Smart Grid Security Market

Smart Grid Security Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705668 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Smart Grid Security Market Size

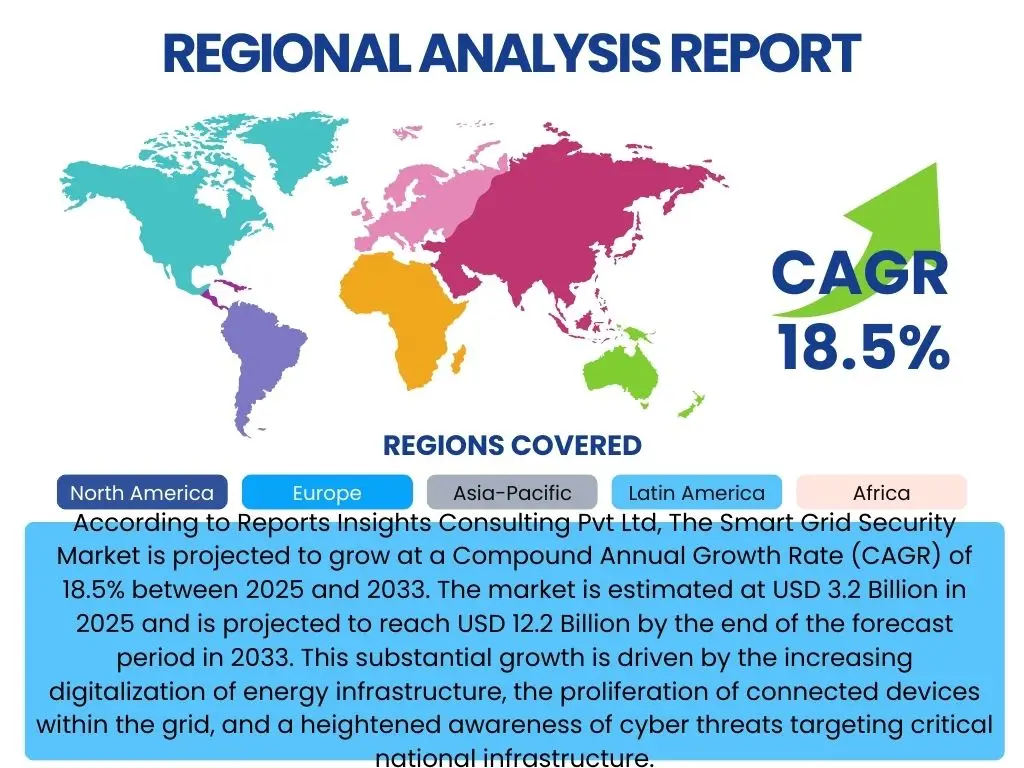

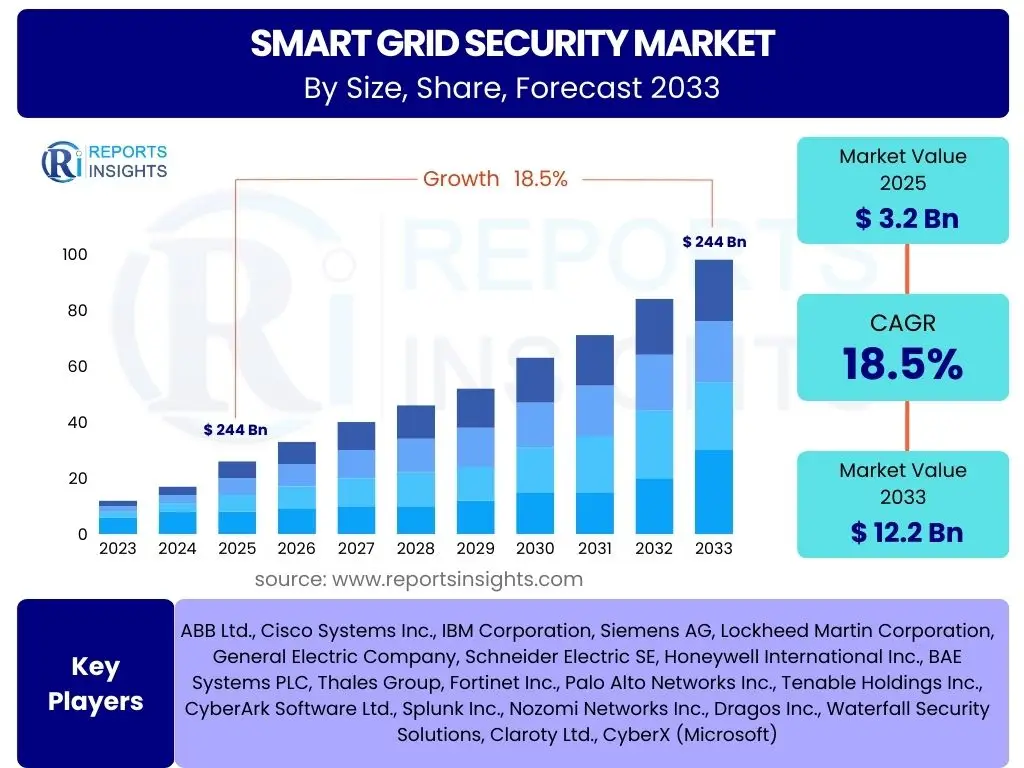

According to Reports Insights Consulting Pvt Ltd, The Smart Grid Security Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033. The market is estimated at USD 3.2 Billion in 2025 and is projected to reach USD 12.2 Billion by the end of the forecast period in 2033. This substantial growth is driven by the increasing digitalization of energy infrastructure, the proliferation of connected devices within the grid, and a heightened awareness of cyber threats targeting critical national infrastructure.

The anticipated expansion reflects the imperative for utilities and energy providers to fortify their smart grid systems against sophisticated cyberattacks. As smart grids integrate more advanced technologies such as IoT, AI, and distributed energy resources, the attack surface expands, necessitating robust security frameworks. Investment in advanced security solutions, including threat intelligence, anomaly detection, and real-time monitoring, is becoming paramount to ensure grid stability, reliability, and data integrity.

Key Smart Grid Security Market Trends & Insights

User queries regarding Smart Grid Security market trends frequently focus on the evolving threat landscape, technological advancements, and regulatory pressures. There is significant interest in understanding how new technologies like AI and blockchain are being integrated into security solutions and the impact of increasing connectivity on overall grid vulnerability. Users also seek information on the shift from traditional perimeter defenses to more dynamic, multi-layered security architectures, as well as the growing importance of supply chain security.

The market is experiencing a significant pivot towards proactive and predictive security measures, moving beyond reactive incident response. This includes the adoption of advanced analytics and machine learning to identify anomalous behavior and potential threats before they can cause widespread disruption. Furthermore, the convergence of IT (Information Technology) and OT (Operational Technology) security is a defining trend, demanding unified security platforms that can protect both conventional IT networks and specialized industrial control systems that govern grid operations. This holistic approach is critical as the lines between physical and cyber threats blur within the smart grid ecosystem.

- Increased adoption of AI and Machine Learning for predictive threat detection and anomaly identification.

- Convergence of IT and OT security operations for unified protection across the grid.

- Growing emphasis on supply chain security to mitigate risks from third-party components and software.

- Shift towards cloud-based security solutions for scalability and flexibility.

- Development of robust identity and access management (IAM) frameworks for smart grid devices and users.

- Rising demand for real-time threat intelligence and vulnerability management platforms.

- Proliferation of IoT devices and distributed energy resources expanding the attack surface.

- Focus on compliance with evolving cybersecurity regulations and standards globally.

- Implementation of blockchain technology for enhanced data integrity and secure peer-to-peer energy transactions.

AI Impact Analysis on Smart Grid Security

Common user questions concerning AI's impact on Smart Grid Security largely revolve around its capabilities in threat detection, automation of responses, and the potential for AI itself to be exploited. Users are keen to understand how AI can enhance the speed and accuracy of identifying sophisticated cyberattacks, particularly those exhibiting novel characteristics, and whether it can effectively reduce the burden on human analysts. There is also interest in the dual-edged nature of AI, recognizing its potential for both defense and offense in the cybersecurity domain.

Artificial intelligence is profoundly transforming smart grid security by enabling a paradigm shift from signature-based detection to behavior-based anomaly recognition. AI and machine learning algorithms can analyze vast datasets from grid sensors, network traffic, and operational data to identify patterns indicative of cyberattacks, even those previously unseen. This capability is crucial for protecting dynamic and complex smart grid environments. Beyond detection, AI is increasingly being leveraged for automated incident response, orchestrating defensive actions and mitigating threat propagation in near real-time, thereby significantly improving the resilience and responsiveness of grid security systems.

- Enhanced predictive threat intelligence through analysis of large datasets for patterns and anomalies.

- Automated detection of sophisticated and zero-day attacks, reducing response times.

- Improved anomaly detection in operational technology (OT) environments, safeguarding critical infrastructure.

- Autonomous incident response capabilities for faster containment and mitigation of cyber threats.

- Optimization of security resource allocation and prioritization of vulnerabilities.

- Potential for AI-driven attack vectors, necessitating AI-based countermeasures.

- Reduced reliance on manual security analysis, leading to more efficient operations.

- Development of self-healing and adaptive security systems within the smart grid.

Key Takeaways Smart Grid Security Market Size & Forecast

User inquiries regarding key takeaways from the Smart Grid Security market size and forecast typically center on identifying the most critical growth drivers, the primary factors impeding market expansion, and the regions poised for the most significant development. There is a strong desire to understand the essential technologies propelling market growth and the overarching strategic imperatives for stakeholders. Users often seek concise summaries that highlight the most impactful insights for investment and strategic planning.

The smart grid security market is set for robust growth, primarily fueled by the accelerating digital transformation of energy utilities and the persistent escalation of cyber threats. Utilities are increasingly recognizing that cybersecurity is not merely a compliance issue but a fundamental component of operational resilience and service continuity. This understanding is driving significant investments in advanced security solutions that protect against evolving attack methodologies and safeguard critical infrastructure from both state-sponsored and criminal actors. The market's trajectory underscores the indispensable role of comprehensive security in realizing the full benefits of smart grid technologies while minimizing associated risks.

- Significant market expansion driven by escalating cyber threats and grid modernization efforts.

- Crucial investments in AI, machine learning, and real-time threat intelligence are paramount for effective defense.

- Convergence of IT and OT security is a defining trend, demanding integrated solutions.

- Regulatory mandates and compliance requirements are major catalysts for security solution adoption.

- North America and Europe currently lead the market, with Asia Pacific exhibiting the highest growth potential.

- Supply chain security is emerging as a critical vulnerability area requiring focused attention.

- High upfront costs and complexity of integration remain significant barriers, requiring scalable and flexible solutions.

- The market is shifting towards proactive, predictive, and automated security measures.

Smart Grid Security Market Drivers Analysis

The increasing frequency and sophistication of cyberattacks targeting critical infrastructure represent the most significant driver for the Smart Grid Security Market. As energy grids become more interconnected and digitalized, they present a broader attack surface for malicious actors, including state-sponsored groups, cybercriminals, and hacktivists. The potential for these attacks to cause widespread power outages, economic disruption, and loss of life compels utilities and governments to invest heavily in robust security solutions. Furthermore, the proliferation of Internet of Things (IoT) devices within smart grids, from smart meters to grid sensors, introduces numerous new endpoints that require stringent security measures, further propelling market growth.

Global regulatory bodies and governments are enacting stricter cybersecurity mandates for critical infrastructure sectors, including energy. These regulations, such as NERC CIP in North America or NIS Directive in Europe, compel utilities to adhere to specific security standards, conduct regular risk assessments, and implement protective measures. Non-compliance often results in significant penalties, providing a strong incentive for investment in smart grid security. Additionally, the increasing integration of distributed energy resources (DERs) like solar panels and wind farms, along with electric vehicle charging infrastructure, complicates grid management and expands potential entry points for cyber threats, necessitating enhanced security frameworks.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Escalating Cyber Threats and Attacks on Critical Infrastructure | +5.5% | Global, particularly North America, Europe, and Asia Pacific | Short to Long-term (2025-2033) |

| Increasing Digitalization and IoT Integration in Smart Grids | +4.8% | Global, particularly developed and rapidly developing economies | Mid to Long-term (2026-2033) |

| Stringent Regulatory Compliance and Government Mandates | +4.2% | North America (NERC CIP), Europe (NIS2), Asia Pacific (specific national regulations) | Short to Mid-term (2025-2029) |

| Integration of Distributed Energy Resources (DERs) and Electric Vehicles | +4.0% | Global, particularly regions with high renewable energy adoption (Europe, North America, parts of APAC) | Mid to Long-term (2027-2033) |

| Need for Operational Efficiency and Grid Resilience | +3.5% | Global | Long-term (2028-2033) |

Smart Grid Security Market Restraints Analysis

One of the primary restraints in the Smart Grid Security market is the high initial cost associated with implementing comprehensive security solutions. Utilities often operate on tight budgets and face pressure to minimize operational expenditures, making significant investments in new, sophisticated security infrastructure challenging. This includes not only the cost of software and hardware but also the expenses related to integration with existing legacy systems, staff training, and ongoing maintenance. The complexity of integrating disparate security systems across IT and OT environments further exacerbates these cost challenges, particularly for older grid infrastructures.

Another significant restraint is the shortage of skilled cybersecurity professionals with specialized knowledge of operational technology (OT) environments. The unique nature of industrial control systems (ICS) and SCADA systems requires expertise that differs from traditional IT security. This scarcity of talent makes it difficult for utilities to effectively implement, manage, and monitor their smart grid security systems, often leading to reliance on external consultants or managed security service providers, which adds another layer of cost and complexity. Additionally, concerns regarding data privacy and the potential for surveillance through smart grid technologies can lead to public resistance and slow down the adoption of new, more intrusive security measures.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Implementation Costs and Budget Constraints | -3.5% | Global, particularly developing economies | Short to Mid-term (2025-2029) |

| Lack of Skilled Cybersecurity Professionals in OT Environments | -2.8% | Global, particularly less developed regions | Mid to Long-term (2026-2033) |

| Complexity of Integrating New Security Solutions with Legacy Systems | -2.5% | Global, particularly regions with aging infrastructure (North America, Europe) | Short to Mid-term (2025-2030) |

| Data Privacy Concerns and Regulatory Hurdles | -1.8% | Europe (GDPR), North America, regions with strong privacy laws | Mid-term (2027-2031) |

Smart Grid Security Market Opportunities Analysis

The increasing convergence of Information Technology (IT) and Operational Technology (OT) within smart grids presents a substantial opportunity for integrated security solutions. Traditionally, IT and OT networks operated in silos, with distinct security practices. However, as smart grids increasingly rely on IP-based communication and interconnected systems, a unified security approach is becoming essential. This trend creates demand for solutions that can seamlessly bridge the gap between enterprise IT systems and industrial control systems, offering comprehensive visibility and control across the entire grid infrastructure. Companies that can provide holistic, integrated security platforms are well-positioned to capitalize on this evolving requirement, reducing complexity and enhancing overall security posture for utilities.

The growing adoption of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and blockchain offers significant opportunities for innovation within smart grid security. AI and ML can dramatically improve threat detection capabilities, enable predictive analytics, and automate response mechanisms, making security systems more agile and effective against sophisticated attacks. Blockchain technology, with its inherent decentralization and cryptographic security, can enhance data integrity, secure peer-to-peer energy transactions, and create tamper-proof audit trails. Furthermore, the expansion of managed security services and the potential for public-private partnerships to share threat intelligence and develop common security frameworks represent avenues for market growth and enhanced collective defense against cyber threats.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Convergence of IT and OT Security for Integrated Solutions | +4.0% | Global | Short to Mid-term (2025-2030) |

| Emergence of AI, ML, and Blockchain for Enhanced Security Capabilities | +3.8% | Global, particularly technology-advanced regions | Mid to Long-term (2027-2033) |

| Expansion of Managed Security Services (MSS) for Utilities | +3.2% | Global, particularly for smaller utilities and developing regions | Mid to Long-term (2026-2033) |

| Increased Focus on Public-Private Partnerships and Threat Intelligence Sharing | +2.5% | Global, particularly North America and Europe | Short to Mid-term (2025-2029) |

| Retrofit and Modernization of Aging Grid Infrastructure | +2.0% | North America, Europe, parts of Asia Pacific | Long-term (2028-2033) |

Smart Grid Security Market Challenges Impact Analysis

The rapidly evolving nature of cyber threats poses a significant challenge for smart grid security. Attackers constantly develop new techniques, vulnerabilities, and malware, making it difficult for defense mechanisms to keep pace. This requires continuous updates to security systems, proactive threat intelligence, and a flexible security architecture that can adapt to emerging risks. The sheer volume and complexity of data generated by smart grids also present a challenge in identifying genuine threats amidst noise, often leading to alert fatigue or overlooked critical incidents. Furthermore, the increasing reliance on third-party vendors and supply chains for grid components introduces supply chain vulnerabilities, where malicious code or hardware could be introduced during manufacturing or distribution, compromising the integrity of the grid before deployment.

Another formidable challenge is ensuring interoperability between diverse smart grid components and security solutions from various vendors. Smart grids comprise a complex ecosystem of legacy equipment, modern IoT devices, communication networks, and control systems, often supplied by different manufacturers. Achieving seamless security integration across this heterogeneous environment while maintaining operational efficiency and compliance is highly complex. Additionally, the potential for insider threats, whether malicious or unintentional, remains a persistent challenge, as privileged access to grid systems can be exploited. Addressing these challenges requires a multi-faceted approach involving advanced technological solutions, robust policy frameworks, continuous training, and strong collaborative efforts across the industry.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Evolving and Sophisticated Cyber Threat Landscape | -3.0% | Global | Continuous (2025-2033) |

| Interoperability Issues Across Diverse Smart Grid Components | -2.5% | Global, particularly regions with fragmented grid development | Mid to Long-term (2026-2032) |

| Supply Chain Vulnerabilities and Third-Party Risks | -2.0% | Global | Short to Mid-term (2025-2029) |

| Budgetary Constraints and Cost-Benefit Justification | -1.5% | Global, particularly developing economies | Short to Mid-term (2025-2029) |

| Insider Threats (Malicious and Unintentional) | -1.0% | Global | Continuous (2025-2033) |

Smart Grid Security Market - Updated Report Scope

This market research report provides an in-depth analysis of the global Smart Grid Security market, covering historical market performance from 2019 to 2023 and offering detailed forecasts from 2025 to 2033. The report meticulously examines market size, growth drivers, restraints, opportunities, and challenges across various segments and key geographical regions. It also includes comprehensive insights into the competitive landscape, profiling leading industry players and their strategic initiatives, alongside a robust analysis of AI's transformative impact on smart grid cybersecurity.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 12.2 Billion |

| Growth Rate | 18.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Cisco Systems Inc., IBM Corporation, Siemens AG, Lockheed Martin Corporation, General Electric Company, Schneider Electric SE, Honeywell International Inc., BAE Systems PLC, Thales Group, Fortinet Inc., Palo Alto Networks Inc., Tenable Holdings Inc., CyberArk Software Ltd., Splunk Inc., Nozomi Networks Inc., Dragos Inc., Waterfall Security Solutions, Claroty Ltd., CyberX (Microsoft) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Smart Grid Security market is comprehensively segmented to provide a granular view of its various facets, enabling stakeholders to understand specific areas of growth, demand, and technological adoption. These segmentations are critical for identifying niche opportunities and developing targeted strategies, reflecting the diverse requirements of different grid components, security threats, deployment models, and end-user types. The robust segmentation analysis offers insights into which solutions are gaining traction, where security vulnerabilities are most pronounced, and how different market players are addressing unique operational challenges within the smart grid ecosystem.

Analysis by component differentiates between tangible security solutions, such as firewalls and SIEM, and essential services like consulting, implementation, and managed security. Security type segmentation highlights specific areas of defense, from network and endpoint security to specialized SCADA and cloud security, reflecting the multi-layered approach required for smart grids. Deployment models categorize adoption based on on-premise, cloud, or hybrid environments, influenced by factors like data sovereignty, scalability, and cost efficiency. Furthermore, segmenting by application (generation, transmission, distribution, consumption) and end-user (utilities, commercial, industrial, residential) provides a clear understanding of market demand across the entire energy value chain and various consumer types, revealing key investment areas and evolving security priorities.

- By Component: Solutions (Firewall, Intrusion Detection/Prevention Systems (IDS/IPS), Security Information and Event Management (SIEM), Encryption, Unified Threat Management (UTM), Data Loss Prevention (DLP), Identity and Access Management (IAM), Antivirus/Antimalware, Distributed Denial of Service (DDoS) Mitigation, Vulnerability Management, Other Solutions), and Services (Consulting, Implementation, Support & Maintenance, Managed Security Services, Training & Education).

- By Security Type: Network Security, Endpoint Security, Application Security, Database Security, Cloud Security, SCADA Security, Operational Technology (OT) Security.

- By Deployment: On-premise, Cloud, Hybrid.

- By Application: Generation, Transmission, Distribution, Consumption/Smart Homes.

- By End-User: Government & Utilities, Commercial, Industrial, Residential.

Regional Highlights

- North America: Dominates the market due to stringent regulatory frameworks (e.g., NERC CIP), significant investments in grid modernization, and a high incidence of cyberattacks targeting critical infrastructure. The presence of major technology providers and cybersecurity firms also contributes to its leading position.

- Europe: A prominent market driven by the European Union's strong emphasis on cybersecurity through directives like NIS2, coupled with substantial investments in renewable energy and smart city initiatives. Countries like Germany, the UK, and France are at the forefront of adopting advanced smart grid security solutions.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate, fueled by rapid industrialization, urbanization, and large-scale smart grid projects in countries like China, India, Japan, and South Korea. Increasing awareness of cyber threats and government initiatives to secure critical infrastructure are key growth drivers.

- Latin America: Showing nascent growth, primarily driven by increasing digitalization of energy sectors in countries like Brazil and Mexico. However, market adoption faces challenges related to economic constraints and a less mature regulatory environment.

- Middle East and Africa (MEA): Emerging as a growing market due to significant infrastructure development projects, particularly in Gulf Cooperation Council (GCC) countries, and a rising recognition of the importance of cybersecurity for energy assets. Increased foreign investment and government-led digitalization initiatives are propelling demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Grid Security Market.- ABB Ltd.

- Cisco Systems Inc.

- IBM Corporation

- Siemens AG

- Lockheed Martin Corporation

- General Electric Company

- Schneider Electric SE

- Honeywell International Inc.

- BAE Systems PLC

- Thales Group

- Fortinet Inc.

- Palo Alto Networks Inc.

- Tenable Holdings Inc.

- CyberArk Software Ltd.

- Splunk Inc.

- Nozomi Networks Inc.

- Dragos Inc.

- Waterfall Security Solutions

- Claroty Ltd.

- CyberX (Microsoft)

Frequently Asked Questions

What is Smart Grid Security?

Smart Grid Security refers to the comprehensive measures, technologies, and practices implemented to protect the interconnected digital infrastructure of smart grids from cyberattacks, unauthorized access, data breaches, and operational disruptions. It encompasses the security of IT and OT systems, communication networks, and all connected devices to ensure the reliability, resilience, and integrity of electricity generation, transmission, and distribution.

Why is Smart Grid Security important?

Smart Grid Security is crucial because cyberattacks on energy infrastructure can lead to widespread power outages, economic disruption, national security threats, and even loss of life. As grids become more digitalized and connected, they become more vulnerable to sophisticated threats, making robust security essential to maintain service continuity, protect critical data, and ensure public safety.

What are the primary types of threats to Smart Grid Security?

Primary threats include malware and ransomware attacks targeting control systems, denial-of-service (DoS) attacks disrupting communication, phishing and social engineering aimed at personnel, insider threats (malicious or accidental), supply chain vulnerabilities in hardware/software, and sophisticated nation-state sponsored cyber espionage or sabotage attempts.

What role does AI play in Smart Grid Security?

AI plays a transformative role by enabling advanced threat detection through anomaly identification, predictive analytics for anticipating attacks, and automated incident response. AI algorithms can analyze vast amounts of operational data to identify deviations from normal behavior, providing faster and more accurate threat intelligence and enhancing the overall resilience of smart grid security systems.

What are the key challenges in implementing Smart Grid Security?

Key challenges include the high cost of implementation, the shortage of cybersecurity professionals with OT expertise, the complexity of integrating new security solutions with existing legacy systems, managing evolving and sophisticated cyber threats, and ensuring data privacy and compliance across diverse regulatory environments.