Offshore Drilling Fluid Market

Offshore Drilling Fluid Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700864 | Last Updated : July 28, 2025 |

Format : ![]()

![]()

![]()

![]()

Offshore Drilling Fluid Market Size

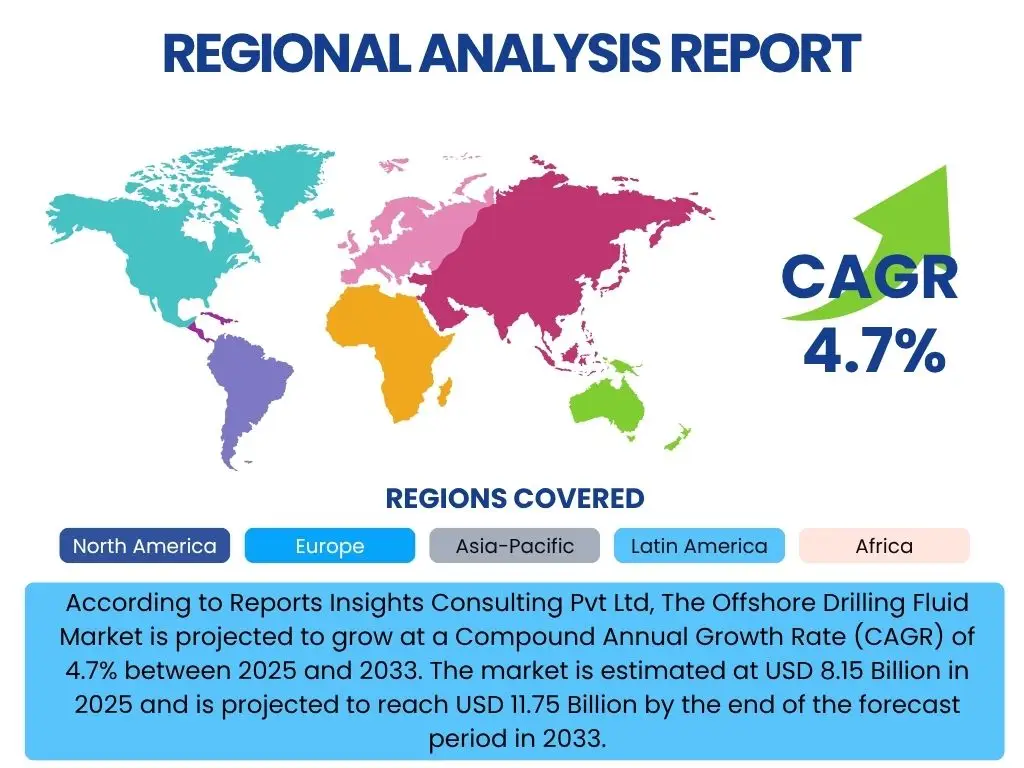

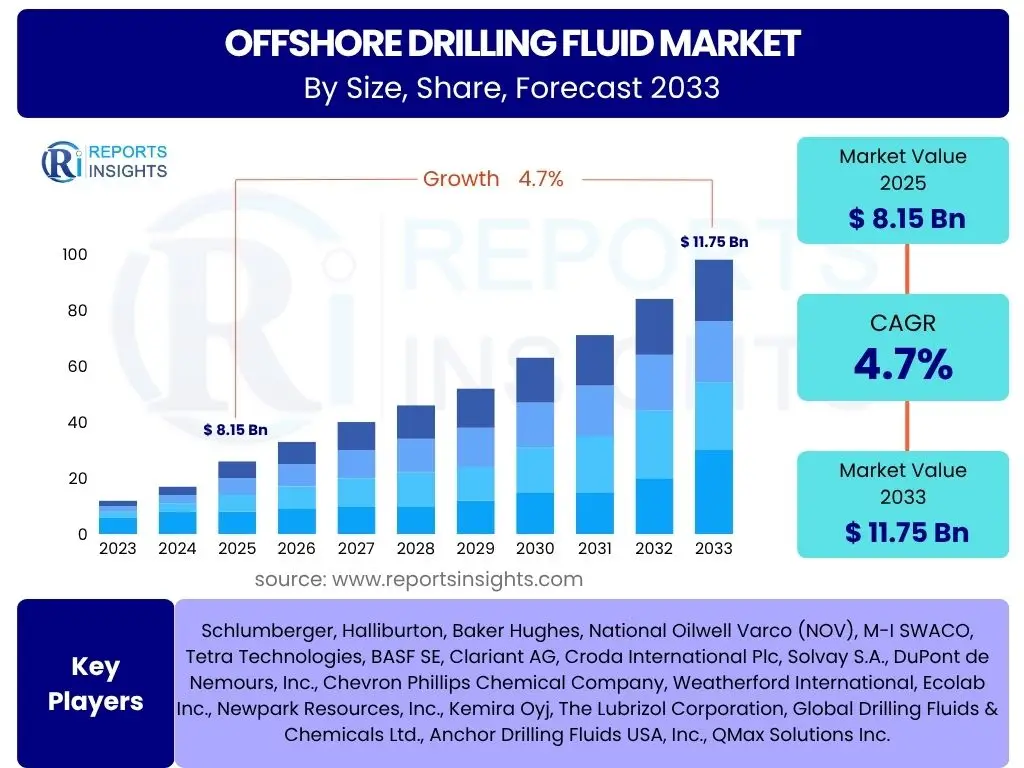

According to Reports Insights Consulting Pvt Ltd, The Offshore Drilling Fluid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.7% between 2025 and 2033. The market is estimated at USD 8.15 Billion in 2025 and is projected to reach USD 11.75 Billion by the end of the forecast period in 2033.

Key Offshore Drilling Fluid Market Trends & Insights

The offshore drilling fluid market is undergoing significant transformations, driven by evolving energy demands, technological advancements, and stringent environmental regulations. Users frequently inquire about the leading trends shaping this sector, particularly concerning sustainability, operational efficiency, and the adoption of advanced materials. A primary trend is the escalating focus on developing and deploying environmentally friendly drilling fluids, such as advanced water-based muds (WBMs) and biodegradable synthetic-based fluids (SBFs), to mitigate the ecological footprint of offshore operations. This shift is a direct response to global environmental mandates and public pressure, pushing industry stakeholders towards greener chemistries and waste reduction strategies.

Another crucial insight points to the increasing demand for high-performance drilling fluids capable of withstanding extreme conditions encountered in deepwater and ultra-deepwater environments. This includes fluids that maintain stability under high-pressure, high-temperature (HPHT) conditions and offer superior wellbore stability. The integration of digitalization and automation in fluid management systems is also gaining traction, enhancing real-time monitoring, predictive analytics, and optimizing fluid properties to improve drilling efficiency and reduce non-productive time (NPT). Furthermore, the market observes a strategic emphasis on fluid recycling and reuse, aiming to reduce operational costs and environmental impact, thereby driving innovation in separation and purification technologies.

- Growing adoption of environmentally friendly drilling fluids (EFDFs) due to stricter regulations.

- Increasing demand for high-performance fluids suitable for deepwater and ultra-deepwater HPHT conditions.

- Integration of advanced digital solutions and automation for real-time fluid monitoring and optimization.

- Expansion of fluid recycling and reuse programs to reduce waste and operational costs.

- Focus on specialized fluid formulations for complex geological formations and extended reach drilling.

AI Impact Analysis on Offshore Drilling Fluid

Common user questions regarding AI's impact on offshore drilling fluids often revolve around its potential to optimize fluid performance, enhance operational safety, and reduce environmental risks. Artificial intelligence, including machine learning and advanced analytics, is poised to revolutionize the design, management, and application of drilling fluids. AI algorithms can analyze vast datasets from drilling operations, including geological data, fluid properties, and downhole conditions, to predict optimal fluid formulations and adjust them in real time. This capability significantly improves drilling efficiency, reduces non-productive time, and ensures better wellbore stability by proactively identifying and mitigating potential issues related to fluid performance.

Furthermore, AI-driven solutions are enhancing predictive maintenance for drilling equipment and fluid systems, preventing costly failures and ensuring continuous operations. For instance, AI can monitor fluid contamination levels or degradation patterns, triggering timely interventions. The technology also plays a crucial role in improving the safety of offshore operations by optimizing fluid circulation and pressure management, thereby minimizing the risk of blowouts or well control incidents. While the adoption is still in early stages for some aspects, the long-term outlook suggests AI will be integral to achieving more precise, efficient, and environmentally responsible offshore drilling fluid management, fostering a new era of data-driven decision-making in the sector.

- AI-driven optimization of drilling fluid formulations for specific well conditions, enhancing performance and stability.

- Predictive analytics for real-time monitoring and adjustment of fluid properties during drilling operations.

- Automation of fluid mixing, delivery, and recycling processes, reducing human error and improving efficiency.

- Enhanced safety through AI-powered risk assessment and early detection of wellbore instability or fluid-related issues.

- Supply chain optimization for drilling fluid components, leveraging AI for demand forecasting and inventory management.

Key Takeaways Offshore Drilling Fluid Market Size & Forecast

User inquiries frequently aim to grasp the fundamental drivers and strategic implications derived from the offshore drilling fluid market's size and forecast. A primary takeaway is the market's resilient growth trajectory, primarily fueled by the sustained global demand for energy and the increasing complexity of offshore exploration and production activities, particularly in deepwater and ultra-deepwater basins. Despite a global push towards renewable energy, offshore oil and gas remains a critical component of the energy mix for the foreseeable future, necessitating advanced drilling fluid technologies. The projected market expansion underscores the continuous investment in offshore E&P, driven by the discovery of new reserves and the extension of existing fields, especially in regions with rich hydrocarbon potential.

Another significant insight highlights the pivotal role of technological innovation in shaping the market's future. The forecast growth is heavily reliant on the industry's capacity to develop and adopt more efficient, environmentally compliant, and high-performance drilling fluids. This includes advancements in fluid rheology, solids control, and the integration of digital solutions for optimized fluid management. The market dynamics also reflect a strong emphasis on regulatory compliance, with environmental protection agencies worldwide imposing stricter guidelines that compel fluid manufacturers and operators to prioritize sustainable solutions. Consequently, companies that invest in R&D for next-generation, eco-friendly fluids and smart drilling technologies are poised to capture significant market share and drive the sector forward, navigating both economic and environmental challenges.

- The offshore drilling fluid market exhibits steady growth, driven by consistent global energy demand and increasing deepwater exploration.

- Technological advancements in fluid chemistry and digital integration are crucial for future market expansion and operational efficiency.

- Environmental regulations are significantly influencing fluid formulation, pushing towards sustainable and biodegradable options.

- Deepwater and ultra-deepwater projects are key growth engines, demanding specialized, high-performance fluid solutions.

- Strategic investments in research and development by key players are vital for maintaining competitive advantage and addressing evolving drilling complexities.

Offshore Drilling Fluid Market Drivers Analysis

The offshore drilling fluid market is propelled by several robust drivers, each contributing significantly to its growth trajectory. A primary driver is the escalating global energy demand, particularly from emerging economies, which continues to necessitate the exploration and production of offshore oil and gas reserves. This sustained demand encourages increased investment in offshore drilling activities, directly translating to a higher consumption of drilling fluids. Concurrently, the depletion of onshore reserves and advancements in drilling technology have made deepwater and ultra-deepwater exploration more technically feasible and economically viable, opening up new frontiers that require specialized, high-performance drilling fluids.

Technological advancements in drilling fluid formulations also serve as a crucial driver. Continuous innovation leads to the development of fluids that can perform under extreme conditions, such as high pressure and high temperature (HPHT), and in challenging geological formations. These advanced fluids improve drilling efficiency, reduce operational risks, and enhance well productivity, making them indispensable for complex offshore projects. Additionally, supportive government policies and initiatives in several resource-rich nations aimed at boosting domestic energy production further stimulate offshore E&P activities, thereby expanding the market for drilling fluids. The strategic importance of energy security also plays a role, as countries seek to diversify their energy sources and reduce reliance on imports, often turning to their offshore hydrocarbon potential.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Energy Demand | +1.2% | Asia Pacific, Middle East, Latin America | Long-term (2025-2033) |

| Rising Deepwater and Ultra-Deepwater Exploration | +1.0% | Latin America (Brazil, Guyana), West Africa, Gulf of Mexico | Medium-term (2025-2029) |

| Technological Advancements in Drilling Fluids | +0.8% | Global, particularly North America, Europe | Ongoing, Long-term |

| Favorable Government Policies and E&P Investments | +0.7% | Norway, Brazil, Saudi Arabia, UAE, China | Medium-term (2026-2030) |

| Focus on Enhanced Oil Recovery (EOR) Techniques | +0.5% | North America, Middle East | Short-to-Medium term (2025-2028) |

Offshore Drilling Fluid Market Restraints Analysis

Despite promising growth prospects, the offshore drilling fluid market faces several significant restraints that could impede its expansion. One major constraint is the increasing stringency of environmental regulations and growing public pressure to reduce the environmental impact of offshore operations. This leads to higher compliance costs for operators and demands continuous innovation in developing more environmentally benign drilling fluids, which can be costly and technically challenging. The heightened scrutiny on discharges and waste management necessitates significant investments in R&D and operational adjustments, potentially slowing down project approvals and increasing overall operational expenditures.

Another critical restraint is the inherent volatility of crude oil and natural gas prices. Fluctuations in energy commodity prices directly impact investment decisions in offshore exploration and production projects. Prolonged periods of low oil prices can lead to a reduction in capital expenditure by oil and gas companies, resulting in deferred or cancelled drilling projects. This directly translates to decreased demand for drilling fluids. Furthermore, the high operational costs associated with offshore drilling, including specialized equipment, logistics, and personnel, combined with the capital-intensive nature of deepwater projects, can deter new investments and restrict market growth. The increasing global shift towards renewable energy sources and the long-term energy transition strategies also pose a fundamental challenge, as they could gradually diminish the overall demand for fossil fuels and, consequently, for offshore drilling activities in the distant future.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Strict Environmental Regulations and Compliance Costs | -1.0% | Europe, North America, Global | Long-term (2025-2033) |

| Volatility of Crude Oil and Natural Gas Prices | -0.9% | Global | Short-to-Medium term (2025-2028) |

| High Operational Costs of Offshore Drilling | -0.7% | Global, especially Deepwater regions | Long-term (2025-2033) |

| Growing Shift Towards Renewable Energy Sources | -0.6% | Europe, North America, Asia Pacific | Long-term (2030 onwards) |

| Geopolitical Instability and Regulatory Uncertainties | -0.5% | Specific regions (e.g., South China Sea, Arctic) | Short-to-Medium term (2025-2027) |

Offshore Drilling Fluid Market Opportunities Analysis

The offshore drilling fluid market presents several compelling opportunities for growth and innovation. A significant opportunity lies in the burgeoning demand for environmentally friendly drilling fluids. As regulations become more stringent and environmental stewardship gains prominence, the development and commercialization of biodegradable, low-toxicity, and high-performance fluid systems offer a substantial competitive advantage. Companies that invest in green chemistries and sustainable fluid management practices can tap into a growing niche market and differentiate themselves from competitors, aligning with global sustainability goals.

Furthermore, the expansion of deepwater and ultra-deepwater exploration and production activities worldwide provides immense opportunities. These complex environments necessitate highly specialized drilling fluids capable of performing under extreme pressure, temperature, and corrosive conditions. Developing innovative fluid solutions tailored for these challenging frontiers, which constitute a significant portion of future offshore hydrocarbon potential, represents a key growth avenue. The integration of digitalization, artificial intelligence, and machine learning into drilling fluid management also offers a transformative opportunity. These technologies can optimize fluid performance, predict maintenance needs, enhance real-time decision-making, and improve overall drilling efficiency, leading to cost savings and improved operational outcomes for offshore operators. Additionally, opportunities exist in strategic collaborations and partnerships between drilling fluid manufacturers, service providers, and E&P companies to co-develop advanced solutions and leverage combined expertise for market expansion.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Environmentally Friendly Fluids | +1.1% | Global, particularly Europe, North America | Long-term (2025-2033) |

| Expansion of Deepwater/Ultra-Deepwater Projects | +1.0% | Latin America (Brazil, Guyana), West Africa, Gulf of Mexico | Medium-to-Long term (2026-2033) |

| Integration of Digital Technologies (AI/ML) in Fluid Management | +0.9% | Global | Medium-term (2027-2031) |

| Enhanced Oil Recovery (EOR) Applications in Mature Fields | +0.6% | North Sea, Gulf of Mexico, Middle East | Short-to-Medium term (2025-2029) |

| Strategic Partnerships and Collaborations | +0.5% | Global | Ongoing, Medium-term |

Offshore Drilling Fluid Market Challenges Impact Analysis

The offshore drilling fluid market is confronted by several significant challenges that necessitate strategic responses from industry participants. A primary challenge involves navigating the increasingly stringent regulatory landscape governing offshore operations and environmental discharges. Compliance with diverse and evolving international, regional, and national environmental standards for fluid composition, disposal, and toxicity requires continuous R&D investment and can significantly increase operational costs and complexity for fluid manufacturers and service providers. Failure to comply can result in hefty fines, operational shutdowns, and reputational damage, creating a substantial hurdle for market players.

Another key challenge is managing the technical complexities associated with developing and deploying high-performance fluids for extreme offshore environments, such as ultra-deepwater and high-pressure, high-temperature (HPHT) wells. These conditions demand highly specialized fluid chemistries that can maintain stability and effectiveness, which often translates to higher material costs and extensive research efforts. Furthermore, the offshore industry faces a persistent challenge of supply chain volatility and logistical complexities. Transporting and managing drilling fluid components and finished products to remote offshore locations can be expensive, time-consuming, and susceptible to disruptions from geopolitical events, weather conditions, or global trade imbalances. Additionally, a shortage of skilled labor with expertise in advanced drilling fluid technologies and offshore operations poses a recruitment and retention challenge, potentially impacting operational efficiency and innovation in the sector.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Regulatory Compliance and Environmental Scrutiny | -1.1% | Global, particularly Europe, North America | Long-term (2025-2033) |

| Technical Complexities for Extreme Drilling Conditions | -0.8% | Deepwater, Ultra-Deepwater regions | Long-term (2025-2033) |

| Supply Chain Disruptions and Logistical Challenges | -0.7% | Global | Short-to-Medium term (2025-2028) |

| High Capital Expenditure and Investment Risk | -0.6% | Global | Medium-to-Long term (2026-2033) |

| Skilled Labor Shortage and Talent Gap | -0.5% | North America, Europe, Middle East | Long-term (2025-2033) |

Offshore Drilling Fluid Market - Updated Report Scope

This market research report offers an in-depth analysis of the Offshore Drilling Fluid Market, providing comprehensive insights into its current landscape, historical performance, and future growth projections. The scope encompasses detailed market sizing, segmentation analysis by fluid type, application, and water depth, and an exhaustive examination of regional market dynamics. It also includes a thorough competitive landscape analysis, profiling key industry players and their strategic initiatives, along with an assessment of the impact of emerging technologies like AI. The report aims to provide stakeholders with actionable intelligence for strategic decision-making and market positioning within the global offshore drilling fluid industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 8.15 Billion |

| Market Forecast in 2033 | USD 11.75 Billion |

| Growth Rate | 4.7% CAGR |

| Number of Pages | 267 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger, Halliburton, Baker Hughes, National Oilwell Varco (NOV), M-I SWACO, Tetra Technologies, BASF SE, Clariant AG, Croda International Plc, Solvay S.A., DuPont de Nemours, Inc., Chevron Phillips Chemical Company, Weatherford International, Ecolab Inc., Newpark Resources, Inc., Kemira Oyj, The Lubrizol Corporation, Global Drilling Fluids & Chemicals Ltd., Anchor Drilling Fluids USA, Inc., QMax Solutions Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The offshore drilling fluid market is comprehensively segmented to provide a granular view of its diverse components and their respective growth dynamics. This segmentation facilitates a deeper understanding of market drivers, restraints, opportunities, and challenges across various product types, applications, and operational environments. Analyzing these segments helps stakeholders identify key growth areas, tailor product offerings, and devise effective market entry and expansion strategies. Each segment exhibits unique characteristics and demand patterns influenced by technological advancements, regulatory frameworks, and regional energy landscapes.

The primary segmentation is based on the fluid type, which includes Water-Based Fluids (WBF), Oil-Based Fluids (OBF), and Synthetic-Based Fluids (SBF), each possessing distinct properties and environmental implications. Water-based fluids are generally preferred for their environmental friendliness and cost-effectiveness, while oil-based and synthetic-based fluids offer superior performance in challenging well conditions. Application-wise, the market is segmented across critical drilling phases such as exploration, production, well completion, and workover operations, reflecting the varying fluid requirements at each stage of a well's lifecycle. Furthermore, segmentation by water depth into shallow, deep, and ultra-deepwater categories highlights the specialized fluid needs for increasingly complex and environmentally sensitive offshore projects. This multi-faceted segmentation provides a robust framework for assessing market potential and strategic planning.

- By Fluid Type: Identifies market share and growth potential across Water-Based Fluids (WBF), Oil-Based Fluids (OBF), Synthetic-Based Fluids (SBF), and other specialized fluid types.

- By Application: Analyzes fluid consumption and trends in various offshore drilling phases, including Exploration Drilling, Production Drilling, Well Completion, Workover Operations, and Well Abandonment.

- By Water Depth: Categorizes the market based on the depth of drilling operations, specifically Shallow Water, Deepwater, and Ultra-Deepwater, each demanding unique fluid properties.

Regional Highlights

- North America: A mature market with significant activity in the Gulf of Mexico, driven by deepwater and ultra-deepwater projects. The region emphasizes technological innovation and environmental compliance, with major players and service providers focused on advanced fluid solutions. The U.S. and Canada remain key contributors due to substantial existing infrastructure and ongoing E&P.

- Europe: Characterized by stringent environmental regulations and a focus on sustainable drilling practices, particularly in the North Sea (Norway, UK). The region is a leader in developing eco-friendly drilling fluids and advanced digital solutions for fluid management. Despite a push for renewables, gas production remains strategically important, sustaining drilling activities.

- Asia Pacific (APAC): Emerging as a high-growth region due to increasing energy demand, new offshore discoveries, and expanding E&P investments in countries like China, India, Australia, Malaysia, and Vietnam. The region is witnessing a rise in deepwater projects, driving demand for specialized and cost-effective drilling fluids, with significant investments in both exploration and production.

- Latin America: A significant growth hub, predominantly driven by Brazil's pre-salt discoveries and Guyana's rapidly expanding offshore sector. Mexico is also contributing to growth with new energy reforms. The region requires high-performance fluids for challenging deepwater and ultra-deepwater conditions, attracting substantial international investment and technology transfer.

- Middle East and Africa (MEA): Remains a crucial region for offshore drilling, particularly in the Persian Gulf and off the coasts of West Africa (e.g., Angola, Nigeria). Saudi Arabia, UAE, Qatar, and Kuwait are investing heavily in offshore field development to maintain global energy supply. Africa's offshore potential, though developing, shows significant promise, particularly for gas projects, driving steady demand for drilling fluids.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Offshore Drilling Fluid Market.- Schlumberger

- Halliburton

- Baker Hughes

- National Oilwell Varco (NOV)

- M-I SWACO

- Tetra Technologies

- BASF SE

- Clariant AG

- Croda International Plc

- Solvay S.A.

- DuPont de Nemours, Inc.

- Chevron Phillips Chemical Company

- Weatherford International

- Ecolab Inc.

- Newpark Resources, Inc.

- Kemira Oyj

- The Lubrizol Corporation

- Global Drilling Fluids & Chemicals Ltd.

- Anchor Drilling Fluids USA, Inc.

- QMax Solutions Inc.

Frequently Asked Questions

Analyze common user questions about the Offshore Drilling Fluid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of offshore drilling fluids used?

The primary types are Water-Based Fluids (WBF), Oil-Based Fluids (OBF), and Synthetic-Based Fluids (SBF). WBFs are cost-effective and environmentally friendly, while OBFs and SBFs offer superior performance in challenging high-pressure, high-temperature (HPHT) and deepwater environments, providing enhanced wellbore stability and lubricity.

How do environmental regulations impact the offshore drilling fluid market?

Environmental regulations significantly influence the market by mandating the development and use of more eco-friendly, biodegradable, and low-toxicity drilling fluids. This drives innovation towards sustainable chemistries and proper waste management practices, increasing compliance costs but also creating opportunities for green technologies.

What role do technological advancements play in this market?

Technological advancements are crucial, enabling the formulation of high-performance fluids for extreme conditions (HPHT, deepwater) and improving drilling efficiency. Digitalization, AI, and machine learning are increasingly integrated for real-time fluid monitoring, optimization, and predictive maintenance, enhancing operational effectiveness and safety.

Which regions are key growth areas for offshore drilling fluids?

Key growth areas include Latin America (especially Brazil and Guyana), Asia Pacific (China, India, Southeast Asia), and parts of the Middle East and Africa. These regions are characterized by increasing energy demand, significant new offshore discoveries, and substantial investments in deepwater and ultra-deepwater exploration and production.

What are the main challenges facing the offshore drilling fluid industry?

The main challenges include navigating stringent environmental regulations, managing the technical complexities of drilling in extreme offshore conditions, mitigating the impact of volatile crude oil prices on investment, addressing supply chain disruptions, and overcoming the high operational costs associated with offshore projects.