SAP Digital Service Ecosystem Market

SAP Digital Service Ecosystem Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705842 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

SAP Digital Service Ecosystem Market Size

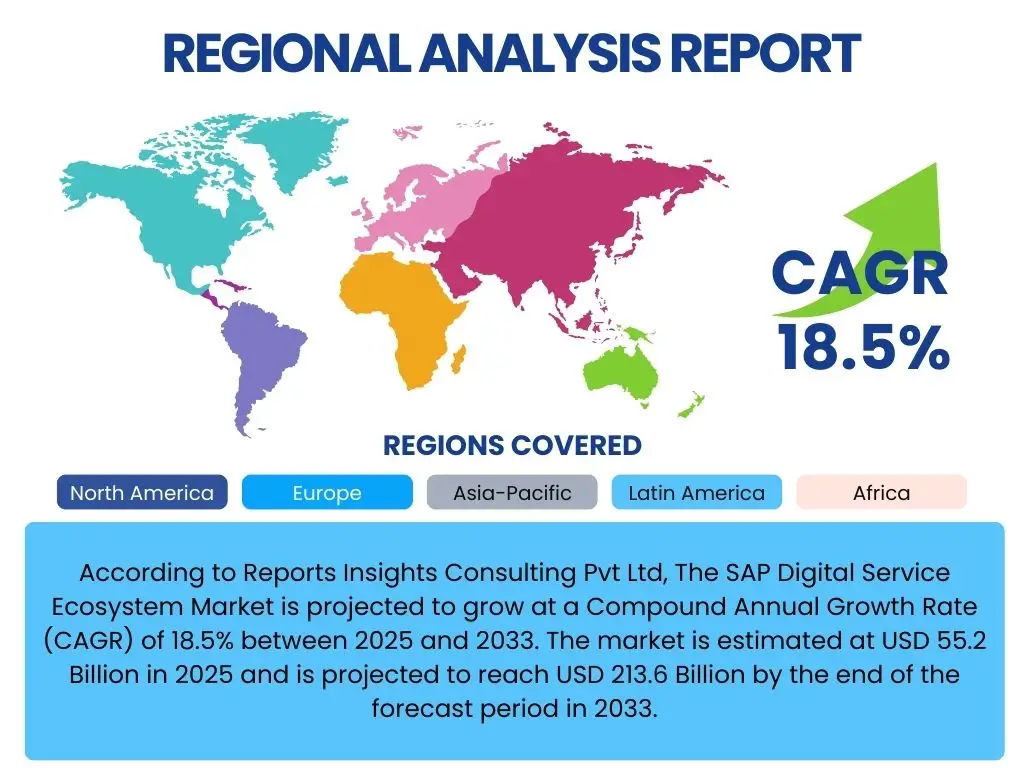

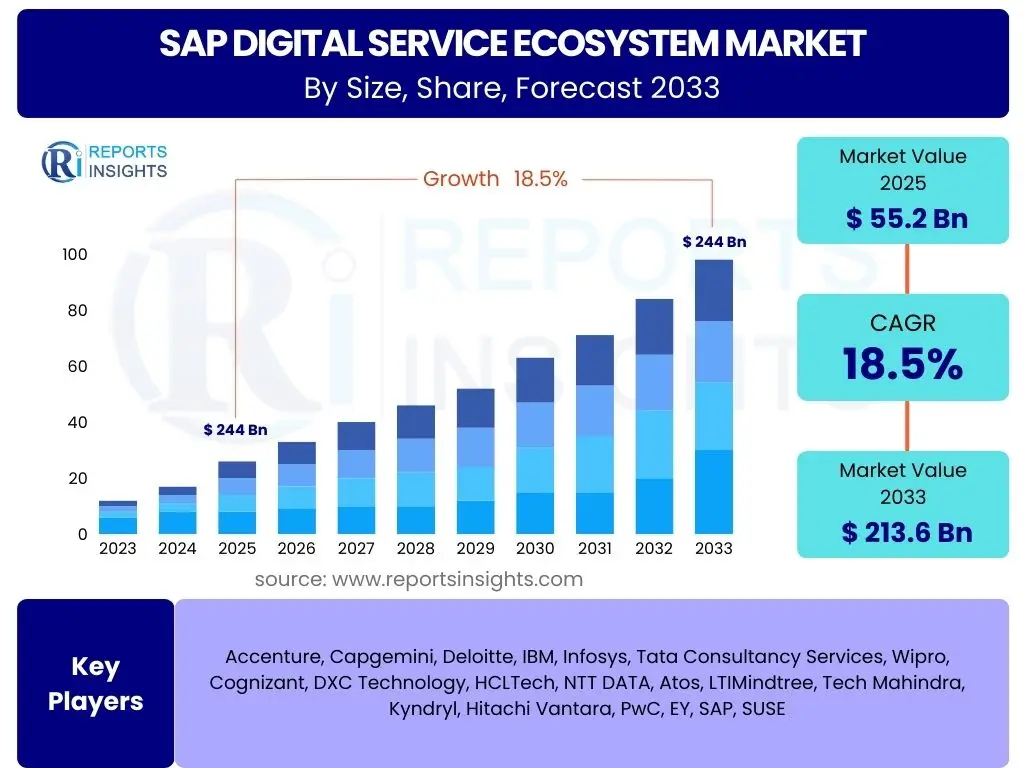

According to Reports Insights Consulting Pvt Ltd, The SAP Digital Service Ecosystem Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033. The market is estimated at USD 55.2 Billion in 2025 and is projected to reach USD 213.6 Billion by the end of the forecast period in 2033.

Key SAP Digital Service Ecosystem Market Trends & Insights

The SAP Digital Service Ecosystem is experiencing significant transformation, driven by an accelerating shift towards cloud-centric solutions and the increasing demand for integrated, intelligent enterprise processes. Users are keenly interested in understanding how evolving technological landscapes, particularly the widespread adoption of S/4HANA and the RISE with SAP program, are reshaping service delivery models and value propositions. There is a strong focus on enhancing business agility, improving operational efficiency, and leveraging data for strategic decision-making through advanced SAP services. The market is also seeing a surge in specialized services that cater to specific industry nuances and regulatory compliance.

Furthermore, the focus on hyper-personalization and a seamless customer experience is driving service providers to offer more tailored and proactive support. This involves not only technical expertise but also deep industry knowledge to optimize SAP functionalities for unique business requirements. The ongoing digital imperative across all sectors necessitates a robust and adaptable SAP ecosystem, prompting continuous innovation in service offerings from consulting to managed services.

- Accelerated cloud migration and adoption of S/4HANA Cloud and RISE with SAP.

- Increased demand for industry-specific solutions and tailored consulting services.

- Integration of emerging technologies such as Artificial Intelligence, Machine Learning, and IoT into core SAP processes.

- Shift towards managed services and subscription-based models for enhanced operational efficiency and cost predictability.

- Growing emphasis on data analytics, predictive capabilities, and real-time insights for strategic decision-making.

- Focus on sustainability and green IT initiatives within SAP landscapes.

- Expansion of hyper-automation and intelligent process automation within business workflows.

AI Impact Analysis on SAP Digital Service Ecosystem

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is profoundly influencing the SAP Digital Service Ecosystem, fundamentally altering how enterprises manage their operations and how service providers deliver value. Users frequently inquire about the practical applications of AI within SAP environments, including automation of routine tasks, enhanced data analysis for predictive insights, and the development of intelligent applications that optimize complex business processes. The primary expectations revolve around improved efficiency, reduced operational costs, and the ability to derive more actionable intelligence from vast datasets. However, there are also concerns regarding data privacy, ethical AI deployment, and the need for specialized skills to manage these advanced systems.

AI is transforming traditional service models by enabling proactive issue resolution, predictive maintenance, and highly personalized user experiences within SAP systems. Generative AI, in particular, is poised to revolutionize content creation for training, documentation, and even code generation, significantly accelerating development and deployment cycles. Service providers are increasingly leveraging AI tools to enhance their own operations, offering more sophisticated and data-driven consulting, implementation, and support services. This shift underscores a critical need for the workforce to adapt and acquire new competencies to effectively utilize these intelligent capabilities.

- Automation of routine SAP support tasks and incident management through AI-powered chatbots and virtual assistants.

- Enhanced predictive analytics for demand forecasting, supply chain optimization, and proactive maintenance within SAP ERP systems.

- Development of intelligent process automation (IPA) solutions to streamline complex business workflows in SAP.

- Improved data quality and governance through AI-driven anomaly detection and data cleansing within SAP data lakes.

- Personalized user experiences and intelligent recommendations within SAP Fiori and other user interfaces.

- Accelerated development and testing cycles through generative AI for code, test data, and documentation.

- Optimization of resource allocation and project management for SAP implementations using AI algorithms.

Key Takeaways SAP Digital Service Ecosystem Market Size & Forecast

Analysis of market inquiries reveals a keen interest in understanding the core implications of the SAP Digital Service Ecosystem's projected growth and what this means for businesses and service providers alike. A primary takeaway is the undeniable trajectory towards significant market expansion, driven by the indispensable role of digital transformation and cloud strategies across all industries. This growth signals a robust demand for specialized SAP services, indicating that businesses are increasingly investing in sophisticated solutions to maintain competitiveness and foster innovation. The market's substantial forecast highlights the critical need for organizations to align their IT strategies with cutting-edge SAP advancements to capitalize on future opportunities.

Furthermore, the data emphasizes that success in this evolving ecosystem will hinge on adaptability, embracing new technologies like AI, and forming strategic partnerships. The continuous evolution of SAP's offerings, particularly in cloud and intelligent technologies, necessitates a proactive approach from both enterprises seeking to leverage these tools and service providers delivering them. This sustained growth underscores the importance of ongoing skill development and strategic resource allocation to navigate the complexities and unlock the full potential of modern SAP landscapes.

- The market is poised for substantial expansion, reflecting the global imperative for digital transformation and cloud adoption.

- Significant investment in S/4HANA migration and cloud-based SAP solutions is a key growth catalyst.

- Emerging technologies, especially AI and advanced analytics, are becoming integral to maximizing SAP ecosystem value.

- Specialized consulting, implementation, and managed services are crucial for successful SAP landscape evolution.

- The market offers immense opportunities for service providers capable of delivering innovative and industry-specific solutions.

SAP Digital Service Ecosystem Market Drivers Analysis

The SAP Digital Service Ecosystem is propelled by several potent drivers stemming from the global imperative for digital transformation and the continuous evolution of enterprise technology. Businesses are increasingly recognizing the strategic necessity of modernizing their core systems to achieve operational agility, enhance customer experiences, and gain competitive advantages. This push is strongly aligned with SAP's strategic shift towards cloud-centric solutions like S/4HANA Cloud and the RISE with SAP offering, which promise reduced total cost of ownership, improved scalability, and access to advanced functionalities like embedded analytics and AI.

Furthermore, the demand for integrated business processes, capable of providing real-time data and insights across disparate departments, significantly fuels the need for expert SAP services. Organizations are seeking to unify their operations, from supply chain management to customer relationship management, into a cohesive digital core. This necessitates comprehensive implementation, migration, and ongoing managed services that can optimize these complex landscapes, ensuring seamless functionality and maximum value realization from their SAP investments.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Accelerated Digital Transformation Initiatives | +5.0% | Global, particularly North America, Europe, and APAC | 2025-2033 |

| Increased Adoption of S/4HANA and Cloud Solutions | +4.5% | Global, especially developed economies | 2025-2033 |

| Demand for Integrated Business Processes and Real-time Data | +3.8% | Global, all enterprise sizes | 2025-2033 |

| Rising Need for Industry-Specific and Niche Solutions | +3.0% | Europe, APAC, emerging markets | 2026-2033 |

| Growth in Automation and AI Integration into Enterprise Systems | +2.2% | North America, Europe | 2027-2033 |

SAP Digital Service Ecosystem Market Restraints Analysis

Despite robust growth, the SAP Digital Service Ecosystem market faces several significant restraints that can impede its full potential. One of the primary concerns for organizations is the substantial upfront investment required for SAP implementations and migrations, particularly for large-scale S/4HANA transformations. The perceived high cost, coupled with potential budget constraints, can deter or delay adoption, especially for small and medium-sized enterprises (SMEs) or in regions with more volatile economic conditions. Furthermore, the complexity of integrating diverse SAP modules with existing legacy systems, or even with other enterprise applications, presents a considerable challenge, leading to extended project timelines and increased resource demands.

Another major restraint is the scarcity of highly skilled SAP professionals, particularly those proficient in newer technologies like S/4HANA Cloud, embedded AI, and specific industry solutions. The talent gap often results in higher consulting fees, slower project execution, and potential quality compromises. Additionally, data security and compliance concerns, especially with sensitive enterprise data moving to cloud environments, remain a hurdle. Organizations are increasingly cautious about vendor lock-in and require flexible, secure, and compliant solutions, which service providers must meticulously address to alleviate these market inhibitions.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment and Implementation Costs | -3.5% | Global, particularly SMEs | 2025-2029 |

| Complexity of Migration and Integration with Legacy Systems | -2.8% | Global, large enterprises with extensive legacy systems | 2025-2031 |

| Scarcity of Skilled SAP Professionals and Talent Gap | -2.0% | North America, Europe, emerging markets | 2025-2033 |

| Data Security and Compliance Concerns in Cloud Environments | -1.5% | Europe (GDPR), North America, financial services, healthcare | 2025-2033 |

| Economic Uncertainties and Budget Constraints | -1.2% | Global, sensitive to regional economic downturns | Short to Medium Term (2025-2027) |

SAP Digital Service Ecosystem Market Opportunities Analysis

The SAP Digital Service Ecosystem presents a wealth of opportunities driven by ongoing technological advancements and evolving business needs. The expansion into new geographic markets, particularly in emerging economies with nascent digital infrastructure, offers significant untapped potential for SAP service providers. These regions are increasingly adopting modern ERP solutions to foster economic growth and enhance global competitiveness, creating a fertile ground for greenfield implementations and digital transformation projects. Furthermore, the growing demand for highly specialized, industry-specific solutions presents a lucrative avenue for service providers to differentiate themselves by developing deep vertical expertise, tailoring SAP functionalities to unique sector requirements, and addressing specific regulatory challenges.

Moreover, the continuous innovation within SAP's product portfolio, including advancements in AI, blockchain, and IoT integration, opens doors for new service offerings centered around these cutting-edge technologies. Generative AI, for instance, offers immense potential for automating aspects of service delivery, from code generation to documentation, enhancing efficiency and scalability. The increasing complexity of SAP landscapes also fuels the demand for advanced managed services and proactive support, allowing providers to build long-term, high-value relationships with clients. Strategic mergers and acquisitions (M&A) represent another key opportunity for market consolidation and expansion of capabilities, enabling service providers to rapidly acquire specialized skills or expand their geographical footprint.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into New Geographic Markets (e.g., emerging economies) | +4.0% | APAC, Latin America, MEA | 2026-2033 |

| Development of Niche, Industry-Specific SAP Solutions | +3.5% | Global, across all verticals | 2025-2033 |

| Leveraging Generative AI for Service Delivery and Optimization | +3.0% | Global, particularly North America, Europe | 2027-2033 |

| Growing Demand for Advanced Managed Services and Proactive Support | +2.5% | Global, large and medium enterprises | 2025-2033 |

| Strategic Partnerships and Mergers & Acquisitions for Capability Expansion | +2.0% | Global, competitive markets | 2025-2030 |

SAP Digital Service Ecosystem Market Challenges Impact Analysis

The SAP Digital Service Ecosystem, while exhibiting significant growth, navigates several inherent challenges that demand strategic responses from market participants. One prominent challenge is the rapid pace of technological evolution within the SAP landscape itself. With frequent updates to S/4HANA, the introduction of new cloud services, and the integration of emerging technologies like AI and IoT, service providers must continuously invest in upskilling their workforce and adapting their methodologies. This constant need for innovation can strain resources and require significant training budgets, potentially impacting profit margins if not managed effectively. Maintaining expertise across a constantly expanding and complex product portfolio is a perpetual balancing act for service firms.

Another critical challenge involves talent acquisition and retention. The specialized nature of SAP skills, coupled with high demand, creates a competitive market for skilled professionals. Attracting and retaining top talent, especially those proficient in newer cloud-based SAP modules and intelligent technologies, is crucial for delivering high-quality services and meeting client expectations. Additionally, managing client expectations, particularly regarding project timelines, budget adherence, and desired business outcomes, can be challenging. Complex SAP projects often encounter scope creep or unforeseen technical hurdles, requiring robust project management and transparent communication to ensure client satisfaction and successful project delivery in an environment where cybersecurity threats are also constantly evolving, demanding sophisticated protective measures and continuous vigilance.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Technological Evolution and Keeping Pace with SAP Innovations | -3.0% | Global, highly impactful for service providers | 2025-2033 |

| Talent Acquisition and Retention of Skilled SAP Professionals | -2.5% | North America, Europe, APAC | 2025-2033 |

| Managing Complex Integrations and Interoperability Issues | -2.0% | Global, large enterprises | 2025-2030 |

| Ensuring Data Governance, Privacy, and Regulatory Compliance | -1.8% | Europe (GDPR), highly regulated industries | 2025-2033 |

| Cybersecurity Threats and Data Breach Risks | -1.5% | Global, all industries | 2025-2033 |

SAP Digital Service Ecosystem Market - Updated Report Scope

This comprehensive report delves into the intricate dynamics of the SAP Digital Service Ecosystem market, providing an in-depth analysis of its current landscape, historical performance, and future growth trajectories. The scope encompasses detailed segmentation across various service types, deployment models, enterprise sizes, and industry verticals, offering a granular view of market opportunities and challenges. It provides critical insights for stakeholders seeking to understand market trends, competitive positioning, and strategic growth avenues within this rapidly evolving sector, leveraging data from key market players and regional highlights to present a holistic market overview and future outlook for decision-makers.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 55.2 Billion |

| Market Forecast in 2033 | USD 213.6 Billion |

| Growth Rate | 18.5% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Accenture, Capgemini, Deloitte, IBM, Infosys, Tata Consultancy Services, Wipro, Cognizant, DXC Technology, HCLTech, NTT DATA, Atos, LTIMindtree, Tech Mahindra, Kyndryl, Hitachi Vantara, PwC, EY, SAP, SUSE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The SAP Digital Service Ecosystem market is meticulously segmented to provide a granular understanding of its diverse components and drivers. These segmentations allow for a detailed analysis of specific market niches, enabling stakeholders to identify key growth areas and tailor their strategies accordingly. By breaking down the market based on service type, deployment model, enterprise size, and industry vertical, the report provides a comprehensive view of where demand is strongest and how different sectors are adopting SAP solutions and related services.

Understanding these segments is crucial for both service providers and enterprises. Service providers can identify specific service offerings with high growth potential, such as cloud migration or AI integration services, and focus on particular industry verticals experiencing rapid digital transformation. Enterprises, on the other hand, can benchmark their adoption strategies against industry trends and identify the most suitable service models and partners for their specific operational needs and strategic objectives, ensuring that their SAP investments yield maximum returns and align with evolving technological landscapes and business demands.

- By Service Type: This segment includes Consulting Services, which guide businesses through strategic planning and solution architecture; Implementation Services, covering the actual deployment and configuration of SAP systems; Managed Services, providing ongoing operational support; Application Management Services (AMS), focusing on maintenance and optimization of SAP applications; Support and Maintenance Services; Migration and Upgrade Services, crucial for transitioning to newer SAP versions like S/4HANA; and Cloud Integration Services, addressing the complexities of hybrid and multi-cloud environments.

- By Deployment Model: This segment differentiates between On-premise deployments, where software is installed and run on local servers; and various Cloud deployment models, including Public Cloud for shared infrastructure, Private Cloud for dedicated environments, and Hybrid Cloud, combining both for flexibility and scalability.

- By Enterprise Size: The market is analyzed for Large Enterprises, typically requiring extensive and complex SAP landscapes, and Small and Medium-sized Enterprises (SMEs), which often seek more agile and cost-effective solutions.

- By Industry Vertical: This segmentation highlights the adoption and specific requirements of the SAP ecosystem across Manufacturing, Retail and Consumer Goods, IT and Telecommunications, Healthcare and Life Sciences, Automotive, Energy and Utilities, Public Sector, and Financial Services, reflecting varied industry-specific needs and regulatory landscapes.

Regional Highlights

- North America: Leads the SAP Digital Service Ecosystem market due to the high adoption rate of cloud technologies, significant investments in digital transformation by large enterprises, and a strong presence of key market players and innovative solution providers. The region benefits from robust IT infrastructure and a culture of early technology adoption.

- Europe: Exhibits substantial growth driven by stringent regulatory compliance requirements (e.g., GDPR), a focus on data privacy, and significant S/4HANA migration projects across various industries, particularly manufacturing and financial services. Germany and the UK are prominent contributors due to strong industrial bases and digital initiatives.

- Asia Pacific (APAC): Represents the fastest-growing region, fueled by rapid industrialization, increasing digitalization initiatives, and expanding economic development in countries like China, India, Japan, and Australia. Emerging economies are increasingly investing in enterprise-grade solutions to scale operations and enhance global competitiveness.

- Latin America: Shows steady growth, spurred by rising demand for cloud-based ERP solutions, particularly among mid-sized enterprises seeking to optimize operations and improve efficiency. Countries like Brazil and Mexico are leading the adoption curve, driven by increasing foreign investments and regional digital agendas.

- Middle East and Africa (MEA): This region is experiencing considerable investment in digital infrastructure and smart city initiatives, particularly in the Gulf Cooperation Council (GCC) countries. The focus on economic diversification and modernization is driving the adoption of advanced SAP solutions across sectors like energy, public services, and finance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SAP Digital Service Ecosystem Market.- Accenture

- Capgemini

- Deloitte

- IBM

- Infosys

- Tata Consultancy Services

- Wipro

- Cognizant

- DXC Technology

- HCLTech

- NTT DATA

- Atos

- LTIMindtree

- Tech Mahindra

- Kyndryl

- Hitachi Vantara

- PwC

- EY

- SAP

- SUSE

Frequently Asked Questions

What is the current estimated market size of the SAP Digital Service Ecosystem?

The SAP Digital Service Ecosystem market is estimated at USD 55.2 Billion in 2025, demonstrating significant ongoing investment in digital transformation and cloud-based SAP solutions.

What is the projected Compound Annual Growth Rate (CAGR) for the SAP Digital Service Ecosystem market?

The market is projected to grow at a robust CAGR of 18.5% between 2025 and 2033, driven by increasing cloud adoption and the demand for integrated enterprise solutions.

How is Artificial Intelligence (AI) impacting the SAP Digital Service Ecosystem?

AI is significantly impacting the ecosystem by enabling automation of routine tasks, enhancing predictive analytics, improving decision-making, and fostering intelligent process automation within SAP landscapes, leading to greater efficiency and optimized operations.

What are the primary drivers for the growth of the SAP Digital Service Ecosystem market?

Key drivers include accelerated digital transformation initiatives, widespread adoption of S/4HANA and cloud solutions, the imperative for integrated business processes, and the rising demand for industry-specific and intelligent enterprise solutions.

Which regions are leading the adoption of SAP Digital Services?

North America and Europe are currently leading in adoption due to mature IT infrastructures and high digital transformation investments, while Asia Pacific is emerging as the fastest-growing region with rapid industrialization and digitalization efforts.