Regulatory Technology Market

Regulatory Technology Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703227 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Regulatory Technology Market Size

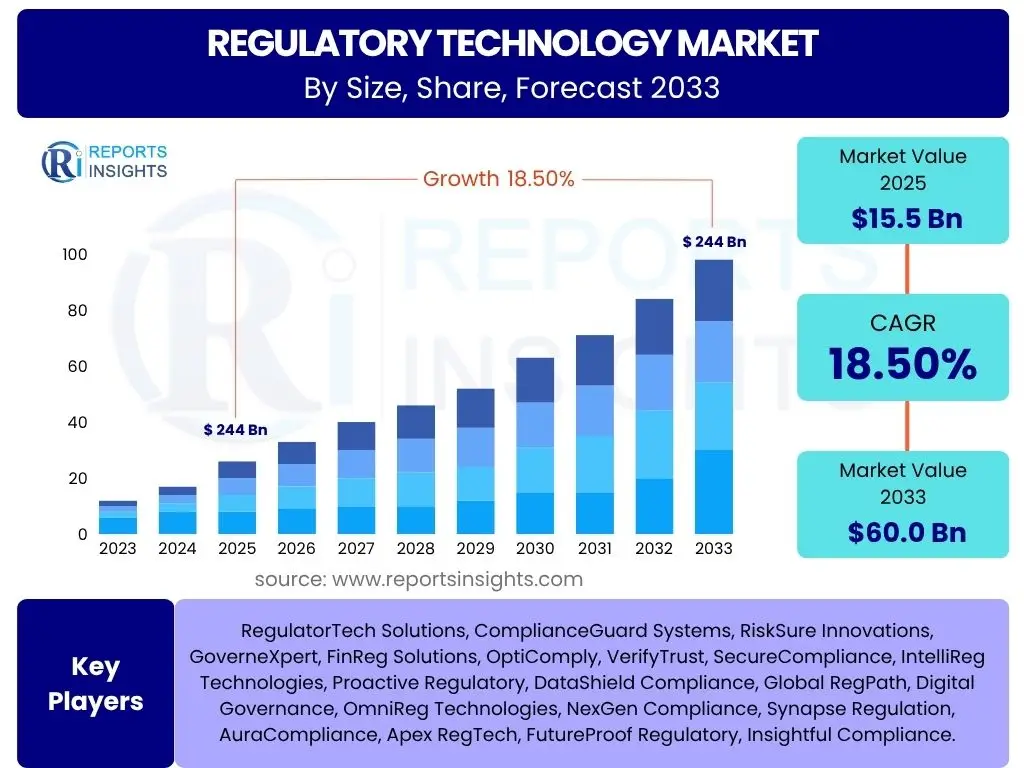

According to Reports Insights Consulting Pvt Ltd, The Regulatory Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033. The market is estimated at USD 15.5 billion in 2025 and is projected to reach USD 60.0 billion by the end of the forecast period in 2033. This significant expansion is driven by the escalating complexity of global regulations across various industries and the increasing digital transformation initiatives undertaken by enterprises worldwide.

The robust growth trajectory reflects the critical need for automated and efficient solutions to manage compliance, mitigate risks, and ensure adherence to ever-evolving regulatory frameworks. As businesses grapple with stringent reporting requirements, data privacy mandates, and anti-money laundering regulations, the adoption of advanced RegTech solutions becomes imperative. This growth is further propelled by the desire to reduce operational costs associated with manual compliance processes and to enhance decision-making through real-time data analytics.

Key Regulatory Technology Market Trends & Insights

Users frequently inquire about the dominant forces shaping the Regulatory Technology landscape. Analysis reveals a strong focus on how digital transformation, increasing data volumes, and evolving regulatory pressures are compelling organizations to adopt sophisticated RegTech solutions. The prevailing trends indicate a shift towards proactive compliance management, leveraging advanced technologies to predict and prevent regulatory breaches rather than merely reacting to them. Furthermore, there is a clear demand for integrated platforms that offer holistic views of compliance and risk, moving away from siloed legacy systems.

A significant insight is the growing emphasis on data-driven regulatory intelligence. Organizations are seeking solutions that can not only automate routine compliance tasks but also provide actionable insights from vast datasets to identify potential compliance gaps and emerging risks. This reflects a strategic pivot from mere compliance to a more robust, risk-informed regulatory posture. Additionally, the drive for greater operational efficiency and cost reduction continues to be a primary motivator for RegTech adoption, reinforcing the trend towards automation and streamlined workflows across diverse industries.

- Hyper-personalization of compliance solutions driven by specific industry needs.

- Increased demand for real-time compliance monitoring and reporting.

- Expansion of RegTech into non-financial sectors such as healthcare and energy.

- Emphasis on holistic and integrated risk and compliance management platforms.

- Growing adoption of cloud-based RegTech solutions for scalability and accessibility.

- Focus on AI-powered predictive analytics for proactive regulatory intelligence.

- The rise of ‘compliance-as-a-service’ models.

AI Impact Analysis on Regulatory Technology

User queries regarding AI's influence on Regulatory Technology frequently center on its potential to revolutionize compliance processes, its perceived benefits in efficiency and accuracy, and inherent concerns about data ethics and bias. There is a strong expectation that AI will automate routine tasks, enhance analytical capabilities for risk assessment, and enable more predictive compliance. Users are keen to understand how AI can move RegTech beyond reactive compliance to a proactive, forward-looking discipline.

The summarized insights indicate that AI is viewed as a transformative force, enabling sophisticated pattern recognition, anomaly detection, and natural language processing to interpret complex regulatory texts. While the promise of increased efficiency, reduced human error, and the ability to manage massive data volumes is widely acknowledged, there is also a discernible thread of concern regarding the explainability of AI models (XAI), potential algorithmic bias, and the imperative for robust data governance to ensure ethical deployment. Overall, the sentiment is overwhelmingly positive about AI's potential, provided these critical challenges are adequately addressed.

- Enhanced automation of routine compliance tasks, reducing manual effort and errors.

- Advanced data analysis and pattern recognition for fraud detection and risk assessment.

- Predictive compliance modeling, anticipating future regulatory changes and potential breaches.

- Natural Language Processing (NLP) for rapid interpretation and application of complex regulations.

- Improved anomaly detection in financial transactions and behavioral patterns for AML/CTF.

- Creation of intelligent compliance chatbots and virtual assistants for query resolution.

- Challenges related to data privacy, algorithmic bias, and the need for explainable AI in regulatory decisions.

Key Takeaways Regulatory Technology Market Size & Forecast

Common user questions regarding key takeaways from the Regulatory Technology market size and forecast consistently point to an interest in understanding the core growth drivers, the longevity of the market expansion, and the primary benefits for adopting organizations. The insights reveal that the market is poised for sustained, significant growth, primarily fueled by the accelerating pace of regulatory changes, the increasing complexity of global compliance frameworks, and the widespread digital transformation efforts across industries aiming for greater efficiency and reduced operational costs.

A crucial takeaway is the strategic imperative for businesses to invest in RegTech not just for compliance, but as a competitive advantage. The market forecast underscores that proactive risk management and efficient regulatory adherence are becoming non-negotiable for maintaining reputation and avoiding substantial penalties. Furthermore, the convergence of advanced technologies like AI and blockchain within RegTech solutions suggests a future where compliance is seamlessly integrated into business operations, moving from a burden to a strategic enabler of business agility and resilience.

- The Regulatory Technology market is experiencing substantial growth, driven by escalating regulatory complexity.

- Digital transformation initiatives are a primary catalyst for increased RegTech adoption.

- Proactive compliance and risk management are becoming strategic business imperatives.

- Cost reduction and operational efficiency are key benefits motivating RegTech investments.

- The market is shifting towards integrated, data-driven, and AI-powered solutions.

- Significant opportunities exist for providers offering flexible, scalable, and adaptable RegTech platforms.

- Investments in RegTech are critical for maintaining reputational integrity and avoiding penalties.

Regulatory Technology Market Drivers Analysis

The Regulatory Technology market is significantly propelled by a confluence of factors, primarily centered around the global intensification of regulatory scrutiny and the escalating costs associated with traditional compliance methods. As governmental bodies and financial authorities worldwide introduce stricter mandates concerning data privacy, anti-money laundering (AML), counter-terrorism financing (CTF), and financial reporting, organizations are compelled to seek advanced technological solutions. This regulatory deluge creates an environment where manual compliance is not only inefficient but also increasingly prone to human error, leading to substantial fines and reputational damage.

Furthermore, the rapid pace of digital transformation across industries acts as a powerful catalyst. Businesses are generating vast amounts of data, necessitating automated and intelligent tools to monitor, analyze, and report on compliance-related activities in real-time. The inherent desire for operational efficiency and cost reduction also drives adoption, as RegTech solutions promise to streamline complex processes, reduce the reliance on extensive human resources for compliance tasks, and free up capital that can be reinvested into core business activities. This dual pressure of regulatory burden and operational optimization forms the bedrock of market expansion.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Regulatory Complexity & Volume | +5.0% | Global, particularly EU (GDPR, MiFID II), US (Dodd-Frank), APAC (regional data laws) | Long-term (2025-2033) |

| Rising Costs of Non-Compliance & Penalties | +4.5% | Global, impacting BFSI, Healthcare, Tech | Long-term (2025-2033) |

| Digital Transformation & Data Proliferation | +4.0% | North America, Europe, Asia Pacific | Mid-term (2025-2029) |

| Need for Operational Efficiency & Cost Reduction | +3.5% | Global, across all industries | Short-to-Mid term (2025-2028) |

| Enhanced Risk Management & Fraud Detection | +3.0% | Global, especially BFSI | Long-term (2025-2033) |

| Growing Demand for Real-time Monitoring | +2.5% | Highly developed financial markets | Mid-term (2025-2030) |

Regulatory Technology Market Restraints Analysis

Despite the strong growth prospects, the Regulatory Technology market faces several significant restraints that could temper its expansion. One of the primary impediments is the high initial implementation cost associated with deploying sophisticated RegTech solutions. Many organizations, particularly small and medium-sized enterprises (SMEs), find the upfront investment in technology, infrastructure, and skilled personnel prohibitive, despite the long-term benefits of efficiency and penalty avoidance. This cost factor can lead to delayed adoption or a preference for traditional, albeit less efficient, manual processes.

Another crucial restraint pertains to data privacy and security concerns. RegTech solutions often require access to sensitive corporate and customer data to perform effective compliance monitoring and risk analysis. Organizations are hesitant to transfer such critical information to third-party cloud-based solutions due to fears of data breaches, non-compliance with data localization laws, or potential misuse. Furthermore, the fragmented and constantly evolving nature of global regulations presents a challenge, as RegTech providers must continuously update their solutions to remain compliant, which can be resource-intensive and create complexities for international operations.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Implementation and Maintenance Costs | -2.8% | Global, particularly impacting SMEs | Short-to-Mid term (2025-2028) |

| Data Privacy and Security Concerns | -2.5% | Global, prominent in Europe (GDPR), APAC (local data laws) | Long-term (2025-2033) |

| Lack of Skilled Personnel & Expertise | -2.0% | Global, especially emerging markets | Mid-term (2025-2030) |

| Regulatory Fragmentation & Interoperability Issues | -1.8% | Global, impacting multi-national firms | Long-term (2025-2033) |

| Resistance to Change & Legacy Systems | -1.5% | Established enterprises in developed economies | Mid-term (2025-2029) |

Regulatory Technology Market Opportunities Analysis

The Regulatory Technology market is ripe with opportunities, particularly stemming from the accelerating adoption of emerging technologies and the expansion into previously underserved sectors. The increasing sophistication of Artificial Intelligence (AI), Machine Learning (ML), Blockchain, and Big Data analytics offers immense potential for RegTech solutions to become more predictive, efficient, and secure. These technologies can enable real-time risk assessment, automated compliance checks, and immutable audit trails, moving beyond simple data aggregation to truly intelligent regulatory oversight. Companies that can effectively integrate these cutting-edge technologies into user-friendly and scalable platforms will gain a significant competitive advantage.

Furthermore, significant growth opportunities lie in the diversification of RegTech adoption beyond the traditional financial services sector. Industries such as healthcare, energy, telecommunications, and retail are facing their own unique and evolving regulatory pressures, creating a fertile ground for tailored RegTech solutions. The increasing global focus on environmental, social, and governance (ESG) compliance also presents a substantial new frontier for RegTech, requiring robust frameworks for data collection, reporting, and assurance. Moreover, the demand for cloud-based and Software-as-a-Service (SaaS) RegTech models continues to grow, offering scalable and accessible solutions that lower entry barriers for a wider range of organizations.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration of AI, ML, & Blockchain | +3.5% | Global, especially tech-forward regions | Long-term (2025-2033) |

| Expansion into Non-Financial Sectors (Healthcare, Energy, Retail) | +3.0% | North America, Europe, Asia Pacific | Mid-to-Long term (2026-2033) |

| Growing Demand for ESG Compliance Solutions | +2.8% | Global, particularly Europe and North America | Long-term (2027-2033) |

| Development of Niche & Specialized RegTech Solutions | +2.5% | Regional specific, highly regulated industries | Mid-term (2025-2030) |

| Increased Adoption of Cloud-based & SaaS Models | +2.0% | Global, appealing to SMEs and large enterprises | Short-to-Mid term (2025-2028) |

| Partnerships & Collaborations within the Ecosystem | +1.5% | Global | Mid-term (2025-2029) |

Regulatory Technology Market Challenges Impact Analysis

The Regulatory Technology market, while promising, is not without its significant challenges, which can impede full-scale adoption and effective implementation. One of the primary hurdles is the dynamic and ever-changing nature of regulatory frameworks across different jurisdictions. Regulations are frequently updated, amended, or entirely new ones are introduced, demanding continuous adaptation and updates from RegTech solution providers. This constant flux requires substantial research and development investment to ensure solutions remain compliant and effective, posing a significant operational burden for vendors and a complexity for users operating across multiple regions.

Another critical challenge lies in the interoperability of new RegTech solutions with legacy IT systems prevalent in many established organizations. Integrating modern, cloud-native RegTech platforms with outdated on-premises infrastructure can be complex, costly, and time-consuming, often requiring extensive customization or complete system overhauls. This integration complexity can lead to vendor lock-in, data silos, and hinder the seamless flow of information necessary for comprehensive compliance. Furthermore, the global shortage of skilled professionals with expertise in both regulatory compliance and advanced technology poses a significant barrier to effective RegTech implementation and management within organizations, impacting the ability to fully leverage the capabilities of these sophisticated tools.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Dynamic & Evolving Regulatory Landscape | -2.0% | Global, multi-jurisdictional firms | Long-term (2025-2033) |

| Integration with Legacy Systems & Interoperability | -1.8% | Established enterprises in developed markets | Mid-term (2025-2030) |

| Shortage of Skilled Talent (Compliance + Tech) | -1.5% | Global | Long-term (2025-2033) |

| Vendor Lock-in & Customization Limitations | -1.2% | Global, larger enterprises | Mid-term (2025-2029) |

| Ensuring Data Quality & Integrity | -1.0% | Global, all industries | Long-term (2025-2033) |

Regulatory Technology Market - Updated Report Scope

This report offers an in-depth analysis of the global Regulatory Technology market, providing comprehensive insights into its current size, historical trends, and future growth projections. It meticulously examines the key drivers, restraints, opportunities, and challenges shaping the market landscape, offering strategic perspectives for stakeholders. The scope includes a detailed segmentation analysis across various solution types, deployment modes, organization sizes, end-use industries, and underlying technologies, alongside a thorough regional and country-level assessment. The report also highlights the competitive landscape, profiling key market players and their strategic initiatives, to provide a holistic understanding of market dynamics from 2019 to 2033.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 60.0 Billion |

| Growth Rate | 18.5% CAGR |

| Number of Pages | 267 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | RegulatorTech Solutions, ComplianceGuard Systems, RiskSure Innovations, GoverneXpert, FinReg Solutions, OptiComply, VerifyTrust, SecureCompliance, IntelliReg Technologies, Proactive Regulatory, DataShield Compliance, Global RegPath, Digital Governance, OmniReg Technologies, NexGen Compliance, Synapse Regulation, AuraCompliance, Apex RegTech, FutureProof Regulatory, Insightful Compliance. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Regulatory Technology market is comprehensively segmented to provide a granular understanding of its diverse landscape and growth dynamics across various dimensions. This segmentation allows for precise analysis of market trends, identifying high-growth areas and informing strategic decisions for market participants. The market is primarily broken down by the type of solution offered, the method of deployment, the scale of organizations utilizing these solutions, the specific industries they serve, and the underlying technological innovations that power them. Each segment reflects unique demands and adoption patterns, contributing to the overall market trajectory.

Further analysis within these segments highlights the dominance of risk management and compliance management solutions, reflecting the core needs of regulated entities. The increasing preference for cloud-based deployment across all organization sizes underscores the shift towards scalable and accessible RegTech platforms. The BFSI sector remains the largest end-use industry, given its stringent regulatory environment, but significant expansion is noted in emerging sectors like healthcare and government. Technological advancements, particularly in AI and Machine Learning, are pivotal across all segments, driving the intelligence and efficiency of modern RegTech tools.

- By Solution:

- Risk Management

- Compliance Management

- Identity Management

- Regulatory Reporting

- Transaction Monitoring

- Financial Crime Prevention

- Others (e.g., Audit Management, Trade Surveillance)

- By Deployment Mode:

- Cloud-based

- On-premises

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By End-Use Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Government

- Healthcare

- Energy and Utilities

- IT and Telecommunications

- Retail and E-commerce

- Manufacturing

- Others

- By Technology:

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain

- Big Data Analytics

- Cloud Computing

- Robotic Process Automation (RPA)

- Natural Language Processing (NLP)

Regional Highlights

The global Regulatory Technology market exhibits distinct growth patterns and maturity levels across different geographical regions, each driven by unique regulatory landscapes, technological adoption rates, and economic factors. North America, particularly the United States, represents a leading market largely due to its highly developed financial sector, stringent regulatory environment, and a strong inclination towards adopting advanced technological solutions. The presence of numerous RegTech providers and a high level of digital transformation initiatives further cement its market leadership. Companies in this region are proactively investing in RegTech to manage complex federal and state-level compliance requirements, including those related to data privacy and financial crime prevention.

Europe stands as another significant market, propelled by comprehensive regulatory frameworks such as GDPR, MiFID II, and PSD2, which necessitate robust compliance solutions. The European Union's efforts to harmonize financial regulations across member states also drive the demand for integrated RegTech platforms. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by rapid economic development, increasing foreign investments, and evolving regulatory environments in countries like China, India, Japan, and Australia. The growing awareness of financial crime, coupled with government initiatives to strengthen regulatory oversight, is accelerating RegTech adoption in this region. Latin America and the Middle East and Africa (MEA) are also experiencing nascent growth, with increasing digitalization and efforts to align with international regulatory standards creating new opportunities for market expansion, albeit at a slower pace compared to the developed economies.

- North America: Dominates the market due to a mature financial industry, complex regulatory frameworks (e.g., Dodd-Frank, CCPA), and high technological adoption rates. The U.S. and Canada are key contributors.

- Europe: A significant market driven by extensive regulatory reforms (e.g., GDPR, MiFID II, PSD2, AMLD5), leading to strong demand for compliance and risk management solutions. The UK, Germany, France, and Switzerland are prominent.

- Asia Pacific (APAC): Fastest-growing region, characterized by increasing digitalization, expanding financial sectors, and evolving regulatory landscapes in countries like China, India, Japan, and Australia. Government initiatives to curb financial crime are also major drivers.

- Latin America: Emerging market with increasing awareness of regulatory compliance and growing digitalization. Brazil and Mexico are leading the adoption, driven by regional financial regulations and efforts to combat financial crime.

- Middle East & Africa (MEA): Shows gradual adoption, spurred by efforts to diversify economies, implement modern financial regulations, and enhance compliance in key sectors like banking and energy, particularly in the GCC countries and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Regulatory Technology Market.- RegulatorTech Solutions

- ComplianceGuard Systems

- RiskSure Innovations

- GoverneXpert

- FinReg Solutions

- OptiComply

- VerifyTrust

- SecureCompliance

- IntelliReg Technologies

- Proactive Regulatory

- DataShield Compliance

- Global RegPath

- Digital Governance

- OmniReg Technologies

- NexGen Compliance

- Synapse Regulation

- AuraCompliance

- Apex RegTech

- FutureProof Regulatory

- Insightful Compliance

Frequently Asked Questions

Analyze common user questions about the Regulatory Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Regulatory Technology (RegTech)?

RegTech refers to the use of technology, often advanced tools like AI, blockchain, and big data, to help organizations manage and comply with regulatory requirements more efficiently and effectively. It streamlines compliance processes, reduces costs, and enhances risk management.

Why is RegTech becoming increasingly important?

RegTech's importance stems from the exponential growth in regulatory complexity, the rising costs of non-compliance, and the need for greater operational efficiency. It enables proactive risk identification, automates routine tasks, and provides real-time insights, essential for modern businesses.

Which industries benefit most from RegTech?

While traditionally strong in the Banking, Financial Services, and Insurance (BFSI) sector, RegTech is rapidly expanding its reach. Healthcare, energy, IT and telecommunications, and government bodies are increasingly adopting RegTech solutions to manage their specific and evolving regulatory burdens.

What are the main challenges in adopting RegTech solutions?

Key challenges include the high initial implementation costs, concerns over data privacy and security when integrating with third-party solutions, difficulties in integrating new RegTech with existing legacy IT systems, and the ongoing need to adapt to a constantly evolving global regulatory landscape.

How does AI impact the future of RegTech?

AI is set to profoundly transform RegTech by enabling predictive compliance, sophisticated anomaly detection for fraud, automated interpretation of complex regulations, and personalized risk assessments. It moves RegTech from reactive to proactive, enhancing decision-making and efficiency significantly.