Two wheeler Tire Market

Two wheeler Tire Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_706849 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

Two wheeler Tire Market Size

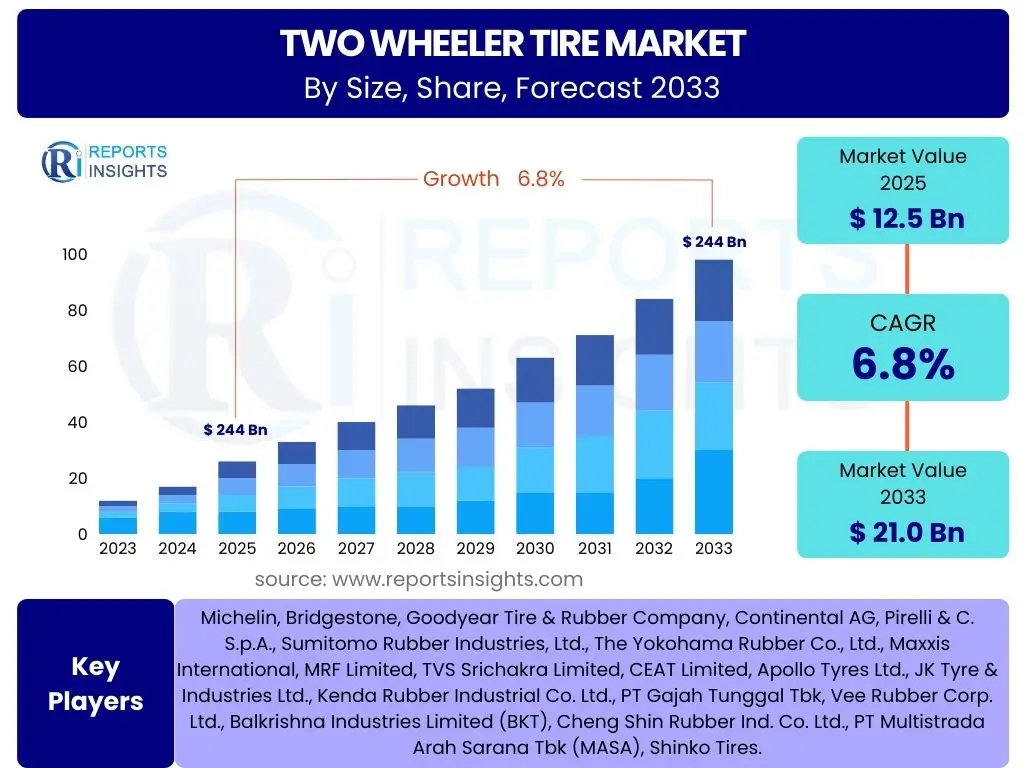

According to Reports Insights Consulting Pvt Ltd, The Two wheeler Tire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 12.5 billion in 2025 and is projected to reach USD 21.0 billion by the end of the forecast period in 2033.

Key Two wheeler Tire Market Trends & Insights

Common user questions regarding market trends frequently revolve around technological advancements, sustainability initiatives, and the impact of evolving consumer preferences. A significant trend is the increasing adoption of smart tire technologies, which integrate sensors to monitor pressure, temperature, and wear in real-time, providing crucial data for safety and performance optimization. This move towards intelligent tires is driven by a desire for enhanced rider safety and improved vehicle maintenance efficiency, appealing to both original equipment manufacturers (OEMs) and aftermarket consumers.

Another prominent trend is the growing emphasis on sustainable manufacturing practices and the development of eco-friendly tires. Consumers and regulators are increasingly demanding products that minimize environmental impact, leading manufacturers to invest in renewable materials, energy-efficient production processes, and tire recycling initiatives. This shift addresses environmental concerns while also opening new avenues for product differentiation and market leadership. The burgeoning market for electric two-wheelers is also influencing tire development, necessitating tires with different performance characteristics to handle higher torque, unique weight distribution, and extended range requirements.

- Integration of smart tire technologies for real-time monitoring and predictive maintenance.

- Increased focus on sustainable and eco-friendly tire materials and manufacturing processes.

- Development of specialized tires for electric two-wheelers addressing unique performance demands.

- Rising demand for high-performance and application-specific tires in premium segments.

- Expansion of aftermarket services driven by vehicle parc growth and DIY maintenance trends.

AI Impact Analysis on Two wheeler Tire

User inquiries about AI's impact on the two-wheeler tire market often explore its potential to revolutionize manufacturing, enhance product design, and optimize supply chain efficiencies. Artificial intelligence is increasingly being leveraged in the design and simulation phases, enabling engineers to predict tire performance under various conditions with greater accuracy and speed. This accelerates the R&D cycle, reduces prototype costs, and facilitates the development of innovative tire compounds and tread patterns that are more durable, fuel-efficient, and safer. AI-driven simulations can optimize material composition and structural integrity, leading to superior product outcomes.

Furthermore, AI is transforming manufacturing processes by enabling predictive maintenance for machinery, improving quality control through automated inspection systems, and optimizing production schedules for maximum output. In the realm of smart tires, AI algorithms analyze data from integrated sensors to provide riders with real-time insights into tire health, anticipate potential issues, and recommend optimal inflation pressures. This not only enhances rider safety but also extends tire lifespan and improves fuel economy. The logistical aspects of the tire industry, from raw material sourcing to distribution, are also benefiting from AI-powered analytics, leading to more resilient and efficient supply chains.

- Accelerated tire design and development through AI-driven simulations and material optimization.

- Enhanced manufacturing efficiency and quality control via AI-powered automation and predictive maintenance.

- Integration of AI in smart tires for advanced real-time performance monitoring and predictive analytics.

- Optimization of supply chain and logistics, improving inventory management and distribution networks.

- Personalization of tire recommendations and services based on rider behavior and environmental data.

Key Takeaways Two wheeler Tire Market Size & Forecast

Common user questions regarding key takeaways often seek a succinct understanding of the market's trajectory, its primary growth drivers, and the most significant areas for future development. The two-wheeler tire market is poised for robust expansion, driven primarily by the escalating demand for two-wheelers in emerging economies, increasing disposable incomes, and the continuous innovation in tire technology. The forecasted growth to USD 21.0 billion by 2033 underscores a healthy and dynamic market environment, indicating substantial opportunities for both established players and new entrants.

Technological advancements, particularly in smart and sustainable tire solutions, are critical to this growth, addressing evolving consumer expectations for safety, performance, and environmental responsibility. Moreover, the aftermarket segment continues to be a crucial revenue stream, fueled by the growing global two-wheeler parc and the necessity for regular tire replacements. Strategic emphasis on expanding manufacturing capacities in key growth regions and investing in R&D for next-generation tires will be pivotal for market participants aiming to capitalize on this upward trend.

- Significant market growth projected to USD 21.0 billion by 2033, demonstrating robust expansion.

- Strong demand from emerging economies and rising disposable incomes are primary growth catalysts.

- Technological innovation, especially in smart and eco-friendly tires, is crucial for market development.

- The aftermarket segment remains a dominant contributor to market revenue due to high replacement rates.

- Investment in R&D and manufacturing capacity expansion in key regions are essential for competitive advantage.

Two wheeler Tire Market Drivers Analysis

The global two-wheeler tire market is significantly propelled by several macro and microeconomic factors that collectively contribute to its robust growth. A primary driver is the rapid urbanization and increasing traffic congestion in developing countries, which positions two-wheelers as an affordable and efficient mode of personal transportation. This trend is amplified by the rising middle-class population and disposable incomes in regions like Asia Pacific, enabling more consumers to afford two-wheelers, thus directly stimulating the demand for new and replacement tires.

Furthermore, the booming e-commerce sector and the proliferation of last-mile delivery services have substantially increased the commercial utilization of two-wheelers, particularly in urban and semi-urban areas. This consistent commercial usage leads to higher mileage accumulation and faster tire wear, necessitating more frequent replacements. Additionally, government initiatives promoting two-wheeler ownership through subsidies or favorable policies, coupled with improvements in road infrastructure in various regions, further encourage vehicle sales and, consequently, tire demand.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Two-Wheeler Sales in Emerging Economies | +1.5% | Asia Pacific, Latin America, Africa | 2025-2033 |

| Rising Disposable Incomes and Urbanization | +1.2% | Global, particularly India, China, Southeast Asia | 2025-2033 |

| Growth of E-commerce and Last-Mile Delivery Services | +1.0% | Global, with high impact in dense urban areas | 2025-2033 |

| Technological Advancements in Tire Manufacturing | +0.8% | Global | 2025-2033 |

| Increasing Demand for Electric Two-Wheelers | +0.7% | Europe, China, India | 2027-2033 |

Two wheeler Tire Market Restraints Analysis

Despite robust growth prospects, the two-wheeler tire market faces several significant restraints that could impede its expansion. One of the primary concerns is the volatility in raw material prices, particularly for natural rubber and crude oil-derived synthetic rubbers. These fluctuations directly impact production costs, potentially leading to increased tire prices for consumers or reduced profit margins for manufacturers, which can dampen demand or investment in innovation.

Another notable restraint is the increasing stringency of environmental regulations and sustainability mandates globally. While these regulations promote eco-friendly practices, they also impose additional costs on manufacturers for research and development into sustainable materials and processes, as well as for compliance. This can sometimes translate into higher product costs or necessitate significant capital expenditure, particularly for smaller market players. Furthermore, intense competition among numerous domestic and international players often leads to price wars and compressed profit margins, especially in the highly fragmented aftermarket segment.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in Raw Material Prices (Rubber, Crude Oil) | -0.9% | Global | 2025-2033 |

| Stringent Environmental Regulations and Standards | -0.7% | Europe, North America, parts of Asia | 2025-2033 |

| Intense Competition and Price Sensitivity | -0.6% | Global, particularly emerging markets | 2025-2033 |

| Supply Chain Disruptions | -0.5% | Global | 2025-2028 |

| Shift Towards Shared Mobility Solutions | -0.4% | Developed Urban Areas | 2028-2033 |

Two wheeler Tire Market Opportunities Analysis

Significant opportunities exist within the two-wheeler tire market, driven by evolving technological landscapes and shifting consumer demands. One major avenue is the accelerated development and adoption of smart tires, which offer embedded sensors for real-time monitoring of tire pressure, temperature, and wear. These intelligent tires provide enhanced safety, improved fuel efficiency, and predictive maintenance capabilities, appealing to a growing segment of tech-savvy consumers and commercial fleet operators. Manufacturers investing in these advanced solutions can gain a significant competitive edge and unlock premium market segments.

Another substantial opportunity lies in the burgeoning market for electric two-wheelers, which requires specialized tires engineered to handle higher torque, unique weight distribution, and reduced rolling resistance for extended range. As global environmental consciousness increases and governments promote EV adoption, the demand for these purpose-built tires is set to surge. Furthermore, the expansion into untapped rural markets in developing countries, coupled with the rising demand for premium and performance-oriented tires in developed markets, presents diverse growth pathways. The focus on sustainable and recycled materials in tire manufacturing also creates new product lines and strengthens brand image for environmentally conscious consumers.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development and Adoption of Smart Tires | +1.3% | Global, particularly North America, Europe, China | 2026-2033 |

| Growing Market for Electric Two-Wheeler Tires | +1.1% | Europe, China, India, Southeast Asia | 2025-2033 |

| Focus on Sustainable and Eco-Friendly Tire Solutions | +0.9% | Global | 2025-2033 |

| Expansion into Untapped Rural and Semi-Urban Markets | +0.8% | Asia Pacific, Latin America, Africa | 2025-2033 |

| Increasing Demand for High-Performance and Premium Tires | +0.6% | Developed markets, premium segments globally | 2025-2033 |

Two wheeler Tire Market Challenges Impact Analysis

The two-wheeler tire market faces several critical challenges that require strategic responses from industry players. Counterfeit products represent a significant impediment, not only impacting legitimate manufacturers' revenues but also posing serious safety risks to riders due to substandard quality and lack of adherence to safety standards. The proliferation of fake tires erodes consumer trust and necessitates robust enforcement measures and consumer awareness campaigns. Moreover, managing complex global supply chains, often spanning multiple continents for raw materials and finished goods, presents a considerable logistical and economic challenge, especially in the face of geopolitical instability or natural disasters.

Rapid technological changes within the automotive industry, such as the shift towards electric vehicles and the integration of advanced vehicle systems, demand continuous and substantial investment in research and development for tire manufacturers. Adapting tire design and performance characteristics to meet these evolving vehicle specifications while maintaining cost-effectiveness is a persistent challenge. Furthermore, the inherent price sensitivity of consumers in mass-market segments, particularly in developing economies, restricts manufacturers' ability to pass on increased production costs or invest heavily in premium features, thereby necessitating a delicate balance between innovation, quality, and affordability.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Threat of Counterfeit Products | -0.8% | Global, particularly emerging markets | 2025-2033 |

| Managing Complex and Vulnerable Supply Chains | -0.7% | Global | 2025-2030 |

| High Research and Development Costs | -0.6% | Global | 2025-2033 |

| Consumer Price Sensitivity in Mass Market | -0.5% | Asia Pacific, Latin America | 2025-2033 |

| Adapting to Evolving Vehicle Technologies (e.g., EVs) | -0.4% | Global | 2025-2033 |

Two wheeler Tire Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the two-wheeler tire market, encompassing a detailed examination of market size, growth drivers, restraints, opportunities, and key trends. It offers strategic insights into market segmentation, regional dynamics, competitive landscape, and the impact of emerging technologies. The report aims to furnish stakeholders with actionable intelligence necessary for informed decision-making and strategic planning within the dynamic global two-wheeler tire industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 21.0 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Bridgestone, Goodyear Tire & Rubber Company, Continental AG, Pirelli & C. S.p.A., Sumitomo Rubber Industries, Ltd., The Yokohama Rubber Co., Ltd., Maxxis International, MRF Limited, TVS Srichakra Limited, CEAT Limited, Apollo Tyres Ltd., JK Tyre & Industries Ltd., Kenda Rubber Industrial Co. Ltd., PT Gajah Tunggal Tbk, Vee Rubber Corp. Ltd., Balkrishna Industries Limited (BKT), Cheng Shin Rubber Ind. Co. Ltd., PT Multistrada Arah Sarana Tbk (MASA), Shinko Tires. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The two-wheeler tire market is meticulously segmented to provide a granular understanding of its diverse components and drivers. This segmentation allows for precise analysis of consumer preferences, technological adoption patterns, and market dynamics across various categories. Understanding these segments is crucial for manufacturers to tailor their product offerings, marketing strategies, and distribution channels to effectively meet the specific demands of different end-users and vehicle types.

- By Vehicle Type: This segment includes motorcycles, scooters, mopeds, and the rapidly growing category of electric two-wheelers. Each vehicle type has distinct tire requirements based on performance, speed, load capacity, and intended use, influencing design and material choices.

- By Tire Type: Categorization into Bias Tires and Radial Tires reflects different construction methods, impacting ride comfort, handling, durability, and cost. Radial tires, offering superior performance and fuel efficiency, are gaining traction, especially in premium and high-performance segments.

- By End Use: This segment differentiates between Original Equipment Manufacturers (OEMs) and the Aftermarket. OEM sales are driven by new vehicle production, while the aftermarket, driven by replacement demand, represents a consistently larger and more stable revenue stream, influenced by vehicle parc size and average mileage.

- By Distribution Channel: This segment covers sales through OEM channels (for new vehicles), retail stores (independent tire shops, auto parts stores), and increasingly, online sales platforms. The rise of e-commerce offers significant opportunities for expanded reach and convenience for consumers.

Regional Highlights

- Asia Pacific (APAC): Dominates the global two-wheeler tire market, primarily due to the vast populations, high two-wheeler penetration, and rising disposable incomes in countries like India, China, Indonesia, and Vietnam. The region is a major manufacturing hub and experiences robust demand for both OEM and aftermarket tires.

- Europe: Characterized by a mature market with a focus on premium, high-performance, and increasingly, specialized tires for electric two-wheelers. Stringent environmental regulations and a strong emphasis on road safety standards influence product development and market trends.

- North America: Exhibits a stable market for two-wheeler tires, driven by a strong motorcycle culture, leisure riding, and a growing demand for performance-oriented and specialized tires. The adoption of smart tire technology and premium brands is notable in this region.

- Latin America: Presents a growing market with increasing two-wheeler sales, particularly in countries like Brazil and Mexico, fueled by urbanization and the need for affordable transportation. The aftermarket segment holds significant potential here.

- Middle East and Africa (MEA): Represents an emerging market with gradual growth, influenced by economic development, infrastructure improvements, and increasing adoption of two-wheelers for commuting and commercial purposes in select countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Two wheeler Tire Market.- Michelin

- Bridgestone

- Goodyear Tire & Rubber Company

- Continental AG

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries, Ltd.

- The Yokohama Rubber Co., Ltd.

- Maxxis International

- MRF Limited

- TVS Srichakra Limited

- CEAT Limited

- Apollo Tyres Ltd.

- JK Tyre & Industries Ltd.

- Kenda Rubber Industrial Co. Ltd.

- PT Gajah Tunggal Tbk

- Vee Rubber Corp. Ltd.

- Balkrishna Industries Limited (BKT)

- Cheng Shin Rubber Ind. Co. Ltd.

- PT Multistrada Arah Sarana Tbk (MASA)

- Shinko Tires

Frequently Asked Questions

Analyze common user questions about the Two wheeler Tire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the two-wheeler tire market?

The market's growth is primarily driven by increasing two-wheeler sales in emerging economies, rising disposable incomes, rapid urbanization, and the expanding e-commerce sector boosting last-mile delivery services. Technological advancements in tire manufacturing also play a significant role.

How is the adoption of electric two-wheelers impacting the tire market?

The surge in electric two-wheeler adoption creates a demand for specialized tires designed to handle higher torque, unique weight distribution, and lower rolling resistance for extended range, presenting a significant opportunity for manufacturers.

What are the key technological innovations expected in two-wheeler tires?

Key innovations include the integration of smart tire technologies for real-time monitoring of pressure, temperature, and wear, advancements in sustainable and eco-friendly material compositions, and the development of tires optimized for specific vehicle performance characteristics.

Which regions are expected to show the most significant growth in the two-wheeler tire market?

Asia Pacific, particularly countries like India, China, and Southeast Asian nations, is projected to exhibit the most significant growth due to high two-wheeler penetration, large populations, and increasing economic development.

What challenges does the two-wheeler tire market currently face?

Major challenges include volatility in raw material prices, the widespread issue of counterfeit products, increasing stringency of environmental regulations, intense market competition leading to price sensitivity, and the need for continuous investment in R&D to adapt to evolving vehicle technologies.