Robotic Process Automation in Finance Market

Robotic Process Automation in Finance Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702564 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Robotic Process Automation in Finance Market Size

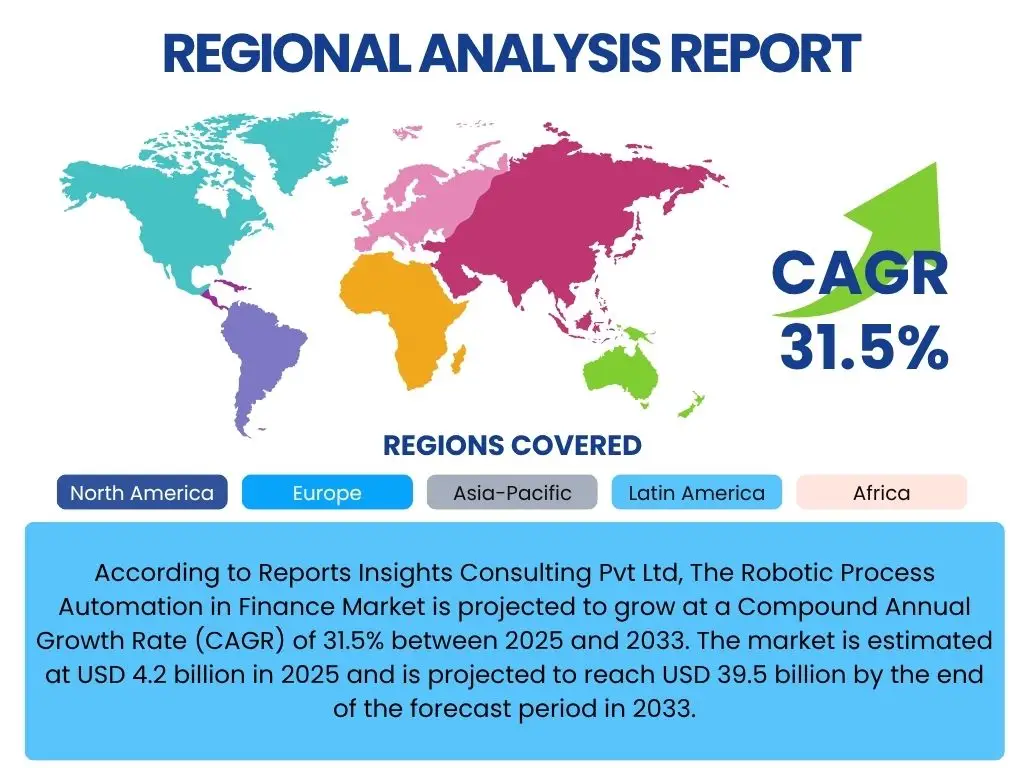

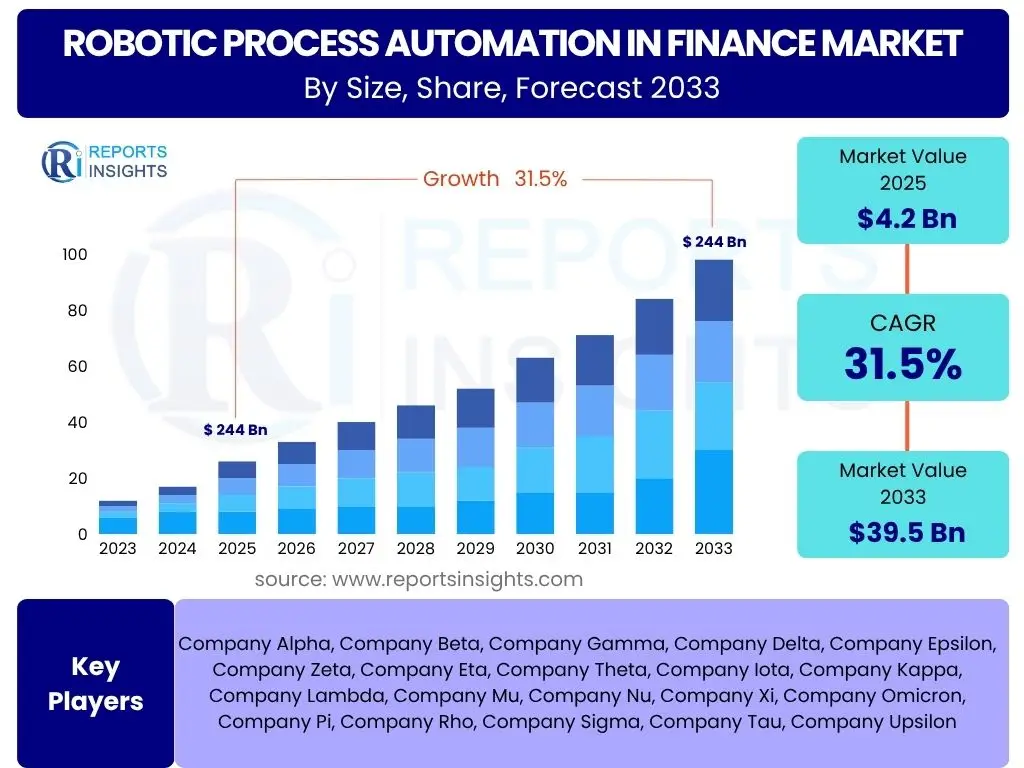

According to Reports Insights Consulting Pvt Ltd, The Robotic Process Automation in Finance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 31.5% between 2025 and 2033. The market is estimated at USD 4.2 billion in 2025 and is projected to reach USD 39.5 billion by the end of the forecast period in 2033.

Key Robotic Process Automation in Finance Market Trends & Insights

The Robotic Process Automation (RPA) in Finance market is experiencing rapid evolution, driven by the imperative for operational efficiency, cost reduction, and enhanced regulatory compliance within financial institutions. A notable trend is the shift from basic task automation towards intelligent process automation (IPA) and hyperautomation, integrating RPA with artificial intelligence (AI), machine learning (ML), and natural language processing (NLP). This advanced integration allows financial processes to handle unstructured data, make intelligent decisions, and adapt to dynamic operational environments, moving beyond rule-based automation.

Another significant insight is the increasing adoption of cloud-based RPA solutions, which offer greater scalability, flexibility, and reduced infrastructure overheads compared to on-premise deployments. This trend is particularly appealing to small and medium-sized enterprises (SMEs) in finance, democratizing access to powerful automation capabilities. Furthermore, the concept of the "citizen developer" is gaining traction, empowering business users with low-code/no-code RPA platforms to automate their own processes, thereby accelerating deployment and fostering a culture of automation across organizations.

The focus is also intensely shifting towards quantifiable return on investment (ROI) and strategic alignment of RPA initiatives with broader digital transformation goals. Financial institutions are not merely automating for automation's sake but are meticulously measuring the impact on key performance indicators such as processing time, error rates, compliance adherence, and employee productivity. This strategic perspective ensures that RPA investments contribute directly to competitive advantage and long-term business resilience in a highly regulated and competitive financial landscape.

- Shift towards intelligent process automation (IPA) and hyperautomation.

- Increased adoption of cloud-based RPA solutions for scalability and flexibility.

- Empowerment of citizen developers through low-code/no-code platforms.

- Strong emphasis on measurable ROI and strategic alignment with digital transformation.

- Enhanced focus on regulatory compliance and fraud detection through automation.

AI Impact Analysis on Robotic Process Automation in Finance

The integration of Artificial Intelligence (AI) is fundamentally transforming the landscape of Robotic Process Automation in finance, transitioning it from simple, rule-based task execution to sophisticated, cognitive process automation. AI capabilities, including machine learning for predictive analytics, natural language processing for understanding unstructured data, and computer vision for digitizing physical documents, empower RPA bots to handle complex, varied, and exception-rich financial processes that were previously beyond their scope. This synergy enables financial institutions to automate tasks such as credit risk assessment, loan processing, and compliance reporting with greater accuracy and speed, while significantly reducing manual intervention.

While AI offers immense opportunities, common user concerns often revolve around job displacement, the accuracy and bias of AI algorithms, and the ethical implications of autonomous decision-making in critical financial operations. However, the prevailing expectation is that AI will augment human capabilities rather than replace them entirely, freeing up financial professionals from repetitive tasks to focus on strategic analysis, complex problem-solving, and client relationship management. AI-powered RPA is seen as a tool to enhance decision-making through deeper insights derived from vast datasets, improving fraud detection, personalized customer experiences, and optimized financial planning.

The long-term impact of AI on RPA in finance is anticipated to lead to the creation of truly "self-learning" and "self-correcting" automation systems. These systems will continuously adapt to changing market conditions, regulatory updates, and evolving customer needs, requiring minimal human oversight. This evolution promises to unlock unprecedented levels of efficiency, resilience, and competitive agility for financial organizations globally, allowing them to scale operations and innovate at a pace previously unimaginable, thereby shaping the future of digital finance.

- Transforms rule-based RPA into cognitive process automation.

- Enables handling of unstructured data and complex decision-making in financial processes.

- Enhances capabilities in fraud detection, risk assessment, and compliance.

- Augments human roles by automating repetitive tasks, allowing focus on strategic work.

- Facilitates the development of self-learning and adaptive automation systems.

Key Takeaways Robotic Process Automation in Finance Market Size & Forecast

The Robotic Process Automation in Finance market is poised for exceptional growth, demonstrating its critical role in the digital transformation agendas of financial institutions worldwide. The significant projected Compound Annual Growth Rate (CAGR) to 2033 underscores a widespread recognition of RPA’s potential to deliver substantial operational efficiencies, cost reductions, and improvements in accuracy. This rapid expansion is not merely a reflection of technological adoption but a strategic pivot by financial entities to remain competitive, resilient, and compliant in an increasingly complex and data-intensive operating environment. The market trajectory indicates that RPA is moving beyond an experimental phase to become an indispensable component of modern financial infrastructure.

A key takeaway from the market forecast is the acceleration of investment in intelligent automation capabilities, driven by the desire to leverage AI and machine learning alongside traditional RPA. This convergence is crucial for automating complex, knowledge-based processes that require cognitive abilities, such as interpreting unstructured data or making dynamic decisions. The substantial increase in market size projected by 2033 highlights a deepening integration of these technologies into core financial operations, leading to higher levels of straight-through processing and reduced human intervention in routine tasks across departments like accounting, compliance, and customer service.

Furthermore, the robust growth forecast signals a democratization of advanced automation tools within finance, extending beyond large enterprises to encompass small and medium-sized financial services firms. This expansion is fueled by the availability of scalable cloud-based solutions and the increasing ease of deployment, allowing more organizations to realize the benefits of automation without prohibitive upfront investments. The sustained demand for RPA in finance is a clear indicator that institutions view it as a foundational technology for achieving operational excellence, improving regulatory adherence, and ultimately enhancing client satisfaction in the long term.

- Exceptional growth driven by demand for efficiency, cost reduction, and compliance.

- Strong emphasis on the convergence of RPA with AI and machine learning for intelligent automation.

- Broadening adoption across both large enterprises and small to medium-sized financial institutions.

- RPA is transitioning from a nascent technology to a foundational component of financial operations.

- Significant potential for improved operational excellence, regulatory adherence, and client satisfaction.

Robotic Process Automation in Finance Market Drivers Analysis

The Robotic Process Automation in Finance market is propelled by several potent drivers, primarily the persistent demand for operational efficiency and cost optimization across all financial processes. Financial institutions face immense pressure to reduce overheads while simultaneously handling increasing transaction volumes and managing complex data. RPA offers a scalable solution to automate repetitive, rule-based tasks, thereby minimizing human error, accelerating processing times, and significantly cutting operational expenses. This efficiency gain allows for reallocation of human capital to more strategic and customer-centric activities.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Demand for Operational Efficiency and Cost Reduction | +8.5% | Global, particularly developed economies | Short to Mid-term (2025-2029) |

| Increasing Need for Regulatory Compliance and Risk Management | +7.0% | Global, high impact in Europe & North America | Mid-term (2027-2033) |

| Enhancement of Customer Experience and Service Delivery | +6.0% | Emerging markets with growing customer bases | Mid to Long-term (2028-2033) |

| Digital Transformation Initiatives Across Financial Sector | +10.0% | Global, strong in Asia Pacific | Long-term (2029-2033) |

Robotic Process Automation in Finance Market Restraints Analysis

Despite its significant growth, the Robotic Process Automation in Finance market faces several restraints that could impede its full potential. A primary constraint is the substantial initial investment required for RPA software licenses, implementation services, and the necessary infrastructure. While RPA promises long-term cost savings, the upfront capital expenditure can be a barrier for some financial institutions, particularly smaller ones or those with tight budget constraints, necessitating careful financial planning and robust ROI projections to justify the investment. Another significant restraint is the resistance to change within organizations, as employees may harbor concerns about job displacement or require extensive training to adapt to new automated workflows, leading to slower adoption rates and potential implementation bottlenecks.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment and Implementation Costs | -4.0% | Global, particularly SMEs | Short to Mid-term (2025-2029) |

| Resistance to Change and Lack of Employee Buy-in | -3.5% | Globally pervasive challenge | Short to Mid-term (2025-2030) |

| Security Concerns and Data Privacy Risks | -2.5% | Europe (GDPR) and highly regulated regions | Long-term (Ongoing) |

| Complexity of Integrating RPA with Legacy Systems | -3.0% | Mature financial markets with older infrastructure | Mid to Long-term (2027-2033) |

Robotic Process Automation in Finance Market Opportunities Analysis

The Robotic Process Automation in Finance market is rich with opportunities, particularly driven by the accelerating trend towards hyperautomation. This involves combining RPA with advanced technologies like AI, machine learning, and process mining to create end-to-end automated business processes that are not only efficient but also intelligent and self-optimizing. Financial institutions can leverage hyperautomation to tackle more complex, unstructured data processes such as advanced fraud detection, personalized financial advisory, and dynamic risk management, thereby unlocking deeper operational efficiencies and new service offerings. This evolution broadens the scope of automation beyond routine tasks to critical strategic functions, creating significant value.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion of Hyperautomation Beyond Core RPA | +9.0% | Global, high potential in North America & Europe | Mid to Long-term (2027-2033) |

| Growing Adoption of Cloud-based RPA Solutions | +7.5% | Global, particularly SMEs in all regions | Short to Mid-term (2025-2030) |

| Untapped Potential in Small and Medium-sized Enterprises (SMEs) | +6.5% | Asia Pacific, Latin America, emerging markets | Mid to Long-term (2028-2033) |

| Integration with Advanced Analytics for Enhanced Insights | +8.0% | Global, key for competitive differentiation | Long-term (2029-2033) |

Robotic Process Automation in Finance Market Challenges Impact Analysis

The Robotic Process Automation in Finance market, while promising, faces several challenges that require strategic navigation to ensure successful adoption and long-term value realization. One significant challenge is accurately measuring and demonstrating the Return on Investment (ROI) from RPA initiatives. While the benefits of automation are often evident in terms of efficiency and cost savings, quantifying these benefits precisely, especially in complex, interconnected financial processes, can be difficult. This difficulty can hinder further investment or scalability of RPA programs if the financial justification is not clearly articulated and measured, leading to skepticism among stakeholders. Another key challenge is managing the ongoing maintenance and scalability of RPA bots, as changes in underlying systems, processes, or regulations can necessitate frequent updates and reconfigurations, creating a continuous operational overhead.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Difficulty in Measuring and Demonstrating Clear ROI | -3.0% | Global, impacts large-scale enterprise adoption | Short to Mid-term (2025-2029) |

| Ongoing Bot Maintenance and Scalability Issues | -2.5% | Global, affects long-term sustainability of programs | Mid to Long-term (2027-2033) |

| Ensuring Data Security and Compliance Post-Automation | -3.5% | Europe, North America, highly regulated markets | Long-term (Ongoing) |

| Vendor Lock-in and Interoperability Concerns | -2.0% | Global, particularly for multi-vendor environments | Long-term (Ongoing) |

Robotic Process Automation in Finance Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Robotic Process Automation in Finance market, offering a detailed understanding of market dynamics, segmentation, regional insights, and the competitive landscape. It covers historical trends, current market size, and future projections, focusing on key drivers, restraints, opportunities, and challenges shaping the industry. The report also incorporates an extensive AI impact analysis and addresses frequently asked questions to provide a holistic view for stakeholders seeking to navigate or invest in this rapidly evolving sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 39.5 Billion |

| Growth Rate | 31.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Company Alpha, Company Beta, Company Gamma, Company Delta, Company Epsilon, Company Zeta, Company Eta, Company Theta, Company Iota, Company Kappa, Company Lambda, Company Mu, Company Nu, Company Xi, Company Omicron, Company Pi, Company Rho, Company Sigma, Company Tau, Company Upsilon |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Robotic Process Automation in Finance market is comprehensively segmented to provide granular insights into its diverse applications and operational models. This segmentation highlights the various facets through which RPA is integrated into financial workflows, offering a detailed perspective on market penetration and growth opportunities across different functions, organizational scales, and technological deployments. Understanding these segments is crucial for stakeholders to identify specific market niches and develop targeted strategies that align with the evolving needs of the financial sector.

The market is primarily segmented by process, component, deployment model, organization size, and application. The "By Process" segment captures the specific financial operations that benefit most from automation, reflecting the core functional areas where RPA delivers tangible value. The "By Component" segment differentiates between the software tools themselves and the array of services that support their implementation and ongoing management. "By Deployment" illustrates the shift towards cloud-based solutions, indicating evolving infrastructure preferences, while "By Organization Size" categorizes adoption patterns across different business scales. Finally, "By Application" details the specific sectors within the broader financial industry that are leveraging RPA, providing a clear map of the technology's industry-specific impact.

- By Process: Accounts Payable Automation, Accounts Receivable Automation, General Ledger Reconciliation, Financial Planning & Analysis (FP&A), Payroll Processing, Compliance & Reporting, Fraud Detection & Risk Management, Loan Origination & Servicing, Treasury Operations, Customer Service & Onboarding, Others.

- By Component: Software (Tools, Platforms), Services (Professional Services - Consulting, Implementation, Training & Support; Managed Services).

- By Deployment: On-Premise, Cloud-Based (Public Cloud, Private Cloud, Hybrid Cloud).

- By Organization Size: Large Enterprises, Small & Medium-sized Enterprises (SMEs).

- By Application: Banking, Financial Services, and Insurance (BFSI), Investment Banking, Capital Markets, Asset & Wealth Management, FinTech Companies, Others.

Regional Highlights

- North America: This region stands as a dominant force in the Robotic Process Automation in Finance market, driven by early adoption of advanced technologies, a mature financial services industry, and significant investments in digital transformation initiatives. The United States and Canada are at the forefront, with a strong presence of major financial institutions and a high awareness of RPA's benefits in cost reduction, efficiency, and compliance. Strict regulatory environments also compel financial firms to adopt automated solutions for better governance and risk management.

- Europe: Europe represents a robust market for RPA in finance, with countries like the UK, Germany, and France leading the adoption. The region is characterized by stringent data privacy regulations (e.g., GDPR), which necessitate secure and compliant automation solutions. European financial institutions are increasingly focusing on improving operational resilience and customer experience through automation, contributing to steady market growth.

- Asia Pacific (APAC): The APAC region is projected to exhibit the fastest growth in the RPA in Finance market, fueled by rapid digitalization, expanding financial services sectors, and a burgeoning number of FinTech companies, particularly in China, India, Japan, and Australia. Government initiatives supporting digital transformation and a large unbanked population creating demand for efficient financial services are key drivers. The region offers significant opportunities for scalability and new market penetration.

- Latin America: This region is experiencing nascent but growing adoption of RPA in finance, driven by the need for efficiency gains and improved customer service in emerging economies like Brazil and Mexico. Economic volatility and the drive for modernization within the banking sector are compelling financial institutions to explore automation for cost control and competitive advantage.

- Middle East and Africa (MEA): The MEA region is witnessing increasing interest in RPA within its financial sector, particularly in countries like the UAE and Saudi Arabia, as part of broader economic diversification and digital transformation agendas. Investments in smart city initiatives and efforts to modernize financial infrastructure are creating a fertile ground for RPA adoption, focusing on operational streamlining and enhanced service delivery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Robotic Process Automation in Finance Market.- Company Alpha

- Company Beta

- Company Gamma

- Company Delta

- Company Epsilon

- Company Zeta

- Company Eta

- Company Theta

- Company Iota

- Company Kappa

- Company Lambda

- Company Mu

- Company Nu

- Company Xi

- Company Omicron

- Company Pi

- Company Rho

- Company Sigma

- Company Tau

- Company Upsilon

Frequently Asked Questions

What is Robotic Process Automation (RPA) in Finance?

RPA in Finance involves the use of software robots (bots) to automate repetitive, rule-based tasks traditionally performed by humans within financial operations. This includes activities such as data entry, invoice processing, reconciliation, compliance reporting, and customer service inquiries, significantly enhancing efficiency and accuracy across financial institutions.

How does RPA benefit financial institutions?

RPA delivers substantial benefits to financial institutions by reducing operational costs, minimizing human error, accelerating processing times for tasks, improving data accuracy, ensuring regulatory compliance, and enhancing overall productivity. It also frees up human employees to focus on more strategic, value-added activities.

What is the role of AI in RPA for finance?

AI augments RPA by enabling intelligent automation, allowing bots to handle complex, unstructured data and make cognitive decisions. This integration transforms basic task automation into intelligent process automation (IPA), facilitating advanced capabilities like predictive analytics, natural language processing for customer interactions, and sophisticated fraud detection.

What are the main challenges in implementing RPA in finance?

Key challenges include high initial investment costs, managing organizational change and employee resistance, ensuring robust data security and compliance, and effectively integrating RPA solutions with existing legacy IT systems. Long-term scalability and ongoing maintenance of bots also present operational hurdles.

What is the future outlook for RPA in the finance market?

The future outlook for RPA in finance is exceptionally positive, with sustained growth anticipated through the adoption of hyperautomation and deeper integration with AI. The market is expected to expand significantly, driven by the continuous demand for efficiency, enhanced customer experiences, and increasingly complex regulatory requirements, pushing financial institutions towards more intelligent and adaptive automation solutions.