Old age Facility Construction Market

Old age Facility Construction Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702041 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Old age Facility Construction Market Size

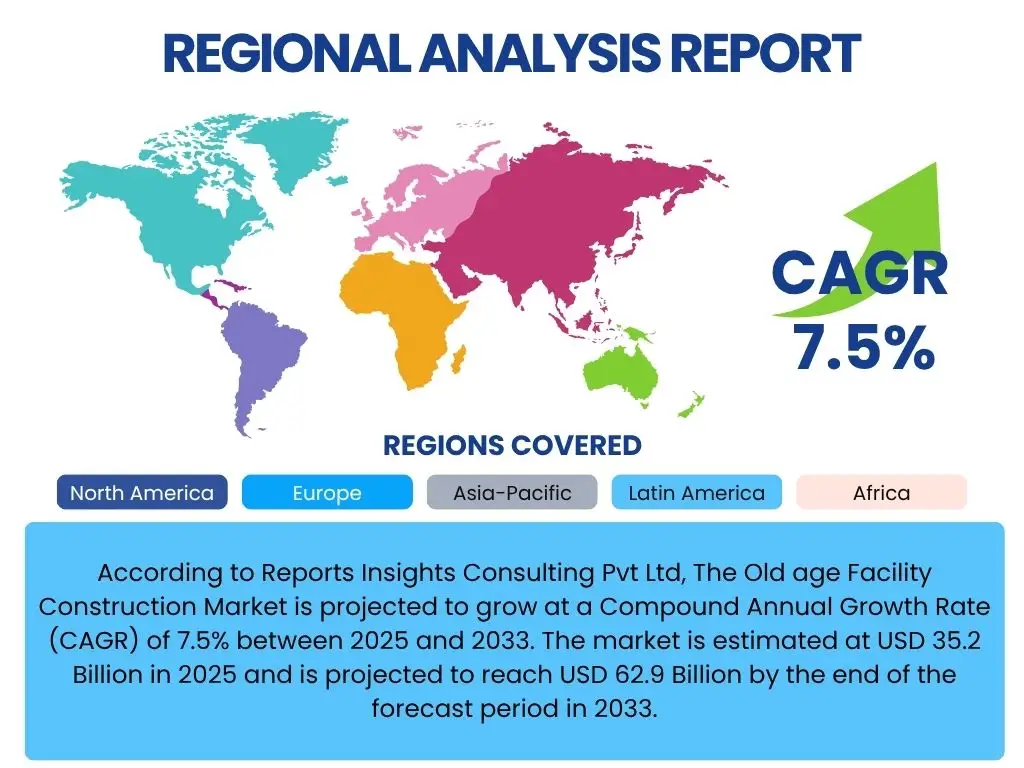

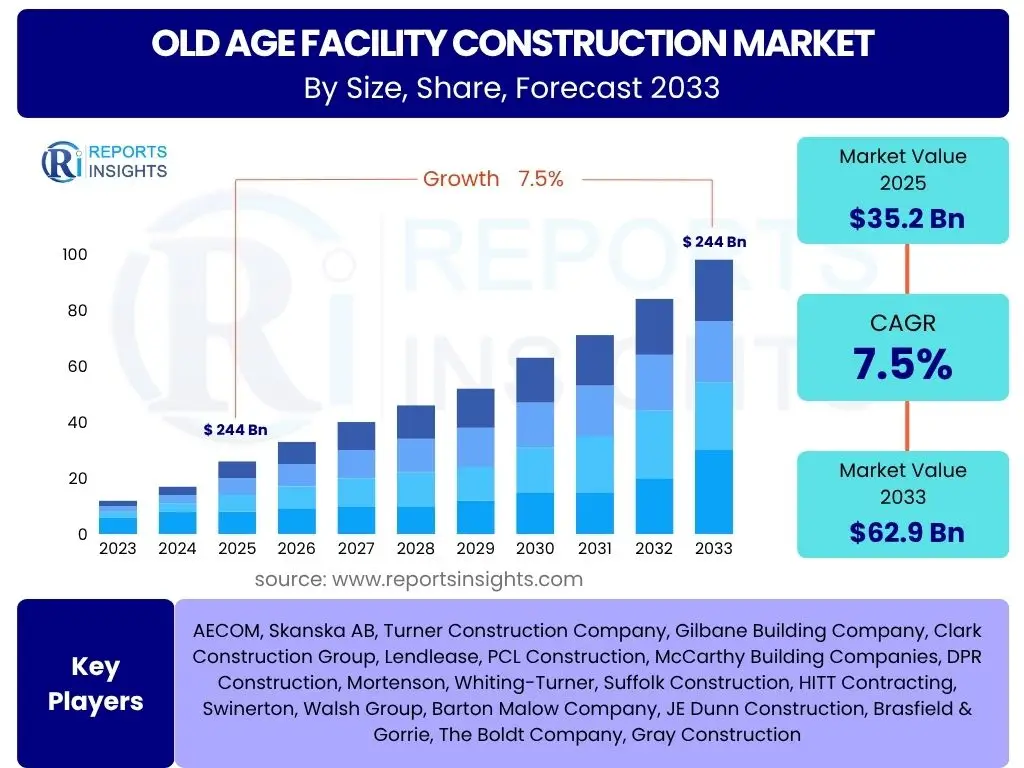

According to Reports Insights Consulting Pvt Ltd, The Old age Facility Construction Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2033. The market is estimated at USD 35.2 Billion in 2025 and is projected to reach USD 62.9 Billion by the end of the forecast period in 2033.

Key Old age Facility Construction Market Trends & Insights

The Old age Facility Construction market is experiencing significant evolution driven by changing demographic needs and advancements in building technologies. Common inquiries often revolve around how design is adapting to promote well-being, the integration of smart solutions, and the shift towards more sustainable and community-integrated models. These trends highlight a move beyond traditional institutional settings towards facilities that offer enhanced quality of life, greater independence, and personalized care experiences for residents.

New construction projects are increasingly focused on creating environments that support active aging, social engagement, and specialized medical needs, reflecting a holistic approach to senior care. This includes designing spaces that are adaptable, resilient, and equipped to handle future healthcare demands, alongside an emphasis on aesthetics and comfort that mirror residential living. The integration of advanced building materials and construction techniques also plays a crucial role in shaping these modern facilities.

- Emphasis on person-centered design and resident well-being.

- Integration of smart building technologies and automation.

- Growing demand for sustainable and eco-friendly construction practices.

- Development of hybrid models combining independent living with assisted care.

- Focus on intergenerational living spaces and community integration.

- Customization of facilities for specialized care, such as memory support.

- Modular construction techniques to expedite project delivery.

AI Impact Analysis on Old age Facility Construction

User inquiries frequently explore the transformative potential of Artificial Intelligence in optimizing various facets of Old age Facility Construction. There is keen interest in how AI can streamline project management, enhance operational efficiency once facilities are built, and ultimately improve the quality of life for residents. The consensus points towards AI's capacity to introduce predictive capabilities, automate routine tasks, and facilitate data-driven decision-making across the construction lifecycle and subsequent facility management.

AI's influence extends from the initial planning and design phases, where it can optimize layouts and material usage, to construction management for improved safety and scheduling, and post-construction for intelligent facility operations. Concerns typically revolve around data privacy, the cost of implementation, and the need for skilled personnel to manage these advanced systems. However, the overarching expectation is that AI will significantly contribute to more efficient, safer, and user-centric old age facilities.

- AI-driven project management for enhanced scheduling and resource allocation.

- Predictive maintenance systems for facility infrastructure and equipment.

- Optimized energy management and environmental control within facilities.

- Enhanced security and surveillance systems with AI-powered analytics.

- Personalized resident experiences through AI-enabled smart living environments.

- Improved safety protocols on construction sites through AI monitoring.

- Data analytics for optimizing facility design based on occupancy and usage patterns.

Key Takeaways Old age Facility Construction Market Size & Forecast

Common user questions regarding the Old age Facility Construction market size and forecast reveal a strong interest in understanding the primary growth drivers, regional disparities, and the long-term sustainability of this sector. The key takeaways indicate a robust growth trajectory, primarily fueled by global demographic shifts towards an aging population and increasing demand for specialized elder care infrastructure. Investors and developers are keen to identify the most promising geographic markets and segments within this expanding industry.

The forecast highlights that while established markets in North America and Europe will continue to grow, emerging economies, particularly in Asia Pacific, are poised for accelerated expansion due to rapidly aging populations and evolving healthcare standards. Furthermore, the market's resilience is underpinned by the essential nature of old age care, making it less susceptible to short-term economic fluctuations compared to other construction sectors. Strategic partnerships and innovative financing models are also emerging as crucial factors for future development.

- Significant growth driven by global demographic aging.

- Strong investment potential in specialized care facilities.

- Asia Pacific identified as a high-growth region.

- Emphasis on technology integration for competitive advantage.

- Increasing preference for purpose-built, high-quality facilities.

Old age Facility Construction Market Drivers Analysis

The Old age Facility Construction market is propelled by several potent drivers, primarily centered around the global demographic shift towards an aging population. As life expectancy increases and birth rates decline in many regions, the demand for specialized housing and care facilities for the elderly is escalating. This demographic imperative creates a sustained need for new construction and renovation projects tailored to senior living requirements, ranging from independent living communities to high-acuity nursing homes. Additionally, rising disposable incomes in many economies enable greater investment in premium senior living options, further stimulating market growth.

Furthermore, government initiatives and policy support for elderly care infrastructure development play a crucial role in fostering market expansion. Many countries are implementing incentives, grants, and regulatory frameworks to encourage the construction of modern, safe, and accessible old age facilities. Technological advancements, such as smart home integration, telehealth capabilities, and advanced construction techniques, are also driving demand by allowing for more efficient, comfortable, and sophisticated facilities. These innovations improve operational efficiency for developers and enhance the quality of life for residents, making new facilities more attractive to both investors and end-users.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global Aging Population | +2.8% | Global, particularly APAC & Europe | Long-term (2025-2033) |

| Increasing Healthcare Expenditure | +1.5% | North America, Western Europe, Japan | Mid-term (2027-2033) |

| Government Support & Initiatives | +1.2% | China, Germany, Australia, UK | Mid-term (2026-2032) |

| Technological Advancements in Construction | +1.0% | Developed Nations, Urban Centers | Long-term (2025-2033) |

| Demand for Specialized Care Facilities | +1.0% | Global, particularly high-income areas | Long-term (2025-2033) |

Old age Facility Construction Market Restraints Analysis

Despite robust growth prospects, the Old age Facility Construction market faces several significant restraints that can impede its expansion. One primary challenge is the high cost associated with land acquisition and construction. Urban areas, where demand for senior living facilities is often highest, typically have prohibitive land prices, making new developments costly and limiting profitability margins. Additionally, the specialized nature of these facilities, requiring specific architectural designs, accessibility features, and advanced medical infrastructure, contributes to higher construction expenses compared to conventional residential or commercial buildings.

Another key restraint involves the complex and often stringent regulatory environment governing healthcare and senior living facilities. Obtaining permits, adhering to zoning laws, and complying with ever-evolving health and safety standards can be time-consuming and expensive. This regulatory burden not only adds to project timelines and costs but also acts as a barrier to entry for new market players. Furthermore, labor shortages in the construction industry, particularly for skilled trades, can delay projects and increase labor costs, impacting the overall feasibility and profitability of new developments in this specialized sector.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Construction Costs & Land Prices | -1.5% | Global, particularly urban centers | Long-term (2025-2033) |

| Stringent Regulations & Permitting | -1.0% | North America, Europe | Mid-term (2026-2032) |

| Skilled Labor Shortages | -0.8% | Global, Developed Countries | Mid-term (2027-2033) |

| NIMBYism (Not In My Backyard) Resistance | -0.5% | Local communities in developed nations | Ongoing |

Old age Facility Construction Market Opportunities Analysis

Despite existing challenges, the Old age Facility Construction market presents numerous significant opportunities for growth and innovation. The increasing demand for facilities that offer a continuum of care, from independent living to skilled nursing and memory care, creates avenues for integrated development projects. There is a growing preference for facilities that combine healthcare services with lifestyle amenities, offering a more holistic approach to senior well-being. This trend encourages the development of mixed-use communities that can cater to varying levels of acuity and provide a vibrant social environment for residents.

Technological advancements also open new frontiers, particularly in the realm of smart building integration and sustainable construction. Developers can leverage technologies like IoT sensors for remote health monitoring, AI-powered predictive maintenance, and energy-efficient building materials to create more attractive, cost-effective, and environmentally friendly facilities. Furthermore, the expansion into emerging markets, where aging populations are growing rapidly but infrastructure is still nascent, offers substantial untapped potential. Public-private partnerships and innovative financing models can also unlock large-scale projects and accelerate development in these regions, catering to a diverse range of socio-economic groups.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Integrated Care Campuses | +1.5% | Global, particularly urban and suburban areas | Long-term (2025-2033) |

| Smart Home & IoT Integration | +1.3% | Developed Nations, Tech-savvy markets | Mid-term (2026-2032) |

| Green Building & Sustainable Construction | +1.0% | Europe, North America, Australia | Long-term (2025-2033) |

| Expansion into Emerging Markets | +0.9% | China, India, Southeast Asia, Latin America | Long-term (2027-2033) |

Old age Facility Construction Market Challenges Impact Analysis

The Old age Facility Construction market faces a unique set of challenges that can hinder project execution and profitability. Economic downturns and inflationary pressures pose a significant threat, as they can lead to increased material costs and reduced investment capital. Volatility in the price of raw materials, such as steel, concrete, and lumber, directly impacts project budgets and timelines, making accurate cost estimation and financial planning more complex. These economic uncertainties can deter potential investors and lead to delays or cancellations of planned construction projects, directly affecting market growth.

Another critical challenge is community opposition, often referred to as NIMBYism (Not In My Backyard). Local residents may resist the construction of new old age facilities due to concerns about increased traffic, changes in neighborhood character, or perceived impacts on property values. This resistance can lead to prolonged permitting processes, legal battles, and increased development costs, sometimes even forcing developers to abandon projects. Additionally, attracting and retaining a skilled workforce in the construction sector, especially those proficient in specialized healthcare facility construction, remains an ongoing challenge, impacting project efficiency and quality. Adapting to evolving healthcare regulations and changing resident expectations also requires continuous innovation and investment, adding another layer of complexity for developers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Economic Volatility & Inflation | -1.2% | Global | Short-to-Mid-term (2025-2028) |

| Community Opposition & Zoning Issues | -0.9% | Developed Nations, Densely Populated Areas | Ongoing |

| Labor Shortages & Rising Wages | -0.7% | North America, Europe, Australia | Mid-to-Long-term (2026-2033) |

| Adaptation to Evolving Healthcare Standards | -0.5% | Global | Ongoing |

Old age Facility Construction Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Old age Facility Construction market, covering historical trends, current market dynamics, and future growth projections. The scope includes detailed segmentation by facility type, construction materials, technology integration, and regional insights, offering a holistic view of the market landscape. It aims to equip stakeholders with critical data and strategic insights to navigate market complexities and identify lucrative opportunities within this rapidly evolving sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 35.2 Billion |

| Market Forecast in 2033 | USD 62.9 Billion |

| Growth Rate | 7.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | AECOM, Skanska AB, Turner Construction Company, Gilbane Building Company, Clark Construction Group, Lendlease, PCL Construction, McCarthy Building Companies, DPR Construction, Mortenson, Whiting-Turner, Suffolk Construction, HITT Contracting, Swinerton, Walsh Group, Barton Malow Company, JE Dunn Construction, Brasfield & Gorrie, The Boldt Company, Gray Construction |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Old age Facility Construction market is intricately segmented to provide a granular understanding of its diverse components, reflecting the varied needs and preferences within the elderly care sector. These segmentations allow for a detailed analysis of specific growth areas, technological adoption rates, and regional demand patterns. Understanding these distinct market segments is crucial for developers, investors, and policymakers to tailor their strategies and investments effectively, ensuring that new constructions meet the evolving demands of an aging global population.

The market is primarily segmented by the type of facility, recognizing the spectrum of care needs from fully independent living to specialized memory care and hospice services. Further differentiation is provided by construction materials, highlighting the shift towards more sustainable and efficient building practices. Technology integration forms another vital segment, showcasing the increasing role of smart systems in enhancing resident safety, comfort, and operational efficiency. The service model and end-use application segments provide insights into the operational structures and funding mechanisms influencing facility development. This multi-faceted segmentation allows for a comprehensive assessment of the market's current state and future potential.

- By Type of Facility: Assisted Living, Nursing Homes, Independent Living, Memory Care Facilities, Continuing Care Retirement Communities (CCRCs), Hospice Facilities, Rehabilitation Centers

- By Construction Material: Concrete, Steel, Wood, Green Materials, Prefabricated Components

- By Technology Integration: Smart Home Systems, Telehealth Infrastructure, Security & Surveillance Systems, Energy Management Systems, Nurse Call Systems

- By Service Model: For-Profit Facilities, Non-Profit Organizations, Publicly Funded Facilities

- By End-Use Application: Private Sector, Public Sector, Hybrid Models

Regional Highlights

- North America: This region, particularly the United States and Canada, represents a mature market for old age facility construction, driven by a significant aging population, high disposable incomes, and advanced healthcare infrastructure. The demand here is often for luxury senior living, integrated care campuses, and facilities incorporating cutting-edge technology. Regulatory frameworks are well-established but can be complex.

- Europe: Countries like Germany, the UK, France, and the Nordics lead in innovative design and sustainable construction for elder care facilities. Europe's rapidly aging population and strong social welfare systems create consistent demand. The focus is on person-centered care, energy efficiency, and adapting existing buildings. Eastern European countries present emerging opportunities for modernization.

- Asia Pacific (APAC): This region is poised for the most rapid growth in old age facility construction, driven by the sheer size and speed of its aging population in countries like China, Japan, India, and Australia. While Japan has an established market, China and India are seeing booming demand for modern senior living facilities, often in conjunction with private investment and government support to address the growing demographic shift.

- Latin America: The market here is developing, with countries like Brazil and Mexico experiencing demographic shifts that will necessitate more dedicated elder care infrastructure. Growth is often concentrated in urban centers, with a mix of private developments and increasing government recognition of the need for public old age facilities. Economic stability and foreign investment will be key to unlocking full potential.

- Middle East and Africa (MEA): While still nascent, the MEA region is beginning to see an uptick in old age facility construction, particularly in wealthier Gulf Cooperation Council (GCC) countries like the UAE and Saudi Arabia. This is driven by changing societal structures, increased healthcare spending, and a growing expatriate and local elderly population. South Africa also shows potential as healthcare infrastructure develops.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Old age Facility Construction Market.

- AECOM

- Skanska AB

- Turner Construction Company

- Gilbane Building Company

- Clark Construction Group

- Lendlease

- PCL Construction

- McCarthy Building Companies

- DPR Construction

- Mortenson

- Whiting-Turner

- Suffolk Construction

- HITT Contracting

- Swinerton

- Walsh Group

- Barton Malow Company

- JE Dunn Construction

- Brasfield & Gorrie

- The Boldt Company

- Gray Construction

Frequently Asked Questions

Analyze common user questions about the Old age Facility Construction market and generate a concise list of summarized FAQs reflecting key topics and concerns.

What is the primary driver of growth in the Old age Facility Construction market?

The primary driver is the global increase in the aging population, leading to a rising demand for specialized housing and care facilities tailored to senior needs and preferences.

How is technology impacting the construction and operation of old age facilities?

Technology impacts by enabling smart building systems for energy efficiency and security, integrating telehealth for medical care, and utilizing AI for predictive maintenance and personalized resident experiences, streamlining operations and enhancing living quality.

What are the biggest challenges facing developers in this market?

Key challenges include high construction and land costs, complex regulatory hurdles, labor shortages for skilled trades, and potential community opposition (NIMBYism) to new developments.

Which geographical regions offer the most significant opportunities for growth?

While North America and Europe remain strong, the Asia Pacific region, particularly countries like China and India, offers the most significant growth opportunities due to rapidly aging populations and evolving elder care infrastructure.

What types of old age facilities are currently in highest demand?

There is high demand for a continuum of care facilities, including assisted living, memory care units, and integrated continuing care retirement communities (CCRCs) that offer a range of services as residents' needs evolve.