Polyurethane Dispersion Market

Polyurethane Dispersion Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700828 | Last Updated : July 28, 2025 |

Format : ![]()

![]()

![]()

![]()

Polyurethane Dispersion Market Size

The Polyurethane Dispersion (PUD) market is a dynamic sector within the broader chemicals industry, characterized by its versatility and increasingly sustainable profile. PUDs are water-based polyurethane systems, offering an eco-friendly alternative to solvent-borne coatings and adhesives, driven by stringent environmental regulations and a growing preference for green technologies across various end-use industries. These dispersions leverage the robust performance characteristics of polyurethanes, including excellent adhesion, abrasion resistance, and flexibility, while mitigating the volatile organic compound (VOC) emissions associated with traditional solvent systems. This shift towards water-based solutions is a critical factor underpinning the market's robust expansion.

The market's expansion is further propelled by diverse application areas, ranging from high-performance coatings in automotive and construction sectors to specialized binders in textiles and leather. The inherent adaptability of PUDs allows for tailored formulations that meet specific performance requirements, such as enhanced durability for flooring, improved haptic properties for textiles, or superior bonding strength for adhesives. This continuous innovation in product development, coupled with an escalating demand for high-performance and environmentally responsible materials, positions the PUD market for sustained growth. Manufacturers are increasingly investing in research and development to create advanced PUDs with improved functionalities and broader applicability, further solidifying their market relevance.

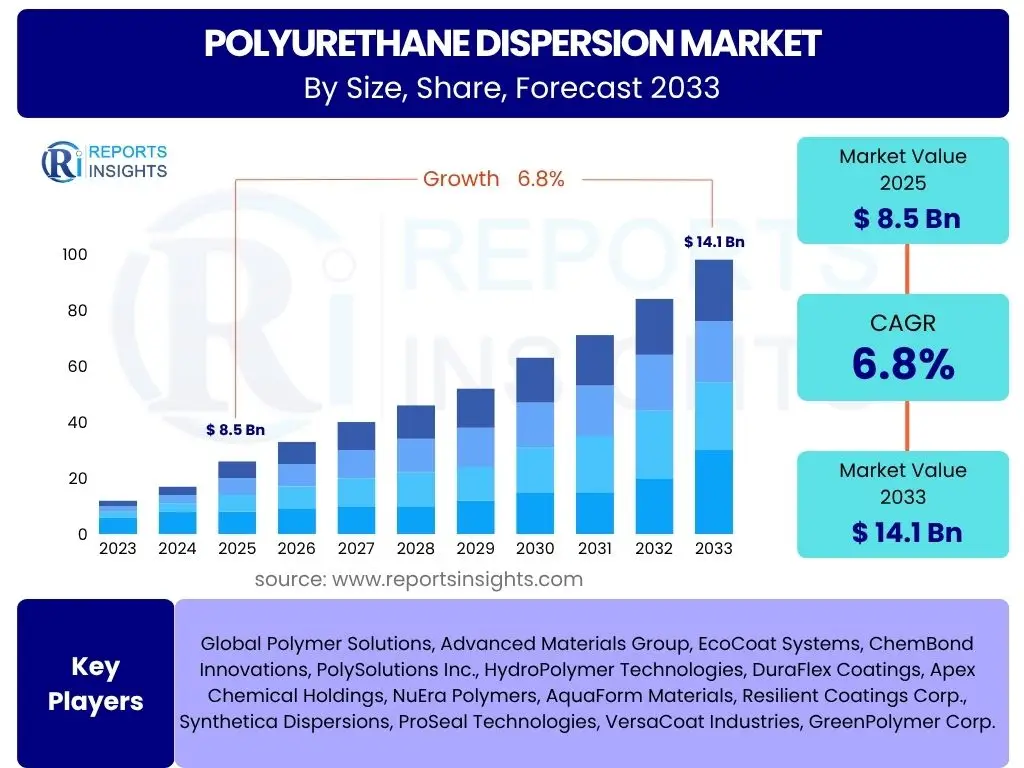

According to Reports Insights Consulting Pvt Ltd, The Polyurethane Dispersion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 8.5 Billion in 2025 and is projected to reach USD 14.1 Billion by the end of the forecast period in 2033.

Key Polyurethane Dispersion Market Trends & Insights

The Polyurethane Dispersion (PUD) market is currently shaped by several transformative trends, reflecting a global push towards sustainability, advanced material performance, and innovative application methodologies. Common user inquiries often revolve around the shift towards eco-friendly formulations, the increasing demand for water-based solutions, and the emergence of specialized PUDs for niche applications. Another significant area of interest is the impact of evolving regulatory landscapes on product development and market dynamics, particularly regarding VOC emissions and material safety. Users also frequently seek information on how PUDs are integrating into high-growth sectors such as electric vehicles, sustainable packaging, and advanced electronics, indicating a strong focus on future market opportunities and technological advancements.

- Growing adoption of bio-based and sustainable PUDs driven by environmental consciousness and regulatory pressures.

- Increasing demand for water-based PUDs as a substitute for solvent-borne systems to reduce VOC emissions.

- Technological advancements leading to high-performance PUDs with enhanced durability, flexibility, and adhesion properties.

- Expansion of PUD applications beyond traditional coatings, adhesives, sealants, and elastomers (CASE) into new areas like composites, medical devices, and 3D printing.

- Focus on developing PUDs with improved thermal and chemical resistance for demanding industrial applications.

- Rising integration of smart functionalities into PUD formulations, such as self-healing or anti-microbial properties.

AI Impact Analysis on Polyurethane Dispersion

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is beginning to profoundly influence various aspects of the Polyurethane Dispersion (PUD) market, from R&D and manufacturing processes to supply chain optimization and market analysis. User inquiries often highlight curiosity about how AI can accelerate new material discovery, optimize formulation development, and enhance predictive maintenance in production facilities. There is also significant interest in AI's role in improving supply chain resilience, forecasting demand with greater accuracy, and identifying emerging market trends. Common concerns include the initial investment required for AI implementation, data privacy, and the need for specialized skills, yet the overarching expectation is that AI will drive efficiency, reduce costs, and foster innovation across the PUD value chain.

- AI-driven material discovery and optimization: Accelerating the development of novel PUD formulations with desired properties by predicting molecular structures and performance.

- Predictive analytics for manufacturing: Optimizing production processes, identifying potential equipment failures, and enhancing quality control in PUD synthesis, leading to reduced downtime and waste.

- Supply chain optimization: Using AI algorithms to forecast demand, manage inventory, and optimize logistics for raw materials and finished PUD products, improving efficiency and reducing costs.

- Automated quality control: Implementing AI-powered vision systems for real-time defect detection and quality assessment in PUD coating applications, ensuring consistent product quality.

- Enhanced market analysis and forecasting: Utilizing AI to process vast datasets, identify emerging market trends, predict demand fluctuations, and inform strategic decision-making for PUD manufacturers.

Key Takeaways Polyurethane Dispersion Market Size & Forecast

Analyzing common user questions regarding the Polyurethane Dispersion (PUD) market size and forecast reveals a strong interest in the underlying growth drivers, the projected market value, and the long-term sustainability of this sector. Users frequently inquire about the primary factors contributing to market expansion, such as the increasing adoption of eco-friendly solutions and the diversification of application areas. There is also significant curiosity about the estimated market valuation at different points in the forecast period and the Compound Annual Growth Rate (CAGR), seeking to understand the investment potential and overall health of the market. Furthermore, questions often touch upon the impact of regulatory changes and technological innovations on the market's trajectory, highlighting a desire for comprehensive insights into future growth prospects and potential challenges.

- The Polyurethane Dispersion market is experiencing robust growth, projected to reach USD 14.1 Billion by 2033, driven significantly by the global push for sustainable and water-based chemical solutions.

- A key driver for this expansion is the increasing demand for environmentally friendly coatings, adhesives, sealants, and elastomers (CASE) across various industries.

- Technological advancements leading to enhanced performance characteristics and broader application versatility are crucial for market momentum.

- Emerging opportunities lie in the development of bio-based PUDs and their integration into niche applications such as medical devices and advanced textiles.

- The market's resilience against raw material price volatility and the navigation of stringent environmental regulations will be critical for sustained growth.

- Asia Pacific is anticipated to be a major growth engine, fueled by rapid industrialization and escalating demand from key end-use sectors.

Polyurethane Dispersion Market Drivers Analysis

The Polyurethane Dispersion (PUD) market is propelled by a confluence of powerful drivers, primarily stemming from the global shift towards sustainability and the continuous demand for high-performance materials. The increasing stringency of environmental regulations, particularly concerning Volatile Organic Compounds (VOCs) emissions, has created an imperative for industries to adopt greener alternatives. PUDs, being water-based, offer a compelling solution by significantly reducing VOC content compared to traditional solvent-borne systems, making them a preferred choice across various applications. This regulatory push, combined with a growing corporate and consumer preference for eco-friendly products, is fundamentally reshaping market dynamics and accelerating the transition to PUDs.

Beyond environmental considerations, the inherent versatility and superior performance attributes of PUDs contribute significantly to their market adoption. PUDs deliver excellent adhesion, abrasion resistance, chemical resistance, and flexibility, making them ideal for diverse applications in coatings, adhesives, sealants, and elastomers (CASE), textiles, leather, and automotive sectors. The expansion of these end-use industries, particularly in developing economies, further fuels the demand for PUDs. For instance, the burgeoning construction sector requires durable and sustainable coating solutions, while the automotive industry seeks lightweight and high-performance materials, all of which can be effectively addressed by advanced PUD formulations. Continuous innovation in PUD technology, leading to customized solutions for specific industrial needs, reinforces their market position.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing demand for eco-friendly coatings & adhesives | +1.2% | Global, particularly Europe & North America | 2025-2033 (Long-term) |

| Stringent environmental regulations on VOC emissions | +1.0% | Global, highly impactful in Europe & North America | 2025-2033 (Long-term) |

| Expansion of automotive & construction industries | +0.8% | Asia Pacific, North America, Europe | 2025-2033 (Medium-term) |

| Technological advancements in PUD formulations | +0.7% | Global | 2025-2033 (Continuous) |

Polyurethane Dispersion Market Restraints Analysis

Despite the robust growth trajectory, the Polyurethane Dispersion (PUD) market faces several restraints that could impede its full potential. One of the primary challenges is the volatility and fluctuation in the prices of key raw materials, such as isocyanates and polyols. These raw materials are largely derived from petrochemicals, making their supply and pricing susceptible to geopolitical events, crude oil price swings, and supply-chain disruptions. Such price instability can significantly impact the production costs of PUDs, subsequently affecting profit margins for manufacturers and potentially leading to higher end-product prices, which could dampen demand or shift preference towards alternative, more stable-priced materials. This unpredictability necessitates robust supply chain management and strategic sourcing to mitigate financial risks.

Another significant restraint stems from the performance gap that, in some niche applications, still exists between water-based PUDs and their solvent-borne counterparts. While PUD technology has advanced considerably, certain high-performance industrial applications still rely on the superior durability, drying times, or adhesion properties offered by solvent-based polyurethanes. Overcoming this perception and demonstrating equivalent or superior performance of PUDs in all demanding scenarios requires continuous research and development, which can be resource-intensive. Furthermore, the higher initial investment costs associated with converting existing manufacturing infrastructure from solvent-based to water-based systems can be a barrier for some smaller or less capital-intensive players, limiting broader adoption.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in raw material prices | -0.8% | Global | 2025-2033 (Ongoing) |

| Performance limitations in specific high-end applications | -0.5% | Global | 2025-2030 (Short to Medium-term) |

| High initial investment for manufacturing transitions | -0.4% | Developing regions | 2025-2028 (Short-term) |

Polyurethane Dispersion Market Opportunities Analysis

The Polyurethane Dispersion (PUD) market is ripe with significant opportunities, primarily driven by the escalating global demand for sustainable and bio-based materials. As environmental consciousness grows and regulatory frameworks become more stringent, there is an immense push towards developing and adopting PUDs derived from renewable resources rather than petrochemicals. This trend not only aligns with sustainability goals but also offers a pathway to reduce reliance on volatile fossil fuel-derived raw materials, potentially stabilizing production costs in the long term. Innovations in bio-based polyols and isocyanates are opening new avenues for PUD manufacturers, allowing them to cater to a burgeoning market segment that prioritizes green chemistry and circular economy principles.

Further opportunities emerge from the continuous expansion into novel and high-growth application areas. While PUDs have traditionally excelled in coatings and adhesives, their versatility is increasingly being recognized in sectors such as medical devices, advanced textiles, and 3D printing. In medical applications, the biocompatibility and flexibility of PUDs make them suitable for implants, wound dressings, and medical tubing. In the textile industry, PUDs offer enhanced performance characteristics for smart fabrics, protective wear, and functional apparel. Moreover, the burgeoning field of additive manufacturing (3D printing) presents a unique opportunity for PUDs to serve as binders or base materials, enabling the creation of complex geometries with superior mechanical properties. These diverse and evolving applications underscore the market's potential for significant diversification and value creation.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising demand for bio-based PUDs | +1.5% | Global, particularly Europe & North America | 2025-2033 (Long-term) |

| Emerging applications in medical devices & 3D printing | +1.0% | North America, Europe, Asia Pacific | 2028-2033 (Medium to Long-term) |

| Untapped potential in sustainable packaging solutions | +0.9% | Global | 2025-2033 (Medium to Long-term) |

Polyurethane Dispersion Market Challenges Impact Analysis

The Polyurethane Dispersion (PUD) market, while promising, contends with distinct challenges that could influence its growth trajectory. A significant hurdle is the complexity and cost associated with research and development of new PUD formulations, particularly those aiming for enhanced performance or bio-based compositions. Developing PUDs that match or surpass the properties of traditional solvent-based polyurethanes, while maintaining environmental compliance and cost-effectiveness, requires substantial investment in advanced polymer chemistry and process engineering. This R&D intensity can create high barriers to entry for new players and extend time-to-market for innovative products, potentially slowing down the pace of widespread adoption in certain demanding applications.

Furthermore, the market faces challenges related to the disposal and end-of-life management of PUD-containing products. While PUDs are inherently more environmentally friendly during application due to lower VOCs, the recyclability and biodegradability of the final polyurethane product remain complex issues, particularly for cross-linked systems. This presents a challenge in the context of a growing circular economy paradigm, where product lifecycle management is paramount. Addressing these concerns requires collaborative efforts across the value chain, from raw material suppliers to end-product manufacturers, to develop more sustainable end-of-life solutions for polyurethane materials. Additionally, the increasing global competition and the need to differentiate products in a crowded market segment pose ongoing strategic challenges for PUD manufacturers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High R&D costs for advanced formulations | -0.7% | Global | 2025-2033 (Ongoing) |

| Complexities in recyclability & end-of-life management | -0.6% | Global, particularly Europe | 2028-2033 (Long-term) |

| Intense competition from alternative technologies | -0.5% | Global | 2025-2030 (Medium-term) |

Polyurethane Dispersion Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Polyurethane Dispersion (PUD) market, covering historical data, current market dynamics, and future projections. The scope includes a detailed examination of market size, growth drivers, restraints, opportunities, and challenges influencing the industry. It offers a thorough segmentation analysis by type, application, and end-use industry, alongside a comprehensive regional outlook highlighting key market trends and growth prospects across major geographical areas. The report also profiles leading market players, offering insights into their strategic initiatives, product portfolios, and competitive positioning, all aimed at providing stakeholders with actionable intelligence for informed decision-making.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 14.1 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Polymer Solutions, Advanced Materials Group, EcoCoat Systems, ChemBond Innovations, PolySolutions Inc., HydroPolymer Technologies, DuraFlex Coatings, Apex Chemical Holdings, NuEra Polymers, AquaForm Materials, Resilient Coatings Corp., Synthetica Dispersions, ProSeal Technologies, VersaCoat Industries, GreenPolymer Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Polyurethane Dispersion (PUD) market is extensively segmented to provide a granular view of its diverse applications, types, and end-use industries. This segmentation is crucial for understanding the specific dynamics within each category, identifying high-growth areas, and recognizing the evolving preferences of various industrial consumers. By analyzing the market across these dimensions, stakeholders can pinpoint lucrative opportunities, tailor product development to meet specific demands, and refine market entry strategies. The detailed breakdown highlights the versatility of PUDs and their adaptability to a wide array of functional requirements, from enhancing durability in construction materials to providing soft touch finishes in textiles, thereby underpinning their broad market appeal.

The segmentation by type, such as anionic, cationic, and non-ionic PUDs, reflects differences in their chemical structure and performance characteristics, influencing their suitability for distinct applications. For instance, anionic PUDs are widely used in coatings due to their excellent film-forming properties, while cationic PUDs might find use in specialized adhesive formulations. Application-based segmentation, encompassing coatings, adhesives, sealants, elastomers, textiles, and others, illustrates the primary end-uses and their respective market sizes and growth rates. Further, the breakdown by end-use industry, including automotive, construction, furniture, and footwear, showcases the vertical integration of PUDs and the sector-specific demands that drive their consumption. This multi-faceted segmentation provides a comprehensive framework for assessing the PUD market's complex structure and future potential.

- By Type:

- Anionic PUDs: Dominant due to versatility and compatibility.

- Cationic PUDs: Niche applications requiring specific adhesion.

- Non-ionic PUDs: Used in formulations sensitive to ionic interactions.

- By Application:

- Coatings: Largest segment, covering automotive, wood, industrial, and decorative coatings.

- Adhesives & Sealants: Growing demand in construction, packaging, and automotive.

- Elastomers: Used in flexible and durable components.

- Textiles & Leather: For synthetic leather, coatings, and binders.

- Others: Including medical devices, composites, and 3D printing.

- By End-Use Industry:

- Automotive & Transportation: For interior and exterior coatings, adhesives.

- Building & Construction: Flooring, roofing, wall coatings, sealants.

- Furniture & Wood: Wood coatings, lacquers, laminates.

- Footwear & Apparel: Shoe adhesives, textile coatings, synthetic leather.

- Packaging: Food packaging coatings, flexible packaging adhesives.

- Electronics: Encapsulants, protective coatings.

- Others: Industrial, marine, healthcare.

Regional Highlights

- North America: This region demonstrates a mature but steadily growing market for PUDs, driven by stringent environmental regulations encouraging the shift towards water-based solutions and continuous innovation in performance-enhancing formulations. The automotive, construction, and furniture industries are key demand drivers, with a strong focus on sustainable and high-quality products. Investment in research and development for bio-based PUDs is also notable, positioning North America as a hub for advanced PUD technologies.

- Europe: Europe is a frontrunner in the adoption of eco-friendly and sustainable PUDs, propelled by the REACH regulations and the European Green Deal initiatives, which mandate reduced VOC emissions and promote circular economy principles. The region's automotive, textile, and industrial coatings sectors are significant consumers, with a strong emphasis on high-performance and specialty PUDs. Germany, France, and the UK are key markets, characterized by advanced manufacturing capabilities and a strong commitment to green chemistry.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the PUD market, fueled by rapid industrialization, urbanization, and increasing disposable incomes, particularly in countries like China, India, Japan, and South Korea. The expanding construction, automotive, and consumer goods industries are driving robust demand for coatings, adhesives, and sealants. While environmental regulations are becoming stricter, the sheer volume of manufacturing activity and the emerging middle class are key factors contributing to the region's dominant market share and high growth rate.

- Latin America: This region presents emerging opportunities for PUD manufacturers, largely due to developing industrial bases and increasing foreign investments in manufacturing sectors like automotive and construction. Brazil and Mexico are leading markets, experiencing a gradual shift towards more sustainable chemical solutions. Economic stability and regulatory developments will play a crucial role in accelerating PUD adoption in the region.

- Middle East and Africa (MEA): The PUD market in MEA is in its nascent stages but shows potential, primarily driven by large-scale infrastructure projects and diversification efforts in countries like Saudi Arabia and UAE. The construction sector is the dominant end-user, with a growing awareness of environmentally compliant building materials. Investment in local manufacturing capabilities and rising environmental consciousness are expected to bolster PUD demand in the coming years.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyurethane Dispersion Market.- Global Polymer Solutions

- Advanced Materials Group

- EcoCoat Systems

- ChemBond Innovations

- PolySolutions Inc.

- HydroPolymer Technologies

- DuraFlex Coatings

- Apex Chemical Holdings

- NuEra Polymers

- AquaForm Materials

- Resilient Coatings Corp.

- Synthetica Dispersions

- ProSeal Technologies

- VersaCoat Industries

- GreenPolymer Corp.

Frequently Asked Questions

What is Polyurethane Dispersion (PUD)?

Polyurethane Dispersion (PUD) is a water-based polyurethane system where polyurethane polymers are dispersed in water rather than organic solvents. PUDs are recognized for their low volatile organic compound (VOC) content, making them an environmentally friendly alternative for coatings, adhesives, and other applications, offering excellent durability, flexibility, and adhesion.

What are the primary drivers of the Polyurethane Dispersion market growth?

Key drivers include stringent environmental regulations promoting low VOC solutions, increasing demand for eco-friendly products across various industries, the expanding automotive and construction sectors, and continuous technological advancements improving PUD performance and versatility.

Which applications heavily utilize Polyurethane Dispersion?

PUDs are extensively used in coatings for automotive, wood, and industrial applications; adhesives and sealants for construction and packaging; textiles and leather for synthetic leathers and performance fabrics; and elastomers for flexible components. Emerging applications include medical devices and 3D printing.

What is the market size and projected growth rate for Polyurethane Dispersion?

The Polyurethane Dispersion market is estimated at USD 8.5 Billion in 2025 and is projected to reach USD 14.1 Billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period.

What are the key regional trends in the PUD market?

Asia Pacific is the fastest-growing region due to rapid industrialization and manufacturing expansion. Europe leads in sustainable PUD adoption due to strict environmental regulations, while North America focuses on innovation and high-performance applications. Latin America and MEA are emerging markets driven by infrastructure development.