Plow Market

Plow Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704527 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Plow Market Size

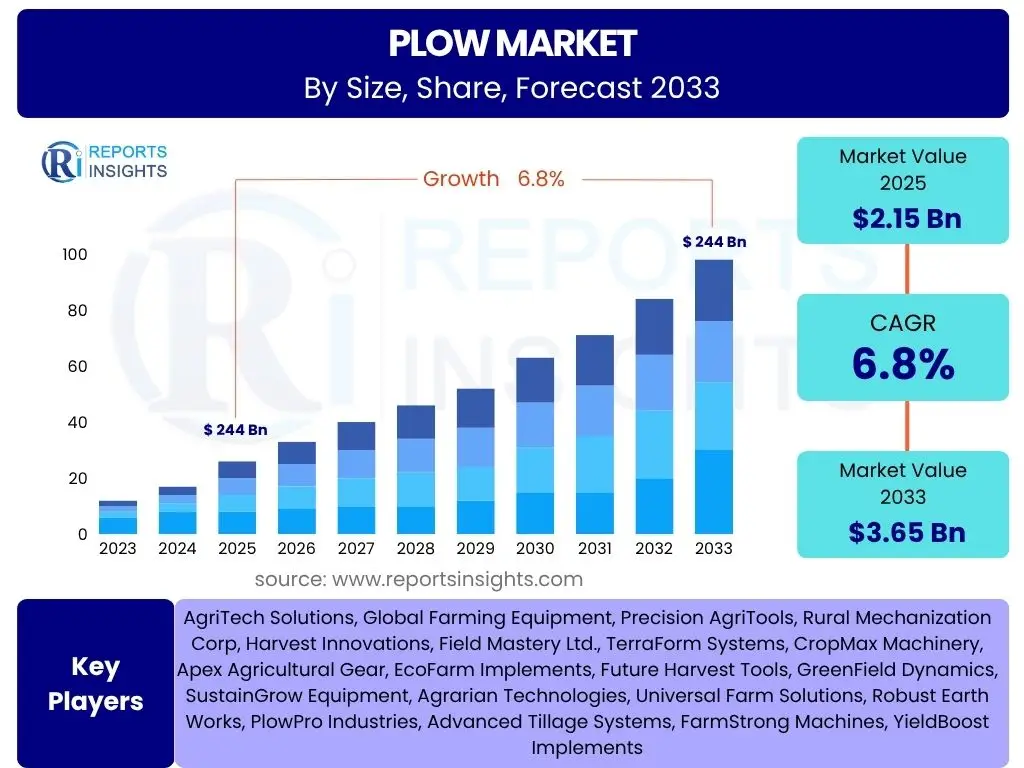

According to Reports Insights Consulting Pvt Ltd, The Plow Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 2.15 Billion in 2025 and is projected to reach USD 3.65 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the increasing global demand for food, necessitating enhanced agricultural productivity and efficiency. As populations continue to rise, there is an escalating pressure on agricultural sectors worldwide to maximize crop yields, which directly fuels the demand for advanced and efficient tillage equipment like plows. Modern plows contribute significantly to soil preparation, ensuring optimal conditions for planting and improving overall farm output.

The expansion of arable land in developing economies, coupled with government initiatives promoting agricultural mechanization, further bolsters the market's growth. Farmers are increasingly adopting modern farming techniques and machinery to overcome labor shortages, reduce operational costs, and improve cultivation quality. This shift towards mechanization, particularly in regions where traditional farming methods are prevalent, provides a substantial impetus for the plow market. Additionally, the replacement cycle of aging agricultural machinery and the introduction of technologically advanced plows with features like precision farming compatibility and reduced fuel consumption are key factors sustaining market expansion throughout the forecast period.

Key Plow Market Trends & Insights

The plow market is undergoing significant transformation, driven by a confluence of technological advancements, environmental considerations, and shifting agricultural practices. A prominent trend is the increasing adoption of smart and precision agriculture technologies, integrating plows with GPS-guided systems, sensors, and data analytics to optimize tillage operations. This allows farmers to achieve precise furrow depth, consistent seedbed preparation, and reduced soil compaction, leading to improved yields and resource efficiency. Another key trend is the growing demand for conservation tillage practices, such as minimum tillage and no-till farming, which are influencing the design and sales of specific plow types like chisel plows and subsoilers that disturb the soil less while still addressing compaction issues.

Furthermore, there is a clear move towards more sustainable and eco-friendly plowing solutions. Manufacturers are focusing on developing plows that minimize fuel consumption, reduce emissions, and preserve soil health through less aggressive tilling. Electrification and alternative power sources are emerging, albeit slowly, as long-term trends aimed at reducing agriculture's carbon footprint. The market also observes an increased preference for versatile and multi-functional plows that can perform various tasks, offering greater operational flexibility to farmers. Lastly, the consolidation of agricultural land and the rise of large-scale commercial farming operations are driving demand for larger, more robust, and highly automated plowing equipment capable of covering extensive areas efficiently.

- Integration of precision agriculture and GPS-guided plowing systems.

- Rising adoption of conservation tillage methods like minimum and no-till.

- Development of fuel-efficient and environmentally friendly plow designs.

- Increasing demand for versatile and multi-functional plowing equipment.

- Automation and autonomy features in advanced plow models.

- Focus on soil health preservation and erosion control through optimized tillage.

AI Impact Analysis on Plow

The integration of Artificial Intelligence (AI) into agricultural machinery, including plows, is poised to revolutionize tillage practices by enhancing efficiency, precision, and sustainability. Common user questions related to AI's impact on plows often revolve around autonomous operation, predictive maintenance, and data-driven optimization. AI-powered systems can enable plows to operate autonomously, navigating fields with unparalleled accuracy, optimizing turns, and adjusting plowing parameters in real-time based on soil conditions detected by integrated sensors. This not only reduces the need for manual labor but also minimizes human error, leading to more consistent and effective soil preparation. The ability of AI to process vast amounts of data from soil sensors, weather forecasts, and historical yield data allows for dynamic adjustments to depth, angle, and speed, ensuring optimal conditions for crop growth across varying field terrains.

Beyond autonomous functionality, AI significantly contributes to predictive maintenance for plows, addressing user concerns about equipment downtime and operational costs. AI algorithms can analyze operational data, such as vibration patterns, engine performance, and wear on plowshares, to predict potential component failures before they occur. This enables farmers to schedule maintenance proactively, reducing unexpected breakdowns, extending equipment lifespan, and minimizing costly repair interventions. Moreover, AI is instrumental in optimizing resource utilization; by precisely controlling the plowing process, it can reduce fuel consumption, minimize unnecessary passes, and prevent over-tilling, which preserves soil structure and reduces environmental impact. The long-term implications include increased farm profitability, enhanced sustainability, and a shift towards more intelligent and adaptive agricultural systems where plows are not just mechanical tools but smart, data-driven implements.

- Autonomous plowing operations for increased efficiency and reduced labor.

- Predictive maintenance analytics for enhanced equipment reliability and lifespan.

- Real-time optimization of plowing parameters based on soil data and field conditions.

- Improved fuel efficiency and reduced environmental footprint through precise tillage.

- Data-driven decision-making for optimal furrow depth, angle, and speed.

- Enhanced safety features and reduced human error in field operations.

Key Takeaways Plow Market Size & Forecast

The Plow Market is set for robust growth, with a projected Compound Annual Growth Rate (CAGR) of 6.8% from 2025 to 2033, reaching USD 3.65 Billion by the end of the forecast period. This significant expansion underscores the critical role of tillage equipment in global agriculture's drive towards higher productivity and efficiency. A key takeaway is the consistent demand for plows, fueled by an expanding global population that necessitates increased food production and the ongoing mechanization of farming practices across various regions, particularly in emerging economies. The forecast highlights a sustained investment in agricultural machinery as farmers seek to optimize yields, reduce labor dependency, and adopt modern farming techniques to remain competitive and profitable in a dynamic agricultural landscape.

Another crucial insight is the evolving nature of plow technology, moving beyond traditional designs to incorporate advanced features and digital integration. The market's growth is not merely about volume but also about value, driven by the adoption of precision agriculture capabilities, AI integration for autonomous operations, and solutions focused on sustainability and soil health. This technological shift presents significant opportunities for manufacturers developing innovative, energy-efficient, and data-enabled plows. Furthermore, the regional disparities in agricultural development will continue to shape market dynamics, with Asia Pacific and Latin America emerging as high-growth regions due to large agricultural bases and increasing mechanization rates, while mature markets in North America and Europe will focus on replacement demand and technological upgrades. Understanding these trends is vital for stakeholders to strategically position themselves for long-term success.

- Strong market growth anticipated at 6.8% CAGR, reaching USD 3.65 Billion by 2033.

- Global food demand and agricultural mechanization are primary growth drivers.

- Technological advancements, including precision agriculture and AI, are key value propositions.

- Emerging economies offer substantial growth opportunities for new equipment sales.

- Developed markets focus on replacement demand and adoption of high-tech solutions.

- Sustainability and soil health considerations are influencing product development.

Plow Market Drivers Analysis

The Plow Market is propelled by several robust drivers that collectively contribute to its positive growth trajectory. Foremost among these is the ever-increasing global population, which directly translates into a higher demand for food and agricultural produce. To meet this escalating demand, farmers worldwide are compelled to enhance productivity and optimize their farming operations, leading to greater adoption of advanced agricultural machinery like plows. Additionally, government initiatives and subsidies aimed at promoting agricultural mechanization, particularly in developing countries, play a crucial role. These programs often provide financial assistance, training, and incentives for farmers to invest in modern equipment, thereby boosting the market for plows. The continuous evolution of agricultural technology, including the development of more efficient and sophisticated plows capable of better soil preparation and reduced fuel consumption, also acts as a significant driver, encouraging farmers to upgrade their existing machinery for improved operational efficiency and yield.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Population & Food Demand | +1.5% | Global | Long-term (2025-2033) |

| Advancements in Agricultural Mechanization | +1.2% | Asia Pacific, Latin America, Africa | Mid-term (2025-2029) |

| Government Support & Subsidies for Agriculture | +1.0% | India, China, Brazil, Sub-Saharan Africa | Long-term (2025-2033) |

| Shift Towards Modern Farming Practices | +0.8% | Global, particularly emerging economies | Mid-term (2025-2029) |

Plow Market Restraints Analysis

Despite the positive growth outlook, the Plow Market faces certain restraints that could impede its full potential. A primary challenge is the high initial capital investment required for purchasing modern and technologically advanced plows. Small and marginal farmers, particularly in developing regions, may find it difficult to afford such equipment, thus limiting market penetration. Fluctuations in raw material prices, such as steel and other metals, directly impact manufacturing costs, leading to increased product prices and potentially dampening demand. Additionally, environmental regulations pertaining to soil conservation and sustainable farming practices can sometimes restrict the aggressive use of certain plow types, promoting alternative tillage methods that may reduce the demand for traditional plows. The fragmentation of agricultural landholdings in many parts of the world also poses a significant restraint, as large, efficient plows are less viable for small, disjointed plots, favoring smaller, less expensive equipment or manual labor.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment Cost of Equipment | -0.9% | Developing Economies (e.g., Africa, Southeast Asia) | Long-term (2025-2033) |

| Fluctuating Raw Material Prices | -0.7% | Global | Short-term to Mid-term (2025-2027) |

| Environmental Regulations & Conservation Tillage Adoption | -0.6% | Europe, North America | Mid-term (2025-2029) |

| Land Fragmentation in Agricultural Regions | -0.5% | India, China, parts of Europe | Long-term (2025-2033) |

Plow Market Opportunities Analysis

Significant opportunities exist within the Plow Market that manufacturers and stakeholders can leverage for future growth. The increasing focus on precision agriculture and smart farming technologies presents a major avenue for innovation. Developing plows integrated with GPS, sensors, and data analytics capabilities that enable variable-rate tillage, real-time soil analysis, and autonomous operation will cater to the growing demand for highly efficient and data-driven farming. Expanding into emerging markets, particularly in Asia Pacific, Latin America, and Africa, where agricultural mechanization is still in nascent stages, offers substantial potential for new equipment sales. These regions are witnessing a rapid transformation in farming practices, driven by government support and the need to improve food security. Furthermore, the development of eco-friendly and energy-efficient plows aligns with global sustainability goals, opening doors for market differentiation and capturing segments of environmentally conscious farmers. Lastly, offering comprehensive after-sales services, including maintenance, spare parts, and training, can foster customer loyalty and generate recurring revenue streams.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration of Precision Agriculture & Smart Farming Tech | +1.3% | North America, Europe, Developed Asia | Long-term (2025-2033) |

| Expansion into Emerging Agricultural Markets | +1.1% | Asia Pacific, Latin America, Africa | Mid-term to Long-term (2025-2033) |

| Development of Eco-friendly & Energy-efficient Plows | +0.9% | Global, especially Europe & North America | Mid-term (2025-2029) |

| Focus on After-Sales Services & Support | +0.7% | Global | Long-term (2025-2033) |

Plow Market Challenges Impact Analysis

The Plow Market faces several challenges that require strategic navigation from industry players. One significant challenge is the increasing intensity of competition from alternative tillage methods, such as no-till drills and direct seeders, which offer benefits like reduced soil erosion and lower fuel consumption, potentially diminishing the demand for traditional plows. Supply chain disruptions, often triggered by geopolitical events, natural disasters, or pandemics, can severely impact manufacturing and distribution, leading to production delays and increased costs. Climate change and its unpredictable effects, including erratic weather patterns and prolonged droughts or floods, can directly affect planting seasons and soil conditions, altering the immediate demand for plowing equipment. Lastly, farmer adoption resistance to new, high-tech plows, particularly in regions where traditional farming practices are deeply entrenched or where technological literacy is low, can slow down the market's progression and the uptake of innovative solutions. Overcoming these challenges will require robust R&D, resilient supply chain management, and effective farmer education initiatives.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Competition from Alternative Tillage Methods | -0.8% | North America, Europe, parts of Asia Pacific | Long-term (2025-2033) |

| Supply Chain Disruptions | -0.7% | Global | Short-term to Mid-term (2025-2027) |

| Impacts of Climate Change on Agriculture | -0.6% | Global, particularly vulnerable regions | Long-term (2025-2033) |

| Farmer Adoption Resistance to New Technologies | -0.5% | Developing Economies | Long-term (2025-2033) |

Plow Market - Updated Report Scope

This comprehensive report delves into the intricate dynamics of the global Plow Market, offering an in-depth analysis of its current size, historical performance, and future growth projections up to 2033. It provides a detailed examination of market trends, drivers, restraints, opportunities, and challenges that collectively shape the industry landscape. The report also highlights the profound impact of Artificial Intelligence on plow technology and agricultural practices. Through meticulous segmentation, it breaks down the market by various dimensions, including product type, application, power source, farm size, and sales channels, enabling stakeholders to pinpoint specific areas of growth and investment. Furthermore, a thorough regional analysis identifies key geographical markets and their unique characteristics, while profiling top industry players offers insights into the competitive environment. This report serves as an essential resource for businesses, investors, and policymakers seeking to understand and capitalize on the evolving opportunities within the plow industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.65 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | AgriTech Solutions, Global Farming Equipment, Precision AgriTools, Rural Mechanization Corp, Harvest Innovations, Field Mastery Ltd., TerraForm Systems, CropMax Machinery, Apex Agricultural Gear, EcoFarm Implements, Future Harvest Tools, GreenField Dynamics, SustainGrow Equipment, Agrarian Technologies, Universal Farm Solutions, Robust Earth Works, PlowPro Industries, Advanced Tillage Systems, FarmStrong Machines, YieldBoost Implements |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Plow Market is meticulously segmented to provide a granular understanding of its diverse components and drivers. These segments allow for a comprehensive analysis of market dynamics across different product types, applications, power sources, farm sizes, sales channels, and end-use sectors. Each segment represents distinct market demands, technological preferences, and regional adoption patterns. For instance, the market for moldboard plows continues to be robust for primary tillage, while disc plows are preferred in areas with heavy or sticky soils. The increasing emphasis on sustainable farming practices has also boosted the demand for chisel plows and subsoilers that promote conservation tillage. Understanding these distinctions is crucial for manufacturers to tailor their product offerings and for investors to identify high-potential niches within the broader market.

Furthermore, the segmentation by application highlights the varied roles of plows beyond traditional crop production, extending into specialized agricultural domains like vineyards and orchards, as well as landscaping and gardening, each with specific requirements for size, maneuverability, and precision. The distinction between tractor-mounted and self-propelled plows reflects the evolution of farm mechanization, with self-propelled units gaining traction among large-scale commercial operations seeking autonomy and efficiency. Analyzing the market by farm size allows for an appreciation of the different needs of small, medium, and large farms, from basic, cost-effective models to highly automated, robust machinery. The sales channel segmentation, between OEM and aftermarket, provides insights into distribution strategies and the importance of spare parts and service networks. Finally, understanding the end-use breakdown between commercial farms, individual farmers, and governmental/institutional buyers reveals varied purchasing behaviors and procurement processes, offering a holistic view of the market's structure.

- By Type:

- Moldboard Plows

- Disc Plows

- Chisel Plows

- Subsoilers

- Rotary Plows

- Reversible Plows

- Offset Plows

- By Application:

- Agricultural (Crop Production, Vineyard, Orchard)

- Landscaping and Gardening

- Specialty Applications

- By Power Source:

- Tractor-Mounted Plows

- Self-Propelled Plows

- Animal-Drawn Plows

- By Farm Size:

- Small Farms

- Medium Farms

- Large Farms

- By Sales Channel:

- OEM

- Aftermarket

- By End-Use:

- Commercial Farms

- Individual Farmers

- Government & Institutions

Regional Highlights

- North America: This region represents a mature market characterized by large-scale commercial farming, high adoption of advanced agricultural machinery, and a strong emphasis on precision agriculture. Demand is driven by replacement cycles, technological upgrades, and the increasing integration of AI and automation into plowing operations. The United States and Canada are key contributors due to extensive arable land and significant R&D investments in smart farming solutions.

- Europe: The European market is highly influenced by stringent environmental regulations and a strong focus on sustainable and conservation tillage practices. This drives demand for specialized plows that minimize soil disturbance and improve soil health. Western European countries lead in adopting technologically advanced and eco-friendly plows, while Eastern European nations are gradually increasing mechanization.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market for plows, propelled by a vast agricultural land base, increasing population leading to higher food demand, and robust government support for agricultural mechanization. Countries like China, India, and Southeast Asian nations are undergoing rapid transformation from traditional farming to modern, mechanized methods, fueling substantial demand for new equipment.

- Latin America: This region, particularly Brazil and Argentina, is experiencing significant growth due to the expansion of large-scale commercial farming, increasing agricultural exports, and a rising awareness of modern farming techniques. The demand for robust and efficient plows is strong as farmers seek to improve productivity and manage extensive landholdings.

- Middle East and Africa (MEA): The MEA market for plows is in its nascent stages but shows promising growth potential. Driven by efforts to enhance food security, diversify economies away from oil, and improve agricultural productivity, governments in this region are investing in modern farming equipment and infrastructure. Sub-Saharan Africa, in particular, offers untapped opportunities for basic to mid-range plowing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plow Market.- AgriTech Solutions

- Global Farming Equipment

- Precision AgriTools

- Rural Mechanization Corp

- Harvest Innovations

- Field Mastery Ltd.

- TerraForm Systems

- CropMax Machinery

- Apex Agricultural Gear

- EcoFarm Implements

- Future Harvest Tools

- GreenField Dynamics

- SustainGrow Equipment

- Agrarian Technologies

- Universal Farm Solutions

- Robust Earth Works

- PlowPro Industries

- Advanced Tillage Systems

- FarmStrong Machines

- YieldBoost Implements

Frequently Asked Questions

What is the projected growth rate for the Plow Market?

The Plow Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033, driven by increasing global food demand and agricultural mechanization.

How is AI impacting the plow industry?

AI is transforming the plow industry by enabling autonomous plowing, predictive maintenance for machinery, and real-time optimization of tillage parameters based on field data, leading to enhanced efficiency and sustainability.

What are the primary drivers of the Plow Market's expansion?

Key drivers include the growing global population and subsequent demand for food, advancements in agricultural mechanization, supportive government policies and subsidies, and the increasing adoption of modern farming practices.

Which regions are leading in plow market growth?

Asia Pacific is expected to be the fastest-growing region due to increasing mechanization in countries like China and India, while North America and Europe lead in adopting advanced, precision-enabled plows.

What are the main types of plows covered in the market?

The market covers various types, including moldboard plows, disc plows, chisel plows, subsoilers, rotary plows, reversible plows, and offset plows, each suited for different soil conditions and agricultural practices.