Restaurant Inventory Management and Purchasing Software Market

Restaurant Inventory Management and Purchasing Software Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702807 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Restaurant Inventory Management and Purchasing Software Market Size

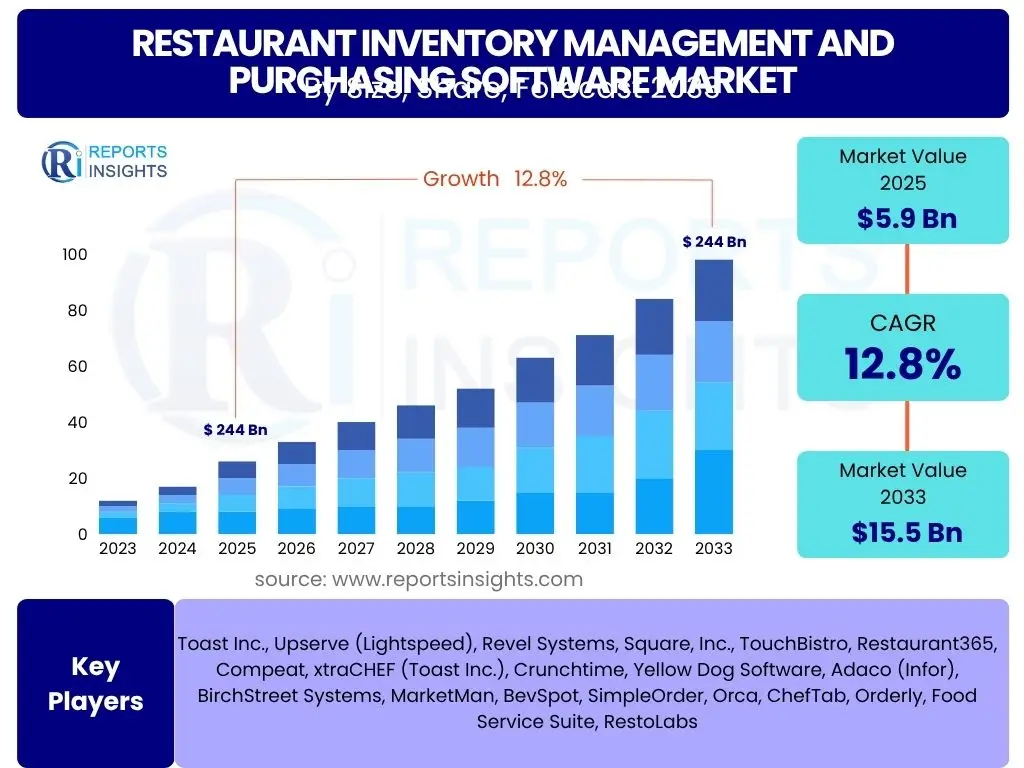

According to Reports Insights Consulting Pvt Ltd, The Restaurant Inventory Management and Purchasing Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2025 and 2033. The market is estimated at USD 5.9 billion in 2025 and is projected to reach USD 15.5 billion by the end of the forecast period in 2033.

Key Restaurant Inventory Management and Purchasing Software Market Trends & Insights

User inquiries frequently highlight the shift towards cloud-based solutions and the increasing demand for integrated platforms that combine inventory management with purchasing, vendor management, and even point-of-sale (POS) systems. There is a growing interest in how automation can reduce manual errors and improve efficiency in daily restaurant operations. Furthermore, restaurateurs are exploring solutions that offer real-time data analytics for better decision-making regarding stock levels and procurement strategies.

The market is witnessing a strong emphasis on mobile accessibility and user-friendly interfaces, enabling restaurant staff to manage inventory and place orders from anywhere. Sustainability and waste reduction are also emerging as key considerations, driving demand for software that can accurately forecast needs and minimize spoilage. Integration with food delivery platforms and third-party logistics providers is becoming crucial for seamless supply chain management.

- Shift to cloud-based and SaaS models for flexibility and scalability.

- Increased demand for integrated platforms offering end-to-end operational management.

- Emphasis on real-time data analytics and predictive forecasting for optimized inventory.

- Growing adoption of mobile-friendly applications for on-the-go management.

- Focus on sustainability and food waste reduction through improved accuracy.

- Seamless integration with POS, accounting, and third-party delivery systems.

- Personalization and customization options to cater to diverse restaurant formats.

AI Impact Analysis on Restaurant Inventory Management and Purchasing Software

Common user questions regarding AI's impact on restaurant inventory management and purchasing software revolve around its ability to enhance predictive analytics, automate mundane tasks, and optimize ordering processes. Users are keen to understand how AI can help in demand forecasting, taking into account variables like seasonality, promotions, and even local events, thereby reducing overstocking and stockouts. There is also significant interest in AI's role in identifying cost-saving opportunities through optimized purchasing and vendor negotiations.

Concerns often include the initial investment required for AI-powered systems, the complexity of implementation, and the need for accurate data input to leverage AI effectively. However, the overarching expectation is that AI will revolutionize efficiency, significantly lower food costs, and provide deeper insights into operational performance. The potential for AI to automate routine reordering and suggest optimal stock levels based on sales patterns and supplier lead times is a key area of focus for restaurateurs looking to gain a competitive edge.

- Enhanced Demand Forecasting: AI algorithms analyze historical sales data, seasonal trends, promotions, and external factors (weather, local events) to predict future demand with higher accuracy, minimizing waste and stockouts.

- Automated Reordering: AI can automate the reordering process by triggering purchase orders when stock levels hit predefined thresholds, considering supplier lead times and optimal order quantities.

- Optimized Purchasing Decisions: AI can identify the best suppliers based on price, quality, delivery reliability, and historical performance, leading to cost savings and improved procurement efficiency.

- Waste Reduction: By providing precise forecasts and tracking perishable items, AI helps reduce food spoilage and waste, contributing to both profitability and sustainability.

- Dynamic Pricing Recommendations: While less direct, AI insights into inventory levels and demand can indirectly support dynamic pricing strategies to move expiring stock or capitalize on high-demand items.

- Fraud Detection and Anomaly Identification: AI can monitor inventory movements and purchasing patterns to detect unusual activities or discrepancies, enhancing security and accountability.

- Labor Efficiency: Automation of inventory counts, reconciliation, and order placement frees up staff time, allowing them to focus on customer service and other value-added tasks.

Key Takeaways Restaurant Inventory Management and Purchasing Software Market Size & Forecast

Analysis of user inquiries reveals a strong focus on understanding the primary growth drivers and the long-term potential of the Restaurant Inventory Management and Purchasing Software market. Users seek clarity on how the accelerating adoption of digital solutions across the foodservice industry contributes to market expansion. A significant area of interest is the impact of operational efficiencies and cost control demands on the widespread implementation of these software solutions. Furthermore, questions frequently arise regarding the specific technological advancements, such as cloud computing and AI, that underpin the forecasted market growth.

The market is poised for robust expansion, primarily fueled by the imperative for restaurants to optimize their supply chain, minimize food waste, and enhance profitability in a competitive landscape. The forecast underscores a sustained trend towards greater digitalization within the restaurant sector, moving away from manual processes to sophisticated, integrated software solutions. This trajectory indicates that restaurants of all sizes will increasingly rely on these platforms to manage complex inventory workflows and make data-driven purchasing decisions, ensuring operational resilience and improved customer satisfaction.

- The market is on a robust growth trajectory, driven by the increasing need for operational efficiency and cost control in restaurants.

- Cloud-based and integrated solutions are primary catalysts for market expansion, offering scalability and real-time data access.

- Technological advancements, particularly in AI and predictive analytics, are central to the market's future growth and competitive advantage.

- Reducing food waste and optimizing inventory levels are critical drivers, leading to significant cost savings for businesses.

- Small and medium-sized restaurants are increasingly adopting these solutions, broadening the market's reach beyond large chains.

- The shift towards data-driven decision-making is accelerating the adoption of advanced inventory and purchasing software.

Restaurant Inventory Management and Purchasing Software Market Drivers Analysis

The imperative for restaurants to minimize operational costs, particularly food waste, stands as a paramount driver for the adoption of inventory management and purchasing software. As food costs fluctuate and margins remain tight, businesses are aggressively seeking solutions to track ingredients accurately, prevent spoilage, and optimize ordering quantities. This software enables precise inventory counts, reduces over-ordering, and highlights slow-moving items, directly impacting a restaurant's bottom line. The competitive nature of the foodservice industry further compels establishments to embrace technology that offers a clear return on investment through improved efficiency.

Another significant driver is the growing complexity of supply chains and the need for real-time visibility into stock levels and vendor performance. Restaurants are dealing with diverse suppliers, fluctuating prices, and dynamic consumer preferences, necessitating sophisticated tools to manage these variables effectively. Integrated software platforms streamline the entire procurement process, from requisition to payment, fostering better vendor relationships and ensuring consistent product availability. The demand for seamless integration with other restaurant technologies, such as POS systems and accounting software, also propels market growth, as operators seek holistic management solutions that provide a unified view of their business operations.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing need for cost control and waste reduction | +2.5% | Global, particularly North America, Europe | Short to Medium Term (2025-2029) |

| Rising adoption of cloud-based solutions | +1.8% | Global, especially APAC, Latin America | Medium to Long Term (2027-2033) |

| Demand for real-time data and analytics for decision-making | +1.5% | North America, Europe, Developed APAC | Short to Medium Term (2025-2030) |

| Growing trend of digitalization in the foodservice industry | +1.2% | Global | Medium Term (2026-2031) |

| Emphasis on improving operational efficiency and accuracy | +1.0% | Global | Short to Medium Term (2025-2029) |

Restaurant Inventory Management and Purchasing Software Market Restraints Analysis

One primary restraint inhibiting broader market adoption is the significant initial cost associated with implementing comprehensive inventory management and purchasing software, especially for small and independent restaurants. Beyond the software licensing fees, there are expenses related to hardware, system integration, data migration, and staff training. For businesses operating on thin margins, this upfront investment can be a substantial barrier, leading them to rely on manual processes or less sophisticated, often inadequate, spreadsheet-based systems. The perceived complexity of transitioning from existing methods to new digital platforms also contributes to reluctance among potential users, particularly those with limited technical expertise.

Another notable restraint is the resistance to change and lack of technical literacy among some restaurant staff. Implementing new software requires a cultural shift and dedicated training to ensure successful adoption. Many smaller establishments may lack the resources or bandwidth to provide adequate training, leading to underutilization of the software's capabilities or outright rejection. Concerns about data security and privacy, particularly when sensitive operational data is stored in cloud-based systems, also act as a deterrent. While security measures are continually improving, perceived vulnerabilities can make some restaurateurs hesitant to fully embrace digital solutions for their critical inventory and purchasing functions.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High initial investment and ongoing subscription costs | -0.9% | Global, particularly developing economies | Short to Medium Term (2025-2030) |

| Resistance to change and lack of technical expertise | -0.7% | Global, especially small and independent restaurants | Short to Medium Term (2025-2029) |

| Data security and privacy concerns | -0.5% | Global | Medium Term (2026-2031) |

| Integration challenges with legacy systems | -0.4% | Established markets, larger chains | Short Term (2025-2028) |

Restaurant Inventory Management and Purchasing Software Market Opportunities Analysis

The increasing proliferation of ghost kitchens, virtual brands, and dark stores presents a significant growth opportunity for restaurant inventory management and purchasing software providers. These new business models operate without traditional storefronts, relying heavily on efficient, technology-driven backend operations to manage multiple menus, complex supply chains, and rapid delivery demands. Software solutions that can seamlessly integrate across various virtual restaurant concepts, manage shared inventory, and optimize purchasing for high-volume, delivery-only operations will find a burgeoning market. Providers have the chance to develop specialized features catering to the unique needs of these emerging foodservice formats, such as multi-kitchen inventory synchronization and streamlined supplier management for a distributed network.

Another substantial opportunity lies in the development of highly customized and niche-specific solutions tailored for different types of culinary establishments, such as fine dining, casual, quick-service, and even specialized segments like catering or food trucks. While generic solutions exist, there is an unmet demand for software that deeply understands the specific inventory complexities and purchasing nuances of each segment. For instance, a fine dining restaurant might prioritize detailed ingredient tracking for specific recipes and high-value items, whereas a quick-service restaurant would focus on rapid inventory turns and efficient bulk purchasing. Offering modular, scalable, and customizable solutions that integrate with niche POS systems and unique operational workflows can unlock significant untapped market potential. The ongoing digital transformation in developing economies also presents an opportunity for market penetration with localized, affordable, and mobile-first solutions.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence of ghost kitchens and virtual brands | +1.8% | North America, Europe, Asia Pacific | Short to Medium Term (2025-2030) |

| Expansion into untapped markets (e.g., developing economies, independent restaurants) | +1.5% | Asia Pacific, Latin America, MEA | Medium to Long Term (2027-2033) |

| Integration with emerging technologies (e.g., IoT for smart kitchens) | +1.2% | Developed markets | Long Term (2029-2033) |

| Demand for specialized solutions for specific restaurant formats | +1.0% | Global | Medium Term (2026-2032) |

| Increased focus on sustainability and supply chain transparency | +0.8% | Europe, North America | Medium to Long Term (2028-2033) |

Restaurant Inventory Management and Purchasing Software Market Challenges Impact Analysis

One significant challenge facing the restaurant inventory management and purchasing software market is the complexity of integrating with diverse existing restaurant technologies and legacy systems. Many restaurants, particularly established ones, utilize a patchwork of separate systems for POS, accounting, payroll, and supplier management. Achieving seamless data flow and functionality across these disparate platforms can be technically challenging, time-consuming, and expensive. This integration hurdle often leads to fragmented data, operational inefficiencies, and reluctance from operators to invest in new solutions that may disrupt their current, albeit imperfect, workflows. Lack of standardization across different software vendors exacerbates this issue, making universal compatibility a distant goal.

Another pressing challenge is ensuring data accuracy and consistency, which is fundamental for the software to deliver its promised benefits. Manual data entry errors, inconsistencies in units of measurement, and failure to regularly update inventory counts can severely compromise the reliability of the system's insights. Restaurants operate in a dynamic environment where stock moves quickly, and discrepancies can arise from various sources, including spoilage, theft, and human error. Overcoming this requires robust data validation mechanisms, user-friendly input interfaces, and consistent training, which can be difficult to implement and maintain across a diverse workforce. Furthermore, intense competition among numerous software providers leads to pricing pressures and the need for continuous innovation, making it challenging for smaller players to sustain market share and profitability.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration complexities with existing POS and accounting systems | -0.6% | Global | Short to Medium Term (2025-2030) |

| Ensuring data accuracy and consistency | -0.5% | Global | Short to Medium Term (2025-2029) |

| High competition and pricing pressure | -0.4% | Global | Short to Medium Term (2025-2028) |

| Scalability for diverse restaurant sizes and types | -0.3% | Global | Medium Term (2026-2031) |

Restaurant Inventory Management and Purchasing Software Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the Restaurant Inventory Management and Purchasing Software market, covering historical trends, current market dynamics, and future growth projections from 2025 to 2033. It details market size, growth drivers, restraints, opportunities, and challenges, offering strategic insights for stakeholders. The report meticulously segments the market by deployment type, restaurant type, functionality, and enterprise size, providing a granular view of market performance across various dimensions.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 5.9 billion |

| Market Forecast in 2033 | USD 15.5 billion |

| Growth Rate | 12.8% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Toast Inc., Upserve (Lightspeed), Revel Systems, Square, Inc., TouchBistro, Restaurant365, Compeat, xtraCHEF (Toast Inc.), Crunchtime, Yellow Dog Software, Adaco (Infor), BirchStreet Systems, MarketMan, BevSpot, SimpleOrder, Orca, ChefTab, Orderly, Food Service Suite, RestoLabs |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Restaurant Inventory Management and Purchasing Software market is meticulously segmented to provide a comprehensive understanding of its various facets, enabling stakeholders to identify specific growth areas and target audiences. This detailed segmentation allows for a granular analysis of adoption patterns, technological preferences, and operational needs across different restaurant formats and business scales, driving tailored market strategies and product development.

- By Deployment:

- Cloud-based

- On-premise

- By Restaurant Type:

- Quick Service Restaurants (QSRs)

- Full Service Restaurants (FSRs)

- Cafes & Bars

- Others (Hotels, Catering, Ghost Kitchens)

- By Functionality:

- Inventory Tracking

- Recipe Management

- Supplier Management

- Purchasing & Ordering

- Waste Management

- Reporting & Analytics

- Menu Costing

- Integration Capabilities (POS, Accounting)

- By Enterprise Size:

- Small & Medium Enterprises (SMEs)

- Large Enterprises (Chains, Multi-unit Operations)

Regional Highlights

- North America: Dominates the market due to early technology adoption, high labor costs driving automation, and the presence of numerous large restaurant chains and technology providers. Strong emphasis on cloud-based solutions and AI integration.

- Europe: Exhibits significant growth driven by increasing regulatory compliance for food traceability, rising operational costs, and a growing awareness of food waste. Germany, the UK, and France are key contributors, focusing on integrated solutions.

- Asia Pacific (APAC): Expected to register the highest CAGR due to rapid expansion of the foodservice industry, increasing disposable income, and rising digital literacy in emerging economies like China, India, and Southeast Asian countries. Focus on mobile-first solutions and cost-effective deployments.

- Latin America: Demonstrates steady growth fueled by the digitalization of restaurant operations, particularly in Brazil and Mexico, as businesses seek to enhance efficiency and compete with international chains. Adoption is driven by accessible SaaS models.

- Middle East and Africa (MEA): Emerging market with increasing investments in hospitality and tourism, leading to greater adoption of modern restaurant technologies. Growth is particularly notable in the UAE, Saudi Arabia, and South Africa, driven by new restaurant openings and the demand for operational excellence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Restaurant Inventory Management and Purchasing Software Market.- Toast Inc.

- Upserve (Lightspeed)

- Revel Systems

- Square, Inc.

- TouchBistro

- Restaurant365

- Compeat

- xtraCHEF (Toast Inc.)

- Crunchtime

- Yellow Dog Software

- Adaco (Infor)

- BirchStreet Systems

- MarketMan

- BevSpot

- SimpleOrder

- Orca

- ChefTab

- Orderly

- Food Service Suite

- RestoLabs

Frequently Asked Questions

What is restaurant inventory management software?

Restaurant inventory management software is a digital tool designed to help restaurants track ingredients, manage stock levels, monitor food costs, and streamline purchasing processes to reduce waste and improve profitability.

How does restaurant inventory software help reduce food waste?

It reduces food waste by providing accurate, real-time inventory counts, enabling precise ordering, tracking perishable items, and offering insights into usage patterns to prevent overstocking and spoilage.

What are the benefits of cloud-based inventory management for restaurants?

Cloud-based solutions offer benefits such as remote access, automatic updates, scalability for growing businesses, reduced IT infrastructure costs, and enhanced data security through off-site backups, making them highly flexible.

Can this software integrate with existing Point-of-Sale (POS) systems?

Yes, most modern restaurant inventory and purchasing software solutions are designed to integrate seamlessly with various POS systems to automatically update inventory levels based on sales and provide comprehensive sales-to-stock insights.

Is restaurant inventory software suitable for small independent restaurants?

Absolutely. Many providers offer scalable, user-friendly solutions specifically designed for small and independent restaurants, providing essential tools for cost control, efficiency, and growth without requiring extensive technical expertise.