Serial NOR Flash Market

Serial NOR Flash Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700676 | Last Updated : July 26, 2025 |

Format : ![]()

![]()

![]()

![]()

Serial NOR Flash Market Size

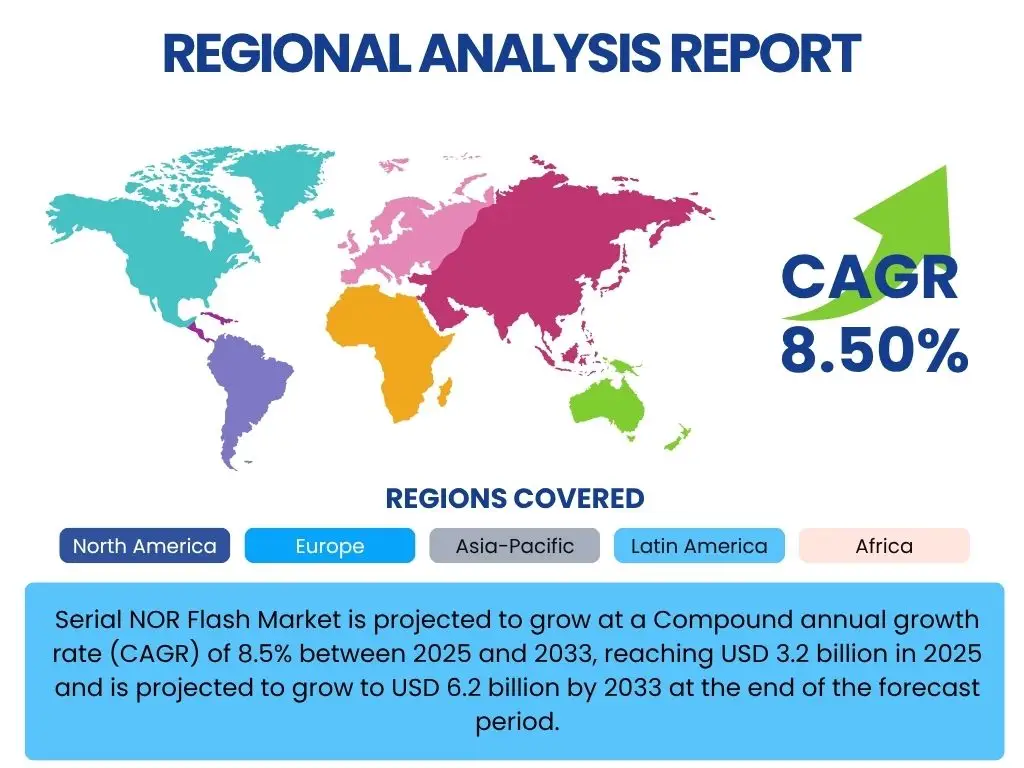

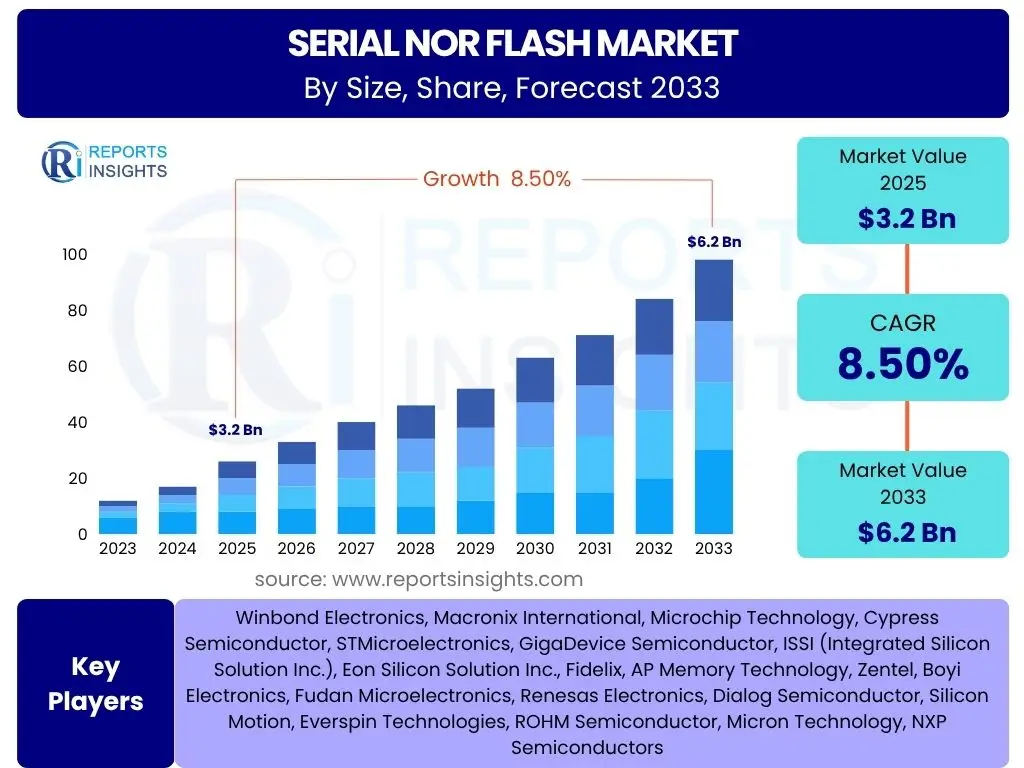

Serial NOR Flash Market is projected to grow at a Compound annual growth rate (CAGR) of 8.5% between 2025 and 2033, reaching USD 3.2 billion in 2025 and is projected to grow to USD 6.2 billion by 2033 at the end of the forecast period.

Key Serial NOR Flash Market Trends & Insights

The Serial NOR Flash market is currently experiencing significant shifts driven by advancements in connected technologies and the increasing demand for robust, high-performance, and secure memory solutions. A key trend is the accelerating adoption of Serial NOR Flash in the automotive sector, particularly for advanced driver-assistance systems (ADAS), in-vehicle infotainment (IVI), and instrument clusters, where reliability and instant-on capabilities are paramount. The pervasive growth of the Internet of Things (IoT) and edge computing devices also fuels demand, requiring compact, low-power, and secure boot memory for billions of connected sensors and smart devices. Furthermore, the expansion of 5G infrastructure and network equipment necessitates high-density Serial NOR Flash for boot code and configuration data, ensuring rapid system startup and dependable operation. Manufacturers are increasingly focusing on developing higher-density Serial NOR Flash memory with enhanced security features, such as hardware root-of-trust and secure boot capabilities, to address the rising cybersecurity concerns across various applications. The convergence of artificial intelligence (AI) at the edge is another pivotal trend, as AI-enabled devices require fast and reliable memory for efficient execution of embedded AI models and firmware. Innovations in packaging technologies, leading to smaller form factors and multi-chip packages (MCPs) that integrate Serial NOR Flash with other memory types or microcontrollers, are also contributing to market growth by enabling more compact and integrated system designs. Finally, the ongoing trend towards industrial automation and the proliferation of smart factories are driving demand for rugged and long-lifecycle Serial NOR Flash solutions in industrial control systems and robotics.

- Automotive sector integration (ADAS, infotainment, instrument clusters).

- Surge in IoT and edge computing device adoption.

- Expansion of 5G infrastructure and networking equipment.

- Development of higher-density and enhanced security features.

- AI integration at the edge requiring fast, reliable memory.

- Miniaturization and advanced packaging technologies (MCPs).

- Increased demand from industrial automation and smart factories.

AI Impact Analysis on Serial NOR Flash

Artificial Intelligence (AI) is exerting a transformative impact on the Serial NOR Flash market, primarily by creating new demands for highly reliable, low-latency, and energy-efficient memory solutions at the edge. As AI computations shift from centralized cloud servers to edge devices, there is an escalating need for embedded memory that can securely store AI models, firmware, and critical boot code, enabling instant-on functionality and local processing. Serial NOR Flash is uniquely positioned to address these requirements due to its excellent read speeds, byte-level addressability, and enduring data retention, which are crucial for quick access to AI algorithms and rapid system boot-up in real-time AI applications. The integration of AI capabilities into a myriad of devices, from smart home appliances and wearables to industrial robots and autonomous vehicles, directly translates into increased demand for Serial NOR Flash. These AI-enabled devices often operate with limited power budgets and require highly secure memory to protect intellectual property and ensure system integrity. The ongoing development of more sophisticated AI algorithms necessitates higher density NOR Flash to accommodate larger models, while the emphasis on energy efficiency drives innovations in low-power Serial NOR Flash variants. Furthermore, AI's role in predictive maintenance and operational optimization within industrial settings necessitates rugged and reliable memory like Serial NOR Flash for continuous data logging and system parameter storage. The demand for secure over-the-air (OTA) updates for AI models further underscores the importance of Serial NOR Flash, as it provides a stable and secure storage medium for new firmware iterations, ensuring the continuous performance and improvement of AI functionalities in deployed devices.

- Increased demand for low-latency, energy-efficient edge AI memory.

- Storage of AI models and firmware requiring reliable, instant-on boot.

- Growth in AI-enabled consumer electronics and industrial applications.

- Need for secure memory to protect AI intellectual property.

- Requirement for higher density NOR Flash to store larger AI models.

- Support for secure over-the-air (OTA) updates for AI algorithms.

Key Takeaways Serial NOR Flash Market Size & Forecast

- Market projected to reach USD 6.2 billion by 2033.

- Expected to grow at a CAGR of 8.5% from 2025 to 2033.

- Strong growth driven by automotive, IoT, and 5G sectors.

- Increasing demand for secure and high-density memory solutions.

- AI and edge computing acting as significant growth accelerators.

- Focus on low-power and integrated memory solutions.

Serial NOR Flash Market Drivers Analysis

The Serial NOR Flash market is propelled by a confluence of technological advancements and expanding application landscapes. A primary driver is the accelerating proliferation of the Internet of Things (IoT) and various connected devices, ranging from smart home appliances to industrial sensors. These devices invariably require reliable, compact, and low-power memory for boot code, configuration data, and firmware storage, a role perfectly suited for Serial NOR Flash due to its instant-on capabilities and robust data retention. The rapidly evolving automotive industry also serves as a significant growth catalyst; with the increasing integration of advanced driver-assistance systems (ADAS), in-vehicle infotainment (IVI) systems, and electric vehicle (EV) components, there is a heightened demand for dependable and high-performance memory to ensure system integrity and rapid startup times. The global rollout of 5G networks and the subsequent deployment of advanced telecommunications infrastructure further contribute to market expansion, as Serial NOR Flash is essential for storing boot code and operational parameters in base stations, networking equipment, and edge devices. Moreover, the inherent need for secure boot and over-the-air (OTA) update capabilities across a broad spectrum of embedded systems reinforces the reliance on Serial NOR Flash, which provides a secure and immutable storage foundation. Miniaturization trends in electronics, driving the demand for smaller form factors and higher integration levels, also favor Serial NOR Flash due to its compact size and potential for multi-chip packaging. Finally, the growing adoption of artificial intelligence (AI) at the edge necessitates fast and reliable local storage for AI models and associated firmware, where Serial NOR Flash offers critical advantages in terms of speed and longevity. These intertwined factors collectively underpin the robust growth trajectory of the Serial NOR Flash market.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Proliferation of IoT and Connected Devices | +2.1% | Global, especially APAC (manufacturing) and North America/Europe (adoption) | Short to Long-term |

| Expansion of Automotive Electronics (ADAS, IVI) | +1.8% | Europe, North America, Japan, China | Medium to Long-term |

| Global 5G Network Deployment | +1.5% | Global, particularly China, US, South Korea, EU | Short to Medium-term |

| Demand for Secure Boot and OTA Updates | +1.3% | Global, across all secure embedded systems | Short to Long-term |

| Advancements in AI and Edge Computing | +1.0% | North America, Europe, APAC (leading tech hubs) | Medium to Long-term |

| Increasing Adoption in Industrial Automation | +0.8% | Europe, North America, Japan, China (manufacturing regions) | Medium to Long-term |

Serial NOR Flash Market Restraints Analysis

Despite its robust growth, the Serial NOR Flash market faces several inherent restraints that could temper its expansion. A significant challenge comes from the intense competition posed by alternative memory technologies, most notably NAND Flash. While Serial NOR Flash excels in random read access and boot code storage, NAND Flash offers significantly higher densities at a lower cost per bit, making it a more attractive option for mass data storage applications in consumer electronics and computing. This cost-density advantage of NAND often limits the potential for Serial NOR Flash in applications where large-scale storage is paramount. Another restraint is the growing trend towards memory integration within System-on-Chips (SoCs). As SoC designs become more complex, incorporating various functional blocks including memory, the need for discrete Serial NOR Flash components can diminish, potentially leading to a plateau in demand for standalone NOR Flash chips in certain segments. Furthermore, the commoditization of lower-density Serial NOR Flash products has led to significant price erosion, impacting the revenue growth potential for manufacturers in this segment. While higher-density and specialized NOR Flash products command better margins, the overall market average can be dragged down by intense price competition. Lastly, the relatively long product lifecycles in some traditional embedded applications, such as industrial control systems, can result in slower upgrade cycles and thus a more gradual replacement demand for Serial NOR Flash components compared to faster-moving consumer segments. These factors collectively necessitate continuous innovation and differentiation for Serial NOR Flash manufacturers to maintain market share and profitability.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Competition from NAND Flash and other memory types | -1.2% | Global, especially in consumer and mass storage segments | Short to Long-term |

| Increasing Memory Integration into SoCs | -0.9% | Global, impacting embedded and mobile segments | Medium to Long-term |

| Price Erosion and Commoditization of Low-Density NOR | -0.7% | Global, affecting revenue margins | Short to Medium-term |

| Long Product Lifecycles in Traditional Embedded Systems | -0.5% | Primarily industrial and legacy systems in mature markets | Long-term |

Serial NOR Flash Market Opportunities Analysis

The Serial NOR Flash market is poised for significant growth stemming from several emerging opportunities. A major avenue for expansion lies in the increasing demand for advanced security features in embedded systems. With the proliferation of connected devices, cybersecurity has become paramount, and Serial NOR Flash is uniquely positioned to offer secure boot capabilities, hardware root-of-trust, and secure firmware storage, providing an essential layer of protection against unauthorized access and tampering. This drives demand for NOR Flash with integrated security engines and cryptographic accelerators. The rapid evolution of the Internet of Medical Things (IoMT) also presents a lucrative opportunity. Medical devices, from patient monitoring systems to portable diagnostic tools, require highly reliable, low-power, and secure memory for critical firmware and patient data logging, where Serial NOR Flash's characteristics are highly advantageous. Furthermore, the burgeoning augmented reality (AR) and virtual reality (VR) markets, along with advanced wearable devices, require compact, high-performance memory for instant-on capabilities and quick loading of complex applications, aligning perfectly with Serial NOR Flash's strengths. The growing emphasis on industrial automation and the concept of Industry 4.0 are creating new needs for robust and long-lifecycle memory in factory automation, robotics, and smart manufacturing equipment. Serial NOR Flash provides the necessary endurance and reliability for these demanding industrial environments. Lastly, the continued innovation in packaging technologies, such as multi-chip packages (MCPs) that integrate Serial NOR Flash with other memory types or microcontrollers, offers an opportunity to create highly integrated, space-saving solutions that meet the evolving design requirements of diverse electronic systems, enabling more compact and powerful end products.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for Enhanced Security Features | +1.5% | Global, across all IoT, automotive, and industrial sectors | Short to Long-term |

| Expansion in Internet of Medical Things (IoMT) | +1.2% | North America, Europe, Japan (strong healthcare sectors) | Medium to Long-term |

| Growth in AR/VR and Advanced Wearable Devices | +1.0% | North America, APAC (consumer tech innovators) | Medium to Long-term |

| Innovation in Multi-Chip Packaging (MCP) Solutions | +0.8% | Global, impacting miniaturized and integrated designs | Short to Medium-term |

Serial NOR Flash Market Challenges Impact Analysis

The Serial NOR Flash market, while robust, faces several challenges that require strategic navigation from manufacturers. One significant hurdle is the escalating cost of research and development (R&D) required to keep pace with rapidly evolving technological demands. As applications become more sophisticated, there is a continuous need for higher densities, faster speeds, lower power consumption, and enhanced security features in Serial NOR Flash, which necessitates substantial investment in advanced fabrication processes and design innovation. Another challenge is ensuring broad compatibility and interoperability across a diverse ecosystem of microcontrollers, processors, and system architectures. As embedded systems integrate components from various vendors, achieving seamless operation for Serial NOR Flash across different platforms can be complex and requires extensive validation and adherence to industry standards. Furthermore, the market is characterized by intense competition and pricing pressures, especially in the low to mid-density segments. The presence of numerous global and regional players, coupled with the commoditization of certain products, often leads to aggressive pricing strategies that can compress profit margins for manufacturers. Geopolitical factors and supply chain volatility also pose ongoing challenges. Disruptions from trade disputes, natural disasters, or pandemics can severely impact the production and timely delivery of components, leading to shortages and increased costs. Finally, the rapid pace of innovation in competing memory technologies, such as hybrid memory solutions or specialized non-volatile memories, presents a continuous threat, requiring Serial NOR Flash manufacturers to consistently differentiate their products through superior performance, security, and integration capabilities to maintain their competitive edge.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High R&D Investment for Advanced Features | -1.0% | Global, impacting smaller players more significantly | Short to Long-term |

| Ensuring Broad Compatibility and Interoperability | -0.8% | Global, critical for market adoption | Medium-term |

| Intense Competition and Pricing Pressures | -0.7% | Global, particularly in high-volume segments | Short to Medium-term |

| Supply Chain Volatility and Geopolitical Risks | -0.6% | Global, with emphasis on APAC manufacturing hubs | Short-term (cyclical) |

Serial NOR Flash Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Serial NOR Flash market, covering historical trends, current market dynamics, and future projections. It offers a detailed examination of market size, growth drivers, restraints, opportunities, and challenges impacting the industry. The report segments the market by type, density, application, and voltage, providing granular insights into each category. Furthermore, it includes a thorough regional analysis, highlighting key country-level developments and their contributions to the market. A competitive landscape section profiles key market players, detailing their strategies, product portfolios, and market positioning. The report also integrates an AI impact analysis, illustrating how artificial intelligence is influencing demand and innovation within the Serial NOR Flash sector. Designed for business professionals, investors, and decision-makers, this report serves as an essential tool for understanding market potential, identifying strategic imperatives, and making informed business decisions in the evolving Serial NOR Flash ecosystem. It delivers actionable insights derived from extensive primary and secondary research, coupled with robust analytical frameworks to provide a clear and concise outlook on market opportunities and industry trends.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 8.5% from 2025 to 2033 |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Winbond Electronics, Macronix International, Microchip Technology, Cypress Semiconductor, STMicroelectronics, GigaDevice Semiconductor, ISSI (Integrated Silicon Solution Inc.), Eon Silicon Solution Inc., Fidelix, AP Memory Technology, Zentel, Boyi Electronics, Fudan Microelectronics, Renesas Electronics, Dialog Semiconductor, Silicon Motion, Everspin Technologies, ROHM Semiconductor, Micron Technology, NXP Semiconductors |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Serial NOR Flash market is extensively segmented to provide a comprehensive understanding of its diverse landscape and to highlight key areas of growth and investment. These segmentations allow for a granular analysis of market dynamics, enabling stakeholders to identify specific opportunities and tailor their strategies effectively. The market is primarily broken down by type, density, application, and voltage, each offering unique insights into the demand patterns and technological preferences across various end-use sectors. Understanding these segments is crucial for manufacturers, suppliers, and end-users to navigate the competitive environment and capitalize on emerging trends. The detailed sub-segmentation within applications further clarifies the specific use cases driving demand, from high-volume consumer electronics to critical industrial and automotive systems, reflecting the versatility and pervasive nature of Serial NOR Flash technology.

- By Type: This segment differentiates between the communication interfaces.

- SPI NOR Flash: Dominant in the market due to its simplicity, low pin count, and high-speed serial interface, making it ideal for a wide range of embedded applications requiring quick boot-up and compact designs.

- Parallel NOR Flash: Used in legacy systems or specific applications where wider bus interfaces and higher parallel data transfer rates are preferred, though its market share is diminishing compared to SPI NOR Flash.

- By Density: This segmentation categorizes Serial NOR Flash by storage capacity.

- Low Density (below 64Mb): Typically used for basic boot code storage in microcontrollers, consumer appliances, and simple IoT devices where only minimal memory is required.

- Medium Density (64Mb-256Mb): Common in more sophisticated embedded systems, automotive applications, and networking equipment, balancing cost and performance for moderate storage needs.

- High Density (above 256Mb): Increasingly demanded for advanced automotive systems (ADAS, IVI), industrial IoT gateways, AI-enabled edge devices, and telecommunications infrastructure, requiring substantial memory for firmware, operating systems, and data logging.

- By Application: This segment highlights the diverse end-use industries leveraging Serial NOR Flash.

- Consumer Electronics: Encompasses a broad range of devices, including smartphones and tablets (for boot code), wearable devices (smartwatches, fitness trackers), smart home devices (thermostats, cameras, smart speakers), and gaming consoles, all requiring fast and reliable boot memory.

- Automotive: A critical and rapidly growing segment, including ADAS (Advanced Driver-Assistance Systems) for sensor data and algorithms, Infotainment Systems for boot and user interface data, Instrument Clusters for fast startup, and Powertrain and Body Electronics for critical control unit firmware.

- Industrial: Covers robust applications such as IoT Devices and Sensors for data collection and control, Industrial Control Systems for automation and machinery, Robotics for embedded programming, and Medical Devices (portable diagnostic equipment, patient monitors) requiring high reliability and long product lifecycles.

- Telecommunications: Essential for 5G Infrastructure components like base stations and small cells, Networking Equipment (routers, switches, modems) for secure boot and configuration, and Set-Top Boxes for quick startup and firmware updates.

- Computing: Includes applications in Servers and Data Centers for BIOS and firmware, Laptops and Desktops for secure boot and system initialization, and Solid State Drives (SSDs) for controller firmware.

- Other Applications: Diverse niche markets like Aerospace and Defense, requiring rugged and highly reliable memory solutions for specialized equipment.

- By Voltage: This segment reflects the power requirements and compatibility with different system architectures.

- 1.8V: Predominantly used in low-power and portable devices, aligning with battery-operated and energy-efficient designs.

- 3V: A widely adopted standard, offering a balance of performance and power consumption, suitable for general-purpose embedded systems.

- 5V: Primarily found in legacy systems or specific industrial applications that operate at higher voltage rails.

- Multi-Voltage Options: Devices capable of operating across multiple voltage ranges, providing flexibility and compatibility for various system designs.

Regional Highlights

The Serial NOR Flash market exhibits distinct regional growth patterns influenced by manufacturing hubs, technological adoption rates, and governmental initiatives. Understanding these regional dynamics is crucial for market participants to identify lucrative opportunities and optimize their supply chain and sales strategies. Each major region contributes uniquely to the market's overall trajectory, driven by specific industry strengths and technological priorities.

- Asia Pacific (APAC): APAC is projected to be the dominant region in the Serial NOR Flash market, driven by its unparalleled strength in electronics manufacturing. Countries like China, Taiwan, South Korea, and Japan are global hubs for consumer electronics, automotive components, and industrial automation equipment production, which are major end-users of Serial NOR Flash. The rapid expansion of 5G infrastructure, increasing smartphone penetration, and surging demand for IoT devices in emerging economies within the region further cement APAC's leading position. Government initiatives supporting local semiconductor manufacturing and technological innovation also contribute significantly to the market's growth in this region.

- North America: North America holds a significant share in the Serial NOR Flash market, primarily due to its robust research and development ecosystem, early adoption of advanced technologies, and a strong presence of key technology companies. The region leads in innovation for AI, edge computing, automotive electrification, and high-tech industrial applications. Demand for high-density and secure Serial NOR Flash is particularly strong in the automotive (ADAS), telecommunications (5G deployments), and industrial IoT sectors, where reliable and high-performance memory solutions are paramount. The focus on cybersecurity also drives demand for NOR Flash with integrated security features.

- Europe: Europe represents a substantial market for Serial NOR Flash, characterized by its advanced automotive industry, strong focus on industrial automation, and growing medical technology sector. Countries like Germany, France, and the UK are at the forefront of automotive innovation, driving demand for dependable memory in ADAS and infotainment systems. The region's emphasis on Industry 4.0 initiatives and smart factory deployments fuels the need for rugged and long-lifecycle Serial NOR Flash in industrial control systems and robotics. Additionally, the increasing adoption of secure embedded systems in critical infrastructure contributes to market growth.

- Latin America & Middle East and Africa (MEA): While smaller in market share compared to other regions, Latin America and MEA are emerging markets for Serial NOR Flash. Growth in these regions is driven by increasing digitalization, expanding telecommunications infrastructure, and localized manufacturing initiatives. Rising disposable incomes and growing adoption of consumer electronics, alongside investments in smart city projects and industrialization, are gradually creating new demand for Serial NOR Flash in various embedded applications. As these regions continue to develop their technological infrastructure, the market for Serial NOR Flash is expected to witness steady, albeit slower, growth.

Top Key Players:

The market research report covers the analysis of key stake holders of the Serial NOR Flash Market. Some of the leading players profiled in the report include -- Winbond Electronics

- Macronix International

- Microchip Technology

- Cypress Semiconductor

- STMicroelectronics

- GigaDevice Semiconductor

- ISSI (Integrated Silicon Solution Inc.)

- Eon Silicon Solution Inc.

- Fidelix

- AP Memory Technology

- Zentel

- Boyi Electronics

- Fudan Microelectronics

- Renesas Electronics

- Dialog Semiconductor

- Silicon Motion

- Everspin Technologies

- ROHM Semiconductor

- Micron Technology

- NXP Semiconductors

Frequently Asked Questions:

What is Serial NOR Flash and why is it important?

Serial NOR Flash is a type of non-volatile memory that stores data persistently, even without power. It is crucial for embedded systems because it offers extremely fast random read access, making it ideal for storing boot code, firmware, and configuration parameters. Its instant-on capability ensures rapid system startup, which is vital for applications in automotive, IoT, and consumer electronics where immediate operation is required.

How does Serial NOR Flash differ from NAND Flash?

Serial NOR Flash differs from NAND Flash primarily in its architecture and performance characteristics. NOR Flash allows for byte-level random access, similar to RAM, which makes it excellent for executing code directly from memory (execute-in-place). NAND Flash, conversely, is block-addressable and optimized for high-density data storage at a lower cost per bit, but requires data to be moved to RAM for execution. NOR Flash generally offers faster read speeds and higher reliability for boot code, while NAND Flash provides larger storage capacity for mass data.

What are the primary applications of Serial NOR Flash?

The primary applications of Serial NOR Flash span across various industries due to its reliability and speed. Key applications include automotive electronics (such as ADAS, infotainment systems, and instrument clusters), Internet of Things (IoT) devices, smart home appliances, wearable devices, telecommunications infrastructure (like 5G base stations and networking equipment), industrial control systems, and medical devices. It is predominantly used for storing boot code, firmware, and critical configuration data that needs to be accessed quickly and securely.

What is the future outlook for the Serial NOR Flash market?

The future outlook for the Serial NOR Flash market is positive, driven by the continuous expansion of embedded systems, particularly in the automotive, IoT, and 5G sectors. Demand for higher densities, enhanced security features, and lower power consumption will fuel innovation. The increasing integration of AI at the edge and the need for robust, reliable memory in critical applications are expected to sustain its growth, despite competition from other memory technologies.

How does AI impact the Serial NOR Flash market?

Artificial Intelligence significantly impacts the Serial NOR Flash market by creating new demands for reliable and fast local memory in edge AI devices. As AI processing moves closer to the data source (edge computing), Serial NOR Flash is essential for storing AI models, algorithms, and secure boot code, enabling instant-on functionality and efficient local inference. This shift drives the need for higher-density and more secure NOR Flash solutions to support the growing complexity and volume of AI-driven applications.