Optical Transceiver Market

Optical Transceiver Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704045 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Optical Transceiver Market Size

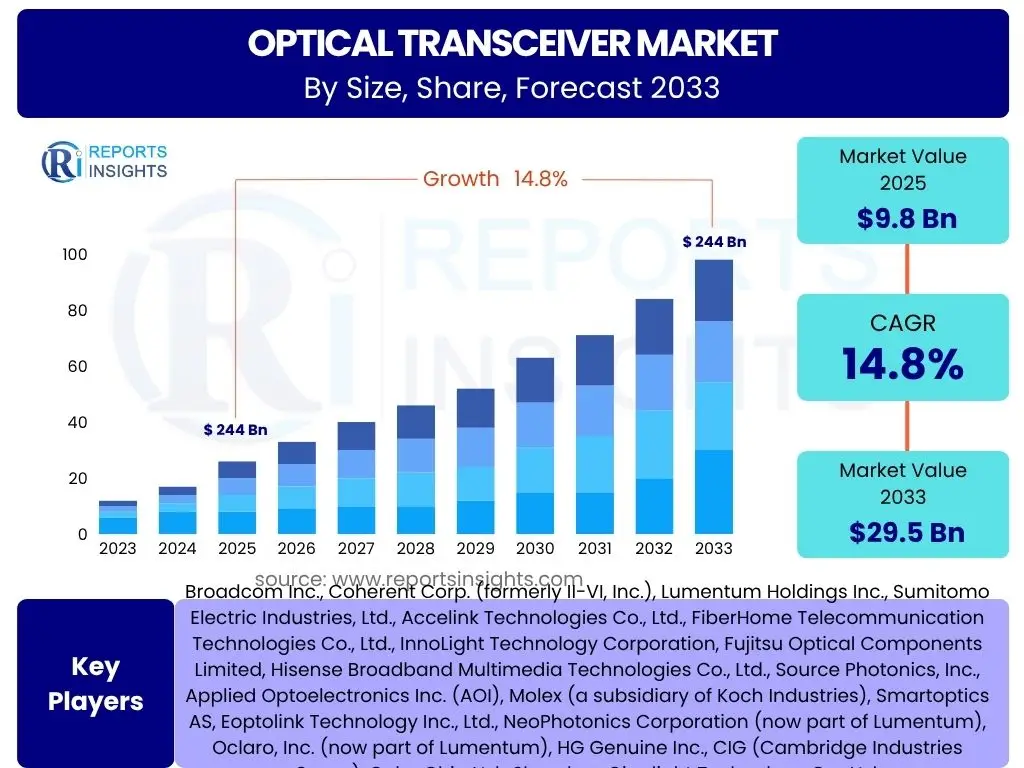

According to Reports Insights Consulting Pvt Ltd, The Optical Transceiver Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2025 and 2033. The market is estimated at USD 9.8 Billion in 2025 and is projected to reach USD 29.5 Billion by the end of the forecast period in 2033.

Key Optical Transceiver Market Trends & Insights

The Optical Transceiver market is experiencing significant evolution, driven by the escalating demand for higher bandwidth, faster data transmission, and reduced latency across various sectors. Common user queries frequently revolve around the prevailing technological shifts, the impact of emerging communication standards, and the increasing integration of advanced components. Key insights indicate a pervasive trend towards miniaturization, enhanced power efficiency, and the development of transceivers capable of handling ultra-high data rates, such as 800Gbps and beyond. The proliferation of data centers, the global rollout of 5G networks, and the relentless expansion of cloud computing infrastructure are fundamentally reshaping market dynamics, pushing manufacturers to innovate rapidly to meet these escalating requirements.

The industry is also witnessing a concerted effort towards standardizing transceiver interfaces and protocols to ensure interoperability and scalability within complex network environments. Furthermore, there is a growing emphasis on sustainability, with a focus on developing optical transceivers that consume less power and have a smaller carbon footprint, aligning with global environmental objectives. The adoption of silicon photonics technology is gaining momentum, offering a promising avenue for integrating multiple optical components onto a single chip, leading to cost-effective, high-performance solutions. These trends collectively underscore a market poised for robust growth, driven by relentless technological advancement and pervasive digital transformation.

- Exponential growth in cloud computing and hyperscale data centers.

- Rapid deployment and expansion of 5G telecommunication networks.

- Increasing adoption of high-speed interconnects (400Gbps, 800Gbps) for AI/ML workloads.

- Emergence of co-packaged optics (CPO) for enhanced power efficiency and density.

- Growing demand for compact, lower power consumption form factors.

- Advancements in silicon photonics technology for integrated solutions.

- Emphasis on enhanced security and reliability in optical networks.

AI Impact Analysis on Optical Transceiver

The pervasive integration of Artificial Intelligence (AI) across various industries is profoundly impacting the Optical Transceiver market, prompting numerous inquiries about its specific effects on demand, technology development, and market trajectory. Users are particularly interested in how AI's insatiable data processing requirements translate into a need for more sophisticated optical interconnects. AI workloads, characterized by massive data transfers between GPUs, CPUs, and memory within data centers, necessitate ultra-high bandwidth, extremely low latency, and highly reliable optical transceivers. This demand is propelling the development and adoption of next-generation transceivers capable of 400Gbps, 800Gbps, and even 1.6Tbps, along with innovations in optical switching and routing technologies.

The influence of AI also extends to the design and manufacturing processes of optical transceivers, where AI-driven optimization can enhance efficiency and reduce costs. Furthermore, the future of AI infrastructure, particularly in the realm of advanced machine learning and deep learning models, points towards a significant increase in the sheer volume and speed of data traffic, making optical transceivers an indispensable component for maintaining network performance and scalability. Concerns often raised include the power consumption of high-speed transceivers in AI clusters and the need for robust thermal management solutions, which are critical for the sustained operation of AI-intensive data centers. The market response involves accelerating research and development into more energy-efficient and thermally optimized optical solutions, including liquid cooling integration and advanced materials, to support the ever-growing computational demands of AI.

- Spurred demand for ultra-high-speed (400Gbps, 800Gbps, 1.6Tbps) transceivers for AI/ML clusters.

- Increased focus on low-latency optical interconnects essential for AI processing.

- Driving innovation in power-efficient optical modules due to high AI compute energy demands.

- Acceleration of co-packaged optics development for optimized AI hardware integration.

- Expansion of hyperscale data centers specifically designed for AI workloads, increasing transceiver deployment.

Key Takeaways Optical Transceiver Market Size & Forecast

Common user questions regarding the Optical Transceiver market size and forecast often focus on understanding the primary drivers of growth, the resilience of the market against potential disruptions, and the long-term viability of current technological trends. A key takeaway from the analysis is the significant and sustained growth trajectory, primarily fueled by the relentless expansion of global data traffic, the widespread adoption of cloud-based services, and the ongoing buildout of advanced telecommunication infrastructures, notably 5G. The market exhibits strong resilience, underpinned by fundamental shifts in digital consumption and enterprise IT strategies, making optical transceivers an indispensable component of modern digital ecosystems. This robust demand ensures continued investment in research and development, fostering innovation and pushing the boundaries of data rates and efficiency.

Another crucial insight is the increasing complexity and sophistication of optical transceiver technology, driven by the need to support higher bandwidths and lower latencies. The forecast indicates a strategic shift towards more integrated and power-efficient solutions, such as silicon photonics and co-packaged optics, which will play a pivotal role in shaping future market dynamics. While challenges such as manufacturing costs and supply chain vulnerabilities persist, the overarching trends of digitalization and the burgeoning AI revolution are creating substantial opportunities for market expansion. Therefore, the market is not only growing in size but also evolving in terms of technological sophistication, solidifying its critical role in enabling the global digital transformation.

- The market is poised for robust double-digit CAGR growth driven by escalating data traffic and digital transformation.

- Hyperscale data centers and 5G network expansion are the primary engines of demand.

- Technological advancements towards 800Gbps and 1.6Tbps modules will define future market segments.

- Silicon photonics and co-packaged optics are emerging as key enablers for next-generation solutions.

- Significant investment in R&D is anticipated to address power efficiency and thermal management challenges.

Optical Transceiver Market Drivers Analysis

The Optical Transceiver market is propelled by a confluence of powerful drivers, primarily stemming from the pervasive digitalization of economies and societies worldwide. The exponential growth of internet traffic, fueled by streaming services, online gaming, and pervasive digital communication, directly necessitates more robust and higher-capacity network infrastructure, for which optical transceivers are fundamental. This increase in data volume places immense pressure on existing networks, driving continuous upgrades and expansion efforts across telecom and data center sectors. Consequently, the demand for high-speed, reliable, and efficient optical interconnects remains consistently high, reinforcing the market's upward trajectory.

Furthermore, the global rollout of 5G networks is a monumental driver. 5G technology, designed to deliver unprecedented speeds and ultra-low latency, inherently relies on advanced optical transceivers for backhaul, fronthaul, and mid-haul connections to support its distributed architecture and massive MIMO capabilities. Similarly, the continued expansion of cloud computing and the proliferation of hyperscale data centers globally are creating an insatiable demand for optical transceivers. These facilities require vast numbers of transceivers to connect servers, switches, and storage units, enabling high-speed intra-data center communication and connectivity to external networks. The growing adoption of Artificial Intelligence and Machine Learning applications, which demand massive parallel processing and high-bandwidth data transfer, further amplifies this demand, driving innovation towards even higher data rates and more compact form factors.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Exponential Growth in Data Traffic | +3.5% | Global, particularly North America, APAC, Europe | 2025-2033 |

| Global 5G Network Deployments | +2.8% | APAC, North America, Europe | 2025-2030 (Peak) |

| Expansion of Hyperscale Data Centers & Cloud Computing | +4.0% | North America, APAC, Europe | 2025-2033 |

| Increasing Adoption of AI/ML Applications | +2.5% | Global, especially US, China, Western Europe | 2027-2033 (Accelerating) |

Optical Transceiver Market Restraints Analysis

Despite the robust growth drivers, the Optical Transceiver market faces several significant restraints that could temper its expansion. One primary restraint is the inherently high manufacturing cost associated with advanced optical components. The precision engineering, specialized materials, and complex assembly processes required for high-performance optical transceivers, particularly those operating at 400Gbps and above, contribute to elevated production expenses. This can lead to higher average selling prices, potentially limiting adoption in cost-sensitive applications or smaller enterprises. Furthermore, the intense competition within the market, driven by numerous players vying for market share, can lead to aggressive price erosion, impacting profitability margins for manufacturers and potentially stifling investment in long-term research and development necessary for future innovation.

Another critical restraint is the vulnerability of the global supply chain. The production of optical transceivers relies on a complex network of specialized component suppliers, often concentrated in specific geographic regions. Geopolitical tensions, trade disputes, natural disasters, or global health crises can disrupt this delicate supply chain, leading to material shortages, production delays, and increased logistical costs. Additionally, the significant power consumption of high-speed optical transceivers, particularly in large-scale data center deployments, presents an operational challenge. As data rates increase, so does the power draw, contributing to higher operational expenditures for data center operators and raising environmental sustainability concerns. Addressing this restraint requires continuous innovation in power-efficient designs and advanced thermal management solutions, which adds to the complexity and cost of product development.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Manufacturing and R&D Costs | -1.5% | Global | 2025-2033 |

| Intense Price Competition and Margin Pressure | -1.2% | Global, especially APAC | 2025-2033 |

| Supply Chain Vulnerabilities and Geopolitical Risks | -0.8% | Global, particularly US-China relations | 2025-2030 |

| Increased Power Consumption of High-Speed Modules | -0.7% | Global, particularly energy-sensitive regions | 2027-2033 |

Optical Transceiver Market Opportunities Analysis

The Optical Transceiver market is replete with significant opportunities driven by evolving technological landscapes and burgeoning application areas. A major opportunity lies in the continuous advancement towards higher data rates, particularly the transition to 800Gbps and the anticipated development of 1.6Tbps transceivers. As data center bandwidth demands continue their exponential climb, driven by AI, cloud, and big data analytics, the need for these ultra-high-speed modules will create substantial revenue streams. This push also accelerates the development of novel technologies like co-packaged optics (CPO), where optical components are integrated directly into processor packages, promising unprecedented levels of power efficiency and density. CPO represents a paradigm shift from traditional pluggable modules, potentially revolutionizing data center architectures and offering a long-term growth avenue for innovative manufacturers.

Another lucrative opportunity stems from the expanding applications of optical transceivers beyond traditional telecom and data center domains. Emerging fields such as automotive LiDAR, industrial automation, quantum computing, and even consumer electronics are beginning to leverage optical technologies for high-speed, reliable data links, offering diversified revenue streams. Furthermore, the increasing adoption of passive optical networks (PON) for fiber-to-the-home (FTTH) deployments in underserved regions, coupled with the ongoing upgrades to next-generation PON standards (e.g., XGS-PON, 25GS-PON), provides a stable and expanding market for specific types of optical transceivers. Finally, the global push for enhanced cybersecurity and resilient network infrastructure opens opportunities for transceivers with integrated security features, such as quantum-safe encryption capabilities, addressing a growing market need for secure high-speed communication.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence of 800G and 1.6T Transceivers | +3.0% | Global, driven by hyperscalers | 2026-2033 |

| Development and Adoption of Co-packaged Optics (CPO) | +2.5% | North America, APAC (Hyperscale data centers) | 2028-2033 |

| Expansion into New Verticals (e.g., Automotive, Industrial) | +1.5% | Global, particularly developed economies | 2029-2033 |

| Upgrades to Next-Gen Passive Optical Networks (PON) | +1.0% | APAC, Europe, Emerging Markets | 2025-2030 |

Optical Transceiver Market Challenges Impact Analysis

The Optical Transceiver market, while promising, grapples with several formidable challenges that necessitate strategic responses from manufacturers and stakeholders. One significant challenge is the ongoing push for miniaturization and increased port density. As data centers strive to maximize computational capacity within finite physical footprints, the demand for smaller, more compact transceivers becomes critical. Achieving this miniaturization while simultaneously increasing data rates and maintaining power efficiency requires sophisticated engineering, advanced packaging techniques, and significant R&D investment, often leading to complex design hurdles and higher development costs. Closely related is the challenge of thermal management; high-speed optical transceivers generate substantial heat, and dissipating this heat effectively within increasingly dense environments is a major technical hurdle that impacts reliability and performance.

Another notable challenge is ensuring interoperability across a diverse ecosystem of vendors and networking equipment. As networks become more complex and hybrid, the seamless integration of optical transceivers from different manufacturers with various switches and routers is paramount. Lack of universal standards or inconsistent adherence to existing ones can lead to compatibility issues, deployment delays, and increased operational complexity for network operators. Furthermore, the rapid pace of technological change means that existing product lines can quickly become obsolete, necessitating continuous innovation and substantial capital expenditure to remain competitive. Geopolitical tensions and trade policies also present a looming challenge, potentially disrupting access to critical raw materials, specialized components, or key manufacturing facilities, thereby impacting production timelines and costs across the global supply chain.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Miniaturization and Thermal Management | -1.0% | Global, particularly high-density data centers | 2025-2033 |

| Ensuring Interoperability Across Vendor Ecosystems | -0.9% | Global | 2025-2030 |

| Rapid Technological Obsolescence | -0.8% | Global | 2025-2033 |

| Geopolitical Factors & Supply Chain Resilience | -0.7% | Global | 2025-2033 |

Optical Transceiver Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Optical Transceiver market, covering historical trends, current market dynamics, and future projections. The scope encompasses detailed segmentation by form factor, data rate, technology, application, and wavelength, offering a granular view of market performance across various dimensions. The report also includes a thorough regional analysis, identifying key growth hubs and their unique market characteristics, alongside a competitive landscape assessment profiling leading industry players. The objective is to equip stakeholders with actionable insights to navigate market complexities, identify lucrative opportunities, and formulate informed strategic decisions within the evolving optical transceiver ecosystem.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 9.8 Billion |

| Market Forecast in 2033 | USD 29.5 Billion |

| Growth Rate | 14.8% |

| Number of Pages | 267 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Broadcom Inc., Coherent Corp. (formerly II-VI, Inc.), Lumentum Holdings Inc., Sumitomo Electric Industries, Ltd., Accelink Technologies Co., Ltd., FiberHome Telecommunication Technologies Co., Ltd., InnoLight Technology Corporation, Fujitsu Optical Components Limited, Hisense Broadband Multimedia Technologies Co., Ltd., Source Photonics, Inc., Applied Optoelectronics Inc. (AOI), Molex (a subsidiary of Koch Industries), Smartoptics AS, Eoptolink Technology Inc., Ltd., NeoPhotonics Corporation (now part of Lumentum), Oclaro, Inc. (now part of Lumentum), HG Genuine Inc., CIG (Cambridge Industries Group), Color Chip Ltd., Shenzhen Gigalight Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Optical Transceiver market is meticulously segmented across various dimensions to provide a detailed understanding of its complex structure and diverse applications. This segmentation enables stakeholders to identify specific growth areas, analyze competitive landscapes within niche markets, and tailor strategies to address distinct technological requirements and consumer needs. The primary segments include form factor, data rate, technology, application, and wavelength, each revealing unique market dynamics and growth trajectories. Analyzing these segments helps in understanding the market's current state and its potential evolution.

For instance, the segmentation by form factor showcases the industry's shift towards compact, high-density modules like QSFP-DD and OSFP, which are critical for hyperscale data centers. Similarly, data rate segmentation highlights the rapid transition to 400Gbps and 800Gbps solutions driven by AI and cloud computing demands. Technology-wise, silicon photonics is gaining prominence for its integration capabilities and cost-efficiency. Application-based segmentation underscores the dominance of data centers and telecommunications, while also identifying emerging opportunities in enterprise and industrial sectors. Wavelength segmentation, crucial for optimizing fiber utilization, reflects the widespread adoption of CWDM and DWDM technologies for long-haul and metro networks. Each segment presents specific challenges and opportunities, requiring tailored strategies for success.

- By Form Factor: This segment categorizes transceivers based on their physical dimensions and connector types, which dictate their compatibility and application environments.

- QSFP-DD (Quad Small Form-factor Pluggable Double Density): High-density, high-speed modules for data centers.

- OSFP (Octal Small Form-factor Pluggable): Another high-density form factor, often competing with QSFP-DD for 400Gbps and 800Gbps applications.

- SFP (Small Form-factor Pluggable): Widely used for 1Gbps and 10Gbps, prevalent in enterprise and telecom access networks.

- SFP-DD (Small Form-factor Pluggable Double Density): Enhanced SFP form factor supporting higher speeds like 50Gbps or 100Gbps.

- CFP (C Form-factor Pluggable): Larger modules typically for 40Gbps and 100Gbps, often used in telecom and metro networks.

- CXP (CXP Pluggable): Designed for high-density 100Gbps applications, particularly in Infiniband and high-performance computing.

- XFP (10 Gigabit Small Form Factor Pluggable): Used for 10Gbps applications before SFP+ became dominant.

- Other Form Factors: Includes older or specialized form factors for specific legacy or niche applications.

- By Data Rate: This segment classifies transceivers by their maximum supported transmission speed, reflecting the escalating bandwidth demands.

- 10Gbps: Still widely used in enterprise networks and as foundational speeds.

- 25Gbps: Critical for server connectivity and 5G fronthaul.

- 40Gbps: Often used for aggregation in smaller data centers and enterprise networks.

- 100Gbps: A prevalent speed for intra-data center links and metro networks.

- 200Gbps: Bridging speed towards higher data rates, finding applications in specific data center interconnects.

- 400Gbps: Becoming the standard for hyperscale data centers and core networks.

- 800Gbps: Emerging as the next frontier for AI/ML clusters and ultra-high-density data centers.

- 1.6Tbps: Under development, anticipated for future extreme bandwidth requirements.

- Other Data Rates: Includes lower speeds for specific applications or custom solutions.

- By Technology: This segment differentiates transceivers based on the underlying optical and electrical components used for signal generation and detection.

- VCSEL (Vertical Cavity Surface Emitting Laser): Cost-effective for short-reach multi-mode fiber applications.

- DFB (Distributed Feedback Laser): Commonly used for single-mode fiber, medium-to-long reach applications.

- EML (Electro-absorption Modulated Laser): Preferred for long-reach, high-speed applications due to superior performance.

- Silicon Photonics: Integrates multiple optical components on a silicon chip, promising higher integration, lower cost, and power efficiency.

- Others: Includes other specialized laser technologies or integrated photonics approaches.

- By Application: This segment defines the primary end-use industries and environments where optical transceivers are deployed.

- Data Center: Hyperscale, enterprise, and co-location data centers for internal and external connectivity.

- Telecommunication: Used in core networks, metro networks, access networks, and 5G infrastructure.

- Enterprise: Corporate networks, campus networks, and storage area networks.

- Industrial: Emerging applications in smart manufacturing, industrial IoT, and specialized high-speed communication within factories.

- Others: Includes niche applications like automotive, medical imaging, and defense.

- By Wavelength: This segment categorizes transceivers based on the specific light wavelengths they operate on, crucial for wavelength division multiplexing (WDM) and fiber type compatibility.

- 850nm: Typically used with multi-mode fiber for short-reach applications.

- 1310nm: Common for single-mode fiber, suitable for short to medium reach.

- 1550nm: Used for single-mode fiber, primarily for long-reach and DWDM applications.

- CWDM (Coarse Wavelength Division Multiplexing): Allows multiple wavelengths over a single fiber for short to medium distances.

- DWDM (Dense Wavelength Division Multiplexing): Enables a large number of wavelengths over a single fiber for long-haul and high-capacity networks.

- Other Wavelengths: Includes specific wavelengths for particular fiber types or niche applications.

Regional Highlights

- North America: This region is a leading market for optical transceivers, driven by the presence of numerous hyperscale data centers, pioneering cloud service providers, and extensive 5G network deployments. The United States, in particular, showcases high adoption rates of advanced optical technologies due to significant investments in digital infrastructure, R&D, and the strong presence of tech giants and innovative startups. Canada also contributes to regional growth with expanding telecom networks and data center buildouts. The demand for 400Gbps and 800Gbps transceivers is exceptionally strong here, fueled by AI/ML workloads and big data analytics.

- Europe: The European market is characterized by a strong emphasis on digital transformation initiatives, increasing cloud adoption, and ongoing 5G network expansion across major economies like Germany, the UK, France, and the Nordics. Regulatory frameworks promoting data sovereignty and local cloud infrastructures also contribute to the demand for high-speed optical interconnects. While slightly slower than North America in hyperscale data center proliferation, Europe is catching up, and its focus on industrial IoT and smart cities further boosts the need for robust optical communication infrastructure.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, primarily due to its vast population, rapidly increasing internet penetration, and massive data consumption. Countries like China, India, Japan, South Korea, and Australia are experiencing unprecedented growth in cloud services, mobile broadband, and 5G infrastructure deployment. China, in particular, is a dominant force, leading in 5G rollout and hyperscale data center expansion. The region also hosts a significant portion of the world's optical component manufacturing capabilities, contributing to both supply and demand dynamics. The increasing adoption of AI and e-commerce further fuels the demand for high-speed transceivers.

- Latin America: The market in Latin America is witnessing steady growth, primarily driven by increasing internet penetration, burgeoning cloud services, and governmental initiatives for digital inclusion and infrastructure upgrades. Countries such as Brazil, Mexico, and Argentina are investing in expanding their fiber optic networks and establishing local data centers, creating a growing demand for optical transceivers. While the market size is smaller compared to mature regions, the potential for expansion remains significant as digital transformation gains momentum across the continent.

- Middle East and Africa (MEA): The MEA region is an emerging market for optical transceivers, propelled by rising investments in smart city projects, data center development, and the expansion of telecommunication networks. Countries in the Gulf Cooperation Council (GCC) such as Saudi Arabia and UAE are actively diversifying their economies, leading to substantial infrastructure spending on digital connectivity. Africa, though starting from a lower base, presents long-term growth opportunities as mobile broadband penetration increases and governments prioritize digital infrastructure development, including fiber optic deployments and data center hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optical Transceiver Market.- Broadcom Inc.

- Coherent Corp. (formerly II-VI, Inc.)

- Lumentum Holdings Inc.

- Sumitomo Electric Industries, Ltd.

- Accelink Technologies Co., Ltd.

- FiberHome Telecommunication Technologies Co., Ltd.

- InnoLight Technology Corporation

- Fujitsu Optical Components Limited

- Hisense Broadband Multimedia Technologies Co., Ltd.

- Source Photonics, Inc.

- Applied Optoelectronics Inc. (AOI)

- Molex (a subsidiary of Koch Industries)

- Smartoptics AS

- Eoptolink Technology Inc., Ltd.

- HG Genuine Inc.

- CIG (Cambridge Industries Group)

- Color Chip Ltd.

- Shenzhen Gigalight Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Optical Transceiver market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an optical transceiver and its primary function?

An optical transceiver is a device that converts electrical signals into optical signals for transmission over fiber optic cables and then converts optical signals back into electrical signals at the receiving end. Its primary function is to enable high-speed data communication over long distances with minimal loss, forming the backbone of modern data networks, telecommunication systems, and data centers.

What are the key drivers of growth in the Optical Transceiver market?

The key drivers of market growth include the exponential increase in global data traffic, the widespread adoption of cloud computing and hyperscale data centers, the ongoing global rollout of 5G telecommunication networks, and the rising demand for high-speed interconnects driven by Artificial Intelligence and Machine Learning applications.

How is Artificial Intelligence impacting the Optical Transceiver market?

Artificial Intelligence significantly impacts the market by driving demand for ultra-high-speed (400Gbps, 800Gbps, 1.6Tbps) and low-latency optical transceivers. AI workloads require massive data transfer capabilities within data centers, pushing innovation in power-efficient designs and advancing the development of technologies like co-packaged optics (CPO).

What are the major technological trends shaping the future of optical transceivers?

Major technological trends include the continuous push for higher data rates (e.g., 800Gbps and 1.6Tbps), advancements in silicon photonics for greater integration and efficiency, the emergence of co-packaged optics (CPO) for closer integration with processing units, and a strong focus on enhancing power efficiency and thermal management solutions for denser deployments.

Which regions are leading the demand for optical transceivers?

North America and Asia Pacific (APAC) are currently leading the demand for optical transceivers. North America is driven by its extensive hyperscale data center infrastructure and pioneering cloud adoption, while APAC is propelled by massive 5G deployments, rapid internet penetration, and significant cloud service expansion in countries like China and India.