries are primary drivers of demand, leveraging additive manufacturing for lightweighting, customization, and complex part production.

How does Artificial Intelligence impact Additive Manufacturing?

AI significantly impacts additive manufacturing by enabling generative design, optimizing printing parameters, ensuring real-time quality control, and facilitating predictive maintenance, leading to enhanced efficiency and part quality.

What are the main challenges facing the Additive Manufacturing and Material market?

Key challenges include the high initial investment costs for equipment, limitations in material diversity for certain applications, the absence of comprehensive industry standards, and the scarcity of skilled professionals.

Which region is expected to lead market growth in the Additive Manufacturing and Material sector?

The Asia Pacific (APAC) region is anticipated to exhibit the highest growth rate, driven by rapid industrialization, increasing manufacturing investments, and growing adoption across various end-use industries in countries like China and India.