Software Defined Storage Market

Software Defined Storage Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700302 | Last Updated : July 24, 2025 |

Format : ![]()

![]()

![]()

![]()

Software Defined Storage Market Size

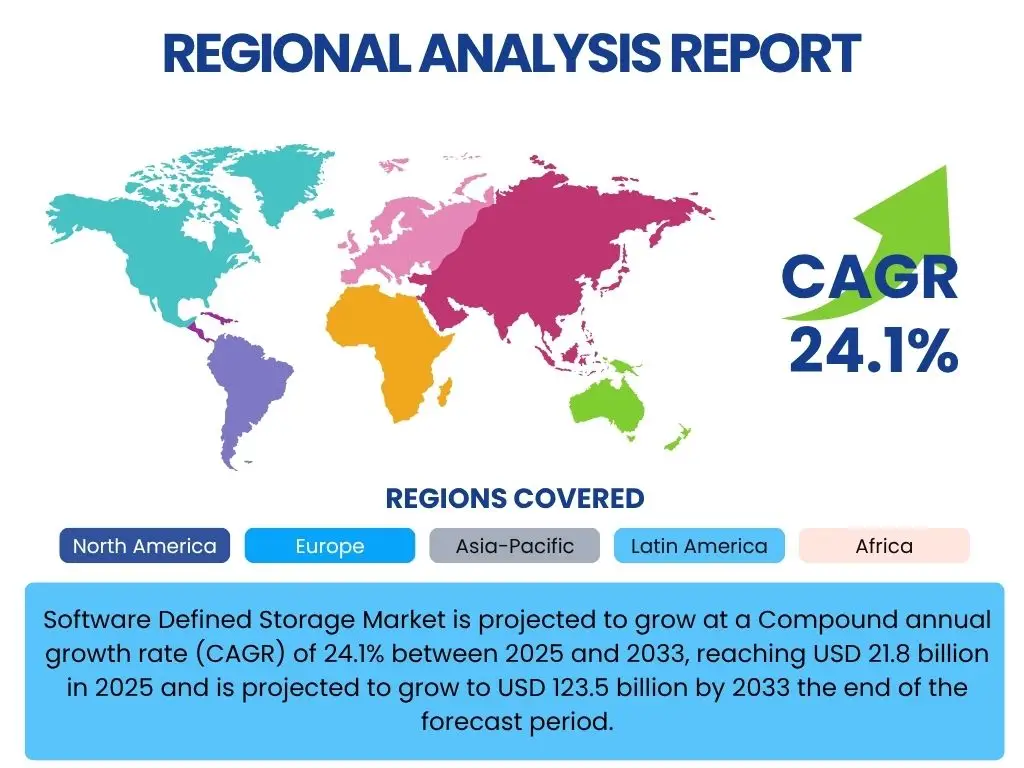

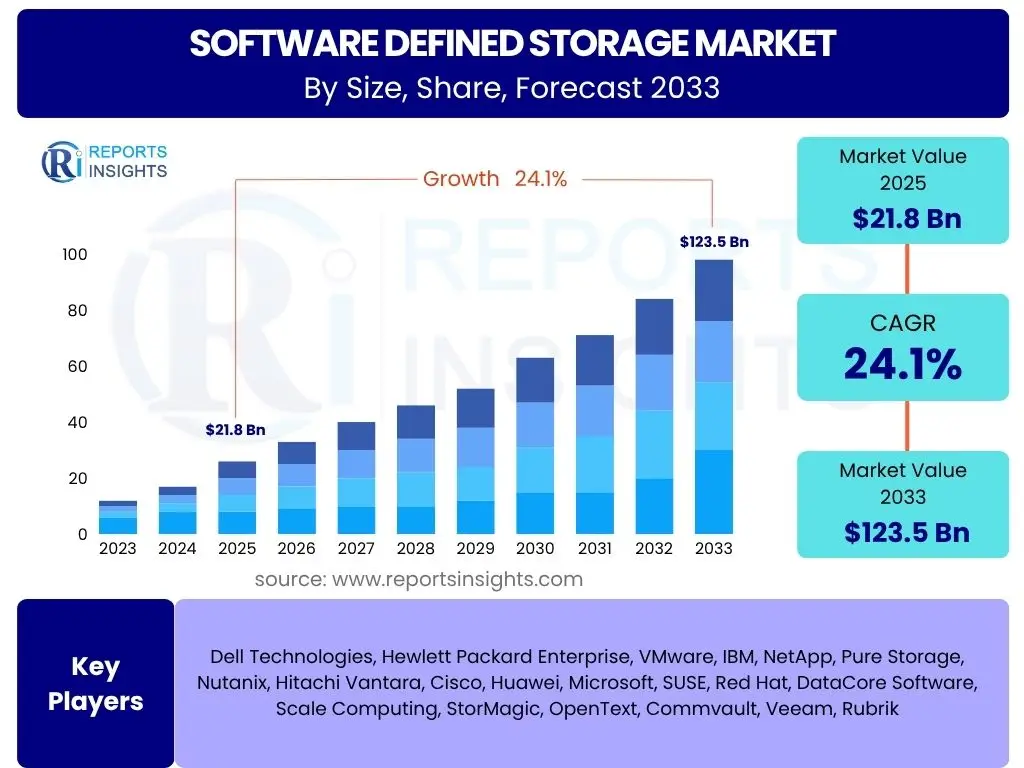

Software Defined Storage Market is projected to grow at a Compound annual growth rate (CAGR) of 24.1% between 2025 and 2033, reaching USD 21.8 billion in 2025 and is projected to grow to USD 123.5 billion by 2033 the end of the forecast period.

Key Software Defined Storage Market Trends & Insights

The Software Defined Storage (SDS) market is experiencing dynamic shifts driven by escalating data volumes, the imperative for cost efficiency, and the increasing adoption of cloud-native architectures. Key trends indicate a significant move towards integrated hybrid cloud environments, enabling organizations to manage data across diverse infrastructures seamlessly. Furthermore, the market is witnessing an intensified focus on data security and compliance within SDS frameworks, alongside the integration of advanced analytics and artificial intelligence for optimized storage management and predictive insights. The rapid evolution of enterprise digital transformation initiatives is further accelerating the demand for flexible, scalable, and programmable storage solutions. These trends collectively underscore the critical role SDS plays in modern IT infrastructure, offering a strategic pathway to agile and resilient data management.

- Hybrid and multi-cloud SDS adoption surge.

- Increased demand for AI/ML-driven storage optimization.

- Enhanced focus on data security and compliance features.

- Edge computing expanding SDS deployment scenarios.

- Containerization and microservices driving SDS integration.

AI Impact Analysis on Software Defined Storage

Artificial intelligence is profoundly transforming the Software Defined Storage landscape by enhancing automation, predictability, and efficiency in data management. AI and machine learning algorithms are being embedded into SDS solutions to perform tasks such as intelligent tiering, anomaly detection, predictive maintenance, and optimized resource allocation. This integration allows SDS systems to proactively identify performance bottlenecks, anticipate storage needs, and automate data placement based on access patterns and criticality. The net effect is a significant reduction in operational overhead, improved storage utilization, and a more resilient and self-optimizing storage infrastructure, positioning AI as a crucial enabler for the next generation of intelligent SDS deployments. This synergy ensures SDS environments are not just scalable but also highly adaptive and intelligently managed.

- Automated tiering and data placement optimization.

- Predictive analytics for performance and capacity management.

- Anomaly detection and proactive fault resolution.

- Enhanced security posture through intelligent threat detection.

- Reduced human intervention and operational costs.

Key Takeaways Software Defined Storage Market Size & Forecast

- Robust market growth driven by data explosion and digital transformation.

- Significant CAGR of 24.1% projected from 2025 to 2033.

- Market size to expand from USD 21.8 billion in 2025 to USD 123.5 billion by 2033.

- Shift towards hybrid and multi-cloud SDS solutions.

- AI and machine learning integration revolutionizing storage efficiency and management.

- Increased emphasis on data resilience, security, and compliance.

- Strategic investment in SDS for agile and cost-effective IT infrastructure.

Software Defined Storage Market Drivers Analysis

The Software Defined Storage market is propelled by a convergence of technological advancements and evolving enterprise requirements for agile and cost-effective data management. A primary driver is the exponential growth in data volumes, demanding scalable and flexible storage solutions that traditional hardware-centric approaches struggle to provide efficiently. SDS offers the agility to abstract storage capabilities from underlying hardware, enabling enterprises to optimize resource utilization, reduce capital expenditure, and streamline operations. Furthermore, the widespread adoption of cloud computing, virtualized environments, and container technologies necessitates a highly adaptable storage infrastructure that SDS inherently provides. The increasing emphasis on data security, compliance, and disaster recovery also champions SDS, as it facilitates centralized control and robust policy enforcement across diverse storage tiers.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Explosive Data Growth and Management Complexity | +3.2% | Global, particularly APAC and North America | Long-term |

| Demand for Cost Efficiency and Operational Agility | +2.8% | Global, across all enterprise sizes | Mid-term to Long-term |

| Increasing Adoption of Cloud and Virtualization Technologies | +2.5% | North America, Europe, rapidly growing in APAC | Mid-term |

| Focus on Data Security, Governance, and Compliance | +1.9% | Highly relevant in regulated industries globally | Mid-term to Long-term |

Software Defined Storage Market Restraints Analysis

Despite its significant advantages, the Software Defined Storage market faces certain impediments that can temper its growth trajectory. One notable restraint is the inherent complexity associated with migrating from traditional storage infrastructures to SDS environments. This transition often requires significant upfront investment in training IT personnel, potential integration challenges with existing legacy systems, and a learning curve for new management paradigms. Furthermore, concerns regarding performance consistency and perceived vendor lock-in in specific proprietary SDS solutions can deter some organizations. While SDS offers flexibility, ensuring optimal performance for highly demanding applications in a purely software-defined environment can be a technical hurdle. Addressing these complexities and building trust in open, interoperable solutions will be crucial for overcoming these restraints and accelerating broader SDS adoption.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complexity of Migration from Legacy Systems | -1.5% | Global, particularly for large enterprises with entrenched systems | Short-term to Mid-term |

| Performance Concerns for Mission-Critical Applications | -1.0% | Global, prevalent in sectors requiring ultra-low latency | Mid-term |

| Lack of Skilled IT Personnel and Training Costs | -0.8% | Emerging economies and regions with limited tech talent pools | Mid-term |

Software Defined Storage Market Opportunities Analysis

The Software Defined Storage market is rife with opportunities stemming from emerging technologies and evolving business models. A significant opportunity lies in the burgeoning adoption of edge computing and IoT, where data generated at the periphery requires localized and agile storage solutions that SDS can effectively provide. The continuous expansion of hybrid and multi-cloud strategies creates a strong impetus for SDS, offering a unified control plane for distributed data. Furthermore, the increasing integration of artificial intelligence and machine learning within SDS solutions presents an opportunity to deliver highly intelligent, self-optimizing, and predictive storage environments. This evolution empowers organizations to derive greater value from their data while minimizing manual intervention. The growing demand for enhanced cybersecurity and ransomware protection also opens avenues for SDS solutions that offer immutable storage and robust data resilience features, securing data against sophisticated threats.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Proliferation of Edge Computing and IoT Devices | +2.1% | Global, significant in manufacturing, retail, and smart cities | Mid-term to Long-term |

| Expansion of Hybrid and Multi-Cloud Architectures | +1.8% | Global, dominant strategy for enterprises | Long-term |

| Integration of AI/ML for Intelligent Data Management | +1.6% | North America, Europe, with growing adoption in APAC | Mid-term |

| Growing Demand for Cyber Resilience and Data Protection | +1.4% | Global, across all regulated industries | Short-term to Mid-term |

Software Defined Storage Market Challenges Impact Analysis

The Software Defined Storage market, while promising, contends with several critical challenges that can influence its adoption rate and deployment success. One significant hurdle is ensuring interoperability and seamless integration across diverse hardware platforms and vendor ecosystems, which can be complex and require significant engineering effort. Data migration during SDS implementation presents challenges in terms of downtime, data integrity, and complexity for large-scale enterprise environments. Furthermore, maintaining consistent performance and guaranteed service levels across heterogeneous SDS environments can be difficult, particularly for latency-sensitive applications. The evolving threat landscape also poses challenges, necessitating continuous innovation in security features to protect data within software-defined perimeters. Addressing these integration, performance, and security complexities effectively will be paramount for widespread SDS market penetration.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Interoperability and Vendor Ecosystem Complexity | -1.2% | Global, particularly for multi-vendor environments | Mid-term |

| Data Migration and Integration with Legacy Infrastructure | -1.0% | Global, affects enterprises with established IT setups | Short-term |

| Ensuring Performance Consistency Across Diverse Workloads | -0.9% | Global, critical for high-performance computing and real-time analytics | Mid-term |

Software Defined Storage Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Software Defined Storage (SDS) market, offering critical insights into its current landscape and future growth trajectory. The report encompasses a thorough examination of market size, trends, drivers, restraints, opportunities, and challenges, providing a strategic blueprint for stakeholders. It details the impact of emerging technologies like AI on SDS, segments the market by various dimensions, and highlights key regional dynamics. The objective is to equip business professionals and decision-makers with actionable intelligence to navigate the evolving SDS ecosystem and capitalize on growth avenues. The updated scope ensures that the analysis remains highly relevant and forward-looking, addressing the latest market shifts and technological advancements that are shaping the future of data storage.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 21.8 billion |

| Market Forecast in 2033 | USD 123.5 billion |

| Growth Rate | 24.1% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Dell Technologies, Hewlett Packard Enterprise, VMware, IBM, NetApp, Pure Storage, Nutanix, Hitachi Vantara, Cisco, Huawei, Microsoft, SUSE, Red Hat, DataCore Software, Scale Computing, StorMagic, OpenText, Commvault, Veeam, Rubrik |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Software Defined Storage market is meticulously segmented to provide a granular view of its diverse components, deployment models, organizational adoption, and industry applications. This segmentation analysis is crucial for understanding specific market dynamics and identifying niche opportunities. By dissecting the market across these dimensions, the report offers stakeholders the ability to pinpoint the most lucrative areas for investment and strategic development, tailoring their offerings to specific needs within the expansive SDS landscape. This detailed breakdown ensures a comprehensive understanding of where growth is most pronounced and how different market facets interact to shape the overall industry trajectory.

- By Component: This segment distinguishes between SDS Solutions and associated Services. Solutions further categorize into Storage Platforms, which form the core software infrastructure, and Data Management, encompassing software tools for data orchestration, backup, and recovery. Services include vital Consulting, Integration, and ongoing Support necessary for successful SDS deployment and maintenance.

- By Deployment Model: This categorizes SDS based on where the software is implemented. On-Premise deployments involve installing SDS software within an organization's own data center, offering maximum control. Cloud deployments leverage public or private cloud infrastructures, providing scalability and flexibility. Hybrid models combine both on-premise and cloud environments, facilitating seamless data flow and management across distributed IT landscapes.

- By Organization Size: This segment analyzes adoption patterns across different business scales. Small and Medium Enterprises (SMEs) often seek cost-effective and easy-to-manage SDS solutions, while Large Enterprises demand robust, high-performance, and highly scalable SDS platforms to handle massive data volumes and complex IT environments.

- By End-Use Industry: This segmentation highlights the diverse applications of SDS across various sectors. Key industries include BFSI (Banking, Financial Services, and Insurance) for data security and compliance, IT & Telecom for infrastructure optimization, Healthcare for large-scale medical data management, Government for secure public sector data, Retail for inventory and customer data, Manufacturing for operational technology data, Media & Entertainment for content storage, and Education for academic and research data, among others.

Regional Highlights

The global Software Defined Storage market exhibits distinct regional dynamics, with certain geographies emerging as pivotal contributors to overall market expansion. These regions are characterized by varying levels of technological maturity, digital transformation initiatives, and investment capacities, all of which influence SDS adoption rates and solution preferences.

- North America: This region consistently leads the Software Defined Storage market, primarily due to its advanced IT infrastructure, high rate of technological adoption, and the presence of numerous key market players and early adopters. Significant investments in cloud computing, virtualization, and enterprise digital transformation across sectors like IT & Telecom and BFSI drive robust demand. The emphasis on data security and compliance, coupled with the need for agile data management solutions, positions North America as a dominant force.

- Europe: Europe represents another substantial market for SDS, propelled by stringent data protection regulations such as GDPR, which necessitate sophisticated and flexible data management solutions. Countries like Germany, the UK, and France are key contributors, driven by a mature IT landscape, increasing cloud adoption, and a strong focus on optimizing operational costs through software-defined architectures. The manufacturing and healthcare sectors are particularly keen on SDS for efficient data handling.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the SDS market, fueled by rapid digital transformation initiatives, burgeoning data centers, and increasing cloud adoption across emerging economies like China, India, and Southeast Asian nations. Governments and enterprises in this region are heavily investing in modernizing their IT infrastructures to support explosive data growth and burgeoning digital services, creating immense opportunities for SDS providers. The competitive landscape and a strong focus on cost-efficiency further accelerate SDS deployment.

- Latin America: This region is experiencing steady growth in SDS adoption, driven by the expansion of cloud services, increasing digitalization across industries, and the need for scalable and affordable storage solutions. Economic development and rising IT spending contribute to the gradual shift from traditional storage to SDS, particularly in sectors like financial services and telecommunications.

- Middle East and Africa (MEA): The MEA region is witnessing emerging adoption of SDS, primarily spurred by government-led digital initiatives, smart city projects, and investments in cloud infrastructure, particularly in the GCC countries. The drive for diversification of economies and modernization of IT environments across various sectors, including oil and gas, finance, and public services, is gradually fostering demand for flexible and scalable SDS solutions.

Top Key Players:

The market research report covers the analysis of key stake holders of the Software Defined Storage Market. Some of the leading players profiled in the report include -- Dell Technologies

- Hewlett Packard Enterprise

- VMware

- IBM

- NetApp

- Pure Storage

- Nutanix

- Hitachi Vantara

- Cisco

- Huawei

- Microsoft

- SUSE

- Red Hat

- DataCore Software

- Scale Computing

- StorMagic

- OpenText

- Commvault

- Veeam

- Rubrik

Frequently Asked Questions:

What is Software Defined Storage (SDS)?

Software Defined Storage (SDS) is an approach to data storage where the management and control planes are decoupled from the underlying hardware. This allows storage resources to be pooled and provisioned dynamically, offering enhanced flexibility, scalability, and cost efficiency by running on commodity hardware.

How does SDS differ from traditional storage systems?

Traditional storage systems often tightly integrate hardware and software, leading to vendor lock-in and limited flexibility. SDS, conversely, abstracts the storage software from hardware, enabling organizations to use standard servers, scale capacity easily, and manage storage through a centralized software interface, irrespective of the underlying physical infrastructure.

What are the primary benefits of implementing SDS?

Implementing SDS offers numerous benefits, including significant cost savings due to reduced reliance on proprietary hardware, improved agility and scalability to meet evolving data demands, simplified storage management through automation, enhanced data protection and disaster recovery capabilities, and greater flexibility for integrating with cloud and virtualized environments.

What industries are adopting Software Defined Storage most rapidly?

Industries rapidly adopting Software Defined Storage include IT and Telecommunications, due to their immense data processing needs; BFSI (Banking, Financial Services, and Insurance) for robust data security and compliance; Healthcare for managing large volumes of patient data; and Government sectors seeking cost-effective and secure data solutions. Cloud service providers are also major adopters due to SDS's inherent scalability.

What role does AI play in the future of Software Defined Storage?

Artificial intelligence will play a transformative role in the future of Software Defined Storage by enabling intelligent automation, predictive analytics, and self-optimizing storage environments. AI algorithms will enhance capabilities such as automated data tiering, proactive anomaly detection, intelligent resource allocation, and advanced security threat identification, making SDS systems more efficient, resilient, and autonomous.