Shoe Care Product Market

Shoe Care Product Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702640 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Shoe Care Product Market Size

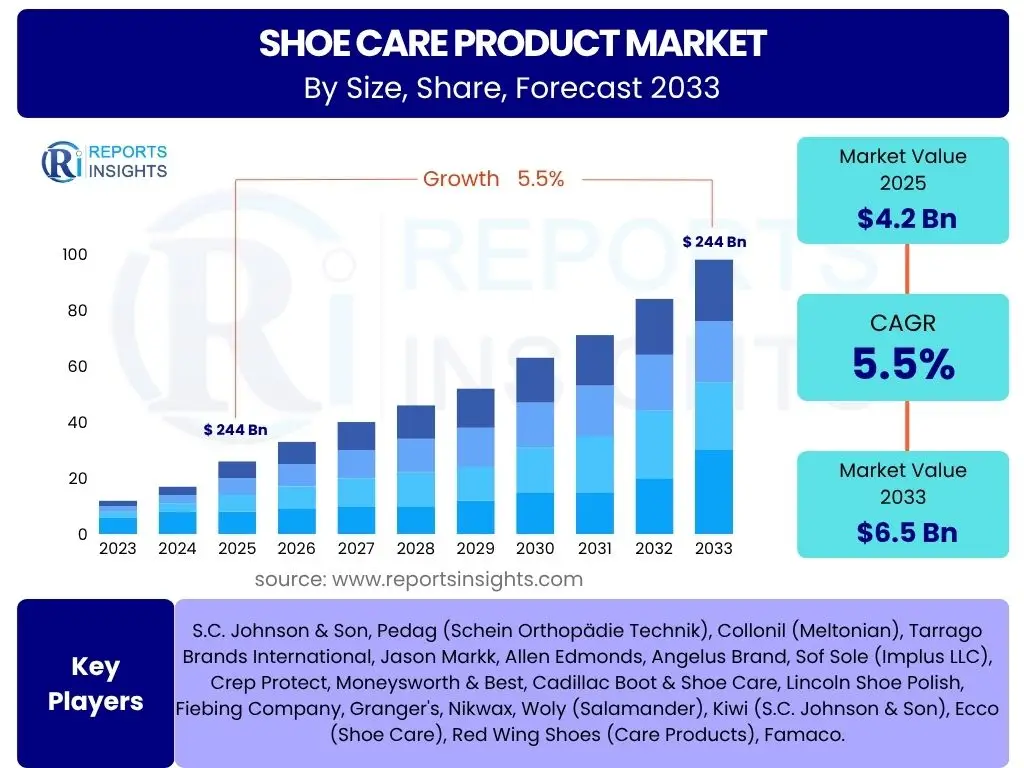

According to Reports Insights Consulting Pvt Ltd, The Shoe Care Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2025 and 2033. The market is estimated at USD 4.2 billion in 2025 and is projected to reach USD 6.5 billion by the end of the forecast period in 2033.

Key Shoe Care Product Market Trends & Insights

The shoe care product market is experiencing dynamic shifts driven by evolving consumer preferences and increasing awareness regarding footwear longevity and appearance. A significant trend involves the growing demand for sustainable and eco-friendly products, as consumers become more conscious of environmental impact. This shift is prompting manufacturers to innovate with biodegradable ingredients and sustainable packaging solutions. Furthermore, the rise of e-commerce platforms has significantly expanded market reach, making a diverse range of specialized shoe care products accessible to a global audience, thereby fostering convenience and product discovery.

Another prominent trend is the premiumization of shoe care, where consumers are increasingly willing to invest in high-quality, specialized products for specific footwear materials like premium leather, suede, or performance fabrics. This is coupled with a growing interest in DIY shoe care, driven by online tutorials and social media, empowering individuals to perform professional-level care at home. The market is also witnessing a surge in multi-functional products that offer combined benefits such as cleaning, conditioning, and waterproofing, catering to the busy lifestyles of modern consumers and simplifying their shoe care routines.

- Growing consumer demand for sustainable and eco-friendly shoe care solutions.

- Increased adoption of premium and specialized shoe care products for diverse materials.

- Expansion of e-commerce channels facilitating broader market access and product discovery.

- Rise of DIY shoe care practices fueled by digital content and accessibility of specialized tools.

- Development of multi-functional products offering combined cleaning, conditioning, and protection.

- Emphasis on advanced formulations providing enhanced protection against water, stains, and dirt.

- Influence of fashion and streetwear trends driving demand for sneaker care products.

AI Impact Analysis on Shoe Care Product

Artificial Intelligence (AI) is poised to revolutionize the shoe care product market by enhancing personalization, optimizing supply chains, and driving innovation in product development. AI-powered analytics can process vast amounts of consumer data, including purchasing habits, footwear types, and material preferences, to offer highly personalized product recommendations. This enables brands to anticipate demand for specific care items, tailor marketing campaigns, and improve the overall customer experience through predictive insights into individual needs.

Furthermore, AI can streamline manufacturing processes by optimizing production schedules, predicting equipment maintenance needs, and ensuring quality control through automated inspection systems. In the retail sector, AI-driven chatbots and virtual assistants can provide instant expert advice on shoe care routines, product selection, and troubleshooting, significantly improving customer support. The integration of AI in smart application devices or future shoe care gadgets could also lead to more efficient and effective product application, potentially offering real-time feedback on coverage and absorption, thus transforming the consumer interaction with shoe care products.

- Personalized product recommendations based on AI-driven consumer data analysis.

- Optimized supply chain and inventory management through predictive analytics.

- Enhanced customer support via AI-powered chatbots and virtual assistants for care advice.

- Automated quality control and process optimization in shoe care product manufacturing.

- Potential for smart shoe care devices with AI integration for precise application.

- Data-driven insights for new product development and formulation improvements.

- Fraud detection and brand protection in online marketplaces.

Key Takeaways Shoe Care Product Market Size & Forecast

The Shoe Care Product Market is set for robust expansion, driven by increasing consumer awareness regarding footwear longevity and the rising trend of sneaker and premium footwear ownership. The projected CAGR of 5.5% signifies a healthy growth trajectory, indicating strong underlying demand across various segments. This growth is underpinned by innovation in product formulations, including eco-friendly options, and the strategic expansion of distribution channels, particularly through online retail platforms that enhance product accessibility.

A significant takeaway is the market's resilience and adaptability to changing consumer behaviors, such as the preference for specialized care and DIY maintenance. The forecast also highlights the potential for market players to capitalize on emerging opportunities in developing regions and through the integration of advanced technologies like AI for personalized solutions. Understanding these dynamics is crucial for stakeholders aiming to formulate effective growth strategies and secure a competitive edge in this evolving market.

- The market exhibits a stable and promising growth outlook with a 5.5% CAGR to 2033.

- Increasing focus on footwear longevity and appearance drives sustained demand.

- E-commerce platforms are pivotal in expanding market reach and consumer access.

- Premiumization and specialization of products are key growth segments.

- Sustainability and eco-friendliness are becoming essential market differentiators.

- Technological integration, including AI, presents significant future growth opportunities.

- Emerging economies offer untapped potential for market penetration.

Shoe Care Product Market Drivers Analysis

The global shoe care product market is significantly propelled by several key drivers, primarily the rising consumer awareness regarding the maintenance and extended lifespan of footwear. As consumers invest in higher-quality and more expensive shoes, there is a commensurate increase in the demand for specialized care products to protect these investments. This trend is amplified by the influence of social media and fashion culture, which emphasize the aesthetic appeal and preservation of footwear, particularly in the booming sneaker and athleisure segments.

Furthermore, the rapid expansion of the e-commerce sector has played a crucial role in enhancing market accessibility. Online platforms offer a vast array of niche and premium shoe care products that might not be readily available in traditional brick-and-mortar stores, thereby stimulating demand and facilitating product discovery for a global consumer base. The increasing disposable income in developing economies, coupled with evolving lifestyle trends and a growing affinity for branded footwear, also contributes to the heightened consumption of shoe care solutions.

Lastly, innovations in product formulation, including the development of multi-functional and material-specific products (e.g., for vegan leather, exotic skins, or technical fabrics), are attracting a broader consumer base. The shift towards sustainable and environmentally friendly products, driven by consumer demand and regulatory pressures, encourages manufacturers to innovate, thereby expanding the market and catering to conscious consumers who prioritize ecological impact alongside product efficacy.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Footwear Ownership & Value | +0.4% | Global, particularly APAC & North America | Long-term (5+ years) |

| Rising Consumer Awareness on Footwear Longevity | +0.3% | North America, Europe, Developed Asia | Mid-term (3-5 years) |

| Growth of E-commerce & Online Retail | +0.5% | Global | Short-term (1-3 years) |

| Influence of Fashion & Sneaker Culture | +0.35% | North America, Europe, Asia (Urban Centers) | Mid-term (3-5 years) |

| Product Innovation & Specialization | +0.25% | Global | Long-term (5+ years) |

| Increasing Disposable Income in Emerging Economies | +0.2% | Asia Pacific, Latin America | Long-term (5+ years) |

Shoe Care Product Market Restraints Analysis

Despite robust growth drivers, the shoe care product market faces several restraints that could impede its full potential. A primary challenge is the relatively low consumer awareness in certain demographics or regions regarding the benefits and necessity of dedicated shoe care. Many consumers still rely on improvised home remedies or neglect shoe care altogether, perceiving it as a non-essential expense. This lack of education about proper maintenance techniques and product efficacy limits market penetration, especially in price-sensitive segments.

Another significant restraint is the environmental concern associated with chemical-based shoe care products. As consumers become more eco-conscious, the use of harsh chemicals, volatile organic compounds (VOCs), and non-biodegradable packaging raises sustainability concerns. This creates a dilemma for manufacturers who must balance performance with environmental responsibility, often leading to higher production costs for eco-friendly alternatives which might translate to higher retail prices, potentially deterring some consumers.

Furthermore, economic downturns and fluctuations in disposable income can directly impact discretionary spending on non-essential items like shoe care products. In times of economic uncertainty, consumers may prioritize basic necessities over shoe maintenance, leading to a decline in sales. The market also faces competition from manufacturers who integrate protective features directly into footwear materials, reducing the perceived need for external care products, though this is often limited to specific types of shoes.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Low Consumer Awareness in Certain Regions | -0.3% | Emerging Economies, Rural Areas | Long-term (5+ years) |

| Environmental Concerns over Chemical Formulations | -0.2% | Europe, North America | Mid-term (3-5 years) |

| Economic Downturns Affecting Discretionary Spending | -0.4% | Global (variable) | Short-term (1-3 years) |

| Availability of DIY & Home Remedies | -0.15% | Global | Long-term (5+ years) |

| Competition from Integrated Footwear Protection | -0.1% | Global | Mid-term (3-5 years) |

Shoe Care Product Market Opportunities Analysis

The shoe care product market is ripe with opportunities for innovation and expansion, particularly driven by the accelerating demand for sustainable and natural formulations. As environmental consciousness grows, there is a significant market gap for products that are effective yet free from harsh chemicals, biodegradable, and packaged responsibly. Companies that invest in green chemistry and sustainable sourcing will gain a competitive edge and appeal to a widening segment of eco-conscious consumers, thereby opening up new revenue streams and fostering brand loyalty.

Another lucrative opportunity lies in the burgeoning market for specialized and premium products tailored to specific footwear types and materials. The global surge in sneaker culture, alongside investments in high-end leather goods and performance athletic wear, creates a strong demand for dedicated cleaning, protection, and restoration solutions. Developing products that cater to these niche segments, such as advanced sneaker cleaners, waterproofers for technical fabrics, or conditioners for exotic leathers, allows manufacturers to tap into higher-value markets and differentiate their offerings.

Furthermore, the integration of technology, including smart packaging, IoT-enabled application devices, and AI-driven personalized recommendations, represents a significant growth avenue. Such technological advancements can enhance product efficacy, improve user experience, and create a more interactive relationship between consumers and shoe care brands. Expanding distribution channels into emerging markets, establishing stronger online presences, and forging strategic partnerships with footwear manufacturers or retailers also present substantial opportunities for market penetration and brand visibility.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Sustainable & Eco-friendly Products | +0.6% | Global, particularly Europe & North America | Long-term (5+ years) |

| Expansion into Specialized & Premium Care Segments | +0.5% | Global (Urban Centers) | Mid-term (3-5 years) |

| Technological Integration (e.g., Smart Packaging, AI) | +0.4% | Developed Markets | Long-term (5+ years) |

| Untapped Potential in Emerging Markets | +0.3% | Asia Pacific, Latin America, MEA | Long-term (5+ years) |

| Subscription-based & Direct-to-Consumer Models | +0.25% | North America, Europe | Short-term (1-3 years) |

| Strategic Partnerships with Footwear Brands | +0.2% | Global | Mid-term (3-5 years) |

Shoe Care Product Market Challenges Impact Analysis

The shoe care product market, while dynamic, faces several significant challenges that could hinder its expansion and profitability. A major hurdle is the intense competition from a multitude of local and international players, leading to price wars and reduced profit margins. The market is highly fragmented, with numerous brands offering similar products, making it difficult for new entrants to establish a strong foothold and for existing players to maintain market share without continuous innovation and aggressive marketing.

Another challenge is navigating the complex and evolving regulatory landscape, particularly concerning the chemical composition of shoe care products. Different regions and countries have varying environmental and health safety standards for chemical substances, ingredients, and labeling requirements. Compliance with these diverse regulations can be costly and time-consuming, posing a significant barrier to market entry and expansion for companies operating on a global scale, and potentially limiting the types of formulations that can be used.

Furthermore, changing consumer habits and the prevalence of fast fashion present a long-term challenge. As some consumers opt for more affordable, disposable footwear, the perceived need for extensive shoe care diminishes. This shifts consumer focus from preserving shoes to simply replacing them, impacting the demand for long-lasting care products. Supply chain disruptions, including raw material price volatility and logistics issues, also pose operational challenges that can affect production costs and product availability, influencing market stability and growth.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Market Competition & Fragmentation | -0.4% | Global | Long-term (5+ years) |

| Evolving Regulatory Landscape for Chemical Products | -0.35% | Europe, North America, Developed Asia | Mid-term (3-5 years) |

| Changing Consumer Habits (e.g., Fast Fashion) | -0.25% | Global (Developed Markets) | Long-term (5+ years) |

| Raw Material Price Volatility & Supply Chain Issues | -0.2% | Global | Short-term (1-3 years) |

| Counterfeiting & Intellectual Property Infringement | -0.15% | Emerging Markets | Mid-term (3-5 years) |

Shoe Care Product Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Shoe Care Product Market, offering valuable insights into its current size, historical performance, and future growth trajectory. The scope encompasses detailed segmentation across various product types, forms, material compatibility, applications, distribution channels, and end-user segments. It also includes a thorough regional analysis, identifying key market dynamics, trends, drivers, restraints, opportunities, and challenges influencing market expansion across major geographical regions. The report further provides profiles of key market players, competitive landscape analysis, and strategic recommendations for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 5.5% CAGR |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | S.C. Johnson & Son, Pedag (Schein Orthopädie Technik), Collonil (Meltonian), Tarrago Brands International, Jason Markk, Allen Edmonds, Angelus Brand, Sof Sole (Implus LLC), Crep Protect, Moneysworth & Best, Cadillac Boot & Shoe Care, Lincoln Shoe Polish, Fiebing Company, Granger's, Nikwax, Woly (Salamander), Kiwi (S.C. Johnson & Son), Ecco (Shoe Care), Red Wing Shoes (Care Products), Famaco. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Shoe Care Product Market is comprehensively segmented to provide a granular understanding of its diverse components and dynamics. This segmentation facilitates a detailed analysis of various product types, forms, and their applicability across different footwear materials, thereby offering insights into specific consumer needs and market niches. Understanding these segments is crucial for manufacturers to tailor their product offerings and for retailers to optimize their inventory and marketing strategies, ensuring maximum market penetration and catering to a wide range of consumer preferences.

The market is further segmented by application, which distinguishes between products designed for athletic, casual, formal, and specialized footwear, reflecting the varying care requirements of different shoe categories. Distribution channels also form a critical segmentation, highlighting the shift towards online retail while acknowledging the continued importance of traditional brick-and-mortar stores. Lastly, the end-user segmentation differentiates between residential consumers and commercial entities such as footwear retailers and repair shops, each with distinct volume and product requirements, showcasing the broad applicability of shoe care solutions across various user groups.

- By Product Type: This segment includes a wide array of products designed for specific care functions.

- Cleaners: Encompassing foam, gel, liquid cleaners, and convenient wipes tailored for surface dirt and deeper grime.

- Polishes: Such as wax, cream, and liquid polishes that enhance shine, color, and protection for various materials.

- Protectors: Including waterproofers and stain repellents that create barriers against environmental damage.

- Deodorizers: Available as sprays or inserts, aimed at neutralizing odors and maintaining freshness.

- Conditioners: Products designed to moisturize and preserve the flexibility and integrity of materials, especially leather.

- Accessories: Comprising essential tools like brushes, applicators, shoe trees for shape retention, and replacement laces.

- Kits: Bundled products offering a comprehensive solution for complete shoe care routines.

- By Form: Categorizes products based on their physical consistency.

- Liquid: Easy to apply for cleaning and conditioning.

- Spray: Convenient for waterproofing, deodorizing, and light cleaning.

- Cream: Ideal for conditioning and polishing, offering good absorption.

- Wax: Provides a high shine and strong protective barrier.

- Gel: Often used for deep cleaning or specific material treatments.

- Wipes: For quick, on-the-go cleaning and touch-ups.

- Solid: Typically refers to specific types of polishes or specialized cleaning blocks.

- By Material Type: Addresses the specific care needs of different shoe materials.

- Leather: Includes products for smooth leather, suede, and nubuck, each requiring specialized formulations.

- Fabric: Designed for materials like canvas and mesh, common in sneakers and casual shoes.

- Synthetics: Formulations for various synthetic leathers and textile blends.

- Rubber: For cleaning and protecting rubber soles and components.

- Exotic Materials: Niche products for unique or delicate materials like reptile skin or delicate fabrics.

- By Application: Differentiates products based on the type of footwear they are intended for.

- Athletic Footwear: High-performance cleaners and protectors for sneakers and sports shoes.

- Casual Footwear: General-purpose care for everyday shoes.

- Formal Footwear: Polishes and conditioners specifically for dress shoes.

- Boots: Robust solutions for various types of boots, including work boots and fashion boots.

- Sandals: Light cleaners and deodorizers for open-toe footwear.

- Children's Footwear: Gentle, non-toxic formulations for kids' shoes.

- By Distribution Channel: Examines how products reach consumers.

- Online Retail: Encompassing direct company websites and major e-commerce platforms like Amazon, eBay, etc.

- Supermarkets/Hypermarkets: Broad retail chains offering general shoe care items.

- Specialty Stores: Including dedicated footwear stores, outdoor gear shops, and shoe repair outlets.

- Department Stores: Upscale retail environments often carrying premium brands.

- Convenience Stores: Limited selection of basic care products.

- Direct-to-Consumer: Brands selling directly to customers, often via their own online stores.

- By End-User: Identifies the primary consumer base.

- Residential: Individual consumers purchasing for personal use.

- Commercial: Businesses such as footwear retailers, repair shops, hotels, and professional cleaning services that require bulk or specialized products.

Regional Highlights

The global Shoe Care Product Market exhibits distinct regional dynamics, influenced by varying consumer preferences, economic development, and cultural factors related to footwear. North America is a prominent market, characterized by high disposable incomes, a strong fashion influence particularly in sneaker culture, and a growing consumer awareness regarding shoe maintenance. The region's robust e-commerce infrastructure also supports the widespread availability and adoption of diverse shoe care solutions, driving demand for both premium and specialized products.

Europe represents a mature market with a strong emphasis on quality, craftsmanship, and sustainability. Countries like Germany, the UK, and France show significant demand for eco-friendly and high-performance shoe care products, especially for leather and luxury footwear. Regulatory standards concerning chemical formulations also play a crucial role in shaping product development in this region. The rising trend of shoe repair and restoration services in Europe further boosts the demand for professional-grade shoe care items.

Asia Pacific (APAC) is projected to be the fastest-growing region, primarily driven by rapid urbanization, increasing disposable incomes, and the burgeoning middle class in countries like China and India. The growing adoption of Western fashion trends, coupled with a booming footwear industry, is fueling the demand for shoe care products. While awareness is still developing in some areas, the expanding online retail landscape and the increasing brand consciousness among consumers are creating substantial opportunities for market players. Latin America, the Middle East, and Africa (MEA) are emerging markets with developing potential, spurred by economic growth and increasing access to a wider range of footwear. These regions offer opportunities for affordable yet effective shoe care solutions, with a gradual shift towards organized retail and online sales channels.

- North America: Leading market share due to high consumer spending on footwear, strong sneaker culture, and advanced e-commerce penetration. Emphasis on convenience and premiumization.

- Europe: Mature market with significant demand for high-quality, sustainable, and eco-friendly products, particularly for traditional leather footwear and luxury brands. Strong focus on product efficacy and compliance with environmental regulations.

- Asia Pacific (APAC): Fastest-growing region driven by rising disposable incomes, urbanization, and increasing footwear consumption. Developing consumer awareness and expanding online retail channels are key growth catalysts in countries like China, India, and Japan.

- Latin America: Emerging market with increasing adoption of branded footwear and growing awareness of shoe maintenance. Opportunities exist for affordable and accessible product ranges, particularly in urban areas.

- Middle East and Africa (MEA): Nascent market with potential for growth, supported by economic diversification and increasing fashion consciousness. Demand is expected to rise with expanding retail infrastructure and evolving consumer lifestyles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shoe Care Product Market.- S.C. Johnson & Son

- Pedag (Schein Orthopädie Technik)

- Collonil (Meltonian)

- Tarrago Brands International

- Jason Markk

- Allen Edmonds

- Angelus Brand

- Sof Sole (Implus LLC)

- Crep Protect

- Moneysworth & Best

- Cadillac Boot & Shoe Care

- Lincoln Shoe Polish

- Fiebing Company

- Granger's

- Nikwax

- Woly (Salamander)

- Ecco (Shoe Care)

- Red Wing Shoes (Care Products)

- Famaco

Frequently Asked Questions

What is the current market size of the Shoe Care Product Market?

The Shoe Care Product Market is estimated at USD 4.2 billion in 2025. This valuation reflects the current demand for a wide range of products aimed at cleaning, protecting, and maintaining footwear across various materials and applications.

What is the projected growth rate for the Shoe Care Product Market?

The Shoe Care Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2025 and 2033. This consistent growth indicates a rising global demand for shoe care solutions driven by increased footwear ownership and a focus on product longevity.

What are the key trends influencing the Shoe Care Product Market?

Key trends include a strong consumer shift towards sustainable and eco-friendly products, the premiumization of specialized care items for high-value footwear, the widespread adoption of e-commerce for product accessibility, and the growing popularity of DIY shoe care routines aided by online resources.

How does AI impact the Shoe Care Product Market?

AI impacts the Shoe Care Product Market by enabling personalized product recommendations based on consumer data, optimizing supply chain and inventory management, and enhancing customer support through AI-powered virtual assistants. It also has potential for smart application devices and advanced quality control.

Which regions are key to the growth of the Shoe Care Product Market?

North America and Europe are significant established markets driven by high consumer awareness and disposable incomes. Asia Pacific, particularly countries like China and India, is projected to be the fastest-growing region due to urbanization, increasing disposable incomes, and evolving fashion trends.