Wealth Management Platform Market

Wealth Management Platform Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704159 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Wealth Management Platform Market Size

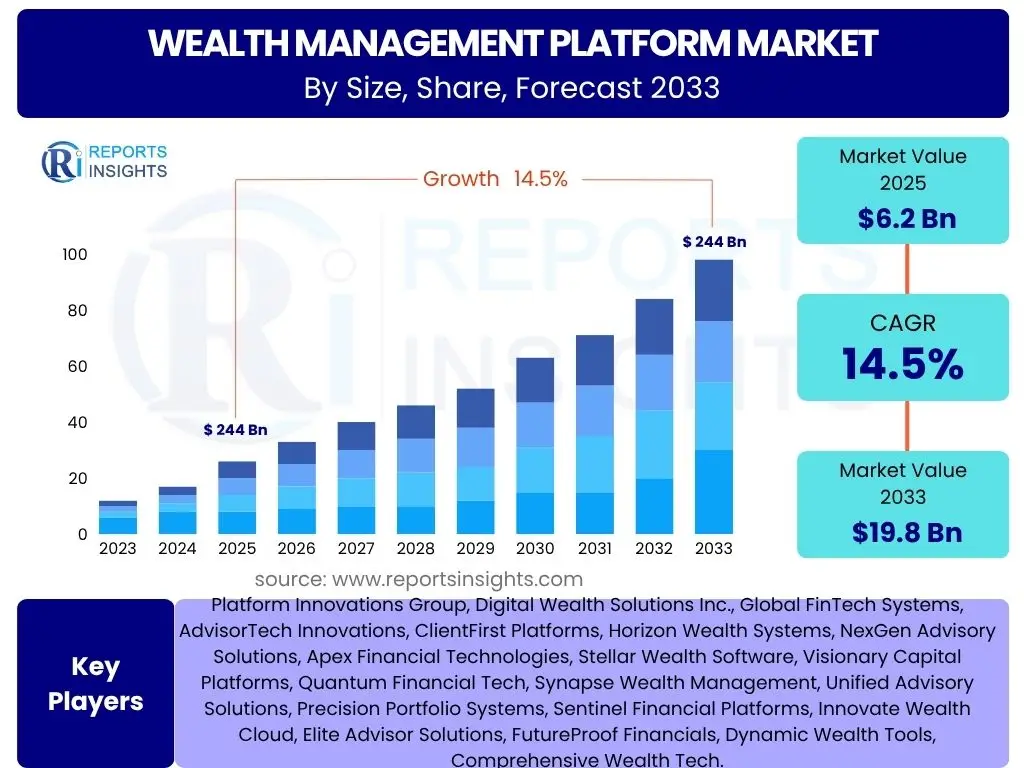

According to Reports Insights Consulting Pvt Ltd, The Wealth Management Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2025 and 2033. The market is estimated at USD 6.2 billion in 2025 and is projected to reach USD 19.8 billion by the end of the forecast period in 2033.

Key Wealth Management Platform Market Trends & Insights

The Wealth Management Platform market is experiencing significant evolution driven by shifting client expectations, technological advancements, and a competitive landscape. User inquiries frequently center on the adoption of digital solutions, the pursuit of hyper-personalization, and the integration of sophisticated analytical tools. This indicates a strong market demand for platforms that offer comprehensive functionality beyond traditional portfolio management, emphasizing client engagement, efficient operations, and data-driven insights. The ongoing digital transformation across financial services is a primary catalyst, pushing firms to adopt cloud-based, scalable, and interconnected platforms.

Furthermore, discussions highlight the growing emphasis on environmental, social, and governance (ESG) investing capabilities, reflecting a broader societal shift towards sustainable financial practices. The integration of Open Banking APIs and the increasing prevalence of hybrid advisory models are also key themes, demonstrating the industry's move towards more collaborative and technology-augmented human advice. These trends collectively underscore a market moving towards integrated, intelligent, and client-centric solutions that can adapt to rapid technological change and evolving regulatory environments.

- Hyper-personalization of client services and financial advice.

- Increased adoption of digital client onboarding and engagement tools.

- Integration of ESG (Environmental, Social, and Governance) investing capabilities.

- Expansion of Open Banking and API-driven connectivity for holistic views.

- Prevalence of hybrid advisory models combining human expertise with automated tools.

- Migration towards cloud-native and SaaS-based platform solutions for scalability.

AI Impact Analysis on Wealth Management Platform

User inquiries regarding the impact of Artificial Intelligence (AI) on Wealth Management Platforms reveal a dual perspective: immense potential for transformation alongside concerns about ethical implications and job displacement. The primary themes revolve around AI's capacity to enhance predictive analytics, automate routine tasks, and enable unprecedented levels of personalization in client engagement. Users are keen to understand how AI can move beyond basic robo-advisory functions to offer deeper insights, optimize portfolio performance, and streamline compliance processes, ultimately leading to more efficient and profitable operations for wealth managers.

However, there are also prevalent concerns about data privacy, the transparency of AI-driven decisions (the "black box" problem), and the potential for AI to diminish the human element in financial advice. Expectations often include AI acting as a powerful augmentation tool for human advisors, rather than a complete replacement, allowing advisors to focus on complex problem-solving and client relationship building. The market anticipates AI will drive significant advancements in risk management, personalized financial planning, and proactive client service, necessitating a balance between technological efficiency and human trust.

- Enhanced predictive analytics for market trends and client behavior.

- Automated portfolio rebalancing and tax-loss harvesting.

- Hyper-personalized financial planning and product recommendations.

- Improved fraud detection and compliance monitoring.

- Streamlined operational workflows and back-office automation.

- Development of intelligent chatbots and virtual assistants for client support.

Key Takeaways Wealth Management Platform Market Size & Forecast

Common user questions regarding the Wealth Management Platform market size and forecast consistently point to a strong interest in growth drivers, future opportunities, and the underlying technological shifts shaping the industry. The primary insights derived indicate that the market is poised for robust expansion, largely fueled by the digital transformation imperative within financial services and the increasing demand from clients for more sophisticated, accessible, and personalized wealth management solutions. This growth is not merely incremental but represents a fundamental shift in how wealth advice is delivered and consumed, emphasizing efficiency, data-driven insights, and integrated service offerings.

Furthermore, the market's trajectory is significantly influenced by the continuous innovation in areas such as artificial intelligence, machine learning, and cloud computing, which enable platforms to offer advanced analytics, automated processes, and scalable services. Firms that strategically invest in these technologies and adapt to evolving client preferences, particularly among younger generations and underserved affluent segments, are positioned to capture substantial market share. The overall takeaway is a dynamic market characterized by technological adoption, a focus on client-centricity, and a clear path towards integrated, intelligent wealth management ecosystems.

- The market is on a robust growth trajectory, driven by digitalization and evolving client expectations.

- Technological advancements, particularly AI and cloud computing, are fundamental growth enablers.

- Demand for hyper-personalized and holistic financial advice is reshaping platform offerings.

- Regulatory landscapes are adapting, presenting both opportunities and compliance challenges.

- Strategic mergers, acquisitions, and partnerships are prevalent to enhance capabilities and market reach.

Wealth Management Platform Market Drivers Analysis

The Wealth Management Platform market is propelled by a confluence of factors, primarily centered on the ongoing digital transformation within the financial sector and the escalating expectations of clients for more sophisticated and accessible services. The pervasive need for firms to enhance operational efficiency, reduce costs, and deliver superior client experiences through technology is a significant driver. Furthermore, the global rise in high-net-worth and ultra-high-net-worth individuals, coupled with the generational transfer of wealth, creates a sustained demand for advanced wealth management solutions capable of handling complex financial needs and offering personalized advice.

Technological advancements, including the widespread adoption of cloud computing, artificial intelligence, and big data analytics, enable the development of more powerful and flexible platforms. These technologies support better risk management, predictive insights, and automated administrative tasks, freeing up advisors to focus on strategic client relationships. Additionally, regulatory shifts encouraging transparency and consumer protection often necessitate technological upgrades, inadvertently driving platform adoption to ensure compliance and robust data management practices.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Digitalization and Automation in Financial Services | +2.5% | Global, particularly North America, Europe, APAC | Short to Mid-term (2025-2030) |

| Growing High-Net-Worth (HNW) and Ultra-High-Net-Worth (UHNW) Population | +2.0% | Global, especially APAC, North America | Long-term (2025-2033) |

| Evolving Client Expectations for Personalized and Holistic Advice | +1.8% | Global | Short to Mid-term (2025-2030) |

| Need for Operational Efficiency and Cost Reduction for Wealth Firms | +1.5% | Global | Mid-term (2027-2033) |

| Supportive Regulatory Environment for Fintech Innovation | +1.2% | Europe (Open Banking), North America (Robo-Advisory) | Short to Mid-term (2025-2030) |

Wealth Management Platform Market Restraints Analysis

Despite the robust growth prospects, the Wealth Management Platform market faces several significant restraints that can impede its full potential. Foremost among these are the persistent concerns surrounding data security and privacy. As wealth platforms handle highly sensitive financial and personal information, the risk of cyberattacks and data breaches poses a substantial threat, leading to apprehension among both firms and clients and potentially hindering adoption rates. This challenge is exacerbated by the increasing sophistication of cyber threats, demanding continuous investment in advanced security protocols and compliance measures.

Another critical restraint is the high initial implementation cost and the ongoing maintenance expenses associated with advanced wealth management platforms. Smaller and mid-sized wealth management firms, in particular, may find these costs prohibitive, limiting their ability to upgrade from legacy systems or invest in cutting-edge solutions. Furthermore, the complexities involved in integrating new platforms with existing diverse and often outdated legacy IT infrastructures within financial institutions can lead to significant operational disruptions and extended deployment timelines, creating a barrier to seamless transition and adoption.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Data Security and Privacy Concerns | -1.8% | Global | Long-term (2025-2033) |

| High Initial Implementation and Maintenance Costs | -1.5% | Global, particularly SMEs | Short to Mid-term (2025-2030) |

| Integration Complexities with Legacy Systems | -1.2% | Global, particularly established institutions | Mid-term (2027-2033) |

| Regulatory Fragmentation and Compliance Burdens | -1.0% | Europe, Asia Pacific | Long-term (2025-2033) |

| Resistance to Automation and Lack of Trust in AI-driven Advice | -0.8% | Global, particularly older demographics | Short to Mid-term (2025-2030) |

Wealth Management Platform Market Opportunities Analysis

Significant opportunities exist within the Wealth Management Platform market, particularly in addressing underserved client segments and expanding into emerging economies. The mass affluent and next-generation clients, including millennials and Gen Z, represent a vast untapped market seeking digital-first, transparent, and values-aligned financial advice. Platforms capable of tailoring solutions and engagement models for these demographics, often through hybrid or purely digital channels, stand to gain substantial market share. Emerging markets, characterized by rapid wealth creation and a burgeoning middle class, also present fertile ground for expansion, offering significant potential for greenfield implementations and scaled growth.

Technological innovation continues to open new avenues for growth. The integration of blockchain technology could enhance security, transparency, and efficiency in asset management and transactional processes, while further advancements in AI and machine learning promise hyper-personalization and predictive capabilities far beyond current offerings. The trend towards Open Banking and Open Finance presents an opportunity for platforms to integrate more seamlessly with broader financial ecosystems, providing clients with a holistic view of their financial lives and enabling cross-selling of related services. Developing specialized platforms for niche markets, such as sustainable investing or wealth transfer solutions, also represents a promising growth area.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Underserved Client Segments (e.g., Mass Affluent, Next-Gen) | +2.2% | Global, particularly developing economies | Mid to Long-term (2027-2033) |

| Geographic Expansion into Emerging Markets | +2.0% | Asia Pacific, Latin America, MEA | Long-term (2028-2033) |

| Leveraging Blockchain for Enhanced Security and Transparency | +1.8% | Global | Long-term (2029-2033) |

| Development of Niche and Specialized Platforms (e.g., ESG, Crypto) | +1.5% | Global | Short to Mid-term (2025-2030) |

| Integration with Broader Open Finance Ecosystems | +1.2% | Europe, North America | Short to Mid-term (2025-2030) |

Wealth Management Platform Market Challenges Impact Analysis

The Wealth Management Platform market faces several critical challenges that demand strategic navigation. The escalating threat of cybersecurity breaches remains a paramount concern. As platforms become more interconnected and handle vast amounts of sensitive financial data, they become prime targets for cybercriminals. Mitigating these risks requires continuous investment in advanced security infrastructure, robust data encryption, and proactive threat intelligence, placing a significant financial and operational burden on platform providers and wealth management firms. Failure to adequately address cybersecurity can lead to severe reputational damage and regulatory penalties, impacting market trust and adoption.

Another key challenge is the rapid pace of technological innovation. Keeping wealth management platforms agile and relevant in an environment where new technologies (like advanced AI, quantum computing, and decentralized finance) emerge frequently requires significant research and development investments. This constant need to innovate can strain resources, particularly for smaller players, and create a gap between cutting-edge capabilities and widespread adoption. Additionally, attracting and retaining skilled talent capable of developing, implementing, and managing these complex platforms, particularly those proficient in specialized areas like data science and cybersecurity, is a persistent challenge that can hinder market growth and efficiency.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intensifying Cybersecurity Threats and Data Breaches | -2.0% | Global | Long-term (2025-2033) |

| Rapid Pace of Technological Change and Obsolescence | -1.7% | Global | Mid to Long-term (2027-2033) |

| Shortage of Skilled Talent in FinTech and Data Science | -1.4% | Global, particularly developed markets | Long-term (2025-2033) |

| Building and Maintaining Client Trust in Automated Systems | -1.0% | Global | Short to Mid-term (2025-2030) |

| Interoperability and Integration with Diverse Legacy Systems | -0.9% | Global, particularly large financial institutions | Mid-term (2027-2033) |

Wealth Management Platform Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Wealth Management Platform market, covering current trends, growth drivers, restraints, opportunities, and challenges across various segments and key regions. The scope encompasses detailed quantitative analysis of market size, historical performance, and future projections, offering a strategic overview for stakeholders. It also includes qualitative insights into the impact of emerging technologies like Artificial Intelligence, along with a thorough examination of the competitive landscape and profiles of major industry players, designed to aid decision-making for market entry, expansion, and investment strategies.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 6.2 billion |

| Market Forecast in 2033 | USD 19.8 billion |

| Growth Rate | 14.5% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Platform Innovations Group, Digital Wealth Solutions Inc., Global FinTech Systems, AdvisorTech Innovations, ClientFirst Platforms, Horizon Wealth Systems, NexGen Advisory Solutions, Apex Financial Technologies, Stellar Wealth Software, Visionary Capital Platforms, Quantum Financial Tech, Synapse Wealth Management, Unified Advisory Solutions, Precision Portfolio Systems, Sentinel Financial Platforms, Innovate Wealth Cloud, Elite Advisor Solutions, FutureProof Financials, Dynamic Wealth Tools, Comprehensive Wealth Tech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Wealth Management Platform market is intricately segmented to provide a granular understanding of its diverse components, deployment methods, end-user applications, and advisory models. This comprehensive segmentation allows for a detailed analysis of market dynamics, identifying specific areas of growth and opportunity. Each segment reflects unique demands and technological preferences, contributing to the overall market landscape. Understanding these distinctions is crucial for market players to tailor their offerings and strategic approaches effectively, addressing the varied needs across the wealth management ecosystem.

The segmentation further highlights the industry's shift towards more specialized solutions, from distinct software modules for financial planning and risk management to comprehensive integrated platforms. The growing preference for cloud-based deployment underscores the demand for scalability and accessibility, while the breakdown by end-user illustrates the varying technological maturity and adoption rates across different types of financial institutions. The analysis of advisory models, particularly the rise of hybrid approaches, indicates a blend of human expertise with technological efficiency, catering to a broader spectrum of client preferences.

- By Component: This segment includes the core software offerings and the accompanying services essential for platform operation.

- Software: Covers dedicated Platform Solutions, Customer Relationship Management (CRM), Portfolio Management, Reporting & Analytics, Financial Planning, and Risk Management & Compliance tools.

- Services: Encompasses Consulting Services for implementation strategies, Integration Services for seamless connectivity with existing systems, and ongoing Support & Maintenance Services.

- By Deployment: Differentiates how platforms are hosted and accessed.

- Cloud-based: Includes SaaS (Software as a Service) models, offering flexibility, scalability, and remote access.

- On-premises: Refers to software installed and run locally on the client's own servers, typically chosen for maximum control over data and customization.

- By End-user: Categorizes the primary beneficiaries and users of these platforms.

- Banks: Large financial institutions leveraging platforms for their wealth divisions.

- Wealth Management Firms: Specialized firms focused exclusively on wealth advisory.

- Investment Management Firms: Companies primarily managing investment portfolios.

- Robo-Advisors: Fully automated platforms providing algorithm-driven financial advice.

- Others: Includes Family Offices, Broker-Dealers, and Mutual Funds that utilize wealth management technologies.

- By Advisory Model: Defines the approach to client interaction and advice delivery.

- Human Advisory: Traditional model where human advisors provide personalized guidance.

- Robo-Advisory: Automated, digital-only advice based on algorithms.

- Hybrid Advisory: A combination of human advice augmented by technology and automated tools.

Regional Highlights

- North America: This region dominates the Wealth Management Platform market, primarily driven by a mature financial services industry, high adoption rates of advanced technologies, and a significant presence of high-net-worth individuals. The United States and Canada are at the forefront of innovation, with strong venture capital investments in FinTech and a readiness among wealth management firms to integrate AI and cloud-based solutions. Robust regulatory frameworks and a competitive landscape further accelerate market development.

- Europe: Characterized by diverse regulatory environments (e.g., MiFID II, GDPR), Europe is witnessing strong growth in wealth management platforms, particularly in countries like the UK, Germany, and Switzerland. The region emphasizes compliance, data security, and the adoption of Open Banking initiatives, which drive demand for integrated and secure platform solutions. Hybrid advisory models and ESG investing capabilities are gaining significant traction.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid wealth creation, an expanding middle class, and increasing digital literacy across countries like China, India, Singapore, and Australia. While nascent in some areas, the region presents immense opportunities for new entrants and localized platform solutions catering to diverse cultural and regulatory nuances. Digitalization of financial services is a key driver, alongside the emergence of robo-advisors.

- Latin America: This region is an emerging market for wealth management platforms, characterized by growing internet penetration, a rising affluent population, and increasing efforts towards financial inclusion. Brazil and Mexico lead in adopting digital financial solutions, though challenges like economic volatility and regulatory inconsistencies remain. Opportunities exist for scalable, cost-effective cloud-based platforms.

- Middle East and Africa (MEA): The MEA region is experiencing gradual adoption, driven by sovereign wealth funds, a concentration of high-net-worth individuals in certain countries, and government initiatives promoting financial technology. While still developing, the market shows potential for growth, particularly in areas like Saudi Arabia, UAE, and South Africa, as financial institutions modernize their offerings and seek greater efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wealth Management Platform Market.- Platform Innovations Group

- Digital Wealth Solutions Inc.

- Global FinTech Systems

- AdvisorTech Innovations

- ClientFirst Platforms

- Horizon Wealth Systems

- NexGen Advisory Solutions

- Apex Financial Technologies

- Stellar Wealth Software

- Visionary Capital Platforms

- Quantum Financial Tech

- Synapse Wealth Management

- Unified Advisory Solutions

- Precision Portfolio Systems

- Sentinel Financial Platforms

- Innovate Wealth Cloud

- Elite Advisor Solutions

- FutureProof Financials

- Dynamic Wealth Tools

- Comprehensive Wealth Tech

Frequently Asked Questions

What is a wealth management platform?

A wealth management platform is an integrated software solution designed to help financial advisors and wealth managers efficiently manage client portfolios, provide personalized financial advice, and streamline various operational processes. These platforms typically include functionalities such as portfolio management, financial planning, client relationship management (CRM), risk assessment, performance reporting, and compliance monitoring, often leveraging technologies like AI and cloud computing.

Who uses wealth management platforms?

Wealth management platforms are primarily utilized by a diverse range of financial entities including traditional banks, specialized wealth management firms, independent financial advisors, investment management companies, and emerging robo-advisory services. They are also increasingly adopted by family offices and brokerage firms seeking to centralize client data, automate tasks, and enhance the overall client experience.

How do these platforms benefit clients and advisors?

For clients, these platforms offer enhanced transparency into their investments, personalized financial plans, convenient digital access to their portfolios, and often lower costs through automation. For advisors, benefits include improved operational efficiency, reduced administrative burden, better client relationship management, data-driven insights for more informed decision-making, and the ability to scale their services and focus on high-value advisory tasks.

What role does AI play in wealth management platforms?

Artificial Intelligence (AI) plays a transformative role by enabling advanced analytics, predictive modeling for market trends and client behavior, automated portfolio management (robo-advisory), hyper-personalization of financial advice, and enhanced compliance checks. AI also powers intelligent chatbots for client support, improves fraud detection, and streamlines back-office operations, significantly boosting efficiency and decision-making capabilities.

What are the key considerations when choosing a wealth management platform?

Key considerations include the platform's scalability to accommodate growth, its integration capabilities with existing systems, robust data security and privacy features, the level of customization offered, the user experience for both advisors and clients, and the total cost of ownership (TCO) including implementation and ongoing support. Additionally, evaluating the vendor's reputation, innovation roadmap, and compliance with relevant financial regulations is crucial.