Non Alcoholic Beer Market

Non Alcoholic Beer Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703667 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Non Alcoholic Beer Market Size

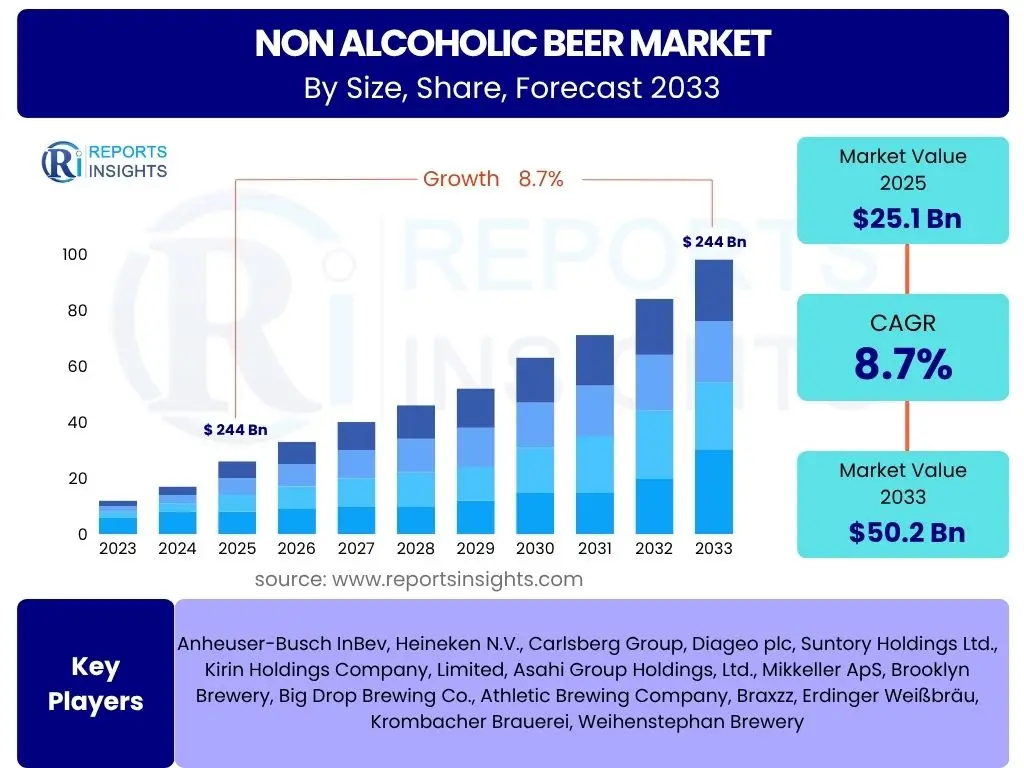

According to Reports Insights Consulting Pvt Ltd, The Non Alcoholic Beer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2033. The market is estimated at USD 25.1 Billion in 2025 and is projected to reach USD 50.2 Billion by the end of the forecast period in 2033.

Key Non Alcoholic Beer Market Trends & Insights

The non-alcoholic beer market is experiencing significant evolution driven by shifting consumer preferences and innovative product development. Common user inquiries often revolve around the motivations behind this growth, the evolution of taste profiles, and the social acceptance of non-alcoholic alternatives. Consumers are increasingly seeking healthier lifestyle choices, leading to a surge in demand for beverages that offer the social experience of beer without the alcohol content. This trend is further amplified by improved brewing techniques that deliver sophisticated and appealing flavor profiles, effectively addressing historical perceptions of non-alcoholic beer lacking taste.

Furthermore, the market is benefiting from a broader cultural shift towards mindful drinking and inclusivity in social settings. Many users are curious about how non-alcoholic options fit into various occasions, from casual gatherings to formal events. The availability of diverse styles, including craft non-alcoholic IPAs, stouts, and lagers, caters to a wider array of palates and occasions, making these beverages a mainstream choice rather than a niche alternative. The marketing strategies employed by manufacturers also play a crucial role, often highlighting the health benefits, the social aspect, and the artisanal quality of their non-alcoholic offerings.

- Rising health and wellness consciousness among consumers.

- Significant advancements in brewing technology leading to improved taste and mouthfeel.

- Expansion of product variety, including craft non-alcoholic styles (IPAs, stouts, sours).

- Increased social acceptance and de-stigmatization of non-alcoholic beverage consumption.

- Growth of mindful drinking movements and sober curious lifestyles.

- Strong presence in on-trade channels (restaurants, bars) and off-trade channels (retail, e-commerce).

- Premiumization of non-alcoholic beer offerings.

AI Impact Analysis on Non Alcoholic Beer

The impact of Artificial Intelligence (AI) on the non-alcoholic beer sector is a frequent point of interest for users, who often inquire about how technology can enhance production, personalize consumer experiences, and optimize market strategies. AI offers transformative potential across the entire value chain, from raw material sourcing to consumer engagement. In brewing, AI can optimize fermentation processes, predict flavor profiles, and ensure consistency in non-alcoholic product development, which is critical for replicating the complexity of traditional beer without the alcohol. This technological integration leads to higher quality, more consistent products, addressing a key concern for consumers regarding taste parity with alcoholic counterparts.

Beyond production, AI plays a pivotal role in understanding and responding to consumer behavior. By analyzing vast datasets from sales, social media, and market research, AI algorithms can identify emerging trends, predict demand, and personalize marketing campaigns. Users are interested in how AI can lead to more tailored product recommendations or even new flavor innovations based on predictive analytics. Furthermore, AI-driven supply chain optimization can enhance efficiency, reduce waste, and improve distribution, ensuring non-alcoholic beers are available where and when consumers desire them, thereby boosting market penetration and profitability for manufacturers.

- AI-driven optimization of brewing processes for consistent taste and quality.

- Predictive analytics for consumer preference and trend forecasting.

- Personalized marketing and recommendation engines based on AI-powered data analysis.

- Enhanced supply chain management and logistics efficiency.

- Quality control and defect detection in production lines.

- New product development and flavor innovation driven by AI algorithms.

- Data-driven insights for targeted market segmentation.

Key Takeaways Non Alcoholic Beer Market Size & Forecast

Common user questions regarding the non-alcoholic beer market size and forecast often center on the longevity of its growth, the primary drivers of its expansion, and the most promising regions or segments for future development. The market is positioned for sustained and robust growth, underpinned by fundamental shifts in consumer lifestyles towards health and wellness. This indicates that the current momentum is not merely a fleeting trend but a significant, enduring change in beverage consumption habits. The forecast highlights a substantial increase in market valuation, signifying a strong return on investment for companies entering or expanding within this sector.

The impressive Compound Annual Growth Rate (CAGR) projected through 2033 underscores the market's dynamism and responsiveness to evolving consumer demands. A key takeaway is the increasing premiumization within the non-alcoholic segment, suggesting that consumers are willing to pay more for high-quality, flavorful, and innovative options. Furthermore, the global nature of this growth, while varying in intensity by region, indicates widespread acceptance and market penetration, particularly in established markets and rapidly expanding in emerging economies. The market's resilience and adaptability to changing consumer preferences are crucial factors contributing to its optimistic long-term outlook.

- The non-alcoholic beer market is expected to double in value from 2025 to 2033, demonstrating robust growth potential.

- Health and wellness trends are the primary long-term growth catalysts.

- Significant opportunities exist in product diversification and premium segment expansion.

- Global market expansion is evident, with strong growth in North America, Europe, and Asia Pacific.

- Technological advancements in brewing are crucial for maintaining market momentum and consumer satisfaction.

- The shift towards mindful drinking is a pervasive societal trend supporting continued market development.

- Strategic investments in marketing and distribution are vital for market share acquisition.

Non Alcoholic Beer Market Drivers Analysis

The non-alcoholic beer market's growth is predominantly propelled by a confluence of evolving consumer preferences, health consciousness, and a broadening social acceptance of low or no-alcohol beverages. Consumers globally are increasingly prioritizing well-being, leading to a noticeable shift away from alcoholic beverages. This health-conscious movement directly fuels the demand for non-alcoholic options that offer similar sensory experiences without the associated health risks of alcohol consumption. Improved taste and variety have also been crucial, as modern brewing techniques have largely overcome previous quality issues, making non-alcoholic beers genuinely appealing.

Furthermore, stricter regulations on alcohol consumption in various regions and a general societal trend towards inclusivity and mindful drinking contribute significantly to market expansion. Individuals are seeking alternatives that allow them to participate in social events without consuming alcohol, for reasons ranging from personal choice to religious or health considerations. This growing demand creates a fertile ground for market players to innovate and expand their portfolios, addressing a wider range of consumer needs and occasions. The continuous innovation in flavor profiles and brewing processes ensures that non-alcoholic beer remains a competitive and attractive option in the broader beverage market.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Health and Wellness Awareness | +2.5% | Global, particularly North America, Europe | Long-term (2025-2033) |

| Improved Taste and Quality of NA Beers | +1.8% | Global | Mid to Long-term (2025-2033) |

| Increasing Social Acceptance and Inclusivity | +1.5% | Europe, North America, Oceania | Mid to Long-term (2025-2033) |

| Stricter Alcohol Consumption Regulations | +0.9% | Middle East, Asia Pacific, select European countries | Long-term (2025-2033) |

| Growth in Sober Curious and Mindful Drinking Movements | +1.0% | North America, Europe | Mid to Long-term (2025-2033) |

Non Alcoholic Beer Market Restraints Analysis

Despite robust growth, the non-alcoholic beer market faces several restraints that could potentially temper its expansion. A primary challenge remains the lingering perception among some consumers that non-alcoholic beer compromises on taste or lacks the full-bodied experience of its alcoholic counterpart. While significant advancements have been made, overcoming ingrained biases and the historical image of bland non-alcoholic options requires continuous consumer education and product innovation. This perception gap can limit trial and repeat purchases, especially among traditional beer drinkers who are less inclined to compromise on flavor.

Another significant restraint is the relatively higher production cost associated with brewing non-alcoholic beer. The de-alcoholization process adds complexity and expense to manufacturing, which can translate into higher retail prices for consumers compared to some conventional beers or other non-alcoholic beverages. This cost factor can impact affordability and competitiveness, particularly in price-sensitive markets. Additionally, limited distribution channels in certain regions, coupled with intense competition from a wide array of other non-alcoholic beverages like sodas, juices, and specialty drinks, present hurdles for market penetration and share growth. Overcoming these restraints requires strategic investment in technology, marketing, and distribution network expansion.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Lingering Perception of Inferior Taste/Quality | -1.2% | Global | Mid-term (2025-2029) |

| Higher Production Costs and Pricing | -0.8% | Global, particularly developing economies | Long-term (2025-2033) |

| Limited Distribution and Availability in Some Regions | -0.6% | Asia Pacific, Latin America, MEA | Short to Mid-term (2025-2028) |

| Intense Competition from Other NA Beverages | -0.5% | Global | Long-term (2025-2033) |

| Consumer Apathy in Traditional Beer Markets | -0.3% | Parts of Europe (e.g., Germany, Czech Republic) | Long-term (2025-2033) |

Non Alcoholic Beer Market Opportunities Analysis

The non-alcoholic beer market presents numerous promising opportunities for growth and innovation, driven by evolving consumer landscapes and technological advancements. One significant area of opportunity lies in the premiumization of offerings. As consumer palates become more discerning and their willingness to pay for quality increases, developing sophisticated, craft-style non-alcoholic beers with unique flavor profiles, high-quality ingredients, and appealing packaging can capture a significant market share. This trend allows brands to differentiate themselves and command higher price points, boosting overall market value. Furthermore, collaborations with health and wellness platforms, sports organizations, and lifestyle brands can significantly enhance market reach and appeal to target demographics.

Another major opportunity exists in expanding into new geographical markets, particularly in emerging economies where health consciousness is rising and regulations surrounding alcohol are often stringent or cultural norms favor non-alcoholic options. Asia Pacific, Latin America, and parts of the Middle East and Africa represent untapped potential for market penetration. The burgeoning e-commerce sector also provides a robust platform for distribution, enabling brands to reach a wider consumer base directly and efficiently. Innovation in ingredients, such as functional components or diverse grain usage, offers avenues for product differentiation and caters to niche dietary preferences, further expanding the market's addressable consumer base.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Premiumization and Craft NA Beer Development | +1.7% | North America, Europe, Australia | Long-term (2025-2033) |

| Expansion into Emerging Markets | +1.5% | Asia Pacific, Latin America, MEA | Mid to Long-term (2027-2033) |

| E-commerce and Direct-to-Consumer Sales Growth | +1.2% | Global | Short to Mid-term (2025-2029) |

| Innovation in Flavors and Functional Ingredients | +1.0% | Global | Long-term (2025-2033) |

| Strategic Partnerships with Wellness & Lifestyle Brands | +0.8% | North America, Europe | Mid-term (2025-2030) |

Non Alcoholic Beer Market Challenges Impact Analysis

The non-alcoholic beer market, while dynamic, faces several significant challenges that could impede its trajectory. A key challenge is the complexity and cost associated with developing and consistently producing non-alcoholic beers that truly mimic the sensory attributes of their alcoholic counterparts. Achieving the desired taste, aroma, and mouthfeel without alcohol requires sophisticated brewing processes and often specialized equipment, which can increase production expenses and pose technical hurdles. Maintaining this quality consistently across large-scale production runs is crucial for consumer acceptance and brand loyalty, but it remains a considerable technical and operational challenge for brewers.

Furthermore, consumer education is a continuous challenge. Despite growing awareness, many potential consumers still hold outdated perceptions about the taste and quality of non-alcoholic beer. Overcoming these preconceptions requires sustained marketing efforts and clear communication about product improvements and benefits. Competition for shelf space in retail environments is also fierce, not only from alcoholic beers but also from an expanding array of other non-alcoholic beverages. Navigating diverse and often fragmented regulatory landscapes concerning alcohol-free labeling and marketing claims across different countries presents another layer of complexity for global brands. Addressing these challenges effectively will be critical for sustained market growth and widespread adoption.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Achieving Consistent Taste Profile Without Alcohol | -1.0% | Global | Long-term (2025-2033) |

| Consumer Education and Overcoming Stigma | -0.7% | Global | Mid-term (2025-2029) |

| Competition for Retail Shelf Space | -0.5% | North America, Europe | Mid to Long-term (2025-2033) |

| Navigating Complex Regulatory Frameworks | -0.4% | Europe, Asia Pacific | Long-term (2025-2033) |

| Supply Chain Vulnerabilities and Ingredient Sourcing | -0.3% | Global | Short to Mid-term (2025-2027) |

Non Alcoholic Beer Market - Updated Report Scope

This comprehensive report delves into the dynamics of the global Non Alcoholic Beer market, providing an in-depth analysis of market size, growth drivers, restraints, opportunities, and challenges. It offers a detailed forecast from 2025 to 2033, segmenting the market by various criteria and providing regional insights to help stakeholders make informed strategic decisions. The report covers the competitive landscape, profiling key players and highlighting their strategies, and examines the impact of emerging trends like AI on the industry's future trajectory.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 25.1 Billion |

| Market Forecast in 2033 | USD 50.2 Billion |

| Growth Rate | 8.7% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, Diageo plc, Suntory Holdings Ltd., Kirin Holdings Company, Limited, Asahi Group Holdings, Ltd., Mikkeller ApS, Brooklyn Brewery, Big Drop Brewing Co., Athletic Brewing Company, Braxzz, Erdinger Weißbräu, Krombacher Brauerei, Weihenstephan Brewery |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The non-alcoholic beer market is meticulously segmented to provide a granular view of its diverse components and understand the varied consumer preferences and market dynamics. This segmentation allows for targeted analysis of different product types, categories, distribution channels, and consumer demographics, offering critical insights into specific growth pockets and strategic opportunities within the broader market. Understanding these segments is crucial for manufacturers and distributors to tailor their product offerings, marketing strategies, and supply chain operations effectively, maximizing their market penetration and profitability.

- By Product Type: This segment includes a range of popular beer styles adapted into non-alcoholic versions, such as Lager, Stout, IPA, Wheat Beer, and other niche categories like Ale and Pilsner. Lagers typically dominate due to their widespread appeal and crisp profile, while IPAs and stouts represent the growing craft segment.

- By Category: This divides the market into Alcohol-Free (0.0% ABV) and Low-Alcohol (up to 0.5% ABV). The distinction is critical for regulatory compliance and consumer preference, with 0.0% ABV gaining traction due to absolute abstinence trends.

- By Distribution Channel: Encompasses how products reach consumers, including On-Trade (restaurants, bars, pubs, hotels) and Off-Trade (supermarkets, hypermarkets, convenience stores, online retail, specialty stores). Online retail is experiencing rapid growth, reflecting shifts in consumer shopping habits.

- By Packaging Type: Examines the prevalent packaging formats, primarily Bottles and Cans, with a growing presence of Others like draught systems in on-trade venues. Packaging innovation is key for brand appeal and sustainability.

- By Flavor Profile: Categorizes products based on their dominant taste characteristics, such as Hoppy, Malty, Fruity, and Crisp, reflecting the increasing sophistication and diversity of non-alcoholic beer offerings.

- By Consumer Age Group: Analyzes consumption patterns across different age demographics (18-29, 30-45, 46-60, 60+), helping to identify core consumer segments and their specific needs and preferences.

Regional Highlights

- North America: This region is a significant market, driven by increasing health consciousness, the rising popularity of craft non-alcoholic beers, and a growing sober curious movement, especially in the United States and Canada. Strong marketing campaigns and diverse product availability fuel growth.

- Europe: Leading the global market in terms of consumption and innovation, particularly in countries like Germany, Spain, and the UK. Strong beer culture, coupled with evolving health trends and robust research and development in de-alcoholization technologies, contributes to its dominance.

- Asia Pacific (APAC): Emerging as a high-growth region, propelled by rising disposable incomes, urbanization, and a growing awareness of health benefits in countries like China, Japan, and Australia. Local breweries are increasingly entering the non-alcoholic segment, adapting flavors to regional palates.

- Latin America: Showing nascent but promising growth, driven by shifting cultural attitudes towards alcohol consumption and an increasing demand for diverse beverage options. Brazil and Mexico are key markets to watch for future expansion.

- Middle East and Africa (MEA): This region presents unique growth opportunities, particularly in the Middle East, due to cultural and religious factors that favor non-alcoholic beverages. South Africa also shows potential with increasing health awareness among its younger population.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Non Alcoholic Beer Market.- Anheuser-Busch InBev

- Heineken N.V.

- Carlsberg Group

- Diageo plc

- Suntory Holdings Ltd.

- Kirin Holdings Company, Limited

- Asahi Group Holdings, Ltd.

- Mikkeller ApS

- Brooklyn Brewery

- Big Drop Brewing Co.

- Athletic Brewing Company

- Braxzz

- Erdinger Weißbräu

- Krombacher Brauerei

- Weihenstephan Brewery

- Clausthaler (Radeberger Gruppe)

- Grolsch (Asahi Group Holdings)

- Bitburger Brewery Group

- Bavaria N.V.

- Lagunitas Brewing Company (Heineken Subsidiary)

Frequently Asked Questions

What is non-alcoholic beer?

Non-alcoholic beer is a beverage that closely resembles traditional beer in taste and appearance but contains very little or no alcohol, typically less than 0.5% alcohol by volume (ABV), or in some cases, 0.0% ABV, achieved through various de-alcoholization processes or specialized brewing methods.

How is non-alcoholic beer made?

Non-alcoholic beer is primarily made using methods such as arrested fermentation, vacuum distillation, or reverse osmosis. Arrested fermentation prevents significant alcohol production, while distillation and reverse osmosis remove alcohol from fully fermented beer, allowing brewers to control flavor and alcohol content precisely.

Is non-alcoholic beer healthy?

Non-alcoholic beer is generally considered a healthier alternative to alcoholic beer due to its lower calorie count and absence of alcohol-related health risks. It can also contain beneficial compounds like vitamins, minerals, and polyphenols, similar to traditional beer, supporting hydration and certain aspects of well-being.

What are the primary drivers of the non-alcoholic beer market growth?

The key drivers of the non-alcoholic beer market growth include rising global health and wellness trends, significant improvements in the taste and quality of non-alcoholic products, increasing social acceptance and inclusivity of mindful drinking, and evolving regulatory environments surrounding alcohol consumption.

Which regions show the highest growth potential for non-alcoholic beer?

Europe currently leads the non-alcoholic beer market in terms of consumption and innovation, while North America also demonstrates robust growth. Asia Pacific, particularly countries like China and Japan, along with parts of Latin America and the Middle East, are emerging as regions with significant future growth potential due to changing consumer lifestyles and cultural factors.