Selective Catalytic Reduction for Diesel Commercial Vehicles Market

Selective Catalytic Reduction for Diesel Commercial Vehicles Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_678283 | Last Updated : July 21, 2025 |

Format : ![]()

![]()

![]()

![]()

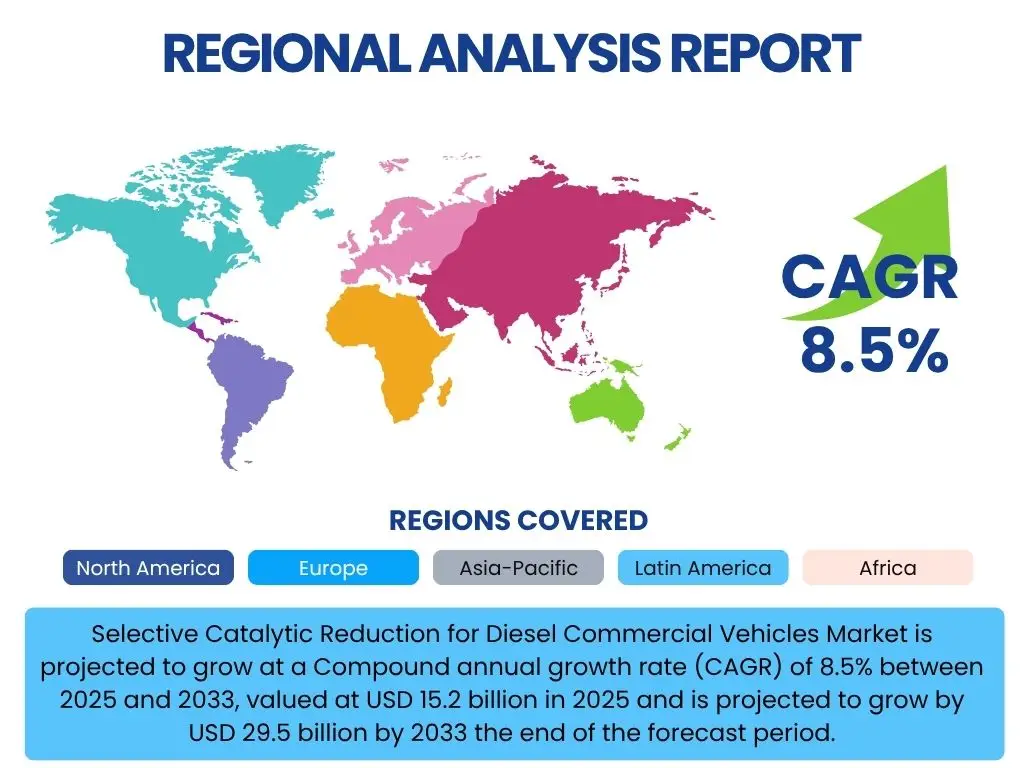

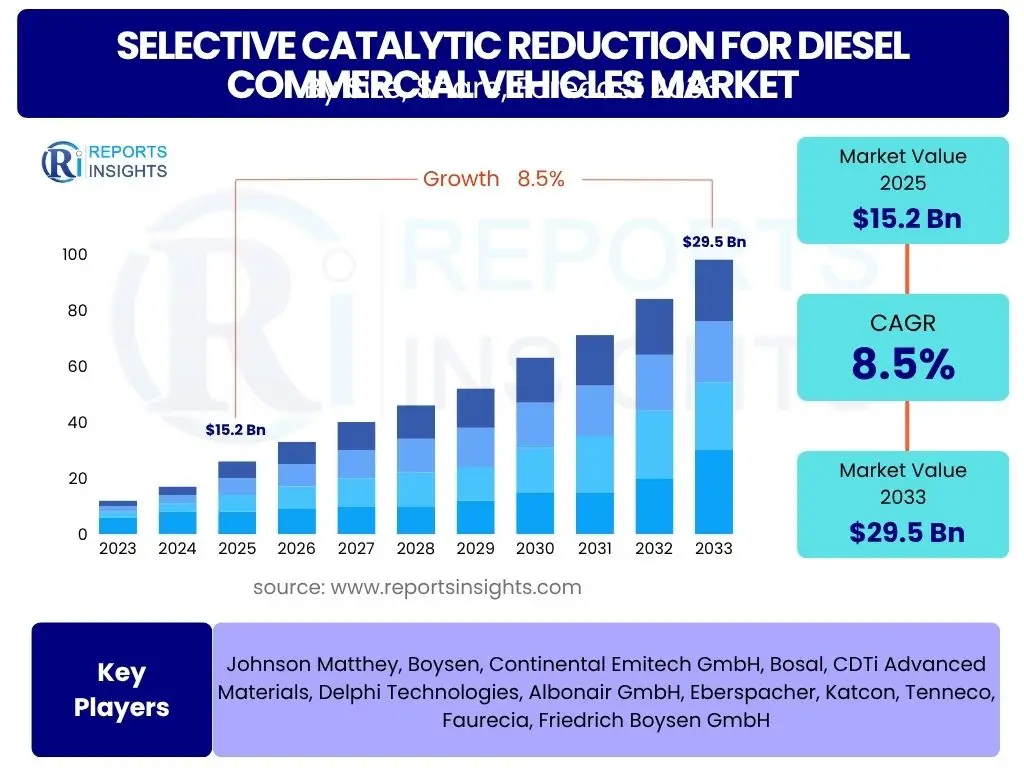

Selective Catalytic Reduction for Diesel Commercial Vehicles Market is projected to grow at a Compound annual growth rate (CAGR) of 8.5% between 2025 and 2033, valued at USD 15.2 billion in 2025 and is projected to grow by USD 29.5 billion by 2033 the end of the forecast period.

Key Selective Catalytic Reduction for Diesel Commercial Vehicles Market Trends & Insights

The Selective Catalytic Reduction (SCR) market for diesel commercial vehicles is experiencing dynamic shifts driven by escalating environmental mandates and technological advancements aimed at reducing harmful emissions. A prominent trend involves the continuous refinement of SCR systems to enhance efficiency and durability, ensuring compliance with increasingly stringent global emission standards such as Euro VII and EPA 2027. Furthermore, there is a growing focus on integrating SCR technology with other emission control systems, like Diesel Particulate Filters (DPF) and Diesel Oxidation Catalysts (DOC), to achieve comprehensive pollutant reduction and optimize overall exhaust aftertreatment performance. This integrated approach not only improves emission control but also contributes to better fuel efficiency and reduced operational costs for fleet owners.

Another significant trend is the expansion of SCR system applications across a broader range of commercial vehicle segments, including light-duty trucks and buses, in addition to traditional heavy-duty vehicles. This diversification is propelled by global efforts to mitigate urban air pollution and meet sustainability targets across the entire commercial transportation sector. Moreover, the market is witnessing an increased adoption of advanced monitoring and diagnostic systems for SCR, leveraging telematics and data analytics to predict maintenance needs, ensure optimal performance, and prevent non-compliance issues. The drive towards electrification and alternative fuels, while challenging the long-term dominance of diesel, also necessitates highly efficient SCR solutions for hybrid diesel vehicles and transitional fleets, sustaining demand for the foreseeable future.

- Stricter global emission regulations (e.g., Euro VII, EPA 2027) driving demand.

- Integration of SCR with other aftertreatment systems (DPF, DOC) for holistic emission control.

- Technological advancements enhancing SCR efficiency, robustness, and cost-effectiveness.

- Expansion of SCR application to light and medium commercial vehicles.

- Increased adoption of telematics and data analytics for SCR system monitoring and diagnostics.

- Focus on improving urea quality and supply infrastructure.

- Development of low-temperature SCR catalysts for improved cold-start performance.

- Emphasis on total cost of ownership (TCO) for fleet operators, driving demand for efficient systems.

- Emergence of hybrid diesel commercial vehicles requiring optimized SCR solutions.

AI Impact Analysis on Selective Catalytic Reduction for Diesel Commercial Vehicles

Artificial Intelligence (AI) is poised to significantly transform the Selective Catalytic Reduction (SCR) market for diesel commercial vehicles by enhancing system performance, optimizing maintenance, and improving regulatory compliance. AI algorithms can analyze vast datasets from vehicle sensors to predict optimal urea injection rates based on real-time driving conditions, engine load, and exhaust gas temperatures, thereby maximizing NOx reduction efficiency and minimizing AdBlue consumption. This predictive capability moves beyond traditional calibration, enabling dynamic adjustments that ensure consistent emission control under varying operational scenarios, from urban stop-and-go traffic to long-haul highway driving. Furthermore, AI-driven diagnostics can proactively identify potential malfunctions or performance degradation in SCR components, such as clogged injectors or catalyst degradation, before they lead to costly repairs or regulatory non-compliance.

Beyond operational efficiency, AI's impact extends to the design and manufacturing of SCR systems. Generative AI and machine learning can optimize catalyst formulations and system architectures, leading to more compact, lightweight, and cost-effective designs with improved durability. In fleet management, AI can integrate SCR performance data with route optimization and predictive maintenance schedules, ensuring that vehicles operate at peak efficiency and meet environmental standards throughout their lifecycle. This integration supports a shift towards more intelligent and sustainable logistics, where emission performance is continuously monitored and optimized. As the automotive industry increasingly embraces digitalization, AI will become an indispensable tool for developing next-generation emission control technologies that balance stringent environmental requirements with operational realities for commercial vehicle fleets.

- AI-driven optimization of urea dosing for improved NOx conversion efficiency.

- Predictive maintenance for SCR components, reducing downtime and operational costs.

- Real-time monitoring and anomaly detection for proactive system management.

- Enhanced diagnostic capabilities identifying root causes of performance issues.

- AI in catalyst material design and system architecture for improved performance and cost.

- Integration of SCR data with fleet management systems for holistic optimization.

- Development of self-learning SCR systems adapting to varying driving conditions.

- Support for regulatory compliance through continuous performance verification.

Key Takeaways Selective Catalytic Reduction for Diesel Commercial Vehicles Market Size & Forecast

- The global Selective Catalytic Reduction for Diesel Commercial Vehicles Market is anticipated to achieve substantial growth, reaching USD 29.5 billion by 2033.

- The market is projected to expand at a robust Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033.

- Regulatory pressures and the increasing adoption of Euro VI/VII and EPA 2027 standards are primary drivers for market expansion.

- Heavy Commercial Vehicles (HCVs) currently constitute the largest application segment, with significant growth expected in Light and Medium Commercial Vehicles (LCVs, MCVs).

- Asia Pacific, particularly China and India, is poised to be a dominant growth region due to burgeoning commercial vehicle fleets and tightening emission norms.

- Technological advancements in catalyst efficiency, system integration, and smart monitoring are key factors contributing to market value.

- Despite the rise of electric vehicles, diesel commercial vehicles with advanced SCR systems will remain critical for long-haul and heavy-duty logistics in the forecast period.

Selective Catalytic Reduction for Diesel Commercial Vehicles Market Drivers Impact Analysis

The growth of the Selective Catalytic Reduction (SCR) market for diesel commercial vehicles is predominantly propelled by a confluence of stringent global environmental regulations and an increasing emphasis on air quality. Governments worldwide are implementing more rigorous emission standards, such as Euro VII in Europe and EPA 2027 in North America, which mandate significant reductions in nitrogen oxide (NOx) emissions from commercial vehicles. This regulatory push forces vehicle manufacturers to integrate highly efficient SCR systems as a standard component, creating sustained demand across all commercial vehicle segments. Beyond compliance, growing public awareness regarding the health impacts of air pollution also contributes to the adoption of cleaner technologies, influencing policy decisions and consumer preferences for environmentally responsible transportation solutions.

Furthermore, advancements in SCR technology itself, including the development of more durable catalysts, improved urea dosing systems, and enhanced cold-start performance, are making these systems more efficient and economically viable for fleet operators. These technological improvements lead to better NOx conversion rates, lower AdBlue consumption, and reduced maintenance costs, thereby improving the overall total cost of ownership (TCO) for commercial vehicle fleets. The expanding production and sales of new diesel commercial vehicles, particularly in emerging economies where road infrastructure development is booming, further solidify the demand for integrated SCR solutions. Additionally, the need for diesel vehicles in long-haul and heavy-duty applications, where electrification is still nascent or impractical, ensures a continued market for advanced diesel engines equipped with effective SCR technology.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Emission Regulations | +3.0% | Global (Europe, North America, Asia Pacific) | Short to Long-term (Ongoing) |

| Increasing Commercial Vehicle Production & Sales | +2.5% | Asia Pacific, Latin America, Middle East & Africa | Medium to Long-term |

| Technological Advancements in SCR Systems | +1.5% | Global | Short to Medium-term |

| Growing Environmental Awareness and Public Health Concerns | +1.0% | Global | Long-term |

| Demand for Efficient Logistics & Freight Transportation | +0.5% | Global | Medium to Long-term |

Selective Catalytic Reduction for Diesel Commercial Vehicles Market Restraints Impact Analysis

Despite the strong drivers, the Selective Catalytic Reduction (SCR) market for diesel commercial vehicles faces several notable restraints that could temper its growth trajectory. One significant challenge is the rising competition from alternative powertrain technologies, most notably Battery Electric Vehicles (BEVs) and Fuel Cell Electric Vehicles (FCEVs). As these technologies mature and become more economically viable, particularly for certain commercial vehicle segments like last-mile delivery vans and city buses, they present a direct alternative to diesel-powered vehicles, potentially reducing the overall demand for new diesel engines equipped with SCR systems. Government incentives and corporate sustainability goals are accelerating this shift, creating a long-term threat to the diesel engine market.

Another crucial restraint is the fluctuating price and availability of urea (Diesel Exhaust Fluid - DEF), which is essential for SCR system operation. Geopolitical factors, supply chain disruptions, and the energy intensity of urea production can lead to price volatility and supply uncertainties, increasing operational costs for fleet owners. Furthermore, the initial high cost of implementing advanced SCR systems, alongside the ongoing maintenance and AdBlue refill expenses, can be a deterrent for some smaller fleet operators or in regions with less stringent enforcement of emission norms. The complexity of maintaining SCR systems and ensuring the quality of urea also presents operational hurdles that could slow widespread adoption in certain markets.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Adoption of Electric and Alternative Fuel Vehicles | -2.0% | North America, Europe, China | Medium to Long-term |

| Fluctuating Cost and Availability of Urea (DEF) | -1.0% | Global | Short to Medium-term |

| High Initial Investment and Maintenance Costs | -0.8% | Emerging Markets, Small Fleets | Short to Medium-term |

| Lack of Standardized DEF Infrastructure in Some Regions | -0.5% | Latin America, Africa | Medium-term |

Selective Catalytic Reduction for Diesel Commercial Vehicles Market Opportunities Impact Analysis

The Selective Catalytic Reduction (SCR) market for diesel commercial vehicles is presented with several promising opportunities that can significantly bolster its growth despite existing challenges. A key opportunity lies in the continuous advancement of catalyst technologies, which enables SCR systems to achieve higher NOx conversion efficiencies at lower temperatures and with greater durability. This innovation addresses crucial operational aspects for commercial vehicles, especially during cold starts and in urban environments, expanding the applicability and effectiveness of SCR across diverse driving cycles. The development of next-generation catalysts, potentially with reduced precious metal content, also offers avenues for cost reduction, making SCR systems more competitive and attractive for widespread adoption across various fleet sizes.

Furthermore, the expanding global commercial vehicle fleet, particularly in emerging economies undergoing rapid industrialization and urbanization, represents a substantial market for new SCR installations and aftermarket solutions. As these regions adopt more stringent emission standards, the demand for compliant diesel vehicles equipped with SCR will surge. The integration of SCR systems with advanced telematics and IoT solutions offers another significant opportunity. Real-time monitoring, predictive diagnostics, and optimization of AdBlue consumption through data analytics can enhance the overall efficiency and reliability of SCR systems, providing value-added services for fleet managers. Lastly, the retrofit market for older diesel commercial vehicles, especially in regions pushing for stricter in-use compliance, presents a viable segment for SCR technology providers, allowing existing fleets to meet updated environmental mandates without full vehicle replacement.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Technological Advancements in Catalyst Materials & Efficiency | +1.8% | Global | Medium to Long-term |

| Growing Demand from Emerging Economies for Commercial Vehicles | +1.5% | Asia Pacific, Latin America, Middle East & Africa | Medium to Long-term |

| Integration with Telematics & IoT for Optimized Performance | +1.2% | North America, Europe, Asia Pacific | Short to Medium-term |

| Retrofit Market for Existing Diesel Commercial Vehicles | +0.8% | Europe, North America, rapidly regulating cities globally | Short to Medium-term |

Selective Catalytic Reduction for Diesel Commercial Vehicles Market Challenges Impact Analysis

The Selective Catalytic Reduction (SCR) market for diesel commercial vehicles encounters several significant challenges that require strategic responses from industry stakeholders. A primary challenge revolves around the consistent quality and widespread availability of Diesel Exhaust Fluid (DEF) or AdBlue. Inconsistent DEF quality can lead to system malfunction, reduced NOx conversion efficiency, and potential damage to SCR components, resulting in costly repairs and non-compliance with emission standards. Ensuring a robust, accessible, and high-quality DEF supply chain globally is crucial, especially as stricter regulations expand the mandate for SCR systems into new regions or for smaller vehicle segments, which might lack established fueling infrastructure.

Another substantial challenge is the potential for tampering or disabling of SCR systems by some operators to avoid DEF costs or maintenance, particularly in regions with lax enforcement. Such activities undermine the environmental benefits of SCR technology and create an unfair competitive landscape. Regulatory bodies and manufacturers are continually working on anti-tampering measures, but this remains an ongoing battle. Furthermore, the increasing complexity of integrated aftertreatment systems, combining SCR with DPF and DOC, adds to the manufacturing costs and maintenance requirements. Ensuring optimal performance of these interconnected systems, diagnosing issues, and providing adequate technical support and training for mechanics pose significant hurdles, especially for a diverse global commercial vehicle fleet with varying technical capabilities.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Ensuring Consistent Quality & Availability of Urea (DEF) | -1.5% | Global (especially remote areas) | Short to Medium-term |

| SCR System Tampering and Non-Compliance Issues | -1.0% | Regions with lax enforcement or high operational cost pressures | Ongoing |

| Technical Complexity & Maintenance of Integrated Aftertreatment Systems | -0.7% | Global | Short to Medium-term |

| Infrastructure Gaps for DEF Refill & Service in Developing Regions | -0.5% | Africa, parts of Latin America & Asia | Long-term |

Selective Catalytic Reduction for Diesel Commercial Vehicles Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Selective Catalytic Reduction for Diesel Commercial Vehicles Market, offering critical insights into its current state, growth trajectory, and future outlook. The report delves into key market dynamics, including drivers, restraints, opportunities, and challenges, providing a holistic understanding for stakeholders. It encompasses detailed segmentation analysis by product type, application, end-use industry, and geographical region, ensuring granular insights into various market facets. The aim is to equip business professionals and decision-makers with actionable intelligence to navigate market complexities, identify emerging trends, and formulate effective strategies for sustainable growth and competitive advantage in the evolving landscape of emission control technologies for commercial vehicles.

| Report Attributes | Report Details |

|---|---|

| Report Name | Selective Catalytic Reduction for Diesel Commercial Vehicles Market |

| Market Size in 2025 | USD 15.2 billion |

| Market Forecast in 2033 | USD 29.5 billion |

| Growth Rate | CAGR of 2025 to 2033 8.5% |

| Number of Pages | 220 |

| Key Companies Covered | Johnson Matthey, Boysen, Continental Emitech GmbH, Bosal, CDTi Advanced Materials, Delphi Technologies, Albonair GmbH, Eberspacher, Katcon, Tenneco, Faurecia, Friedrich Boysen GmbH |

| Segments Covered | By Type, By Application, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Customization Scope | Avail customised purchase options to meet your exact research needs. Request For Customization |

Segmentation Analysis

: Market Product Type Segmentation:- NH3-SCR

- Urea-SCR

- Ammonia-SCR

- Light Commercial Vehicles (LCVs)

- Medium Commercial Vehicles (MCVs)

- Heavy Commercial Vehicles (HCVs)

Regional Highlights

The global Selective Catalytic Reduction for Diesel Commercial Vehicles Market exhibits distinct regional dynamics, largely influenced by varying emission regulations, economic development, and commercial vehicle fleet sizes. Each region presents unique opportunities and challenges that shape market growth and technological adoption.

North America and Europe are mature markets, characterized by highly stringent emission standards (e.g., EPA 2027, Euro VII) that mandate the widespread adoption of advanced SCR systems in new commercial vehicles. These regions focus on technological innovation, integration with advanced vehicle systems, and robust enforcement of environmental compliance. The aftermarket for DEF and SCR component replacement also plays a significant role here, driven by large existing fleets and a strong emphasis on reducing in-use emissions.

Asia Pacific (APAC) stands out as the leading and fastest-growing region in the SCR market for diesel commercial vehicles. This growth is propelled by rapid industrialization, increasing freight movement, and a burgeoning commercial vehicle production base, especially in countries like China and India. These nations are progressively adopting stricter emission norms, mirroring European and North American standards, leading to a surge in demand for SCR-equipped vehicles. The sheer volume of commercial vehicles sold and operating in APAC makes it a critical market for SCR system manufacturers and suppliers.

Latin America, the Middle East, and Africa (MEA) represent emerging markets with significant growth potential, although they currently lag behind in terms of emission regulation stringency and enforcement compared to developed regions. However, increasing awareness of air pollution, coupled with economic development and infrastructure projects, is gradually leading to the adoption of cleaner vehicle technologies. The demand for SCR systems in these regions will be primarily driven by government initiatives, foreign investments in modern fleets, and the gradual phasing out of older, less efficient vehicles. Challenges here include the development of reliable DEF supply chains and the establishment of adequate service and maintenance infrastructure for advanced emission control systems.

- Asia Pacific: The largest and fastest-growing region, driven by robust commercial vehicle sales, increasing freight transportation, and rapidly tightening emission standards (e.g., China V/VI, India Bharat Stage VI). Countries like China and India are major contributors due to their expanding logistics sectors and burgeoning urban populations.

- Europe: A mature market with highly stringent emission regulations (e.g., Euro VI, Euro VII in development) pushing for advanced SCR technologies and widespread adoption across all commercial vehicle segments. Focus on reducing urban emissions and promoting sustainable transport.

- North America: Another key mature market, driven by EPA 2010 and upcoming EPA 2027 regulations. Strong emphasis on heavy-duty truck segments, with a focus on fuel efficiency alongside emissions reduction. Aftermarket and retrofit solutions also significant.

- Latin America: Emerging market with growing commercial vehicle fleets. Regulatory adoption of Euro V/VI equivalents is driving SCR implementation, albeit at a slower pace than developed regions. Brazil and Mexico are key markets.

- Middle East & Africa: Developing markets with diverse regulatory landscapes. Growing infrastructure projects and increasing trade are boosting commercial vehicle demand. Adoption of SCR is gradual, influenced by local regulatory frameworks and the availability of high-quality diesel fuel and DEF infrastructure.

Top Key Players:

The market research report covers the analysis of key stake holders of the Selective Catalytic Reduction for Diesel Commercial Vehicles Market. Some of the leading players profiled in the report include -

- Johnson Matthey

- Boysen

- Continental Emitech GmbH

- Bosal

- CDTi Advanced Materials

- Delphi Technologies

- Albonair GmbH

- Eberspacher

- Katcon

- Tenneco

- Faurecia

- Friedrich Boysen GmbH

Frequently Asked Questions:

What is Selective Catalytic Reduction (SCR) in diesel commercial vehicles?

Selective Catalytic Reduction (SCR) is an advanced active emissions control technology that injects a liquid-reductant agent through a special catalyst into the exhaust stream of a diesel engine. The reductant agent, typically Diesel Exhaust Fluid (DEF) or AdBlue, chemically reacts with harmful nitrogen oxides (NOx) in the exhaust, converting them into harmless nitrogen (N2) and water (H2O). This process significantly reduces NOx emissions from diesel commercial vehicles, helping them meet stringent environmental regulations.

Why is SCR important for diesel commercial vehicles?

SCR is crucial for diesel commercial vehicles because it is the most effective technology for reducing harmful nitrogen oxide (NOx) emissions to levels required by modern emission standards like Euro VI/VII and EPA 2010/2027. NOx contributes to smog, acid rain, and respiratory illnesses. By converting NOx into harmless substances, SCR enables diesel commercial vehicles to operate cleanly and comply with environmental regulations, ensuring their continued viability in urban and long-haul transportation while protecting public health and the environment.

What is Diesel Exhaust Fluid (DEF) or AdBlue, and how is it used in SCR systems?

Diesel Exhaust Fluid (DEF), also known as AdBlue, is a high-purity aqueous urea solution (32.5% urea, 67.5% deionized water) used as the reductant in SCR systems. It is stored in a dedicated tank on the commercial vehicle and is precisely injected into the hot exhaust gas stream before it enters the SCR catalyst. When heated, the urea in DEF decomposes into ammonia, which then reacts with NOx in the catalyst to form nitrogen and water. DEF is consumed during operation and must be refilled regularly.

What are the main types of SCR systems for commercial vehicles?

The main types of SCR systems for commercial vehicles are categorized primarily by the reductant used or the system's design. Urea-SCR is the most prevalent type, utilizing Diesel Exhaust Fluid (DEF) as the reductant. Other theoretical or less common types include NH3-SCR (using ammonia directly) and Ammonia-SCR, which are often variations or descriptions of the urea-based process where ammonia is formed in-situ. The fundamental principle across these systems is the catalytic reduction of NOx with an ammonia-based reductant, with Urea-SCR dominating the commercial vehicle market due to safety and practical considerations.