Reefer Container Market

Reefer Container Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701510 | Last Updated : July 30, 2025 |

Format : ![]()

![]()

![]()

![]()

Reefer Container Market Size

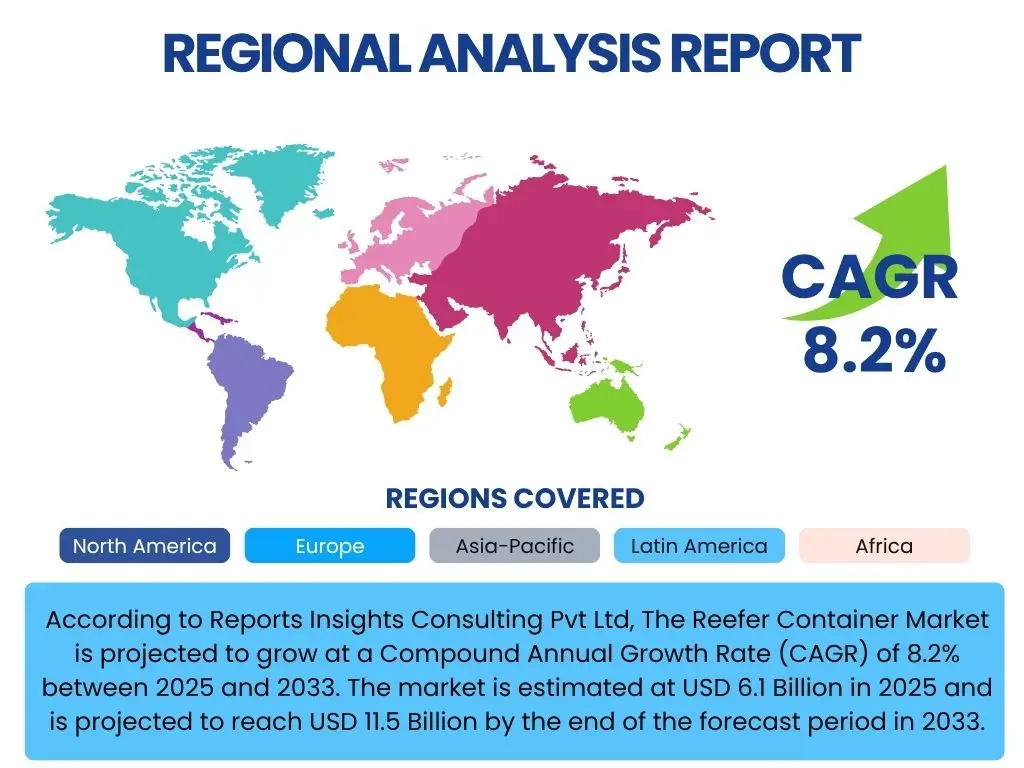

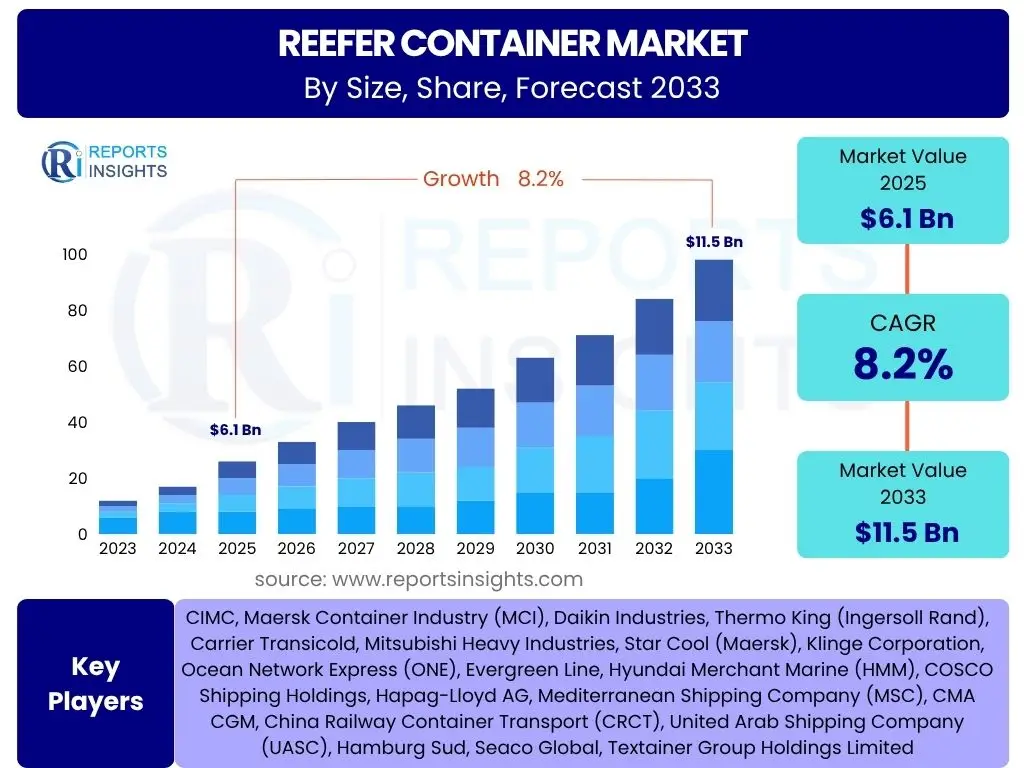

According to Reports Insights Consulting Pvt Ltd, The Reefer Container Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2025 and 2033. The market is estimated at USD 6.1 Billion in 2025 and is projected to reach USD 11.5 Billion by the end of the forecast period in 2033.

Key Reefer Container Market Trends & Insights

The global reefer container market is experiencing significant transformation, driven by evolving consumer demands, technological advancements, and a heightened focus on sustainability. A key trend is the accelerating demand for fresh and frozen perishable goods, including pharmaceuticals, across international borders, necessitating robust cold chain logistics. This is further fueled by the expansion of global trade routes and the increasing disposable income in emerging economies, leading to diversified dietary preferences and greater access to high-value temperature-sensitive products.

Another prominent trend involves the widespread adoption of smart reefer technologies. These include IoT-enabled sensors for real-time temperature and humidity monitoring, GPS tracking, and remote control capabilities. Such innovations enhance transparency, reduce spoilage, and improve operational efficiency, addressing critical concerns related to cargo integrity and security. Furthermore, the market is witnessing a shift towards eco-friendly refrigerants and energy-efficient container designs, driven by stringent environmental regulations and corporate sustainability initiatives aiming to minimize carbon footprints throughout the cold chain.

The rise of e-commerce and last-mile delivery services for perishable goods, particularly in urban centers, is also shaping the reefer container landscape. This necessitates smaller, more agile refrigerated transport solutions and sophisticated inventory management systems to ensure product freshness from origin to consumer. Strategic partnerships and consolidation activities among logistics providers, shipping lines, and technology firms are becoming more common, aiming to offer integrated, end-to-end cold chain solutions that meet complex global demands.

- Growing demand for perishable food and pharmaceutical products globally.

- Increased adoption of smart reefer technologies (IoT, remote monitoring).

- Shift towards eco-friendly refrigerants and energy-efficient container designs.

- Expansion of e-commerce and last-mile delivery for temperature-sensitive goods.

- Development of integrated cold chain logistics solutions.

AI Impact Analysis on Reefer Container

Artificial intelligence (AI) is poised to revolutionize the reefer container market by enhancing efficiency, predictability, and sustainability across the cold chain. Users are keenly interested in how AI can optimize complex logistical challenges, such as dynamic route planning that accounts for real-time traffic, weather conditions, and temperature fluctuations, thereby minimizing transit times and energy consumption. There is significant expectation that AI will improve predictive maintenance, enabling early detection of potential equipment failures in refrigeration units, reducing costly breakdowns, and ensuring uninterrupted temperature control for sensitive cargo.

Furthermore, AI applications are anticipated to play a crucial role in demand forecasting and inventory management. By analyzing vast datasets including historical sales, seasonal trends, and external factors, AI can provide highly accurate predictions for perishable goods, optimizing storage and transport needs, and significantly reducing food waste. This capability addresses user concerns about overstocking or understocking, ensuring optimal utilization of reefer container capacity and minimizing financial losses due to spoilage. Users also envision AI enhancing security and compliance by monitoring cargo conditions and detecting anomalies that could indicate tampering or deviations from required environmental parameters.

However, user inquiries also reveal concerns about the practical implementation of AI within the reefer container sector. These include the initial investment costs associated with AI-powered systems, the need for robust data infrastructure, and the challenges of integrating new technologies with existing legacy systems. There are also considerations regarding data privacy and cybersecurity, given the sensitive nature of supply chain data. The human element is another area of interest, with questions arising about the necessary upskilling of the workforce to manage and interact with AI systems, and the potential impact on traditional roles within logistics operations.

- Optimized route planning and logistics through predictive analytics.

- Enhanced predictive maintenance for refrigeration units, reducing downtime.

- Improved demand forecasting and inventory management, minimizing waste.

- Real-time monitoring and anomaly detection for cargo security and integrity.

- Automated decision-making for temperature adjustments and power optimization.

- Challenges include high implementation costs, data infrastructure needs, and cybersecurity risks.

Key Takeaways Reefer Container Market Size & Forecast

The reefer container market is set for substantial growth, driven by the escalating global demand for temperature-sensitive products, notably fresh produce, seafood, and pharmaceuticals. This growth is underpinned by expanding international trade, evolving consumer preferences for diverse and fresh food options, and the critical need for robust cold chain logistics to maintain product quality and safety. The market's upward trajectory is also a reflection of continuous innovation in container technology, including the integration of smart features and a focus on sustainable solutions, which collectively enhance efficiency and reduce environmental impact across the supply chain.

The forecast period from 2025 to 2033 highlights a sustained positive outlook, with significant investment expected in advanced refrigeration technologies and expanded cold storage infrastructure, particularly in emerging markets. Key stakeholders, including shipping lines, logistics providers, and reefer manufacturers, are poised to capitalize on these opportunities by offering specialized services and technologically advanced containers. The market will continue to be influenced by global economic trends, regulatory frameworks pertaining to food safety and environmental protection, and the ongoing push for digitalization within logistics operations.

Ultimately, the reefer container market's expansion signifies its indispensable role in global commerce, bridging geographical gaps to deliver vital goods while maintaining their integrity. The projected growth underscores the increasing sophistication of cold chain management and its vital contribution to food security, public health, and global economic stability. Adaptability to supply chain disruptions and continued innovation in energy efficiency and data-driven logistics will be crucial for sustained market leadership.

- Strong demand for perishable goods and pharmaceuticals drives market expansion.

- Technological advancements, especially smart containers, are key growth enablers.

- Focus on sustainability and eco-friendly solutions is shaping future development.

- Global trade expansion and evolving consumer habits are major contributors to growth.

- Emerging markets present significant opportunities for infrastructure development.

- Market resilience against supply chain disruptions is a critical factor for success.

Reefer Container Market Drivers Analysis

The reefer container market's robust growth is primarily propelled by a confluence of interconnected factors, chief among them the escalating global demand for perishable food products and pharmaceuticals. As populations grow and disposable incomes rise, particularly in developing economies, there is an increased consumption of fresh fruits, vegetables, meat, and seafood, necessitating efficient temperature-controlled logistics for international distribution. Concurrently, the burgeoning pharmaceutical and biotechnology sectors are generating a massive need for precise temperature control during transit for vaccines, biologics, and other sensitive medical supplies, directly driving investment in specialized reefer capabilities.

Another significant driver is the continuous advancement in cold chain infrastructure and technology. Innovations such as remote monitoring, IoT integration, and improved refrigeration systems ensure product integrity throughout the entire supply chain, reducing spoilage and enhancing food safety standards. These technological leaps make it more feasible and reliable to transport sensitive goods over long distances, opening up new trade routes and markets. Furthermore, the global expansion of organized retail and e-commerce platforms, which increasingly offer fresh and frozen goods for direct-to-consumer delivery, places a growing demand on the reefer container segment to support last-mile cold chain logistics.

Regulatory frameworks also play a pivotal role, with tightening food safety and pharmaceutical transportation regulations across various regions. Compliance with these stringent standards often mandates the use of advanced reefer containers capable of maintaining precise temperature ranges and providing comprehensive data logging. This regulatory push, combined with a heightened consumer awareness regarding product quality and safety, compels businesses to invest in high-standard cold chain solutions, thereby bolstering the reefer container market.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Demand for Perishable Goods | +2.5% | Asia Pacific, Europe, North America | Long-term (5+ years) |

| Growth in Pharmaceutical and Biotech Industries | +2.0% | North America, Europe, Asia Pacific | Mid-term (3-5 years) |

| Advancements in Cold Chain Technology and Infrastructure | +1.5% | Globally, particularly Developed Regions | Short-term (1-3 years) |

| Expansion of Organized Retail and E-commerce for Fresh Goods | +1.0% | Emerging Markets (APAC, Latin America) | Mid-term (3-5 years) |

| Stringent Food Safety and Pharmaceutical Regulations | +0.7% | Globally | Ongoing |

Reefer Container Market Restraints Analysis

Despite significant growth potential, the reefer container market faces several formidable restraints that could impede its expansion. One of the primary challenges is the high operational and maintenance cost associated with these specialized containers. Reefer units require substantial energy consumption for refrigeration, leading to elevated fuel and electricity expenses, particularly given fluctuating global energy prices. Additionally, the complex refrigeration systems necessitate regular, specialized maintenance and repair, which adds to the overall cost of ownership and operation, making them significantly more expensive than standard dry containers.

Another critical restraint involves the regulatory complexities and diverse standards across different countries and regions. Navigating a myriad of import/export regulations, customs procedures, and varying temperature control requirements for different types of perishable goods can be cumbersome for logistics providers. This fragmentation of regulations creates barriers to seamless international trade and can lead to delays or rejections of shipments, increasing operational risks and costs. Geopolitical instabilities, trade disputes, and protectionist policies further exacerbate these challenges by disrupting established trade routes and creating uncertainty in the global supply chain, directly impacting the demand for international reefer transport.

Furthermore, infrastructure limitations in developing regions pose a significant hurdle. Many emerging markets lack the necessary port infrastructure, reliable power supply, and extensive cold storage facilities to support a rapidly expanding reefer container fleet. This deficiency can lead to bottlenecks, increased transit times, and a higher risk of spoilage, diminishing the efficiency and reliability of the cold chain in these crucial growth markets. Environmental concerns, specifically related to the use of certain refrigerants with high global warming potential, also present a restraint as the industry grapples with the transition to more eco-friendly, yet often more expensive, alternatives.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Operational and Maintenance Costs | -1.5% | Globally | Ongoing |

| Complex Regulatory Frameworks and Trade Barriers | -1.0% | Globally, specific to trade blocs | Mid-term (3-5 years) |

| Infrastructure Limitations in Developing Regions | -0.8% | Africa, parts of Asia, Latin America | Long-term (5+ years) |

| Volatile Energy Prices | -0.7% | Globally | Short-term (1-3 years) |

| Environmental Concerns over Refrigerants | -0.5% | Developed Regions (Europe, North America) | Mid-term (3-5 years) |

Reefer Container Market Opportunities Analysis

The reefer container market is rife with opportunities stemming from technological innovation and the expansion into untapped geographical and application areas. The increasing adoption of smart container technologies, including IoT sensors, blockchain for traceability, and advanced telematics, presents a significant avenue for growth. These technologies enable real-time monitoring of temperature, humidity, and location, providing unprecedented transparency and control over sensitive cargo. This not only reduces spoilage and improves security but also optimizes operational efficiency through data-driven insights, offering a distinct competitive advantage to companies that embrace them.

Furthermore, the growing emphasis on sustainability is creating opportunities for manufacturers to develop and implement eco-friendly reefer solutions. This includes designing containers with enhanced insulation, employing energy-efficient refrigeration units, and exploring natural or low-GWP (Global Warming Potential) refrigerants. Companies that can provide greener solutions will increasingly appeal to environmentally conscious consumers and meet evolving regulatory requirements, positioning themselves as leaders in a sustainability-driven market. The expansion into emerging markets, particularly in Africa, parts of Asia, and Latin America, which are experiencing rapid urbanization and rising consumer demand for diverse food products, represents a substantial growth frontier as cold chain infrastructure develops in these regions.

The burgeoning pharmaceutical and biotechnology sectors, with their highly sensitive and high-value products, offer specialized growth opportunities. The demand for ultra-low temperature reefers and precise temperature-controlled solutions for vaccines, biologics, and specialized medical kits is on the rise. Moreover, the integration of reefer containers into multimodal transport solutions, combining sea, rail, and road, can unlock efficiencies and expand reach, especially for inland destinations. The continuous growth of the e-commerce sector for perishable goods also necessitates more agile and reliable cold chain logistics, opening doors for specialized reefer services and smaller, last-mile delivery refrigerated units.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Adoption of Smart Reefer Technologies (IoT, Telematics) | +2.2% | Globally, particularly Developed Regions | Mid-term (3-5 years) |

| Development of Eco-friendly and Energy-efficient Reefers | +1.8% | Europe, North America, Asia Pacific | Long-term (5+ years) |

| Expansion into Emerging Markets and Untapped Geographies | +1.5% | Africa, Latin America, Southeast Asia | Long-term (5+ years) |

| Growth in Specialized Pharmaceutical Logistics | +1.2% | Globally | Mid-term (3-5 years) |

| Integration with Multimodal Transport Networks | +0.8% | Globally | Short-term (1-3 years) |

Reefer Container Market Challenges Impact Analysis

The reefer container market is confronted by several significant challenges that necessitate strategic responses from industry players. One major challenge is the inherent susceptibility to supply chain disruptions, which can range from geopolitical conflicts and trade wars to natural disasters and pandemics. Events like port congestion, canal blockages (e.g., Suez Canal), or labor shortages can severely impede the movement of reefer containers, leading to delayed shipments, increased spoilage, and significant financial losses for businesses reliant on timely cold chain logistics. These disruptions highlight the need for robust contingency planning and diversified shipping routes.

Another pressing concern is the escalating issue of cybersecurity threats, particularly with the increasing digitalization and integration of smart technologies in reefer containers. As IoT sensors and telematics systems become more prevalent, they present potential vulnerabilities to cyberattacks, which could compromise temperature data, tracking information, or even allow for malicious manipulation of refrigeration units. Ensuring the security and integrity of these connected systems is paramount to maintaining cargo safety and preventing financial fraud, requiring continuous investment in advanced cybersecurity measures and secure data protocols.

Moreover, the reefer container market faces challenges related to volatile energy prices and the ongoing pressure to reduce carbon emissions. Fluctuations in fuel and electricity costs directly impact operational expenses for reefer units, making cost management a constant battle. Simultaneously, stricter environmental regulations and growing industry commitments to sustainability compel companies to invest in more expensive, eco-friendly refrigerants and energy-efficient technologies, adding to capital expenditure. Intense competition among container manufacturers, shipping lines, and logistics providers also puts downward pressure on pricing, demanding continuous innovation and operational excellence to maintain profitability and market share.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Supply Chain Disruptions (e.g., Port Congestion, Geopolitics) | -1.8% | Globally | Short-term (1-3 years) |

| Cybersecurity Threats to Smart Reefer Systems | -1.2% | Globally | Ongoing |

| Volatile Energy Prices and Emissions Regulations | -1.0% | Globally | Mid-term (3-5 years) |

| High Capital Investment and Replacement Costs | -0.8% | Globally | Long-term (5+ years) |

| Skilled Labor Shortage for Maintenance and Operations | -0.7% | Developed Regions | Mid-term (3-5 years) |

Reefer Container Market - Updated Report Scope

This comprehensive report delves into the intricate dynamics of the global reefer container market, providing a detailed analysis of its current size, historical trends, and future growth projections. It covers the crucial drivers and restraints shaping the industry, alongside key opportunities and challenges that market players must navigate. The scope encompasses detailed segmentation analysis by various parameters, offering granular insights into specific market niches and their growth trajectories. Furthermore, the report provides a thorough regional breakdown, highlighting market performance and potential across major geographical areas. A competitive landscape assessment, profiling key industry participants and their strategic initiatives, completes the analytical framework, offering actionable intelligence for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 6.1 Billion |

| Market Forecast in 2033 | USD 11.5 Billion |

| Growth Rate | 8.2% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | CIMC, Maersk Container Industry (MCI), Daikin Industries, Thermo King (Ingersoll Rand), Carrier Transicold, Mitsubishi Heavy Industries, Star Cool (Maersk), Klinge Corporation, Ocean Network Express (ONE), Evergreen Line, Hyundai Merchant Marine (HMM), COSCO Shipping Holdings, Hapag-Lloyd AG, Mediterranean Shipping Company (MSC), CMA CGM, China Railway Container Transport (CRCT), United Arab Shipping Company (UASC), Hamburg Sud, Seaco Global, Textainer Group Holdings Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The reefer container market is comprehensively segmented across various critical dimensions to provide a granular understanding of its dynamics and growth prospects. These segmentations allow for a detailed analysis of market performance based on specific product characteristics, technological applications, temperature requirements, end-use industries, and transportation modes. Such a breakdown helps stakeholders identify high-growth areas, assess competitive landscapes, and tailor strategies to specific market needs. The insights derived from these segments are crucial for strategic planning, investment decisions, and product development within the global cold chain logistics sector.

- By Type: Includes classifications such as 20 ft, 40 ft, and 45 ft (High Cube) reefer containers, reflecting varying capacities and applications.

- By Technology: Covers Cryogenic Refrigeration, Mechanical Refrigeration (traditional and advanced), Controlled Atmosphere (CA), and Modified Atmosphere (MA) systems, showcasing technological advancements.

- By Temperature Range: Categorizes containers based on their ability to maintain Chilled (above 0°C), Frozen (below 0°C), Deep Frozen (below -25°C), and Ultra-low Temperature (below -60°C) conditions.

- By End-Use Industry: Differentiates demand from sectors like Meat & Seafood, Fruits & Vegetables, Dairy & Beverages, Pharmaceuticals, and Chemicals, highlighting diverse industry needs.

- By Mode of Transport: Examines usage across Sea/Ocean Freight, Road Freight, Rail Freight, and Air Freight, indicating multimodal logistics integration.

- By Ownership Type: Distinguishes between Leased Containers and Owned Containers, shedding light on market structure and investment patterns.

- By Container Material: Classifies containers by materials such as Aluminum, Steel, and Composite, influencing durability and efficiency.

Regional Highlights

- Asia Pacific (APAC): Positioned as the largest and fastest-growing market, driven by increasing population, rising disposable incomes, expansion of organized retail, and growing intra-regional trade of perishable goods. Countries like China, India, Japan, and Australia are key contributors due to robust economic growth and developing cold chain infrastructure. The region also benefits from significant pharmaceutical manufacturing and export activities.

- Europe: A mature market with strong demand for temperature-sensitive food and pharmaceutical products. Stringent food safety regulations, advanced cold chain infrastructure, and a significant pharmaceutical industry contribute to steady growth. Key countries include Germany, the UK, France, and the Netherlands, which serve as major trade hubs. Focus on sustainability and eco-friendly refrigerants is a key trend.

- North America: Characterized by high demand for processed and fresh perishable foods, a robust pharmaceutical sector, and advanced logistics capabilities. The U.S. and Canada are significant markets, driven by consumer preferences for fresh produce year-round and sophisticated supply chain networks. Investment in smart reefer technologies and intermodal transport is prominent.

- Latin America: An emerging market with significant growth potential, driven by increasing exports of agricultural products (e.g., fruits from Brazil, Chile, Argentina) and growing domestic consumption. Infrastructure development is crucial for market expansion, with countries like Brazil and Mexico leading the regional demand for reefer containers.

- Middle East and Africa (MEA): Represents a developing market with vast untapped potential. Growth is fueled by increasing food imports, efforts to enhance food security, and the development of modern retail and cold chain facilities, particularly in Gulf Cooperation Council (GCC) countries and parts of South Africa. Challenges include infrastructure limitations and political stability, but opportunities for investment are substantial.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reefer Container Market.- CIMC

- Maersk Container Industry (MCI)

- Daikin Industries

- Thermo King (Ingersoll Rand)

- Carrier Transicold

- Mitsubishi Heavy Industries

- Star Cool (Maersk)

- Klinge Corporation

- Ocean Network Express (ONE)

- Evergreen Line

- Hyundai Merchant Marine (HMM)

- COSCO Shipping Holdings

- Hapag-Lloyd AG

- Mediterranean Shipping Company (MSC)

- CMA CGM

- China Railway Container Transport (CRCT)

- United Arab Shipping Company (UASC)

- Hamburg Sud

- Seaco Global

- Textainer Group Holdings Limited

Frequently Asked Questions

What is a reefer container?

A reefer container is a specialized shipping container equipped with a built-in refrigeration unit designed to maintain a controlled temperature range, crucial for transporting temperature-sensitive goods such as perishable foods, pharmaceuticals, and chemicals across long distances via sea, road, or rail.

What are the primary factors driving the growth of the reefer container market?

Key drivers include the surging global demand for fresh and frozen perishable goods, the rapid expansion of the pharmaceutical and biotechnology industries requiring precise temperature control, and continuous advancements in cold chain technologies and infrastructure, enhancing efficiency and reliability.

How does AI impact the reefer container industry?

AI significantly impacts the reefer container industry by optimizing logistics through predictive analytics for route planning, enhancing predictive maintenance for refrigeration units, improving demand forecasting to minimize waste, and providing real-time monitoring for cargo security and integrity.

What challenges does the reefer container market face?

Major challenges include high operational and maintenance costs due to energy consumption, susceptibility to global supply chain disruptions (e.g., port congestion), complex and varied international regulations, and growing cybersecurity threats to increasingly connected smart container systems.

Which regions are key contributors to the reefer container market?

Asia Pacific is the largest and fastest-growing market due to high demand and developing infrastructure. Europe and North America are mature markets with strong demand from pharmaceutical and high-value food sectors. Latin America and MEA offer significant growth potential as their cold chain infrastructure develops.