Tight Gas Market

Tight Gas Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700638 | Last Updated : July 26, 2025 |

Format : ![]()

![]()

![]()

![]()

Tight Gas Market Size

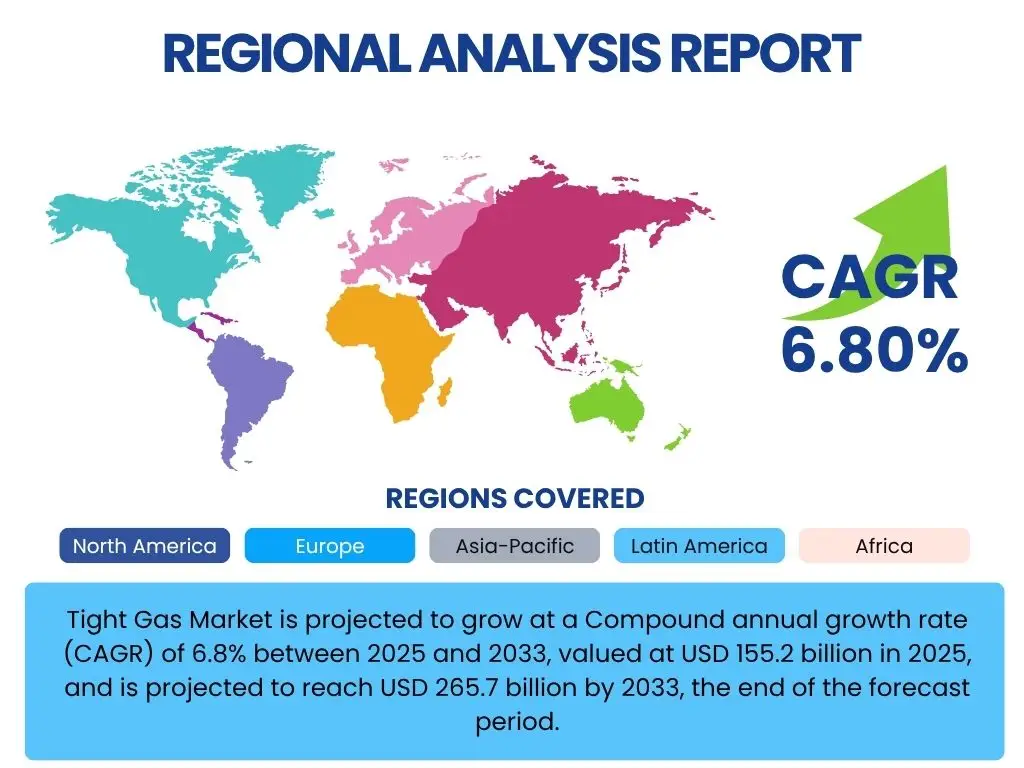

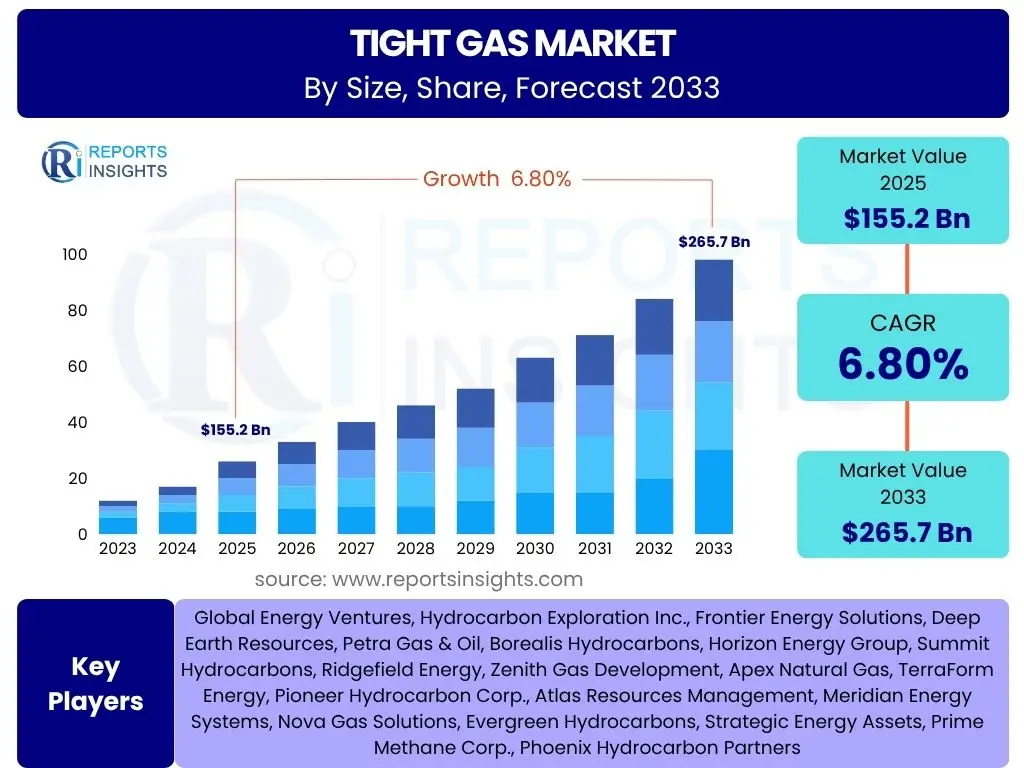

Tight Gas Market is projected to grow at a Compound annual growth rate (CAGR) of 6.8% between 2025 and 2033, valued at USD 155.2 billion in 2025, and is projected to reach USD 265.7 billion by 2033, the end of the forecast period.

Key Tight Gas Market Trends & Insights

The Tight Gas market is undergoing significant transformation driven by advancements in extraction technologies, evolving energy policies, and a global shift towards cleaner energy sources. These trends are shaping investment patterns, operational strategies, and market dynamics, pushing the industry towards greater efficiency and environmental considerations. The insights reflect a complex interplay of geological potential, technological innovation, and geopolitical factors.

- Advancements in horizontal drilling and hydraulic fracturing techniques enhancing recovery rates.

- Increased focus on carbon capture and storage (CCS) technologies to mitigate environmental impact.

- Growing demand for natural gas as a transitional fuel in the global energy mix.

- Regional shifts in production and consumption patterns, particularly in North America and Asia.

- Integration of digital technologies for optimizing exploration and production processes.

AI Impact Analysis on Tight Gas

Artificial Intelligence (AI) is set to revolutionize the Tight Gas sector by enhancing operational efficiencies, optimizing resource management, and improving safety protocols. AI-driven solutions are being deployed across the exploration, drilling, production, and maintenance phases, leading to significant cost reductions and increased productivity. The adoption of AI is still in its nascent stages for many operators but holds immense potential to unlock further value from challenging tight gas reservoirs.

- Enhanced seismic data interpretation for precise reservoir characterization.

- Predictive maintenance of drilling equipment, minimizing downtime and operational costs.

- Optimization of hydraulic fracturing fluid composition and pressure for maximized yield.

- Automated well control systems improving safety and operational stability.

- Real-time data analytics for informed decision-making in production forecasting.

Key Takeaways Tight Gas Market Size & Forecast

- The Tight Gas Market is poised for substantial growth, driven by technological advancements and energy transition imperatives.

- Forecasts indicate a robust CAGR of 6.8% from 2025 to 2033, reflecting sustained demand.

- Market valuation is projected to increase significantly, from USD 155.2 billion in 2025 to USD 265.7 billion by 2033.

- Technological innovations in extraction and processing are critical enablers for this growth.

- The market's expansion is intrinsically linked to global energy security needs and cleaner fuel initiatives.

Tight Gas Market Drivers Analysis

The Tight Gas market's expansion is propelled by several critical drivers that collectively enhance its viability and attractiveness as an energy source. These drivers range from technological breakthroughs that make extraction more economical to global energy policies prioritizing natural gas as a bridge fuel during the energy transition. The increasing global energy demand, coupled with advancements in drilling and completion techniques, has made previously inaccessible tight gas reserves commercially viable. Furthermore, geopolitical considerations and the quest for energy independence incentivize nations to develop their domestic tight gas resources, reducing reliance on volatile international markets. The lower carbon footprint of natural gas compared to coal and oil also positions tight gas favorably in the context of climate change mitigation efforts, stimulating further investment and development.

Technological innovation, particularly in horizontal drilling and multi-stage hydraulic fracturing, remains the foremost driver. These advancements have drastically improved recovery rates and reduced the cost of extracting gas from low-permeability reservoirs. This technical prowess allows for the economic development of vast tight gas resources that were once deemed uneconomical. Simultaneously, the global energy transition, which seeks to reduce reliance on more carbon-intensive fossil fuels, positions natural gas, including tight gas, as a cleaner-burning alternative for power generation and industrial processes. This increasing preference for natural gas over coal supports continued investment and consumption. Moreover, the imperative of energy security drives many nations to develop their indigenous energy resources, with tight gas playing a crucial role in diversifying national energy portfolios and mitigating risks associated with energy supply disruptions from external sources. These combined factors create a fertile ground for sustained market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Advancements in Extraction Technologies (e.g., Hydraulic Fracturing, Horizontal Drilling) | +2.5% | North America, Asia Pacific, Europe | Short to Medium Term (2025-2030) |

| Increasing Global Energy Demand, particularly for cleaner alternatives | +1.8% | Asia Pacific, Europe, Latin America | Medium to Long Term (2027-2033) |

| Government Policies and Incentives Supporting Natural Gas Development | +1.2% | North America, Middle East & Africa | Medium Term (2026-2031) |

| Focus on Energy Security and Diversification of Energy Mix | +0.8% | Europe, Asia Pacific, North America | Long Term (2028-2033) |

| Rising Price Competitiveness of Tight Gas vs. Other Fossil Fuels | +0.5% | Global | Short Term (2025-2028) |

Tight Gas Market Restraints Analysis

Despite significant growth prospects, the Tight Gas market faces several formidable restraints that could temper its expansion. Environmental concerns, primarily related to hydraulic fracturing and water usage, represent a significant challenge. Public perception and regulatory scrutiny surrounding these practices can lead to moratoria or outright bans in certain regions, limiting development. Furthermore, the inherent complexity and higher costs associated with tight gas extraction, compared to conventional gas, pose economic hurdles, particularly during periods of low natural gas prices. The capital-intensive nature of unconventional drilling also makes projects sensitive to fluctuating market conditions and investor confidence.

Regulatory hurdles and environmental activism are paramount restraints. Public opposition stemming from concerns about groundwater contamination, seismic activity, and greenhouse gas emissions associated with tight gas extraction often translates into stricter environmental regulations or outright bans on hydraulic fracturing. These regulatory uncertainties can deter investment and increase operational costs, affecting project viability. Moreover, the capital intensity of tight gas exploration and production, which requires significant upfront investment in specialized equipment and techniques, makes projects highly vulnerable to commodity price volatility. Periods of sustained low natural gas prices can render new tight gas developments uneconomical, leading to deferrals or cancellations of projects. Competition from alternative energy sources, including renewables and conventional gas, also acts as a restraint, as policy support and decreasing costs for renewables could shift investment away from fossil fuels, including tight gas. These factors collectively necessitate careful strategic planning and technological innovation to mitigate their impact.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Environmental Concerns and Regulatory Scrutiny (e.g., water usage, emissions) | -1.5% | Europe, North America (specific states/provinces), Australia | Medium to Long Term (2026-2033) |

| High Capital Costs and Operational Complexity of Extraction | -1.0% | Global | Short to Medium Term (2025-2030) |

| Volatility in Natural Gas Prices and Market Fluctuations | -0.8% | Global | Short Term (2025-2028) |

| Competition from Renewable Energy Sources and Other Conventional Gas Supplies | -0.7% | Europe, North America | Medium to Long Term (2027-2033) |

| Geological Challenges and Reservoir Heterogeneity | -0.5% | Asia Pacific, Europe | Long Term (2028-2033) |

Tight Gas Market Opportunities Analysis

Opportunities within the Tight Gas market are emerging from several strategic avenues, primarily driven by the ongoing global energy transition and the need for energy security. As nations seek to diversify their energy portfolios away from more carbon-intensive fuels, natural gas, including tight gas, is increasingly viewed as a crucial transitional energy source. This perspective creates opportunities for investment in new exploration and production activities, particularly in regions with significant untapped tight gas reserves. Furthermore, advancements in carbon capture, utilization, and storage (CCUS) technologies offer a pathway to reduce the environmental footprint of natural gas production, enhancing its long-term viability and acceptability. The development of integrated energy hubs that combine tight gas production with CCUS and renewable energy sources represents a novel opportunity to create more sustainable energy systems. The strategic importance of tight gas for energy independence also incentivizes governments to support its development through favorable policies and infrastructure investments, opening up new markets and facilitating supply chain enhancements.

A key opportunity lies in the continuous refinement of drilling and completion technologies. Further innovations in horizontal drilling, hydraulic fracturing, and enhanced oil and gas recovery techniques can unlock greater volumes of tight gas at lower costs and with reduced environmental impact, improving the economic attractiveness of tight gas projects. The expanding applications of natural gas beyond power generation, such as in the petrochemical industry, as a feedstock, or in liquefied natural gas (LNG) for international trade, also present significant growth opportunities. Developing infrastructure for LNG export, for example, can connect landlocked tight gas resources to global markets, boosting demand and price stability. Moreover, the integration of digital technologies, including AI, machine learning, and advanced analytics, offers avenues for optimizing the entire tight gas value chain, from seismic imaging and reservoir modeling to production optimization and predictive maintenance. These digital advancements can significantly enhance operational efficiency, reduce downtime, and improve safety, thereby maximizing returns on investment. Strategic collaborations and partnerships between technology providers, exploration and production companies, and governments can further accelerate the realization of these opportunities by pooling resources and expertise.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Further Technological Innovations in Enhanced Gas Recovery (EGR) and Smart Drilling | +1.8% | Global, particularly North America, China | Medium to Long Term (2027-2033) |

| Expansion of Liquefied Natural Gas (LNG) Infrastructure and Export Markets | +1.5% | North America, Australia, Russia, Middle East, Asia Pacific (importers) | Long Term (2028-2033) |

| Integration of Carbon Capture, Utilization, and Storage (CCUS) Technologies | +1.0% | Europe, North America, Middle East | Medium to Long Term (2026-2033) |

| Untapped Reserves in Emerging Regions with Favorable Geology and Policy | +0.8% | South America, Africa, Central Asia | Long Term (2029-2033) |

| Increasing Demand for Natural Gas as a Feedstock in Petrochemical Industry | +0.7% | Asia Pacific, Middle East | Medium Term (2026-2031) |

Tight Gas Market Challenges Impact Analysis

The Tight Gas market confronts several significant challenges that necessitate strategic mitigation to ensure sustained growth. High operational costs, especially in deeper and more complex reservoirs, continue to be a barrier, making profitability sensitive to natural gas price fluctuations. Environmental regulations, while necessary, often introduce complexity and additional costs, ranging from stringent water management requirements to methane emission controls. Social license to operate is also a growing challenge, with local community opposition and environmental activism impacting project timelines and public acceptance. Furthermore, the inherent geological complexities of tight gas reservoirs, characterized by low permeability and porosity, demand advanced and costly technologies for successful extraction, posing technical hurdles and increasing investment risks.

One of the foremost challenges is managing the substantial water requirements and wastewater disposal associated with hydraulic fracturing. Regions experiencing water scarcity face amplified tensions between energy production and agricultural or domestic needs, leading to increased public opposition and regulatory constraints. This necessitates innovation in water recycling and alternative fracturing fluids. Another critical challenge is the significant capital expenditure required for developing tight gas fields, which are typically more expensive to explore and produce from compared to conventional reserves. This high upfront investment makes projects vulnerable to market downturns and necessitates access to robust financing. Additionally, the tight gas industry faces intense scrutiny regarding its environmental footprint, particularly methane emissions, which are potent greenhouse gases. Meeting increasingly stringent emission standards and demonstrating responsible environmental stewardship is crucial for maintaining social license and avoiding punitive regulations. Lastly, the workforce skills gap, particularly for specialized roles in unconventional drilling and digital technologies, poses a challenge to efficient operations and innovation, necessitating continuous training and talent development initiatives. Addressing these challenges through technological innovation, sustainable practices, and effective stakeholder engagement is vital for the long-term health of the tight gas market.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Environmental Regulations and Compliance Costs | -1.2% | Europe, North America | Medium to Long Term (2026-2033) |

| Public Opposition and Social Acceptance Issues (e.g., NIMBYism) | -1.0% | North America, Europe, Australia | Short to Medium Term (2025-2030) |

| Fluctuating Global Energy Prices and Market Volatility | -0.9% | Global | Short Term (2025-2028) |

| Water Scarcity and Management for Hydraulic Fracturing | -0.7% | Arid regions in North America, China, Middle East | Medium to Long Term (2027-2033) |

| Infrastructure Bottlenecks for Transporting Gas from Remote Fields | -0.6% | Emerging Tight Gas Regions (e.g., Argentina, Algeria) | Long Term (2028-2033) |

Tight Gas Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Tight Gas market, offering a detailed understanding of its current landscape, growth trajectories, and future outlook. It encapsulates critical insights into market size, segmentation, regional dynamics, and competitive analysis, serving as an invaluable resource for stakeholders seeking to navigate this complex energy sector. The report leverages extensive primary and secondary research to deliver accurate and actionable intelligence, empowering strategic decision-making and fostering a nuanced perspective on market opportunities and challenges.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 155.2 Billion |

| Market Forecast in 2033 | USD 265.7 Billion |

| Growth Rate | 6.8% CAGR from 2025 to 2033 |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Energy Ventures, Hydrocarbon Exploration Inc., Frontier Energy Solutions, Deep Earth Resources, Petra Gas & Oil, Borealis Hydrocarbons, Horizon Energy Group, Summit Hydrocarbons, Ridgefield Energy, Zenith Gas Development, Apex Natural Gas, TerraForm Energy, Pioneer Hydrocarbon Corp., Atlas Resources Management, Meridian Energy Systems, Nova Gas Solutions, Evergreen Hydrocarbons, Strategic Energy Assets, Prime Methane Corp., Phoenix Hydrocarbon Partners |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Tight Gas market is meticulously segmented to provide a granular view of its diverse components, allowing for targeted analysis and strategic planning. This comprehensive segmentation considers the type of tight gas, its various applications across different sectors, and the underlying technologies enabling its extraction and processing, along with the well types utilized. Such a detailed breakdown facilitates a deeper understanding of market dynamics, growth drivers within specific niches, and emerging opportunities in distinct market segments.

- By Type: This segment differentiates the market based on the geological formation from which tight gas is extracted, recognizing distinct characteristics and extraction complexities.

- Tight Sand Gas: Gas trapped in low-permeability sandstone reservoirs.

- Tight Shale Gas: Gas stored in shale rock formations, often requiring hydraulic fracturing.

- Coalbed Methane (CBM): Natural gas extracted from coal seams, considered a subset of unconventional gas.

- By Application: This segmentation highlights the various end-use industries and sectors that utilize tight gas, reflecting demand patterns and market consumption.

- Power Generation: Use of tight gas as fuel for electricity production in power plants.

- Industrial Use: Gas consumed by manufacturing, chemical, and other industrial processes (e.g., fertilizers, steel production).

- Residential & Commercial Use: Natural gas for heating, cooking, and other energy needs in homes and businesses.

- Vehicle Fuel: Use of compressed natural gas (CNG) or liquefied natural gas (LNG) as transportation fuel.

- Chemicals & Petrochemicals: Tight gas as a feedstock for producing various chemicals and plastics.

- By Technology: This segment focuses on the advanced techniques and methodologies employed for exploring, drilling, and extracting tight gas, crucial for unlocking these challenging reservoirs.

- Hydraulic Fracturing: Involves injecting high-pressure fluid to create fractures in rock.

- Conventional Fracturing: Standard hydraulic fracturing methods.

- Advanced Fracturing: Innovations like zipper frac, multi-well pad drilling.

- Horizontal Drilling: Drilling wells horizontally to maximize reservoir contact.

- Multistage Fracturing: Performing hydraulic fracturing at multiple points along a horizontal wellbore.

- Enhanced Recovery Techniques: Methods like gas injection or solvent injection to improve recovery rates.

- Hydraulic Fracturing: Involves injecting high-pressure fluid to create fractures in rock.

- By Well Type: This category distinguishes between the different orientations of wells drilled to access tight gas reserves, impacting drilling efficiency and production volumes.

- Vertical Wells: Traditional straight wells drilled perpendicularly into the reservoir.

- Horizontal Wells: Wells drilled with a horizontal section to access a larger portion of the reservoir.

- By Regional Outlook: This segmentation provides a geographical breakdown of the market, identifying key regions and countries contributing to or consuming tight gas, reflecting varying geological potentials, regulatory environments, and energy demands.

- North America: Focus on the U.S. (major producer), Canada, and Mexico.

- Europe: Key markets include Russia, Norway, UK, Germany, France, and the Rest of Europe.

- Asia Pacific (APAC): Dominant players include China, Australia, India, and the Rest of APAC.

- Latin America: Argentina and Brazil are significant, along with the Rest of Latin America.

- Middle East & Africa (MEA): Key countries are Saudi Arabia, UAE, Algeria, and the Rest of MEA.

Regional Highlights

The Tight Gas market exhibits distinct regional dynamics, influenced by geological endowments, technological readiness, regulatory frameworks, and energy policies. Certain regions stand out as pivotal to the global tight gas landscape due to their extensive reserves and advanced extraction capabilities. Understanding these regional contributions is crucial for comprehending the overall market trajectory and identifying localized opportunities or challenges. Each geographical area contributes uniquely to the market's supply and demand equilibrium.

- North America: This region remains the undisputed leader in the Tight Gas market, primarily driven by the United States and Canada. The U.S. has pioneered and perfected hydraulic fracturing and horizontal drilling technologies, making vast tight gas reserves economically viable. Factors making it critical include mature infrastructure, strong technological innovation, a supportive regulatory environment in key producing states, and a significant domestic demand for natural gas, fostering continuous investment and production efficiency.

- Asia Pacific (APAC): Emerging as a crucial growth engine, the APAC region, particularly China and Australia, is poised for significant tight gas development. China holds substantial tight gas reserves and is actively investing in technology and infrastructure to meet its burgeoning energy demand and enhance energy security. Australia's significant coalbed methane and tight gas resources, coupled with established LNG export capabilities, position it as a vital supplier to regional and global markets. The increasing industrialization and urbanization across APAC are driving demand for natural gas, making this region critical for future market expansion.

- Europe: While Europe possesses considerable tight gas potential, its development faces significant hurdles, primarily due to stringent environmental regulations and strong public opposition to hydraulic fracturing. Countries like Russia and Norway, with their vast conventional and unconventional gas resources, continue to be major players. However, other European nations are exploring options to diversify their gas supplies, creating potential for tight gas development if technological advancements can address environmental concerns and gain public acceptance. Energy security concerns, particularly in Eastern Europe, could reignite interest in domestic tight gas resources.

- Middle East & Africa (MEA): This region holds significant untapped tight gas potential, particularly in countries like Saudi Arabia and Algeria. While traditionally known for conventional oil and gas, nations in MEA are increasingly looking to diversify their energy mix and monetize their unconventional gas reserves. The presence of established energy infrastructure and a growing domestic energy demand make MEA a region with long-term growth potential, contingent on technological transfer, investment, and favorable government policies for unconventional resource development.

Top Key Players:

The market research report covers the analysis of key stake holders of the Tight Gas Market. Some of the leading players profiled in the report include -:- Global Energy Ventures

- Hydrocarbon Exploration Inc.

- Frontier Energy Solutions

- Deep Earth Resources

- Petra Gas & Oil

- Borealis Hydrocarbons

- Horizon Energy Group

- Summit Hydrocarbons

- Ridgefield Energy

- Zenith Gas Development

- Apex Natural Gas

- TerraForm Energy

- Pioneer Hydrocarbon Corp.

- Atlas Resources Management

- Meridian Energy Systems

- Nova Gas Solutions

- Evergreen Hydrocarbons

- Strategic Energy Assets

- Prime Methane Corp.

- Phoenix Hydrocarbon Partners

Frequently Asked Questions:

What is Tight Gas?

Tight gas refers to natural gas trapped in low-permeability reservoir rocks, such as sandstone, limestone, or shale. Unlike conventional gas, which flows easily through porous rock, tight gas requires advanced extraction techniques like hydraulic fracturing and horizontal drilling to unlock its reserves due to the very small, interconnected pore spaces.

How does hydraulic fracturing contribute to Tight Gas production?

Hydraulic fracturing, commonly known as fracking, is a key technology for tight gas production. It involves injecting a high-pressure mixture of water, sand, and chemicals into the tight rock formations to create tiny fissures. These fissures, propped open by the sand, allow the trapped natural gas to flow more freely to the wellbore, significantly enhancing extraction rates from otherwise impermeable reservoirs.

What are the primary applications of Tight Gas?

Tight gas, once extracted and processed, is primarily used for power generation, feeding industrial processes, and supplying residential and commercial heating and cooking needs. It also serves as a raw material (feedstock) for the chemical and petrochemical industries and, to a lesser extent, as a vehicle fuel in compressed or liquefied forms.

What are the major environmental concerns associated with Tight Gas extraction?

Key environmental concerns related to tight gas extraction, particularly hydraulic fracturing, include the potential for groundwater contamination from fracturing fluids or produced water, significant water usage, induced seismicity (small earthquakes), and greenhouse gas emissions (especially methane leaks) during extraction and transportation. These concerns often lead to stringent regulations and public scrutiny.

Which regions are leading in Tight Gas production and reserves?

North America, particularly the United States and Canada, leads the world in tight gas production due to extensive shale and tight sand formations and advanced extraction technologies. Other significant regions with substantial tight gas reserves and emerging production include parts of Asia Pacific (e.g., China, Australia), and some areas in Latin America (e.g., Argentina) and the Middle East & Africa (e.g., Algeria, Saudi Arabia).