Roofing Underlayment Market

Roofing Underlayment Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705857 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Roofing Underlayment Market Size

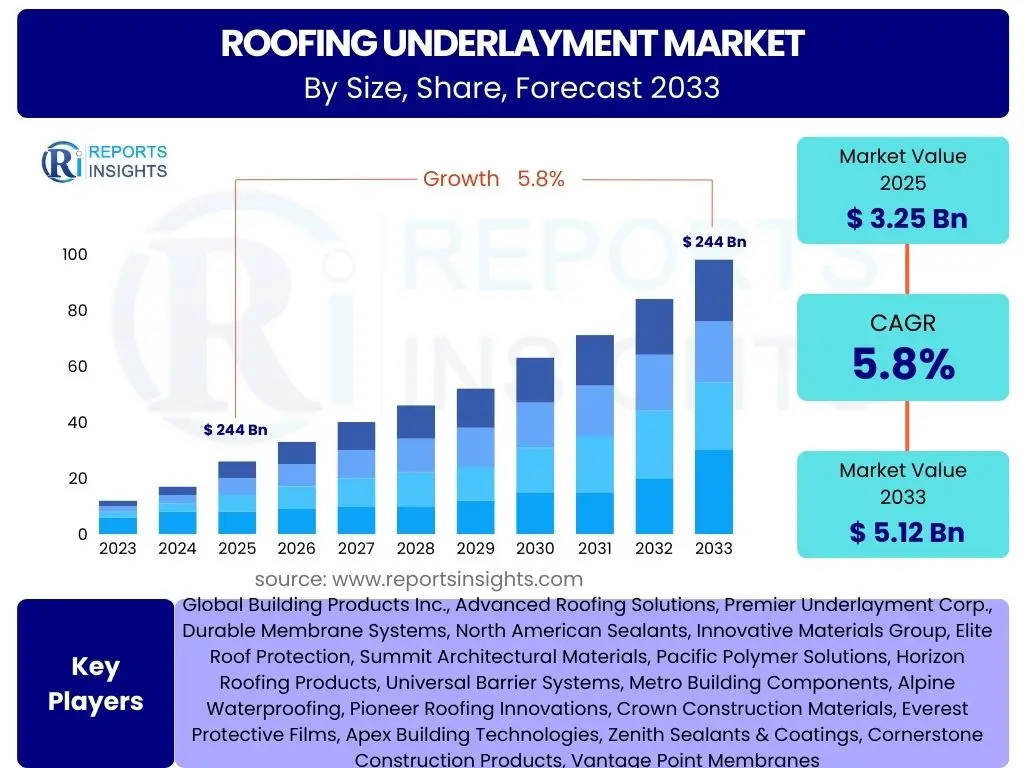

According to Reports Insights Consulting Pvt Ltd, The Roofing Underlayment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033. The market is estimated at USD 3.25 Billion in 2025 and is projected to reach USD 5.12 Billion by the end of the forecast period in 2033.

Key Roofing Underlayment Market Trends & Insights

The roofing underlayment market is currently experiencing significant shifts driven by evolving building practices, material science advancements, and a heightened focus on sustainability and energy efficiency. Common inquiries from users highlight interest in innovative materials, the impact of green building initiatives, and the increasing adoption of synthetic products over traditional ones. There is also a strong emphasis on understanding how extreme weather patterns are influencing the demand for more durable and resilient underlayment solutions, prompting a move towards higher performance and multi-functional products that offer enhanced protection against moisture and wind uplift.

Another prominent trend attracting user attention involves the integration of smart technologies within roofing systems, which, while nascent, is beginning to influence underlayment characteristics. This includes considerations for breathability, vapor permeability, and compatibility with photovoltaic installations or other integrated roof elements. The market is also seeing a surge in demand for products that simplify installation, reduce labor costs, and offer long-term performance guarantees, reflecting a broader industry push for efficiency and reliability in construction. These trends collectively underscore a market moving towards more advanced, specialized, and performance-oriented underlayment solutions.

- Growing adoption of synthetic underlayments over traditional asphalt-saturated felt due to superior performance and longevity.

- Increasing focus on sustainable and eco-friendly underlayment materials, including those with recycled content or low VOC emissions.

- Integration of advanced moisture management and breathable technologies in underlayment designs to enhance building envelope performance.

- Rising demand for self-adhered underlayments for ease of installation and enhanced waterproofing capabilities.

- Development of specialized underlayments tailored for specific roofing materials, climate conditions, and energy efficiency standards.

AI Impact Analysis on Roofing Underlayment

Common user questions related to the impact of Artificial Intelligence (AI) on the roofing underlayment sector primarily revolve around efficiency gains, quality control, and supply chain optimization. Stakeholders are keen to understand how AI can streamline manufacturing processes, predict material performance under various conditions, and enhance the overall reliability of roofing systems. The analysis indicates that while direct AI application within the underlayment material itself is limited, its indirect influence across the supply chain, production, and installation phases is poised for significant growth, addressing key concerns such as waste reduction and error minimization.

AI's potential also extends to predictive maintenance and damage assessment, areas where users anticipate substantial improvements. For instance, AI-powered drones can conduct rapid and accurate roof inspections, identifying potential underlayment issues before they escalate, thereby reducing long-term repair costs and extending roof lifespan. Furthermore, AI can optimize logistics and inventory management for underlayment manufacturers and distributors, ensuring timely delivery and reducing storage costs. This technological integration is expected to lead to more data-driven decision-making, better product development cycles, and improved service delivery across the roofing underlayment value chain.

- AI-driven predictive analytics for raw material sourcing and demand forecasting, optimizing production schedules.

- Enhanced quality control in manufacturing through AI-powered visual inspection systems detecting defects in underlayment rolls.

- Optimization of supply chain logistics and inventory management using AI algorithms to reduce waste and improve delivery times.

- AI-assisted design and simulation tools for developing new underlayment materials with improved performance characteristics.

- Drone-based AI inspections for pre-installation site analysis and post-installation quality assurance of underlayment.

Key Takeaways Roofing Underlayment Market Size & Forecast

The global roofing underlayment market is poised for robust growth through 2033, driven primarily by escalating construction activities worldwide, increasing awareness regarding building envelope integrity, and a global shift towards sustainable and resilient infrastructure. Key insights from user inquiries highlight the critical role of underlayments in extending roof lifespan, enhancing energy efficiency, and providing superior moisture protection. The market's expansion is intrinsically linked to stringent building codes and the increasing frequency of extreme weather events, which necessitate higher performance materials capable of withstanding diverse environmental challenges and ensuring long-term structural integrity.

Furthermore, the forecast indicates a significant shift from traditional felt products towards advanced synthetic and modified bitumen underlayments, reflecting a preference for durability, ease of installation, and enhanced protective qualities. Regional dynamics also play a crucial role, with burgeoning construction sectors in emerging economies driving new demand, while mature markets focus on renovation, re-roofing, and the adoption of premium, high-performance solutions. These factors collectively underscore a market that is not only growing in size but also evolving in terms of technological sophistication and product specialization to meet contemporary building demands.

- Robust market growth driven by global construction boom and re-roofing projects.

- Shift towards high-performance synthetic and modified bitumen underlayments for enhanced durability and weather resistance.

- Increasing importance of underlayments in achieving energy efficiency and meeting green building standards.

- Market expansion influenced by stricter building codes and regulations emphasizing roof system integrity.

- Significant opportunities in emerging economies due to rapid urbanization and infrastructure development.

Roofing Underlayment Market Drivers Analysis

The roofing underlayment market is significantly propelled by several concurrent factors that collectively amplify demand for these essential building materials. A primary driver is the continuous expansion of construction activities globally, encompassing both new residential and commercial infrastructure. As urban populations grow and economies develop, the need for robust and long-lasting buildings becomes paramount, directly translating into increased demand for high-quality underlayments that form the critical base of any reliable roofing system. This growth is not limited to new builds but also extends to the constant need for repair, renovation, and upgrading of existing structures to meet modern standards and extend their useful life.

Moreover, the escalating frequency and intensity of extreme weather events, ranging from hurricanes and heavy snowfalls to prolonged heatwaves, have underscored the necessity for resilient building envelopes. Underlayments, serving as a crucial secondary barrier against moisture intrusion and wind uplift, are increasingly viewed as indispensable components for enhancing a roof's resistance to such environmental stresses. This heightened awareness among builders and property owners drives the adoption of advanced underlayment technologies. Concurrently, the global push towards energy efficiency and sustainable building practices further fuels the market, as modern underlayments contribute significantly to a building's thermal performance and overall energy conservation by improving insulation and reducing air leakage, aligning with stringent new energy codes and green building certifications.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Construction & Renovation Activities | +1.5% | Global, particularly APAC, North America | Short to Mid-term (2025-2029) |

| Rising Demand for Energy-Efficient Buildings | +1.2% | Europe, North America, Developing Economies | Mid to Long-term (2027-2033) |

| Stringent Building Codes & Regulations | +1.0% | North America, Europe, Select APAC Countries | Mid-term (2026-2030) |

| Growing Awareness of Roof System Longevity | +0.8% | Developed Markets, Expanding to Emerging | Short to Long-term (2025-2033) |

| Increased Frequency of Extreme Weather Events | +1.3% | Coastal Regions, Disaster-Prone Areas Globally | Short to Mid-term (2025-2029) |

Roofing Underlayment Market Restraints Analysis

Despite the favorable market outlook, the roofing underlayment sector faces several significant restraints that could temper its growth trajectory. A primary concern is the volatility in raw material prices, particularly for petroleum-based products that are crucial components in synthetic and modified bitumen underlayments. Fluctuations in crude oil prices directly impact manufacturing costs, which can then be passed on to consumers, potentially deterring adoption of higher-performance but more expensive underlayment solutions. This price instability makes long-term planning and consistent pricing strategies challenging for manufacturers and distributors alike, affecting market stability and profitability.

Another considerable restraint is the skilled labor shortage within the construction industry. The proper installation of roofing underlayments, especially advanced self-adhering or specialized synthetic products, requires specific expertise and adherence to manufacturer guidelines. A lack of trained and experienced roofing professionals can lead to improper installation, compromising the underlayment's performance and the overall integrity of the roof system. This not only results in potential performance failures but can also slow down project completion times and increase overall costs due to reworks. Furthermore, the persistent competition from traditional or less effective roofing solutions, particularly in price-sensitive markets, can also limit the market penetration of higher-quality underlayments, as some builders may opt for lower upfront costs over long-term performance benefits.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in Raw Material Prices | -0.9% | Global, particularly regions dependent on imports | Short to Mid-term (2025-2028) |

| Skilled Labor Shortage & Installation Challenges | -0.7% | North America, Europe | Mid-term (2026-2030) |

| High Initial Cost of Advanced Underlayments | -0.5% | Developing Economies, Budget-sensitive segments | Short to Mid-term (2025-2029) |

Roofing Underlayment Market Opportunities Analysis

The roofing underlayment market is ripe with opportunities driven by innovation, sustainability, and geographical expansion. A significant avenue for growth lies in continuous advancements in material science. Research and development efforts are leading to the creation of next-generation underlayments with enhanced properties such as superior breathability, increased tear resistance, improved UV stability, and better self-sealing capabilities. These innovations not only address existing market needs but also open up new applications and performance benchmarks, allowing manufacturers to differentiate their products and capture higher market share by offering solutions that provide unprecedented protection and longevity for roofing systems.

Furthermore, the global imperative towards green building initiatives and energy efficiency standards presents a substantial opportunity. As more countries adopt stricter regulations and provide incentives for sustainable construction, the demand for eco-friendly and energy-saving underlayments is expected to surge. Products that contribute to LEED certification, reduce a building's carbon footprint, or improve thermal performance will find increased market acceptance. Concurrently, the burgeoning construction sectors in emerging economies across Asia Pacific, Latin America, and Africa offer vast untapped potential. Rapid urbanization, industrialization, and infrastructure development in these regions are creating enormous demand for modern building materials, presenting a fertile ground for market expansion for underlayment manufacturers willing to adapt to local market dynamics and pricing sensitivities.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Advancements in Material Science & Product Innovation | +1.3% | Global | Long-term (2028-2033) |

| Growth in Green Building & Sustainability Initiatives | +1.1% | Europe, North America, Asia Pacific | Mid to Long-term (2027-2033) |

| Expansion in Emerging Economies & Urbanization | +1.5% | Asia Pacific, Latin America, MEA | Short to Long-term (2025-2033) |

Roofing Underlayment Market Challenges Impact Analysis

The roofing underlayment market, despite its growth prospects, confronts several challenges that demand strategic responses from industry players. One significant hurdle is the complexity and potential for disruptions within global supply chains. Geopolitical events, trade disputes, natural disasters, or pandemics can severely impact the availability of raw materials or disrupt the transportation of finished products, leading to increased costs and delayed deliveries. Such disruptions create uncertainty for manufacturers and contractors, affecting project timelines and overall market stability, ultimately impacting product availability and pricing for the end-user. This necessitates a robust and diversified supply chain strategy to mitigate risks effectively.

Another key challenge is the pervasive price sensitivity, especially in developing markets and among certain segments of the construction industry. While high-performance underlayments offer significant long-term benefits in terms of durability and energy efficiency, their higher upfront cost can be a deterrent for builders operating on tight budgets. Convincing these stakeholders of the long-term value proposition over cheaper, traditional alternatives requires extensive education and demonstration of return on investment. Furthermore, the lack of widespread awareness and adequate education regarding the crucial role and varied benefits of modern underlayments poses a significant challenge. Many homeowners and even some smaller contractors may not fully understand the technical advantages of advanced products, leading them to underestimate their importance and choose less effective solutions. Bridging this knowledge gap through industry-wide initiatives and targeted marketing is essential for greater adoption of premium underlayment solutions.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Supply Chain Disruptions & Raw Material Shortages | -0.8% | Global | Short to Mid-term (2025-2028) |

| Price Sensitivity & Competition from Cheaper Alternatives | -0.6% | Developing Economies, Budget-constrained markets | Short to Long-term (2025-2033) |

| Lack of Awareness & Education on Advanced Underlayments | -0.4% | Global, particularly residential and smaller contractors | Long-term (2027-2033) |

Roofing Underlayment Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Roofing Underlayment Market, offering critical insights into its current state, historical performance, and future growth projections. The scope encompasses detailed segmentation across various product types, materials, applications, end-uses, and distribution channels, providing a granular view of market dynamics. It further highlights key regional trends and competitive landscape analysis, identifying major players and their strategic initiatives, all aimed at offering stakeholders actionable intelligence for informed decision-making within this evolving industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.25 Billion |

| Market Forecast in 2033 | USD 5.12 Billion |

| Growth Rate | 5.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Building Products Inc., Advanced Roofing Solutions, Premier Underlayment Corp., Durable Membrane Systems, North American Sealants, Innovative Materials Group, Elite Roof Protection, Summit Architectural Materials, Pacific Polymer Solutions, Horizon Roofing Products, Universal Barrier Systems, Metro Building Components, Alpine Waterproofing, Pioneer Roofing Innovations, Crown Construction Materials, Everest Protective Films, Apex Building Technologies, Zenith Sealants & Coatings, Cornerstone Construction Products, Vantage Point Membranes |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The roofing underlayment market is meticulously segmented to provide a comprehensive understanding of its diverse components and sub-sectors, allowing for granular analysis of market dynamics. This segmentation helps stakeholders identify specific growth areas, understand competitive landscapes within niches, and tailor product development and marketing strategies. The primary segmentation is based on product type, distinguishing between traditional felt, synthetic, and modified bitumen underlayments, each catering to different performance requirements and cost considerations. Further layers of analysis include material composition, which highlights the prevalence and innovation in polymers like polypropylene and polyethylene, as well as asphalt-based solutions.

Beyond material and product type, the market is segmented by application, separating residential, commercial, and industrial uses, reflecting varying demands in terms of volume, performance specifications, and regulatory compliance. End-use segmentation differentiates between new construction projects and the robust re-roofing and renovation market, which often drives demand for advanced, easy-to-install solutions. Lastly, the distribution channel analysis provides insights into how these products reach the end-user, covering wholesale, direct sales, retail, and the burgeoning online platforms. This multi-dimensional segmentation is crucial for navigating the complexities of the global roofing underlayment market and for developing targeted market penetration strategies.

- By Product Type:

- Asphalt Saturated Felt (Felt Underlayment)

- Non-Bitumen Synthetic Underlayment

- Rubberized Asphalt (Modified Bitumen)

- By Material:

- Polypropylene

- Polyethylene

- Asphalt/Bitumen

- Others (Fiberglass, Polyester)

- By Application:

- Residential

- Commercial

- Industrial

- By End-Use:

- New Construction

- Re-roofing/Renovation

- By Distribution Channel:

- Wholesale & Distribution

- Direct Sales

- Retail (Hardware Stores, Home Improvement Chains)

- Online

Regional Highlights

Geographic analysis reveals diverse market dynamics and growth potentials for roofing underlayments across different regions. North America stands as a mature market, characterized by significant renovation and re-roofing activities, alongside a strong emphasis on durable and high-performance materials driven by stringent building codes and extreme weather events. The region exhibits a high adoption rate of synthetic and self-adhered underlayments, reflecting a preference for advanced solutions that offer superior protection and longevity. The consistent demand for resilient infrastructure and energy-efficient buildings will continue to fuel innovation and market stability in this region.

Europe mirrors North America in its focus on energy efficiency and sustainable construction, with stringent environmental regulations promoting the use of eco-friendly and high-performance underlayments. The region’s market is influenced by the need to upgrade aging buildings and the increasing popularity of green building certifications. Asia Pacific, however, represents the fastest-growing market due to rapid urbanization, booming construction activities, and significant infrastructure development, particularly in countries like China, India, and Southeast Asian nations. While price sensitivity remains a factor, increasing awareness of quality construction and improving economic conditions are driving the adoption of modern underlayment solutions. Latin America and the Middle East and Africa (MEA) are also emerging as promising markets, driven by ongoing construction projects, rising disposable incomes, and a growing understanding of the benefits of robust roofing systems, albeit with varying levels of market maturity and product preferences.

- North America: Dominant market share driven by robust residential and commercial construction, extensive re-roofing projects, and stringent building codes emphasizing durability and energy efficiency.

- Europe: Strong focus on sustainable building practices, energy conservation, and adherence to evolving regulations, leading to demand for advanced and eco-friendly underlayments.

- Asia Pacific (APAC): Fastest-growing region due to rapid urbanization, increasing disposable incomes, and massive infrastructure development projects, particularly in developing economies.

- Latin America: Emerging market with increasing construction activities, growing awareness of high-quality building materials, and demand for weather-resistant solutions.

- Middle East and Africa (MEA): Significant growth potential due to diversification of economies, large-scale construction projects (e.g., smart cities), and need for underlayments suited for diverse climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Roofing Underlayment Market.- Global Building Products Inc.

- Advanced Roofing Solutions

- Premier Underlayment Corp.

- Durable Membrane Systems

- North American Sealants

- Innovative Materials Group

- Elite Roof Protection

- Summit Architectural Materials

- Pacific Polymer Solutions

- Horizon Roofing Products

- Universal Barrier Systems

- Metro Building Components

- Alpine Waterproofing

- Pioneer Roofing Innovations

- Crown Construction Materials

- Everest Protective Films

- Apex Building Technologies

- Zenith Sealants & Coatings

- Cornerstone Construction Products

- Vantage Point Membranes

Frequently Asked Questions

Analyze common user questions about the Roofing Underlayment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is roofing underlayment and why is it essential?

Roofing underlayment is a protective layer installed directly onto the roof deck beneath the primary roofing material. It serves as a crucial secondary barrier against moisture intrusion, preventing leaks from wind-driven rain, ice dams, or shingle damage. It also provides a smooth surface for roofing materials, adds fire resistance, and can contribute to overall roof system longevity and energy efficiency.

What are the primary types of roofing underlayments available?

The main types include asphalt-saturated felt (traditional felt paper), non-bitumen synthetic underlayments, and rubberized asphalt (modified bitumen) underlayments. Felt is cost-effective but less durable; synthetics offer superior tear resistance, UV stability, and lighter weight; while rubberized asphalt provides excellent self-sealing and waterproofing properties, often used in critical areas or low-slope roofs.

How is the Roofing Underlayment Market performing globally?

The global roofing underlayment market is experiencing robust growth, projected to reach USD 5.12 Billion by 2033 with a CAGR of 5.8%. This growth is primarily driven by increasing construction activities worldwide, stringent building codes mandating better protection, a growing focus on energy-efficient buildings, and rising renovation and re-roofing projects across various regions.

What factors are driving growth in the Roofing Underlayment Market?

Key growth drivers include the global increase in residential and commercial construction, heightened demand for energy-efficient and resilient buildings, the implementation of stricter building codes and regulations, and a rise in renovation and re-roofing activities. The increasing frequency of extreme weather events also compels the adoption of high-performance underlayments for enhanced protection.

What are the latest trends shaping the future of roofing underlayments?

Current trends include a significant shift towards synthetic and self-adhering underlayments for improved performance and ease of installation. There is also a strong emphasis on developing sustainable and eco-friendly materials, integrating advanced moisture management technologies, and designing specialized underlayments to meet specific climate conditions and building types, ultimately enhancing roof system longevity and efficiency.