Para aramid Fiber Market

Para aramid Fiber Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703024 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Para aramid Fiber Market Size

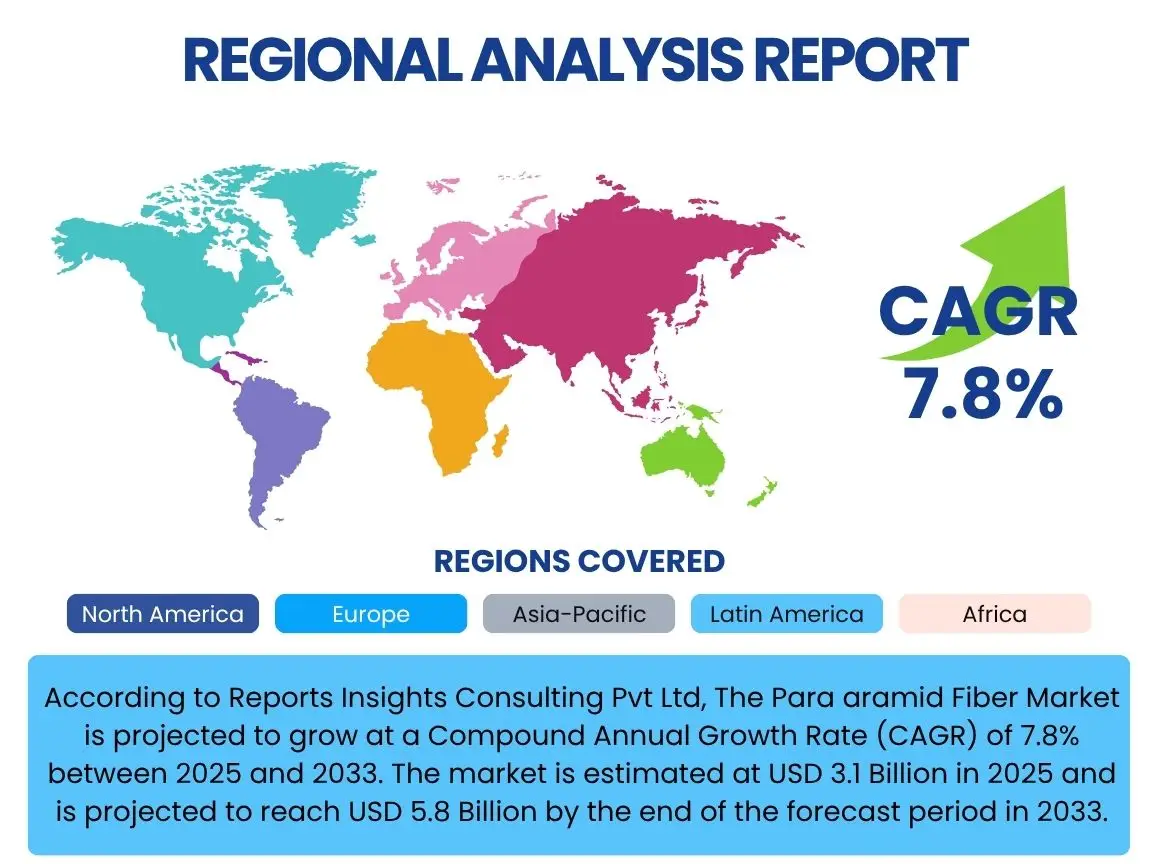

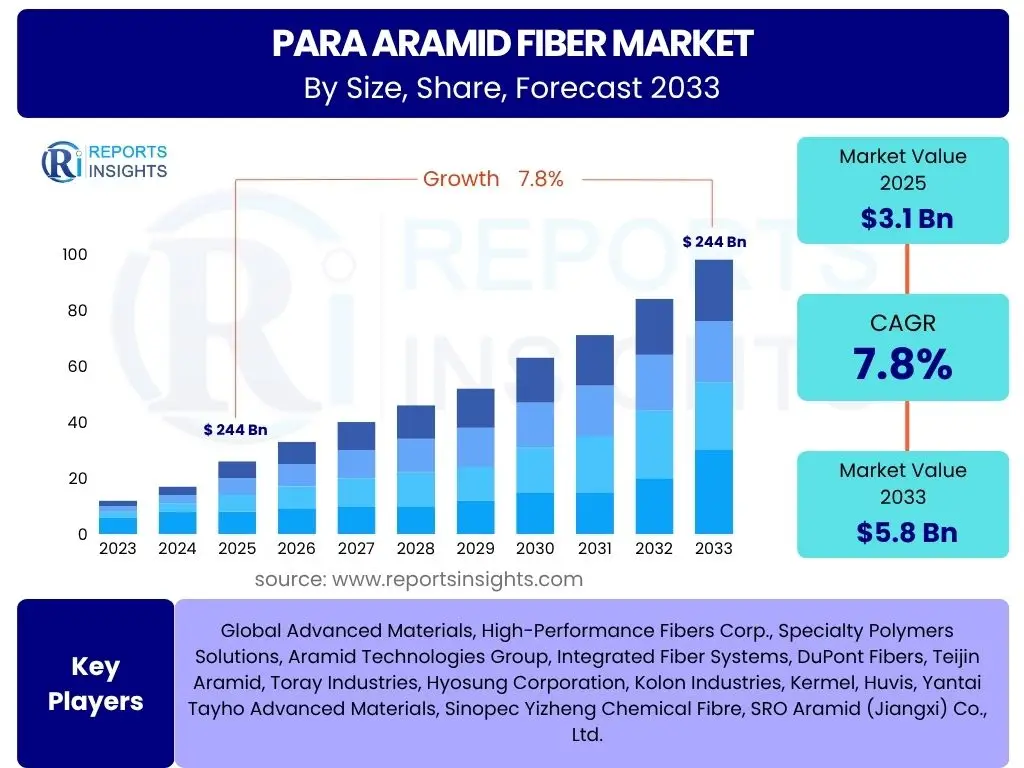

According to Reports Insights Consulting Pvt Ltd, The Para aramid Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033. The market is estimated at USD 3.1 Billion in 2025 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2033.

Key Para aramid Fiber Market Trends & Insights

User inquiries frequently highlight the increasing demand for high-performance materials across diverse industries, focusing on how this translates into the evolving Para aramid Fiber market. A significant trend identified is the relentless pursuit of lightweighting in the automotive and aerospace sectors, driven by fuel efficiency mandates and performance enhancements. This push directly favors Para aramid fibers due to their exceptional strength-to-weight ratio, enabling manufacturers to reduce overall vehicle weight without compromising structural integrity or safety. The integration of these fibers in advanced composites for electric vehicles (EVs) is also emerging as a pivotal area, addressing the unique structural and thermal management requirements of next-generation mobility solutions.

Another prominent area of interest concerns the expansion of protective applications and personal protective equipment (PPE), particularly in industries such as oil & gas, defense, law enforcement, and industrial safety. Heightened awareness regarding workplace safety and more stringent regulatory standards globally are propelling the adoption of Para aramid fibers for ballistic protection, cut-resistant gloves, and fire-retardant apparel. Furthermore, there have been growing discussions around the development of more sustainable production methods and recycling initiatives for Para aramid fibers, reflecting broader industry shifts towards environmental responsibility and circular economy principles. Innovations in fiber processing and composite manufacturing techniques are also trending, enabling new forms and functionalities that broaden the application scope of these advanced materials.

The market is also witnessing a surge in research and development activities aimed at enhancing the performance characteristics of Para aramid fibers, such as improved temperature resistance, chemical inertness, and adhesion to various matrices. This continuous innovation is crucial for addressing the evolving and increasingly complex demands of end-use applications. Regional market dynamics, particularly the rapid industrialization and infrastructure development in emerging economies, are shaping new demand centers for Para aramid-based solutions. The shift towards advanced manufacturing and smart materials also underscores a foundational trend influencing the market's trajectory, positioning Para aramid fibers as indispensable components in future high-tech applications.

- Increasing adoption in lightweight automotive and aerospace components for enhanced fuel efficiency.

- Rising demand for personal protective equipment (PPE) due to stringent safety regulations across industries.

- Growing integration into advanced composites for electric vehicles (EVs) and urban air mobility (UAM).

- Emphasis on sustainable production practices and recycling solutions for Para aramid waste.

- Technological advancements in fiber spinning and composite manufacturing techniques.

- Expansion into new applications such as high-performance sports equipment and infrastructure reinforcement.

AI Impact Analysis on Para aramid Fiber

User queries regarding the impact of Artificial Intelligence (AI) on the Para aramid Fiber market often revolve around its potential to revolutionize material discovery, manufacturing processes, and supply chain management. AI and machine learning algorithms are being increasingly applied in materials science to predict the properties of novel Para aramid fiber compositions, accelerating the research and development cycle. This involves analyzing vast datasets from experiments, simulations, and existing material libraries to identify optimal molecular structures and processing parameters, significantly reducing the time and cost associated with traditional trial-and-error methods. Such AI-driven approaches can lead to the development of Para aramid fibers with enhanced tensile strength, thermal stability, or specific functionalities tailored for niche applications, thereby expanding market opportunities and competitive advantages for manufacturers.

In manufacturing, AI's influence is notable in optimizing production efficiency, quality control, and predictive maintenance. AI-powered analytics can monitor real-time sensor data from production lines, identifying anomalies that indicate potential defects in the fiber or variations in process parameters. This allows for immediate adjustments, ensuring consistent product quality and minimizing waste. Predictive maintenance algorithms can forecast equipment failures, enabling proactive servicing and reducing costly downtime. Furthermore, AI can optimize energy consumption in the highly energy-intensive Para aramid production, contributing to cost savings and environmental sustainability. The integration of robotics and automation, often guided by AI, also enhances precision and speed in various stages of fiber processing and composite fabrication.

Beyond production, AI is transforming supply chain logistics for Para aramid fibers, from raw material procurement to product distribution. AI-driven predictive analytics can anticipate supply and demand fluctuations, optimize inventory levels, and enhance logistics routing, leading to more resilient and cost-effective supply chains. This is particularly crucial given the global nature of both raw material sourcing and end-product distribution for Para aramid fibers. Moreover, AI can assist in market analysis by processing large volumes of data on industry trends, customer preferences, and competitor activities, providing manufacturers with actionable insights for strategic decision-making and identifying emerging market opportunities. The net effect of AI integration is a more agile, efficient, and innovative Para aramid fiber industry, capable of responding rapidly to market demands and technological advancements.

- Accelerated material discovery and optimization through AI-driven simulations and data analysis.

- Enhanced manufacturing efficiency, quality control, and predictive maintenance in fiber production.

- Optimized supply chain management and logistics for raw materials and finished products.

- Improved energy consumption and resource utilization in manufacturing processes.

- AI-powered market analysis for identifying new application areas and strategic growth opportunities.

Key Takeaways Para aramid Fiber Market Size & Forecast

Common user questions regarding key takeaways from the Para aramid Fiber market size and forecast reveal a strong interest in understanding the core growth drivers and the long-term viability of this specialized material. A primary insight is the sustained robust growth expected through 2033, largely underpinned by an escalating demand from critical end-use industries. The inherent properties of Para aramid fibers, such as their exceptional strength-to-weight ratio, high temperature resistance, and ballistic protection capabilities, make them indispensable for applications where performance and safety are paramount. This intrinsic value proposition ensures a steady adoption rate, even amidst economic fluctuations, as industries continuously seek advanced material solutions.

Another significant takeaway is the pivotal role of regulatory frameworks and increasing safety consciousness in driving market expansion. Stricter standards for personal protection, industrial safety, and environmental impact in sectors like defense, aerospace, and automotive necessitate the use of materials like Para aramid fibers that can meet these elevated requirements. This regulatory push acts as a foundational driver, creating a persistent demand floor for high-performance aramid solutions. Furthermore, the market's trajectory is heavily influenced by ongoing innovation, with a focus on developing more cost-effective production methods and exploring novel applications. The ability to customize fiber properties for specific needs will be a key differentiator and growth enabler for manufacturers in the coming years.

The market forecast also highlights regional growth disparities, with Asia Pacific projected to be a major growth engine due to rapid industrialization, infrastructure development, and increasing defense spending in countries like China and India. While North America and Europe remain mature markets, they continue to drive demand through technological advancements and high-value applications. The shift towards lightweight, durable, and sustainable materials in modern engineering and manufacturing practices globally underscores the enduring relevance and strategic importance of Para aramid fibers. This indicates a positive outlook, characterized by continuous innovation, broadening application spectrums, and a strong dependency on the material's unique performance attributes for critical industrial and safety solutions.

- The Para aramid fiber market is projected for significant growth, driven by demand in high-performance applications.

- Key growth sectors include aerospace, automotive (especially EVs), defense, and personal protective equipment.

- Stringent safety regulations and the need for lightweight, high-strength materials are primary market accelerators.

- Asia Pacific is anticipated to be the fastest-growing region due to industrial expansion and defense investments.

- Technological advancements in fiber production and composite manufacturing are crucial for market expansion.

Para aramid Fiber Market Drivers Analysis

The Para aramid Fiber market is primarily driven by the escalating demand from end-use industries that require materials with superior performance characteristics under extreme conditions. The aerospace and defense sectors are significant consumers, driven by the continuous need for lightweight, high-strength composites for aircraft, ballistic protection, and military vehicles, which directly impacts fuel efficiency and operational safety. Similarly, the automotive industry, particularly with the advent of electric vehicles, increasingly relies on Para aramid fibers for structural components, battery housings, and interior parts to reduce weight, enhance safety, and improve thermal management. These applications leverage the fiber's exceptional tensile strength and impact resistance, contributing substantially to market growth.

Stringent regulatory frameworks concerning safety and environmental protection also act as a powerful market driver. Governments and international bodies are imposing stricter standards for personal protective equipment in industrial and hazardous environments, boosting the adoption of Para aramid fibers for fire-retardant clothing, cut-resistant gloves, and heat-protective gear. Furthermore, the global trend towards lightweighting in various applications, beyond just aerospace and automotive, such as in sporting goods and industrial machinery, creates a sustained demand for high-performance, low-density materials. The superior performance attributes of Para aramid fibers, coupled with their long lifespan, make them a preferred choice over conventional materials in demanding applications, fueling their market expansion.

Technological advancements in manufacturing processes and the exploration of new application areas further contribute to market growth. Innovations in spinning techniques and composite fabrication methods are enabling more efficient production and the creation of novel forms of Para aramid, such as short fibers for reinforcement in thermoplastics or pulp for friction materials. The growing urbanization and infrastructure development in emerging economies also indirectly stimulate demand for Para aramid fibers in civil engineering applications, such as bridge reinforcement and seismic retrofitting, where their high tensile strength and durability provide long-term structural integrity. These multifaceted drivers collectively contribute to the robust expansion of the Para aramid fiber market.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand from Automotive & Aerospace | +2.5% | North America, Europe, Asia Pacific (China, Japan) | Mid-term to Long-term |

| Rising Adoption in Personal Protective Equipment (PPE) | +1.8% | Global, particularly Industrially Developing Regions | Short-term to Mid-term |

| Growing Emphasis on Lightweighting and Fuel Efficiency | +1.5% | Global | Mid-term to Long-term |

| Advancements in Composite Manufacturing Technology | +1.2% | Europe, North America, Asia Pacific | Mid-term |

Para aramid Fiber Market Restraints Analysis

Despite robust growth prospects, the Para aramid Fiber market faces significant restraints, primarily stemming from its high manufacturing cost. The complex and energy-intensive production process, involving advanced polymerization techniques and specialized equipment, leads to a premium price for Para aramid fibers compared to conventional materials. This high cost can limit adoption in price-sensitive applications or industries where cost-performance trade-offs are critically evaluated. For instance, in some industrial applications or consumer goods, alternative materials, even if they offer slightly inferior performance, might be preferred due to their lower cost, thereby restricting the market penetration of Para aramid fibers.

Another major restraint is the volatility in raw material prices. The production of Para aramid fibers relies on specific chemical precursors, the prices of which can be subject to fluctuations based on global supply and demand dynamics, geopolitical factors, and crude oil prices. Such volatility can lead to unpredictable manufacturing costs for Para aramid fiber producers, impacting their profit margins and potentially deterring long-term investments in expanding production capacities. Furthermore, the limited number of suppliers for these specialized raw materials can create bottlenecks and supply chain vulnerabilities, exacerbating price instability and affecting the overall market's stability.

The availability of substitute materials, while not always offering identical performance, poses a competitive challenge. Materials like carbon fibers, glass fibers, and ultra-high molecular weight polyethylene (UHMWPE) fibers can serve as alternatives in certain applications, especially where the absolute highest performance of Para aramid is not strictly necessary or where cost considerations outweigh performance. For example, in some composite structures or protective gear, carbon fiber or UHMWPE might be chosen due to a different balance of properties and cost. Additionally, the challenge of recycling Para aramid fibers, primarily due to their thermoset nature and complex chemical structure, poses an environmental and economic hurdle. While research into recycling methods is ongoing, the lack of established, scalable recycling infrastructure currently limits their circularity, which could become a more significant restraint as sustainability mandates become stricter.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Manufacturing Cost | -1.5% | Global, particularly Cost-Sensitive Markets | Long-term |

| Volatility of Raw Material Prices | -1.0% | Global | Short-term to Mid-term |

| Availability of Substitute Materials | -0.8% | Global, Competitive Markets | Mid-term |

| Challenges in Recycling and Disposal | -0.5% | Developed Regions (Europe, North America) | Long-term |

Para aramid Fiber Market Opportunities Analysis

The Para aramid Fiber market is ripe with opportunities, particularly in the realm of new application development and diversification across emerging industrial sectors. As industries continue to evolve, the demand for materials that can withstand increasingly harsh environments and offer enhanced performance characteristics creates a fertile ground for Para aramid fibers. Emerging fields such as advanced robotics, drones, and future mobility solutions beyond traditional automotive and aerospace, are actively seeking lightweight yet robust materials, presenting significant untapped potential. The development of next-generation composite structures, where Para aramid fibers can be synergistically combined with other materials, also opens avenues for specialized, high-value applications that were previously unattainable.

Another substantial opportunity lies in the growing focus on sustainable and eco-friendly manufacturing processes within the Para aramid fiber industry. While traditional production methods are energy-intensive, research and development into green chemistry, bio-based precursors, and more efficient synthesis routes could significantly reduce the environmental footprint and appeal to a broader market segment prioritizing sustainability. Furthermore, the development of scalable and economically viable recycling technologies for end-of-life Para aramid products would not only address current disposal challenges but also create a circular economy model, potentially reducing raw material dependency and offering a competitive edge. These advancements could unlock new markets where environmental certifications and sustainable sourcing are critical purchasing criteria.

Geographic expansion, particularly into rapidly industrializing economies in Asia Pacific, Latin America, and parts of Africa, represents a significant growth opportunity. As these regions undergo infrastructure development, urbanization, and increasing industrialization, the demand for high-performance materials in construction, automotive manufacturing, and safety applications is set to surge. Localizing production or establishing strong distribution networks in these regions can enable companies to capitalize on rising demand and cater to specific regional market needs. Additionally, ongoing innovation in fiber modification, such as surface treatments or hybrid fiber compositions, can lead to tailored solutions for niche markets, enhancing performance attributes like adhesion to polymers or electrical conductivity, thereby creating entirely new market segments and reinforcing the Para aramid fiber market's long-term growth trajectory.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into New Applications (e.g., EVs, UAM, Advanced Robotics) | +2.0% | Global, with emphasis on Developed Economies | Mid-term to Long-term |

| Development of Sustainable Production and Recycling Methods | +1.5% | Europe, North America (Driven by Regulations) | Mid-term to Long-term |

| Emerging Market Growth (Asia Pacific, Latin America) | +1.3% | Asia Pacific (China, India), Latin America | Short-term to Long-term |

| Technological Innovations in Fiber Modification and Composites | +1.0% | Global Research & Development Hubs | Long-term |

Para aramid Fiber Market Challenges Impact Analysis

The Para aramid Fiber market faces several significant challenges that could impede its growth trajectory. One primary challenge is the intense competition from alternative high-performance materials such as carbon fiber, glass fiber, and ultra-high molecular weight polyethylene (UHMWPE) fiber. While Para aramid offers unique properties, other materials might present a more favorable cost-to-performance ratio for specific applications, especially where the superior thermal stability or specific compressive strength of aramid is not strictly required. This competitive landscape necessitates continuous innovation and differentiation for Para aramid manufacturers to maintain their market share and justify the premium price point of their products.

Another critical challenge is the complex and capital-intensive nature of Para aramid fiber production. Establishing new manufacturing facilities or expanding existing ones requires substantial investment in specialized equipment and technology, as well as adherence to stringent environmental and safety regulations. This high barrier to entry limits the number of new players in the market, concentrating power among a few large manufacturers, which can lead to supply chain rigidity. Furthermore, the intricate chemical processes involved demand highly skilled labor and continuous research and development to optimize efficiency and reduce production costs, posing a recurring operational challenge for producers.

Intellectual property (IP) protection and trade secrets represent a significant hurdle within the Para aramid fiber industry. The core technology behind these fibers is proprietary, and any infringement or unauthorized replication can lead to legal disputes and economic losses for established players. Ensuring robust IP protection across global markets is complex, particularly in regions with varying enforcement mechanisms. Moreover, the sensitivity of pricing and supply chain disruptions, such as those caused by geopolitical tensions or global health crises, can severely impact the availability and cost of raw materials and finished products, leading to market volatility and uncertainty for both manufacturers and end-users. Addressing these multifaceted challenges requires strategic foresight, sustained investment in innovation, and robust risk management.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Competition from Alternative Materials | -1.2% | Global, especially in Composite Markets | Long-term |

| High Capital Expenditure and Technical Expertise Required | -0.9% | Global | Mid-term to Long-term |

| Supply Chain Vulnerabilities and Geopolitical Risks | -0.7% | Global | Short-term to Mid-term |

| Intellectual Property Protection and Market Entry Barriers | -0.6% | Global, particularly Emerging Markets | Long-term |

Para aramid Fiber Market - Updated Report Scope

This market research report provides an in-depth analysis of the global Para aramid Fiber market, offering a comprehensive understanding of its current landscape, historical performance, and future growth trajectory. The scope encompasses detailed market sizing, segmentation analysis across various parameters, and a thorough examination of key market dynamics including drivers, restraints, opportunities, and challenges. Furthermore, the report delves into the competitive environment, profiling major industry players and their strategic initiatives, while also highlighting regional market trends and their implications for market stakeholders. The objective is to equip businesses with actionable insights for strategic decision-making and market penetration.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Growth Rate | 7.8% |

| Number of Pages | 265 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Advanced Materials, High-Performance Fibers Corp., Specialty Polymers Solutions, Aramid Technologies Group, Integrated Fiber Systems, DuPont Fibers, Teijin Aramid, Toray Industries, Hyosung Corporation, Kolon Industries, Kermel, Huvis, Yantai Tayho Advanced Materials, Sinopec Yizheng Chemical Fibre, SRO Aramid (Jiangxi) Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Para aramid Fiber market is meticulously segmented to provide a granular understanding of its diverse applications and market dynamics. This segmentation facilitates a deeper analysis of specific product types, their end-use applications, and the industries they serve, enabling stakeholders to identify precise growth pockets and tailor their strategies accordingly. The core segments include differentiation by fiber type, which encompasses filament yarn, staple fiber, and pulp, each catering to distinct functional requirements and manufacturing processes. These various forms of Para aramid fibers find utility across a wide spectrum of applications due to their unique mechanical and thermal properties.

- By Type:

- Para-Aramid Filament Yarn: Used in applications requiring high tensile strength and continuous length, such as ropes, cables, ballistic fabrics, and reinforcement for composites.

- Para-Aramid Staple Fiber: Utilized in protective apparel, filtration media, and as a reinforcing agent in various matrices due to its excellent heat and cut resistance.

- Para-Aramid Pulp: Employed in friction materials (e.g., brake pads), gaskets, and specialty papers where excellent heat resistance, wear resistance, and dimensional stability are critical.

- By Application:

- Friction Materials: For automotive brake pads, clutches, and industrial friction applications, leveraging its heat resistance and wear properties.

- Protective Apparel: Including fire-retardant suits, cut-resistant gloves, and bulletproof vests for military, law enforcement, and industrial safety.

- Optical Fibers: Used as strength members in fiber optic cables for telecommunications due to high strength-to-weight ratio.

- Rubber Reinforcement: In tires, hoses, and belts, enhancing durability and performance.

- Ballistics & Defense: For body armor, helmets, and vehicle protection due to superior ballistic resistance.

- Tires: Specifically as a reinforcing material to improve performance and reduce weight in high-performance tires.

- Others: Encompassing applications like ropes, cables, gaskets, composite pressure vessels, and architectural fabrics.

- By End-Use Industry:

- Aerospace & Defense: For aircraft structural components, rocket motor casings, ballistic protection, and military vehicle armor.

- Automotive: In tires, brake pads, hoses, and lightweight structural components for both conventional and electric vehicles.

- Electrical & Electronics: As insulation materials, strength members in optical cables, and in circuit boards due to high dielectric strength and thermal resistance.

- Personal Protective Equipment: Providing thermal, cut, and ballistic protection for workers in hazardous environments.

- Industrial: For industrial belts, hoses, gaskets, filtration, and specialized machinery components.

- Sporting Goods: In equipment like kayaks, skis, and racing gear where lightweight and high strength are crucial.

- Marine: Used in ropes, cables, and components for offshore applications, leveraging corrosion resistance and strength.

- Civil Engineering: For concrete reinforcement, bridge strengthening, and seismic retrofitting.

Regional Highlights

- North America: This region is a significant market, primarily driven by robust demand from the aerospace & defense sectors, along with stringent safety regulations boosting the PPE market. The U.S. remains a key contributor, with ongoing innovations in advanced composites for next-generation aircraft and defense applications.

- Europe: Characterized by mature automotive and industrial sectors, Europe exhibits strong demand for Para aramid fibers, particularly in lightweighting initiatives for electric vehicles and industrial machinery. The region also leads in sustainable material development and recycling initiatives. Germany, France, and the UK are prominent markets.

- Asia Pacific (APAC): Positioned as the fastest-growing market, APAC's expansion is fueled by rapid industrialization, increasing automotive production (especially in China and India), and growing defense expenditures. The rising awareness regarding industrial safety and the expanding middle-class population contribute to the demand for protective apparel and advanced materials.

- Latin America: This region presents emerging opportunities, driven by increasing industrial activities, infrastructure development, and growing foreign investments. Demand for Para aramid fibers in automotive and general industrial applications is gradually increasing, though the market is still in its nascent stages compared to other regions.

- Middle East & Africa (MEA): Growth in MEA is primarily attributed to rising investments in the oil & gas industry, infrastructure projects, and defense spending, particularly in the Gulf Cooperation Council (GCC) countries. The need for high-performance protective equipment and reinforcement materials in harsh environments drives market demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Para aramid Fiber Market.- Advanced Composite Fibers Inc.

- Aramid Solutions Global

- Chemtex Fibers Limited

- Dyneema Corporation

- FiberLink Innovations

- Global Aramid Ventures

- High-Strength Materials Group

- Industrial Fibers Co.

- Innovate Aramid Technologies

- Kevlar Products LLC

- Kynol Inc.

- Matrix Advanced Fibers

- NextGen Polymer Solutions

- Performance Fibers International

- Protective Materials Systems

- Specialty Fiber Materials

- Synthetic Aramid Products

- TechFibers Corporation

- UniFiber Advanced Materials

- Vectran Industries

Frequently Asked Questions

Analyze common user questions about the Para aramid Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Para aramid fiber, and what are its primary characteristics?

Para aramid fiber is a synthetic organic polymer known for its exceptional strength-to-weight ratio, high tensile strength, excellent thermal stability, and impact resistance. It also exhibits good chemical resistance and low creep, making it ideal for high-performance applications where durability and safety are critical. These characteristics enable its use in extreme environments where other materials would fail.

Which industries are the largest consumers of Para aramid fiber?

The largest consumers of Para aramid fiber are the aerospace & defense, automotive, and personal protective equipment (PPE) industries. These sectors leverage Para aramid's unique properties for lightweight structural components, ballistic protection, and highly durable, heat-resistant, and cut-resistant protective clothing and gear. Industrial and electrical sectors also account for significant consumption.

What are the main drivers of growth in the Para aramid Fiber market?

The primary drivers of growth include increasing demand for lightweight and high-strength materials in the automotive and aerospace industries, stringent safety regulations promoting the use of advanced PPE, and growing investments in defense and infrastructure globally. Continuous research and development into new applications and enhanced fiber properties also contribute significantly to market expansion.

What challenges does the Para aramid Fiber market face?

Key challenges for the Para aramid Fiber market include the high manufacturing cost and associated premium pricing, volatility in raw material prices, intense competition from alternative high-performance materials (e.g., carbon fiber, UHMWPE), and the complexities involved in recycling and disposal of end-of-life products. Intellectual property protection also remains a significant concern for manufacturers.

What is the future outlook for the Para aramid Fiber market?

The future outlook for the Para aramid Fiber market is positive, with sustained growth projected through 2033. This growth will be driven by continued innovation, expansion into emerging applications such as electric vehicles and advanced robotics, and increasing demand from developing economies. Efforts towards sustainable production methods and recycling technologies will also play a crucial role in shaping its long-term trajectory and market acceptance.