Secure Element Market

Secure Element Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700685 | Last Updated : July 26, 2025 |

Format : ![]()

![]()

![]()

![]()

Secure Element Market Size

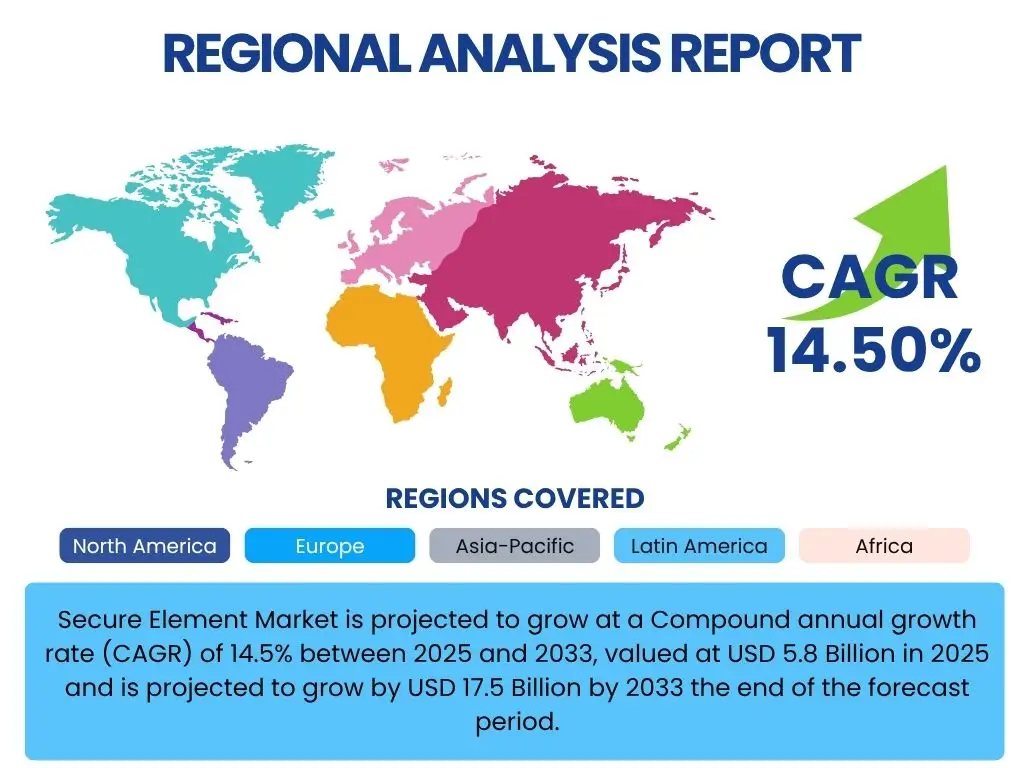

Secure Element Market is projected to grow at a Compound annual growth rate (CAGR) of 14.5% between 2025 and 2033, valued at USD 5.8 Billion in 2025 and is projected to grow by USD 17.5 Billion by 2033 the end of the forecast period.

Key Secure Element Market Trends & Insights

The Secure Element market is characterized by several dynamic trends reflecting evolving digital security needs. These include the escalating demand for robust hardware-based authentication solutions, the continuous proliferation of IoT devices requiring embedded security at the chip level, the rapid expansion of contactless payment systems globally, the increasing integration of secure elements into emerging automotive and industrial applications for enhanced safety and connectivity, and the growing emphasis on data privacy regulations compelling industries to adopt stronger foundational security measures.

AI Impact Analysis on Secure Element

Artificial Intelligence is profoundly influencing the Secure Element market by enhancing threat detection capabilities through sophisticated anomaly identification, enabling more resilient fraud prevention mechanisms across digital transactions, and optimizing the performance and lifecycle management of secure hardware. AI-driven analytics are also crucial for predicting potential security vulnerabilities within systems, customizing secure element deployments for specific application requirements, and facilitating the development of adaptive security protocols, thereby improving overall system resilience, efficiency, and proactive defense against advanced cyber threats.

Key Takeaways Secure Element Market Size & Forecast

- The Secure Element market is undergoing significant expansion, primarily driven by the global acceleration of digital transformation across various sectors.

- Rising adoption of secure elements in the Internet of Things (IoT) and connected devices is a fundamental growth catalyst, ensuring data integrity and device authentication.

- Secure Elements are becoming indispensable for next-generation payment systems, mobile transactions, and robust digital identity authentication across diverse platforms.

- The market is poised for substantial growth over the forecast period, with key verticals like telecommunications, BFSI, automotive, and consumer electronics showing strong integration trends.

- Strategic investments in research and development by key players are focusing on miniaturization, enhanced cryptographic capabilities, and versatile integration options to meet evolving security demands.

Secure Element Market Drivers Analysis

The Secure Element market is experiencing robust growth propelled by a confluence of critical drivers, each contributing significantly to its expansion. These drivers reflect the increasing global need for enhanced digital security, data privacy, and reliable authentication mechanisms across a multitude of industries and applications. The inherent capabilities of secure elements to provide isolated, tamper-resistant environments for sensitive data and cryptographic operations make them indispensable in today's interconnected world, fostering widespread adoption and driving market forward.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Digital Security and Data Protection: The growing volume of sensitive personal and financial data transferred digitally necessitates robust security measures. Secure elements provide a hardware-rooted trust anchor, essential for protecting critical information from sophisticated cyber threats and unauthorized access, thereby addressing fundamental security concerns for individuals and enterprises. | +2.8% | Global, particularly North America, Europe, Asia Pacific (APAC) | Short to Long-term |

| Proliferation of IoT and Connected Devices: The explosion of IoT devices, ranging from smart home appliances to industrial sensors, creates a vast attack surface. Secure elements are vital for authenticating these devices, securing their communication, and protecting the data they generate and transmit, ensuring the integrity and trustworthiness of the entire IoT ecosystem. | +2.5% | Global, with significant uptake in APAC and North America | Medium to Long-term |

| Growth in Contactless Payments and Mobile Transactions: The shift towards digital wallets, mobile banking, and contactless payment methods relies heavily on secure elements for cryptographic key storage and secure transaction execution. These elements ensure the integrity and confidentiality of payment data, mitigating fraud risks and enhancing user convenience. | +2.2% | Europe, APAC, North America (rapid adoption) | Short to Medium-term |

| Rising Adoption of E-identification and Government Initiatives: Governments worldwide are increasingly implementing digital identity schemes, e-passports, and secure digital services. Secure elements are fundamental to these initiatives, providing the foundational security for identity verification, citizen services, and national security applications, driving demand for secure hardware. | +1.9% | Europe, Asia Pacific, select African nations | Medium-term |

| Need for Hardware-Level Security in Critical Infrastructure: Industries such as automotive, industrial control systems, and healthcare require uncompromising security due to the potential catastrophic impact of breaches. Secure elements offer hardware-rooted security, protecting critical operational technology (OT) and sensitive patient data, which software-only solutions cannot fully guarantee. | +1.5% | North America, Europe, developing industrial hubs in APAC | Medium to Long-term |

Secure Element Market Restraints Analysis

Despite the strong growth trajectory, the Secure Element market faces certain restraints that could impede its expansion. These challenges often relate to the inherent complexities of integrating hardware-based security, cost considerations, and the evolving competitive landscape from alternative security paradigms. Addressing these restraints will be crucial for the sustained growth and wider adoption of secure element technology across various applications and industries.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Cost of Integration and Deployment: Integrating secure elements into devices and systems involves significant upfront costs, including hardware components, specialized design, and complex software development. This can be a barrier for smaller manufacturers or applications with tight budget constraints, potentially limiting widespread adoption in cost-sensitive segments. | -1.2% | Global, affecting emerging markets and small businesses more significantly | Medium-term |

| Complexity in Secure Element Ecosystem Management: Managing the lifecycle of secure elements, from provisioning and key management to updates and revocation, can be highly complex. This complexity requires specialized expertise and infrastructure, posing a challenge for organizations lacking the necessary resources or technical capabilities, thereby slowing down deployment cycles. | -0.9% | Global, particularly for multi-vendor environments | Short to Medium-term |

| Competition from Software-Based Security Solutions: While hardware-based security offers superior protection, software-only security solutions, such as Trusted Execution Environments (TEEs) or virtualized secure enclaves, often present a lower-cost and easier-to-implement alternative. These software solutions, though inherently less secure against certain physical attacks, can compete in applications where the highest level of security is not strictly mandated. | -0.7% | Global, especially in consumer electronics and non-critical IoT | Short to Medium-term |

| Lack of Standardization Across Different Platforms: The secure element market lacks universally adopted standards across various platforms, architectures, and use cases. This fragmentation can lead to interoperability issues, vendor lock-in, and increased development costs for manufacturers striving to create cross-compatible solutions, hindering broader market acceptance. | -0.5% | Global, impacts diverse industry applications | Long-term |

Secure Element Market Opportunities Analysis

The Secure Element market is presented with several compelling opportunities that can significantly accelerate its growth trajectory. These opportunities stem from technological advancements, the emergence of new application areas, and an increasing global awareness of cybersecurity needs. Capitalizing on these evolving trends and market shifts will enable secure element providers to innovate, diversify their offerings, and capture new revenue streams, reinforcing their foundational role in the digital economy.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence of 5G Technology and Edge Computing: The rollout of 5G networks and the proliferation of edge computing devices create new frontiers for secure element integration. These technologies demand robust, low-latency security at the network edge, making secure elements crucial for authenticating devices, securing data in transit, and enabling trusted execution environments closer to the data source. | +2.5% | Global, particularly North America, APAC, and Europe (leading 5G deployment) | Medium to Long-term |

| Growing Demand for Secure Elements in Automotive Industry: The rise of connected cars, autonomous vehicles, and electric vehicles necessitates sophisticated security to protect vehicle systems, communication, and sensitive user data. Secure elements are becoming integral for functions like secure boot, over-the-air (OTA) updates, vehicle-to-everything (V2X) communication, and in-vehicle payment systems, presenting a substantial growth area. | +2.0% | Europe, North America, Japan, China (major automotive manufacturing hubs) | Medium to Long-term |

| Expansion into New Applications like Blockchain and Digital Currencies: Blockchain technology, cryptocurrencies, and Central Bank Digital Currencies (CBDCs) require highly secure environments for private key storage and transaction signing. Secure elements provide the ideal hardware-based protection, safeguarding digital assets and enabling secure participation in decentralized finance ecosystems, opening up significant new market segments. | +1.8% | Global, particularly regions exploring blockchain and digital currency innovation | Medium to Long-term |

| Increased Focus on Supply Chain Security: With global supply chains becoming more complex and vulnerable to tampering, there's a growing need for trusted hardware throughout the product lifecycle. Secure elements can be integrated at the manufacturing stage to ensure product authenticity, prevent counterfeiting, and provide verifiable provenance, addressing a critical concern for both consumers and businesses. | +1.5% | Global, impacting manufacturing and logistics hubs | Medium-term |

Secure Element Market Challenges Impact Analysis

While opportunities abound, the Secure Element market is also confronted by distinct challenges that demand innovative solutions and strategic adaptation. These challenges range from the perpetual evolution of cyber threats to the complexities of balancing stringent security with seamless user experience, and navigating the intricate landscape of global regulations and supply chain vulnerabilities. Successfully addressing these hurdles will be pivotal for secure element providers to sustain their growth momentum and solidify their position as essential components in the cybersecurity ecosystem.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Evolving Cyber Threats and Sophisticated Attacks: The rapid evolution of cyber threats, including advanced persistent threats (APTs), side-channel attacks, and quantum computing threats, constantly pressures secure element manufacturers to develop more resilient and future-proof designs. Keeping pace with these sophisticated attack vectors requires continuous R&D and significant investment, posing a substantial challenge. | -0.8% | Global, across all industries leveraging digital technologies | Continuous, Short to Long-term |

| Balancing Security with User Convenience: Implementing robust security often introduces friction in user experience, such as requiring multiple authentication steps or complex setup processes. A key challenge for secure element integration is to provide state-of-the-art protection without compromising ease of use, which is critical for mass market adoption, particularly in consumer electronics. | -0.6% | Global, especially prevalent in consumer-facing applications | Short to Medium-term |

| Supply Chain Vulnerabilities and Counterfeiting Risks: The global supply chain for electronic components, including secure elements, is susceptible to various risks such as tampering, insertion of malicious hardware, or counterfeiting. Ensuring the integrity and authenticity of secure elements throughout their manufacturing and distribution journey is a significant challenge that impacts trust and reliability. | -0.5% | Global, particularly affecting diverse manufacturing regions like APAC | Medium to Long-term |

| Regulatory Compliance and Data Privacy Concerns Across Diverse Regions: Navigating the complex and often disparate regulatory landscapes concerning data privacy (e.g., GDPR, CCPA) and cybersecurity standards across different countries is a substantial challenge. Secure element providers must ensure their solutions meet stringent, evolving compliance requirements, which can vary significantly by geography and industry. | -0.4% | Europe, North America, rapidly developing regulatory frameworks in APAC | Continuous, Medium-term |

Secure Element Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Secure Element Market, offering critical insights into its current state, historical performance, and future growth trajectory. The scope encompasses detailed segmentation, regional analysis, competitive landscape evaluation, and an examination of market drivers, restraints, opportunities, and challenges. Designed for business professionals and decision-makers, this report serves as a vital resource for strategic planning and informed investment decisions within the dynamic secure element ecosystem.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 17.5 Billion |

| Growth Rate | 14.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | NXP Semiconductors, Infineon Technologies, STMicroelectronics, Thales Group (Gemalto), Giesecke+Devrient (G+D), Samsung Electronics, Apple Inc., Qualcomm Technologies, IDEMIA, Texas Instruments, Renesas Electronics, Microchip Technology, Sony Corporation, Intel Corporation, Broadcom |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Secure Element Market is comprehensively segmented to provide granular insights into its diverse components and application areas. This segmentation allows for a detailed understanding of market dynamics across various product types, functional applications, and end-use industries, highlighting key growth pockets and strategic focus areas. Analyzing these segments helps in identifying niche opportunities and understanding the specific requirements that drive the adoption of secure elements across the global landscape.

- By Type:

- Embedded Secure Element (eSE): These are integrated directly into the device during manufacturing, offering the highest level of tamper-resistance and performance for applications like mobile payments and identity.

- Universal Integrated Circuit Card (UICC): Commonly known as SIM cards (for mobile networks) and USIMs, these removable secure elements primarily facilitate mobile communication security and subscriber identity.

- Trusted Platform Module (TPM): Found primarily in computers and servers, TPMs provide hardware-based security functions for platform integrity, cryptographic operations, and secure storage of keys.

- Smart Cards: These are physical cards with an embedded secure element, widely used for payment cards, access control, and public transportation.

- SIM Cards: A specific form of UICC, primarily used in mobile phones for subscriber authentication and network access.

- Others: Includes secure microcontrollers, hardware security modules (HSMs), and specialized secure ICs for specific industrial or embedded applications.

- By Application:

- Payment & Banking: Secure elements are critical for contactless payments, mobile banking, EMV card transactions, and digital wallets, ensuring secure financial data processing.

- Identity Management & Access Control: Used in e-passports, national ID cards, corporate badges, and digital authentication for secure access to physical and digital resources.

- Mobile Communication: Fundamental for subscriber identity, secure messaging, and network authentication in smartphones and other mobile devices.

- IoT & M2M: Provides hardware-rooted security for connected devices, securing data, device authentication, and enabling secure communication in IoT ecosystems.

- Automotive: Integrates into connected cars for secure vehicle access, infotainment, V2X communication, and over-the-air (OTA) updates.

- Consumer Electronics: Found in wearables, smart TVs, and other consumer devices for secure content protection, device authentication, and personal data privacy.

- Others: Encompasses diverse applications such as industrial control systems, healthcare devices, and smart metering for enhanced security.

- By End-Use Industry:

- Telecommunication: Drives demand for secure elements in SIM cards, eSIMs, and network infrastructure.

- Banking, Financial Services, and Insurance (BFSI): Critical for secure payment cards, mobile banking, and digital financial transactions.

- Government & Public Sector: Utilizes secure elements for e-governance services, national IDs, and secure public infrastructure.

- Automotive: Integrates secure elements for connected and autonomous vehicle security.

- Consumer Electronics: Includes smartphones, tablets, smart wearables, and other personal devices requiring robust security.

- Industrial: Deploys secure elements in industrial IoT (IIoT) devices, control systems, and machinery for operational security.

- Healthcare: Uses secure elements for patient data protection, secure medical devices, and digital health applications.

- Retail: Essential for point-of-sale (POS) terminals, loyalty programs, and secure inventory management systems.

- Others: Covers sectors like transportation, energy, and smart cities implementing secure element technologies.

Regional Highlights

Regional analysis plays a pivotal role in understanding the diverse dynamics and growth pockets within the Secure Element Market. Each region exhibits unique characteristics influenced by technological adoption rates, regulatory frameworks, economic development, and prevalent industry trends. Focusing on key countries and zones provides valuable insights into demand drivers, competitive intensity, and future growth opportunities, enabling targeted strategies for market penetration and expansion.

- North America: This region stands as a dominant force in the Secure Element market, primarily due to its early adoption of advanced digital technologies, robust cybersecurity infrastructure, and a strong presence of key technology developers and end-use industries like BFSI and telecommunications. The increasing focus on data privacy regulations and the rapid deployment of IoT devices across commercial and industrial sectors further fuel the demand for hardware-rooted security solutions. The United States and Canada are at the forefront of innovation and integration.

- Europe: Europe represents a significant market for Secure Elements, largely driven by stringent data protection regulations such as GDPR and PSD2, which mandate higher levels of security for digital transactions and personal data. The region's thriving automotive industry is a key consumer, integrating secure elements into connected cars for enhanced safety and security features. Countries like Germany, France, and the UK are prominent contributors, with a strong emphasis on smart infrastructure and e-governance initiatives.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth in the Secure Element market, propelled by rapid digitalization, explosive growth in mobile payments, and the burgeoning adoption of IoT and smart city initiatives across countries like China, India, Japan, and South Korea. The expanding middle class, increasing smartphone penetration, and government support for digital transformation initiatives are creating immense opportunities for secure element proliferation in diverse applications.

- Latin America: This region is an emerging market for Secure Elements, witnessing increasing digital transformation and financial inclusion efforts. The growing adoption of mobile banking and contactless payments, alongside expanding IoT deployments in smart cities and industrial applications, is driving the demand for secure hardware. Brazil and Mexico are leading the way in the region's secure element adoption.

- Middle East and Africa (MEA): The MEA region is experiencing steady growth in the Secure Element market, primarily fueled by significant investments in smart city projects, increasing digital infrastructure development, and a rising awareness of cybersecurity. Government initiatives aimed at digitalizing public services and developing secure financial ecosystems are key growth catalysts, particularly in countries like UAE, Saudi Arabia, and South Africa.

Top Key Players:

The market research report covers the analysis of key stake holders of the Secure Element Market. Some of the leading players profiled in the report include -- NXP Semiconductors

- Infineon Technologies

- STMicroelectronics

- Thales Group (Gemalto)

- Giesecke+Devrient (G+D)

- Samsung Electronics

- Apple Inc.

- Qualcomm Technologies

- IDEMIA

- Texas Instruments

- Renesas Electronics

- Microchip Technology

- Sony Corporation

- Intel Corporation

- Broadcom

- Huawei Technologies

- Watchdata Systems

- Beijing HuaDa ZhiBao Electronic Co., Ltd.

- Fudan Microelectronics

- Maxim Integrated (now Analog Devices)

Frequently Asked Questions:

What is a Secure Element (SE) and why is it important?

A Secure Element (SE) is a tamper-resistant microcontroller or chip designed to securely store sensitive data such as cryptographic keys, credentials, and digital certificates, and execute cryptographic operations in an isolated, secure environment. It is crucial because it provides the highest level of hardware-rooted security, protecting critical information from sophisticated physical and logical attacks, thereby ensuring the integrity and confidentiality of digital transactions and sensitive data in connected devices.

Which industries primarily utilize Secure Elements?

Secure Elements are widely utilized across various industries requiring robust data protection and authentication. Key sectors include Telecommunication (for SIM cards and eSIMs), Banking, Financial Services, and Insurance (BFSI) for secure payments and mobile banking, Automotive (for connected car security and V2X communication), Government & Public Sector (for e-passports and digital IDs), and Consumer Electronics (for smartphones, wearables, and smart TVs).

How does the Secure Element market address evolving cybersecurity threats?

The Secure Element market continually evolves to address sophisticated cybersecurity threats by developing chips with enhanced cryptographic algorithms, stronger physical tamper-detection mechanisms, and resistance against side-channel attacks. Manufacturers also focus on secure lifecycle management, including secure provisioning, firmware updates, and robust key management, to maintain a high level of security against emerging vulnerabilities and ensure long-term protection.

What are the key drivers for the growth of the Secure Element market?

The Secure Element market's growth is primarily driven by the escalating global demand for digital security and data protection, the widespread proliferation of IoT and connected devices requiring hardware-level trust, the rapid expansion of contactless payment systems and mobile transactions, and increasing government initiatives for e-identification and digital public services. These factors underscore the fundamental need for robust, hardware-based security solutions.

How is AI impacting the development and deployment of Secure Elements?

Artificial Intelligence is significantly impacting the Secure Element market by enabling more intelligent threat detection and fraud prevention systems through advanced analytics. AI can optimize the performance and management of secure elements, predict potential vulnerabilities, and facilitate adaptive security protocols. This integration allows for more dynamic, resilient, and efficient secure element deployments, enhancing overall system security and responsiveness to evolving threats.