SiC CMP Slurry Market

SiC CMP Slurry Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702407 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

SiC CMP Slurry Market Size

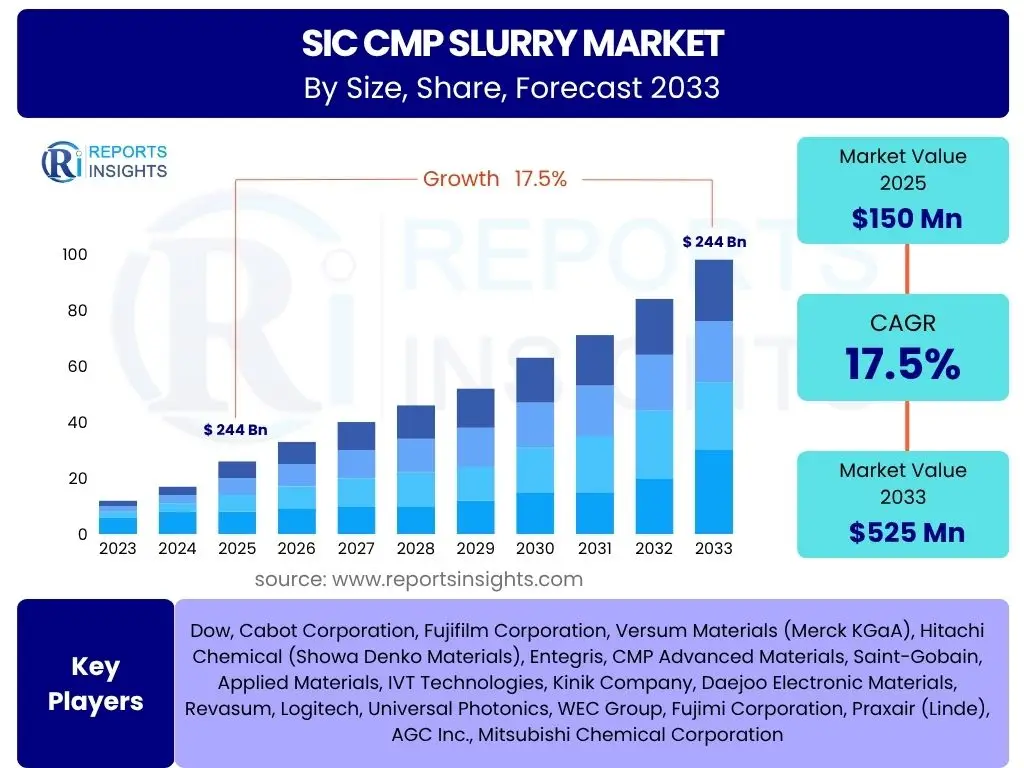

According to Reports Insights Consulting Pvt Ltd, The SiC CMP Slurry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.5% between 2025 and 2033. The market is estimated at USD 150 Million in 2025 and is projected to reach USD 525 Million by the end of the forecast period in 2033.

Key SiC CMP Slurry Market Trends & Insights

User queries regarding trends in the SiC CMP Slurry market frequently revolve around the impact of next-generation electronics, the evolving landscape of electric vehicles, and advancements in material science. The market is witnessing a strong impetus from the escalating demand for high-performance power electronics and RF devices, particularly those built on SiC substrates. Innovations in slurry compositions, focusing on achieving superior surface quality with minimal defects, are paramount to addressing the stringent requirements of advanced semiconductor manufacturing processes. Furthermore, the integration of automation and data analytics in CMP processes is becoming a notable trend aimed at enhancing efficiency and predictability.

Another significant trend is the increasing focus on sustainability and cost-efficiency, driving research into recyclable slurry formulations and more environmentally benign polishing processes. The drive towards miniaturization and higher power density in electronic components necessitates extremely precise and defect-free SiC surfaces, pushing manufacturers to develop novel abrasive materials and chemical additives for CMP slurries. The ongoing expansion of 5G infrastructure and the increasing adoption of renewable energy systems also significantly contribute to the demand for SiC-based power devices, thereby directly influencing the SiC CMP slurry market dynamics.

- Growing adoption of SiC power devices in electric vehicles (EVs) and charging infrastructure.

- Advancements in 5G and 6G telecommunications requiring high-frequency SiC RF devices.

- Increasing demand for SiC substrates in renewable energy systems, such as solar inverters and wind turbines.

- Development of novel abrasive particles and chemical formulations for enhanced material removal rates and surface quality.

- Focus on environmentally friendly and cost-effective slurry solutions, including recycling initiatives.

- Integration of advanced analytics and AI for optimizing CMP processes and predictive maintenance.

- Expansion of SiC applications into aerospace, industrial motor drives, and consumer electronics.

AI Impact Analysis on SiC CMP Slurry

User inquiries concerning AI's influence on the SiC CMP Slurry market often center on process optimization, quality control, and predictive capabilities. Artificial intelligence is transforming SiC CMP by enabling more precise control over polishing parameters, leading to higher yields and reduced material waste. AI algorithms can analyze vast datasets from CMP processes, identifying patterns and correlations that human operators might miss, thereby optimizing slurry composition, flow rates, and platen speeds in real-time. This data-driven approach significantly enhances the consistency and quality of SiC wafer surfaces.

The application of AI extends to predictive maintenance of CMP equipment, forecasting potential failures before they occur and minimizing downtime. Moreover, AI accelerates the research and development of new SiC CMP slurry formulations by simulating and predicting the performance of different chemical compositions and abrasive types, drastically reducing the time and cost associated with traditional trial-and-error methods. This integration of AI not only streamlines manufacturing but also drives innovation, allowing for the rapid development of slurries tailored to increasingly complex SiC applications.

- Optimization of CMP process parameters through real-time data analysis and machine learning algorithms.

- Enhanced defect detection and reduction on SiC wafer surfaces, leading to improved yield rates.

- Predictive maintenance for CMP equipment, minimizing unplanned downtime and operational costs.

- Accelerated R&D for novel SiC CMP slurry formulations by simulating material interactions and performance.

- Improved supply chain management and inventory optimization for raw materials and finished slurries.

- Automated quality control systems ensuring consistent slurry performance and wafer quality.

Key Takeaways SiC CMP Slurry Market Size & Forecast

Common user questions regarding key takeaways from the SiC CMP Slurry market size and forecast often focus on the core drivers of growth, the resilience of the market to external factors, and the overall investment potential. The market exhibits robust growth, primarily propelled by the insatiable demand for SiC-based power semiconductors across various high-growth sectors. The projected Compound Annual Growth Rate (CAGR) underscores a significant expansion phase, reflecting increasing adoption in electric vehicles, 5G technology, and renewable energy systems. This trajectory is supported by continuous advancements in SiC material science and manufacturing processes, which necessitate high-quality CMP slurries for efficient wafer production.

The critical role of SiC CMP slurries in achieving the stringent surface quality requirements for next-generation power and RF devices firmly establishes its indispensable position within the semiconductor ecosystem. Opportunities for innovation, particularly in developing greener and more efficient slurry formulations, are abundant. The forecast indicates a resilient market, less susceptible to short-term economic fluctuations due to its foundational role in long-term technological shifts like vehicle electrification and sustainable energy transitions. Strategic investments in R&D and manufacturing capacity for slurries are key to capitalizing on this expanding market.

- The SiC CMP Slurry market is poised for significant growth, driven by escalating demand for SiC power and RF devices.

- Electric vehicles (EVs) and 5G infrastructure represent primary growth catalysts for SiC wafer production and subsequent slurry consumption.

- Technological advancements in slurry formulation are crucial for meeting the stringent surface quality requirements of advanced SiC substrates.

- Asia Pacific is expected to remain the dominant region, fueled by its robust semiconductor manufacturing ecosystem.

- The market presents substantial opportunities for innovation in sustainable and high-performance polishing solutions.

SiC CMP Slurry Market Drivers Analysis

The expansion of the SiC CMP Slurry market is intrinsically linked to several powerful macroeconomic and technological drivers. Foremost among these is the accelerating global transition towards electric vehicles (EVs) and hybrid electric vehicles (HEVs). SiC power devices are foundational to EV efficiency, enabling lighter, more compact, and more efficient power electronics for inverters, onboard chargers, and DC-DC converters. As EV production scales up worldwide, the demand for high-quality SiC wafers, and consequently SiC CMP slurries, experiences a direct proportional surge. This automotive sector transformation is a long-term and potent driver for market growth.

Another significant driver is the rapid global deployment of 5G and future 6G telecommunications infrastructure. SiC-based RF devices offer superior performance in high-frequency applications, crucial for advanced communication systems due to their high power handling capabilities and excellent thermal conductivity. The continuous upgrade and expansion of cellular networks, alongside the proliferation of IoT devices, generate substantial demand for these high-performance components. This in turn necessitates precise and efficient SiC wafer processing, for which CMP slurries are indispensable, contributing significantly to market volume.

Furthermore, the growing emphasis on renewable energy sources, such as solar power and wind energy, drives the adoption of SiC in power conversion systems. SiC components enhance the efficiency and reliability of inverters, rectifiers, and power modules used in solar farms and wind turbines. The broader industrial sector's increasing need for high-efficiency power electronics in motor drives, uninterruptible power supplies (UPS), and industrial automation systems also acts as a robust driver. These diverse applications collectively underscore the critical role of SiC technology, directly fueling the market for SiC CMP slurries.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Growth of Electric Vehicles (EVs) | +5.0% | Global, especially China, North America, Europe | Long-term (2025-2033) |

| Expansion of 5G/6G Telecommunications Infrastructure | +4.5% | Global, especially APAC, North America | Mid-term (2025-2029) |

| Increasing Adoption in Renewable Energy Systems | +4.0% | Global, particularly Europe, APAC | Long-term (2025-2033) |

| Technological Advancements in SiC Substrate Manufacturing | +3.5% | Global, particularly Japan, South Korea, Taiwan, USA | Mid-term (2025-2030) |

| Growing Demand for High-Efficiency Power Electronics | +3.0% | Global | Long-term (2025-2033) |

SiC CMP Slurry Market Restraints Analysis

Despite significant growth potential, the SiC CMP Slurry market faces several restraining factors that could impede its expansion. One primary restraint is the inherently high cost associated with SiC wafer manufacturing, including the raw materials and the complex fabrication processes. This elevated cost translates to higher prices for SiC devices compared to traditional silicon-based alternatives, potentially slowing down broader adoption in cost-sensitive applications. Consequently, the demand for SiC CMP slurries is indirectly affected by these upstream cost considerations, as manufacturers aim to optimize overall production expenses.

Another critical restraint involves the technical complexities and stringent quality requirements associated with SiC wafer polishing. Achieving ultra-flat, defect-free surfaces is challenging due to the extreme hardness and chemical inertness of SiC. This necessitates highly specialized and often proprietary CMP slurry formulations and processes, which can be difficult to develop and scale. The precise control required to prevent subsurface damage and maintain consistency across large wafer batches presents a constant challenge for slurry manufacturers and end-users, potentially limiting widespread adoption if optimal performance is not consistently met.

Furthermore, supply chain vulnerabilities and geopolitical tensions can act as significant restraints. The global supply of certain rare earth elements or specialized abrasive materials used in advanced SiC CMP slurries can be concentrated in specific regions, making the market susceptible to supply disruptions or price volatility. Regulatory hurdles related to environmental protection and waste disposal for certain chemical components within slurries also pose a challenge, requiring manufacturers to invest in costly compliance measures and develop more environmentally benign solutions. These factors collectively contribute to operational complexities and can temper market growth.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Cost of SiC Wafer Manufacturing | -3.0% | Global | Mid-term (2025-2030) |

| Technical Complexities in Achieving Ultra-Precise Polishing | -2.5% | Global, particularly R&D intensive regions | Short-term (2025-2028) |

| Supply Chain Volatility and Raw Material Availability | -2.0% | Global | Short-term (2025-2027) |

| Environmental Regulations and Waste Management Challenges | -1.5% | Europe, North America, parts of APAC | Long-term (2025-2033) |

SiC CMP Slurry Market Opportunities Analysis

The SiC CMP Slurry market is rich with opportunities stemming from ongoing technological advancements and expanding application areas. A significant opportunity lies in the continuous innovation of slurry formulations, particularly the development of novel abrasive materials and chemical additives. As SiC wafers become larger and more complex, there is an increasing need for slurries that can achieve higher material removal rates (MRR) while simultaneously minimizing subsurface damage and improving surface finish. Research into advanced nano-abrasives and specialized chemical agents that can selectively polish SiC offers a lucrative avenue for market players to differentiate their offerings and capture premium segments.

Another promising opportunity emerges from the burgeoning demand for recycled and reclaimed SiC wafers. With the high cost of SiC substrates, industries are increasingly exploring methods to recover and reuse wafers that might otherwise be discarded due to defects or test runs. This trend creates a specific niche market for CMP slurries optimized for reclaiming processes, enabling effective removal of contaminants and damaged layers to bring wafers back to manufacturing standards. Companies that can provide efficient and cost-effective recycling solutions will find a growing market for their specialized CMP slurries, contributing to circular economy principles within the semiconductor industry.

Furthermore, the diversification of SiC applications beyond traditional power electronics into new emerging sectors presents substantial growth opportunities. Areas such as high-temperature electronics for aerospace and defense, advanced medical devices, and specialized industrial sensors are beginning to leverage SiC's unique properties. Each new application often demands specific SiC device characteristics, which in turn necessitates tailored CMP solutions. Strategic collaborations between slurry manufacturers, equipment providers, and end-use device makers can facilitate the co-development of optimized solutions for these nascent markets, unlocking significant long-term growth potential and expanding the overall addressable market for SiC CMP slurries.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Advanced & Environmentally Friendly Formulations | +4.0% | Global, particularly R&D hubs | Mid-term (2026-2031) |

| Growing Demand for Recycled SiC Wafers | +3.5% | Global, particularly regions with high manufacturing output | Long-term (2027-2033) |

| Expansion into New Applications (Aerospace, Medical, etc.) | +3.0% | Global, niche markets in developed economies | Long-term (2028-2033) |

| Strategic Partnerships and Collaborations Across Value Chain | +2.5% | Global | Mid-term (2025-2030) |

SiC CMP Slurry Market Challenges Impact Analysis

The SiC CMP Slurry market, while promising, is not without its significant challenges that could hinder growth and operational efficiency. One of the primary hurdles is achieving ultra-low defect rates and extremely precise surface flatness required for advanced SiC devices. The inherent hardness and chemical inertness of SiC make it difficult to polish without introducing surface scratches, crystal defects, or residual contaminants. Meeting the increasingly stringent quality specifications for next-generation power and RF devices demands constant innovation in slurry chemistry and abrasive technology, often at a high research and development cost, posing a significant technical barrier for many market entrants.

Another critical challenge lies in managing the waste disposal and environmental impact of CMP slurries. Traditional slurries often contain hazardous chemicals and nano-sized abrasive particles, which require specialized treatment and disposal procedures to comply with environmental regulations. As production volumes of SiC wafers increase, so does the volume of spent slurry, intensifying the need for sustainable and eco-friendly solutions. Developing biodegradable or easily recyclable slurry components without compromising performance presents a complex R&D challenge, adding to the operational burden and compliance costs for manufacturers.

Furthermore, the intellectual property landscape surrounding SiC CMP technology is highly complex and fiercely competitive. Proprietary formulations, specific abrasive types, and unique chemical additives are often protected by patents, limiting market entry for new players and increasing licensing costs for others. Skilled workforce shortages, particularly experts in materials science, chemical engineering, and semiconductor manufacturing, also pose a challenge, affecting the pace of innovation and efficiency within the industry. These factors collectively create an environment where sustained competitive advantage relies heavily on continuous R&D investment and strategic management of intellectual assets and human capital.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Achieving Ultra-Low Defect Rates and Superior Surface Quality | -3.5% | Global | Short-term (2025-2028) |

| Complexities of Waste Disposal and Environmental Compliance | -3.0% | Europe, North America, specific Asian countries | Mid-term (2026-2031) |

| High R&D Investment and Intellectual Property Challenges | -2.5% | Global, particularly competitive markets | Long-term (2025-2033) |

| Shortage of Skilled Workforce in Semiconductor Manufacturing | -2.0% | Global, particularly developed economies | Mid-term (2025-2030) |

SiC CMP Slurry Market - Updated Report Scope

This market research report provides an in-depth analysis of the global SiC CMP Slurry market, offering comprehensive insights into its current state, historical performance, and future growth projections. The scope encompasses detailed segmentation based on slurry type, application, and end-use industry, along with a thorough regional breakdown. It aims to deliver a holistic understanding of market dynamics, competitive landscape, and key strategic developments shaping the industry through the forecast period.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 150 Million |

| Market Forecast in 2033 | USD 525 Million |

| Growth Rate | 17.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Dow, Cabot Corporation, Fujifilm Corporation, Versum Materials (Merck KGaA), Hitachi Chemical (Showa Denko Materials), Entegris, CMP Advanced Materials, Saint-Gobain, Applied Materials, IVT Technologies, Kinik Company, Daejoo Electronic Materials, Revasum, Logitech, Universal Photonics, WEC Group, Fujimi Corporation, Praxair (Linde), AGC Inc., Mitsubishi Chemical Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The SiC CMP Slurry market is comprehensively segmented to provide granular insights into its diverse components and drivers. These segmentations are critical for understanding specific market niches, identifying high-growth areas, and strategizing market entry or expansion. The primary segmentation criteria include the type of abrasive material used in the slurry, the specific application of the slurry in wafer processing, and the end-use industry leveraging SiC devices.

Understanding these segments allows for a detailed analysis of demand patterns and technological requirements. For instance, the demand for diamond-based slurries may be predominant in initial substrate polishing due to SiC's hardness, while silica-based slurries might be favored for achieving final surface finishes. Similarly, the requirements for slurries used in power device manufacturing differ significantly from those for RF devices, driven by varying critical dimension and surface defect tolerances. Analyzing these segments helps stakeholders to tailor their product offerings and market strategies effectively.

- By Type:

- Abrasive Type: Diamond-based Slurry, Silica-based Slurry, Alumina-based Slurry, Cerium Oxide-based Slurry, Other Abrasive Slurries

- Particle Size: Nanoparticle Slurry, Microparticle Slurry

- By Application:

- SiC Wafer Polishing: SiC Substrate Polishing, SiC Epitaxial Polishing

- Device Fabrication: Power Device Manufacturing, RF Device Manufacturing, Optoelectronic Device Manufacturing

- By End-Use Industry: Automotive (EVs, HEVs, Charging Infrastructure), Telecommunications (5G/6G Base Stations, RF Devices), Energy & Utilities (Solar Inverters, Wind Turbines, Grid Infrastructure), Industrial (Motor Drives, Power Supplies, Automation), Consumer Electronics (Adapters, Chargers), Aerospace & Defense, Others

Regional Highlights

The global SiC CMP Slurry market exhibits distinct regional dynamics, influenced by local semiconductor manufacturing ecosystems, automotive industry growth, and government policies. Asia Pacific (APAC) currently dominates the market and is expected to maintain its leading position throughout the forecast period. This dominance is primarily attributed to the region's robust semiconductor manufacturing infrastructure, particularly in countries like China, Japan, South Korea, and Taiwan, which are major producers of SiC wafers and devices. The rapid expansion of the electric vehicle market and extensive investments in 5G infrastructure across APAC further stimulate the demand for SiC CMP slurries. Government initiatives promoting domestic semiconductor production and technological advancements also play a crucial role in fueling market growth in this region.

North America represents a significant market for SiC CMP slurries, driven by strong research and development activities in advanced materials and semiconductor technologies, coupled with a growing presence in the electric vehicle industry. The United States, in particular, is home to key players in SiC wafer manufacturing and power device development, fostering a high demand for specialized CMP solutions. The region's focus on high-performance computing, defense applications, and renewable energy also contributes to the adoption of SiC technology, ensuring sustained market expansion. Investments in domestic manufacturing capabilities and supply chain resilience further bolster the North American market's position.

Europe is another vital region for the SiC CMP Slurry market, characterized by its well-established automotive industry and increasing investments in renewable energy and industrial automation. Countries like Germany, France, and Italy are at the forefront of EV adoption and the development of efficient power electronics, directly impacting the demand for SiC devices and associated CMP slurries. Strict environmental regulations in Europe are also driving the demand for more sustainable and eco-friendly slurry formulations, pushing innovation in green polishing technologies. The region's emphasis on energy efficiency and industrial transformation continues to create opportunities for market growth.

Latin America and the Middle East & Africa (MEA) currently hold smaller shares in the SiC CMP Slurry market but are projected to experience gradual growth during the forecast period. This growth will be driven by emerging industrialization, increasing investments in renewable energy projects, and the nascent adoption of electric vehicles in certain countries within these regions. While still in early stages, the developing semiconductor infrastructure and growing demand for power electronics in various applications suggest future potential. Strategic partnerships and technology transfer from more established regions could accelerate market development in these areas.

- Asia Pacific (APAC): Dominant market due to strong semiconductor manufacturing base (China, Japan, South Korea, Taiwan), high EV adoption rates, and extensive 5G network expansion.

- North America: Significant growth driven by advanced R&D in semiconductors, increasing EV production, and demand from aerospace and defense sectors.

- Europe: Growth propelled by the robust automotive industry, increasing renewable energy investments, and stringent environmental regulations fostering demand for sustainable solutions.

- Latin America & MEA: Emerging markets with potential growth stemming from industrial development, renewable energy projects, and nascent EV adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SiC CMP Slurry Market.- Dow

- Cabot Corporation

- Fujifilm Corporation

- Versum Materials (Merck KGaA)

- Hitachi Chemical (Showa Denko Materials)

- Entegris

- CMP Advanced Materials

- Saint-Gobain

- Applied Materials

- IVT Technologies

- Kinik Company

- Daejoo Electronic Materials

- Revasum

- Logitech

- Universal Photonics

- WEC Group

- Fujimi Corporation

- Praxair (Linde)

- AGC Inc.

- Mitsubishi Chemical Corporation

Frequently Asked Questions

What is SiC CMP slurry and why is it important?

SiC CMP (Chemical Mechanical Planarization) slurry is a critical consumable used in the semiconductor manufacturing process to achieve ultra-flat and defect-free surfaces on Silicon Carbide (SiC) wafers. It combines abrasive particles with chemical agents to precisely remove material from the wafer surface, which is essential for manufacturing high-performance SiC power and RF devices used in electric vehicles, 5G technology, and renewable energy.

What factors are driving the growth of the SiC CMP Slurry market?

The primary drivers include the surging global demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs), the extensive deployment of 5G and future 6G telecommunication infrastructure, and the increasing adoption of SiC-based power devices in renewable energy systems like solar inverters. Additionally, ongoing technological advancements in SiC wafer manufacturing and device performance are fueling market expansion.

What are the key challenges faced by the SiC CMP Slurry market?

Key challenges include the inherent difficulty in achieving ultra-low defect rates and perfect surface flatness on extremely hard SiC wafers, managing the complex waste disposal and environmental compliance of chemical-laden slurries, and the high research and development investment required for new, high-performance formulations. Intellectual property complexities and a shortage of skilled labor also pose significant hurdles.

How does AI impact the SiC CMP Slurry market?

AI is increasingly used to optimize CMP processes by analyzing real-time data to control polishing parameters, thus improving yield rates and reducing defects. It also aids in predictive maintenance of equipment, minimizing downtime, and accelerates the research and development of new slurry formulations through simulations and performance predictions, leading to more efficient product innovation.

Which regions are key players in the SiC CMP Slurry market?

Asia Pacific (APAC) is the dominant region due to its robust semiconductor manufacturing base in countries like China, Japan, South Korea, and Taiwan. North America and Europe are also significant markets, driven by their strong R&D capabilities, growing electric vehicle industries, and increasing investments in advanced power electronics and renewable energy applications.