Refrigerated Warehousing Market

Refrigerated Warehousing Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701303 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Refrigerated Warehousing Market Size

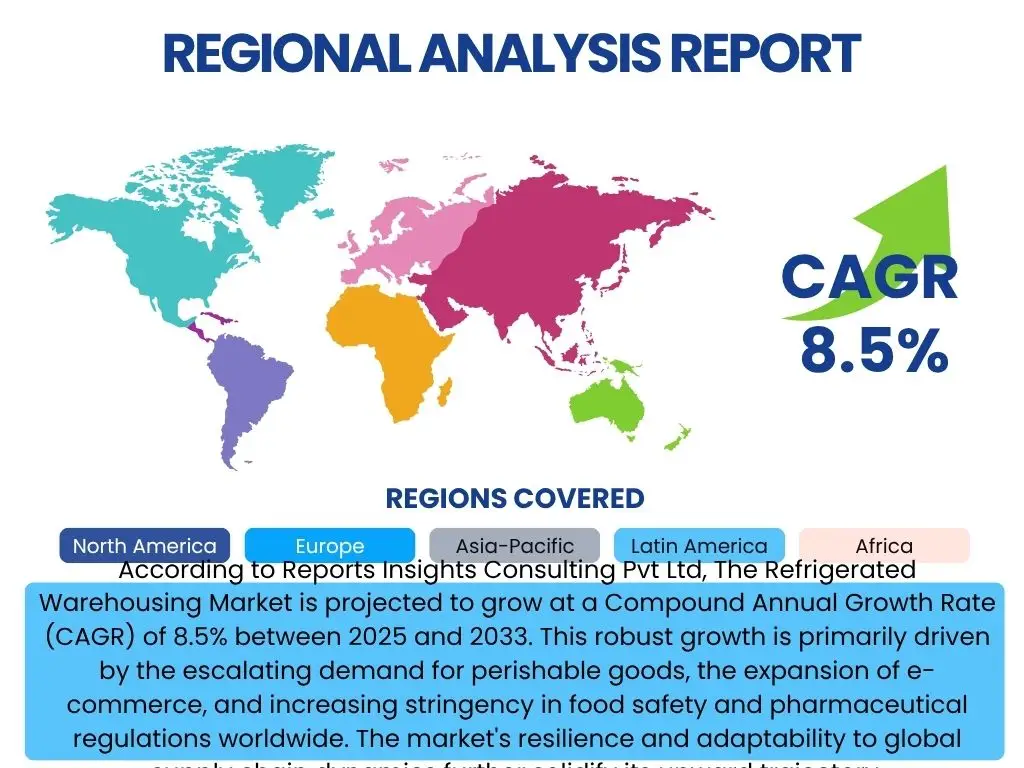

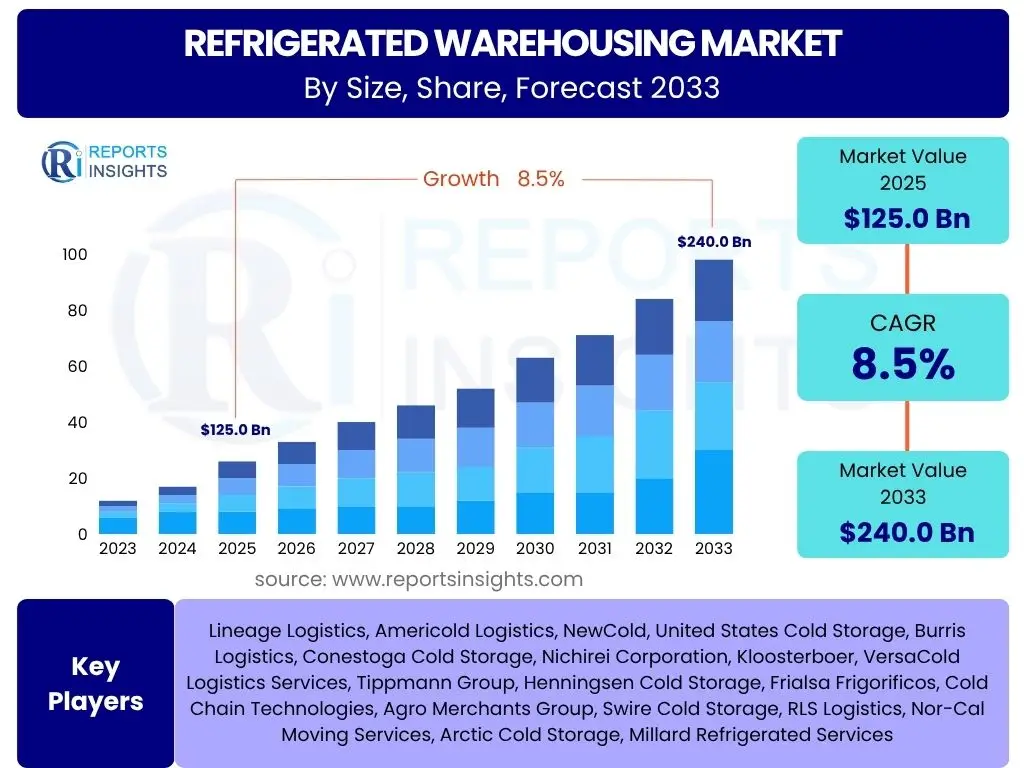

According to Reports Insights Consulting Pvt Ltd, The Refrigerated Warehousing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2033. This robust growth is primarily driven by the escalating demand for perishable goods, the expansion of e-commerce, and increasing stringency in food safety and pharmaceutical regulations worldwide. The market's resilience and adaptability to global supply chain dynamics further solidify its upward trajectory.

The market is estimated at USD 125.0 billion in 2025 and is projected to reach USD 240.0 billion by the end of the forecast period in 2033. This significant expansion reflects ongoing investments in infrastructure, technological advancements in cold chain logistics, and the continuous evolution of consumer preferences towards fresh and frozen products. The forecast underscores the critical role of refrigerated warehousing in supporting global trade and public health.

Key Refrigerated Warehousing Market Trends & Insights

The refrigerated warehousing market is currently shaped by several transformative trends driven by evolving consumer demands, technological advancements, and increasing regulatory scrutiny. Users frequently inquire about the impact of e-commerce growth, the adoption of automation, and the rising focus on sustainability within the cold chain. These themes highlight a market striving for greater efficiency, transparency, and environmental responsibility, while simultaneously adapting to rapid shifts in global consumption patterns and supply chain complexities. The convergence of these factors is leading to more sophisticated, integrated, and responsive cold storage solutions.

Another significant area of interest for users revolves around the increasing demand for specialized cold storage facilities, particularly for pharmaceuticals and advanced biotechnological products, including vaccines. This trend emphasizes the need for ultra-low temperature storage capabilities and stringent temperature control protocols, driving innovation in refrigeration technologies and monitoring systems. Furthermore, the decentralization of cold storage facilities, moving closer to urban consumption centers, is gaining traction to facilitate faster last-mile delivery and reduce transportation costs, reflecting a strategic adaptation to the demands of modern logistics.

- Exponential growth of e-commerce and online grocery, necessitating robust cold chain infrastructure.

- Increasing adoption of automation, robotics, and IoT for enhanced operational efficiency and accuracy.

- Growing emphasis on energy efficiency, renewable energy sources, and sustainable cold storage practices.

- Rising demand for pharmaceutical and biopharmaceutical products requiring ultra-low temperature storage.

- Shift towards smaller, urban-centric cold storage facilities for efficient last-mile delivery.

- Integration of advanced data analytics for predictive maintenance, inventory optimization, and demand forecasting.

- Stricter food safety regulations and quality control standards driving compliance investments.

AI Impact Analysis on Refrigerated Warehousing

Users frequently express interest in how artificial intelligence (AI) is transforming refrigerated warehousing, with common questions centering on operational efficiency, cost reduction, and predictive capabilities. There is a strong expectation that AI will streamline complex cold chain processes, from inventory management to energy consumption. Concerns often arise regarding data privacy, system integration challenges, and the potential impact on labor, yet the overarching sentiment is one of optimism regarding AI's ability to create more intelligent, adaptive, and resilient cold storage environments.

The practical application of AI in refrigerated warehousing extends to optimizing diverse facets of facility operation. AI-powered systems can analyze vast datasets from sensors and historical performance to predict equipment failures, thus enabling proactive maintenance and minimizing costly downtime. They are also instrumental in precise demand forecasting, reducing food waste, and ensuring optimal stock levels. This shift towards data-driven decision-making represents a fundamental change in how cold storage facilities are managed and operated.

Furthermore, AI is pivotal in enhancing energy management by dynamically adjusting refrigeration cycles based on external temperatures, occupancy, and product load, significantly lowering operational costs and environmental footprint. The integration of AI with robotics facilitates highly efficient automated storage and retrieval systems (AS/RS), accelerating throughput and reducing human error. Users anticipate AI will not only boost productivity but also elevate safety and compliance standards across the cold chain.

- Enhanced predictive maintenance for refrigeration equipment, minimizing downtime and repair costs.

- Optimized inventory management through AI-driven demand forecasting and dynamic slotting.

- Automated temperature and humidity control, ensuring precise environmental conditions for various perishables.

- Improved energy efficiency by AI algorithms adjusting cooling based on real-time data and external factors.

- Robotics and automation integration for efficient material handling and order fulfillment within cold environments.

- Advanced analytics for supply chain visibility, risk assessment, and route optimization.

- AI-powered quality control systems to detect spoilage or temperature deviations proactively.

Key Takeaways Refrigerated Warehousing Market Size & Forecast

Users frequently seek concise summaries of the refrigerated warehousing market's growth trajectory and its underlying drivers. The key takeaway emphasizes a market poised for substantial expansion, primarily fueled by the burgeoning e-commerce sector, increasing global demand for perishable goods, and stringent regulatory requirements for cold chain integrity. The market's resilience and strategic importance within the global supply chain underscore its long-term growth potential, making it a critical area for investment and technological innovation.

Another significant insight derived from market forecasts is the increasing prominence of technological adoption as a competitive differentiator. Facilities leveraging automation, IoT, and AI are better positioned to meet the evolving demands for speed, precision, and sustainability. This technological pivot is not merely about efficiency but also about ensuring product quality and safety, which are paramount concerns for both consumers and regulators. The market is thus not just growing in size but also in sophistication.

- The refrigerated warehousing market exhibits robust growth, driven by fundamental shifts in global consumption and supply chain dynamics.

- Technological advancements, including automation and AI, are pivotal in shaping operational efficiency and market competitiveness.

- Rising demand for temperature-sensitive products, particularly pharmaceuticals and fresh food, is a primary growth engine.

- Sustainability initiatives and energy efficiency improvements are becoming core strategic imperatives for market players.

- Emerging economies present significant opportunities for infrastructure development and market expansion in cold storage.

Refrigerated Warehousing Market Drivers Analysis

The refrigerated warehousing market's expansion is fundamentally propelled by several interconnected factors that reflect global consumer trends and regulatory frameworks. The escalating demand for processed and perishable food products, driven by urbanization and changing dietary habits, necessitates sophisticated cold storage solutions. Concurrently, the burgeoning pharmaceutical and biopharmaceutical industries, with their stringent temperature control requirements, are significantly contributing to market growth by demanding specialized cold chain logistics.

Furthermore, the rapid proliferation of e-commerce and online grocery delivery services has created an unprecedented need for extensive, often decentralized, cold storage networks capable of supporting efficient last-mile delivery. Alongside these consumer-driven forces, increasingly stringent food safety regulations and quality control standards imposed by governments worldwide are compelling businesses to invest in compliant and reliable refrigerated warehousing infrastructure, ensuring product integrity from farm to fork.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing demand for perishable food products | +2.1% | Global, particularly APAC and North America | 2025-2033 |

| Expansion of pharmaceutical and biotechnology industries | +1.8% | North America, Europe, parts of APAC (India, China) | 2025-2033 |

| Proliferation of e-commerce and online grocery delivery | +1.5% | Global, especially urban centers | 2025-2030 |

| Increasingly stringent food safety regulations | +1.2% | Europe, North America, developing economies | 2025-2033 |

| Globalization of the food supply chain | +0.9% | Global Intercontinental Trade Routes | 2025-2033 |

Refrigerated Warehousing Market Restraints Analysis

Despite robust growth prospects, the refrigerated warehousing market faces notable restraints that can impede its expansion. A primary challenge is the substantial initial capital investment required for building and equipping cold storage facilities, coupled with high operational costs primarily due to significant energy consumption. This high cost barrier can deter new entrants and limit expansion for smaller players, especially in regions with fluctuating energy prices.

Furthermore, the inherent complexity of managing diverse temperature zones within a single facility and ensuring seamless temperature integrity across the entire cold chain poses significant operational hurdles. This complexity often necessitates advanced monitoring systems and specialized expertise, adding to the operational burden. Additionally, the industry is susceptible to skilled labor shortages, particularly for technicians capable of maintaining complex refrigeration systems and operating sophisticated automation technologies, which can impact efficiency and scalability.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High initial investment and operational costs | -1.5% | Global, developing regions more affected | 2025-2033 |

| Significant energy consumption and related costs | -1.2% | Global, especially regions with high energy prices | 2025-2033 |

| Complexity of managing diverse temperature zones | -0.8% | Global, particularly multi-product facilities | 2025-2033 |

| Shortage of skilled labor and technical expertise | -0.7% | North America, Europe, rapidly industrializing APAC | 2025-2033 |

| Disruptions in global supply chains (e.g., pandemics, geopolitical events) | -0.5% | Global | Short to Medium Term |

Refrigerated Warehousing Market Opportunities Analysis

The refrigerated warehousing market presents numerous opportunities for growth and innovation, driven by technological advancements and unmet market demands. A significant opportunity lies in the widespread adoption of automation, IoT, and artificial intelligence, which can revolutionize operational efficiency, reduce labor costs, and enhance the accuracy of temperature control and inventory management. These technologies enable a more intelligent and responsive cold chain.

Furthermore, emerging economies, particularly in Asia Pacific, Latin America, and the Middle East & Africa, offer vast untapped potential. These regions are experiencing rapid urbanization, rising disposable incomes, and expanding cold chain infrastructure, creating fertile ground for new refrigerated warehousing investments. The increasing consumer demand for fresh and frozen products in these regions, coupled with improving logistics networks, opens doors for significant market penetration.

Another area of opportunity is the development of sustainable and eco-friendly cold storage solutions. With growing environmental consciousness and stricter regulations, facilities adopting green building practices, energy-efficient refrigeration systems, and renewable energy sources can gain a competitive edge. Moreover, the expansion of specialized cold chain services for pharmaceuticals, particularly biologics and vaccines, presents a high-value segment demanding advanced capabilities and compliance expertise.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increased adoption of automation, IoT, and AI technologies | +1.8% | Global, mature markets leading adoption | 2025-2033 |

| Growth in emerging markets and developing regions | +1.5% | Asia Pacific, Latin America, MEA | 2025-2033 |

| Expansion of specialized cold chain for pharmaceuticals and biologics | +1.3% | Global, particularly North America, Europe | 2025-2033 |

| Development of sustainable and energy-efficient solutions | +1.0% | Global, driven by regulatory and consumer pressure | 2025-2033 |

| Rise of cold storage-as-a-service (CSaaS) models | +0.8% | North America, Europe, expanding to APAC | 2027-2033 |

Refrigerated Warehousing Market Challenges Impact Analysis

The refrigerated warehousing market, while growing, is not without its significant challenges that demand innovative solutions and strategic foresight. A persistent challenge is maintaining precise and consistent temperature integrity across various product types, which often require different temperature zones within the same facility. This complexity is compounded by the need to prevent cross-contamination and ensure product safety, especially for sensitive goods like pharmaceuticals and fresh produce.

Another critical concern is cybersecurity risks associated with the increasing digitalization and automation of cold storage operations. As facilities adopt IoT devices, AI systems, and networked controls, they become more vulnerable to cyberattacks that could disrupt operations, compromise sensitive data, or even tamper with temperature settings, leading to significant financial losses and reputational damage. Furthermore, the development of adequate cold chain infrastructure in remote or underdeveloped regions remains a substantial logistical and financial hurdle, limiting market reach and efficiency in certain areas.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Maintaining consistent temperature integrity across diverse products | -1.0% | Global, particularly for multi-client facilities | 2025-2033 |

| Cybersecurity threats to integrated cold chain systems | -0.9% | Global, especially tech-advanced markets | 2025-2033 |

| Infrastructure development and last-mile connectivity in emerging markets | -0.8% | APAC, Latin America, MEA | 2025-2033 |

| Compliance with evolving and diverse global regulatory standards | -0.7% | Global, particularly international trade | 2025-2033 |

| Fluctuating energy prices and sustainability pressures | -0.6% | Global, regions with volatile energy markets | 2025-2033 |

Refrigerated Warehousing Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Refrigerated Warehousing Market, detailing its historical performance, current dynamics, and future growth projections. It offers strategic insights into market size, key trends, drivers, restraints, opportunities, and challenges influencing the industry landscape. The report also includes a detailed segmentation analysis by type, application, temperature, and technology, along with a thorough regional breakdown to provide a holistic view of market performance across different geographies. Additionally, it profiles leading market players, offering valuable competitive intelligence to stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 125.0 billion |

| Market Forecast in 2033 | USD 240.0 billion |

| Growth Rate | 8.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Lineage Logistics, Americold Logistics, NewCold, United States Cold Storage, Burris Logistics, Conestoga Cold Storage, Nichirei Corporation, Kloosterboer, VersaCold Logistics Services, Tippmann Group, Henningsen Cold Storage, Frialsa Frigorificos, Cold Chain Technologies, Agro Merchants Group, Swire Cold Storage, RLS Logistics, Nor-Cal Moving Services, Arctic Cold Storage, Millard Refrigerated Services |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The refrigerated warehousing market is extensively segmented to provide granular insights into its diverse components and their respective growth dynamics. These segmentations allow for a comprehensive understanding of how different types of facilities, specific applications, varying temperature requirements, and emerging technologies contribute to the overall market landscape. Analyzing these segments helps stakeholders identify niche opportunities, tailor their strategies, and allocate resources effectively to capitalize on specific market demands.

Segmentation by type differentiates between public, private, and semi-private warehouses, each serving distinct operational models and client needs. Application-based segmentation highlights the primary end-user industries, with food & beverages (further broken down into various categories like meat, dairy, and processed foods) and pharmaceuticals being the dominant sectors. Temperature segmentation addresses the critical distinctions between chilled, frozen, and deep-frozen storage, reflecting the precise environmental controls required for different perishable goods. Finally, technology segmentation examines the adoption of various refrigeration systems, showcasing the ongoing innovation in this vital infrastructure.

- By Type:

- Public Refrigerated Warehouses: Facilities offering cold storage services to multiple clients on a pay-per-use basis, providing flexibility and economies of scale.

- Private Refrigerated Warehouses: Owned and operated by a single company for its exclusive use, ensuring direct control over operations and specific product requirements.

- Semi-private Refrigerated Warehouses: A hybrid model, often involving long-term contracts or dedicated spaces within a public facility, balancing control and cost efficiency.

- By Application:

- Food & Beverages:

- Fruits & Vegetables

- Meat & Seafood

- Dairy & Frozen Desserts

- Processed Food

- Other Food & Beverages

- Pharmaceuticals: Cold storage for medicines, vaccines, and biological products requiring strict temperature controls.

- Chemicals: Storage for temperature-sensitive chemicals and industrial products.

- Others: Includes floriculture, cosmetics, and other industries requiring controlled temperature environments.

- Food & Beverages:

- By Temperature:

- Chilled: Typically 0°C to 15°C, suitable for fresh produce, dairy, and some processed foods.

- Frozen: Ranging from -18°C to -25°C, ideal for frozen foods, ice cream, and certain pharmaceutical products.

- Deep-frozen: Below -25°C, including ultra-low temperatures (e.g., -80°C), critical for vaccines, biologics, and specialized research materials.

- By Technology:

- Vapor Compression Systems: The most common and energy-efficient refrigeration technology for large-scale cold storage.

- Absorption Systems: Utilizes heat to drive the refrigeration process, often for specific industrial applications or waste heat recovery.

- Evaporative Cooling Systems: Uses water evaporation to lower air temperature, typically in dry climates or as a pre-cooling method.

- Cryogenic Systems: Employs cryogenic liquids like liquid nitrogen for extremely low temperatures, often for specialized or emergency storage.

Regional Highlights

Regional dynamics play a crucial role in shaping the refrigerated warehousing market, reflecting variations in economic development, consumer habits, regulatory environments, and logistical infrastructure. North America stands as a mature market, characterized by significant adoption of automation and advanced cold chain technologies, driven by a robust e-commerce sector and increasing pharmaceutical demand. The region continues to invest heavily in modernizing its cold storage facilities to enhance efficiency and capacity.

Europe demonstrates a strong focus on stringent food safety regulations and sustainability, leading to investments in energy-efficient and environmentally friendly cold storage solutions. The market here is also undergoing consolidation, with larger players acquiring smaller ones to expand their network and service offerings across diverse European countries. Compliance with diverse national and EU-wide standards remains a key driver for technological upgrades and operational excellence.

Asia Pacific (APAC) represents the fastest-growing region, propelled by rapid urbanization, rising disposable incomes, and the expansion of organized retail and e-commerce. Countries like China and India are witnessing massive investments in cold chain infrastructure to meet the escalating demand for fresh food, processed goods, and pharmaceuticals. The region's vast population and evolving consumption patterns make it a highly attractive market for new cold storage developments.

Latin America and the Middle East & Africa (MEA) are emerging markets for refrigerated warehousing, driven by improving economic conditions, increasing global trade, and growing awareness of food safety. While infrastructure development is still in nascent stages in many parts of these regions, there is significant potential for growth as governments and private entities invest in developing robust cold chain logistics to support agricultural exports and meet domestic consumer demand for high-quality perishable goods.

- North America: Leads in market size and technological adoption, driven by e-commerce, pharmaceutical growth, and significant automation investments.

- Europe: Characterized by strict regulatory compliance, strong emphasis on sustainability, and a trend towards market consolidation for operational efficiency.

- Asia Pacific (APAC): The fastest-growing region, fueled by urbanization, rising disposable incomes, expanding food processing industries, and substantial cold chain infrastructure development, especially in China and India.

- Latin America: Exhibits strong growth potential due to increasing demand for fresh and frozen foods, and improving trade relations, though infrastructure remains a developing aspect.

- Middle East and Africa (MEA): Emerging market with significant investment opportunities in cold chain logistics driven by food security initiatives and growing populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refrigerated Warehousing Market.- Lineage Logistics

- Americold Logistics

- NewCold

- United States Cold Storage

- Burris Logistics

- Conestoga Cold Storage

- Nichirei Corporation

- Kloosterboer

- VersaCold Logistics Services

- Tippmann Group

- Henningsen Cold Storage

- Frialsa Frigorificos

- Cold Chain Technologies, Inc.

- Agro Merchants Group

- Swire Cold Storage

- RLS Logistics

- Nor-Cal Moving Services

- Arctic Cold Storage

- Millard Refrigerated Services

- Weller Logistics

Frequently Asked Questions

What is refrigerated warehousing?

Refrigerated warehousing, also known as cold storage, involves storing perishable goods, such as food, pharmaceuticals, and chemicals, in temperature-controlled environments to maintain their quality, extend shelf life, and prevent spoilage or degradation. These facilities utilize specialized refrigeration systems to maintain precise temperature and humidity levels.

What are the primary drivers of the refrigerated warehousing market?

The primary drivers include the surging global demand for perishable food products, the rapid expansion of e-commerce and online grocery services, the growth of the pharmaceutical and biotechnology industries requiring stringent cold chain logistics, and increasingly strict food safety regulations worldwide.

How is AI impacting the refrigerated warehousing industry?

AI is transforming the industry by enabling predictive maintenance for equipment, optimizing inventory management through demand forecasting, enhancing energy efficiency, improving automated material handling with robotics, and providing advanced analytics for better supply chain visibility and risk management.

What are the key challenges faced by the refrigerated warehousing market?

Key challenges include high initial investment and operational costs, significant energy consumption, the complexity of maintaining precise multi-temperature zones, skilled labor shortages, cybersecurity threats to integrated systems, and the need for robust infrastructure development in emerging regions.

Which regions are leading the growth in the refrigerated warehousing market?

North America is a mature market leader with high technological adoption. Asia Pacific, particularly countries like China and India, is the fastest-growing region due to rapid urbanization and increasing consumer demand. Europe also shows strong growth driven by regulatory compliance and sustainability initiatives.