Smart POS Market

Smart POS Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702171 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Smart POS Market Size

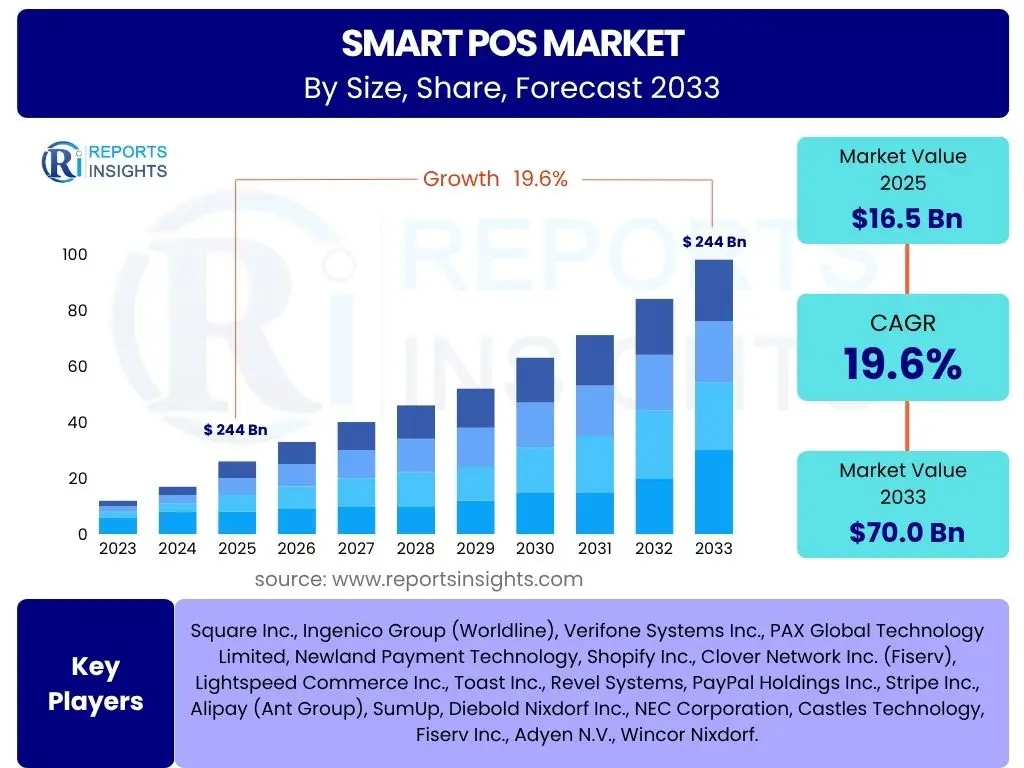

According to Reports Insights Consulting Pvt Ltd, The Smart POS Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.6% between 2025 and 2033. The market is estimated at USD 16.5 Billion in 2025 and is projected to reach USD 70.0 Billion by the end of the forecast period in 2033.

Key Smart POS Market Trends & Insights

The Smart POS market is experiencing a transformative phase, driven by evolving consumer payment preferences and the need for enhanced operational efficiency among businesses. Common user inquiries often revolve around the integration of advanced technologies, the shift towards mobile and cloud-based solutions, and the demand for more seamless and personalized customer experiences. Businesses are increasingly seeking POS systems that go beyond basic transaction processing, offering robust analytics, inventory management, and customer relationship management functionalities. This trend reflects a broader move towards unified commerce platforms that can support diverse sales channels and provide a holistic view of business operations.

Another significant trend frequently discussed by users is the increasing adoption of contactless payment methods and alternative payment options like QR codes and digital wallets. This shift, accelerated by global health concerns and technological advancements, has propelled the demand for Smart POS systems capable of accommodating these diverse payment types securely and efficiently. Furthermore, the market is witnessing a rise in sector-specific Smart POS solutions tailored to the unique needs of industries such as hospitality, healthcare, and specialized retail, indicating a move away from one-size-fits-all approaches. These trends underscore a market that is highly responsive to technological innovation and evolving market demands, making Smart POS a critical investment for businesses aiming to stay competitive.

- Proliferation of contactless and mobile payment technologies.

- Increasing adoption of cloud-based and mobile POS (mPOS) solutions for flexibility and scalability.

- Emphasis on omnichannel retail strategies requiring integrated POS systems.

- Growing demand for data analytics and business intelligence features within POS.

- Integration with loyalty programs and customer relationship management (CRM) systems.

- Rise of self-service kiosks and unattended payment solutions.

- Customization and specialization of POS systems for niche vertical markets.

AI Impact Analysis on Smart POS

User questions regarding the impact of Artificial Intelligence (AI) on Smart POS systems highlight a strong interest in how AI can move beyond simple automation to provide genuine business intelligence and operational advantages. There is a clear expectation that AI will transform POS from a transactional tool into a strategic asset, capable of improving various aspects of retail and service operations. Users are particularly curious about AI's role in personalizing customer interactions, optimizing inventory, enhancing fraud detection, and streamlining back-office processes. The integration of AI is seen as a crucial step towards creating more intelligent, responsive, and autonomous business environments, offering significant competitive advantages to early adopters.

Concerns also emerge around data privacy, the complexity of AI implementation, and the need for robust cybersecurity measures when incorporating advanced AI capabilities into POS systems. However, the overarching sentiment is one of optimism regarding AI's potential to deliver predictive analytics for sales forecasting, enable dynamic pricing, and facilitate highly personalized marketing campaigns directly at the point of sale. AI-powered Smart POS systems are anticipated to provide deep insights into consumer behavior, optimize staff scheduling, and even assist in maintaining equipment proactively, thereby reducing downtime and increasing overall efficiency. This integration is set to redefine the capabilities and expectations for modern payment and business management solutions, making AI a cornerstone of future Smart POS innovation.

- Enhanced predictive analytics for sales forecasting and inventory optimization.

- Personalized customer experiences through AI-driven recommendations and offers.

- Improved fraud detection and security features leveraging machine learning algorithms.

- Automated customer service and support via AI-powered chatbots at POS.

- Dynamic pricing strategies based on real-time demand and competitor analysis.

- Streamlined operations and reduced manual errors through AI-driven process automation.

- Voice recognition and gesture control for intuitive user interfaces.

Key Takeaways Smart POS Market Size & Forecast

Common user questions about the Smart POS market size and forecast reveal a keen interest in understanding the scale and trajectory of this rapidly expanding sector. Users frequently seek concise summaries of growth projections, key growth drivers, and the factors contributing to the market's robust expansion. The primary insight derived is the market's significant momentum, fueled by the accelerating digital transformation across various industries and the increasing demand for advanced, integrated payment solutions. The forecast indicates sustained high growth, positioning Smart POS as a foundational technology for modern commerce, essential for businesses aiming to optimize operations and enhance customer engagement.

Another key takeaway is the clear shift towards higher-value, feature-rich Smart POS systems that offer more than just payment processing. The market's substantial projected value by 2033 underscores the widespread adoption and integration of these solutions into diverse business models, from small and medium-sized enterprises (SMEs) to large retail chains. This growth is not merely volumetric but also qualitative, reflecting the evolving sophistication of Smart POS capabilities, including embedded analytics, cloud connectivity, and seamless integration with broader enterprise resource planning (ERP) systems. The strong CAGR confirms the market's criticality in the digital economy and its potential for continued innovation.

- The Smart POS market is experiencing robust, double-digit growth with a CAGR of 19.6%.

- Market valuation is set to surge significantly, reaching USD 70.0 Billion by 2033 from USD 16.5 Billion in 2025.

- Growth is primarily driven by the global shift towards digital and contactless payments.

- Increased adoption across diverse industries, particularly retail, hospitality, and healthcare.

- Technological advancements and integration of AI are key enablers of market expansion.

- Demand for integrated business management solutions beyond mere payment processing is escalating.

Smart POS Market Drivers Analysis

The Smart POS market is propelled by a confluence of factors that underscore the global shift towards digitalized commerce and enhanced operational efficiency. A primary driver is the pervasive adoption of cashless and digital payment methods, including contactless cards, mobile wallets, and QR code payments, which necessitates more sophisticated and versatile POS terminals. Concurrently, the burgeoning e-commerce sector and the growing trend of omnichannel retail require businesses to seamlessly integrate online and offline sales channels, making Smart POS systems with unified commerce capabilities indispensable. Furthermore, the increasing demand for real-time data analytics and inventory management solutions empowers businesses to make informed decisions and optimize their operations, with Smart POS serving as a crucial data collection point.

Government initiatives and regulatory mandates promoting digital payments and financial inclusion in various regions also significantly contribute to market expansion. These policies often incentivize businesses to upgrade their payment infrastructure, directly boosting Smart POS adoption. The inherent benefits of Smart POS, such as improved customer experience through faster transactions, reduced human error, and enhanced security features, further stimulate demand. Additionally, the proliferation of cloud-based and mobile POS (mPOS) solutions provides scalability and flexibility, particularly appealing to small and medium-sized enterprises (SMEs) that seek cost-effective yet powerful payment processing tools, thereby broadening the market base.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Adoption of Digital & Contactless Payments | +5.5% | Global, particularly Asia Pacific & Europe | Short to Mid-term (2025-2030) |

| Growth of Omnichannel Retail and E-commerce Integration | +4.8% | North America, Europe, Asia Pacific | Mid-term (2026-2033) |

| Demand for Advanced Data Analytics & Inventory Management | +4.2% | Global, across all enterprise sizes | Mid-term (2026-2033) |

| Technological Advancements in POS Hardware & Software | +3.9% | Global, high-tech adoption regions | Short to Mid-term (2025-2030) |

| Government Initiatives for Digitalization & Financial Inclusion | +3.0% | Emerging Economies (LATAM, MEA, Southeast Asia) | Mid to Long-term (2027-2033) |

Smart POS Market Restraints Analysis

Despite its robust growth trajectory, the Smart POS market faces several restraints that could impede its full potential. A significant challenge is the high initial investment cost associated with deploying advanced Smart POS systems, especially for small and medium-sized enterprises (SMEs) with limited capital. This cost often includes not only the hardware and software but also installation, training, and ongoing maintenance, making it a substantial hurdle for budget-conscious businesses. Additionally, the complexity of integrating new Smart POS systems with existing legacy infrastructure, such as older ERP or accounting systems, can lead to significant operational disruptions and further increase implementation costs, discouraging adoption in some established businesses.

Data security and privacy concerns also act as a considerable restraint. Smart POS systems handle sensitive customer payment information and business data, making them prime targets for cyberattacks. The increasing frequency and sophistication of data breaches necessitate robust security measures, which can add to the system's complexity and cost. Businesses, particularly those in highly regulated sectors, may hesitate to adopt new systems without absolute assurance of data protection and compliance with evolving privacy regulations like GDPR or CCPA. Furthermore, the lack of digital literacy and awareness about the comprehensive benefits of Smart POS systems, particularly in less technologically advanced regions or among traditional businesses, can limit adoption rates despite the inherent advantages these systems offer.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment and Operational Costs | -3.5% | Global, particularly affecting SMEs | Short to Mid-term (2025-2030) |

| Data Security and Privacy Concerns | -2.8% | Global, especially regulated industries | Short to Long-term (2025-2033) |

| Integration Complexities with Legacy Systems | -2.0% | Developed Markets with established businesses | Mid-term (2026-2031) |

| Lack of Digital Literacy in Emerging Markets | -1.5% | Emerging Economies (Africa, parts of Asia) | Mid to Long-term (2027-2033) |

Smart POS Market Opportunities Analysis

The Smart POS market is ripe with opportunities, particularly in expanding into untapped geographical regions and niche industry verticals. Emerging economies, characterized by rapidly developing digital infrastructures and increasing mobile penetration, present significant growth avenues for Smart POS providers. As these regions transition from cash-based economies to digital payment systems, the demand for affordable, robust, and localized Smart POS solutions is set to surge. Furthermore, industries beyond traditional retail and hospitality, such as healthcare, logistics, and field services, are increasingly recognizing the value of mobile and integrated POS systems for payment collection, inventory tracking, and operational management, creating new specialized market segments.

Innovation in service delivery models, such as the proliferation of "Payment as a Service" (PaaS) and subscription-based Smart POS offerings, represents another lucrative opportunity. These models reduce the upfront cost burden for businesses, making advanced POS technology accessible to a wider range of SMEs and start-ups. Moreover, the integration of cutting-edge technologies like the Internet of Things (IoT), blockchain for enhanced security and transparency, and advanced AI/ML capabilities for deeper analytics and automation, opens doors for developing next-generation Smart POS solutions. These advancements can provide unparalleled operational efficiencies and richer customer insights, driving demand for more sophisticated systems and enabling providers to differentiate their offerings in a competitive market.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging Markets and Untapped Verticals | +4.0% | Asia Pacific, Latin America, MEA (Healthcare, Logistics) | Mid to Long-term (2026-2033) |

| Development of Subscription-based and PaaS Models | +3.5% | Global, particularly appealing to SMEs | Short to Mid-term (2025-2030) |

| Integration of Advanced Technologies (IoT, Blockchain, AI/ML) | +3.0% | Developed Markets, Technology-focused enterprises | Mid to Long-term (2027-2033) |

| Focus on Value-Added Services (Loyalty, Analytics, ERP Integration) | +2.5% | Global, across all business sizes | Short to Mid-term (2025-2030) |

Smart POS Market Challenges Impact Analysis

The Smart POS market faces several significant challenges that could affect its growth trajectory and the widespread adoption of advanced solutions. Intense market competition among a growing number of providers, ranging from established hardware manufacturers to agile software developers, is a key challenge. This fierce competition often leads to price erosion and necessitates continuous innovation, pressuring companies to invest heavily in research and development while maintaining competitive pricing. Additionally, the rapid pace of technological change means that Smart POS systems can quickly become obsolete, requiring frequent upgrades and significant investment from businesses to keep their payment infrastructure current and compliant with evolving payment standards and security protocols.

Another critical challenge revolves around ensuring interoperability between diverse Smart POS systems and existing business software ecosystems. Businesses often use a variety of tools for inventory, CRM, accounting, and loyalty programs, and seamless integration with the Smart POS is crucial for operational efficiency. Lack of standardized APIs or complex integration processes can deter adoption. Furthermore, navigating the complex and evolving landscape of data privacy regulations, such as GDPR, CCPA, and regional payment card industry (PCI) standards, poses a considerable compliance burden for Smart POS providers and users alike. Ensuring that systems are secure and compliant across different jurisdictions requires significant legal and technical expertise, adding to operational costs and complexity.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Market Competition and Price Pressures | -2.0% | Global | Short to Mid-term (2025-2030) |

| Rapid Technological Obsolescence and Need for Updates | -1.8% | Global, technology-driven sectors | Short to Mid-term (2025-2030) |

| Interoperability and Integration with Diverse Business Systems | -1.5% | Global, impacting large enterprises | Mid-term (2026-2031) |

| Navigating Complex Regulatory & Compliance Landscape | -1.2% | Global, especially Europe & North America | Long-term (2027-2033) |

Smart POS Market - Updated Report Scope

This report offers a comprehensive analysis of the Smart POS market, detailing its current size, historical performance, and future growth projections from 2025 to 2033. It meticulously examines market trends, key drivers, restraints, opportunities, and challenges influencing the sector's evolution. The scope extends to a deep dive into the impact of Artificial Intelligence on Smart POS capabilities, providing insights into technological advancements and their implications for businesses. Furthermore, the report segments the market by various criteria, including component, operating system, deployment, end-use vertical, payment type, and regional landscape, offering a granular view of market dynamics. It also profiles leading companies, providing a holistic understanding of the competitive environment.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 16.5 Billion |

| Market Forecast in 2033 | USD 70.0 Billion |

| Growth Rate | 19.6% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Square Inc., Ingenico Group (Worldline), Verifone Systems Inc., PAX Global Technology Limited, Newland Payment Technology, Shopify Inc., Clover Network Inc. (Fiserv), Lightspeed Commerce Inc., Toast Inc., Revel Systems, PayPal Holdings Inc., Stripe Inc., Alipay (Ant Group), SumUp, Diebold Nixdorf Inc., NEC Corporation, Castles Technology, Fiserv Inc., Adyen N.V., Wincor Nixdorf. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Smart POS market is extensively segmented to provide a granular understanding of its diverse components and applications. These segmentations are critical for businesses to identify specific growth opportunities and tailor their strategies to particular market niches. The primary dimensions of segmentation include the type of component, ranging from the physical hardware terminals to the intricate software solutions and essential support services, each playing a distinct role in the functionality and deployment of a Smart POS system. The choice of operating system, such as Android or iOS, also defines different user experiences and integration capabilities, catering to varying business preferences and existing IT infrastructures.

Further segmentation by deployment model differentiates between on-premise solutions, favored by larger enterprises requiring extensive customization and control, and cloud-based options, which offer greater flexibility, scalability, and lower upfront costs, particularly attractive to small and medium-sized businesses. End-use verticals represent a crucial segmentation, highlighting the specialized needs of sectors like retail, hospitality, healthcare, and entertainment, each demanding tailored features from their Smart POS systems. The evolving landscape of payment types, including contactless, mobile, and QR code payments, also forms a vital segmentation, reflecting consumer trends and technological advancements in payment processing. Finally, the market is segmented by the physical type of POS device, such as mobile POS, desktop POS, or portable POS, addressing various operational requirements and mobility needs within businesses.

- By Component: Hardware (Mobile POS Terminals, Desktop POS Terminals), Software (Cloud-based, On-premise), Services (Integration & Implementation, Support & Maintenance, Consulting).

- By Operating System: Android, iOS, Windows, Linux, Others.

- By Deployment: On-premise, Cloud-based.

- By End-Use Vertical: Retail & Consumer Goods (Hypermarkets/Supermarkets, Department Stores, Specialty Stores, Restaurants/QSR, Small & Medium Businesses (SMBs)), Hospitality (Hotels, Bars & Pubs, Cafes & Bakeries), Healthcare, Entertainment (Theaters, Theme Parks), Transportation, Others (Education, Government).

- By Payment Type: Contactless Payments, Chip & PIN, Mobile Payments, Magnetic Stripe, QR Code Payments.

- By Type: Mobile POS (mPOS), Desktop POS, Countertop POS, Portable POS.

Regional Highlights

- North America: Dominates the market due to high adoption of advanced payment technologies, strong presence of key market players, and continuous innovation in retail and hospitality sectors. The region benefits from early technology adoption and a mature digital payment infrastructure.

- Europe: Exhibits significant growth driven by stringent regulatory frameworks promoting digital payments, such as PSD2, and high consumer preference for contactless transactions. Countries like the UK, Germany, and France are leading in Smart POS deployment.

- Asia Pacific (APAC): Expected to witness the highest growth rate owing to rapid digitalization initiatives, increasing internet and smartphone penetration, and a large unbanked population driving demand for mobile and affordable Smart POS solutions in emerging economies like India and Southeast Asia. China is a major hub for mobile payments.

- Latin America: Showing substantial potential with growing investments in digital infrastructure, increasing adoption of e-commerce, and government efforts to encourage cashless transactions. Brazil and Mexico are key growth markets.

- Middle East and Africa (MEA): Emerging as a promising market, driven by economic diversification efforts, increasing tourism, infrastructure development, and initiatives to boost financial inclusion. Countries in the GCC region are rapidly adopting advanced payment systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart POS Market.- Square Inc.

- Ingenico Group (Worldline)

- Verifone Systems Inc.

- PAX Global Technology Limited

- Newland Payment Technology

- Shopify Inc.

- Clover Network Inc. (Fiserv)

- Lightspeed Commerce Inc.

- Toast Inc.

- Revel Systems

- PayPal Holdings Inc.

- Stripe Inc.

- Alipay (Ant Group)

- SumUp

- Diebold Nixdorf Inc.

- NEC Corporation

- Castles Technology

- Fiserv Inc.

- Adyen N.V.

- Wincor Nixdorf

Frequently Asked Questions

Analyze common user questions about the Smart POS market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Smart POS system?

A Smart POS system is an advanced point-of-sale terminal that goes beyond basic transaction processing by integrating functionalities like inventory management, customer relationship management (CRM), sales analytics, and connectivity options (e.g., cloud, Wi-Fi, 4G). They often run on operating systems like Android or iOS, offering a more versatile and intelligent platform for businesses.

What are the primary benefits of implementing a Smart POS system for businesses?

Key benefits include enhanced operational efficiency through automated inventory and sales tracking, improved customer experience via faster and diverse payment options, access to valuable sales data and analytics for informed decision-making, better fraud prevention, and increased flexibility with mobile and cloud-based solutions. Smart POS systems streamline various business functions, leading to cost savings and increased revenue.

How is Artificial Intelligence (AI) transforming the Smart POS market?

AI is transforming Smart POS by enabling predictive analytics for sales forecasting, personalizing customer recommendations, enhancing fraud detection, optimizing inventory management, and automating customer service. AI-powered Smart POS systems can learn from transaction data to provide deeper business insights, streamline operations, and offer more intelligent, responsive interactions at the point of sale.

What are the main drivers of growth for the Smart POS market?

The primary drivers include the increasing global adoption of digital and contactless payment methods, the expansion of omnichannel retail strategies, the growing demand for real-time business analytics, and ongoing technological advancements in payment hardware and software. Additionally, government initiatives promoting cashless economies and financial inclusion contribute significantly to market expansion.

What is the projected growth trajectory for the Smart POS market?

The Smart POS market is projected for substantial growth, with a Compound Annual Growth Rate (CAGR) of 19.6% between 2025 and 2033. This growth trajectory is expected to increase the market size from an estimated USD 16.5 Billion in 2025 to USD 70.0 Billion by the end of the forecast period in 2033, indicating robust expansion and increasing market penetration.