Refractory Market

Refractory Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702641 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Refractory Market Size

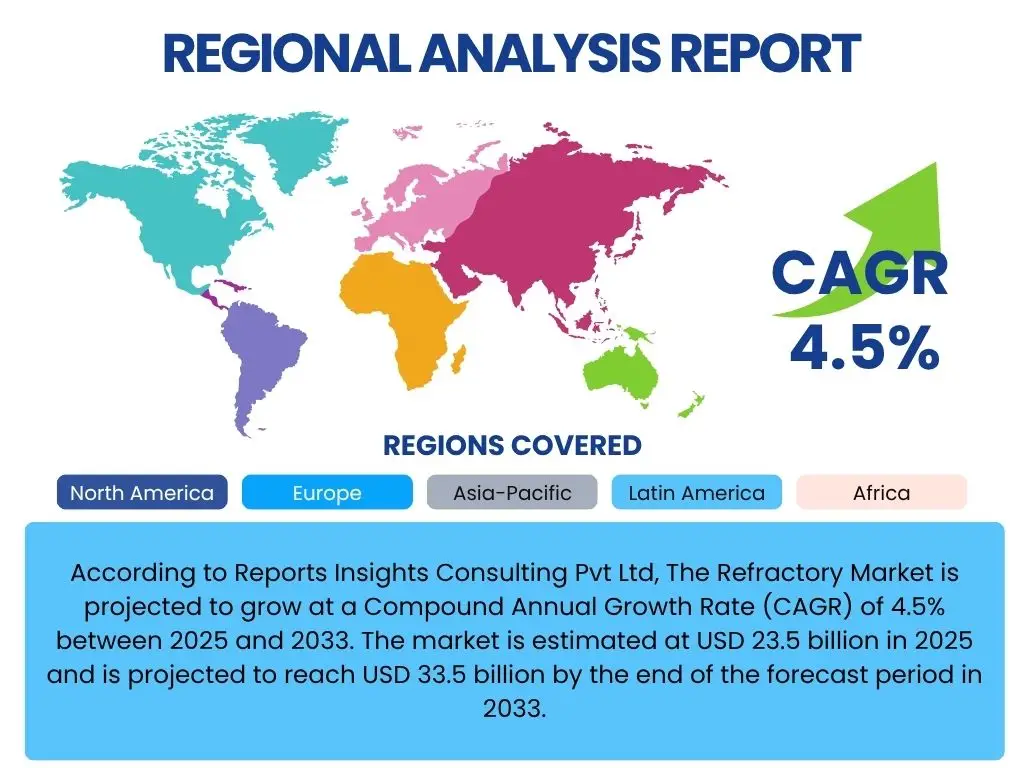

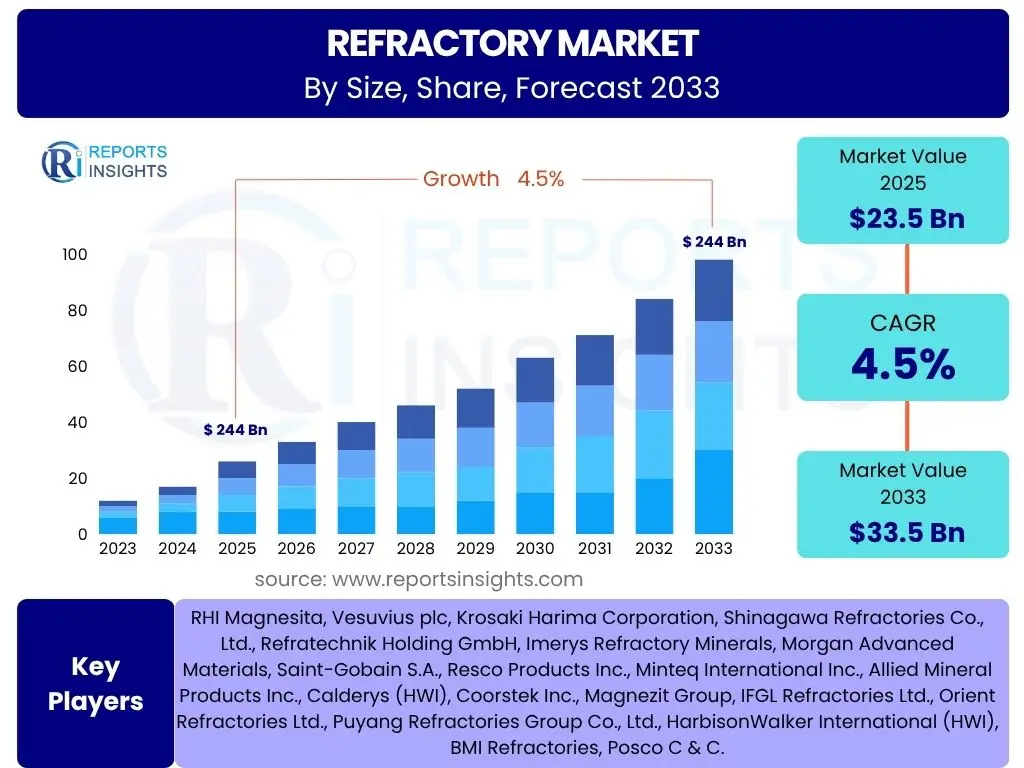

According to Reports Insights Consulting Pvt Ltd, The Refractory Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2025 and 2033. The market is estimated at USD 23.5 billion in 2025 and is projected to reach USD 33.5 billion by the end of the forecast period in 2033.

The refractory market exhibits robust growth driven by the continuous expansion of core industrial sectors globally. These include critical industries such as iron and steel, cement, glass, non-ferrous metals, and petrochemicals, all of which heavily rely on high-performance refractory materials for their high-temperature processes. The foundational role of refractories in maintaining operational efficiency and safety within these industries ensures sustained demand. Additionally, ongoing global infrastructure development and urbanization initiatives contribute significantly to the consumption of materials produced using refractory-intensive processes, thereby bolstering market expansion.

Geographic shifts in manufacturing capabilities, particularly towards emerging economies, are further propelling the market forward. These regions are experiencing rapid industrialization and increased investment in manufacturing facilities, creating new avenues for refractory sales and consumption. Innovations in refractory technology, focusing on enhanced durability, energy efficiency, and environmental sustainability, are also playing a pivotal role in market development, offering more advanced solutions that meet evolving industry standards and performance requirements. This blend of consistent industrial demand and technological progression underpins the positive growth outlook for the refractory market through 2033.

Key Refractory Market Trends & Insights

The refractory market is witnessing several transformative trends driven by evolving industrial demands, environmental concerns, and technological advancements. Users frequently inquire about how the industry is adapting to stringent environmental regulations, what new material compositions are emerging, and the influence of digitalization on refractory production and application. A key area of interest revolves around the push for sustainable refractories, including those with lower carbon footprints and improved recyclability, directly addressing global climate objectives. Furthermore, the integration of advanced manufacturing techniques and data analytics is being explored for optimizing refractory performance and extending product lifecycles, marking a significant shift in operational paradigms within the sector.

Another prominent trend attracting attention is the increasing demand for specialized and high-performance refractories that can withstand more extreme operating conditions in modern industrial furnaces, particularly in sectors like high-strength steel production and advanced glass manufacturing. This specialization often involves tailored solutions that offer superior thermal shock resistance, chemical stability, and wear resistance. There is also a notable trend towards consolidation and strategic partnerships among market players, aimed at leveraging economies of scale, expanding geographical reach, and combining expertise to foster innovation. These collaborations are crucial for navigating complex market dynamics and delivering comprehensive solutions to a diverse client base, reflecting a mature yet highly dynamic market landscape.

- Growing demand for eco-friendly and sustainable refractory solutions with lower carbon footprints.

- Increased adoption of advanced monolithic refractories due to ease of installation and high performance.

- Shift towards specialized and high-performance refractories for extreme industrial applications.

- Integration of digitalization and automation in refractory production and quality control.

- Emphasis on circular economy principles through refractory recycling and reuse initiatives.

- Regional shifts in manufacturing capabilities, particularly towards Asian and developing economies.

- Strategic mergers and acquisitions to enhance market share and technological capabilities.

AI Impact Analysis on Refractory

The integration of Artificial Intelligence (AI) in the refractory industry is a topic of increasing interest, with common user questions centering on its practical applications in manufacturing, quality control, and predictive maintenance. Users are keen to understand how AI can enhance operational efficiency, reduce waste, and improve product consistency in a traditionally materials-intensive sector. The analysis suggests that AI is poised to revolutionize several aspects, from optimizing raw material sourcing and blend formulations to real-time process monitoring and fault detection, leading to significant improvements in production yields and overall cost efficiency. Its capability to process vast datasets quickly offers unprecedented insights into material behavior and performance under various conditions.

Furthermore, AI is expected to play a crucial role in the development of new refractory materials through accelerated R&D processes, simulating material properties and predicting performance without extensive physical prototyping. This reduces the time and cost associated with material innovation, opening doors for the creation of more durable, energy-efficient, and sustainable refractory solutions. Predictive maintenance, powered by AI algorithms analyzing sensor data from furnaces and kilns, can anticipate refractory lining failures, enabling proactive repairs and minimizing costly downtime. This shift from reactive to predictive maintenance strategies is critical for industries relying on continuous high-temperature operations, fundamentally transforming operational resilience and extending asset lifecycles within the refractory end-use sectors.

- Enhanced Quality Control: AI algorithms analyze sensor data from production lines to detect defects and ensure consistent material quality, reducing variability.

- Predictive Maintenance: AI-powered systems monitor refractory linings in furnaces, predicting wear patterns and potential failures to enable proactive maintenance and minimize downtime.

- Process Optimization: AI optimizes mixing ratios, firing temperatures, and pressing parameters, leading to improved material properties and energy efficiency in manufacturing.

- Accelerated R&D: AI models simulate and predict the performance of new refractory compositions, significantly shortening the development cycle for advanced materials.

- Supply Chain Optimization: AI improves inventory management and logistics, ensuring timely supply of raw materials and distribution of finished products.

- Automated Inspection: Computer vision and AI enable automated inspection of refractory products for cracks, inconsistencies, and other defects, improving throughput and accuracy.

Key Takeaways Refractory Market Size & Forecast

User inquiries about the refractory market forecast frequently focus on the primary drivers of growth, the resilience of the industry to economic fluctuations, and the long-term sustainability of demand. The core insight is that the market's trajectory is intrinsically linked to global industrial output, particularly in foundational sectors like steel, cement, and glass, which are projected to experience continued expansion, especially in developing regions. Despite potential short-term volatility stemming from geopolitical events or economic slowdowns, the fundamental requirement for heat-resistant materials in high-temperature processes ensures consistent demand. The forecast indicates a steady, albeit moderate, growth rate, underscoring the mature yet essential nature of the industry.

Another crucial takeaway revolves around the increasing emphasis on technological innovation and sustainability as key differentiators and growth enablers. The market is not merely expanding in volume but also evolving in terms of material composition and performance characteristics. Future growth will be significantly influenced by advancements in eco-friendly refractories, the adoption of smart manufacturing processes, and the development of specialized products that cater to the unique and increasingly demanding requirements of modern industrial applications. Therefore, companies investing in R&D for enhanced durability, energy efficiency, and recyclability are better positioned to capture market share and sustain profitability in the coming decade, reflecting a market that values both quantity and quality in its offerings.

- Consistent growth trajectory of 4.5% CAGR, driven by industrialization and infrastructure development.

- Iron and steel, cement, and glass industries remain primary drivers of demand.

- Emerging economies, particularly in Asia Pacific, are poised for significant market expansion.

- Technological advancements in sustainable and high-performance refractories are critical for future growth.

- Focus on circular economy principles and recycling gains traction within the industry.

- Market resilience despite economic fluctuations due to the essential nature of refractory materials.

Refractory Market Drivers Analysis

The refractory market is primarily propelled by the robust expansion of key end-use industries globally. Industries such as iron and steel, cement, glass, and non-ferrous metals are foundational to global economic development and infrastructure growth, and their production processes are critically dependent on high-performance refractory materials. As these sectors continue to expand, driven by urbanization, industrialization in emerging economies, and increased demand for manufactured goods, the demand for refractories inherently rises. This direct correlation makes the health of these primary industries a significant indicator for the refractory market's trajectory, ensuring a baseline level of consistent demand.

Furthermore, technological advancements within the refractory industry itself are acting as significant drivers. Innovations leading to more durable, energy-efficient, and application-specific refractories are creating new demand and encouraging the replacement of older materials. The development of advanced materials that can withstand higher temperatures, more corrosive environments, and offer extended service life contributes to improved operational efficiency for end-users, thus stimulating investment in newer refractory technologies. Additionally, increasing environmental regulations, though sometimes perceived as restraints, also drive innovation towards cleaner production processes and more sustainable refractory products, opening new market segments for environmentally compliant solutions.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Iron & Steel Industry | +1.2% | Asia Pacific, North America, Europe | 2025-2033 |

| Expansion of Cement & Glass Sectors | +0.9% | Asia Pacific, Latin America, Middle East | 2025-2033 |

| Increasing Infrastructure Development | +0.8% | Emerging Economies, Africa | 2025-2033 |

| Technological Advancements in Materials | +0.7% | Global | 2025-2033 |

| Focus on Energy Efficiency in Industries | +0.5% | Europe, North America, Japan | 2025-2033 |

Refractory Market Restraints Analysis

Despite the positive growth outlook, the refractory market faces several significant restraints that could temper its expansion. One of the primary challenges is the volatility in raw material prices. Critical raw materials like bauxite, magnesia, chromite, and graphite are subject to price fluctuations influenced by global supply-demand dynamics, geopolitical tensions, and mining regulations. These fluctuations directly impact production costs for refractory manufacturers, potentially eroding profit margins and leading to higher end-product prices, which can deter demand from cost-sensitive industries. Managing these unpredictable input costs remains a constant hurdle for market players, requiring robust supply chain management and hedging strategies.

Another significant restraint comes from increasing environmental regulations and concerns over the carbon footprint of refractory production. The manufacturing process for refractories is energy-intensive and can involve materials that raise environmental concerns, leading to stricter emission standards and waste disposal regulations globally. Compliance with these regulations necessitates substantial investments in cleaner technologies and sustainable practices, which can increase operational expenses and manufacturing complexity. While these regulations also drive innovation towards green refractories, their immediate impact can be restrictive, particularly for smaller manufacturers lacking the capital for such transitions. Additionally, the potential for substitution by alternative materials, though currently limited, poses a long-term threat as industries explore new ways to reduce high-temperature process reliance or adopt novel, non-refractory solutions for specific applications.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatile Raw Material Prices | -0.8% | Global, particularly Asia Pacific (supply) | 2025-2033 |

| Environmental Regulations & Compliance Costs | -0.7% | Europe, North America, China | 2025-2033 |

| High Energy Consumption in Production | -0.6% | Global | 2025-2033 |

| Intense Competition & Price Pressure | -0.5% | Global | 2025-2033 |

| Emergence of Alternative Materials/Processes | -0.3% | Specific Niche Applications | 2029-2033 |

Refractory Market Opportunities Analysis

The refractory market is ripe with opportunities driven by global shifts towards sustainability and advanced industrial practices. One significant opportunity lies in the burgeoning demand for "green steel" and other low-carbon industrial production methods. As industries strive to reduce their environmental footprint, there is an increasing need for refractories that can support these greener processes, including those used in electric arc furnaces (EAFs) and hydrogen-based direct reduced iron (DRI) technologies. This pushes manufacturers to innovate in terms of material composition, energy efficiency during production, and product recyclability, thereby opening up new market segments for specialized, eco-friendly refractory solutions.

Another key opportunity stems from the development of advanced refractory materials tailored for highly specialized and demanding applications. This includes refractories designed for extreme temperatures, highly corrosive environments, or those requiring superior thermal insulation in sectors like waste-to-energy, advanced ceramics, and new energy technologies. Furthermore, the concept of a circular economy offers immense potential for refractory recycling and reuse. Developing efficient and cost-effective methods for collecting, processing, and reincorporating used refractories into new products can reduce reliance on virgin raw materials, lower waste disposal costs, and enhance the industry's sustainability credentials, appealing to environmentally conscious end-users and governments alike. The expansion into emerging markets, particularly in Southeast Asia, Africa, and Latin America, where industrialization is still in its early to mid-stages, also presents substantial growth avenues for both established and new market entrants.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Green Steel Production | +1.0% | Europe, North America, China, Japan | 2025-2033 |

| Development of Advanced & Specialty Refractories | +0.9% | Global | 2025-2033 |

| Circular Economy & Refractory Recycling | +0.7% | Europe, North America | 2027-2033 |

| Expansion in Emerging Industrial Markets | +0.6% | Southeast Asia, Africa, Latin America | 2025-2033 |

| Demand for Energy-Efficient Solutions | +0.5% | Global | 2025-2033 |

Refractory Market Challenges Impact Analysis

The refractory market, while resilient, faces several inherent challenges that demand strategic responses from industry players. Intense global competition is a significant hurdle, leading to price pressures and reduced profit margins, particularly for commoditized refractory products. The presence of numerous manufacturers, ranging from large multinational corporations to smaller regional players, creates a highly competitive environment where product differentiation and cost efficiency become critical for market survival. This competitive landscape often necessitates continuous innovation and investment in R&D to maintain a competitive edge and avoid being relegated to low-margin segments.

Another critical challenge is the inherent cyclical nature of key end-use industries such as steel and cement. Economic downturns, geopolitical instability, and shifts in construction or manufacturing demand directly impact the consumption of refractories, leading to periods of reduced sales and overcapacity. This cyclicality makes long-term planning and investment decisions complex for refractory manufacturers. Furthermore, ensuring a consistent supply of high-quality raw materials remains a challenge due to their finite nature, concentration in specific geographical regions, and susceptibility to export restrictions or supply chain disruptions. Attracting and retaining a skilled workforce, particularly for specialized refractory installation and maintenance, also poses a significant operational challenge for the industry, impacting quality and efficiency of service delivery.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Market Competition & Price Pressure | -0.7% | Global | 2025-2033 |

| Cyclicality of End-Use Industries | -0.6% | Global | 2025-2033 |

| Supply Chain Vulnerabilities of Raw Materials | -0.5% | Global, particularly China | 2025-2033 |

| Need for High R&D Investment | -0.4% | Global | 2025-2033 |

| Skilled Labor Shortage | -0.3% | Developed Economies | 2025-2033 |

Refractory Market - Updated Report Scope

This comprehensive market research report on the Refractory Market provides an in-depth analysis of current market dynamics, historical trends, and future growth projections. It covers a detailed segmentation of the market by various types, forms, applications, and end-use industries, offering insights into each segment's performance and future potential. The report also includes a thorough regional analysis, highlighting key growth drivers, restraints, opportunities, and challenges across major geographies. Furthermore, it profiles leading market players, assessing their competitive strategies, product portfolios, and recent developments to provide a holistic view of the market landscape and key trends shaping the industry up to 2033.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 23.5 billion |

| Market Forecast in 2033 | USD 33.5 billion |

| Growth Rate | 4.5% |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | RHI Magnesita, Vesuvius plc, Krosaki Harima Corporation, Shinagawa Refractories Co., Ltd., Refratechnik Holding GmbH, Imerys Refractory Minerals, Morgan Advanced Materials, Saint-Gobain S.A., Resco Products Inc., Minteq International Inc., Allied Mineral Products Inc., Calderys (HWI), Coorstek Inc., Magnezit Group, IFGL Refractories Ltd., Orient Refractories Ltd., Puyang Refractories Group Co., Ltd., HarbisonWalker International (HWI), BMI Refractories, Posco C & C. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The refractory market is comprehensively segmented to provide granular insights into its diverse components and drivers. These segments include classifications by form, type, application, and end-use industry, each revealing specific market dynamics and growth patterns. Understanding these segmentations is crucial for stakeholders to identify lucrative niches, develop targeted strategies, and align product offerings with precise industrial demands. For instance, the distinction between shaped and unshaped refractories highlights varying installation complexities and performance benefits, influencing adoption rates across different industrial settings, while the chemical composition of refractories dictates their suitability for specific high-temperature environments.

The end-use industry segmentation is particularly vital, as it directly reflects the primary demand drivers for refractories. The iron and steel industry consistently represents the largest consumer due to its high-temperature processes, but other sectors like cement, glass, and non-ferrous metals also contribute significantly. The ongoing evolution within these industries, such as the shift towards electric arc furnaces in steelmaking or new glass melting technologies, directly impacts the demand for specific refractory types. This detailed segmentation allows for a precise evaluation of market opportunities and challenges, enabling a more informed strategic approach for manufacturers, suppliers, and investors operating within the refractory ecosystem.

- By Form:

- Shaped Refractories: Bricks, Tiles, Pre-cast shapes.

- Unshaped Refractories (Monolithic): Castables, Gunning mixes, Ramming mixes, Mortars, Plastics.

- By Type:

- Clay Refractories: Fireclay, High Alumina.

- Non-Clay Refractories: Magnesia, Silica, Zirconia, Silicon Carbide, Chromite, Carbon, Dolomite.

- By Application:

- Furnace Linings.

- Kiln Linings.

- Incinerator Linings.

- Reactor Linings.

- Ladle Linings.

- Tundishes.

- Crucibles.

- Others (e.g., Boiler linings, Coking ovens).

- By End-Use Industry:

- Iron & Steel.

- Cement.

- Glass.

- Non-Ferrous Metals (e.g., Aluminum, Copper).

- Power Generation.

- Petrochemicals & Chemicals.

- Ceramics.

- Others (e.g., Waste Incineration, Foundries).

Regional Highlights

- Asia Pacific (APAC): The Asia Pacific region is anticipated to be the largest and fastest-growing market for refractories, driven primarily by the colossal industrial bases of China and India. These countries are experiencing significant growth in steel production, cement manufacturing, and infrastructure development, which are major consumers of refractory materials. The rapid pace of urbanization and industrialization across other Southeast Asian economies further contributes to this growth. Investments in new manufacturing facilities and the modernization of existing ones, coupled with government initiatives supporting domestic industrial output, underpin the sustained demand for refractories in this region, making it a pivotal hub for market expansion.

- Europe: The European refractory market is characterized by mature industrial sectors and a strong emphasis on sustainability and technological innovation. While growth might be slower compared to APAC, the demand for high-performance, energy-efficient, and eco-friendly refractories is increasing due to stringent environmental regulations and a focus on circular economy principles. Key countries like Germany, Italy, and France, with their advanced manufacturing capabilities in steel, glass, and ceramics, continue to drive demand. The region is also at the forefront of developing advanced refractory materials and recycling technologies, signaling a shift towards value-added, specialized products.

- North America: North America presents a stable market for refractories, with demand primarily stemming from its well-established iron and steel, petrochemical, and glass industries. The region is witnessing a trend towards modernization of industrial infrastructure, leading to a demand for longer-lasting and more efficient refractory linings. The increasing focus on reducing carbon emissions and enhancing operational efficiency also drives the adoption of advanced refractory solutions. While raw material imports are significant, domestic innovation and strategic investments in recycling technologies are becoming increasingly important for sustaining market competitiveness and meeting evolving industrial standards.

- Latin America: The Latin American refractory market is projected for steady growth, buoyed by the development of its mining, steel, and cement industries, particularly in Brazil and Mexico. Infrastructure projects and growing domestic consumption of manufactured goods are key demand drivers. The region's market dynamics are influenced by commodity prices and foreign investments, which directly impact the operational capacity of heavy industries. While price sensitivity can be a factor, there's a growing appreciation for durable and efficient refractory solutions that contribute to long-term cost savings and operational stability.

- Middle East and Africa (MEA): The MEA region is emerging as a growth hotspot, primarily due to significant investments in industrialization, particularly in the oil and gas, petrochemicals, and construction sectors across Gulf Cooperation Council (GCC) countries. Expanding steel and aluminum production capacities, coupled with ongoing infrastructure development projects, are fueling the demand for refractories. While some countries are rich in refractory raw materials, the region largely relies on imports for specialized products. Future growth is anticipated as economic diversification efforts continue to spur industrial expansion beyond traditional energy sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refractory Market.- RHI Magnesita

- Vesuvius plc

- Krosaki Harima Corporation

- Shinagawa Refractories Co., Ltd.

- Refratechnik Holding GmbH

- Imerys Refractory Minerals

- Morgan Advanced Materials

- Saint-Gobain S.A.

- Resco Products Inc.

- Minteq International Inc.

- Allied Mineral Products Inc.

- Calderys (HWI)

- Coorstek Inc.

- Magnezit Group

- IFGL Refractories Ltd.

- Orient Refractories Ltd.

- Puyang Refractories Group Co., Ltd.

- HarbisonWalker International (HWI)

- BMI Refractories

- Posco C & C

Frequently Asked Questions

Analyze common user questions about the Refractory market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of refractories?

Refractories are primarily used as linings in high-temperature industrial equipment such as furnaces, kilns, incinerators, and reactors across various sectors, including iron & steel, cement, glass, and non-ferrous metals. They provide thermal insulation and resist extreme heat, chemical attack, and abrasive wear.

Which region dominates the global refractory market?

The Asia Pacific region currently dominates the global refractory market, largely driven by the extensive industrial bases and rapid infrastructure development in countries like China and India, which are major producers of steel and cement.

What is the main difference between shaped and unshaped refractories?

Shaped refractories are pre-formed into specific shapes like bricks or tiles, offering precise dimensions for construction. Unshaped (monolithic) refractories are supplied as mixes (e.g., castables, gunning mixes) that are installed on-site, providing flexibility for complex geometries and repairs.

How do environmental regulations impact the refractory market?

Environmental regulations compel refractory manufacturers to develop more sustainable products and adopt cleaner production processes, focusing on reduced energy consumption, lower emissions, and increased recyclability, which drives innovation but also increases compliance costs.

What are the key drivers of growth in the refractory market?

The key drivers include the robust growth of core end-use industries (iron & steel, cement, glass), increasing global infrastructure development, rapid industrialization in emerging economies, and ongoing technological advancements leading to high-performance and energy-efficient refractory materials.