Waste to Energy Market

Waste to Energy Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702881 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Waste to Energy Market Size

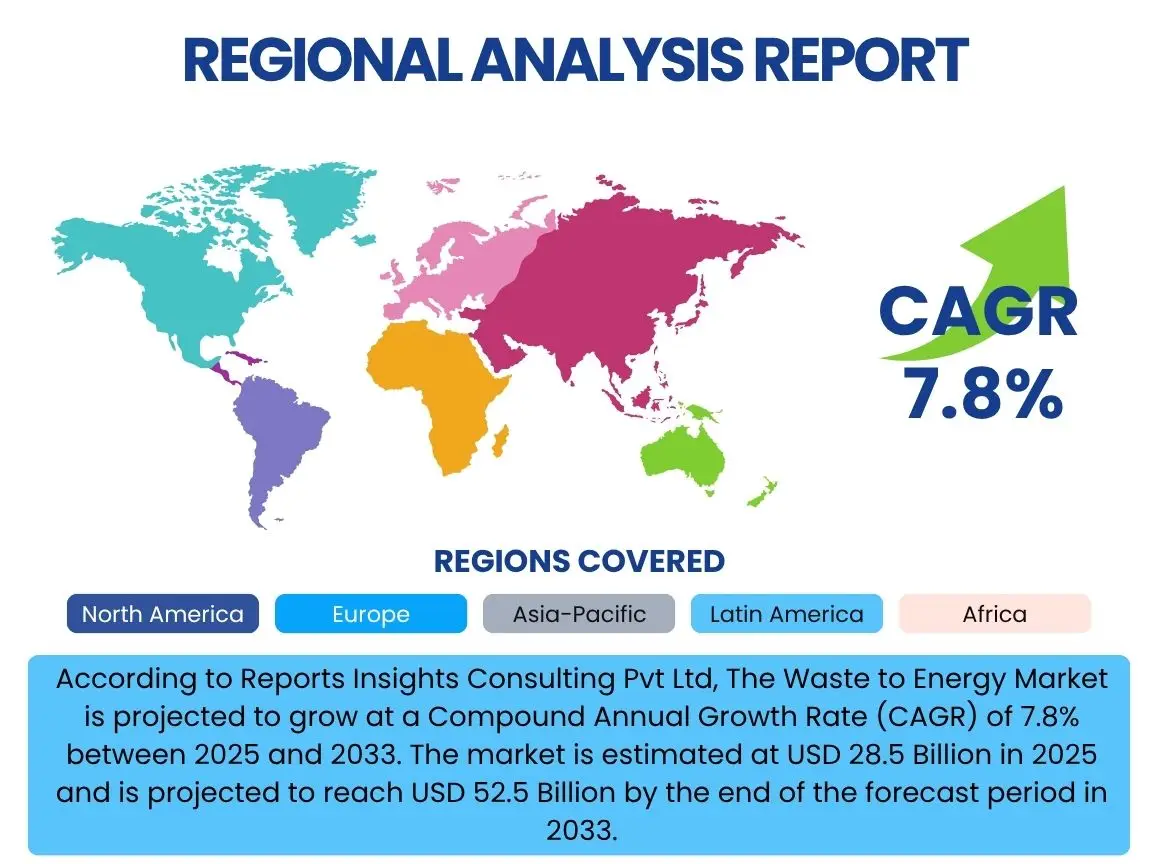

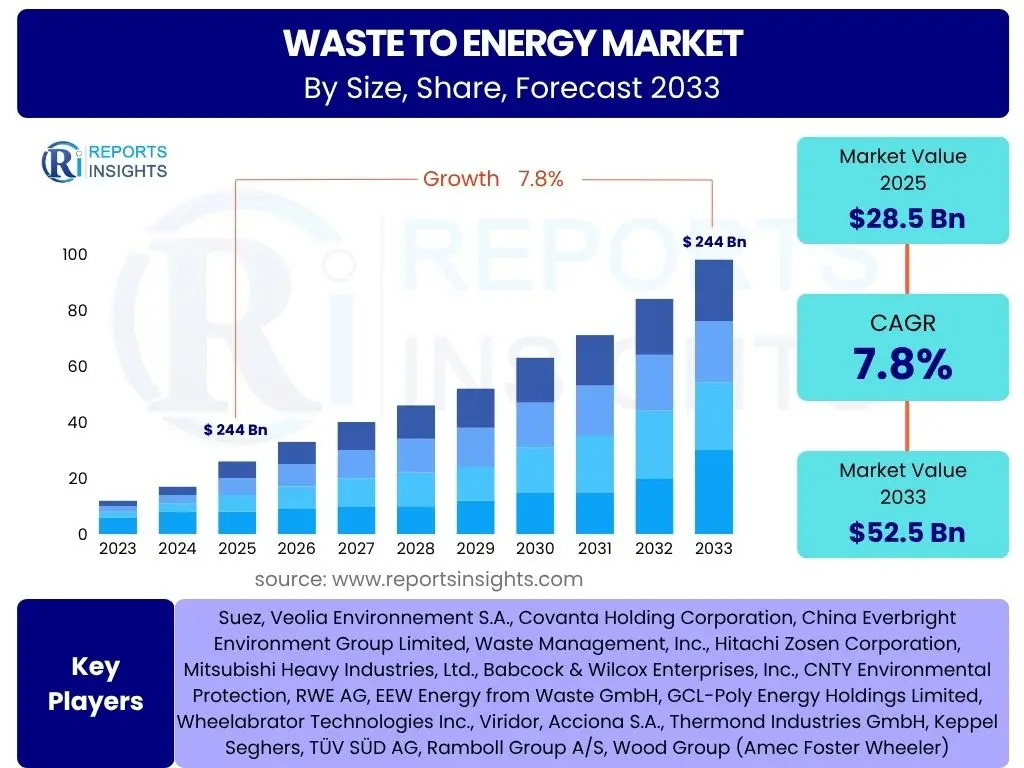

According to Reports Insights Consulting Pvt Ltd, The Waste to Energy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033. The market is estimated at USD 28.5 Billion in 2025 and is projected to reach USD 52.5 Billion by the end of the forecast period in 2033.

Key Waste to Energy Market Trends & Insights

The Waste to Energy (WtE) market is currently experiencing a transformative phase driven by a confluence of environmental imperatives, energy security concerns, and technological advancements. User inquiries frequently highlight the increasing global waste generation as a primary catalyst, compelling governments and industries to seek sustainable disposal methods beyond traditional landfills. This widespread interest underscores a growing recognition of waste not merely as a liability but as a valuable resource for energy recovery.

Another prominent area of user interest revolves around the accelerating adoption of advanced thermal and biological technologies. Beyond conventional incineration, there is significant curiosity regarding the viability and efficiency of gasification, pyrolysis, and anaerobic digestion in maximizing energy yield and minimizing environmental impact. The integration of WtE solutions into broader circular economy frameworks, focusing on resource efficiency and material recovery, is also a frequently discussed trend, signaling a shift towards holistic waste management strategies that prioritize value extraction over simple disposal.

Furthermore, the market's trajectory is heavily influenced by evolving regulatory landscapes and increasing investments in renewable energy infrastructure. Users often inquire about specific government incentives, carbon pricing mechanisms, and international climate agreements that are shaping WtE project development. The drive for energy independence and the reduction of greenhouse gas emissions are critical underlying forces, positioning Waste to Energy as a vital component of future sustainable energy portfolios.

- Shift towards advanced thermal technologies like gasification and pyrolysis for higher efficiency and lower emissions.

- Increased integration of WtE facilities within circular economy models, emphasizing resource recovery and material recycling.

- Growing focus on decentralized WtE solutions to manage waste locally and generate energy closer to demand centers.

- Rising investments in carbon capture, utilization, and storage (CCUS) technologies for WtE plants to reduce carbon footprint.

- Development of hybrid WtE systems combining different technologies for optimized energy output and waste processing flexibility.

- Enhanced policy support and regulatory frameworks promoting waste diversion from landfills and incentivizing WtE projects.

- Emergence of advanced analytics and IoT for predictive maintenance and operational optimization in WtE plants.

- Expansion into new waste streams, including challenging industrial and agricultural wastes, beyond municipal solid waste.

AI Impact Analysis on Waste to Energy

User questions concerning the impact of Artificial Intelligence (AI) on the Waste to Energy sector frequently center on its potential to revolutionize operational efficiency, predictive maintenance, and waste stream optimization. There is significant interest in how AI algorithms can enhance the consistency and quality of energy output from WtE plants by precisely monitoring and adjusting combustion parameters or biological processes. Users are keen to understand if AI can make WtE facilities more resilient, cost-effective, and environmentally compliant, particularly in managing the variability inherent in waste feedstock.

Another key theme in user inquiries pertains to AI's role in the upstream process of waste management, specifically in sorting, segregation, and quality control of incoming waste. The expectation is that AI-powered vision systems and robotics can dramatically improve the purity and consistency of waste input for WtE facilities, thereby increasing energy conversion efficiency and reducing operational downtime. This level of precision is seen as critical for making WtE a more predictable and economically attractive investment.

Furthermore, users are exploring AI's capacity for strategic planning and forecasting within the WtE domain. This includes using AI for predicting waste generation patterns, optimizing logistics for waste collection and transport, and even modeling the environmental impact of various WtE technologies under different scenarios. The consensus is that AI offers a powerful toolset for navigating the complex challenges of waste management and energy production, leading to more sustainable and profitable outcomes for the sector.

- Enhanced operational efficiency through AI-driven process optimization and real-time monitoring of WtE plants.

- Predictive maintenance for critical equipment, reducing downtime and operational costs by anticipating failures.

- Optimized waste sorting and feedstock quality control using AI-powered vision systems and robotics, improving energy conversion.

- Improved energy output consistency and quality through AI algorithms that adjust combustion parameters based on waste composition.

- Advanced data analytics for waste generation forecasting, logistics optimization, and resource allocation in waste collection.

- Development of intelligent control systems for anaerobic digesters and gasifiers to maximize biogas or syngas production.

- Simulation and modeling of environmental impacts, allowing for proactive mitigation strategies and regulatory compliance.

- Autonomous fault detection and diagnostics, leading to quicker resolutions and safer operating conditions.

Key Takeaways Waste to Energy Market Size & Forecast

Analyzing common user questions about the Waste to Energy market size and forecast reveals a strong emphasis on understanding the growth trajectory, the primary drivers behind this expansion, and the regions poised for significant development. Users are keen to grasp the investment potential within the sector, recognizing its dual benefit of waste management and renewable energy generation. The consistent inquiry about the Compound Annual Growth Rate (CAGR) and projected market values underscores a strategic interest in long-term market viability and profitability, reflecting a move towards sustainable infrastructure investments.

A recurring theme in user queries is the impact of global sustainability goals and stringent environmental regulations on the market's growth. There's a clear understanding that increasing waste volumes, coupled with a societal push for reduced landfill dependence and a shift towards cleaner energy sources, are fundamental accelerators. Users are particularly interested in how technological advancements are contributing to the efficiency and economic attractiveness of Waste to Energy solutions, moving beyond traditional combustion methods to more sophisticated conversion processes.

Furthermore, the geographic distribution of market growth is a significant point of interest, with many questions focusing on which regions or countries are leading in WtE adoption and investment. This regional perspective highlights the varying levels of waste management infrastructure and energy needs across different parts of the world. Overall, the key takeaway is a market on a robust growth path, driven by a global commitment to environmental stewardship, energy security, and continuous innovation in waste conversion technologies.

- The Waste to Energy market is poised for substantial growth, driven by increasing global waste generation and escalating demand for renewable energy.

- Significant investment opportunities exist, particularly in regions with developing waste management infrastructure and strong governmental support for sustainable solutions.

- Technological innovation, including advanced gasification, pyrolysis, and anaerobic digestion, is enhancing the efficiency and environmental performance of WtE facilities.

- Government policies, regulatory frameworks, and financial incentives are crucial in accelerating market adoption and project development.

- The market's expansion is intrinsically linked to global efforts to reduce landfill volumes, mitigate climate change, and promote a circular economy.

Waste to Energy Market Drivers Analysis

The Waste to Energy market's expansion is propelled by several critical drivers that collectively address both environmental imperatives and energy demands. A primary driver is the alarming increase in global waste generation, particularly municipal solid waste, which necessitates advanced and sustainable disposal alternatives to traditional landfilling. As urban populations grow and consumption patterns intensify, the sheer volume of waste overwhelms existing infrastructure, creating an urgent need for efficient waste management solutions that can also yield value.

Another significant factor is the escalating global demand for clean and renewable energy sources. With growing concerns about climate change and the depletion of fossil fuels, Waste to Energy offers a dual benefit: it manages waste while simultaneously contributing to energy security and reducing greenhouse gas emissions. Governments worldwide are implementing supportive policies, subsidies, and renewable energy mandates that specifically incentivize the development and operation of WtE plants, making these projects more economically viable and attractive to investors.

Furthermore, continuous technological advancements play a crucial role in driving market growth. Innovations in thermal conversion processes, such as gasification and pyrolysis, along with advancements in anaerobic digestion and other biological treatments, have significantly improved the efficiency, environmental performance, and overall economic attractiveness of WtE facilities. These technological leaps are enabling the processing of diverse waste streams more effectively, expanding the potential feedstock for energy generation and diversifying the market's capabilities.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Waste Generation | +2.1% | Asia Pacific, Africa, Latin America | Short to Mid-term (2025-2030) |

| Rising Demand for Renewable Energy | +1.8% | Europe, North America, Asia Pacific | Mid to Long-term (2025-2033) |

| Supportive Government Policies & Regulations | +1.5% | Europe, China, India, Southeast Asia | Short to Mid-term (2025-2030) |

| Technological Advancements in WtE Processes | +1.3% | Global, particularly developed economies | Mid to Long-term (2025-2033) |

| Focus on Circular Economy and Waste Diversion | +1.1% | Europe, North America, Japan | Mid to Long-term (2025-2033) |

Waste to Energy Market Restraints Analysis

Despite its significant potential, the Waste to Energy market faces several notable restraints that can hinder its growth and adoption. One of the most prominent challenges is the high capital expenditure required for establishing WtE facilities. Building and equipping these plants involves substantial upfront investment in advanced technologies, infrastructure, and environmental control systems, which can be a significant barrier, especially for developing economies or smaller private entities without access to large-scale financing.

Public perception and social acceptance often present another formidable restraint. Concerns regarding air emissions, ash disposal, and potential health impacts, even if scientifically unfounded or mitigated by modern technologies, can lead to strong community opposition (NIMBY - Not In My Backyard) against the siting of WtE plants. Overcoming these negative perceptions requires extensive public engagement, transparent communication, and demonstration of stringent environmental compliance, which can be time-consuming and costly for project developers.

Furthermore, competition from alternative waste management solutions, such as recycling, composting, and landfilling (especially in regions where landfill space is still abundant and inexpensive), poses a significant challenge. The economic viability of WtE projects can be undermined if competing waste disposal methods offer lower costs, even if they are less environmentally sustainable. Additionally, securing a consistent and high-quality feedstock of waste can be unpredictable, as waste composition varies significantly, impacting the efficiency and profitability of WtE operations.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Investment and Project Costs | -1.9% | Global, particularly developing nations | Short to Mid-term (2025-2030) |

| Public Opposition and NIMBYism | -1.5% | North America, Europe, Australia | Short to Mid-term (2025-2030) |

| Competition from Other Waste Management Solutions | -1.2% | Regions with cheap landfilling (e.g., USA, some parts of Africa) | Mid-term (2025-2030) |

| Stringent Environmental Regulations & Permitting | -1.0% | Europe, North America, Japan | Short-term (2025-2027) |

| Fluctuating Waste Composition and Supply | -0.8% | Global | Ongoing |

Waste to Energy Market Opportunities Analysis

The Waste to Energy market is ripe with opportunities driven by an evolving global perspective on waste and energy. A significant opportunity lies in the burgeoning waste generation rates in emerging economies, particularly across Asia Pacific, Latin America, and Africa. These regions often lack adequate waste management infrastructure, leading to severe environmental and public health issues. The growing economic development and urbanization in these areas present a vast untapped potential for establishing new WtE facilities that can address waste crises while simultaneously contributing to local energy grids.

Furthermore, advancements in WtE technologies offer new avenues for growth. The development of more efficient, lower-emission conversion processes like advanced gasification, pyrolysis, and supercritical water oxidation, alongside innovative biological treatments, creates opportunities to process a wider variety of waste streams more effectively. This technological evolution allows for higher energy recovery rates, production of valuable by-products (e.g., syngas, chemicals, biofuels), and reduced environmental footprint, making WtE projects more attractive and profitable.

The increasing global emphasis on circular economy principles also presents a substantial opportunity. Integrating WtE facilities with broader waste management strategies that prioritize recycling and material recovery can enhance their overall value proposition. Opportunities exist in developing integrated waste-to-resource parks, where WtE plants co-exist with recycling facilities, potentially utilizing residual waste from recycling for energy and providing heat/power back to the recycling operations. Additionally, the potential for carbon capture, utilization, and storage (CCUS) in WtE plants opens doors for negative emissions technologies, aligning with long-term climate goals and creating new revenue streams.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Untapped Potential in Emerging Economies | +1.7% | Asia Pacific, Latin America, Africa | Mid to Long-term (2026-2033) |

| Advancements in WtE Technologies | +1.4% | Global | Mid to Long-term (2025-2033) |

| Integration with Circular Economy Concepts | +1.1% | Europe, Japan, North America | Mid to Long-term (2025-2033) |

| Development of Biofuels & Chemicals from Waste | +0.9% | North America, Europe, China | Long-term (2028-2033) |

| Demand for Decentralized & Smaller-Scale WtE | +0.8% | Remote areas, islands, developing countries | Mid-term (2025-2030) |

Waste to Energy Market Challenges Impact Analysis

The Waste to Energy market, while promising, grapples with several significant challenges that can impede its growth and widespread adoption. One key challenge is the complexity and cost of securing project financing. WtE projects typically require substantial upfront capital, and securing loans or attracting investors can be difficult due to perceived risks associated with long project timelines, regulatory uncertainties, and the fluctuating nature of waste feedstock. This financial hurdle often delays or prevents projects from moving forward, particularly in regions with less mature financial markets.

Another major challenge revolves around public perception and the "Not In My Backyard" (NIMBY) phenomenon. Despite modern WtE plants employing advanced emission control technologies, historical misconceptions about incineration and concerns about air pollution, odor, and heavy metal residues persist. Overcoming this public skepticism requires extensive community engagement, transparent environmental impact assessments, and robust public education campaigns, which add to project timelines and costs and can lead to significant delays or even outright project cancellations.

Furthermore, the inconsistent quality and quantity of waste feedstock present an operational challenge. Waste composition varies significantly by region, season, and socioeconomic factors, impacting the calorific value and suitability for energy conversion. Ensuring a stable and predictable supply of suitable waste, coupled with the need for pre-treatment processes (like sorting and shredding) to optimize energy recovery, adds complexity and operational costs. Additionally, the disposal of residues, such as bottom ash and fly ash, requires careful management to prevent secondary environmental pollution, posing another regulatory and logistical hurdle for WtE operators.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Difficulty in Project Financing and High CAPEX | -1.8% | Global, especially emerging markets | Short to Mid-term (2025-2030) |

| Negative Public Perception and Social Acceptance | -1.6% | Developed economies (Europe, North America) | Short to Mid-term (2025-2030) |

| Inconsistent Waste Feedstock Quality and Supply | -1.3% | Global | Ongoing |

| Management and Disposal of Residues (Ash) | -1.0% | Europe, Japan (strict regulations) | Ongoing |

| Regulatory Hurdles and Lengthy Permitting Processes | -0.7% | Global | Short-term (2025-2027) |

Waste to Energy Market - Updated Report Scope

This report provides a comprehensive analysis of the global Waste to Energy market, encompassing a detailed examination of its size, growth trends, key drivers, restraints, opportunities, and challenges. It covers the market landscape across various technologies, waste types, applications, and end-use sectors, offering deep insights into regional dynamics and the competitive environment. The scope includes historical data, current market estimations, and future projections, aiming to equip stakeholders with essential information for strategic decision-making and investment planning in the Waste to Energy sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 52.5 Billion |

| Growth Rate | 7.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Suez, Veolia Environnement S.A., Covanta Holding Corporation, China Everbright Environment Group Limited, Waste Management, Inc., Hitachi Zosen Corporation, Mitsubishi Heavy Industries, Ltd., Babcock & Wilcox Enterprises, Inc., CNTY Environmental Protection, RWE AG, EEW Energy from Waste GmbH, GCL-Poly Energy Holdings Limited, Wheelabrator Technologies Inc., Viridor, Acciona S.A., Thermond Industries GmbH, Keppel Seghers, TÜV SÜD AG, Ramboll Group A/S, Wood Group (Amec Foster Wheeler) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Waste to Energy market is comprehensively segmented to provide granular insights into its diverse components, reflecting the various technological approaches, waste feedstock types, energy applications, and end-user demands that drive its expansion. This segmentation helps in understanding the specific market dynamics within each category, enabling stakeholders to identify niche opportunities and tailor strategies effectively. The technological segmentation, for instance, highlights the dominance of established methods like incineration while also showcasing the rapid growth and innovation in advanced thermal and biological conversion processes.

Further analysis by waste type provides critical insights into the market's capacity to handle different forms of waste, from ubiquitous municipal solid waste to specialized industrial, agricultural, and hazardous streams. This is crucial for project developers aiming to address specific regional waste challenges. The application and end-use segmentations clarify how the generated energy is utilized, whether for power, heat, or combined heat and power, and who the primary beneficiaries are, ranging from large-scale utilities to industrial and commercial consumers, underpinning the versatility of WtE solutions in meeting varied energy needs.

- Technology

- Incineration/Combustion: Traditional and widely adopted method for high-volume waste processing and power generation.

- Gasification: Converts waste into syngas, offering higher efficiency and lower emissions than direct combustion.

- Pyrolysis: Thermally decomposes waste in the absence of oxygen to produce bio-oil, char, and syngas.

- Anaerobic Digestion: Biological process converting organic waste into biogas, suitable for wet organic streams.

- Fermentation: Biochemical process yielding ethanol or other valuable chemicals from organic waste.

- Others: Including hydrothermal carbonization, plasma gasification, and advanced biological treatments.

- Waste Type

- Municipal Solid Waste (MSW): Primary feedstock for most WtE plants, driven by increasing urban waste.

- Industrial Waste: Diverse waste streams from manufacturing, often with higher calorific value.

- Agricultural Waste: Biomass from farming, offering significant potential in rural areas.

- Biomass: Dedicated energy crops and organic residues.

- Hazardous Waste: Specialized WtE for safe disposal of toxic materials.

- Application

- Power Generation: Conversion of waste energy into electricity for grid supply.

- Heat Generation: Production of steam or hot water for industrial processes or district heating.

- Combined Heat & Power (CHP): Simultaneous generation of electricity and useful heat, maximizing efficiency.

- Transportation Fuels: Conversion of waste to biofuels (e.g., ethanol, biodiesel).

- Chemicals/Syngas: Production of synthetic gas or other chemicals as raw materials for industry.

- End-Use

- Utilities: Large-scale power and heat supply to public grids.

- Industrial: Dedicated energy supply for manufacturing and industrial processes.

- Commercial: Energy provision for commercial buildings and complexes.

- Residential: District heating or power supply to residential areas.

Regional Highlights

- Europe: A mature and leading market for Waste to Energy, driven by stringent environmental regulations, limited landfill space, and strong renewable energy targets. Countries like Germany, Sweden, Denmark, and the Netherlands have high rates of waste diversion to WtE facilities. The region focuses on advanced thermal technologies, high energy recovery efficiency, and integrating WtE into circular economy frameworks, with increasing interest in carbon capture.

- North America: Experiencing renewed interest and growth, particularly in the United States and Canada, propelled by the need for sustainable waste management solutions and energy diversification. While historically reliant on landfills, rising costs and environmental pressures are pushing for increased adoption of WtE. Technological upgrades to existing plants and development of new projects, often with community engagement and emphasis on reducing landfill dependence, are key trends.

- Asia Pacific (APAC): The fastest-growing market due to rapid urbanization, immense population growth, and escalating waste generation across countries like China, India, Japan, South Korea, and Southeast Asian nations. Governments are actively promoting WtE as a critical solution for urban waste crises and energy security. Significant investments are being made in constructing new, large-scale WtE plants, often with international technological partnerships.

- Latin America: An emerging market with significant untapped potential, facing increasing waste volumes and inadequate disposal infrastructure. Countries such as Brazil, Mexico, and Argentina are beginning to explore WtE solutions, driven by environmental concerns and the need for new energy sources. Challenges include financing and political stability, but opportunities exist for small to medium-scale projects addressing local waste issues.

- Middle East and Africa (MEA): This region is at an nascent stage but poised for substantial growth, primarily due to rapid urbanization, increasing per capita waste generation, and ambitious diversification of energy portfolios away from fossil fuels. Government initiatives to develop sustainable cities and improve waste management infrastructure are creating significant opportunities for WtE projects, particularly in Gulf Cooperation Council (GCC) countries and parts of South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waste to Energy Market.- Suez

- Veolia Environnement S.A.

- Covanta Holding Corporation

- China Everbright Environment Group Limited

- Waste Management, Inc.

- Hitachi Zosen Corporation

- Mitsubishi Heavy Industries, Ltd.

- Babcock & Wilcox Enterprises, Inc.

- CNTY Environmental Protection

- RWE AG

- EEW Energy from Waste GmbH

- GCL-Poly Energy Holdings Limited

- Wheelabrator Technologies Inc.

- Viridor

- Acciona S.A.

- Thermond Industries GmbH

- Keppel Seghers

- TÜV SÜD AG

- Ramboll Group A/S

- Wood Group (Amec Foster Wheeler)

Frequently Asked Questions

Analyze common user questions about the Waste to Energy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Waste to Energy (WtE) and how does it work?

Waste to Energy (WtE) is a process of generating energy in the form of electricity or heat from the primary treatment of waste. It primarily involves thermal technologies like incineration, gasification, or pyrolysis, which convert non-recyclable waste materials into combustible gas, heat, or oil, subsequently used to produce steam for power generation or direct heating. Biological processes like anaerobic digestion also convert organic waste into biogas for energy.

What are the primary benefits of Waste to Energy technology?

WtE technology offers multiple benefits including significant reduction in landfill waste volume, generation of renewable energy, reduction of greenhouse gas emissions (compared to landfill methane), and recovery of valuable resources from waste. It provides a sustainable alternative to traditional waste disposal, contributing to both environmental protection and energy security goals.

Is Waste to Energy environmentally friendly?

Modern Waste to Energy facilities are designed with advanced emission control technologies to meet stringent environmental standards, significantly reducing pollutants compared to older incinerators. While they produce emissions, these are typically well-controlled. When viewed as part of an integrated waste management system that prioritizes recycling and composting, WtE plays a crucial role in reducing landfill methane, a potent greenhouse gas, and offsetting fossil fuel use.

What types of waste can be used for Waste to Energy?

Waste to Energy plants can process a wide variety of waste types, predominantly municipal solid waste (MSW), but also industrial waste, agricultural waste, and biomass. The suitability of waste depends on its calorific value and composition, with pre-treatment often required to optimize the energy conversion process and minimize harmful emissions.

What are the main challenges for the Waste to Energy market?

Key challenges for the WtE market include high upfront capital costs for plant construction, public perception issues leading to NIMBYism (Not In My Backyard) concerns, stringent environmental regulations requiring sophisticated emission control, and the challenge of securing consistent, high-quality waste feedstock. Effective waste sorting and management of residues like ash are also ongoing operational challenges.