Poultry Processing Plant Market

Poultry Processing Plant Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705915 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Poultry Processing Plant Market Size

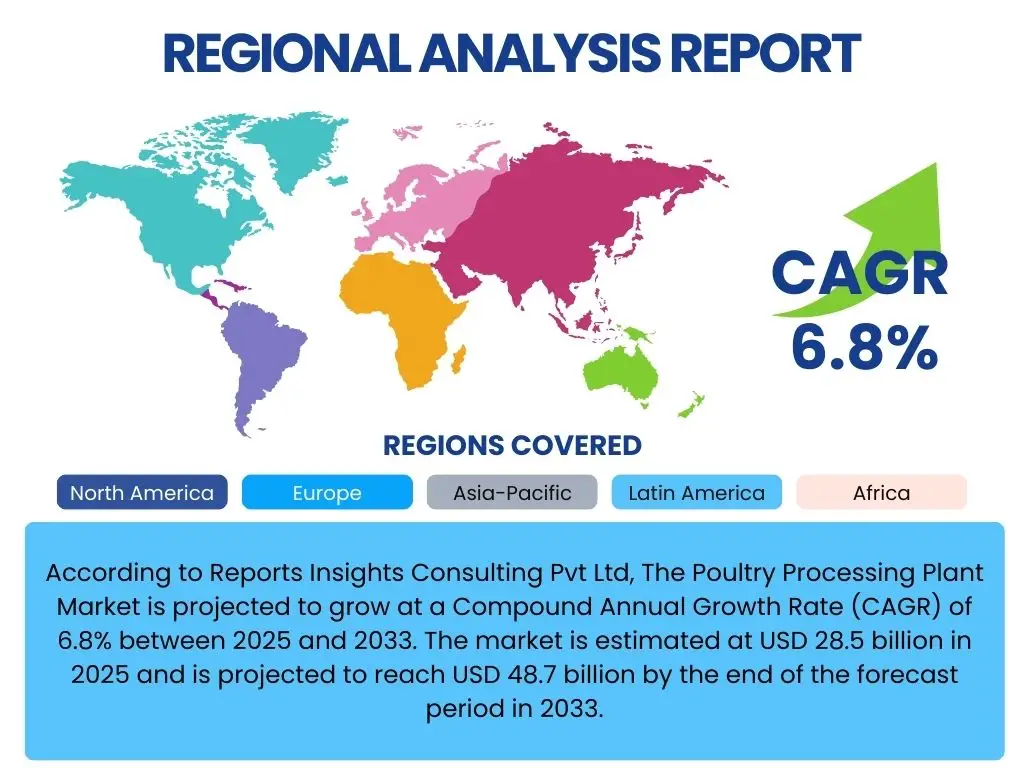

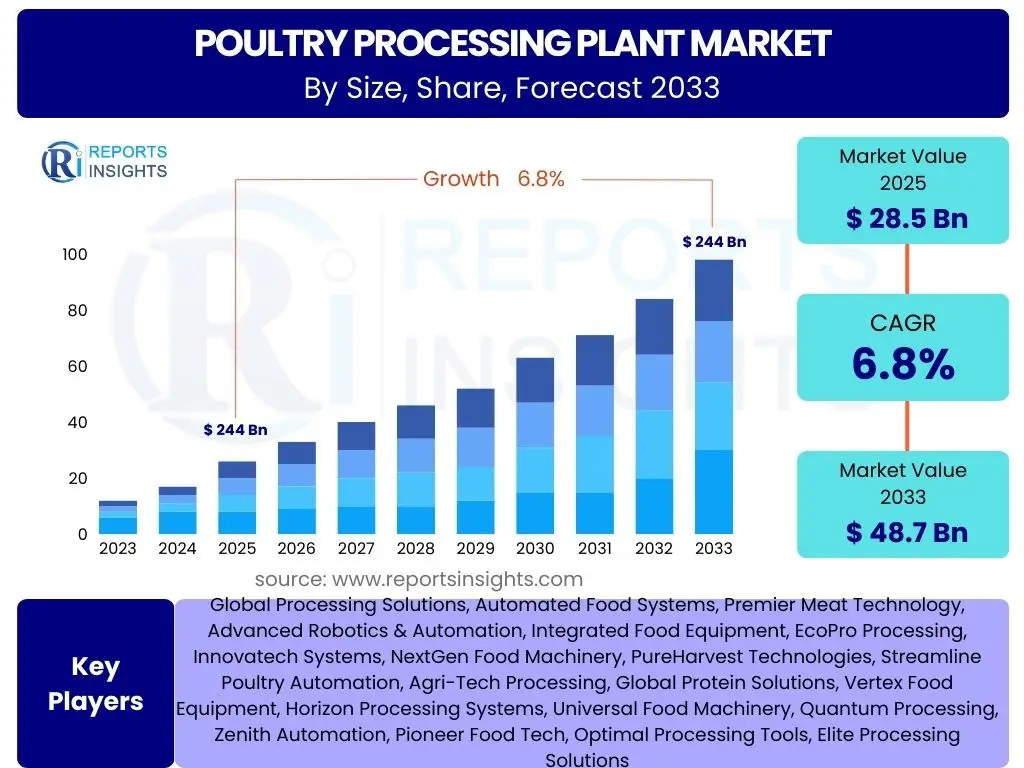

According to Reports Insights Consulting Pvt Ltd, The Poultry Processing Plant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 28.5 billion in 2025 and is projected to reach USD 48.7 billion by the end of the forecast period in 2033.

Key Poultry Processing Plant Market Trends & Insights

The poultry processing plant market is undergoing significant transformation driven by consumer demand shifts, technological advancements, and an increasing focus on efficiency and sustainability. Users frequently inquire about the impact of automation, the adoption of advanced food safety protocols, and the influence of evolving dietary preferences on the industry. The market is increasingly characterized by the integration of smart technologies designed to optimize every stage of the processing chain, from slaughtering to packaging.

Furthermore, there is a pronounced trend towards greater transparency and traceability within the supply chain, responding to consumer and regulatory pressure for safe and ethically produced poultry products. This includes the implementation of robust quality control systems and the utilization of data analytics to monitor and improve operational performance. Sustainability initiatives, such as waste reduction, water conservation, and energy efficiency, are also becoming critical market differentiators and areas of investment for processing plants seeking long-term viability and positive public perception.

- Increased automation and robotics integration across processing stages.

- Rising adoption of advanced food safety and traceability technologies.

- Growing demand for processed and convenience poultry products.

- Emphasis on sustainable and environmentally friendly processing practices.

- Expansion into emerging markets with increasing poultry consumption.

- Implementation of predictive maintenance and data analytics for operational optimization.

AI Impact Analysis on Poultry Processing Plant

The integration of Artificial Intelligence (AI) within the poultry processing plant market is a topic of considerable interest, with common user questions revolving around its applications in enhancing efficiency, ensuring food safety, and reducing operational costs. AI is seen as a transformative force capable of revolutionizing traditional processing methods by enabling more precise and autonomous operations. From quality inspection to predictive maintenance, AI algorithms are being developed to identify anomalies, optimize resource allocation, and improve overall yield.

AI's influence extends to critical areas such as yield optimization, where machine learning models analyze various factors to maximize meat recovery and minimize waste. In food safety, AI-powered vision systems can detect contaminants or quality defects with greater accuracy and speed than human inspectors, significantly reducing the risk of product recalls. Furthermore, AI contributes to improved operational intelligence by providing real-time data analysis, allowing plant managers to make informed decisions regarding production scheduling, equipment performance, and energy consumption, leading to more sustainable and profitable operations.

- Enhanced quality control and defect detection through AI-powered vision systems.

- Optimized production scheduling and yield maximization via machine learning algorithms.

- Predictive maintenance for processing machinery, reducing downtime and operational costs.

- Improved supply chain visibility and traceability using AI-driven data analytics.

- Automated sorting and grading of poultry products based on AI insights.

- Robotics integration powered by AI for complex processing tasks.

Key Takeaways Poultry Processing Plant Market Size & Forecast

The projected growth of the poultry processing plant market reflects a robust and expanding industry, driven by global population growth, rising disposable incomes, and the increasing preference for poultry as an affordable and versatile protein source. Key takeaways frequently highlighted by users include the significant investment opportunities in automation and technology, the critical role of food safety standards in market expansion, and the regional disparities in growth potential. The market’s resilience is also attributed to its ability to adapt to changing consumer demands and regulatory environments.

The forecast indicates a sustained upward trajectory, underscoring the necessity for processing facilities to continuously innovate and upgrade their infrastructure to meet future demand. This includes strategic investments in advanced processing equipment, cold chain logistics, and digital solutions for supply chain management. Furthermore, understanding the nuances of regional consumption patterns and regulatory frameworks will be crucial for stakeholders aiming to capitalize on specific market segments and achieve sustainable growth throughout the forecast period.

- Significant growth anticipated, driven by increasing global poultry consumption.

- Technological adoption, particularly automation and AI, is crucial for competitive advantage.

- Stringent food safety regulations are shaping market practices and investments.

- Emerging economies present substantial growth opportunities due to rising demand.

- Focus on sustainability and efficiency is paramount for long-term market success.

- Market size expansion necessitates continuous investment in infrastructure and innovation.

Poultry Processing Plant Market Drivers Analysis

The poultry processing plant market is propelled by several key drivers, primarily centered around global demographic shifts, evolving dietary patterns, and the continuous advancement of processing technologies. The increasing global population and urbanization trends contribute directly to a heightened demand for accessible and affordable protein sources, positioning poultry as a primary choice due to its economic viability and versatility. This sustained demand necessitates greater processing capacities and efficiencies.

Furthermore, the rising consumer awareness regarding food safety and quality has led to stricter regulatory frameworks, pushing processing plants to adopt advanced sanitation and traceability technologies. The convenience factor associated with processed and ready-to-cook poultry products also fuels market growth, compelling manufacturers to invest in sophisticated processing equipment that can handle diverse product formats. Technological innovations, including automation, robotics, and digital integration, are essential drivers, enabling plants to meet the escalating demand while optimizing operational costs and improving product consistency.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Poultry Consumption | +1.5% | Global, particularly APAC and LatAm | 2025-2033 (Long-term) |

| Rising Demand for Processed and Convenience Foods | +1.2% | North America, Europe, China, India | 2025-2033 (Mid to Long-term) |

| Technological Advancements in Automation & Robotics | +1.0% | North America, Europe, Japan, South Korea | 2025-2030 (Mid-term) |

| Stringent Food Safety Regulations and Standards | +0.8% | Global, especially EU, US, Australia | 2025-2033 (Long-term) |

| Growing Awareness of Protein-Rich Diets | +0.5% | Global | 2025-2033 (Long-term) |

Poultry Processing Plant Market Restraints Analysis

Despite robust growth prospects, the poultry processing plant market faces significant restraints that could impede its expansion. One primary challenge is the substantial capital investment required for establishing and upgrading processing facilities, particularly those incorporating advanced automation and food safety technologies. This high initial cost can be a barrier to entry for new players and a deterrent for existing smaller-scale operations looking to modernize, potentially slowing overall market innovation.

Furthermore, the industry is highly susceptible to disease outbreaks, such as avian influenza, which can lead to widespread culling of flocks, supply chain disruptions, and significant economic losses for processors. Labor availability and rising labor costs, especially for skilled workers capable of operating sophisticated machinery, represent another persistent restraint. Environmental concerns, including waste management, water usage, and greenhouse gas emissions, also pose regulatory and reputational challenges, necessitating costly investments in sustainable practices and compliance measures which can impact profitability.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Investment Requirements | -0.9% | Global | 2025-2033 (Long-term) |

| Volatility in Raw Material Prices (Poultry Feed) | -0.7% | Global | 2025-2033 (Short to Mid-term) |

| Risk of Disease Outbreaks (e.g., Avian Influenza) | -1.2% | Global, particularly regions with dense poultry farming | Sporadic, High Impact (Short-term) |

| Labor Shortages and Increasing Labor Costs | -0.6% | North America, Europe, select Asian countries | 2025-2033 (Long-term) |

| Stringent Environmental Regulations and Waste Management | -0.5% | Europe, North America, developing economies adopting stricter norms | 2025-2033 (Mid to Long-term) |

Poultry Processing Plant Market Opportunities Analysis

Significant opportunities exist within the poultry processing plant market, largely driven by the potential for technological innovation and expansion into underserved regions. The advent of advanced automation, AI, and IoT technologies presents a substantial avenue for processors to enhance operational efficiencies, improve product quality, and reduce labor dependency. Investments in these areas can lead to substantial cost savings and a competitive edge, allowing companies to meet demand with higher output and consistent quality.

Emerging markets, particularly in Asia Pacific, Latin America, and Africa, represent lucrative expansion opportunities. These regions are experiencing rapid urbanization, population growth, and rising disposable incomes, translating into increased poultry consumption. Developing localized processing capabilities and supply chains in these areas can capture significant market share. Furthermore, the growing consumer interest in differentiated poultry products, such as organic, free-range, and value-added convenience items, creates niches for specialized processing lines and premium market offerings, enabling diversification and higher profit margins for agile market players.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging Markets (APAC, LatAm, Africa) | +1.8% | Asia Pacific, Latin America, Africa | 2025-2033 (Long-term) |

| Development of Advanced Automation and AI Solutions | +1.5% | Global | 2025-2030 (Mid-term) |

| Growing Demand for Value-Added and Processed Poultry Products | +1.3% | North America, Europe, Asia Pacific | 2025-2033 (Mid to Long-term) |

| Focus on Sustainable and Eco-Friendly Processing | +0.8% | Europe, North America | 2025-2033 (Long-term) |

| Strategic Partnerships and Collaborations | +0.6% | Global | 2025-2033 (Long-term) |

Poultry Processing Plant Market Challenges Impact Analysis

The poultry processing plant market faces several critical challenges that demand proactive strategies from industry participants. Supply chain disruptions, often triggered by geopolitical events, trade disputes, or natural disasters, can severely impact the availability and cost of raw materials, feed, and packaging, leading to production slowdowns and increased operational expenses. Managing these complex global supply chains effectively is a continuous hurdle for processors, requiring robust risk mitigation strategies and diversified sourcing.

Furthermore, maintaining compliance with increasingly stringent food safety and environmental regulations across different jurisdictions presents a significant operational and financial burden. Adapting to evolving standards for animal welfare, product labeling, and waste disposal necessitates constant investment in technology and procedural updates. Competition from alternative protein sources, such as plant-based or lab-grown meats, also poses a long-term challenge to traditional poultry consumption patterns, requiring the industry to innovate and reinforce the value proposition of conventional poultry products to retain market share. The need for continuous innovation to keep pace with consumer preferences and technological advancements adds another layer of complexity for market players.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Supply Chain Disruptions and Volatility | -1.0% | Global | 2025-2028 (Short to Mid-term) |

| Intense Competition and Price Sensitivity | -0.8% | Global | 2025-2033 (Long-term) |

| Adherence to Evolving Food Safety & Environmental Regulations | -0.7% | Global | 2025-2033 (Long-term) |

| Impact of Alternative Protein Sources | -0.5% | North America, Europe, Developed Asian Markets | 2028-2033 (Long-term) |

| Maintaining High Quality and Consistency | -0.4% | Global | 2025-2033 (Long-term) |

Poultry Processing Plant Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Poultry Processing Plant Market, examining its current size, historical trends, and future growth projections from 2025 to 2033. The report meticulously dissects market dynamics, including key drivers, restraints, opportunities, and challenges, offering a holistic view of the industry landscape. It incorporates an extensive segmentation analysis, breaking down the market by various dimensions such as type, product, process, end-product, and capacity, to provide granular insights into market behavior and potential growth areas. Furthermore, the report offers detailed regional highlights, identifying key countries and their market relevance, and profiles leading market players to provide competitive intelligence.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 28.5 billion |

| Market Forecast in 2033 | USD 48.7 billion |

| Growth Rate | 6.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Processing Solutions, Automated Food Systems, Premier Meat Technology, Advanced Robotics & Automation, Integrated Food Equipment, EcoPro Processing, Innovatech Systems, NextGen Food Machinery, PureHarvest Technologies, Streamline Poultry Automation, Agri-Tech Processing, Global Protein Solutions, Vertex Food Equipment, Horizon Processing Systems, Universal Food Machinery, Quantum Processing, Zenith Automation, Pioneer Food Tech, Optimal Processing Tools, Elite Processing Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The poultry processing plant market is intricately segmented to provide a detailed understanding of its diverse components and their respective contributions to overall market dynamics. This segmentation allows for precise analysis of growth drivers, technological adoption patterns, and consumer preferences across various operational aspects and product categories. Understanding these segments is crucial for stakeholders to identify niche opportunities, tailor their strategies, and allocate resources effectively within a highly competitive industry landscape.

The market is primarily segmented by type, differentiating between primary processing, which involves initial slaughtering and evisceration, and secondary processing, encompassing further value-added activities like deboning, cutting, and marinating. Product segmentation covers major poultry types such as chicken, turkey, and duck, reflecting their varying market demands and processing requirements. Furthermore, segmentation by process highlights specific stages of operation, from initial slaughtering to final packaging, while end-product segmentation distinguishes between fresh, frozen, and various processed poultry forms. Capacity-based segmentation categorizes plants by their throughput, offering insights into operational scale and technological sophistication across different market tiers.

- By Type:

- Primary Processing

- Secondary Processing

- By Product:

- Chicken

- Turkey

- Duck

- Others (e.g., Quail, Goose)

- By Process:

- Slaughtering

- Deboning

- Cutting/Portioning

- Marinating/Seasoning

- Further Processing (e.g., Cooking, Frying)

- Packaging

- By End-Product:

- Fresh Poultry

- Frozen Poultry

- Processed Poultry (e.g., Sausages, Nuggets, Deli Meats)

- By Capacity:

- Small Capacity (Up to 1,000 birds/hour)

- Medium Capacity (1,001-5,000 birds/hour)

- Large Capacity (Above 5,000 birds/hour)

Regional Highlights

- North America: A mature market characterized by high automation adoption, stringent food safety regulations, and significant demand for processed and convenience poultry products. The United States and Canada are leading in technological innovation and large-scale processing facilities, focusing on efficiency and sustainability.

- Europe: Driven by strict animal welfare standards, environmental regulations, and a strong preference for fresh and ethically sourced poultry. Western European countries like Germany, France, and the Netherlands are at the forefront of sustainable processing practices and advanced machinery, while Eastern Europe presents growth opportunities through modernization.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid urbanization, increasing disposable incomes, and a large population base leading to surging poultry consumption. Countries like China, India, and Indonesia are witnessing substantial investments in new processing plants and infrastructure to meet escalating domestic demand, with a focus on both primary and secondary processing.

- Latin America: Characterized by significant poultry production and export capabilities, particularly in Brazil and Argentina. The region benefits from abundant raw material availability and a growing domestic market for processed poultry, with increasing adoption of modern processing technologies to enhance export competitiveness.

- Middle East and Africa (MEA): Emerging as a high-potential market due to rising population, changing dietary habits, and a growing appetite for protein. Investments in localized processing capabilities are expanding, reducing reliance on imports and improving food security, with a strong focus on basic processing infrastructure development.

- Brazil: A global leader in poultry production and export, leveraging its vast agricultural resources and modern processing facilities to serve both domestic and international markets. Significant investments in large-scale, highly automated plants.

- China: Experiencing explosive growth in poultry consumption and domestic production, leading to massive investments in new processing plants and upgrades to meet the demands of its immense population and rapidly expanding middle class.

- India: A burgeoning market with immense potential, driven by rising disposable incomes, shifting dietary patterns, and increasing demand for affordable protein, leading to the development of a more organized poultry processing sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Poultry Processing Plant Market.- Global Processing Solutions

- Automated Food Systems

- Premier Meat Technology

- Advanced Robotics & Automation

- Integrated Food Equipment

- EcoPro Processing

- Innovatech Systems

- NextGen Food Machinery

- PureHarvest Technologies

- Streamline Poultry Automation

- Agri-Tech Processing

- Global Protein Solutions

- Vertex Food Equipment

- Horizon Processing Systems

- Universal Food Machinery

- Quantum Processing

- Zenith Automation

- Pioneer Food Tech

- Optimal Processing Tools

- Elite Processing Solutions

Frequently Asked Questions

What is the projected growth rate for the Poultry Processing Plant Market?

The Poultry Processing Plant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033, driven by increasing global demand for poultry products and technological advancements.

How is AI impacting the Poultry Processing Plant Market?

AI is significantly impacting the market by enhancing quality control through vision systems, optimizing production and yield, enabling predictive maintenance for machinery, and improving supply chain traceability, leading to increased efficiency and safety.

What are the primary drivers of growth in the Poultry Processing Plant Market?

Key drivers include increasing global poultry consumption, rising demand for processed and convenience poultry products, continuous technological advancements in automation and robotics, and stringent food safety regulations.

What are the main challenges faced by the Poultry Processing Plant Market?

Major challenges include high capital investment requirements, the risk of disease outbreaks like avian influenza, labor shortages and rising labor costs, and adherence to evolving food safety and environmental regulations.

Which regions offer the most significant growth opportunities for poultry processing plants?

The Asia Pacific region, particularly countries like China and India, along with Latin America and Africa, are offering the most significant growth opportunities due to rapid population growth, urbanization, and increasing disposable incomes.