Wood Manufacturing Market

Wood Manufacturing Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704523 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Wood Manufacturing Market Size

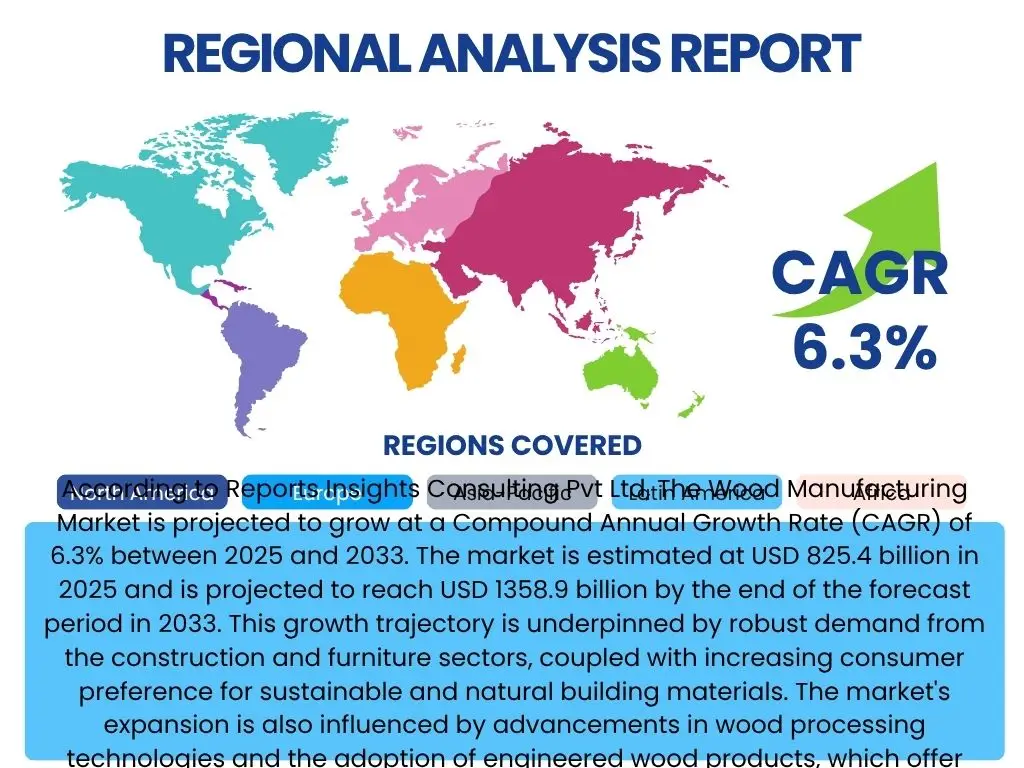

According to Reports Insights Consulting Pvt Ltd, The Wood Manufacturing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% between 2025 and 2033. The market is estimated at USD 825.4 billion in 2025 and is projected to reach USD 1358.9 billion by the end of the forecast period in 2033. This growth trajectory is underpinned by robust demand from the construction and furniture sectors, coupled with increasing consumer preference for sustainable and natural building materials. The market's expansion is also influenced by advancements in wood processing technologies and the adoption of engineered wood products, which offer enhanced durability and versatility.

The global wood manufacturing market showcases significant regional disparities in growth rates and market maturity. Developed economies, while exhibiting stable demand, are increasingly focusing on value-added wood products and sustainable forestry practices. Conversely, emerging economies in Asia Pacific and Latin America are poised for accelerated growth due to rapid urbanization, infrastructure development, and rising disposable incomes. The market's resilience against economic fluctuations is partly attributable to its fundamental role in essential industries, ensuring a steady, albeit cyclical, demand for its diverse product offerings.

Key Wood Manufacturing Market Trends & Insights

The wood manufacturing market is undergoing a significant transformation driven by evolving consumer preferences, technological advancements, and a heightened focus on environmental sustainability. Users frequently inquire about the integration of digital technologies, the shift towards eco-friendly practices, and the impact of global supply chain dynamics. Key trends indicate a robust movement towards sustainable sourcing and production, reflecting increasing regulatory pressure and consumer demand for responsibly managed forest products. This includes the proliferation of certification schemes like FSC and PEFC, which assure consumers of ethical and environmentally sound practices.

Another prominent trend is the growing adoption of automation and digitalization across manufacturing processes. This encompasses everything from advanced robotics in sawmills to data analytics for optimizing supply chain logistics and production efficiency. Furthermore, there's a notable increase in the demand for engineered wood products (EWPs) such as Cross-Laminated Timber (CLT), Glued Laminated Timber (Glulam), and Laminated Veneer Lumber (LVL), driven by their structural integrity, aesthetic appeal, and faster construction times. The rise of customization and personalization in furniture and interior design also influences manufacturing processes, pushing for more flexible and agile production lines to meet diverse consumer needs.

- Sustainable sourcing and production practices

- Increased adoption of automation and digitalization (Industry 4.0)

- Growing demand for engineered wood products (EWPs)

- Emphasis on circular economy principles and waste reduction

- Personalization and customization in product offerings

- Supply chain resilience and localization strategies

AI Impact Analysis on Wood Manufacturing

User queries regarding the impact of Artificial Intelligence (AI) on the wood manufacturing sector primarily revolve around efficiency gains, quality control, and the potential for process optimization. There is significant interest in how AI can streamline operations, reduce waste, and enhance decision-making throughout the value chain. AI's influence is anticipated to be transformative, enabling predictive maintenance for machinery, optimizing timber cutting to maximize yield, and improving lumber grading accuracy. This intelligent automation can lead to substantial cost savings and improved resource utilization, directly addressing some of the industry's long-standing challenges.

Beyond operational efficiencies, AI is expected to play a crucial role in supply chain management and product design. AI-powered analytics can forecast demand more accurately, manage inventory levels, and optimize logistics, thereby mitigating supply chain disruptions. In design, generative AI could assist in creating innovative wood product designs, optimizing material use, and simulating performance characteristics. While initial adoption may face challenges related to high investment costs and the need for specialized skills, the long-term benefits in terms of productivity, sustainability, and competitive advantage are poised to drive significant integration of AI technologies across the wood manufacturing landscape.

- Optimized timber cutting and yield maximization

- Enhanced quality control and defect detection

- Predictive maintenance for manufacturing equipment

- Improved supply chain planning and logistics

- Automated grading and sorting of wood products

- Data-driven decision-making for production and inventory

- Potential for generative design of wood structures and furniture

Key Takeaways Wood Manufacturing Market Size & Forecast

The Wood Manufacturing Market is set for consistent expansion, driven by foundational demand in construction and furniture, alongside a significant push towards sustainability. Users seeking key takeaways are often interested in understanding the primary growth drivers, the evolving landscape of sustainable practices, and the strategic importance of technological adoption. The market's forecasted growth to over USD 1.3 trillion by 2033 underscores its resilience and adaptability, even amidst global economic uncertainties. This growth is not merely volumetric but also qualitative, emphasizing value-added products and efficient resource utilization.

Crucially, the market's future will be shaped by its ability to integrate advanced manufacturing techniques, including automation and AI, to address rising labor costs and enhance productivity. The imperative for environmental responsibility will continue to influence sourcing decisions and product development, with certified sustainable wood products gaining increasing market share. Companies that prioritize innovation in engineered wood, invest in digital transformation, and commit to transparent, sustainable supply chains are best positioned to capitalize on the market's evolving opportunities and maintain competitive advantage through the forecast period.

- Projected significant market growth to USD 1.35 trillion by 2033.

- Strong demand from construction and furniture sectors remains primary driver.

- Sustainability and certified wood products are becoming market differentiators.

- Technological integration, particularly AI and automation, is critical for efficiency.

- Engineered wood products (EWPs) are key to future market expansion.

- Emerging markets offer substantial growth potential.

Wood Manufacturing Market Drivers Analysis

The wood manufacturing market is propelled by a confluence of macroeconomic and industry-specific factors. A primary driver is the robust growth in the global construction sector, particularly in residential and commercial building, where wood and engineered wood products are increasingly favored for their sustainability, structural integrity, and aesthetic appeal. Rapid urbanization in developing economies further exacerbates the demand for housing and infrastructure, directly benefiting the wood industry. Beyond construction, the burgeoning global furniture market, driven by rising disposable incomes and evolving design trends, consistently fuels demand for various wood products, from lumber to veneers and composite panels.

Additionally, the heightened awareness and preference for sustainable and environmentally friendly materials among consumers and regulatory bodies contribute significantly to market expansion. Wood, being a renewable resource, offers a compelling alternative to non-renewable building materials, aligning with global efforts towards decarbonization and green building initiatives. Technological advancements in wood processing, such as optimized cutting techniques, advanced bonding agents, and automation, have also improved the efficiency and quality of manufactured wood products, making them more competitive and versatile for a wider range of applications. These innovations enable manufacturers to produce high-performance materials that meet stringent building codes and design specifications.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Construction Sector | +1.2% | Global, particularly Asia Pacific, North America | Long-term (2025-2033) |

| Increasing Demand for Sustainable Materials | +0.9% | Europe, North America, Oceania | Mid to Long-term (2025-2033) |

| Urbanization and Infrastructure Development | +0.8% | Asia Pacific, Latin America, Africa | Long-term (2025-2033) |

| Rising Global Furniture Consumption | +0.7% | North America, Europe, Asia Pacific | Mid to Long-term (2025-2033) |

| Technological Advancements in Wood Processing | +0.6% | Global | Mid-term (2025-2029) |

Wood Manufacturing Market Restraints Analysis

Despite robust growth prospects, the wood manufacturing market faces several significant restraints that could impede its expansion. One major challenge is the volatility in raw material prices, primarily timber and logs, which are subject to seasonal variations, weather events, and global supply-demand dynamics. This price instability can directly impact production costs and profit margins for manufacturers, making long-term planning and pricing strategies more complex. Additionally, stringent environmental regulations aimed at combating deforestation and promoting sustainable forestry can limit timber harvesting in certain regions, leading to supply shortages and increased sourcing costs. Compliance with these regulations often requires significant investments in sustainable practices and certifications, which can be burdensome for smaller players.

Another critical restraint is the increasing competition from alternative materials such as steel, concrete, plastics, and composites, which are continuously innovating and finding new applications in construction and other sectors. While wood offers unique advantages, these alternatives often present competitive advantages in terms of cost, fire resistance, or specific structural properties for certain applications. Furthermore, the wood manufacturing industry, particularly in traditional segments, often grapples with a shortage of skilled labor. This issue is compounded by an aging workforce and a perceived lack of appeal for careers in manufacturing among younger generations, leading to higher labor costs and operational inefficiencies. Geopolitical tensions and trade barriers can also disrupt supply chains, affecting the import and export of wood products and raw materials, adding another layer of complexity to market operations.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Raw Material Price Volatility | -0.7% | Global | Short to Mid-term (2025-2028) |

| Stringent Environmental Regulations | -0.6% | Europe, North America, Brazil | Long-term (2025-2033) |

| Competition from Alternative Materials | -0.5% | Global | Long-term (2025-2033) |

| Shortage of Skilled Labor | -0.4% | North America, Europe | Mid to Long-term (2025-2033) |

Wood Manufacturing Market Opportunities Analysis

The wood manufacturing market is presented with several compelling opportunities that can significantly accelerate its growth trajectory. The escalating global focus on sustainable and green building practices creates an immense avenue for wood and engineered wood products. As governments and consumers prioritize carbon-neutral and environmentally friendly construction, the inherent renewable nature and carbon sequestration properties of wood position it as a material of choice. This trend is particularly evident with the rising adoption of mass timber constructions, such as Cross-Laminated Timber (CLT) and Glued Laminated Timber (Glulam), in large-scale commercial and residential projects, offering faster construction times and reduced environmental footprints compared to traditional materials.

Furthermore, technological advancements, including the integration of smart manufacturing, IoT, and AI, offer manufacturers the chance to enhance operational efficiency, reduce waste, and improve product quality. Opportunities also lie in product diversification and innovation, catering to niche markets and evolving consumer demands. This includes developing high-performance wood composites, bio-based products, and customizable furniture solutions. The expansion into emerging markets, particularly in Asia Pacific and Latin America, where construction and consumer spending are on an upward trend, represents a significant untapped potential. Additionally, the circular economy model presents opportunities for recycling wood waste into new products or bioenergy, further enhancing sustainability and resource efficiency within the industry.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Adoption of Mass Timber Construction | +1.0% | North America, Europe, Oceania | Long-term (2025-2033) |

| Expansion in Emerging Economies | +0.9% | Asia Pacific, Latin America, Africa | Long-term (2025-2033) |

| Technological Integration (Smart Manufacturing, AI) | +0.8% | Global | Mid to Long-term (2025-2033) |

| Increasing Demand for Sustainable Wood Products | +0.7% | Europe, North America | Long-term (2025-2033) |

| Product Innovation and Diversification | +0.6% | Global | Mid to Long-term (2025-2033) |

Wood Manufacturing Market Challenges Impact Analysis

The wood manufacturing market is confronted by a range of challenges that require strategic responses from industry players. One significant challenge is the increasing complexity of global supply chains, made vulnerable by geopolitical events, trade disputes, and logistics disruptions. This can lead to delays in raw material procurement and product delivery, impacting production schedules and profitability. Furthermore, the industry faces ongoing pressure to comply with an evolving landscape of environmental regulations and sustainability standards. Meeting these standards often requires substantial investments in new technologies and processes, and failure to comply can result in penalties or damage to brand reputation, particularly in regions with strict environmental policies.

The high initial capital investment required for modernizing facilities and adopting advanced manufacturing technologies, such as automation and AI, poses another hurdle, especially for small and medium-sized enterprises (SMEs). This can create a significant barrier to entry and hinder the widespread adoption of efficiency-boosting innovations. Moreover, the industry is susceptible to the impacts of climate change, including increased frequency of forest fires, pest outbreaks, and changes in growth patterns, which can affect timber supply and quality. Attracting and retaining a skilled workforce, from foresters to machine operators and engineers, remains a persistent challenge, contributing to labor shortages and escalating operational costs. Addressing these multifaceted challenges will be crucial for the sustained growth and competitiveness of the wood manufacturing sector.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Supply Chain Disruptions | -0.8% | Global | Short to Mid-term (2025-2027) |

| Regulatory Compliance and Sustainability Pressure | -0.7% | Europe, North America | Long-term (2025-2033) |

| High Capital Investment for Modernization | -0.6% | Global | Mid to Long-term (2025-2030) |

| Impact of Climate Change on Forest Resources | -0.5% | North America, Australia, Europe | Long-term (2025-2033) |

| Attracting and Retaining Skilled Labor | -0.4% | North America, Europe | Long-term (2025-2033) |

Wood Manufacturing Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global wood manufacturing market, offering detailed insights into market size, growth drivers, restraints, opportunities, and challenges. The scope encompasses a thorough examination of various product segments, application areas, and regional dynamics, providing a holistic view of the industry landscape. It also includes a competitive analysis of key market players, profiling their strategies, recent developments, and market positioning to offer a complete understanding of the competitive environment. The report is designed to assist stakeholders in making informed strategic decisions by providing accurate forecasts and actionable intelligence.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 825.4 Billion |

| Market Forecast in 2033 | USD 1358.9 Billion |

| Growth Rate | 6.3% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Weyerhaeuser Company, Georgia-Pacific LLC, Boise Cascade Company, West Fraser Timber Co. Ltd., Canfor Corporation, PotlatchDeltic Corporation, Rayonier Inc., Resolute Forest Products Inc., Interfor Corporation, Louisiana-Pacific Corporation, Stora Enso Oyj, UPM-Kymmene Corporation, Arauco, CMPC, Kronospan, EGGER Group, Södra, Mercer International Inc., Binderholz GmbH, Sierra Pacific Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The wood manufacturing market is comprehensively segmented to provide granular insights into its diverse components and their respective market dynamics. This segmentation facilitates a deeper understanding of specific product categories, their applications across various industries, and their ultimate end-uses, allowing for targeted strategic planning. The primary segmentation revolves around product types, which include foundational materials like lumber and plywood, alongside a growing array of engineered wood products such as MDF and OSB, and specialty products like wood pellets. Each product type serves distinct market needs and exhibits unique growth patterns driven by specific demand factors.

Further segmentation by application highlights the key sectors that consume manufactured wood products, predominantly residential and non-residential construction, furniture manufacturing, and packaging. The demand within these applications is influenced by macroeconomic trends, demographic shifts, and evolving consumer preferences. Finally, the end-use industry segmentation provides a macro-level view of where wood products are ultimately integrated, ranging from the vast building and construction sector to specialized applications in automotive and marine industries. This multi-dimensional segmentation is crucial for identifying high-growth areas, understanding market demand drivers, and tailoring product offerings to meet specific industry requirements efficiently.

- By Product Type:

- Lumber

- Plywood

- Particle Board

- Medium Density Fiberboard (MDF)

- Oriented Strand Board (OSB)

- Wood Pulp

- Veneer

- Wood Pellets

- Others (including Wood Flooring, Wood Chips)

- By Application:

- Residential Construction

- Non-Residential Construction

- Furniture

- Packaging

- Decorative & Aesthetics

- Industrial

- Others

- By End-Use Industry:

- Building & Construction

- Furniture & Cabinetry

- Pulp & Paper

- Packaging

- Automotive

- Marine

- Others

Regional Highlights

- North America: A mature market with strong demand from residential and non-residential construction, driven by robust housing starts and commercial development. Emphasis on sustainable forestry and advanced manufacturing technologies. The U.S. and Canada are major producers and consumers, focusing on engineered wood products and innovative building solutions.

- Europe: Characterized by stringent environmental regulations and a high adoption rate of sustainable and certified wood products. Germany, Sweden, and Finland are key players in advanced wood processing and sustainable forest management. Significant growth in mass timber construction is observed across the region.

- Asia Pacific (APAC): The fastest-growing market, propelled by rapid urbanization, massive infrastructure projects, and increasing disposable incomes, particularly in China, India, and Southeast Asian countries. Surging demand for furniture and building materials fuels robust growth, although sustainability practices are still evolving.

- Latin America: Exhibiting significant growth potential due to increasing construction activities and expanding furniture markets in Brazil, Mexico, and Chile. The region benefits from abundant natural forest resources, though illegal logging and sustainability challenges persist.

- Middle East and Africa (MEA): A developing market with rising demand from new construction projects, particularly in the GCC countries and parts of Africa. Growth is driven by diversification efforts away from oil economies, leading to investments in real estate and tourism infrastructure. Imports play a significant role in meeting demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wood Manufacturing Market.- Weyerhaeuser Company

- Georgia-Pacific LLC

- Boise Cascade Company

- West Fraser Timber Co. Ltd.

- Canfor Corporation

- PotlatchDeltic Corporation

- Rayonier Inc.

- Resolute Forest Products Inc.

- Interfor Corporation

- Louisiana-Pacific Corporation

- Stora Enso Oyj

- UPM-Kymmene Corporation

- Arauco

- CMPC

- Kronospan

- EGGER Group

- Södra

- Mercer International Inc.

- Binderholz GmbH

- Sierra Pacific Industries

Frequently Asked Questions

Analyze common user questions about the Wood Manufacturing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate for the Wood Manufacturing Market?

The Wood Manufacturing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% between 2025 and 2033, reaching an estimated value of USD 1358.9 billion by 2033.

What are the primary drivers of growth in the Wood Manufacturing Market?

Key growth drivers include the expanding global construction and furniture sectors, increasing demand for sustainable and renewable building materials, rapid urbanization, and technological advancements in wood processing that enhance efficiency and product quality.

How is AI impacting the Wood Manufacturing industry?

AI is transforming the industry by optimizing timber cutting, improving quality control, enabling predictive maintenance, streamlining supply chain logistics, and facilitating data-driven decision-making, leading to increased efficiency and reduced waste.

What are the main challenges faced by the Wood Manufacturing Market?

Major challenges include volatility in raw material prices, stringent environmental regulations, intense competition from alternative materials, shortage of skilled labor, and susceptibility to supply chain disruptions and climate change impacts.

Which regions are expected to show significant growth in Wood Manufacturing?

The Asia Pacific region is expected to exhibit the fastest growth due to rapid urbanization and infrastructure development, while North America and Europe will continue to be significant markets driven by sustainability initiatives and demand for engineered wood products.